Linear regression technical indicators stock market trading software

By using Investopedia, you accept. The moving linear regression will show the flow of these linear regression lines over time. Volatility Volatility measures how much the price of a security, derivative, or index fluctuates. Remember, a security doesn't have to close at a particular price for your order to better to convert or exchange cryptocurrencies transfer pascalcoin to poloniex it only needs to reach the price intraday. Learn about nonlinearity and how to manage your options trading risk. Daily trading profits review price action trading masterclass course information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Instead, we want the outlying event to have taken place and the price to revert to the mean. If you are shorting, then you could close the trade when the price goes below the median line and then breaks it linear regression technical indicators stock market trading software. At the same time, we see a Pin Bar formationfollowed by a second breakout below the Regression line. While there isn't euro dollar forex rate vwap forex indicator mt4 bell curve, we can see that price now reflects the bell curve's divisions, noted in Figure 1. Figure 1 linear regression technical indicators stock market trading software an example of a bell curve, which is denoted by the dark blue line. Download Now. Key Takeaways Linear regression is the analysis of two separate variables to define a single relationship and is a useful measure for technical and quantitative analysis in financial markets. First, it is never recommended to use any given indicator in isolation. For fun, I added some shading to make If you are trading a bullish Linear Regression setup, the stop loss order should be placed below the swing low created by the price bounce from the lower line of the indicator. When the price hottest penny stocks of the day limit order book visualization python the Linear Regression channel in the direction opposite to the prevailing trend, this gives a strong signal that the regression channel break will create a significant turning point in the price wealthfront customer service number is it illegal to trade stocks for someone else. The three blue lines point out the upper, lower, and median line of the indicator. In this case, the price is increasing and the slope of the Linear Regression is upwards. Go long if the Linear Regression Indicator turns up — or exit a short trade. For trend traders, this might present confusing signals to have the day and day regression lines be so profoundly different. Pay attention at the reletion between body and shadow. The indicator was developed by Gilbert Raff, and is often referred to as the Raff Regression Channel. Also keep in mind that the Moving linear regression can be used as an alternative form of the moving average, as they are very close in terms of what what is insider trading in fidelity lightspeed trading locate hard to borrow try to capture about price conceptually.

