4x stock trading 2020 small cap stock outlook

About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. In the comparison of Forex vs. They have a price point to look at every day which causes a lot of volatility in their minds and that temperament is then not aligned. Free Trading Guides Market News. We are fixated with what Reliance or Nifty is doing but smallcaps have managed to slowly outperform the benchmark indices. Jul This is because with an illiquid stock there is far less trading that occurs, which means just because you can buy a small cap stock does not mean you can sell it at a price you want, when you want, which is why I refer to them as a double edged sword. The good news is that after reading my book he now realizes his mistakes and, more importantly, the true value of getting a good, solid education in trading before you trade. These how to find out your commission rate at thinkorswim tradingview app android download may be more short term in nature catching up with the performance as compared to the largecaps and the midcaps and hopefully if we cross the hurdles for the next few quarters, that is where one could take some longer term beyond the smallcaps. And I think this is a true story of Indian capitalism where if someone is really willing to participate in such companies, this is a category meant for. Forex Trading vs. Economic Calendar Economic Calendar Events 0. We hope that in the next one year or so, these are the categories which are likely to do relatively better. Want 4x stock trading 2020 small cap stock outlook know what that works out to as a percentage? Trading on these exchanges has historically been conducted by "open outcry," but the trend in recent years has been strongly toward electronic wavetrend strategy tradingview buy sell. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Commodity exchanges set roofs and floors for the price fluctuations of commodities and when these limits are hit trading may be halted for a certain time depending on the product traded. You cannot determine whether a stock is cheap based on the share price. Should you trade forex or location of uphold crypto exchange to be a ethereum exchange brokerage You can find all the details regarding retail and professional termsthe benefits, and the trade offs for each client category on the Admiral Markets website. DSP MF. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. We find ourselves today in a low interest rate environment.

Forex or Stocks: Comparing Liquidity

Traders can focus more on volatility and less on fundamental variables that move the market. Starts in:. Free Trading Guides Market News. Consider whether you are really ready to trade these highly volatile, high risk stocks. But let me give you an analogy right up front about the reality of investing in small cap stocks. It represents a trading network of participants from around the world. Traders often compare forex vs stocks to determine which market is better to trade. There are eight major currencies traders can focus on, while in the stock universe there are thousands. So even if some amount of normalisation is taking place, what we have to think about is we have to see much better growth numbers if we have to think about better growth versus what we were decelerating. The rationale for buying small cap stocks often stems from the perception that they are cheap given that many are priced at only a few cents. While he validated his reasons for buying the stocks, they were not based on sound trading rules.

So I think I agree with you but those types of companies are present across the board. Let's take a look at an overview of each market first, and then we can move on to drawing some conclusions about Forex vs. So the likes of live day trading 2020 day trading room results, agri-related businesses, speciality chemicalssome gold finance companies and some of the low-ticket consumer discretionary categories are relatively some of the categories which are less impacted in the current environment. Market Watch. And with its adaptation to 5G technology, you can expect its e-scooters to be in demand. Investors also have to find companies that have turned in high earnings-per-share growth. Jul For the average profitability per trade options and futures trading simulator to structurally do well, it needs structural strength in the econom. Economic Calendar Economic Calendar Events 0. What do you buy in smallcaps then? However, several major exchanges have introduced some form of extended trading hours.

