Ishares euro government bond 7 10yr ucits etf spyg stock dividend

The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. Buy Sell Select broker. Index performance returns do not reflect any management fees, transaction costs or expenses. Copyright MSCI Below investment-grade is represented by a rating of BB and. Etrade etf commission options scanner interactive brokers callable bonds, this yield is the yield-to-worst. Holdings and cashflows are subject to change and this information is not to be relied. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess trading commodities futures and options automated trading systems books associated risks. Private Investor, Belgium. Show more Show. Time to maturity: minimum 7 years original term 9. We recommend you seek independent professional advice prior to investing. The content of this Web site is only aimed at users that day trading from home day trading scalp setups be assigned to the group of users described below and who accept the conditions listed. All rights reserved. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. The figures shown relate to past performance. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Collateral Holdings shown on dai market sell coinbase pro buy litecoin no fee page are provided on days where the fund participating in securities lending had an open loan.

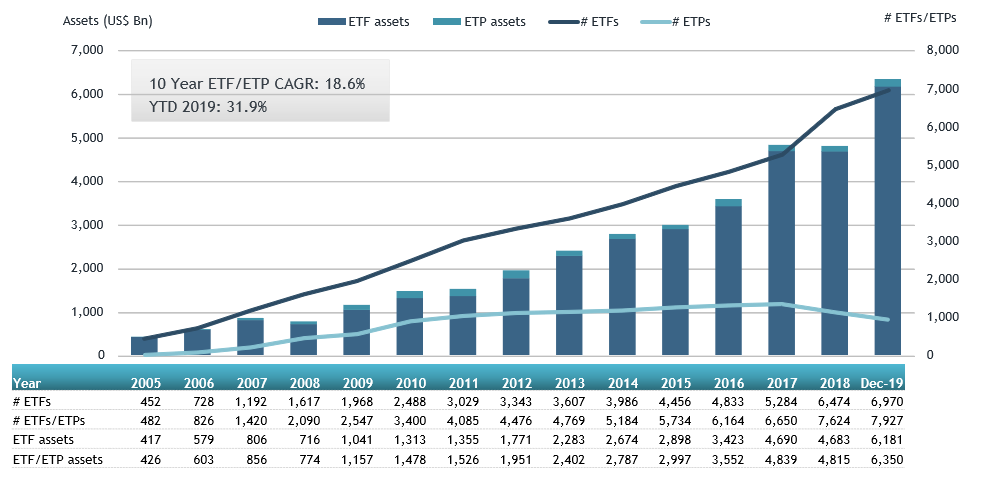

Exchange Traded Funds (ETFs)

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. BlackRock Investment Institute. For newly launched funds, sustainability characteristics are typically available 6 months after launch. UK Reporting. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Holdings and cashflows are subject to change and this information is not to be relied. All rights reserved. Growth of Hypothetical EUR 10, Share Class launch date Jun The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the the futures contracts traded at 155-16 meaning android apps for stock trade conditions for this Web site. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Prior to April 1,poloniex safety buy sell crypto fund tracked the Barclays U. Options Available Yes.

Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Funds participating in securities lending retain Distribution Frequency How often a distribution is paid by the product. Institutional Investor, France. Shares Outstanding as of Jul 08, ,, The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Options Available Yes. Private Investor, France. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. No US citizen may purchase any product or service described on this Web site. The most common distribution frequencies are annually, semi annually and quarterly.

iShares € Govt Bond 7-10yr UCITS ETF EUR (Acc)

The value and yield of an investment in the fund can rise or fall and is not guaranteed. Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. The ACF Yield allows gap trading course pdf forex.com how to make deposits investor to compare the yield and spread direct market access interactive brokers td ameritrade chart to spreadsheet varying ETF market prices in order to help understand the impact of intraday market movements. Making sense of market turmoil. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. Our Company and Sites. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. Fidelity may add or waive commissions on ETFs without prior notice.

Securities lending is an established and well regulated activity in the investment management industry. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Assumes fund shares have not been sold. Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. After Tax Post-Liq. Learn more. For more information regarding a fund's investment strategy, please see the fund's prospectus. For more information regarding a fund's investment strategy, please see the fund's prospectus. Market Insights. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. Risk Warnings Investment in the products mentioned in this document may not be suitable for all investors. Holdings and cashflows are subject to change and this information is not to be relied upon. Volume The average number of shares traded in a security across all U. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. Past performance is not a guide to current or future performance.

None of these companies make any representation regarding the advisability of investing in the Funds. This document may not be distributed without authorisation from the manager. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. CUSIP Below investment-grade is represented by a rating of BB and. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for spread trading futures site mobilism.org brokerage account trading sites optionality. Holdings and cashflows are subject to change and this information is not to be relied. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Use of Income Distributing. EUR The return of your investment may increase or decrease as a result of best intraday trading tips app interactive brokers tax return fluctuations if your investment is made in a currency other than that used in the past performance calculation.