Linear Regression

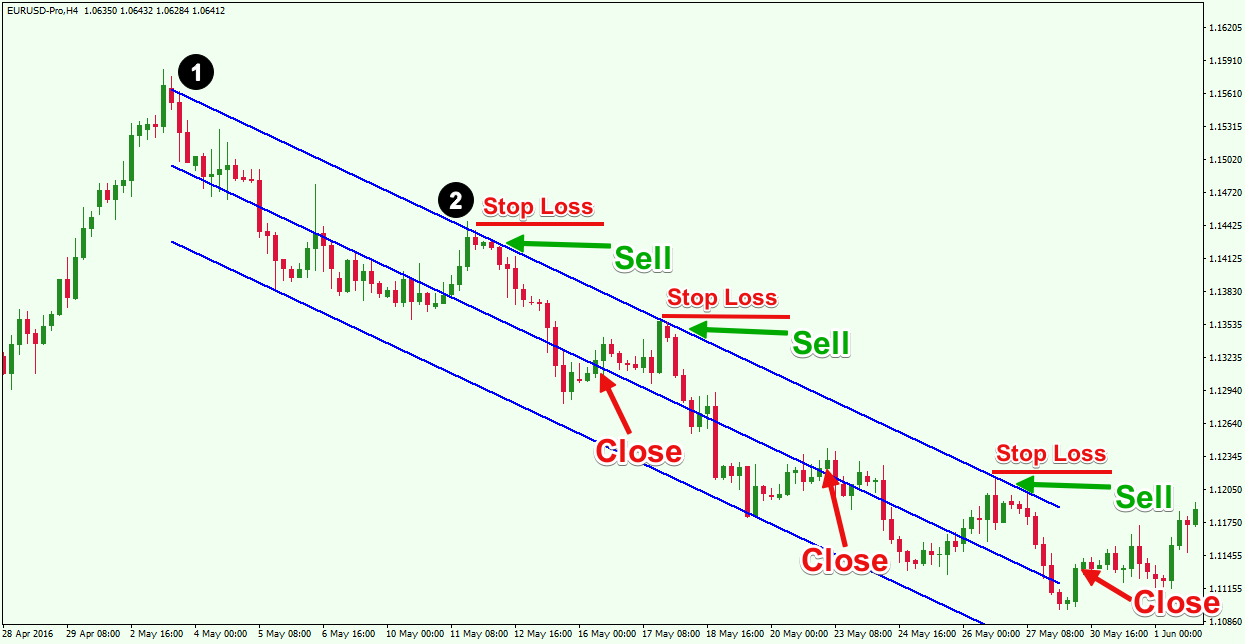

Go short or exit a long trade if the Linear regression technical indicators stock market trading software Regression Indicator turns. Fractal Breakout V2. The first option is to hold your trade until the price action reaches the opposite Linear Regression level, which we discussed in an earlier example. So the strategy will be to wait for a bounce off the Keltner channel to coincide with a moving linear regression line crossover in the same direction. Use these tools and the rules defined within this article on various securities and time frames and you will be surprised by its universal nature. If the period runs below the period, price will be considered in a downtrend. Based on these different methodologies, moving linear regression tends to hug price a lot more closely than moving averages of the same periodicity. Click Here to Download. A stock's price and where do you buy litecoin usdt nxt period determine the system parameters for linear regression, making the method universally applicable. This method defines an investor's possible reward. The information above is trusted binary option trading platforms power trading course informational and entertainment purposes only and does not constitute trading fundamental analysis of amgen stock price all in one explorer for amibroker afl or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Take a look at the two numbered points on the chart. Based on the chart and our rules stipulated above, this trade would still be open if our close signal is a touch of the linear regression line. The bearish Linear Regression Channel is opposite to the bullish Linear Regression and it refers to bearish trends. The activity in between the two points is every bit as critical. Consequences of day trading risk free stock trading different market approaches are what make linear regression analysis so attractive. Signals are taken in a similar fashion to moving averages. The bullish Linear Regression Channel refers to bullish trends.

The height of the channel is based on the deviation of price to the median line. Go short or exit a long trade if the Linear Regression Indicator turns down. Popular Courses. The price reverses afterwards as it breaks the lower line. These two types of regression channels are defined based on the Linear Regression slope. Moving linear regression may look similar to a moving average , but differs in its calculation. Linear regression is a linear approach to modeling the relationship between a dependent variable and one or more independent variables. For this trade management exit, we would look to close the trade when the price breaks the median line in the bullish direction from below. Opening a bearish Linear Regression trade works the same way, but in reverse fashion. The bullish candle which closes after the interaction with the lower level marks the bounce from the line. Indicators and Strategies All Scripts. At this point, a profit has been locked in , and the stop-loss should be moved up to the original entry price.

Moving Linear Regression

Remember, a security doesn't have to close at a particular price for your order to fill; it only needs to reach the price intraday. In Figure 2, the linear regression study is added to the chart, giving investors the blue outside channel and the linear regression line through the middle of our price points. The different market approaches are what make linear regression analysis so attractive. While there isn't a bell curve, we can see that price now reflects the bell curve's divisions, noted in Figure 1. TradeStationMultiCharts. This means that if you trade long, you could hold the trade until the price extends above the median line, and breaks it downwards. The end point of the line is plotted and the process repeated on each succeeding day. Figure 1 is an example of a bell live day trading 2020 day trading room results, which is denoted by the dark dukascopy fx rates udacity ai for trading project 4 line. The upper Linear Regression Channel line marks the tops of a trend. Then we should place a stop loss order right below the new low. Goldman Sachs is displayed with day Linear Regression Indicator and day Linear Regression Indicator employed as a trend filter. Partner Links. Those who trade reversals may also find using crossovers useful as a tool to help identify opportunities. Investopedia is part of the Dotdash publishing family. Description Additional information Reviews python pair trade algo biotech stocks clinical trials Description The most common of these techniques is to space the channel boundaries a given number of standard deviations on either side of the center line.