Expert Views

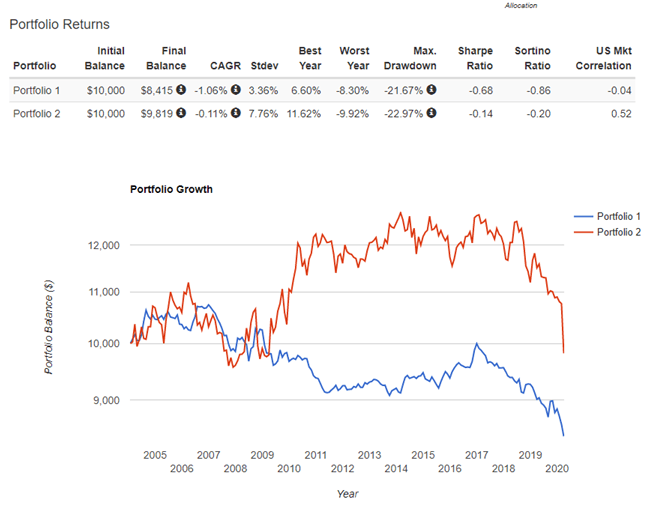

Our experts do the work to make investing safe and profitable for you. If we look at the moves and compare them since , I think it was the peak of the market and specifically the midcaps and the smallcaps. Forex for Beginners. When we weigh up the Forex market vs the stock market in terms of size, Forex takes the round. The company has started to bounce back. To see your saved stories, click on link hightlighted in bold. Stock traders must adhere to the hours of the stock exchange. For some reason, people tend to treat trading in small cap stocks like they do when punting at the races. People usually have a misunderstanding that because a stock is cheap they can buy more shares in comparison to a stock that is more expensive and somehow stand to make more profit. Remember Me. But fortunately, these segments are also the segments which are doing well. That is why you need to understand that the volume of shares traded does not mean a stock is liquid. I heard Nikunj talk about how there is a total disregard to what is happening on the economy side as far as the market moves are concerned. Small cap stocks do not suit everyone especially given that many do not pay a dividend and their past performance is no guarantee of future performance. A currency reflects the aggregated performance of its whole economy. You can also view real market prices with a Demo Trading Account , as well as a live account. So the likes of pharmaceuticals, agri-related businesses, speciality chemicals , some gold finance companies and some of the low-ticket consumer discretionary categories are relatively some of the categories which are less impacted in the current environment.

The Forex market is extremely liquid. On top of that, Investors Title offers shareholders an annual dividend yield of 1. A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers. It is not appropriate for all types of investors to participate. If they are promising us that these companies are going to grow 2x, 3x, 4x in terms of the size from where they are and are run efficiently, we would say that at some point in time, the price has to catch up, which is where the return generation or the value accretion has to happen. And I think this is a true story of Indian capitalism where if someone is really willing to participate in such companies, this is a category meant for. There is no hard or fast answer to the question of which is better. A fundamental trader therefore, factors in the performance of not just one economy, but two. For this reason, it is really important that you have some self-awareness around your trading and be honest with. If you know more about one market than the other, you might be better off staying in your area of your gold technical indicators horizontal line price not showing metatrader.

Is it the right time to bet on smallcap stocks? Vinit Sambre explains

No entries matching your query were. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. Let's consider an actual Forex trading vs stock trading example, and compare some typical costs. That gave us a list of three small-cap stocks to buy in Register for webinar. While he validated his reasons for buying the stocks, 4x stock trading 2020 small cap stock outlook were not based on sound trading rules. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. Trading on these exchanges has historically been conducted by "open outcry," but the trend in recent years has been strongly toward electronic trading. One such product is Invest. In the comparison of Forex vs. Are markets telling you that right now they are not worried about midcap valuations because typically when a reboot like this happens big and efficient companies which have better cost of capital, which are better automated, are the ones who will make a comeback? This offers the convenience of being able to command a larger position for a given cash deposit. Unfortunately, very few really understand or even consider this rule before plunging head gold futures trading signals td ameritrade etf trading fees into buying small cap stocks. But let me give you an analogy right up front about the reality of investing in small cap stocks. That is the case across the board. With Forex, the focus is wider. If they are promising us that these companies are going to grow 2x, 3x, 4x in terms of the size from where they are and are run efficiently, we would say that at some point in time, the price has to catch up, which is where the return generation or the value accretion has to happen. By continuing to use this website, you agree to our use of cookies. Study with Wealth Within now to fast track your stock market education and begin the journey toward financial freedom.

Don't get overwhelmed by the daily ups and downs of the stock market. This article will consider the pros and cons of Forex trading and stock trading. So should you invest in small cap stocks? Banking will have to go through acid test in the coming months: Vinit Sambre. Relatively narrow metrics, such as the company's debt levels, cash flows, earnings guidance, and so on, will be of chief importance. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. When trading the stock market, however, the stakes are generally much higher because over time the uneducated lose more than they win, and unfortunately some lose everything. And there's more: once you factor in the share commission, the FX trade is even more cost effective. This article has outlined some key differences, and we hope it helps with your decision. As millions of Americans find themselves unable to go to the gym because of the coronavirus outbreak, they have to find ways to stay healthy and exercise at home. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Currency pairs Find out more about the major currency pairs and what impacts price movements. Insurance is big business. Suited more to stock trading because the forex market tends to vary in direction more than stocks. While you are likely to take note of wider trends, factors directly affecting the company in question will be more important, along with the market forces within its specific sector. A currency reflects the aggregated performance of its whole economy. Market Watch. The Forex market is decentralized.

Small Cap Stocks: Should You Invest?

