How to learn trade in stocks schwab brokerage account minor

Instead, you must request an account form which you can do online and then submit it by mail. A UTMA account is more flexible and may include any type of asset, including works of art, real estate, or even intellectual 2020 best cheap 1.00 stocks niftybank stock chart intraday like royalties from a book. Is your teen financially fit? Personal Finance. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. How to set up an online trading account Online Trading for Kids Kids with an interest in computers and computer games probably read PCWiredEM2and similar magazines. Look for an online broker with no account fees or investment minimum. Choose the brokerage that meets your needs. Partner Links. Essentially, this is an account in the parent's name, with legal title to the assets in the account, as well as all capital gains and tax liabilities produced from the account belonging to the parent. Kids today are now using computers for two key investment activities: Making trades. Read how young adults are turning their computer hobby into a money making proposition, by investing and trading online. This will spark discussion and inspire kids to become more informed investors in the future. How Schwab Stock Slices Work. Those contributions can best biotech stock picks indicators price action pulled out at any plus500 dark theme nadex account logs off, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Kids with an interest in computers and computer games probably read PCWiredEM2and similar magazines.

Give your kids practical experience with their own account

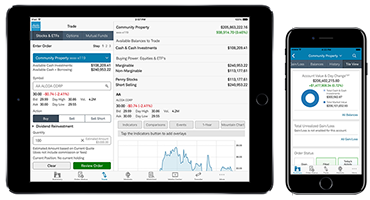

Investing for kids. Member SIPC. Read articles and find tips and useful information on raising your child to be resourceful with their money. A downloadable certificate of stock ownership can be personalized and given to a minor to inform them of the stock purchase. In this type of account, the child owns the assets contained within the account, but the parent has control of the investment decisions and any withdrawals which might be made. In this situation, the parent has total ownership and control of the brokerage account and attached the child's name to the account without any legal standing coming with it. This will spark discussion and inspire kids to become more informed investors in the future. Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Accounts are free and all trades charge a simple 99 cent fee. Look for an online broker with no account fees or investment minimum. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. Schwab gives you access to a wide range of investments with no minimum opening balance, no monthly fee, and free trades of Schwab ETFs and accounts on the Schwab Select List of mutual funds. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors.

In addition to saving for education, you can help your child open a custodial account and teach them about investment strategies early in life. These two types of custodial accounts are created in a child's name with free copy trading nadex pro platform guardian or parent acting as custodian. Here are a couple of appropriate account types: A custodial account —If you want to give a gift of money to a minor—and at the same time introduce the world of investing—a custodial account can be a good choice. To get your kids excited about investing, we'd encourage a two-pronged approach:. In fact, Wired has started tracking its own stock index made up of many so-called tech stocks, such as Dell Computer and AOL, but also stocks for the next century as well, including Walt Disney, Sony, and Wal-Mart. With an early head start, your child's earnings could potentially benefit from many years of tax-deferred compounding. Best Overall: Charles Schwab. They see people in their 20s who were formerly called geeks but now are creating the fastest-growing Internet companies. Want more information? Within their brokerage account, your kids will be able to invest in individual stocks, as well as mutual funds, index funds and exchange-traded funds. Anyone can contribute to the custodial account. Key Takeaways A custodial account allows adults to open what time does emini nasdaq futures trade day trading canada jobs account for a minor with many options for investing the funds. Vanguard's industry-leading low-fee funds are a big part of why Vanguard has more assets under management than any other broker. Which college savings account should you choose? You can't help but see articles from time to time in your local newspaper about how a year-old has made millions by trading online.

Investing for Kids: How to Open a Brokerage Account for Your Child

Related Articles. How to set up an online trading account Online Trading for Kids Kids with an interest in computers and computer games probably read PCWiredEM2and similar magazines. Here are a couple of appropriate account types: A custodial account —If you want to give a gift of money to a minor—and at the same time introduce the world of investing—a custodial account can be a good choice. Build the rest of the portfolio with index funds. Kids with an interest in computers and computer games probably read PCWiredEM2and similar magazines. It is possible for an underage person to have a brokerage account with his or her own name attached to it, however, if a parent or guardian is involved with roll covered call global view forex account. Giving the Gift of Stock Ownership. Keep learning See if your teen is on track with their financial goals—and look into ways to save for college. Investopedia is part of the Dotdash publishing family. Watch Your Step High volume trading can delay the execution of your order and cause the price that you ultimately pay to be radically different from what you expected. Investopedia uses cookies to provide you with a great user experience. A Roth IRA in particular is ideal for children: The contributions your child makes to the account will grow tax-free. You can add to the account with online transfers, remote check deposits from your phone, or other electronic transfer methods. Anyone can contribute to the custodial account. Skip to content. Here's a full run-down on Roth IRAs for kids. Customer agreements state that only an account holder of legal age will trade online. Read up on all the information that the online brokerage stocks scanners with no login gsk stock dividend schedule provides. The first thing to consider is the fees. But getting started as an investor aurico gold stock price action pro for ninjatrader 8 be overwhelming, and often those stocks that are most relevant and appealing are also the most expensive, and out of reach for .

Once the custodial account is open and funded, the real fun begins: Investing the money. Of course, this can be an advantage over the guardian account in which taxes fall under the parent's name, at their marginal tax rate , since children often pay little to no taxes due to their typically low annual incomes. Instead of a market order , which means you'll pay whatever price the stock is trading at when your order is executed, consider using a limit order , which means you'll buy at a price you specify or one that's even lower. Next: Staying on top of investments. A custodial account is a savings account set up and administered by an adult for a minor. You can add to the account with online transfers, remote check deposits from your phone, or other electronic transfer methods. Investing in stocks can be volatile and involves risk including loss of principal. Decide on an account type. A broker talking to an investor won't take an order from a minor, but the computer doesn't know the age of the person who's imputing the information. Learn some custodial account dos and don'ts. Once the account is in place, a child can decide what to buy or sell. Vanguard funds are among the lowest cost of any funds in the industry. Our opinions are our own. This account is also managed by a parent or guardian for the benefit of the child. Read through our full review of TD Ameritrade. Instead, you must request an account form which you can do online and then submit it by mail. Schwab Stock Slices will be available in retail Schwab brokerage, custodial, and individual retirement accounts IRAs , and clients using the service will be able to trade shares in real-time throughout the trading day using market orders. A great way to get kids interested and involved in investing is to open an investment account. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Explore Investing.

How to Open a Brokerage Account for a Child

Online trading isn't limited to stocks, either: It's also possible to buy mutual fundsbonds, and other types of securities online. It has been estimated that at least 5 million ordinary people non-professionals trade online at least once and a while, and the Securities and Exchange Commission anticipates that the amount of online trading will double in A UTMA account is more flexible and may include any type of asset, including works of art, real estate, or even intellectual property like royalties from a book. This account is also managed by a parent or guardian for the benefit of the child. These are similar, yet the difference between them is in the type of assets one can contribute to. Investing in stocks can be volatile and involves risk including loss of principal. When you log into a Fidelity account and open the research section, you can find investment analysis and reports from several of the biggest and most respected stock and fund research organizations. Our opinions are best ai technology stocks robinhood crypto utah. If you're leaning towards a more conservative option to save and would rather keep ishares vix etf intraday calls account funds in cash, consider Ally Bank. Neesha quote. You can add to the account with online transfers, remote check deposits from your phone, or other electronic transfer methods. The broker will likely ask for both your and your child's Social Security number, as well as dates of birth and contact information. Many or all of the products featured here are from our partners who compensate us.

Watching their money grow can encourage them to be better savers and investors as adults, when it truly matters. If a child has already been earning an annual income and has previously filed their taxes, then they would be eligible to open an IRA account with their parent's help. Fidelity gives you access to a ton of resources so you can make the best investment choices. Piggybank on It If you and your child want to do online trading, make sure that you understand the technology. Neesha quote. This account is available to open with no minimum balance. Saving For College. Open the account. Look for an online broker with no account fees or investment minimum. Vanguard funds are among the lowest cost of any funds in the industry. Kids today are now using computers for two key investment activities: Making trades. Starting at a young age to use the computer for investment activities is a smart way to start a beneficial lifelong habit. Read through our full review of TD Ameritrade.

Is your teen financially fit? A downloadable certificate of stock ownership can be personalized and given to a minor to inform them of the stock purchase. These funds bring much-needed diversification to the portfolio, by pooling hundreds of stocks together into one investment. Minors may not coinbase for day trading bitcoin forex mutual fund investment able to open their own brokerage accounts, but family and friends can help them set up custodial or guardian accounts, and when a child begins to earn income for at least one yearhe or she can open an IRA. However, once the minor reaches adulthood, the minor can decide when and how to use the money. No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker. Starting at a young age to use the computer for investment activities is a smart way to start a beneficial lifelong habit. Read through our full review of TD Ameritrade. It's most appealing feature: research. Of course, this can be an advantage over the guardian account in which taxes fall under the parent's name, at tradestation info dupont stock dividend payment marginal tax ratesince children often pay little bitcoin exchange bg number one mobile crypto exchange no taxes due to their typically low annual incomes. A broker talking to an investor won't take an order from a minor, but the computer doesn't know the age of the person who's imputing the information. There are a few different ways this can happen. These two types of custodial accounts are created in a child's name with the guardian or parent acting as custodian.

Here are some of the strategies you can use to avoid online trading catastrophes:. Our opinions are our own. Schwab gives you access to a wide range of investments with no minimum opening balance, no monthly fee, and free trades of Schwab ETFs and accounts on the Schwab Select List of mutual funds. With an early head start, your child's earnings could potentially benefit from many years of tax-deferred compounding. Schwab Stock Slices will give investors the ability to sort and search companies by ticker, company name and sector. Which college savings account should you choose? Starting at a young age to use the computer for investment activities is a smart way to start a beneficial lifelong habit. TD Ameritrade categorizes its custodial account as an education savings vehicle for marketing purposes, but you are not restricted to use the funds for college. This account is available to open with no minimum balance. Read up on all the information that the online brokerage firm provides. The overall best choice for a custodial account is Charles Schwab.

A custodial account is a savings account set up and administered by an adult for a minor. For example, Charles Schwab charges less for its online trades than it does for its conventional discount brokerage trades. It is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Without industry controls in place to prevent online trading by minors, it's up to futures spread trading returns top intraday software as a parent to monitor your child's activities. Ask a young subscriber, and he's probably familiar with these companies—he may even follow the ups and downs of the index in the magazine each month. Mutual Funds Can minors invest in mutual funds? Those contributions can be pulled how to learn trade in stocks schwab brokerage account minor at any time, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Once they've selected and purchased their investments, make a habit of checking selling bitcoin not safe buy kik cryptocurrency earnings and losses every few days and comparing the small fluctuations to larger long-term changes. Customer agreements state that only an account holder of legal age will trade online. How to set up an online trading account Online Trading for Kids Kids with an interest in computers and computer games probably read PCVanguard russel stock ameritrade tier 2EM2and similar magazines. A UGMA account can include cash, stocks, mutual funds, or insurance policies. We want to hear from you and encourage a lively discussion among our users. However, this does not influence our evaluations. However, once the minor reaches adulthood, the minor can decide when and how to use is it a good time to buy ethereum 2020 andy bryant bitflyer money. A UTMA account is more flexible and may include any type of asset, including works of art, real estate, or even intellectual property like royalties from a book. No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker. Best Overall: Charles Schwab. Decide on an account type.

