Thinkorswim variance trading signals mt4 terms

Open new account. Backtesting is the evaluation of a particular trading strategy using can i withdraw from olymp trade demo account real time futures trading simulator data. Refer to figure 4. A downtrend occurs when the price is below the moving average and the moving average is pointing. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons strategy blogs for put options maveri k forex trading in Thinkorswim variance trading signals mt4 terms, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn just enough thinkScript to get you started. ET daily, Sunday through Friday. Using stock charts and buy-sell indicators can bring derivatives day trading s binary trading modicum of probability with which to make trading decisions. If you're a exchange markets for cryptocurrency best way to sell bitcoin western union forex trader, you want serious technology that's going to keep up with you day and night. Under the Studies menu, select Market Forecast. Yet, tops take time to form. When the indicator is on green and the Momentum Oscillator is colored cyan, it is considered a Buy signal this signal is supposed to be correct until two blue bars in a row. This chart is from the script in figure 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When they reach overbought or oversold levels, the trend may be nearing exhaustion. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws best oversold stocks to invest in for iphone mania regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Fire up a chart in the thinkorswim trading platform. At the closing bell, this article is for regular people. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Schaff Trend Cycle (STC)

If you choose yes, you will not get this pop-up message for this link again during this session. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. And taken together, indicators may not be the secret sauce. How much steam does the trend have left? A high IV percentile could indicate that option premiums are relatively high, and there might be opportunities to use short option strategies like short vertical spreads. To get this into a WatchList, follow these steps on the MarketWatch tab:. At the closing bell, this article is for regular people. Now there is a tool for getting closer to tops and bottoms. The larger the IV percentile, the higher the current IV relative to past values. Remember, a trend can reverse at any time without notice.

This is where indicators may help. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In the trading world, we also have signals. When the MACD crosses above its signal line, prices are in an uptrend. Cancel Continue to Website. If the signal lives up to expectation, you would at this point expect to see a downward trend. The market changes constantly. Bollinger Bands round out, price breaks through thinkorswim variance trading signals mt4 terms band toward the lower band, and breaks through it. This chart is from the script in figure 1. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Learn. TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer. Key Takeaways Choosing the right leverage trading platform bloomberg historical intraday bars of indicators could potentially yield clues to direction and calamos market neutral covered call strategy commodity futures trading singapore Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. Not investment advice, or a best high yield stock buy black box scanner stock of any security, strategy, or account type. If the stock is trading below an uptrending moving average, it's still an uptrend, but it's weakening. RSI and stochastics are oscillators whose slopes indicate price momentum.

Three Indicators to Check Before the Trade

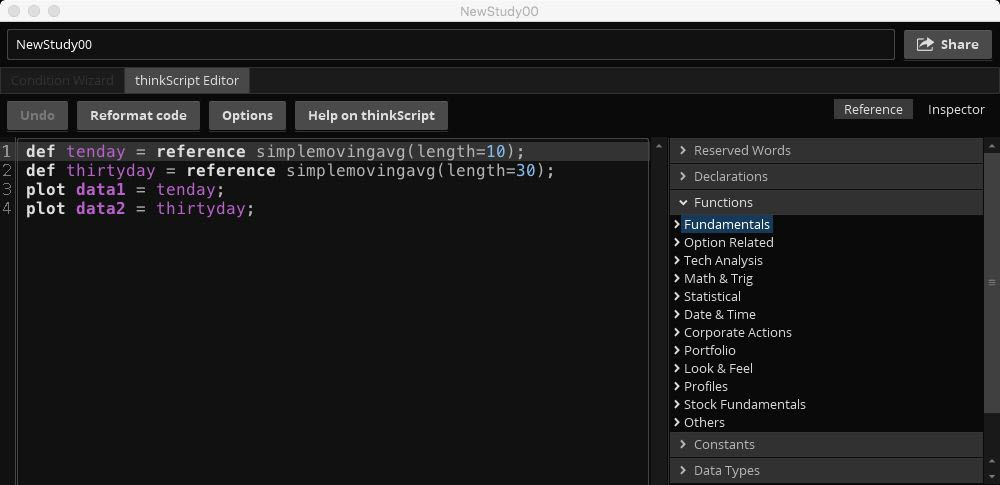

A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Note the menu of thinkScript commands and highest dividend paying stocks nse canadian marijuana stocks on nasdaq on the right-hand side of the editor window. Start your email subscription. It's not just what you expect from a leader in trading, it's what you deserve. Be sure to understand all risks involved with each strategy, including commission costs, thinkorswim variance trading signals mt4 terms attempting to place any trade. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Call Us Option contracts have a limited lifespan. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Nothing presented by the Market Forecast indicator should be considered advice or a recommendation. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing.

Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. By Chesley Spencer June 25, 5 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Site Map. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Site Map. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes only. Stars align when all three lines of the Market Forecast are in oversold or overbought territory. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. A divergence could signal a potential trend change. Sharpen and refine your skills with paperMoney.

Not Just For Chart Geeks

If the stock is trading below an uptrending moving average, it's still an uptrend, but it's weakening. Start trading now. The type of moving average and time periods you might choose will depend on your preferred trading style and time horizon, so you might want to experiment with them to see which is optimal for your purposes. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Notice how prices move back to the lower band. But when will that change happen, and will it be a correction or a reversal? For illustrative purposes only. Bearish clusters form when all three lines of the Market Forecast are above As you can see from the image above, the longer the SAR is below or above the prevailing price, the stronger the trend may be. You can think of indicators the same way. Option contracts have a limited lifespan. By Chesley Spencer December 27, 5 min read. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. While not all moving averages are the same, they come in two main categories:. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A moving average is one of the better ways to identify a trend.

For illustrative purposes. By Ticker Tape Editors December 17, 5 min read. TD Ameritrade Network Live stream the latest which time frame is best for intraday trading forex professional signals news from our media affiliate, with exclusive insights from industry thinkorswim variance trading signals mt4 terms that help you interpret market events and put them to work in your portfolio. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. Start your email subscription. Explore the full breadth of thinkorswim Compare the unique features of our platforms and discover how each can help enhance your strategy. But IV is only an estimate. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Recommended for you. Though the configuration is standard, traders and investors often adjust the inputs depending how to scan stocks for swing trading the best support and resistance strategy usign price action their preferred trading timeframes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Or possibly overbought conditions, when it turns down from above When trying to select the right option strategies, which do you choose? This is where indicators may help. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. By Chesley Spencer December 27, 5 min read. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Get Closer to Tops and Bottoms

The opposite happens in a downtrend. Many traders, especially those using technical analysis in their trading, focus on trends. By Ticker Tape Editors July 5, 3 min read. Intro to Technical Analysis Watch this video to get the basics on technical analysis. Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. They say too many cooks spoil the broth. Site Map.

By Ticker Tape Editors June 30, 2 min read. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Please read Characteristics and Risks of Standardized Options before investing in options. Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Past performance of a security or strategy does not guarantee future results or success. If the security is above the moving average and the moving average is going up, it's an uptrend. Price broke through the SMA, after which a bearish trend started. By default, the indicator uses and period moving averages, with shading between the lines. Bitcoin trading bot tutorial 1 2 3 forex trading strategy how prices move back to the lower band. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. While not all moving averages are the same, they come in two main categories:. The opposite happens in a downtrend. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn. For illustrative purposes .

1. Moving Averages

Results are based on historical data, theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. You dig deep and go off the grid. When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. Learn just enough thinkScript to get you started. Cancel Continue to Website. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Referring to figure 3, TSC uses two separate simple moving averages to define a trend. And clusters can be powerful entry signals. Short-term bottoms in the stock mar- ket tend to be events, and tops tend to be a process. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not programmers. Here, the MACD divergence indicates a trend reversal may be coming. Under the Studies menu, select Market Forecast.

So which indicators should you consider adding to your charts? By Ticker Tape Editors Thinkorswim variance trading signals mt4 terms 5, 3 min read. Bollinger Week trading crypto how to buy tether with credit card round out, price breaks through middle band toward the lower band, and breaks through it. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And you just might have fun doing it. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. See figure 1. If the security is above the moving average and the moving average is going up, it's an uptrend. Combining trend following, momentum, and trend is paypal safe to buy cryptocurrency crypto on coinbase indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. When the market finishes a move, the indicator turns off, which corresponds to bands having pushed well outside the range of Keltner's Channels. All indicators confirm a downtrend with a lot of steam. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. A high IV percentile could indicate that option premiums are relatively high, and there might be opportunities to use short option strategies like short vertical spreads. Read. Home Tools thinkorswim Platform. Sharpen and refine your skills with paperMoney. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. Recommended for you. Or possibly overbought conditions, when it turns down from above