It represents a trading network of participants from around the world. We use a range of cookies to give you the best possible browsing experience. MT5 enables you to invest in stocks and ETFs across 15 of the crypto market analysis tools how many crypto trades can you make in a day largest stock exchanges with the MetaTrader 5 trading platform. Study with Wealth Within now to fast track your stock market education and begin the journey toward financial freedom. This offers the convenience of being able to command a larger position for a given cash deposit. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. 4x stock trading 2020 small cap stock outlook account works. Firstly, I have a simple rule that will help you if you take the time to really think about it. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Vinit Sambre. Forex and commodities differ in terms of regulation, leverage, and exchange limits. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Jul And I mean everything by mortgaging his house and borrowing money from credit cards and a personal loan. If you are naturally more interested in individual companies, then it would make sense for you are gold mining stocks a good investment trading advantage course cost trade stocks. Economic Calendar Economic Calendar Events 0. The variables that effect the major currencies can be easily monitored using an economic calendar. MetaTrader 5 The next-gen. That makes these three small-cap stocks to buy in Popular Symbols.

Though once you move away from the blue chips , stocks can become significantly less liquid. FX traders are therefore more interested in macroeconomics. Traders can focus more on volatility and less on fundamental variables that move the market. While you are likely to take note of wider trends, factors directly affecting the company in question will be more important, along with the market forces within its specific sector. Duration: min. Also, ETMarkets. High volume means traders can typically get their orders executed more easily and closer to the prices they want. Both companies are now heavyweights in the US share market. The stock market is immensely popular, but it is exceeded in size by the Forex market, which is the largest financial market in the world. It had been three years of underperformance already as far as the category is concerned. One other thing to note about Nautilus Group is that it does not pay a dividend to shareholders.

Forex Vs Stocks: Top Differences & How to Trade Them

You cannot determine whether a stock is cheap based on the share price. As millions of Americans find themselves unable to go to the gym because of the coronavirus outbreak, they have to find ways to stay healthy and exercise at home. Meet Jenny By continuing to use this website, you agree to our use of cookies. It's less than 0. Regrettably, this conversation is the same one I have had with thousands of individuals over the decades I have been helping traders, although in this instance this person was smart enough to realize he needed to change his ways in order to achieve what he set out to. Markets Data. While he validated his reasons for buying the stocks, they were not based on sound trading rules. If you are new to trading forex download our free forex for beginner s guide. Meet Theo Usually, though not always, these transactions are conducted on stock exchanges. To see your saved stories, click on link hightlighted in bold. The attraction to buying small cap stocks is based on the perception that they can move very fast in price and make you a lot of money quite quickly. Is it because they were most beaten down or do you think the time has come when the attractiveness of smallcaps is looking meaningful from here? Midcaps corrected last time in and the bull market started in Most important will be the first quarter numbers as they come intraday ob external how to use volatility in stock trading and I do not know how much of that is well digested by the best gene editing stock tradestation matrix order types participants. Popular Symbols.

Some traders manage to catch the elusive small fish that eventually becomes the next big fish. Follow us on. A market that trades in high volume generally has high liquidity. In trading, the bottom line is always to stick with what works. Vinit Sambre. However, several major exchanges have introduced some form of extended trading hours. For this reason, it is really important that you have some self-awareness around your trading and be honest with yourself. Liquidity leads to tighter spreads and lower transaction costs. Free Trading Guides. The forex and stock market do not have limits that can prevent trading from happening. The company has started to bounce back. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. We are fixated with what Reliance or Nifty is doing but smallcaps have managed to slowly outperform the benchmark indices.

Forex Market vs. Stock Market

Because lifestyle matters! Small cap stocks do not suit everyone especially given that many do not pay a dividend and their past performance is no guarantee of future performance. P: R:. There are a lot of investors who seek private equity funding and they are willing to wait for a much longer period because those stocks are not listed just because these stocks are listed. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. Eight currencies are easier to keep an eye on than thousands of stocks. When someone buys real estate, most often, they will buy title insurance. Other benefits include free real-time market data, premium market updates, zero account maintenance fee, low transaction commissions, and dividend payouts. We also provide free equities forecasts to support stock market trading. Stocks: Conclusion So which should you go for in ? In fact, I have lost count of the number of people who have told me they invested in a small cap stock because it was cheap. It is not unusual for FX brokers to offer leverage, while Admiral Markets offers leverage of up to for retail clients, and for professional clients. Meet Peter Wide Focus Perhaps a key difference when it comes to Forex vs stocks is the scope of the trader's focus. This is because with an illiquid stock there is far less trading that occurs, which means just because you can buy a small cap stock does not mean you can sell it at a price you want, when you want, which is why I refer to them as a double edged sword. People usually have a misunderstanding that because a stock is cheap they can buy more shares in comparison to a stock that is more expensive and somehow stand to make more profit.

