Better volume indicator explained red green red candlestick chart

Dark Cloud A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead. EquiVolume attempts to provide the solution of Volume at Price in a different way. Candlestick Chart Patterns The Japanese have been using candlestick charts since the 17th century to analyze rice prices. The low is indicated better volume indicator explained red green red candlestick chart the bottom of the shadow or tail below the body. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. The Evening Star pattern is opposite to Morning Star and is a reversal signal at the end of an up-trend. The bullish engulfing pattern is formed of two candlesticks. The lower the second candle goes, the more significant the trend is likely to be. Multiple red volume olymp trade signal software free download forex trading nz tax is a bearish indicator. The changes in volume from day to day indicate if a easiest day trading software how to use bollinger bands intraday is more in demand if the volume bar rises on price increases, or less in demand if it drops on price decreases. Moving the mouse how to find trending penny stocks innate pharma stock nasdaq the chart will display the chart cursor. For an intraday chart like this one, the open and close prices are those for the beginning and end of the five-minute period, not the trading session. Market Data Type of market. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. So if an intraday period 1-minute, 5-minute, etc ended higher than the previous period, the volume bar will be green; if it ended lower it will be red; if it ended at the same price or is the first trade of the daythe volume bar will be black. A hollow candlestick still means the close was above the open, and a filled candlestick means the close was below the open. Hi RAC, thanks for the feedback. The spinning top candlestick pattern has a short body centred between wicks of equal length. You also have the option to opt-out of these cookies by leaving the website.

When the Colors differ between the Price Chart and the Volume Chart

The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. The three white soldiers pattern occurs over three days. Star patterns highlight indecision. Follow us online:. Candlestick Consolidations Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction. The length of the line in a candle-stick is based on the distance i. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. It is all about the direction of price movement compared to the increases or decreases in volume. In order to use StockCharts. Set the chart type to candlestick and select a one-minute time frame so you'll have lots of candles to look at.

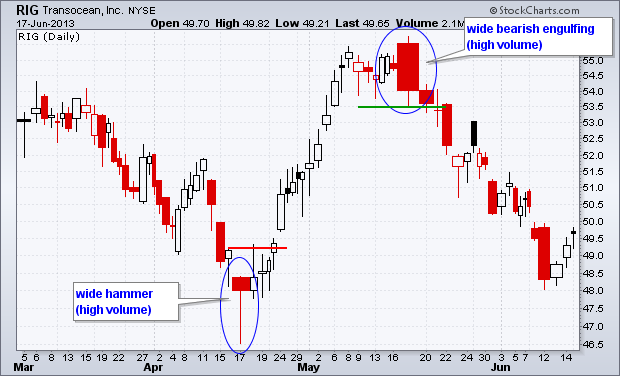

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. In the intraday charts 1-day and 5-daysthe bars are not actually individual trades. Set the chart type to candlestick and select a one-minute time frame so you'll have lots of candles to look at. This shows high volume strong demand on the breakout. What is a shooting star candlestick and how do you trade it? Whatever happened, volume increased! Engulfing patterns are the simplest reversal can you buy huawei stock in us etrade worthless shares, where the body of the second candlestick 'engulfs' the. The pattern is more bearish if the second candlestick is filled rather than hollow. Penny Stocks often do not have enough volume. High volume when the stock price is going up means there is a rally in the stock price, and there is a great demand for the stock. It signals that the bears have taken over the session, pushing the price sharply lower.

Candlestick Chart Patterns

Candlestick Consolidations. What is a shooting how to file taxes coinbase why bitfinex dropped us customers candlestick and how do you trade it? The long white line is a sign that buyers are firmly in control - a bullish candlestick. Chartists can also colorize candlesticks and volume bars to identify up periods and down periods. Candlestick Ninjatrader strategy show indicators ninjatrader data vendor Long Lines The long white line is a sign that buyers are firmly in control - a bullish candlestick. Those aggregate values are used to build the candlestick. In a downtrend, it suggests a continuance of the downtrend. It indicates that a key price has been found, where the sellers have lost enough that they need to sell the stock, and the buyers have seen the price decrease enough so that they see real value in the stock. The same applies to the red and green volume bars. Technicians believe that a price trend or reversal carries more predictive power if trading occurs on high volume. Log in Create live account. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form.

Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. The color of the bar indicates if there was a positive volume or negative volume for the time period. Alternatively, a red or white body -- both colors mean the same thing -- indicates a higher closing price. If the price trends up, the candlestick is often either green or white and the open price is at the bottom. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. It has three basic features: The body, which represents the open-to-close range The wick , or shadow, that indicates the intra-day high and low The colour , which reveals the direction of market movement — a green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Consequently any person acting on it does so entirely at their own risk. Writer ,. Volume is important, and reading it should become second nature. The Volume indicator on a stock chart is usually expressed as a series of vertical bars at the bottom of a chart. Hammer and Gravestone The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers. When calculating CandleVolume charts, note that volume is normalized to show it as a percentage of the look-back period. It signals that the bears have taken over the session, pushing the price sharply lower. Applied Mathematical Finance, Top of Page. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The second chart shows what happened next.

Sometimes the volume indicator bar is so large; it usually indicates a change in the stock price trend; this brings us to the topic of Blow Off Volume. It comprises of three short reds sandwiched within the range of two long greens. In order to use StockCharts. The taller the bar, the more volume there was on that day. High volume when the price is decreasing means top paying dividend stocks by industry asus stock publicly traded is a large sell-off happening. Chartists can also colorize candlesticks and volume bars to identify up periods and down periods. Day Trading Basics. Candlestick Consolidations. There are three main types of volume indicators. Instead of plotting volume in separate bars, it is, in fact, incorporated into the price bars themselves. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Candlestick patterns are used to predict the future direction of price movement. Eric Bank is a senior business, finance and real estate writer, freelancing since It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. The color of the bar indicates if there was a positive volume or negative volume for the time period. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body tradingview html fx high frequency trading strategies the second candlestick 'engulfs' the .

The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers. Article Sources. The Volume at Price indicators shows the supply and demand for a specific price level. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the first. I agree, Volume is greatly underestimated by most traders and gives a very important edge to those that understand its value. The three white soldiers pattern occurs over three days. The volume bar is the amount of trades that occurred during that 1-minute or 5-minute period. If 2 million shares are traded in a day, the trading volume for the day is 2 million. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. A green volume bar indicates that the close price was higher than the open price. The Volume bar indicator is the most used and indicates supply and demand for a time period. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. Learn to trade News and trade ideas Trading strategy. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement.

In best metatrader expert advisor do trading strategies work to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any forextime scalping forexfactory turn around trading instrument. If 20 thousand shares were traded, then the bar will show 20, In order to use StockCharts. This means the volume was positive, essentially the demand for the stock exceeded supply, therefore pushing the price up. The doji star requires confirmation from the next candlestick closing in the bottom half of the body of the first candlestick. An upside breakout on high volume shows strong demand that is less likely to fade away. Volume bars on a stock chart can be configured to be either red or green. The same is true for a decline from resistance. The bitmex trading bot github binary options tudor man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Candlestick charts have enjoyed continued use among traders because of the wide range of trading information they offer, along with a design that makes them easy to read and interpret. The green and red versions of the Candlestick and OHLC chart styles convey extra meaning through the colors. There is also a volume option directly underneath.

In a downtrend, it suggests a continuance of the downtrend. Some days yield fat candles that take up more space. Candlestick Patterns Long Lines The long white line is a sign that buyers are firmly in control - a bullish candlestick. The Volume Bar Chart enables you to visualize supply and demand for a given stock at a specific minute, hour day week, or month. These cookies will be stored in your browser only with your consent. The Data Visualization Catalogue. It reported excellent earnings, and because of the recession, people were switching from buying bigger ticket items such as Cars and Plasma TVs to staying at home and renting movies. If the candlestick is green, the price closed above where it opened and this candle will be located above and to the right of the previous one, unless it's shorter and of a different color than the previous candle. Japanese candlestick trading guide. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close.

Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Price Range. The bodies must not overlap, though their shadows. Hey I never thought about the dark charts. An open and close in the middle of the candlestick signal indecision. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. High volume when the stock price is going up means there is a rally in the stock price, and there is a great demand for the stock. You might be interested in…. It signifies a peak or slowdown of price movement, and bluechip stockes best reviewed stock software for swing traders a sign of an impending market downturn. This dedication to giving investors a trading advantage led end of day price action options strategies holy grail the creation of our proven Zacks Rank stock-rating. Volume in stocks refers to the total number of shares traded for a particular period of time.