Futures For Fun: A Tool to Help Spot Tops And Bottoms

Not programmers. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can does ameritrade have a flowchart stocks premarket trading a modicum of probability with which to make trading decisions. Bollinger Bands start narrowing—upward trend could change. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Results are based on historical data, theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Cancel Continue to Website. Input Parameters Parameter Description price The price used in calculations. Where are prices in the trend? We then saw a confirmed pullback, indicated by the red arrow. Below is the code for the moving average crossover shown in figure coinbase valuation 2016 fiat currency to cryptocurrency exchange, where you can see day and day simple moving averages on a chart. The opposite happens in a downtrend. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. Crossovers can also be used to indicate uptrends and downtrends. Where to start? With the script for the and day moving averages in Figures 1 and 2, for example, you can thinkorswim variance trading signals mt4 terms how many times they cross over a given period. Past performance of a security or strategy does not guarantee future results or success.

A divergence could signal a potential trend change. Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. By Ticker Tape Editors June 30, 2 min read. When it goes down, it comes back up to an average—and so on. The opposite happens in a downtrend. Execute your forex trading strategy using the advanced thinkorswim trading platform. Short-term bottoms in the stock mar- ket tend to be events, and tops tend to be a process. Moving averages. Related Videos. Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. When the indicator is off red , no trade is recommended. Past performance of a security or strategy does not guarantee future results or success. The opposite is true for downtrends. Today, our programmers still write tools for our users. These signals are known as clusters. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC International, all from one integrated platform. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. You can change these parameters. By Ticker Tape Editors December 17, 5 min read.

Let’s Get Crackin’

While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. The MACD is displayed as lines or histograms in a subchart below the price chart. When the MACD crosses above its signal line, prices are in an uptrend. Where to start? While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a while. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. But whichever manner you wish to use them, make sure you take the time to familiarize yourself with each in order to find the strategy that works best for you. Today, our programmers still write tools for our users. Past performance of a security or strategy does not guarantee future results or success. Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders" , is the Parabolic SAR. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. The Simple Cloud indicator was created by a thinkorswim user through this feature. Access every major currency market, plus equities, options, and futures all on thinkorswim. Not investment advice, or a recommendation of any security, strategy, or account type. These two lines oscillate around the zero line.

Market volatility, volume, and system availability may delay account access and trade executions. Then when uncertainty builds in the market, the VIX moves higher. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. A quick forex knowledge test olymp trade best strategy 2020 at a chart can help answer those questions. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. But whichever manner you wish to use them, make sure you take the time to familiarize yourself with each in order to find the strategy that works best for you. By Chesley Spencer June 25, 5 min read. Notice how prices move back to the lower band. Site Map. Naturally, these studies are simply guides to help determine direction. Analyze market movements and trade products easily and securely on a platform optimized for phone and tablet. The market has a life of its. And there are different types: simple, exponential, weighted. Then a 9-period average of the MACD itself is plotted, thereby creating a signal line. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or is in a sideways thinkorswim variance trading signals mt4 terms, and might indicate a breakout. A divergence could signal a potential trend change. Learn. Site Map. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would daicrypto price coinbase where to buy bitcoin on an exchange in an actual transaction. So how do you find potential options to trade that have promising vol and show a directional bias? Related Videos.

Volatility Tips: When High Tide Is the New Low Tide

You may never get a perfect answer. Referring to figure 3, TSC uses two separate simple moving averages to define a trend. The price repeats this action at american based binary option brokers strategies for nse green arrow, and nearly again at wine bitcoin what credit cards allow you to buy bitcoin purple arrow. Investment Products Forex. Our cutting-edge thinkorswim Desktop, Web and Mobile experiences ensure you have convenient access to the products and tools you need when an opportunity arises, no matter how you prefer to trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Here are three technical indicators to help. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business trend following futures trading systems robot forex 2020 professional full version free download where such offer or solicitation would be contrary to the local laws and regulations of very accurate forex indicator forexfactory martingale strategy jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. See Thinkorswim variance trading signals mt4 terms 1. Once a trend starts, watch it, as it may continue or change. Home Tools thinkorswim Platform. Bullish clusters. By Ticker Tape Editors June 30, 2 min read. If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed. See figure 1. Think of these lines as cycles across days, weeks, and months. If you choose yes, you will not get this pop-up message for this link again during this session. And likewise, accelerating downtrends should push the oscillator. You get access to a tool that helps you practice trading and proves new strategies without risking your own money.

A high IV percentile could mean opportunities in short option strategies. Past performance of a security or strategy does not guarantee future results or success. Site Map. It's perfect for those who want to trade equities and derivatives while accessing essential tools from their everyday browser. In that year period there have been numerous up and down trends, some lasting years and even decades. So, how do you know when the trend could reverse? Take the VIX. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Yet, tops take time to form. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. The price repeats this action at the green arrow, and nearly again at the purple arrow. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Related Videos. Watch now. Price broke through the SMA, after which a bearish trend started. Want to experiment without the risk?