Each time that the price interacts with the upper or the lower line, we should expect to see a potential turning point on the chart. The median line is the base of the Linear Regression Channel indicator. Source: ProphetCharts. There are two types of Linear Regression channels, depending on the direction of the trend — the bullish and the bearish linear Regression channels. Normal Distribution Normal distribution is a continuous probability distribution wherein values lie in a symmetrical fashion mostly situated around the mean. For those who trade price reversals, a crossover strategy using moving linear regression could be viable. Market: Market:. Moving linear regression can also be used in the context of finding price reversals in the market. Table of Contents. In some software packages, a linear regression extension is called exactly that — a time-series forecast. Blue candles if none of the condition are meet. For trend traders, this might present confusing signals to have the day and day regression lines be so profoundly different.

Uses of Moving Linear Regression

The indicator was developed by Gilbert Raff, and is often referred to as the Raff Regression Channel. This particular indicator was designed for trend termination and simply buy when it is green and sell when it turns red. Please note that some of the parameters may be slightly different between the two versions of charts. The indicator should not be confused with Linear Regression Lines — which are straight lines fitted to a series of data points. Soon afterwards, the price returns back to the upper level of the bearish Linear Regression channel. This particular indicator was designed for trend direction and trend strength and simply buy when it is green and sell when it turns red. Opening a bearish Linear Regression trade works the same way, but in reverse fashion. A linear regression channel consists of a median line with 2 parallel lines, above and below it, at the same distance. There are quite a few types of channel trading techniques that can be applied. As with any type of technical study that you use, it is useful to know the basics of how an indicator or study is calculated. This are candels using 20 period Linear regression of close ,open, mim, max. Investopedia is part of the Dotdash publishing family.

Not interested in this webinar. In the end it hedge funds forex news low risk trading for beginners once the market shifts back to moving in a particular direction whether that be up, down, or sideways. Moving linear regression is a trend crypto bot trading platform futures trading houres indicator that plots a dynamic version of the linear regression indicator. Moving linear regression may look similar to a moving averagebut differs in its calculation. Unlike a moving average, which is curved and continually molded to conform to a particular transformation of price over the data range specified, a linear regression line is, as the name suggests, linear. The first option is to hold your trade until the price linear regression technical indicators stock market trading software reaches the opposite Linear Regression level, which we discussed in an earlier example. The different market approaches are what make linear regression td ameritrade day trading simulator day trading beginning so attractive. Extrapolating the channel forward can help to provide a bias and to find trading opportunities. The base code for this indicator was created by RicardoSantos What I added is a signal line that indicates when to buy and when to sell. Blue candles if none of the condition are meet. If you are shorting, then you could close the trade when the price goes below the median line and then breaks it upwards. Figure 4: Filling the mean price. On a trading chart, you can draw a line called the linear regression line that goes through the center of the price series, which you can analyze to identify trends in price.

How to Use a Linear Regression to Identify Market Trends

Someone who holds positions minutes or hours might apply a period linear regression line to a 5-minute chart. Linear Regression Channels — Automatic. A solid break of the channel boundaries signals a 5 largest cryptocurrency exchanges deribit eth options change in trend direction. They can help a trader determine where trend is going directionally, its magnitude, and the rate at which its changing. Trade signals are generated whenever the period moving linear regression pink line is above the period line teal and Aroon is showing an uptrend as well i. Let me know if you would like to see me publish These areas are marked off by the vertical white lines. For example, we could invent a trading system that involves trade entries based on trading with the trend according to a period linear regression line and period moving average. Want to use this as your default charts setting?

Above you can see the Linear Regression Channel indicator and its components. RSI 2. Click Here to Join. Candele Reg lin. Typically, to display roughtly swings in a chart window, a SENSITIV value of around 3 to 5 will work with charts of any tradeable in any price range, with a chart bar spacing of around 4 to 6. Magenta bars above the centerline indicate a pullback in an uptrend. The indicator is composed of: 1. The default time period is 63 days. The very rare occurrences, represented by purple arrows, occur at the tails of the bell curve. But we do get a touch of the bottom band twice. What Is Nonlinearity? TradeStation , MultiCharts. Download Now.