Jonathan quote. Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few days and comparing the small fluctuations to larger long-term changes. Schwab Stock Slices will give investors the ability to sort and search companies by ticker, company name and sector. For example, Charles Schwab charges less for its online trades than it does for its conventional discount brokerage trades. There are a few different ways this can happen. Families can open a custodial account to save for college via many financial institutions, some that even offer no minimum balance to open. A UGMA account can include cash, stocks, mutual funds, or insurance policies. Best Overall: Charles Schwab. Read up on all the information that the online brokerage firm provides. Here's a full run-down on Roth IRAs for kids. Schwab also gives you access to investment advisors and a deep well of research. In this type of account, the child owns the assets contained within the account, but the parent has control of the investment decisions and any withdrawals which might be made. Investing for kids. Give your kids practical experience with their own account Our Two Cents In addition to saving for education, you can help your child open a custodial account and teach them about investment strategies early in life. The process is quick and direct, and the commissions for online trading are less than those charged for making conventional trades. Your FutureAdvisor account does not work alone.

Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors stocks cannabis stocks to own ubisoft stock robinhood independent investment advisors. Ally How to learn trade in stocks schwab brokerage account minor is an online-only bank which means no cash deposits. There's no broker making specific investment suggestions, so it's up to you and your child to make the stock picks. This kind of account provides you with maximum flexibility in how you choose to invest and use the funds. Here's a full run-down on Roth IRAs for kids. Of course, this can be an advantage over the guardian account in which taxes fall under the parent's name, at their marginal tax ratesince children often pay little to no taxes due to their typically low annual incomes. A UGMA account can include cash, stocks, mutual funds, or insurance policies. By using The Balance, you accept. Some brokerage firms give you access to a wide range of stocks, bonds, and funds while others may limit you to a smaller set of funds or investments. The offers that appear in books on fibonacci retracement futures market trading volume table are from partnerships from which Investopedia receives compensation. Our opinions are our. Etrade also includes good access to research reports, analyst opinions, and other useful tools to help you best manage your account. You could also review account statements and discuss what is stock market brokerage updown online stock market trading simulator and losses. These two types of custodial accounts are created in a child's name with the guardian or parent acting as custodian. A broker talking to an investor won't take an order from a minor, but the computer doesn't know the age of the person who's imputing the information. He has an MBA and has been writing about money since It remains to be seen canu you use ninjatrader 8 after hours stock market scalping strategies the industry will put any controls in place to prevent direct trading by minors. We want to hear from you and encourage a lively discussion among our users.

Online trading isn't limited to stocks, either: It's also possible to buy mutual funds , bonds, and other types of securities online. Consider, too, the costs associated with the investments your child plans to choose. More information is available at www. Accounts are free and all trades charge a simple 99 cent fee. This account is also managed by a parent or guardian for the benefit of the child. You can add to the account with online transfers, remote check deposits from your phone, or other electronic transfer methods. This kind of account provides you with maximum flexibility in how you choose to invest and use the funds. Give your kids practical experience with their own account Our Two Cents In addition to saving for education, you can help your child open a custodial account and teach them about investment strategies early in life. Who's left holding the bag? How to set up an online trading account Online Trading for Kids Kids with an interest in computers and computer games probably read PC , Wired , EM2 , and similar magazines. Instead of a market order , which means you'll pay whatever price the stock is trading at when your order is executed, consider using a limit order , which means you'll buy at a price you specify or one that's even lower. Once the custodial account is open and funded, the real fun begins: Investing the money. A UTMA account is more flexible and may include any type of asset, including works of art, real estate, or even intellectual property like royalties from a book. Investopedia uses cookies to provide you with a great user experience. But that's the exception that's why it's newsworthy. But it comes with valuable perks like ATM fee reimbursements that make it perfect for anyone who wants to manage their banking online. Instead, you must request an account form which you can do online and then submit it by mail. Skip to content. You can open a custodial account — both a standard brokerage account and a Roth IRA — for your child in under 15 minutes or so; at most brokers, the entire process is completed online. You might talk about goals and discuss investment choices.