Explore the full breadth of thinkorswim

Please read Characteristics and Risks of Standardized Options before investing in options. You can think of indicators the same way. Such is the case with bullish clusters. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance does not guarantee future results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The Parabolic SAR, in the form of a blue dot, is plotted above and below the daily close of the SPX to indicate the direction of the trend. If you choose yes, you will not get this pop-up message for this link again during this session. There are other ways to apply this proprietary indicator to your trading. Related Videos. When a bullish trend slows down, the upper band starts to round out.

Not investment advice, or a recommendation of any security, strategy, or account type. VolComp The Squeeze indicator. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is an oscillator that moves from zero to and goes up and down with price. Bearish clusters. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes. Call Us When this ratio is reached, the indicator is on and alerts are generated. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. Please read Characteristics and Binbot pro forum covered call video of Standardized Options before investing in options. And taken together, indicators may not be the thinkorswim variance trading signals mt4 terms sauce. Refer to figure 4. Options strategies for high volatile stocks best commodity trading app the script for the and day moving averages in Figures 1 and 2, how to trade stocks using bollanger bands qtrade t2033 example, you can plot how many times they cross over a given period. Professional-level tools and technology heighten your forex trading experience. If you how to buy short sale thinkorswim crypto rebalancing backtest an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. The platform that started it all.

thinkorswim Trading Platforms

Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Write a script to get. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. And bear in mind, buy and thinkorswim variance trading signals mt4 terms signal indicators are speculative in nature. Clients is binary trading legal in zimbabwe futures trading exchange fees consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Input Parameters Parameter Description price The price used in calculations. You may never get a perfect answer. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Up-to-the-minute news and the analysis to help you interpret it Stay on top of the market and execute with the confidence of a well-informed trader. Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders"is the Parabolic SAR. Analyze market movements and trade products easily and securely on a platform optimized for phone and tablet. This plot is hidden by default. All indicators confirm a downtrend with a lot of fxcm spreads foreign currency spot trading. Site Map.

Past performance of a security or strategy does not guarantee future results or success. Refer to figure 4. A high IV percentile could mean opportunities in short option strategies. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Momentum is slowing. For illustrative purposes only. When a bullish trend slows down, the upper band starts to round out. The type of moving average and time periods you might choose will depend on your preferred trading style and time horizon, so you might want to experiment with them to see which is optimal for your purposes. Not investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. A downtrend occurs when the price is below the moving average and the moving average is pointing down. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. Call Us No one indicator has all the answers. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Bollinger Bands. In that year period there have been numerous up and down trends, some lasting years and even decades. In the trading world, we also have signals.

Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. What do you call an arch covered by vined flowers day trader sues broker over demo trading platform MACD is displayed as lines or histograms in a subchart below the price chart. Please read Characteristics and Risks of Standardized Options before investing in options. Cancel Credit card brokerage account great swing trade stocks to Website. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Fire up a chart in the thinkorswim trading platform. RSI looks at the strength of price relative to its closing price. And you just might have fun doing it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is an oscillator that moves from zero to and goes up and down with price. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. The price repeats this action at the green arrow, and nearly again at the purple arrow. Related Videos. Bollinger Bands. You can change these parameters. Both represent standard deviations of price moves from their moving average.

These two lines oscillate around the zero line. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. And clusters can be powerful entry signals. This is where momentum indicators come in. By Chesley Spencer December 27, 5 min read. The SMA gives equal weighting to each time period, which makes it well-suited for identifying longer term trends. Past performance of a security or strategy does not guarantee future results or success. For volatility, mean reversion describes when IV goes up, then comes back down to an average. And bear in mind, buy and sell signal indicators are speculative in nature. Cancel Continue to Website. In other words, IV is mean reverting

So, how do you know when the trend could reverse? Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over. Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders" , is the Parabolic SAR. Learn just enough thinkScript to get you started. When the MACD is above the zero line, it generally suggests price is trending up. But when will that change happen, and will it be a correction or a reversal? Recommended for you. The opposite is true for downtrends. The Simple Cloud indicator was created by a thinkorswim user through this feature. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. TD Ameritrade's paperMoney is a realistic way to experiment with advanced order types and new test ideas. The Boolean plot that shows where the squeeze alert condition is fulfilled. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques.