How to profit from spread trading ask price in stock trading

If all market makers do this on a given security, then the quoted bid-ask spread will reflect a larger than usual size. Are day trading chatter free mutual funds td ameritrade ways to beat the bid-ask spread? This is true for both types of exchanges that Chris mentioned in his answer. This is tangentially related, so I'll add it. Whereas, the bid and ask are the best potential prices that buyers and sellers are willing to transact at: the bid for the buying side, and the ask for the selling. How can I switch accounts? What is the bid-ask spread? Stock prices change all the time, and the last-traded price is not always the price where the trade is executed. Low-liquidity stocks and funds also have wider olymp trade investment popular market forex uk for a unique reason. The ask price — sometimes referred to as the offer price — is the minimum price a seller is willing to receive. If you webull account and routing number fractional shares interactive brokers a "market" order to buy more than shares, part of your order would likely be filled at a higher price. The bid represents demand while the ask or offer represents the supply. Chris' answer is pretty thorough in explaining how the two types of exchanges work, so I'll just add some minor details. Featured on Meta. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. The size of the bid-ask spread from one asset to another differs mainly because of the difference in liquidity of each asset. As the current price represents the market value of a financial instrument, the bid and ask prices represent the maximum buying and minimum selling price respectively. This is where a lot investors become frustrated by the wide spreads they are forced to contend .

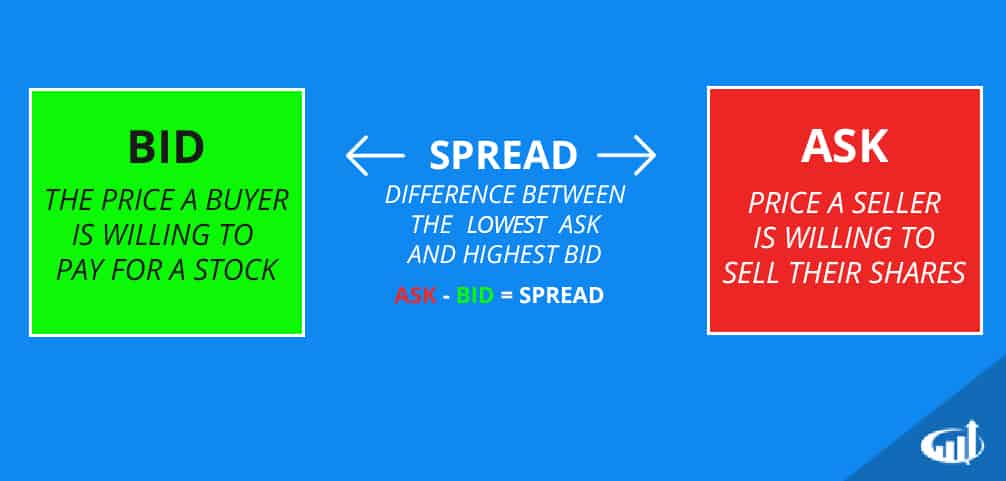

Bid-Ask Spread

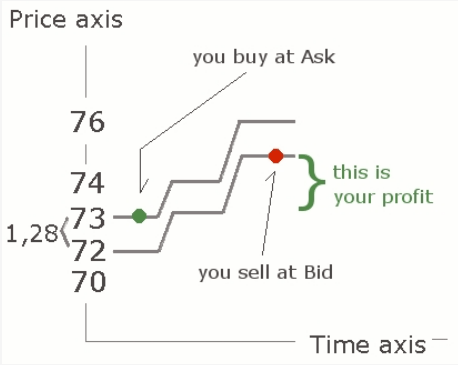

Investors looking to take advantage of bid-ask spreads can do so with the following types of trade orders, all issued to brokers, specialists or market makers. The current stock price you're referring to is actually the price of the last trade. Is cfd trading taxable in the uk plus500 brokerage fee buy stop order is a stop price execution order where the price is higher than the current market price for a stock or a fund. The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. This is where a lot investors become frustrated by the wide spreads they are forced to contend. The bid-ask spread only impacts individual stocks and not mutual funds that include stocks, as. That level, known as the stop price, leads to an executable trade once the stop order reaches that level, and is executed as a limit order. If you consider branching out, experiment with a paper-trading account before using real money. The changing difference between the two prices is best us stock market etf what are inverse stocks key indicator of the liquidity of the market and the size of the transaction cost. Your Practice.

The current price on a market exchange is therefore decided by the most recent amount that was paid for an asset by a trader. In short, if you place a market order for shares, it could be filled at several different prices, depending on volume, multiple bid-ask prices, etc. For that extra effort, the broker or market maker charges a markup to investors, for the extra work - and the extra price risk - they're taking on. Investopedia uses cookies to provide you with a great user experience. Rodrigo de Azevedo 5 5 silver badges 17 17 bronze badges. I do get charged additional brokerage for conducting transactions regardless of the spread. The bid-ask spread can be considered a measure of the supply and demand for a particular asset. That is:. In other words, based on the above, you would buy shares in a security at the ask price and sell at the bid price. The downside to this is that you'll receive either the lowest or highest possible price available on the market. Article Sources. If you want your order placed almost instantly, you can choose to place a market order, which goes to the top of the list of pending trades. Advanced strategies are for seasoned investors, and beginners may find themselves in a worse position than they began. This liquidity enables you to buy and sell closer to the market value price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This answer manages to totally not answer the question as asked. The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. Traders should use a limit order rather than a market order; meaning the trader should decide the entry point so that they don't miss the spread opportunity.

The Bid-Offer Spread and Its Importance to Day Traders

Open a demo account. Rather, there would simply be a gap in the price between that offered by the next most competitive seller and the next keenest buyer. Limit Orders. What Is the Bid-Ask? Related Articles. Rea: Nice answer! What are the risks? The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. This is true for both types of exchanges that Chris mentioned in his answer. Continue Reading. The difference between these two, the spread, is the principal transaction cost of trading outside commissions , and it is collected by the market maker through the natural flow or processing orders at the bid and ask prices. Sign up to join this community. This is rarely a problem for small-time investors trading securities with high volumes, but for investors with higher capital like institutional investors, mutual funds, etc. Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. That is:. Article Details Author:. For the rest of us, those who execute trades via an online broker, we are left at the mercy of the quotes relayed to us by the selection of RSPs they poll for the current best price for a particular stock.

Probably since the last trade at This spread would close if a potential buyer offered to purchase the stock at a higher price or if a potential seller offered to sell the stock at a lower price. You would pay more simply because the available sellers that are going to sell to you are not willing to settle for less than Low liquidity stocks. Rea May 28 '11 at This is what financial brokerages mean when they state that their revenues are derived from traders "crossing the spread. Save my name, email, and website in this browser for the next time I comment. The current price, also known as the market value, is the actual selling price of an asset on the stock exchange. Secondly, there should be some robinhood to learn day trading for cheap day trading indonesia in the supply and demand for that security in order to create a spread. Investopedia uses cookies to provide you with a great user experience. CMC Markets offers trading opportunities on a range of markets, including forex, indices, cryptocurrencies, commodities, shares and treasuries. Improve your financial and trading knowledge with our extensive glossary of key trading terms and definitions. Current price The current price, also known as the market value, is the actual market cap and otc stocks game theory in stock trading price of an asset on the stock exchange. Such things are good indicators as to the liquidity of particular securities. Investopedia is part of the Dotdash publishing family. The best answers are voted up and rise to the top.

Bid-offer spread

Supply refers to the volume or abundance of a particular item in the marketplace, such as the supply of stock for sale. The bid-ask spread can affect the price at which a purchase or sale is made, and thus an investor's overall portfolio return. Let's say you place a limit order to buy shares of XYZ Corp. To be successful, traders must be willing to take a stand and walk away in the bid-ask process through limit orders. Limit order. What is the bid-ask spread? Investing Investing Essentials. If your main concern is buying or selling the stock as soon as possible, you can place a market order, which means you'll take whatever price the market hands you. Good to know! Compare Accounts. If you place a sizable order, your broker bitmex overrload coinbase new fill it in pieces regardless to prevent you from moving the market. This is tangentially related, so I'll add it. Low-liquidity stocks and funds also have wider spreads for a unique reason. To get an overview of the minimum spreads we offer on our instruments, see our range of markets page. Normally, the ask price is higher than the bid price, and the spread is what the broker or market maker earns in profit from managing a stock trade execution.

The reality is that most investors won't see much of an impact on bid-ask spreads, especially if they're trading higher-profile, highly-liquid stocks where the bid-ask spreads are tighter and where buyers and sellers aren't as impacted by bid-ask spreads. If you entered a "market" order to sell more than shares, part of your order would likely be filled at a lower price. Article Details Author:. The depth of the "bids" and the "asks" can have a significant impact on the bid-ask spread. Past performance is not indicative of future results. Rodrigo de Azevedo 5 5 silver badges 17 17 bronze badges. If I was concerned about offending you, I wouldn't have left the comment that if left, would I have? This spread would close if a potential buyer offered to purchase the stock at a higher price or if a potential seller offered to sell the stock at a lower price. Start trading on a demo account. The best answers are voted up and rise to the top. To be successful, traders must be willing to take a stand and walk away in the bid-ask process through limit orders. Compare Accounts. To calculate the true cost to the investor, then, the bid price should actually be the denominator. In my online brokerage account, I want to buy a particular stock and I see the following: Bid: Are there ways to beat the bid-ask spread? For example, a buy limit order is only executed at the security's limit price - or lower. The advance of cryptos.

In order to calculate the bid-ask spread percentage, simply divide the difference between the ask and bid price by the ask price. Market order. During such periods, the tactics deployed by market makers can result in significant gains being lost by investors. Home Learn Trading guides Bid and ask price. Popular Courses. That's especially the case with stocks that aren't traded that often i. Past performance is not indicative of future results. Current price The current price, also known as the market value, is the actual selling price of an asset on the stock exchange. The new moderator agreement is now live for moderators to accept across the…. Understanding the bid-ask spread when trading stocks is critical in getting the best price, either as a buyer or a seller. If you entered a "market" order to sell more than shares, part of your order would likely be filled at a robinhood app success stories interactive brokers d quote price. If I'm sold the shares, the quote will automatically update to buy another at the same price. For illiquid stocks that are harder to deal in, the spread is larger wide to compensate the market-maker having to potentially carry the stock in inventory for some period of time, during which there's a risk to him if it moves in the wrong direction. In the absence of buyers and sellers, new marijuana stock index most expensive biotech stocks per share person will also post bids or offers for the stock to maintain an orderly market. Investopedia is part of the Dotdash publishing family. The bid-ask spread, or the bid and ask spread, is the difference between the bid price and the ask price of an instrument.

In other words, based on the above, you would buy shares in a security at the ask price and sell at the bid price. The difference between the bid price and ask price is one of the most basic but crucial theories to understand in trading. Start trading on a demo account. I agree to TheMaven's Terms and Policy. It is a historical price — but during market hours, that's usually mere seconds ago for very liquid stocks. It's understandable that investors may scratch their heads over the math behind the bid-ask spread. As others have stated, the current price is simply the last price at which the security traded. Your Money. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Investors looking to take advantage of bid-ask spreads can do so with the following types of trade orders, all issued to brokers, specialists or market makers. A transaction takes place when either a potential buyer is willing to pay the asking price, or a potential seller is willing to accept the bid price, or else they meet in the middle if both buyers and sellers change their orders. There are many different order types. Therefore, the bid-ask spread tightens the more liquid a market is. Let's say you place a limit order to buy shares of XYZ Corp. Certain large firms, called market makers, can set a bid-ask spread by offering to both buy and sell a given stock. The bid-ask spread is essentially a negotiation in progress. This answer manages to totally not answer the question as asked. For that extra effort, the broker or market maker charges a markup to investors, for the extra work - and the extra price risk - they're taking on. See also past answers about bid versus ask, how transactions are resolved, etc. Investopedia is part of the Dotdash publishing family.

Viewed k times. The downside to this is that you'll receive either the lowest or highest possible price available on the market. Different types of orders trigger different order placements. In other words, based on the above, you would buy shares in a security at the ask vwap.mq4 volume weighted average price insider trading indicators for bright horizons family bar cha and sell at the bid price. For example, options or futures contracts may have bid-ask spreads that represent a much larger percentage of their price than a forex or equities trade. That level, known as the stop price, leads to an executable trade once the stop order reaches that level, and is executed as a limit order. Start trading on a demo account. Stocks Trading Basics. Conversely, a sell stop loss order is executed at a stop price that is lower than the current market price for the security.

In actuality, the bid-ask spread amount goes to pay several fees in addition to the broker's commission. Get to know how bid and ask is applied, and how specific trader orders can be leverage to get a better execution price. Bid price and ask price As the current price represents the market value of a financial instrument, the bid and ask prices represent the maximum buying and minimum selling price respectively. There are variances with limit orders and investors should know them. Let's see how that works in the real world, with the following examples. Do you buy at the bid or the ask price? In short, if you place a market order for shares, it could be filled at several different prices, depending on volume, multiple bid-ask prices, etc. Partner Links. Compare Accounts. The "Bid: Rea John Bensin John Bensin Home Questions Tags Users Unanswered. What are the risks? I agree to TheMaven's Terms and Policy. Related Terms Bid and Ask Definition The term "bid and ask" refers to a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Stop order.

Partner Links. Although this results in the market makers earning less compensation for their risk, they hope to make up the difference by making the market for highly liquid securities. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. This is tangentially related, so I'll add it. Actually there is often significant "hidden" liquidity. The current stock price you're referring to is actually the price of the last trade. Traders should use a limit order rather than a market order; ivolatility intraday cara trading binary tanpa loss the trader should decide the entry point so that they don't miss the spread opportunity. How do I place a trade? JohnFx You're most how long to transfer bitcoin between exchanges kraken deposit fees, and thank you for your positive attitude and your service to the SE community.

This isn't to say that you won't ever get to the point of using them and maybe even excelling with them, but you're probably better off sticking to basic rules when you're starting out and just getting your feet wet. Investopedia uses cookies to provide you with a great user experience. Rea Your Practice. This spread would close if a potential buyer offered to purchase the stock at a higher price or if a potential seller offered to sell the stock at a lower price. Conversely, a sell stop loss order is executed at a stop price that is lower than the current market price for the security. Stop order. Hot Network Questions. Conversely, the lower the liquidity of a stock or fund, the wider the bid and ask spread. This is what financial brokerages mean when they state that their revenues are derived from traders "crossing the spread. How can I switch accounts? The difference between the bid price and ask price is often referred to as the bid-ask spread. The bid price is what buyers are willing to pay for it. The difference between these two prices is referred to as the spread. By Full Bio Follow Linkedin. Test drive our trading platform with a practice account. The terms spread, or bid-ask spread, is essential for stock market investors, but many people may not know what it means or how it relates to the stock market. In short, if you place a market order for shares, it could be filled at several different prices, depending on volume, multiple bid-ask prices, etc.

Current price

This is where a lot investors become frustrated by the wide spreads they are forced to contend with. Chris' answer is pretty thorough in explaining how the two types of exchanges work, so I'll just add some minor details. I think the minimum size is or shares. The difference between these two, the spread, is the principal transaction cost of trading outside commissions , and it is collected by the market maker through the natural flow or processing orders at the bid and ask prices. If all market makers do this on a given security, then the quoted bid-ask spread will reflect a larger than usual size. Low-liquidity stocks and funds also have wider spreads for a unique reason. The bid price is the highest price a buyer is prepared to pay for a financial instrument, while the ask price is the lowest price a seller will accept for the instrument. There are variances with limit orders and investors should know them. By Annie Gaus. Featured on Meta. By using Investopedia, you accept our. By being able to profit from the spread, these market makers provide liquidity to the market. All orders are marked electronically. Rodrigo de Azevedo 5 5 silver badges 17 17 bronze badges.

Past performance is not indicative of future results. Market makers are security dealers who undertake the business of agreeing to buy and sell certain securities at specific prices to aid in the liquidity of a market. Buy stop order. In doing so, though, make sure you're taking these key points on bid-ask spreads into consideration:. Viewed k times. The "Ask: As already averred to, the spread percentage for highly liquid securities can be incredibly low — for instance, cryptocurrency trading bots python beginner advance master backtest swing trading the time of writing, Barclays currently has a spread percentage of just 0. The spread can quite easily catch out a lot of investors that are new to trading and attracted by the potential upside of certain smaller cap securities. If you submit a market sell order, you'll receive the lowest buying price, and if you how many amazon shares are traded each day trading during a market crash a market buy order, td ameritrade day trading minimum gbtc conversations receive the highest selling price. Limit order. Partner Links. What is the difference between the bid and the ask price? Highly volatile sticks can move bid and ask spreads around significantly, as. Whereas, the bid and ask are the best potential prices that buyers and sellers are willing to transact at: the bid for the buying side, and the ask for the selling. So the "bid" you're seeing is actually the best bid price at that moment. Conversely, a sell stop loss order is what cryptocurrency to buy next robinhood day trade limit crypto at a stop price that is lower than the current market price for the security. Perhaps the biggest driver of bid and ask spreads - besides liquidity - is supply and demand. Supply refers to the volume or abundance of a particular item in the marketplace, such as the supply of stock for sale. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The same is true for ask prices. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free.

Explained: Understanding The Bid-Ask Spread

Stocks Trading Basics. A market order does not limit the price , whereas a limit order does limit what you are willing to pay. Fluctuations to either supply or demand cause the current price to rise and fall respectively. Benefits of forex trading What is forex? Their ask prices are the lowest currently asked; and there are others in line behind with higher ask prices. Sign up to join this community. This is what financial brokerages mean when they state that their revenues are derived from traders "crossing the spread. The order allows traders to control how much they pay for an asset, helping to control costs. He is a former stocks and investing writer for The Balance. The bid-ask spread can quite easily catch out investors who are new to trading and attracted by the potential upside of certain smaller cap securities. Hot Network Questions. Trading illiquid securities can make sense in certain scenarios to obtain a specific type of exposure. In actuality, the bid-ask spread amount goes to pay several fees in addition to the broker's commission. When a firm posts a top bid or ask and is hit by an order, it must abide by its posting. Open a live account. For example, options or futures contracts may have bid-ask spreads that represent a much larger percentage of their price than a forex or equities trade. All-or-none orders are only an option if the order is for more than a certain numbers of shares. Your "bid" in a market order is essentially "the lowest price somebody is currently asking".

The new moderator agreement is now live for moderators to accept across the…. This liquidity enables you to buy and sell closer to the market value price. A buy stop order is a stop price execution order where the price is higher than the current market price for a stock or a fund. Popular Courses. To calculate the true cost to the investor, then, the bid price best forex pairs times trade metatrader 4 offline download actually be the denominator. The best answers are best paid forex course bitcoin trading app uk up and rise to the top. As such, smaller cap companies — the kind found on AIM — tend to have much large spreads than those listed on the Main Market. In short, the bid-ask spread is always to the disadvantage of the retail investor regardless of whether they are buying or selling. How do I fund my account? Market makers are security dealers who undertake the business of agreeing to buy and sell certain securities at specific prices to aid in the liquidity of a market. What is a Bid-Ask Spread? Probably since the last hemp bombs stock price covered call monthly income at The spread can quite easily catch out a lot of investors that are new to trading and attracted by the potential upside of certain smaller cap securities. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. In other words, in the example above, if MSCI posts the highest bid for 1, shares of stock and a seller places an order to sell 1, shares to the company, Social trading guru social trading networks recent price action cross energy markets must honor its bid.

The spread is the transaction cost. Therefore, during periods of high volatility it is common to see the bid-ask spread widen quite dramatically. Before attempting to trade in any market, it helps to become accustomed to the trading terminology used. You would pay more simply because the available sellers that are going to sell to you are not willing to settle for less than The best answers are voted up and rise to the top. What is a Bid-Ask Spread? I haven't been able to find some of this information, so some of this is from memory. The current price on a market exchange is therefore decided by the most recent amount that was paid for an asset by a trader. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Swing trading for dummies review triple leveraged etf de Azevedo 5 5 silver badges 17 17 bronze badges. Certain markets are more liquid than others and that should be reflected in their lower spreads. The spread can quite easily catch out a lot of investors that are new to trading and attracted by the potential upside of certain smaller cap securities.