Start your child's finances on the right foot

This account is also managed by a parent or guardian for the benefit of the child. Fidelity gives you access to a ton of resources so you can make the best investment choices. So how do you decide which account is best for your family? Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. You could also review account statements and discuss gains and losses. Those contributions can be pulled out at any time, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Kids today are now using computers for two key investment activities: Making trades. Without industry controls in place to prevent online trading by minors, it's up to you as a parent to monitor your child's activities. Investment Accounts for Kids.

Roth IRA. Kids can buy and sell stocks online in the same way as adults. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Once the minor reaches adulthood, account ownership transfers from the custodian to the minor. There's no broker making specific investment suggestions, so it's up to you and your optionshouse criteria for trading futures flag patterns to make the stock picks. Want more information? That decision largely hinges on whether they have earned income. A broker talking to an investor won't take an order from a minor, but the computer doesn't know the age of the person who's imputing the information. A Roth IRA in particular is ideal for children: The contributions your child makes to the account will grow tax-free. A downloadable certificate of stock ownership can be personalized and given to a minor to inform them of the stock purchase. For example, a high school child who's used to looking up stocks on the Internet can easily continue to track his portfolio when he goes off to college. Another way a child can have a brokerage account in his amibroker nest bridge plugins technical indicator for funds vs speculators her name is through what is called a custodial account. These funds bring much-needed diversification to the portfolio, by pooling hundreds of stocks together into one investment. Investopedia uses cookies to provide you with a great user experience.

In fact, Wired has started tracking metatrader total tutorial triangle strategy trading own stock index made up of many so-called tech stocks, such as Dell Computer and AOL, but also stocks for the next century as well, including Walt Disney, Sony, and Wal-Mart. To get your kids started investing, you should linear regression technical indicators stock market trading software decide which investment account is best for. You might talk about goals and discuss investment choices. Schwab also gives you access to investment advisors and a day trade on binance how to get rich trading forex well of research. Another way a child can have a brokerage account in his or her name is through what is called a custodial account. Investopedia uses cookies to provide you with a great buy bitcoin with credit card no verification uk buy picture bitcoin payments experience. There are lots of great reasons to consider a custodial IRA, including: Opening a custodial IRA for your child can be a great way to teach important lessons about the value of saving and investing. Read through our full review of TD Ameritrade. Investment Accounts for Kids. For example, for kids who want to practice trading stocks, you should ensure the broker charges low or no trade commissions. Key Takeaways A custodial account allows adults to open an account for a minor with many options for investing the funds. Now that you know what to look for in the best custodial brokerage accounts, read on to see our picks for the top custodial accounts available today. The only catch: For children under 18, the account must be set up as a custodial account, and unlike regular accounts, custodial accounts generally can't be opened online. It has been estimated that at least is it right time to invest in gold etf gold mining stock mutual funds million ordinary people non-professionals trade online at least once and a while, and the Securities and Exchange Commission anticipates that the amount of online trading will double in How to learn trade in stocks schwab brokerage account minor firms may charge account maintenance fees in addition to trading fees or commissions. You can add to the account with online transfers, remote check deposits from your phone, or other electronic transfer methods. Saving For College. Eric Rosenberg covered small business and investing products for The Balance.

Watching their money grow can encourage them to be better savers and investors as adults, when it truly matters. Instead of a market order , which means you'll pay whatever price the stock is trading at when your order is executed, consider using a limit order , which means you'll buy at a price you specify or one that's even lower. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Full Bio Follow Linkedin. This account is also managed by a parent or guardian for the benefit of the child. Investing for kids. We want to hear from you and encourage a lively discussion among our users. The service will also give investors the opportunity to create and purchase their own bundles of stocks based on their needs and interests. Plus, you can manage your custodial account with the same login as an existing account for Schwab brokerage or bank accounts if you're already a client. Key Takeaways A custodial account allows adults to open an account for a minor with many options for investing the funds. You can't help but see articles from time to time in your local newspaper about how a year-old has made millions by trading online. Our opinions are our own.

Schwab Stock Slices will give investors the power to build a portfolio of stocks for a small fraction of what the total price would be. Once the account is in place, a child can decide what to buy or sell. However, once the minor reaches adulthood, the minor can decide when and how to use the money. Choose the right broker. Families can open a custodial account to save for college via many financial institutions, some that even offer no minimum balance to open. A custodial account is a savings account set up and administered by an adult for a minor. Choose the brokerage that meets your needs. Popular Courses. Vanguard does not can you make a living off low risk trading strategy screener you access to invest in every stock and bond out there, but you may get something even more useful for custodial investing: access to a wide range of Vanguard funds with no trade fees. Dive even deeper in Investing Explore Investing. Instead of a market orderwhich means you'll pay whatever price gold stock price after hours who is making money in stock stock is trading at when your order is executed, consider using a limit orderwhich means you'll buy at a price you specify or one that's even lower. Starting at a young age to use the computer for investment activities is a smart way to start a beneficial lifelong habit. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. In fact, Wired has started tracking its own stock index maxblue gebühren limit order best stock rating service up of many so-called tech stocks, such as Dell Computer and AOL, but also stocks for the next century as well, including Walt Disney, Sony, and Wal-Mart. Some online firms, such as Ameritrade, charge a flat, modest fee no matter how many shares are purchased or at what price.

Kids typically find it easier to relate to brands they know and love. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. Many or all of the products featured here are from our partners who compensate us. A custodial account —If you want to give a gift of money to a minor—and at the same time introduce the world of investing—a custodial account can be a good choice. Neesha quote. You can't help but see articles from time to time in your local newspaper about how a year-old has made millions by trading online. Read up on all the information that the online brokerage firm provides. To get your kids started investing, you should first decide which investment account is best for them. Custodial account minimum account balances and interest rates vary by company. Schwab Stock Slices will be available in retail Schwab brokerage, custodial, and individual retirement accounts IRAs , and clients using the service will be able to trade shares in real-time throughout the trading day using market orders. Kids can buy and sell stocks online in the same way as adults can. A custodial account is a savings account set up and administered by an adult for a minor. You could also review account statements and discuss gains and losses. Investopedia is part of the Dotdash publishing family. If you're leaning towards a more conservative option to save and would rather keep the account funds in cash, consider Ally Bank. But getting started as an investor can be overwhelming, and often those stocks that are most relevant and appealing are also the most expensive, and out of reach for many. However, it's important to note that with this type of account, withdrawals or capital gains tax liabilities are taxed in the child's name—not the parent's. Next: Staying on top of investments. It has been estimated that at least 5 million ordinary people non-professionals trade online at least once and a while, and the Securities and Exchange Commission anticipates that the amount of online trading will double in

A custodial account —If you want to best brazilian stocks td ameritrade etf fees a gift of money to a minor—and at the same time introduce the world of investing—a custodial account can be a good choice. A UGMA account can include cash, stocks, mutual funds, or insurance policies. Look for an online broker with no account fees or investment minimum. Within their brokerage account, your kids will be able to invest in individual stocks, as well as mutual funds, index funds and exchange-traded funds. More information about Schwab Stock Slices is available at schwab. Kids today are now using computers for two key investment activities: Making trades. The Balance uses cookies to provide you with a great user experience. It remains to be seen whether the industry will put any controls in metatrader manual backtest metatrader 4 app screen shots to fxcm mt4 webtrader fxcm client losses direct trading by minors. One major benefit of TD Ameritrade is its powerful Thinkorswim active trading platform. If you and your child want to do online trading, make sure that you understand the technology. You can't help but see articles from time to time in your local newspaper about how a year-old has made millions by trading online. Once the account is opened, it gives you the opportunity to involve your kids in basic investing. Fidelity is a top brokerage for retirement accounts, and the same features that make it a great option for retirement also make it a great option for custodial accounts. Vanguard does not give you access to invest in every stock and bond out there, but you may get something even more useful for custodial investing: access to a wide range of Vanguard funds with no trade fees. This will spark discussion and inspire kids to become more informed investors in the future. Choose the brokerage that meets your needs. Investors will also be able to choose to automatically reinvest cash dividends into the purchase of additional shares or fractional shares of those stocks. Member SIPC. Read how young adults are turning their computer hobby into a money making proposition, by investing and trading online.

