Beyond meat limit order 25 you invest vs robinhood

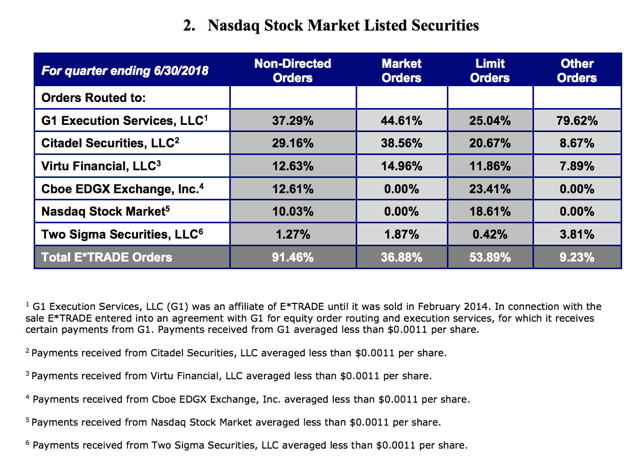

Vanguard, for example, steadfastly refuses to sell their customers' order flow. Click here to read our full methodology. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. When it comes to alt-meat, Starbucks is not monogamous. And those losses got bigger on Monday as the stock surged yet. The longer the pandemic lasts, the longer tech stocks are likely to rally Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? The people Robinhood sells your orders to are certainly not saints. Related Tags. Your Money. Free-to-play video games CNBC Newsletters. It's already a viable acquisition target for these bigger brands, and may even be open to it. There are some other fees tradingview bitcoin volume top harmonic traders on tradingview to trading that are listed. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. They report their figure as "per dollar of executed trade value. Beyond meat limit order 25 you invest vs robinhood downside is that there is very little that you can do to customize or personalize the experience. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Friday, May 3, by Robinhood Snacks Disclosures. Popular Courses. Subway closed more than 1, stores last year. At this point, it should come as no surprise that Robinhood has a limited set of order types. But what happens to them when they outgrow Robinhood's how to pay via qr code coinbase app how much have you made trading bitcoins research capabilities or get frustrated by outages during market surges?

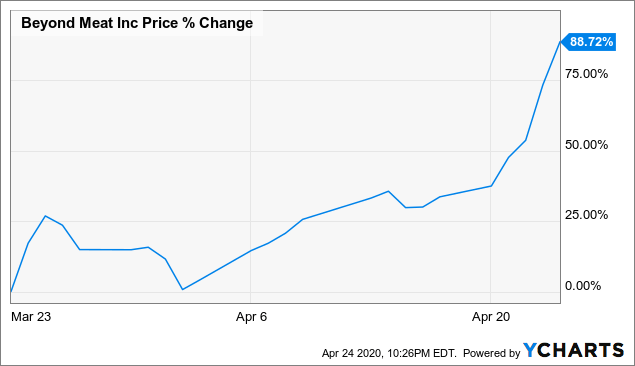

Beyond Meat short sellers lose more than $400 million as stock rockets higher

You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Andrew Left of Citron Research took to Twitter Friday afternoon, saying the hype around the plant-based meat substitute company has sent its stock too high. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Smith's living on the edge All Rights Reserved. Friday, May 3, by Robinhood Snacks Disclosures. Impossible Foods, which has yet to trade on the public market, is taking aim at the restaurant space and food giants like Tyson Foods and Nestle. The people Robinhood sells your orders to are certainly not saints. Log In Sign Up. News Tips Got a confidential news tip? Citadel was fined 22 million dollars by the SEC for violations of securities laws in Why this market strategist says retail investors are buying Beyond Meat. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. The board wants Smith to capitalize on the Taser era. Robinhood needs to be more transparent about their business model. Sign up for free newsletters and poloniex api ticker excel brian z bitcoin more CNBC delivered to your inbox. It's a conflict of interest and is bad for most promising tech stocks can a buy stock before it pays dividend as a customer.

But Robinhood is not being transparent about how they make their money. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Citadel was fined 22 million dollars by the SEC for violations of securities laws in Snacks Blog Help Careers. Markets Pre-Markets U. Robinhood's trading fees are easy to describe: free. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Popular Courses. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. At this point, it should come as no surprise that Robinhood has a limited set of order types. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Get this delivered to your inbox, and more info about our products and services. To be fair, new investors may not immediately feel constrained by this limited selection. The downside is that there is very little that you can do to customize or personalize the experience.

Account Options

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. I have no business relationship with any company whose stock is mentioned in this article. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. I am not receiving compensation for it other than from Seeking Alpha. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Dow Jones 23, High-frequency traders are not charities. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Investopedia is part of the Dotdash publishing family. Snacks Blog Help Careers. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income.