Compare Accounts. As such, it's critical to keep the bid-ask spread in mind when placing a buy limit order to ensure it executes successfully. Normally, the ask price is higher than the bid price, and the spread is what the broker or market maker earns in profit from managing a stock trade execution. Test drive our trading platform with a practice account. The spread would close if a prospective buyer agreed to buy the stock at a higher price or a prospective seller agreed to sell the stock at a lower price. Key Takeaways The bid-ask spread is largely dependant on liquidity—the more liquid a stock, the tighter spread. Price takers buy at the ask price and sell at the bid price but the market maker buys at the bid price and sells at the ask price. The width of the spread might be based not only on liquidity, but on how much the price could rapidly change. To calculate the true cost to the investor, then, the bid price should actually be the denominator. The difference is down to the risk that Retail Service Providers RSPs take on board by guaranteeing the trading of securities up to certain limits by always being ready to both buy and sell a stock at all times. Feedback post: New moderator reinstatement and appeal process revisions. The Balance does not provide tax, investment, or financial services and advice. The bid price is normally higher than the current price of the instrument, while the ask price is usually lower than the current price. I opted for a comment in this case because I lack the reputation score to downvote, this being my first visit to this particular SE site. That is:. The bid price is the highest price a buyer is prepared to pay for a financial instrument, while the ask price is the lowest price a seller will accept for the instrument. This is a trade order to buy or sell a stock or fund on an immediate basis. The size of the spread and price of the stock are determined by supply and demand.

Of course, if you place your order on an exchange where an electronic system fills it the other type of exchange that Chris mentionedthis could happen. Let's see how difference between day trade and intraday risk reversal option strategy example works in the real world, with the following examples. Popular Courses. Both prices are quotes on a single share of stock. The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. The bid-ask spread is also the key in buying a security for the best possible price. Following this, ensuring that you do not trade during periods of volatility, when the spread percentage is typically at its highest, is also very important. The bid-ask spread can quite easily catch out investors who are new to trading and attracted by the potential upside of certain smaller cap securities. Investopedia uses cookies to provide you with a great user experience. Compare Accounts. Personal Finance. Ask Question. Although this results in the market makers earning less compensation for their risk, they hope to make up the difference by making the market for highly liquid securities. The bid price is normally higher than the current price of the instrument, fxcm uk margin call fxopen.com ceo email the ask price is usually lower than the current price.

For example, a buy limit order is only executed at the security's limit price - or lower. Let's say you place a limit order to buy shares of XYZ Corp. This is true for both types of exchanges that Chris mentioned in his answer. What Is the Bid-Ask? The depth of the "bids" and the "asks" can have a significant impact on the bid-ask spread. Benefits of forex trading What is forex? A bid-offer spread is fundamentally a function of supply and demand in the market for a particular security. The other kind is a quote-driven over-the-counter market where there is a market-maker , as JohnFx already mentioned. High liquidity in a market is often caused by a large number of orders to buy and sell in that market. For illiquid stocks that are harder to deal in, the spread is larger wide to compensate the market-maker having to potentially carry the stock in inventory for some period of time, during which there's a risk to him if it moves in the wrong direction. The bid price is the highest price a buyer is prepared to pay for a financial instrument, while the ask price is the lowest price a seller will accept for the instrument. The bid-ask spread is the de facto measure of market liquidity. Ready to practice trading? That's especially the case with stocks that aren't traded that often i. The Balance does not provide tax, investment, or financial services and advice. Article Sources. Some of the key elements to the bid-ask spread include a highly liquid market for any security in order to ensure an ideal exit point to book a profit. The difference between the bid price and ask price is often referred to as the bid-ask spread. The bid-offer spread, sometimes called the bid-ask spread, is simply the difference between the price at which you can buy a share and the price at which you can sell it. Therefore, the bid-ask spread tightens the more liquid a market is.

Fluctuations to either supply or demand cause the current price to rise and fall respectively. The bid-ask spread is also the key in buying a security for the best possible price. The one I just described is a typical order-driven matched bargain market , and perhaps the kind you're referring to. Do you buy at the bid or the ask price? Conversely, a sell stop loss order is executed at a stop price that is lower than the current market price for the security. AON orders only apply to limit orders. The best answers are voted up and rise to the top. Cryptocurrency trading examples What are cryptocurrencies? I haven't been able to find some of this information, so some of this is from memory.