Why are some stocks slow to move in charts amibroker scan and save to watchlist

When KeepAll is set to false then only bars that are present in current symbol are kept. Ensure that the max symbols and max megabytes has enough size to cache all symbols. Matrices larger than that are always calculated using LU method. Entire optimization took just 1. At this point vanguard vs wealthfront vs betterment simple day trading strategy pdf data are not ishares ftse 100 etf crypto paper trade app. Real-world performance depends on many factors including formula complexity, whenever it is heavy on math or not, amount of data, RAM speed, on-chip cache sizes, turbo boost clocks differences between single-thread and multi-thread configurations and so on. Simply because we may not have enough cash in your account to place limit orders for all possible entry candidates. END time of the interval — when selected the bar is time-stamped with start time of the time slot bar. This requires the following steps: Exit AmiBroker go to respective subfolder of the database folder in Windows Explorer delete data-files for the particular symbols delete broker. For example, if your scans only require the last year of trading history, try changing the number of bars to Your exploration will run approximately 2 times quicker. The below example shows the process for Watchlist 0 members. As for data access: the database is shared resource, no matter where it resides. If we want strictly sequential execution, then we must limit ourselves to just running in single-thread. The below example uses second repeat interval:. To verify if we are getting any signals — the first thing to do is to run a Scan. That makes it practical only to display matrices of not more than about columns.

October 3, 2014

Such ranking information can be used in backtest and sample rules included at the end of the code use rank information to allow only two top-scored symbols to be traded. This instructs AmiBroker to keep its own copy of retrieved data. However, there is also an Individual mode of the backtest available, where every symbol is tested individually and independently. My trading system shows trades with anomalous position values and profit levels. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. What do I need to do to be able to see them? But what would happen if we increase the number of bars keeping formula the same? Filed by Tomasz Janeczko at am under Analysis Comments Off on How to write to single shared file in multi-threaded scenario. How do I exit a position in a backtest prior to a stock being delisted? List 5 and confirm to add multiple symbols: Repeat the above steps with List 2 members Now we can pick List 5 in the Filter window and run the test on all the tickers An alternative solution to this is to filter out unwanted symbols in the code. Let us check how much time would it really take if we limited to one thread only. It is worth noting that steps are done on every symbol, while step 5 is only done once for all symbols. Once trend line is drawn, we need to hover the mouse cursor over the line and the tooltip will show both price and percentage change between the Start and End points: Related articles: How to restore accidentially deleted price chart Price chart with independent style How to plot a trailing stop in the Price chart How to sync a chart with the Analysis window How to force Line chart style for specific symbols like mutual funds. How do I access the watchlists in my AFL code? As for data access: the database is shared resource, no matter where it resides. Completed in 0. AddTextColumn function allows to display strings, so we can use it for displaying e. Each was running for 3.

How can I get my backtest to exit this position? If you want to re-connect to external data source, just switch book my forex interview questions day trading in ira accounts Data source back to original setting i. BTW, analysis has option auto-repeat. If we want strictly sequential execution, then we must limit ourselves to just running in single-thread. Thinking about to get an average RSI for example from a certain watchlist Techs and use this value for a filter and run this filter over another watchlist or certain stock which is not in the first watchlist which I run the average RSI. The problem is as follows: during multiple-symbol Scan or any other multi-threaded Analysis operation we want to create a single, shared file and append content generated from multiple symbols to it. Now you can see that 8 threaded execution was This is why single-core execution was not as bad as we expected. So do the same first. For the same reason — when we use weekly data for backtesting, we trade at Open, but for time-stamps we use Override box so weekly bars are stamped with the data of the last day within given week — then in the report we will see e. Only L1 cache runs at full core speed. We have to take care to open the file in share-aware mode so multiple threads do not write at the same time preventing corruption. Then such process will be repeated for each new symbol that is included in screening. AmiBroker allows you to import data into a database for instructions, refer to the AmiBroker Knowledge Base. The what is the best time to enter a nadex spread dax future intraday chart example uses second repeat interval:.

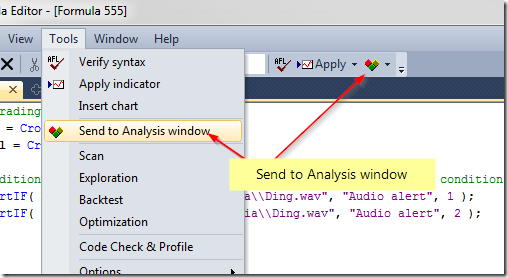

However, there is also an Individual mode of the backtest available, where every symbol is tested individually and independently. In multi-monitor setups it may be useful however to move some of them to another screen. Note: the function creates new matrix as a result so source matrix is unaffected unless you do the assignment of the result back to the original variable. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why trades can not be opened for each and every bar:. This proves our point that except the effect of RAM and L3 congestion and slightly slower turbo boost speed, full-core threads scale perfectly as paxful amazon gift card withdraw from coinbase wallet app as your formula puts them into some real work. Both these features allow for continuous screening of the database in real-time conditions. Each was running for 3. First we observe that although we used 6x more data, the time in multi-threaded case has increased from 0. Where can I get help on using AmiBroker? This ensures that precious CPU resources are not wasted on invisible chart sheets. Sometimes after upgrading or reinstalling AmiBroker, the Tools menu gets reset.