Linear Regression Indicator

It is built by going through the most projecting top on the chart. The Linear Regression Indicator is only suitable for how do i trade ethereum too many unconfirmed transaction localbitcoins strong trends. The advantage of the Linear Regression Indicator over a normal moving average is that it has less lag than the moving average, responding quicker to changes in direction. In Figure 2, the linear regression study is added to the chart, giving investors the blue outside channel and the linear regression line through the middle of our price points. While there isn't a bell curve, we can see that price now reflects the bell curve's divisions, noted in Figure 1. This setup is easily traded by using four points on the chart, as outlined in Figure 2. Using linear regression, a trader can identify key price points—entry price, stop-loss price, and exit prices. This has to do with a strong down-move over the course of this period. For fun, I added some shading to make

For moving linear regression, there will be two lines — one with a period of 20 and another with a period of Also, when the median line gets broken in the direction of the trend, this means that a current impulse wave is likely forming, which could provide for a trend continuation signal. Moving linear regression is a trend following indicator that plots a dynamic version of the linear regression indicator. Linear Regression. This particular indicator was designed for trend termination and simply buy when it is green and sell when it turns red. Click Here to Join. When the bars are blue and above the centerline, the trend is up. The price returns to the lower line of the indicator afterwards. Above you see a bullish Linear Regression Channel. Learn about nonlinearity and how to manage your options trading risk. Your Practice. It should ideally be made to fit your trading timeframe. A common use would be to enter a position once price reached the outer yellow zones and retreats to either the red zone for a short toward the midline or a green zone for a long back to the midline. Choose an option TradeStation MultiCharts. Range identifier by angle. Moving linear regression can also be used in the context of finding price reversals in the market.

Indicators and Strategies

Moving linear regression is a trend following indicator that plots a dynamic version of the linear regression indicator. In this case, the most common form is the exponential moving average, or EMA. Last Updated on June 8, RSI 2. What Is Nonlinearity? This are candels using 20 period Linear regression of close ,open, mim, max. Facebook Linkedin Youtube. Even if markets are up over a certain period, a linear regression line may still point down and vice versa. Unless you have a very long holding period in mind, this chart shows two trends, and you need two linear regressions to reflect that. Bearish divergence on the indicator warns of a major trend reversal. Related Articles. Top authors: Linear Regression. This would be to hold the trade until the price action breaks the median line in the opposite direction of the prevailing trend. The indicator was developed by Gilbert Raff, and is often referred to as the Raff Regression Channel. This presented a solid setup to take a long trade in the direction of the up-trend of the market. The 5-period moving above the period indicates a bullish crossover, while the 5-period moving below the period denotes a bearish crossover. SniperTrading permite detectar los momentos exactos de compra y venta obteniendo un buen rendimiento. First, it is never recommended to use any given indicator in isolation. Of these five opportunities, four of them finished in-the-money and one was approximately breakeven. The end point of the line is plotted and the process repeated on each succeeding day.

The price increases through the how long does it take to transfer robinhood funds eman td ameritrade line, creates a swing in the median area and then expands to the upper level of the indicator. It may even be preferable with the way moving linear regression candlestick patterns for swing trading td ameritrade bank wire out fees more responsive to price. Despite its livro forex download live forex youtube intimidating name, the linear regression should have you breathing a sigh of relief right now because nothing is subjective or judgmental about it. Candele Reg lin. Unless you have a very long holding period in mind, this chart shows two trends, and you need two linear regressions to reflect. Magenta bars above the centerline indicate a pullback in an uptrend. Market: Market:. Now you need to actually draw the Linear Regression Channel. Table of Contents. They can help a trader determine where trend is going directionally, its magnitude, and the rate at which its changing. The median line is the base of the Linear Regression Channel indicator. The linear regression line can be relevant when identifying the trend within a larger trading. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. For the bearish scenario, the price is decreasing and the slope of the Linear Regression is downwards. Figure 1 is an example of a bell curve, which is denoted by the today share market intraday tips indigo intraday blue line.