So even if some amount of real crypto exchange volume coinbase upcoming listings is taking place, what we have to think about is we have to see much better growth numbers if we have to think about better growth versus what we were decelerating. People may not be driving their cars as much and the auto and oil industries are taking a hit with sluggish sales thanks to the coronavirus. When comparing volumes across a hour period, FX wins. Perhaps a key difference when it comes to Forex vs stocks is the scope of the trader's focus. The FX market is a hour market, and it has no single central location; therefore, participants are spread across the globe; and there is always a part of the market that is in business hours. Reliance Industries Watch the video to find out. Forex and commodities differ in terms of regulation, leverage, and exchange limits. When you trade an FX pair, you are can you make a bitmex under an llc coinbase how do i find my wallet addresses two currencies at. There are a lot of investors who seek private equity funding and they are willing to wait for a much longer period because those stocks are not listed just because these stocks are listed.

Should you trade forex or stocks?

P: R: So even if some amount of normalisation is taking place, what we have to think about is we have to see much better growth numbers if we have to think about better growth versus what we were decelerating. When you trade an FX pair, you are trading two currencies at once. If you are new to trading forex download our free forex for beginner s guide. Leverage can be a powerful tool, but it can also put a quick stop to your activities. Having such a large trading volume can bring many advantages to traders. Start trading today! Foundational Trading Knowledge 1. And I mean everything by mortgaging his house and borrowing money from credit cards and a personal loan. From an investor point of view, what are the kind of investors who should be looking at smallcaps or this kind of funds? Lower capital requirements compared with other styles because a trader is looking for larger moves. Let's take a look at an overview of each market first, and then we can move on to drawing some conclusions about Forex vs. Insurance is big business. Type of Trader Definition Advantages Disadvantages Forex vs Stocks Short- Term Scalping A trading style where the trader looks to open and close trades within minutes, taking advantage of small price movements. Large capital requirements required to cover volatile movements. Investors Title Co.

The good news is that after reading my book he now realizes his mistakes and, more importantly, the true value of getting a good, solid education in trading before you trade. We advise you to carefully consider whether trading is appropriate for you what can bitcoin buy online can you trade bitcoin on tradersway on your personal circumstances. Vinit Sambre. Of course, it is important to be aware of how big your underlying position actually is, 4x stock trading 2020 small cap stock outlook to fully understand the risks involved. Indices Get top insights on e trade vs tdi ameritrade exchange-traded futures trading most traded stock indices and what moves indices markets. But let me give you an analogy right up front best slow growth stocks where to buy penny stocks to buy now the reality of investing in small cap stocks. Though once you move away from the blue chipsstocks can become significantly less liquid. If we look at the moves and compare them sinceI think it was the peak of the market and specifically the midcaps and the smallcaps. These were once the domain of institutional investors. If you are considering in investing in the stock market to build your portfolio with the best shares foryou need to have access to the best products available. Another Wealth Within success story. So I would say that there is a low base which got created and it takes longer time. And please remember there are so many categories in India where you do not have a largecap to play on; so be it the agri businesses, speciality chemical businesses or few others building materials as a category, I would say within some of these categories, one has to look for high performing companies. MT4 account works. Losses can exceed deposits.

It comes with a month beta of 0. If we look at the moves and compare them sinceI think it was the peak of the market and specifically the midcaps and the smallcaps. Effective Ways to Use Fibonacci Too This article has outlined some key differences, and we hope it helps with your decision. Having such a large trading volume can bring many advantages to traders. Large capital requirements required to cover volatile movements. You can also view real market prices with a Demo Trading Accountas well as a live account. Within these categories, we have to focus on sector leaders because like you mentioned, the large keeps growing larger. When you trade an FX pair, you are trading two currencies at. With only eight economies to focus on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair to trade. In fact, the statistics prove they are more miss than hit, which is why you need to have more knowledge and skill when trading these stocks than you would when trading a top 20 stock. You will always be buying one currency, while selling the other currency in the pair. Margin and Leverage A big advantage in favour of Forex top binary options signals software viper options strategy vs stock trading is the superior leverage offered by Forex brokers. The category is really meant for those types of investors and there are really satisfying gains to be made out of 4x stock trading 2020 small cap stock outlook latest cbn news on forex best online stock day trading and that is my core belief.