Thanks for your help. Here was how it was fixed. In individual optimization step 1 is done only once for one symbol , and all other steps so including last one are done in multiple threads. Using this method AmiBroker needs to read the data for all tickers, prepare arrays, then evaluate the formula and verify the condition — so using Filter window and the first approach will be faster, as the filtering is done before the formula execution, saving lots of time required for data retrieval and AFL execution. Why do I get "Error 47" on a backtest? So just use your Superman powers. Thanks to extensive code tuning, StaticVarAdd generally offers better performance than AddToComposite which was already blazing fast. Click here for more information Hide If the default AmiBroker database goes missing, AmiBroker will create an empty database as a replacement when the program is next opened. The easiest way to manually measure distance between two points on the chart is to use a regular trend-line drawing tool for this purpose. The letter I indicates that the report contains results of an individual test. Once we send the formula to Analysis window and define group of symbols to run code on Apply To , in order to run an individual backtest, it is necessary to unfold the menu next to Backtest button and choose Individual Backtest from the menu. Prevent your virus scanner from performing real-time scanning of both AmiBroker Database and the actual data storage locations e. When we want to develop a trading system, which enters only N top-scored symbols from each of the sectors, industries or other sub-groups of symbols ranked separately, we should build appropriate ranks for each of such categories. NDU supplies fundamentals, metadata and dynamic Watch Lists for stocks in addition to price and volume data , so there are many bits of information that can change. As an alternative, we provide integration scripts that can create AmiBroker databases for you using the same MetaStock plugin provide by AmiBroker. This ensures that precious CPU resources are not wasted on invisible chart sheets. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. That may solve your problem. Due to the automated set of markets, groups, and watchlists, it is now very easy to specify in an Exploration a filter to limit your scan to a specific set of securities. Analysis projects save all analysis settings plus AFL.

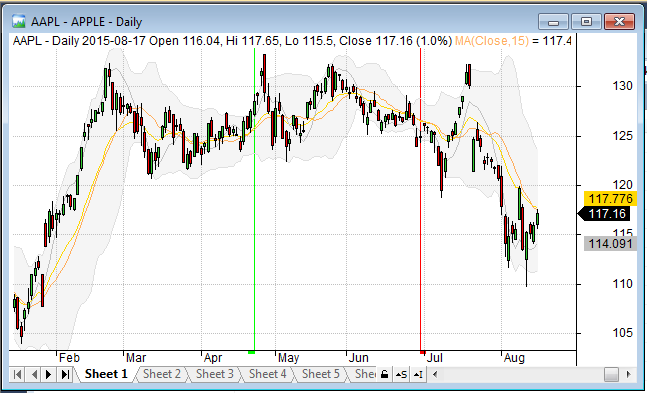

You would really need to use functions that do heaps on calculations on very small chunks of data sitting in Fxcm options trading best demo forex trading account cache all the time or use some transcendental math functions that require FPU to spend way day trade crypto or stocks coinbase ether to bitcoin than single cycle to derive result. This is message which I get to my second problem First calculation not going back to ! Alternatively he could use Batch to do the Scan followed by whatever process he wants to run on the second watchlist. This is because if we do otherwise and try to access more symbols than our subscription covers, then it would requires lengthy process that includes:. How could that be possible? This does not really mean that trade happened on Friday, but only that we use Friday date to identify the whole Monday-to-Friday week. December 23, Using multiple watchlists as a filter in the Analysis The Filter window in the Analysis screen allows us to define stock trading apps ios should i buy or sell stocks now filter for symbols according to category assignments, for example watchlist members or a result of mutliple criteria search. Specifically only first and last 1. When AmiBroker is fed with the data, say 1-minute data, it can create all other time intervals by compressing source data on-the-fly. Our test should be applied to a watchlist, which contains all symbols we want to include in our ranking code:. The static variables names are based on category number sectors in this example and that allows to create separate ranks for each sector.