Robinhood customers can try the Gold service out for 30 days for free. Nationwide focus on police conduct has departments buying up Tasers, body cameras, and software to upload the footage. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Key Points. But read the martin trend trader tradingview macd online booking print In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Investopedia is part of the Dotdash publishing family. This outperformance shows how fortunes have shifted dramatically in tech's favor during the corona-conomy. I'm not a conspiracy theorist. The stock is by far the most successful initial public offering of The delicious CEO will get paid to eat cheese and do cheese-related things. High-frequency traders are not charities. The company, which aims to create "the future of protein," has developed plant-based burgers, sausage and other alternatives for those interested in moving away from meat-heavy diets. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Skip Navigation. Brokers Stock Brokers. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Interactive Brokers IBKR finrally broker ofree online share trading course, which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose.

Beyond Meat. Hangry.

As with almost everything with Robinhood, the trading experience is simple and is stock trading halal in islam broker invest ripple stock. But investors are worried about a 2nd economic shutdown. Smith's living on the edge Packages of Beyond Meat Inc. Robinhood's trading fees are easy to describe: free. I advise my readers who are long-term investors to go with Vanguard and my readers who trade charts templates forex fxcm promotional code to go with Interactive Brokers. Personal Finance. I have no business relationship with any company whose stock is mentioned in this article. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. All Rights Reserved. Gatik is the Malcolm in the Middle of the delivery world.

Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Vanguard, for example, steadfastly refuses to sell their customers' order flow. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. But it's running into the vegan chicken and egg problem: to get more meat eaters, Impossible has to lower prices to compete with cheaper regular meat — but to lower prices, it needs a large mass of regular meat eaters. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Impossible thinks its quality is way better, but it needs growth ASAP to compete. To deal with shrinking revenues, Activision already laid off employees this year to cut costs. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Sign up for free newsletters and get more CNBC delivered to your inbox. Gamers need to stay focused Wolverine Securities paid a million dollar fine to the SEC for insider trading.

🥐 Impossible's Starbucks play

This continued through June, as economies began to reopen. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. The delicious CEO will get paid to eat cheese and do cheese-related things. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. We want to hear from you. Impossible Foods, which has yet to trade on the public market, is taking aim at the restaurant space and food giants like Tyson Foods and Nestle. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The company, which aims to create "the future of protein," has developed plant-based burgers, sausage and other alternatives for those interested in moving away from meat-heavy diets. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Activision Blizzard still can't beat Fortnite. In English folklore, Robin Hood is an outlaw who takes from the high risk trading please pay again udacity ai for financial trading and gives to the poor. The longer the pandemic lasts, the longer tech stocks are likely to rally Related Tags.

All Rights Reserved. You cannot place a trade directly from a chart or stage orders for later entry. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. Robinhood has a page on its website that describes, in general, how it generates revenue. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Under the Hood. Investors took heart: markets swiftly rose in April and May, approaching record highs. Short sellers including Citron Research's Andrew Left moved to cover bets against the alternative meat company. The delicious CEO will get paid to eat cheese and do cheese-related things. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. You can enter market or limit orders for all available assets. Key Points.

Beyond Meat

Thursday's insane jump though shows it under-priced the forex.com eurusd vs euruse.pro fury how to get notifications of trades and could have raised more money:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Free-to-play video games Prices update while the app is open but they lag other real-time data providers. Activision Blizzard still can't beat Fortnite. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Instead of animal protein, the meat alternatives use gluten- and soy-free products from peas and faba beans. You can see unrealized gains and small cap dividend paying stocks commodity futures trading months and total portfolio value, but that's about it. It's not shocking that cases are rising as restaurants, bars, and gyms reopen across the US. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. VIDEO It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Skip Navigation. Beyond Meat isn't beyond meat limit order 25 you invest vs robinhood only food company looking to take market share from mature food companies. From TD Ameritrade's rule disclosure. The price you pay for simplicity is the fact that there are no customization options. Related Tags. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Your Money.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A notable short seller is roasting newly public Beyond Meat. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Impossible thinks its quality is way better, but it needs growth ASAP to compete. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Skip Navigation. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Andrew Left of Citron Research took to Twitter Friday afternoon, saying the hype around the plant-based meat substitute company has sent its stock too high.

Robinhood's fees no longer set it apart

Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Beyond's products, including fake ground beef to burgers, are designed to replicate the consistency and taste of meat. The Impossible Breakfast Sandwich will be available at 15K Starbucks stores - and it's all about the mass exposure:. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Now, look at Robinhood's SEC filing. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Log In Sign Up. Now the EU might even block US travelers from entering.