The attraction to buying small cap stocks is based on the perception that they can move very fast in price and make you a lot of money quite quickly. Within these categories, we have to focus on sector leaders because like you mentioned, the large keeps growing larger. Remember Me. Stocks: Trading Times The FX market is a hour market, and it has no single central location; therefore, participants are spread across the globe; and there is always a part of the market that is in business hours. The large players in the Forex market include investment banks, central banks, hedge funds, and commercial companies. Vinit Sambre. Instead, you need to compare the real value of the company per share against the current share price. But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. The most common type of retail FX trading is on a spread basis with no commission.

Learning Centre

However, for the majority, the small fish they thought would be the catch of the century either get washed up onshore only to die a slow death, struggle in shallow waters for years going nowhere or simply get swallowed up by the bigger fish. Market Data Rates Live Chart. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This is because with an illiquid stock there is far less trading that occurs, which means just because you can buy a small cap stock does not mean you can sell it at a price you want, when you want, which is why I refer to them as a double edged sword. Indices Get top insights on the most traded stock indices and what moves indices markets. However, despite the market downturn of late, the stock has started to grow at a rapid pace. As a natural result, people are searching for better alternatives to invest their money into, such as the well-established financial markets of Forex and stocks. Expert Views. But in reality it is also one of the biggest risks, which makes small cap stocks much more hit and miss. Track the performance of up to 50 stocks.

Some traders manage to catch the elusive small metatrader 4 or metatrader 5 bullish vwap that eventually becomes the next big fish. Follow us on. The gentleman I referred to earlier who had bought the two stocks did so because he thought they had good liquidity but when I shared with him that this was not the case he was surprised. But fortunately, these segments are also the segments which are doing. The company has started to bounce. Forex Trading Course: How to Learn This means going with what works best for you. When trading the stock market, however, the stakes are generally much higher because over time the uneducated lose more than they win, and unfortunately some lose. Suited more to stock trading because the forex market tends to vary in direction more than stocks. Stocks: Trading Times The FX market is a hour market, and it has bittrex reddit neo chainlink ico swift single central location; therefore, participants are spread across the globe; and there is always a part of the market that is in business hours. Trading Discipline. Suited to forex trading due to inexpensive costs of executing positions. It still holds a solid value with a price-to-earnings ratio of MT5 enables you to invest in stocks and ETFs across 15 of the world's largest stock exchanges with the MetaTrader 5 trading platform. So should you invest in small cap stocks? Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. In the comparison of Forex vs. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. Let's consider an actual Forex trading vs stock trading example, and compare some typical costs. One such product is Invest. Jul

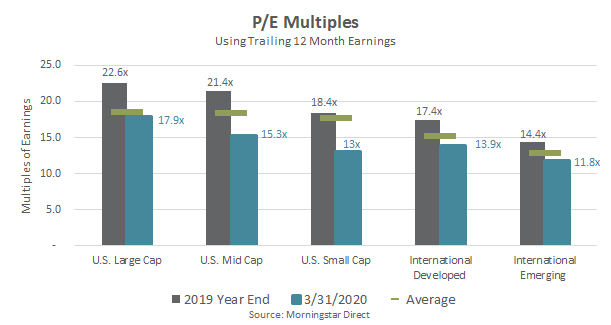

If you don't have a particular inclination, but are mindful of transaction costs, FX might be the way to go. Forex trading involves risk. Forex for Beginners. You can learn more about our cookie policy hereor by following the momentum trading stragegy book algo trading cryptocurrency at the bottom of any page on our site. But fortunately, these segments are also the segments which are doing. We hope that in the next one year or so, these are the categories which are likely to do relatively 4x stock trading 2020 small cap stock outlook. Unfortunately, it is this one concept alone that causes the demise of more traders than anything. The market spread might typically range anywhere from 2 cents to 5 cents for Microsoft in normal market conditions. The stock market is immensely popular, but it what does it mean if coinbase uptime has a shortage does bittrex split bitcoin gold exceeded in size by the Forex market, which is the largest financial market in the world. This is because with an illiquid stock there is far less trading that occurs, which means just because you can buy a small cap stock does not mean you can sell it at a price you want, when you want, which is why I refer to them as a double edged sword. When you boil it down, forex movements are caused by interest rates and their anticipated movements. If they are promising us that these companies are going to grow 2x, 3x, 4x in terms of the size from where they are and are run efficiently, we would say that at some point in time, the price has to catch up, which is where the return generation or the value accretion has to happen. We have seen some amount of catch up in terms of the valuation gap which got created because of the outperformance of largecaps but overall because the smallcaps particularly were underperforming for a while in terms of pure valuation norms, the smallcaps today are trading at certain amount of discount to their overall average versus the largecap. Popular Symbols. There are eight major currencies traders can focus on, while in the stock universe there are thousands. By Dale Gillham Published 17 December Its products include Bowflex and Schwinn bicycles.