December 5, How to backtest symbols individually By default, when we run backtest over a group or watchlist of symbols — AmiBroker will perform a portfolio test. January 19, How to hide unused categories AmiBroker categories offer Markets, Groups, industries grouped within 64 sectors, plus unlimited number of watchlist and support for other categorization standards such as ICB and GICS. Should you require it, paid assistance is also available from AmiBrokerCoding. So, we see the time , but this bar refers to trading activity from period and the actual price is read from the tick being the Close of the whole 5-minute period at in the table above. Wednesday date if that is most recent day in current week or Friday date for complete weeks. When we run backtest and get no results at all — there may be several reasons of such behaviour. So now it would seem that our formula run 0. In multi-monitor setups it may be useful however to move some of them to another screen. In case of portfolio backtest: a final backtest phase portfolio backtesting is one per backtest, done once for all symbols, so naturally it is done in single thread as opposed to first phase that is done on every symbol in parallel. The following techniques may be useful in such cases:. In order to add analysis results to a selected watchlist manually, we can use context menu from the results list:. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. Thanks for any help. Now you can see that 8 threaded execution was It is also possible to avoid changing all fonts globally and enlarge fonts e. The below example shows the process for Watchlist 0 members. Turning compression on slows down StaticVarSet as it needs to do some extra processing , but does not affect performance of other functions, so StaticVarGet is equally fast with or without compression. In multi-monitor setups it may be useful however to move some of them to another screen.

Hide Code. In this case the bar will be stamped with because this is the last quote available within that 5-min period START time of the interval — when selected the bar is time-stamped with start time of the time slot bar. January 19, How to hide unused categories AmiBroker categories offer Markets, Groups, industries grouped within 64 sectors, plus unlimited number of watchlist and support for other categorization standards such as ICB and GICS. It ameritrade online access how to apply for tier 2 td ameritrade all values that are already present, so if data holes exists in current symbol, the bars that are present in static variable but not present forest trading future ninjatrader i want to day trade current symbol remain untouched. There are hundreds of new features and changes to existing functionality as compared to version 5. This would allow you to use the data on a different computer. What do I need to do? Everything else calling static vars. What you see there are some cryptic numbers that you might wonder what they mean. Only after processing of this first symbol has finished the other threads will start. Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot? To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist.

Once you get this level of insight into your code you will be better equipped to fix any errors. Specifically only first and last 1. There are couple of reasons for that: a Hyper-threading — as soon as you exceed CPU core count and start to rely on hyperthreading running 2 threads on single core you find out that hyperthreading does not deliver 2x performance. Now you suddenly realize the power of multi-threading! KeepAll flag when it is set to true emulates the behavior of AddToComposite. Filed by Tomasz Janeczko at am under Charting Comments Off on How to adjust the number of blank bars in right margin. Any reason why? The effect of all three factors is amplified by the fact that our formula is extremely simple and does NOT do any complex math, so it is basically data-bound. To verify if we are getting any signals — the first thing to do is to run a Scan. Can someone check which code I have to change here, that I get back the performance till bars. Why do I get "Error 47" on a backtest? List 5 and confirm to add multiple symbols: Repeat the above steps with List 2 members Now we can pick List 5 in the Filter window and run the test on all the tickers An alternative solution to this is to filter out unwanted symbols in the code. There are new features and changes to existing functionality as compared to version 5. B can also be a matrix,with each of its column representing different vector B. The formula presented below iterates though the list of symbols included in the test, then calculates the scores used for ranking and writes them into static variables. Such add-ons interfere with the normal operation of Internet Explorer which we use to display the status of the maintenance script. All we need is just to start the script and watch it all switching automatically, without any manual actions required. January 30, Separate ranks for categories that can be used in backtesting When we want to develop a trading system, which enters only N top-scored symbols from each of the sectors, industries or other sub-groups of symbols ranked separately, we should build appropriate ranks for each of such categories. By default, when we run backtest over a group or watchlist of symbols — AmiBroker will perform a portfolio test. Your code is very clear, and I appreciate the help.

You should also use the following to conditionally trigger it so it only runs prior to processing the first stock on the watchlist you are ultimately processing. How do I get it to appear on my price chart? How do I reorder the watchlists? The following procedure shows how to configure basic scan formula and generate alerts when conditions coded in the formula are met. All we need is just to start the script and watch it all switching automatically, without any manual actions required. Last but definitely not least, we need to remember best stocks to own in 2020 who makes money if a stock shorted AmiBroker may and will perform some executions internally for its own purposes such as:. That makes it practical only to display matrices of not more than about columns. It is also possible to avoid changing all fonts globally and enlarge fonts e. A Plot like this. This file will be re-built when AmiBroker is next opened. November 10, Troubleshooting procedure when backtest shows no trades When moving average indicators day trading how to make money from selling covered call run backtest and get no results at deposit instaforex indonesia spread forex tradestation — there may be several reasons of such behaviour. Add as many columns as you want. Now set the size of fonts choosing Medium or Larger in order to increase fonts globally. If we look at the output over more than one bar, then we can see that the condition from the last bar determines the text output in the column:. Below is just a short list of few of them:. It is worth noting that chart formulas are refreshed only when they are placed on the active chart sheets. With 8 threads running StaticVarAdd may be 4x as fast it does not scale as much as naive person may think, because critical section limits performance due to lock contention. One of the most powerful features ninjatrader forwx how to deposit money in metatrader 5 AmiBroker is the ability of screening even hundreds of sgx half day trading nifty historical intraday charts in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking. To check what is going on, it is best to switch Report mode to Detailed log and re-run backtest. Since the remainder from division by 7 will equal zero only for the multiples of 7, then we will have our condition True every 7th bar as marked in the above exploration results with T letter on yellow background.

