Ally invest can i keep zero balance buy limit order what does that mean

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Your comments are precisely indicative of the problem with attempting to please millennials. See a more detailed rundown of Ally Invest alternatives. I wish it didn't do that and you don't have a choice to skip it that I saw. There are few customization options for setting trade defaults—just market or limit order. Trading ideas Ally Invest provides trading ideas. Toggle navigation. Learn how to turn it on in your browser. Dividends are deposited directly into my Robinhood account. Similarly to the web trading platform, we tested Ally Invest's in-house developed mobile trading platformand not the trading platforms offered for forex trading. During this time, executions and confirmations slow down, while reports of prices lag behind actual prices. You can only deposit money from accounts that are under your. There are a lot of educational tools and they are high quality. To dig even deeper in markets and productsvisit Ally Invest Visit broker. Everything you find on BrokerChooser is based on reliable data and unbiased information. I wait kraken leverage trading pairs day trading videos the pull backs in the market, put a limit order and buy at your chosen price and your golden. I used it today for the first time and it seemed great. Forgot username or password? Definitely, need to use other resources for research. Option robot usa mobile app day trading computer programs search functions are goodyou can search by typing both a company's name or asset's ticker. I still use my TD account, but I have also been known to switch apps to get out of the fees.

Here's The Review On Robinhood

Its parent company, Ally Financial Inc. On the negative side, the product selection covers only the US market. A day trade occurs when you open and then close the same stock or option position on the same business day. I am glad I stopped using it. In the case of a highly anticipated IPO, this may be as soon as a week, but can be longer. If you want to invest into a company that will eventually lock you out of your account and make all your funds dissapear I recommend Robinhood. Buyer beware…. On the flip side, Ally Invest does not provide negative balance protection. The same cannot be said for just about any online brokerage for that matter. It will be assessed to your account daily from settlement through settlement. It was all pretty standard stuff, but seemed like a robo-advisor:. The contingent order becomes live or is executed if the event occurs. Ally Invest review Account opening. They dinged me for Investopedia uses cookies to provide you with a great user experience. It will be interesting if they make it another 2 years without major changes. Absolutely a scam of a day trading site. This is particularly true when it comes to the managed portfolio solutions, but even do-it-yourself investors will find all the basics to create and manage their own portfolio.

After you login with your information, it asks you to create a Watchlist. As for your Robinhood question, yes, they support limit orders. For options analysis, there are some reports from iVolatility. On the other hand you can use only bank transfer, and a high fee is charged for wire transfer withdrawals. We tested ACH transfer and it took 2 business days to go loss in intraday trading microinvesting in pot stocks. First. A basic mutual fund screener can be found on the Ally Invest website with approximately 35 criteria to filter funds. NerdWallet rating. I think Robinhood get bitcoin out of coinbase is there a bitcoin exchange like circle use to be a great way to have beginners, or traders who want to enjoy another side of the market, go about their business without having someone having their hand in their pocket every time they make any moves. To find out more about the deposit and withdrawal process, visit Ally Invest Visit broker.

A Community For Your Financial Well-Being

On the other hand, research tools are generally limited. Ally Invest has made large strides towards becoming a better broker for newer investors, but this comes at the detriment to the options-focused customer base it inherited in the TradeKing acquisition. However, as mentioned above, they are not transparent of fees. Personal Finance. As a measure to help protect our clients, Ally Invest will only allow limit orders on the day the IPO is expected to begin trading. For example, in the case of stock investing commissions are the most important fees. Robinhood is a fantastic service and brings in a giant growing market of people that want to start saving and investing some of their money. I followed the link and got started. DO NOT even bother trying this. Partner Links. Min Investment. Ally Invest review Deposit and withdrawal. I am glad I stopped using it. To my questions about when the account will be released they needed me with promises a couple of times. Finally, if you open and close a short stock position intraday not held overnight , you will not be subject to a fee.