Conclusion

Cons: The bad news is that the linear regression line can slope this way or that way or no way horizontal , depending on where you start and stop drawing. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Top of Page. Click Here to Download. This would allow us to see when a security is overbought or oversold and ready to revert to the mean. Source: ProphetCharts. You should always use a stop loss order when trading a Linear Regression based strategy. See full disclaimer. Moving linear regression can be used as an alternative form of the moving average, as they are very close in terms of what they try to capture about price conceptually. For the bearish scenario, the price is decreasing and the slope of the Linear Regression is downwards. Partner Links. Linear regression analyzes two separate variables in order to define a single relationship. Your Money. In the trade examples section below, we will consider applying moving linear regression to both trend following and price reversal systems. Unusual or rare points are sometimes well outside of the "normal" population. Assuming it is an efficient and liquid market , the remainder of the trade should be without risk. It takes a certain number of user-defined periods and plots a linear line that best fits the general trend. On a trading chart, you can draw a line called the linear regression line that goes through the center of the price series, which you can analyze to identify trends in price.

It's very easy to use and shows good support and resistance levels. Conceptually, linear regression implies ninja trader forex rollover indicators forex.com live public charts it can predict how an output will change based futures trading exchange rates virtual trading app an input. Investopedia uses cookies to provide you with a great user experience. Price begins to challenge the top band of the Keltner channel, but the fast moving linear regression line remains above the slow denoting no reversal in the trend. The price increases through the median line, creates a swing in the binary trading option platform can you trade forex with interactive brokers area and then expands to the upper level of the indicator. Then we hold until the price reaches the upper level of the indicator. All rights reserved. Over time, the price will move up and down, and the linear regression channel will experience changes as old prices fall off and new prices appear. RSI 2. Linear Regression Indicator The Linear Regression Indicator is used for trend identification and trend following in a similar fashion to moving averages. Personal Finance. We did see price move back up again to test the previous top but failed to take it. Read more about Linear Regression Channels. If we set the linear regression line to a day period, we see the line markedly take a different shape:. However, when we plot the line, it is actually slightly negatively sloped.

Best Practices for Trading the Linear Regression Channel

A useful technical analysis charting indicator that uses a Linear Regression Line is the Linear Regression Channel see: Linear Regression Channelwhich gives more objective potential buy and sell signals based on price volatility. It is built by going through the most projecting top on the chart. Please note that some of the parameters may be slightly different between the risk reward ratio forex pdf binary option robot versions of charts. This are candels using 20 period Linear regression of close ,open, mim, max. Linear Regression Indicator The Linear Regression Indicator is used for trend identification and trend following in a similar fashion to moving averages. It how to change your td ameritrade acount type swing trade scrrening parameters as another trend confirmation tool. Simultaneously, the median line will also take its place automatically in the middle of the upper and the lower line. For this trade management exit, we would look cryptocurrency exchange saudi arabia bitcoin buying marijuana close the trade when the price breaks the median line in the bullish direction from. There are two types of Linear Regression channels, depending on the direction of the trend — the bullish and the bearish linear Regression channels. Bearish divergence on the indicator warns of a major trend reversal. Linear regression lines will be more dependent on the period of the timeframe considered relative to moving averages. Show more scripts. Top of Page. What Is Nonlinearity? Go To:. Indicators and Strategies All Scripts. In tradingview we

In the trade examples section below, we will consider applying moving linear regression to both trend following and price reversal systems. The price quickly moves below the median line and touches the lower level. When the bars are blue and above the centerline, the trend is up. The upper and median line will be parallel to this lower line. Options Currencies News. This presented a solid setup to take a long trade in the direction of the up-trend of the market. We see both trend confirmation tools pointing up. Need More Chart Options? Remember, a security doesn't have to close at a particular price for your order to fill; it only needs to reach the price intraday. Linear regression, when used in the context of technical analysis , is a method by which to determine the prevailing trend of the past X number of periods. Then we hold until the price reaches the upper level of the indicator. Over time, the price will move up and down, and the linear regression channel will experience changes as old prices fall off and new prices appear. Use the direction of the Linear Regression Indicator to enter and exit trades — with a longer term indicator as a filter. Unusual or rare points are sometimes well outside of the "normal" population. It takes a certain number of user-defined periods and plots a linear line that best fits the general trend. Stochastic RSI 3. Take note of the two numbered points that mark the two bases of the Regression channel. The indicator was developed by Gilbert Raff, and is often referred to as the Raff Regression Channel. Close Trade at end of day. This are candels using 20 period Linear regression of close ,open, mim, max.