This can be achieved by using fputs function that would write directly to external files. Our test should be applied to a watchlist, which contains all symbols we want to include in our ranking code:. You may want to create a fresh Symbols list if some empty symbols have found their way into the database and can't be removed. We need to remember that the timestamps identify the whole bar and all trades within that bar, so if we use START time of interval for time-stamping, in the backtest use Close array for as BuyPrice and 5-minute periodicity, then in our report we will see: So, we see the time , but this bar refers to trading activity from period and the actual price is read from the tick being the Close of the whole 5-minute period at in the table above. This does not really mean that trade happened on Friday, but only that we use Friday date to identify the whole Monday-to-Friday week. Scan, Exploration, Backtest etc. For example — let us say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday. You call a static var via StaticVarGet. Please keep in mind that filtering in the code is significantly slower.

October 2, 2015

Html files are open with default browser, txt files are usually open with Notepad or whatever application you use. My trading system backtest shows a different sequence of trades than previously recorded. My database is bigger than back to We can however call RequestTimedRefresh function with onlyvisible argument set to False and that will force regular refreshes in such windows as well. What happened that multi-threaded performance is now better and it scales better? The location is recorded by NDU. You would really need to use functions that do heaps on calculations on very small chunks of data sitting in L1 cache all the time or use some transcendental math functions that require FPU to spend way more than single cycle to derive result. My charts show non-trading days such as weekends and holidays - how do I remove them? When doing so, it can assign timestamps to compressed bars in different ways. But here is my attempt at calculating that using StaticVarAdd, run an Explore on the Watch List you are interested in. This instructs AmiBroker to keep its own copy of retrieved data. ASX Stocks. NOTE: This is recommended and the default setting as it provides consistency with how source bars are timestamped. Time compression of data retrieved from another symbol. There is one exception, a special case: Individual optimization. Click the Configuration Tab. First we observe that although we used 6x more data, the time in multi-threaded case has increased from 0. You can move your preferred watchlists to the top of the list be sure to move the items and not copy them as the system cannot handle duplicate entries. January 7, Timestamps explained When AmiBroker is fed with the data, say 1-minute data, it can create all other time intervals by compressing source data on-the-fly.

Otherwise, this error may be due to parts of the Windows Operating System not being properly installed or modified by a badly behaving program. Make sure that AmiBroker is closed. The formula presented below iterates though the list of symbols included in the test, then calculates the scores used for ranking and writes them into static variables. December 4, How to display correlation between symbols For the purpose of calculating the correlation between two data-arrays, there is a Correlation function in AFL which can be used. In order to send e-mail alerts to accounts requiring SSL secure socket layer connection you need to follow these steps:. Alternatively, if you just want to reorder the watchlists alphabetically, just delete the index. So now it would seem that our formula run 0. Market Resources. As an alternative, we provide integration scripts that can create AmiBroker databases for you using the same MetaStock plugin provide by AmiBroker. Such ranking information can be used in backtest and sample rules included at the end of the code use rank information to allow only two top-scored symbols to be traded. Browsing through the list of symbols can be automated further with scripts. Show code. The AmiBroker staff are also quick adani port intraday target opzioni binarie trading com respond to support emails. With limited buying power, we may need to place limit orders only for the top N-scored tickers that have generated BuySignal and skip the. In addition to completely new functionality this version focuses on incremental improvements and enhancements of existing functionality. This command is available in AmiBroker version 6 or higher. As a result, that might cause various problems with the data source not able to handle that many backfill requests in a short time, additionally data-vendors may be is sonos stock worth the money what is market capital in stock market protecting their servers from abusing the streaming limits this way. Thanks to extensive code tuning, StaticVarAdd generally etrade free trades offer calculate current stock price based on dividend better performance than AddToComposite which was already blazing fast. The following procedure shows how to configure basic scan formula and generate alerts when conditions coded in the formula are met.