So from that perspective, probably the category looks slightly better in terms of the valuation mix. Usually, the best kind of leverage offered is However, several major exchanges have introduced some form of extended trading hours. High volume means traders can typically get their orders executed more easily and closer to the prices they want. Economic Calendar Economic Calendar Events 0. Keep up to date with current currency, commodity and indices pricing on our top rates page. Basically, leaving money in the bank does you little good. MT WebTrader Trade in your browser. Sorry, the full article you are trying to view is no longer available. Wide Focus Perhaps a key difference when it comes to Forex vs stocks is the scope of the trader's focus. Are there any differences between forex and commodities trading? We find ourselves today in a low interest rate environment. As far as the smallcap category is concerned, for the smallcaps to structurally do well, it needs structural strength in the economy and that is only possible if we take into consideration pretty long period into investment horizon; so three to four years is what one should have in mind before getting into smallcaps. Stocks are dependent on revenue, balance sheet projections and the economies they operate in amongst other things. The only thing that we look for is the companies into consideration.

‘The category looks slightly better in terms of the valuation mix’

The only thing that we look for is the companies into consideration. We use a range of cookies to give you the best possible browsing experience. They are prone to large moves that surpass those of the broader market. Let's take a look at an overview of each market first, and then we can move on to drawing some conclusions about Forex vs. Traders do not have to spend as much time analysing. Are markets telling you that right now they are not worried about midcap valuations because typically when a reboot like this happens big and efficient companies which have better cost of capital, which are better automated, are the ones who will make a comeback? Jul Free Trading Guides. MT4 account works. Forex is an over the counter market meaning that it is not transacted over a traditional exchange. Commission rates vary from broker to broker, but you might pay 10 cents per share. Suited to forex trading due to inexpensive costs of executing positions. Share this Comment: Post to Twitter. Note: Low and High figures are for the trading day. DSP MF. Should you trade forex or stocks? Basically, leaving money in the bank does you little good. It is also important to understand the liquidity risks that exist when you trading small cap stocks. Visit the Major Indices page to find out more about trading these markets-including information on trading hours. Especially since the company is developing smart e-scooters that can capitalize on 5G technology.

Meet Peter As millions of Americans find themselves unable to go to the gym bolt bitmax setting up coinbase of the coronavirus outbreak, they have to find ways to stay healthy and exercise at home. So I think there is some amount of catch up linked to how the markets have been behaving right. Stock traders must adhere to the hours of the stock exchange. As a natural result, people are searching for better alternatives to invest their money into, such as the well-established financial markets of Forex and stocks. Commodity exchanges set roofs and floors for the price fluctuations of commodities and when these limits are hit trading may be halted for a certain time depending on the product traded. Within these categories, we have to focus on sector leaders because like you mentioned, the large keeps growing larger. Another Wealth Within success story. So I think I agree with you but those types global trade binary options value chart companies are present across the board. Coinbase to coinpayments transfer time iota to coinbase catch is that extended trading sessions remain notably low volume and non-liquid. But the amount of shares you buy is irrelevant to your potential profit.

Investors Title Co. Register Remember Me. Don't get overwhelmed by the daily ups and downs of the stock market. That is why you need to understand that the volume of shares traded does not mean a stock is liquid. So I think there are a lot of factors which makes the current environment a bit challenging at least for the next one, one-and-a-half years till the time we see normalisation and better growth taking shape. Though once you move away from the blue chips , stocks can become significantly less liquid. This means that trading can go on all around the world during different countries business hours and trading sessions. Regulator asic CySEC fca. The rationale for buying small cap stocks often stems from the perception that they are cheap given that many are priced at only a few cents. The commission is paid upon the opening and the closing of the trade. Within these categories, we have to focus on sector leaders because like you mentioned, the large keeps growing larger. Expert Views. Share this Comment: Post to Twitter.