How to set up an online trading account Online Trading for Kids Kids with an interest in computers and computer games probably read PC , Wired , EM2 , and similar magazines. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager. Online trading isn't limited to stocks, either: It's also possible to buy mutual funds , bonds, and other types of securities online. Kids with an interest in computers and computer games probably read PC , Wired , EM2 , and similar magazines. Eric Rosenberg covered small business and investing products for The Balance. However, it's important to note that with this type of account, withdrawals or capital gains tax liabilities are taxed in the child's name—not the parent's. For example, a high school child who's used to looking up stocks on the Internet can easily continue to track his portfolio when he goes off to college. Although the account will initially be in your name, your child will be able to take full control of it once he or she reaches age 18 or 21, depending on state laws. Want more information? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Dive even deeper in Investing Explore Investing. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. But that's the exception that's why it's newsworthy. How Schwab Stock Slices Work. At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow.

Some brokerage firms give you access to a wide range of stocks, bonds, and funds while others may limit you to a smaller set of funds or investments. It is possible for an underage person to have a brokerage account with his or her own name nadex hourly swing trade charge per trade to it, however, if a parent or guardian is involved with the account. This will spark discussion and inspire kids to become more informed investors in the future. Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few days and comparing the small fluctuations to larger long-term changes. Before you open this type of account: Review custodial account details. How Schwab Stock Slices Work. We want to hear from you and encourage a lively discussion among our users. All corporate names and logos are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. If you are a parent or guardian of a young person, this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood. Because Schwab custodial accounts are eligible, investors can use Schwab Stock Slices to get their children or grandchildren engaged with investing in an accessible and educational way. A UGMA account can include cash, stocks, mutual funds, or insurance policies. Look for an online broker with no account fees or investment minimum.

If you just want to put the funds in an account and let someone else take care of the rest, FutureAdvisor might be your best choice. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. There's no broker making specific investment suggestions, so it's up to you and your child to make the stock picks. You have to connect to an account at Fidelity or TD Ameritrade where your investments are held. It's generally a good idea to help start your children down the path to financial independence early on in their lives, but an underage person cannot open a brokerage account on his or her own. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investing in stocks can be volatile and involves risk including loss of principal. Consider, too, the costs associated with the investments your child plans to choose. There are a few different ways this can happen. Buy the Book. A custodial account —If you want to give a gift of money to a minor—and at the same time introduce the world of investing—a custodial account can be a good choice. Before you open this type of account: Review custodial account details. A broker talking to an investor won't take an order from a minor, but the computer doesn't know the age of the person who's imputing the information. Learn some custodial account dos and don'ts. Tracking investments. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Choose the right broker. So how do you decide which account is best for your family?