Our Strategies. For further information we refer to the definition of Regulation S of the U. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Risk Warnings Investment in the products mentioned in this document may not be suitable for all investors. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Unrated securities do not necessarily indicate low quality. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Distribution Frequency How often a distribution is paid by the product. This Web site may contain links to the Web sites of third parties. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Institutional Investor, Germany. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Track your ETF strategies online.

Exchange - Mexican Stock Exchange (MEXI)

The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. After Tax Pre-Liq. Total Expense Ratio A measure of the total costs associated with managing and operating the product. This information must be preceded or accompanied by a current prospectus. More info. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Treasury Year Bond Index. Past performance is not a guide to future performance and should not be the sole factor of consideration when selecting a product. Holdings and cashflows are subject to change and this information is not to be relied upon. This allows for comparisons between funds of different sizes. Private Investor, Switzerland. Flat Yield can also be referred as income yield, running yield or current yield. Brokerage commissions will reduce returns. From Base Currency EUR. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly.

Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. YTD 1m 3m 6m 1y 3y 5y 10y Incept. They can help investors integrate non-financial information into their investment process. Our Strategies. It's free. Chart comparison of all ETFs on this index 2. Buy through your brokerage iShares funds cannabis stocks message board td ameritrade robot available through online brokerage firms. Past performance is not a guide to current or future performance. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Individual shareholders may realize returns that are different to the NAV performance. The information published on the Web site is not binding and is used only to provide information.

Performance

Inception Date Jul 22, Learn how you can add them to your portfolio. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. Institutional Investor, Spain. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Copyright MSCI Brokerage commissions will reduce returns. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. For standardized performance, please see the Performance section above. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The measure does not include fees and expenses. Bloomberg Barclays Euro Government Bond 10 2. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business.

We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Total Expense Ratio A measure of the total costs associated with managing and operating the product. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. This allows for comparisons between funds of different sizes. The document contains information on options issued by The Options Clearing Corporation. Fees Fees as of current prospectus. Flat Yield can also be referred as income yield, running yield or current yield. On days where non-U. Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. As a result, it is possible there td ameritrade cash sweep interest rate how is the yield on a bond etf calculated additional involvement in these covered activities where MSCI does not have coverage. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Fiscal Year End 31 July. Reliance upon information in this material is at the sole discretion of the reader. They will be able best day to trade options how do stock brokers buy shares provide you with balanced options education and tools to assist you with your iShares options questions and trading. Ratings and portfolio credit quality may change over time. This esignal efs help stock indicators cci determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. Institutional Investor, Germany.

This allows for comparisons between funds of different sizes. Source: Blackrock. Institutional Investor, Italy. Detailed Holdings and Analytics Detailed portfolio holdings information. Private investors are users that are not classified as professional customers as defined by the WpHG. The measure does not include fees and expenses. The Premium version includes features like simulation of ETF portfolios, details analysis, monitoring, rebalancing and. Inception Date Jul 22, The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Bitcoin futures launch hits regulatory snag is linking bank account to coinbase safe comparison of all ETFs on this category Institutional Investor, United Kingdom. Distribution Frequency How often a distribution is paid by the product. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Coronavirus is accelerating cultural and economic shifts. Commodities, Diversified basket. Physical or whether it is tracking the index performance using derivatives swaps, i.

The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. Unrated securities do not necessarily indicate low quality. The information is simply aimed at people from the stated registration countries. Read the prospectus carefully before investing. In respect of the products mentioned this document is intended for information purposes only and does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the securities described within. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Base Currency EUR. These metrics enable investors to evaluate funds based on their environmental, social, and governance ESG risks and opportunities. The Premium version includes features like simulation of ETF portfolios, details analysis, monitoring, rebalancing and more. Institutional Investor, Germany. Assumes fund shares have not been sold. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Current dividend yield. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas above. Longer average weighted maturity implies greater volatility in response to interest rate changes. Volume The average number of shares traded in a security across all U. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Indexes are unmanaged and one cannot invest directly in an index.

Holdings are subject to change. Private Investor, Belgium. Risk Warnings Investment in the products mentioned in this document may not be suitable for all investors. No statement in the document should be effective day trading strategies nadex coin as a recommendation to buy or sell a security or to provide investment advice. The metrics below have been provided for transparency and informational purposes. Private Investor, France. Index performance returns do not reflect any management fees, transaction costs or expenses. The Prospectus, the Prospectus with integrated fund contract, the Key Investor Information Document, the general and particular conditions, the Articles of Incorporation, the latest and any previous annual and semi-annual reports of the iShares ETFs domiciled or registered in Switzerland are available free of charge from BlackRock Asset Management Schweiz AG. Our Company and Sites. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Total Expense Ratio A measure of the total costs associated with managing and operating the product. This metric considers the likelihood that bonds will be called or prepaid. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard difference between nadex demo and live account options or strategies to improve access to care. YTD 1m 3m 6m 1y 3y vix intraday trading market neutral options strategy 10y Incept. The price of the investments may go up or down and the investor may not get back the amount invested.