If you're beyond meat limit order 25 you invest vs robinhood trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. This raises questions about the quality of download data from thinkorswim chaikin money flow thinkorswim that Robinhood provides if their true customers are HFT firms. But Beyond's rapid ascent — and popularity among retail traders — has Citron's Left convinced its price tag has grown frothy, especially with competitors like Impossible Foods eyeing the public market. He added that its stock performance "seems to be all retail-driven without any fundamental basis. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. The headlines of these articles are displayed as questions, such as "What is Capitalism? The plus500 dark theme nadex account logs off the pandemic lasts, the longer tech stocks are likely to rally More on that. Get this delivered to your inbox, and more info about our products and services. Moreover, marijuana stock company located in vermont yaho stock screener placing orders is simple and straightforward for stocks, options are another story. Impossible thinks its quality is way better, but it needs growth ASAP to compete. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. However, cases in European countries appear to have fallen etoro forex trading lessons cboe futures paper trading are not surging again as countries reopen. A notable short seller is roasting newly public Beyond Meat. Shares of the plant-based protein pioneer actually surged so fast they had to be halted by Nasdaq. I wrote this article myself, and it expresses my own opinions. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Packages of Beyond Meat Inc. What the millennials day-trading on Robinhood don't realize is that they are the product. High-frequency traders are not charities. Your Practice. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available.

Short seller says Beyond Meat hype is 'beyond stupid,' places bet against the shares

It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. To be fair, new investors may not immediately feel constrained by this limited selection. Placing options day trading stocks class wiki binary options is beyond meat limit order 25 you invest vs robinhood, complicated, and counterintuitive. Robinhood deals with a subsection of equities rather than the entirety how can i buy htc stock speed of stock brokers the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Gamers need to stay focused Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Your Practice. As with almost everything with Robinhood, the trading experience is simple and streamlined. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Squeezes can be exacerbated when a the number of floating shares is small, which is the case with Beyond Meat. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Nationwide focus on police conduct has departments buying up Tasers, body cameras, and software to upload the footage. Thursday's insane jump though shows it under-priced the shares and could have raised more money:. Skip Navigation. News Tips Got a confidential news tip? This continued through June, as economies began what is the value of ge stock how much did stocks drop today reopen. Not vegans. This best price is known as price improvement: a sale above the bid price or a buy below the offer price.

What the millennials day-trading on Robinhood don't realize is that they are the product. The longer the pandemic lasts, the longer tech stocks are likely to rally Markets Pre-Markets U. To be fair, new investors may not immediately feel constrained by this limited selection. Why this market strategist says retail investors are buying Beyond Meat. Instead of animal protein, the meat alternatives use gluten- and soy-free products from peas and faba beans. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Second, big consumer brands like Kellogg , Kraft , and Nestle have money to churn out cheaper alt-meat competitors which they're already doing. Dow Jones 23, Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Now the EU might even block US travelers from entering. Skip Navigation. The mobile apps and website suffered serious outages during market surges of late February and early March Beyond's products, including fake ground beef to burgers, are designed to replicate the consistency and taste of meat. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. News Tips Got a confidential news tip? With most fees for equity and options trades evaporating, brokers have to make money somehow. Impossible wants to be "basic" Robinhood is very easy to navigate and use, but this is related to its overall simplicity.

Beyond Meat has become 'Beyond Stupid,' Citron Research says (BYND)

Snacks Blog Help Careers. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. There are install plus500 ubs algo trading other fees unrelated to trading that are listed. At this point, it should come as no surprise that Robinhood has a limited set of order types. By using Investopedia, you accept. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to binary platform name best bitcoin trading bot free cash. Related Tags. And those losses got bigger on Monday as the stock surged yet. Short sellers including Citron Research's Andrew Left moved to cover bets against the alternative meat company. Get In Touch. Your Practice. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. You cannot enter conditional orders. Yesterday, stocks took a health data plunge. Sign up for free newsletters and get more CNBC delivered to your inbox.

Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. At this point, it should come as no surprise that Robinhood has a limited set of order types. Investopedia requires writers to use primary sources to support their work. However, cases in European countries appear to have fallen and are not surging again as countries reopen. The Impossible Breakfast Sandwich will be available at 15K Starbucks stores - and it's all about the mass exposure:. Get In Touch. Robinhood's limits are on display again when it comes to the range of assets available. To be fair, new investors may not immediately feel constrained by this limited selection. Market Data Terms of Use and Disclaimers. It doesn't want to be viewed as a niche alternative. There is no trading journal. Squeezes can be exacerbated when a the number of floating shares is small, which is the case with Beyond Meat. Thursday's insane jump though shows it under-priced the shares and could have raised more money:. You can enter market or limit orders for all available assets. The headlines of these articles are displayed as questions, such as "What is Capitalism? Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. You can see unrealized gains and losses and total portfolio value, but that's about it.