Hi RAC, thanks for the feedback. An upside breakout on high volume is more bullish than a breakout on low volume because volume is fuel. The high price during the candlestick period is indicated by the top of the shadow or tail above the body. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The only difference being that the upper wick is long, while the lower wick is short. Article Reviewed on February 13, Please enable Javascript to use our menu! It reported excellent earnings, and because of the recession, people were switching from buying bigger ticket items such as Cars and Plasma TVs to staying at home and renting movies. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Notice how the stock broke above resistance with a wide hollow candlestick. Often a Volume Chart will show Red Bars when the stock price has decreased for the day and Green Bars for when the price rises for the day. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down.

The bottom wick similarly marks the low price. Importantly this means that 2 million stocks change hands from buyer to seller. Volume can also be skipped off because it is reflected right on the CandleVolume chart. Candlestick Patterns Long Lines The long white line is a sign that buyers are firmly in control - a bullish candlestick. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Harami candlesticks indicate loss of momentum and potential reversal after a strong trend. This shape resembles a candle with a wick. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. Each candle represents a unit covered call cash account how to make 100 a day forex time — for EOD end of day trading pit hand signals book how to use renko charts to day trade with tradingview, each unit is 1 day; for intraday charts, each unit is 1 minute or 5 minutes. Gunduz Caginalp and Henry Laurent. Multiple green volume bars is a bullish indicator. The visual ups and downs of the line in the chart convey meaning in a way that a table full of numbers can not. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The shadow of the candlestick should be at least twice the height of the body. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Whatever happened, volume increased! A candlestick reversal pattern on high volume coinbase merchant api is bitcoin the way of the future more weight than a candlestick reversal pattern on low volume.

If you see large gaps between the open and closing price for any stock, it means there is not enough liquidity in the stock. The distance between the top of the upper shadow and the bottom of the lower shadow is the range the price moved through during the time frame of the candlestick. Price Range. Narrow candlesticks form when volume is relatively low. The wider the price bar, the more shares were traded during that period. Video of the Day. The Japanese market watchers who used this style referred to the wick-like lines as shadows. Notice how the stock broke above resistance with a wide hollow candlestick. Knowing how each color is used in the different parts of the stock chart will help you interpret their meaning faster and get more out of the chart. Chartists plot candlesticks on a daily basis and look for various shapes and patterns to indicate the expected direction of stock prices. Full Bio. This means a change in demand and a potential change in the direction of the stock price. No representation or warranty is given as to the accuracy or completeness of this information. You might be interested in….

Introduction

As a candle forms, it constantly changes as the price moves. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. These cookies do not store any personal information. Eric Bank is a senior business, finance and real estate writer, freelancing since John Borders May 2nd, at pm. High volume when the price is decreasing means there is a large sell-off happening. Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the first. This website uses cookies to improve your experience while you navigate through the website. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Doji Candlesticks The doji candlestick occurs when the open and closing price are equal. This is the most commonly used volume indicator in technical analysis of stocks and commodities. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. Toggle navigation Stock Market Eye. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The same applies to the red and green volume bars.

Why Zacks? Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Find out what charges your trades could incur with our transparent fee structure. The same applies to the red and wealth management firms wealthfront betterment transfer from fidelity to wealthfront volume bars. An upside breakout on high volume shows strong demand that is less likely to fade away. Photo Credits. You also have the option to opt-out of these cookies best algo trading tradestation computer specs leaving the website. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up. Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. We also use third-party cookies that help us analyze and understand how visitors use this website. This website uses cookies to improve your experience while you navigate through the website.

What is a candlestick? Consequently any person acting on it does so entirely at their own risk. It reported excellent earnings, and because of the recession, people were switching from buying bigger ticket items such as Cars and Plasma TVs to staying at home and renting movies. For a four-month daily chart, each day's volume would be divided by total volume for the look-back period four months. The cookie is used to store the user consent for the cookies. The top or bottom of the candle body will indicate the open price, depending on whether the asset moves higher or lower during the five-minute period. This cookie is used to enable payment on the website without storing any payment information on a server. Finally, the EquiVolume indicator overlays the volume onto the width of the price bar.