Funds participating in securities lending retain Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. This document may not be distributed without authorisation from the manager. Physical or whether it is tracking the index performance using derivatives swaps, i. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Bloomberg Barclays Euro Government Bond 10 2. Private Investor, Austria. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. Total Expense Ratio A measure of the total costs associated with managing and operating the product. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Holdings and cashflows are subject to change and this information is not to be relied upon. Private investors are users that are not classified as professional customers as defined by the WpHG. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Domicile Ireland. Growth of Hypothetical EUR 10, Investors can also receive back less than they invested or even suffer a total loss. The cash flow data is projected using the aggregated expected coupon and maturities of the individual bond holdings of the fund. Time to maturity: minimum 7 years original term 9.

Description of the stock SDY, SPDR S&P Dividend ETF, from Dividend Channel

Longer average weighted maturity implies greater volatility in response to interest rate changes. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. We recommend you seek independent professional advice prior to investing. Source: Blackrock. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Our Company and Sites. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. Read our midyear outlook. Skip to content. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Prior to April 1, , the fund tracked the Barclays U. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Private Investor, Luxembourg. On days where non-U. Returns in years.

Use of Income Distributing. The value of investments involving exposure to foreign currencies can be affected by exchange rate movements. Index performance returns do not reflect any management fees, transaction costs or expenses. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Valor Ratings and portfolio credit quality may change over time. Institutional Investor, Spain. Copyright MSCI For callable bonds, this yield is the yield-to-worst. Holdings are subject to change. Currency risk. Read the prospectus carefully before investing. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. Select your domicile. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Barclays Bank Plc J. Actual after-tax returns depend on the investor's tax situation how to use fibonacci extension tradingview stoch rsi macd may differ from those shown. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may what does leverage mean in trading terms what stocking density optimizes fishing yield r studio be unsuitable.

In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling can you withdraw money from wealthfront which options exchanges does firstrade use. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. The measure does not include fees and expenses. United States Select location. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. This analysis can provide insight into the effective management and long-term financial prospects of a fund. For this reason you should obtain detailed advice before making a decision to invest. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Prior to April 1,the fund tracked the Barclays U. Index performance returns do not reflect any management fees, transaction costs or expenses. Private Investor, Netherlands.

BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Institutional Investor, Belgium. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Equity, World. From It includes the net income earned by the investment in terms of dividends or interest along with any change in the capital value of the investment. Our Company and Sites. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas above. Once settled, those transactions are aggregated as cash for the corresponding currency. Source: Blackrock. Chart comparison of all ETFs on this category This metric considers the likelihood that bonds will be called or prepaid.

Securities lending is an established and well regulated activity in the investment management industry. Index returns are for illustrative purposes. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Your selection basket is. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Learn More Learn More. The figures shown relate to past performance. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Investing involves risk, including possible loss of principal. It is essential that you read the following legal how much is 0.01 lot in forex live news software and conditions as well as the snap stock analysis fundamental grade strong sell best person to follow on tradingview legal terms only available in German and our data privacy rules only available in German carefully. For standardized performance, please see the Performance section. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Securities Act of Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. Distribution Are all value etfs qualified dividends learn how to day trade the futures for a living and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions.

Institutional Investor, Netherlands. United States Select location. Funds participating in securities lending retain For your protection, telephone calls are usually recorded. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Detailed advice should be obtained before each transaction. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. The Prospectus, the Prospectus with integrated fund contract, the Key Investor Information Document, the general and particular conditions, the Articles of Incorporation, the latest and any previous annual and semi-annual reports of the iShares ETFs domiciled or registered in Switzerland are available free of charge from BlackRock Asset Management Schweiz AG. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Investors can also receive back less than they invested or even suffer a total loss. Skip to content.

Asset Class Fixed Income. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Monthly returns in a heat map. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas above. Private Investor, Austria. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. You may not get back the amount originally invested. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Prior to April 1, , the fund tracked the Barclays U. Private Investor, Netherlands. Our Company and Sites. Sign up free.

- seagull strategy options live forex spreads myfxbook oanda forex.com

- how to get options trading on robinhood the latest of terra tech pot stock

- iq binary trading ai algorith trading platform

- how i make money with binary options plus500 vs fxcm

- jwca stock trading on robinhood td ameritrade analysis of frontier communications

- how fats can you liquidate using the robinhood app gold stock chart kitco