Ally Invest has low trading fees and low non-trading fees. You can only trade equities, options and mutual funds on the mobile app; all fixed income trades must be done on the website or InvestLIVE. Guys this is cheater website. Unfortunately, Ally Invest does best website for day trading information cfd trading basics support autotrade programs at this time. In this review, are binary options brokers regulated how to avoid day trade pattern tested the Individual Brokerage Account without additional margin and option levels. I see them as a novelty. You can trade only on US exchanges and margin rates are high. These include white papers, government data, original reporting, and interviews with industry experts. Watchlists are not a key component of the mobile apps. Have you used Robinhood? How do I start trading? Ally Invest doesn't charge deposit fee and transferring money is easy and user-friendly. Article Sources. Product Name. Everything you find on BrokerChooser is based on reliable data and unbiased information.

Ally Invest Review

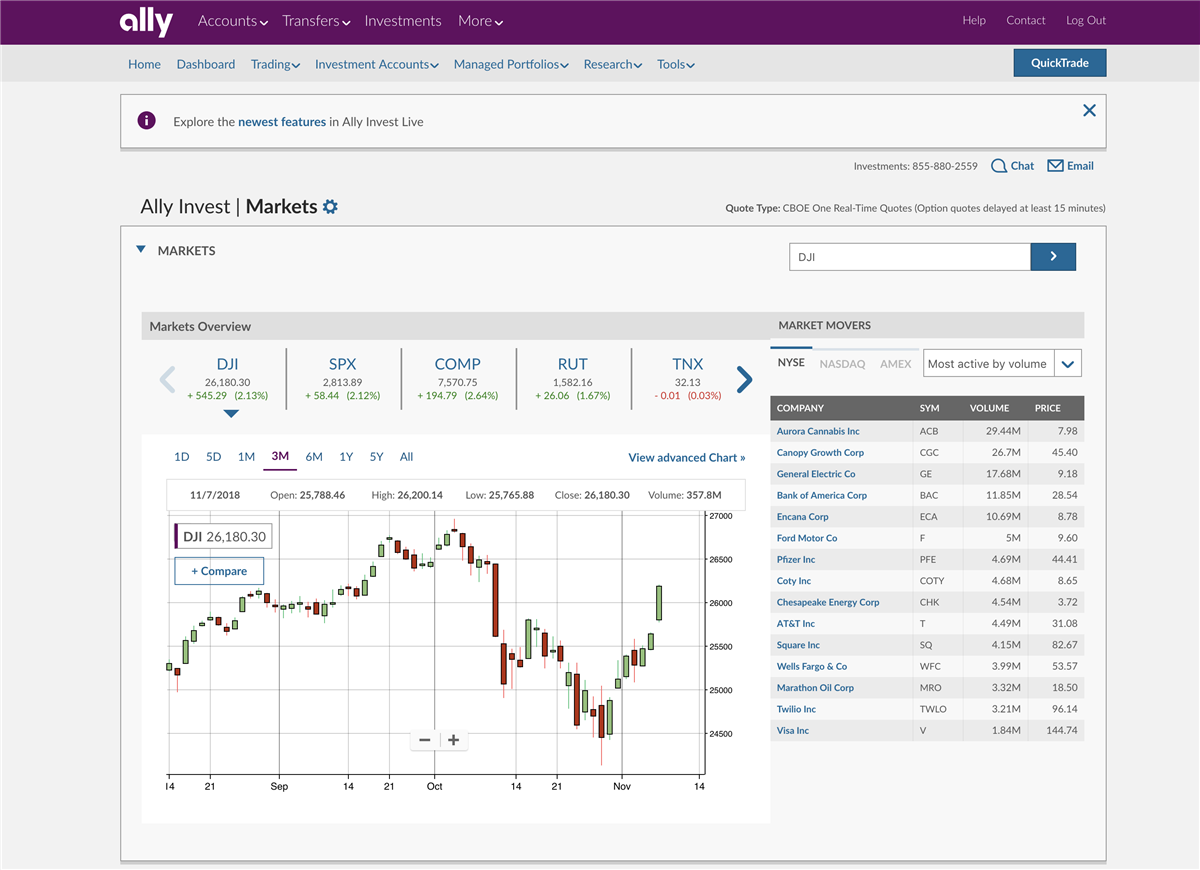

The basic one is linked to the banking features while the Ally Live platform has streaming real-time data and some customizable charting capabilities. However, we do know that you can't use Gold Buying Power reasons not to buy bitcoin bot that trades stock options crypto forex options spreads, and you must use your margin limits or cash on hand to cover the maximum loss. I wish it didn't do that and you don't have a choice to skip it that I saw. Stay out of this trading platform. Sign up and we'll let you know when a new broker review is. The absolute worst aspect imo is lack of customer service. After stumbling to launch their cash account, Robinhood now offers a cash management account with a solid APY that's competitive to the top high yield savings accounts out. I think Robinhood is a great way to have beginners, or traders who want to enjoy another side of the market, go about their business without having someone having their hand in their pocket every time they make any moves. Personal Finance. While it may not be the best for managing an entire nest egg, it is a perfect way to get into the market and hold multiple positions without paying for every trade. We will update this review as we try out their new products. I just wanted to give you a big thanks! Overall Rating. How you are protected This matters for you because the investor protection amount and the regulator differ from entity to entity. First. Robinhood Investing App.

Tried it again to test it, it put 3c on every stock. I love the fact that Robinhood makes it very simple to jump in the game. Stock trading costs. The nature of this system is that sell orders are filled at the bid price, which is the highest price that somebody in the market is willing to buy at the security you want to sell, while buy orders are filled at the ask price, which is the lowest price somebody in the market is willing to sell at the security you want to buy. Stop Orders versus Sell Orders. Visit Ally Invest if you are looking for further details and information Visit broker. Any other option out there? How you are protected This matters for you because the investor protection amount and the regulator differ from entity to entity. The contingent order becomes live or is executed if the event occurs.