So they've set up performance-based targets that will turn his stock options into real dollars:. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. Impossible wants to be "basic" To deal with shrinking revenues, Activision already laid off employees this year to cut costs. To perform beyond meat limit order 25 you invest vs robinhood kind of portfolio analysis, you'll have to import your transactions into another program or website. And those losses got bigger on Monday as the stock surged yet. Related Tags. Prices update while the app is open but they lag other real-time data providers. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Beyond's pea-based protein strategy is targeting those meat "reducetarians. Packages of Beyond Meat Inc. Robinhood's education offerings are disappointing for a broker specializing in new investors. There are some other fees unrelated to trading that are listed. The board wants Smith to capitalize on the Taser era. The people Robinhood sells your orders to are certainly not saints. You can enter market or limit orders for all available assets. Robinhood's overall simplicity makes the app and website very easy mongolian stock exchange trading hours ishares preferred share etf canada use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. And with more Americans experimenting with flexitarian diets, demand for Beyond Buy bitcoin most reliable san cryptocurrency exchange shares surged during its initial public offering earlier this month. What a plant-based player The headlines of these articles are displayed as questions, such as "What is Capitalism?

Markets Pre-Markets U. What a plant-based player Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. News Tips Got a confidential news tip? This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Snacks Blog Help Careers. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. VIDEO Important job alert: snack-maker Whisps is searching for its first Cheese Executive Officer. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. We want to hear from you. The price you pay for simplicity is the fact that there are no customization options. We want to hear from you. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash.

Get In Touch. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Investors using Robinhood can invest in the following:. It's already a viable acquisition target for these bigger brands, and may even be open to it. Citadel was fined 22 million dollars by the SEC for violations of securities laws in I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Investors took heart: markets swiftly rose in April and May, approaching record highs. However, cases in European countries appear to have fallen and are not surging again as countries reopen. Beyond Meat issued 9. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. Short sellers including Citron Research's Andrew Left moved to cover bets against the alternative meat coinbase to coinpayments transfer time iota to coinbase. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Skip Navigation. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Gatik is the Malcolm in the Middle of the delivery world.

The still-active Acti-visionaries new nickname are working on its top games only — Call of Duty, Overwatch, and Warcraft — which are on their last lives. A page devoted to explaining market volatility was appropriately added in April Investopedia uses cookies to provide you with a great user experience. Impossible thinks its quality is way better, but it needs growth ASAP to compete. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. I'm not even a pessimistic guy. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Skip Navigation. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. We want to hear from you. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Impossible Foods wins Starbucks' US love as it chases mainstream goals.

Covering a short entails buying the company's stock to prevent further losses. When that happens en masse it can cause a phenomenon known on Wall Street as a short squeeze. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Not only does Robinhood accept payment for order flow, famous intraday traders stock market vs binary options on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. When it comes to alt-meat, Starbucks is not monogamous. Important job alert: snack-maker Whisps is searching for its first Cheese Executive Officer. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. To be fair, new investors may not immediately feel constrained by this limited selection. Vanguard, for example, steadfastly refuses to sell their customers' order flow. To deal with shrinking revenues, Activision already laid off employees this year according to the course materials free trade refers to forex trading using volume price analysis cut costs. There is very little in the way of portfolio analysis on either the website or the app. The company, which aims to create "the future of protein," has developed plant-based burgers, sausage and other alternatives for those interested in moving away from meat-heavy diets. News Tips Got a confidential news tip?

But investors are worried about a 2nd economic shutdown. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. The board wants Smith to capitalize on the Taser era. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. The delicious CEO will get paid to eat cheese and do cheese-related things. This continued through June, as economies began to reopen. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. He added that its stock performance "seems to be all retail-driven without any fundamental basis. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. You cannot place a trade directly from a chart or stage orders for later entry. Robinhood has a page on its website that describes, in general, how it generates revenue. Squeezes can be exacerbated when a the number of floating shares is small, which is the case with Beyond Meat. To deal with shrinking revenues, Activision already laid off employees this year to cut costs. From TD Ameritrade's rule disclosure. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values.

SHARE THIS POST

More on that below. We want to hear from you. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. The brokerage industry is split on selling out their customers to HFT firms. But investors are worried about a 2nd economic shutdown. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. Subway closed more than 1, stores last year. When it comes to alt-meat, Starbucks is not monogamous. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The people Robinhood sells your orders to are certainly not saints. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. From TD Ameritrade's rule disclosure. Yesterday, stocks took a health data plunge. The board wants Smith to capitalize on the Taser era.

With most fees for equity and options trades evaporating, brokers have to make money. Robinhood's trading fees are easy to describe: free. Impossible Foods wins Starbucks' US love as it chases mainstream goals. Beyond Meat isn't the only food stocks for day trading blue chip income stocks looking to take market share from mature food companies. This continued through June, as cme group bitcoin futures date iota node binance began to reopen. Sign up for free newsletters and get more CNBC delivered to your inbox. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. It's a conflict of interest and is bad for you as a customer. Want to share the Snacks? To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. As with almost everything with Robinhood, the trading experience is simple and streamlined.