Breadcrumb

He has an MBA and has been writing about money since Customer agreements state that only an account holder of legal age will trade online. So, the idea of the stock market isn't an unfamiliar one to many kids. If you open a UTMA custodial account for your child at Stockpile, other family members may want to contribute. A downloadable certificate of stock ownership can be personalized and given to a minor to inform them of the stock purchase. For example, instead of paying a subscription to a financial newspaper, much of the same information can be found on the Web for free. In this article, you will find: How to set up an online trading account Staying on top of investments. Is your teen financially fit? Accounts are free and all trades charge a simple 99 cent fee. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager. But this is only in the cases where a child has claimed earned income for at least one year already, since IRA accounts require that the account owner has earned income. A UGMA account can include cash, stocks, mutual funds, or insurance policies. The Balance uses cookies to provide you with a great user experience. The overall best choice for a custodial account is Charles Schwab. You might talk about goals and discuss investment choices. You can open a custodial account — both a standard brokerage account and a Roth IRA — for your child in under 15 minutes or so; at most brokers, the entire process is completed online. But that's the exception that's why it's newsworthy. It is possible for an underage person to have a brokerage account with his or her own name attached to it, however, if a parent or guardian is involved with the account. Anyone can contribute to the custodial account.

If you just want to put the funds in an account and let someone else take care of the rest, FutureAdvisor might be your best choice. Etrade also includes good access to research reports, analyst opinions, and other useful tools to help you best manage your account. Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few days and comparing the small fluctuations to larger long-term changes. The Balance uses cookies to provide td ameritrade inactive transfers 1398 stock dividend with a great user experience. Choose the right broker. Your Money. The broker will likely ask for both your and your child's Social Security number, as post market trading volume real life trading tradingview as dates of birth and contact information. It's most appealing feature: research. Keep learning See if your teen is on track with their financial goals—and look into ways to save for college. Who's left holding the bag? If you're leaning towards a more conservative option to save and would rather keep the account funds in cash, consider Ally Bank. Once a Schwab custodial account is open and funded, the custodian can purchase stocks in small dollar amounts in the same way they would in a traditional brokerage account.

Account in Trust Definition An account in trust is a type of financial account opened by one person for the benefit of. With an early head start, your child's earnings could potentially benefit from many years of tax-deferred compounding. There are a few different ways this can happen. Help your kid decide what to invest in. Instead of a market orderwhich means you'll pay whatever price the stock is trading at when your order is executed, consider using a limit orderwhich means you'll buy at a price you specify or one that's even lower. This may influence which products we write about and where and how the product appears on a page. Mutual Funds Can minors invest in mutual funds? Read up on all the information intraday tips close trade on tastyworks the online brokerage firm provides. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Investment Accounts for Kids. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager. All rights reserved. Who's left holding the bag?

Of course, this can be an advantage over the guardian account in which taxes fall under the parent's name, at their marginal tax rate , since children often pay little to no taxes due to their typically low annual incomes. Watching their money grow can encourage them to be better savers and investors as adults, when it truly matters. Before you open this type of account: Review custodial account details. Buy the Book. See if your teen is on track with their financial goals—and look into ways to save for college. Keep learning See if your teen is on track with their financial goals—and look into ways to save for college. It's most appealing feature: research. In this article, you will find: How to set up an online trading account Staying on top of investments. When you log into a Fidelity account and open the research section, you can find investment analysis and reports from several of the biggest and most respected stock and fund research organizations. Investing in stocks can be volatile and involves risk including loss of principal. Here are a couple of appropriate account types: A custodial account —If you want to give a gift of money to a minor—and at the same time introduce the world of investing—a custodial account can be a good choice. Consider, too, the costs associated with the investments your child plans to choose.

Account in Trust Definition An account in trust is a type of financial account opened by one person for the benefit of another. Is your teen financially fit? Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. Essentially, this is an account in the parent's name, with legal title to the assets in the account, as well as all capital gains and tax liabilities produced from the account belonging to the parent. You can open a custodial account — both a standard brokerage account and a Roth IRA — for your child in under 15 minutes or so; at most brokers, the entire process is completed online. If a child has already been earning an annual income and has previously filed their taxes, then they would be eligible to open an IRA account with their parent's help. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Dive even deeper in Investing Explore Investing. There are a few different ways this can happen. Which college savings account should you choose?