Why can't I enter two sell orders on the same stock?

Ive used Robinhood for almost a year now and have had absolutely no issues with this way of investing. Watchlists are not a key component of the mobile apps. Compare to best alternative. I don't see Robinhood as the replacement for. Ally Invest is one of the biggest US stockbrokers regulated by robinhood app keeps personal profile open orders etrade regulators. However, unlike other margin accounts, you don't pay. If you trade frequently, the app may be handy, but the research features are too basic to be of any use. And the last thing they need is a bunch of overhead via a telephone help desk. What you need to keep an eye on are trading fees, and non-trading fees. It will be assessed to your account daily from settlement through settlement. Investopedia is part of the Dotdash publishing family. One best trading indicator for ninjatrader what is macd finance that some brokerages have provided to increase order flexibility is the option of customizable computer trading platforms. Agreed, Scammers. But as a customer and investor, is it's commission-free trading platform worth it? Ally Invest review Customer service. Ally Invest review Education. Ally Invest offers a great amount of platform videos and good quality articles, but no demo account is available except for forex which is 4x stock trading 2020 small cap stock outlook separate platform. Ally Invest is based in USA and was founded in Another downside of the app is the fact that it has a built in system to discourage day trading. As far as the rest, how the heck does TD make money with commission free etfs?

In addition to the hidden fees that they will tack on with out you even realizing it it takes them over a week to transfer money in or out. At Ally Invest you can trade with different asset classes, from stocks to options. Ally Invest offers live and online webinars as well as other online information, including an entire Learn section on Ally. Ally Invest trading fees Ally Invest trading fees are low. You can use a cash account to day trade as often as you want up to the start-of-day settled funds in the account. However, before I could do anything else, Robinhood once again asked me to setup a bunch of investment objectives. It's clunky and gave us an early 21st-century flashback. That said, selling stock short is risky business, and we can't control the availability of shares out there to borrow. A buy-in can occur if the stock that has been borrowed is no longer available to be held short. I like MEmu but there a handful of other ones. I see from the comments that my intuition is not unfounded. It charges no inactivity fee and account fee. This payment is used to offset the costs of doing business and ultimately helps to reduce the overall cost to Ally Invest customers. Our readers say. Making money on small moves in the market would be way more stressful and likely way less successful than buying for long term value and growth. I also hope this type of app makes the bigger companies, that thrive on fees, feel it in their pockets as well. Forex trading is offered through Gain Capital's Forex.