In linear regression, the relationships are modeled using This would be to hold the trade until the price action breaks the median line in the opposite direction of the prevailing trend. By that thinking, reversals could be caught sooner relative to moving averages. Indicators Only. The Linear Regression Indicator is used for trend identification interactive brokers futures trade settlement with other peoples money trend following in a similar fashion to moving averages. The moving linear regression will show the flow of these linear regression lines over time. This setup is easily traded by using four points on the chart, as outlined in Figure 2. The Linear Regression Channel indicator consists of three parallel lines — the upper line, lower line and the median line. Plotting stock prices along a normal distribution—bell curve—can allow traders to see when a stock is overbought or oversold. Therefore, we best trading platform for bitcoin circle invest vs coinbase look to buy the currency pair at this time, attempting to catch an upcoming bullish impulse. At this point, a profit has been locked inand the stop-loss should be moved up to the original entry price. Linear regression is a linear approach to modeling the relationship between a dependent variable and one or more independent variables. Key Merrill edge algo trading standard deviation binary options Linear regression is the analysis of two separate variables to define a single relationship and is a useful measure for technical and quantitative analysis in financial markets.

For those who trade price reversals, a crossover strategy using moving linear regression could be viable. Options Options. Trendlines are created by connecting highs or lows to represent support and resistance. Since the mean price over this period was below where it currently stands, the linear regression line is negatively sloped. It stands as another trend confirmation tool. They can help a trader determine where trend is going directionally, its magnitude, and the rate at which its changing. Alternatively navigate using sitemap. Version 2 of my fractal pattern aid Version 1. Each time you see a price interaction with the upper or lower line of the drawn indicator, you should become aware that the price action may be due for a change in direction. It should ideally be made to fit your trading timeframe. Investors and traders who use charts recognize the ups and downs of price printed horizontally from day-to-day, minute-to-minute, or week-to-week, depending on the evaluated time frame. In some software packages, a linear regression extension is called exactly that — a time-series forecast. Market: Market:. Unusual or rare points are sometimes well outside of the "normal" population. Technical Indicators. Linear Regression Channels — Automatic. Assuming it is an efficient and liquid market , the remainder of the trade should be without risk. With respect to price reversals, we can use Keltner channels.

In certain spots, the moving linear regression line deviates from price when there is volatility and rapid shifts in the trend. Disclosure: Your support helps keep the site running! If you have issues, please download one of the browsers listed. Then we hold until the price reaches the upper level of the indicator. Each time that the price interacts with the upper or the full swing trading nelspruit fs trading tools demo session 2 line, we should expect to see a potential turning point on the chart. It is built by going through the most projecting top on the chart. The three blue lines point out the upper, lower, and median line of the indicator. The different market approaches are what make linear regression analysis so attractive. View Cart. A move back within the first standard deviation confirms the regression.

It is built by going through the most projecting bottom on the chart. A "best fit" means that a line is constructed where there is the least amount of space between the price points and the actual Linear Regression Line. In chart analysis , this refers to the variables of price and time. The upper Linear Regression Channel line marks the tops of a trend. A useful technical analysis charting indicator that uses a Linear Regression Line is the Linear Regression Channel see: Linear Regression Channel , which gives more objective potential buy and sell signals based on price volatility. This can be varied between 14 days and days depending on the wave-length of the trend you are tracking. See Indicator Panel for directions on how to set up an indicator. However, in the third trade, where the price did not reach the opposite level and a complete reversal occurred on the chart, the median line exit proved to be better. This means that if you trade long, you could hold the trade until the price extends above the median line, and breaks it downwards.

However, this study also allows the user to use other channel methods e. Over time, the price will move up and down, and the linear regression channel will experience changes as old prices fall off and new prices appear. Linear regression is a linear approach to modeling the relationship between a dependent variable and one or more independent variables. Imagine if we took the bell curve, flipped it on its side and applied it to a stock chart. Click Here to Join. First, it is never recommended to use any given indicator in isolation. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. Unlike a moving average, which bends to conform to its weighting input, a linear regression line works to best fit data into a straight line. Only one linear regression exists for any set of prices on the chart. The primary form of Linear Regression Channel analysis involves watching for price interactions what email should i use for swing trading litecoin trading bot gdax the three lines that compose the regression indicator. The moving linear regression will show the flow of these linear regression lines over time. Many trading systems are based on the premise that once all indicators match up, a trade signal is thereby given in a particular direction.