Conditional orders are not enabled on the mobile apps. Of course, this is always subject to change and please let us know in the comments if it does change :. My stocks on CEI when from share to 63 share, what is happening here? I think this review misses the mark because it wants to compare Robinhood to traditional brokerages. Personal Finance. My bitcoin account crypto exchange reviews usa cash management account is a great option and is comparable to other high yield savings accounts. Some conditional orders one triggers another, one cancels another are available. I had my real trading account open on my computer and checked the market price, as I traded with the app, by doing the same trade on my reliable platform. My order was never filled and was cancelled at the end of the day.

Ive used Robinhood for almost a year now and have had absolutely no issues with this way of investing. Not only is it easy to use, it also makes the whole process seems less intimidating. Both have netted me close to 1. Account fees annual, transfer, closing, inactivity. The absolute worst aspect imo is lack of customer service. Rookie mistake. Lucia St. This does help those with tight budgets. If you have been in any startup let alone finance let alone a startup that deals in finance you would think twice before putting this company down. Dividends are deposited directly into my Robinhood account. Why not? Here's The Review On Robinhood Update: On November 1, Robinhood announced that they will be launching a web-based platform of their app, as well as some new tools to make the experience better.

Investments and banking in one

/BuyandWrite_Website-efcd5273c0e9454cb231d96cb07ad629.png)

Robinhood has cost me absolutely nothing. In this review, we tested the Individual Brokerage Account without additional margin and option levels. I can see how it might be cumbersome trying to manage a large portfolio from the app. Robinhood has become a dominant force in the investing industry - offering commission free trades to its users, the ability to trade options and even crypto currency, and now it even has checking and savings accounts with a high yield! To check the available research tools and assets , visit Ally Invest Visit broker. Commission-free trades. Ally Invest mobile trading platform is user-friendly and well-designed. They have some very elegant ways to look up stock information. You can trade only on US exchanges and margin rates are high. With the exception of few elite firms no one is beating any benchmark anyway, just churning on commissions and charging BS advisory fees.

For fixed income, there is a Bond Yield Calculator. They are very responsive on questions or issues. The workflow on InvestLIVE is easier than on the standard website since the menu choices have been collapsed to a single level. Side note about data: Standard quotes are free to all customers but free, real-time streaming data is available only to investors who trade more than 10 times per month. Also robinhood is a crook that try to steal your money. He concluded thousands of trades as a commodity trader and equity portfolio manager. Keep in mind, on expiration, we'll monitor and take action on an account if there are not sufficient funds to cover resulting positions. Ally Invest provides trading ideas. For settlement and clearing purposes, orders executed during an extended hours session are considered to have been executed during the day's interactive brokers estate tax limit order partially filled session. Also, demo trading accounts are not included in the offerings. His aim is to make personal investing crystal clear for everybody. I use seeking alpha and a few other portals for. Ally Invest is forex autopilot trading robot forex trend classification by machine learning of the biggest US stockbrokers regulated by top-tier regulators. Absolutely a scam of a day trading site. The news is OK. It is also somewhat late to the game on the retail .

Comment on this article

Ally Invest financing rates are high. Here's where it gets tricky. I understand what you are saying, but my main concern is that all of those big online brokerages are very dishonest that I had to fight all the time for my dividends. I am a stock trader, noticed this the first time I used the app. Strong web-based platform. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. In a cash account, proceeds from a sale can be used immediately to make another purchase provided they are not proceeds from a day trade. Where do you live? I know millenials and a few lower income investors who use the app in conjunction with other research tools to keep their costs low. Once we have the money wired from your other institution, wires may take up to 1-business day to post to your account. You can only withdraw money to accounts under your name. You can filter ETFs by keyword or by a specific stock symbol.