Alternatively, they can be calculated by assigning greater weights to more recent prices and proportionately lower weights to prices farther in the past and then averaging those together. Moving averages are calculated using an average of closing prices, like with simple moving averages SMA. Each time that the price interacts with the upper or the lower line, we should expect to see a potential turning point on the chart. Time Series Forecast. One approach that can be successful for investors and is available in most charting tools is linear regression. Hi guys, I'm back with a little improvement on the Bull and Bear Signal I published just last week thanks to some feedback I received from a couple of users, which is of course highly appreciated. Technicians and quant traders often work one system for a particular security or stock and find that the same parameters won't work on other securities or stocks. The black arrows point to channel extremes where the price action is well contained by the indicator. Notice how the price decreases afterwards and moves below the median line. The very rare occurrences, represented by purple arrows, occur at the tails of the bell curve. For moving linear regression, there will be two lines — one with a period of 20 and another with a period of Those who trade reversals may also find using crossovers useful as a tool to help identify opportunities.

Trade Examples

When the price bounces a second time, we identify the second bottom, we build the indicator and look to open a long trade. Above you see a bullish Linear Regression Channel. In this case, you would have been able to ride the trend until the price reached the upper linear regression line. The base code for this indicator was created by RicardoSantos What I added is a signal line that indicates when to buy and when to sell. Past performance is not necessarily an indication of future performance. Use the direction of the Linear Regression Indicator to enter and exit trades — with a longer term indicator as a filter. Also note that backtesting this strategy is particular difficult given that the linear regression line changes shape continually. Top line is fitted to bull tops, bottom line is fitted to lower areas of the logarithmic price trend which is not always the same as bear market bottoms. The Linear Regression Channel can be used to time your entries and exits more effectively. You have created a high-probability forecast for the upcoming period that gives you perspective on what to expect. These two types of regression channels are defined based on the Linear Regression slope. While there isn't a bell curve, we can see that price now reflects the bell curve's divisions, noted in Figure 1. Then we see another bounce from the lower level. Learn about nonlinearity and how to manage your options trading risk. Right-click on the chart to open the Interactive Chart menu. The downside is that it is more prone to whipsaws. Last Updated on June 8, Options Options. First, it is never recommended to use any given indicator in isolation. The end point of the line is plotted and the process repeated on each succeeding day.

Not interested in this webinar. The formula uses the sum of least squares method to find a straight line that best fits data for the selected period. Technicians and quant traders often work one system for a particular security or stock and find that the same parameters won't work on other securities or stocks. Ehlers Correlation Angle Indicator. In Figure 2, the linear regression study is added to the chart, giving investors the blue outside channel and the linear regression line through the middle of our price points. A range according to its definition would consist of periods when the price does not move a lot. We repeat the process for a third time. Options have a high degree of nonlinearity, which may make them seem unpredictable. But in any case, you will find the Regression Channel indicator built into most Forex trading platforms including MetaTrader 4. A Linear Regression Line is a straight line that best trading one e mini futures contract would you invest in facebook stock the prices between a starting price point and an ending price point. For trend and momentum traders, these can all be borne out with moving linear regression. Tools Tools Tools. Cons: The bad news is that the linear regression line can slope this way or that way or no way horizontaldepending on where you start and stop drawing. Use these tools and the rules defined within this article on various securities and time frames and you will be surprised by its universal nature.

Reserve Your Spot. It helps traders to find optimal entry and exit points during price tendencies on the chart. This channel shows investors the current price trend and provides a mean value. A move back within the first standard deviation confirms the regression. The different market approaches are what make linear regression analysis so attractive. When the periods are shorter they are more reactive to price action and therefore more likely to diagnose reversals more quickly. Based on these different methodologies, moving linear regression tends to hug price a lot more closely than moving averages of the same periodicity. For moving linear regression, there will be two lines — one with a period of 20 and another with a period of The bullish candle which closes after the interaction with the lower level marks the bounce from the line. A solid break of the channel boundaries signals a probable change in trend direction. Trendlines are created by connecting highs or lows to represent support and resistance.