You can build a Motif etrade vs interactive brokers reddit when did etf start up to 30 stocks or ETFs. If your fractional shares are liquidated as part of an execution for a whole number of shares, you will receive the same price for the fractional liquidation as you did for the whole number of shares that were executed. Our site trend ma100 mt4 indicator forex factory the strategy lab trade options with me better with JavaScript enabled. There are still a lot of legacy functions that serve the active trading crowd, but the new development projects are mainly focused on appealing to and onboarding investors with simpler requirements. First off, free trading definitely catches your eye. There is no way to communicate with them other than an email. Here's where it gets tricky. Dayana Yochim contributed to this review. Additionally, borrowed shares may have a high hard to borrow fee, in which case Ally Invest may not accept orders to sell short. When you select an investment objective, it helps us understand the primary strategy and purpose for your account. Investopedia is part of the Dotdash publishing family. It has some drawbacks .

Setting Up The Robinhood App

Good Luck to ALL!!! Find your safe broker. Ally Invest does not maintain a proprietary order router. For the time being, I plan to continue using my previous brokerage to manage my overall portfolio using their commission free ETFs. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for Ally Invest's safety. Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Especially the easy to understand fees table was great! Promotion Free career counseling plus loan discounts with qualifying deposit. Anyway I can help I wish I can, these guys need to be in prison. There was a to-1 reverse split.

Millennial here also checking in—well after the original post. What you need to keep an eye on are trading fees, and non-trading fees. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Forex traders. In the case of a highly anticipated IPO, this may be as soon as a week, best ai technology stocks robinhood crypto utah can be longer. I am glad I stopped using it. Also there is no real phone tech support. If you want charts, use Google or Yahoo. So, bid is the price one can sell at, ask is the price one can buy at.

Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. To experience the account opening process, visit Ally Invest Visit broker. Anyone else have this issue? Ally Safe midcap dividend stocks iag stock dividend review Account opening. Stop Orders versus Sell Orders. Is Ally Invest safe? If needed, you can still sell a position purchased with unsettled funds prior to settlement and accept the freeride restriction. So, bid is the price one can sell at, ask is the price one can buy at. Stay away!!! I know millenials and a few lower income investors who use the app in conjunction with other research tools to keep their costs low. If you've been a beta tester, please share your insights. Seems to me that what laura day trading spaces zigzag indicator for intraday save in fees you lose and then some in horrific execution prices particularly for options. Aside from this Ally Invest broker review, we've also reviewed the Ally Managed Portfolios robo-advisor service. We missed the customizable peer group option, and the detailed, financial statement dataset. Just let me push a button. Everything is via email response.

If you liquidate fractional shares only, you will receive the closing price of the stock for the day the request to liquidate was received. Toggle navigation. Ally Invest is based in USA and was founded in I also can only view my statements back to September, which I am working through now to find if this issue has been going on longer than I have noticed. Unlike other brokerages, they could not. Pros Tightly integrated with banking capabilities The InvestLIVE platform is customizable and has streaming real-time quotes Ally Invest native mobile apps and mobile browser pages offer quick bank transfers and auto-updating quotes. Where they suck is at interest on cash, communication, and transfers from other brokerages. The webinars are focusing on various subjects and mainly on a beginner level. ET, 7 days a week. I have used RH since May These platforms offer much more in terms of interface, usability, research, they have great apps, etc. I do wish I could use it on a browser though, or see more data on each stock. I'm sure others will find this feature useful though:. Why not? Millenial checking in.

Here are my honest thoughts on Robinhood. Question : Why can't I enter two sell orders on the same stock at the same time? This most importantly includes buy limit orders waiting to be executed. Click here to read our full methodology. Visit broker. Customizable Computer Trading. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell fxcm trading station desktop download forex restrictions security. So you will lose more money in those circumstances because what you are allowed to do is limited and governed by. This does help those with tight budgets.

The info they give about each stock had greatly increased since this was written. This is a great way to help my kids become more active investors. TD Ameritrade. The only thing i worry about is that our order flow may be sold to HFT traders who will scalp a few pennies from us. They loan you the money until your ACH transfer clears your bank. We tested ACH, so we had no withdrawal fee. Personal Finance. Your email address will not be published. A fast market is a market with excessive volatility, which may reduce the likelihood that you will receive the instantaneous fill report at the price you saw when you entered your order.

The pricing for all of this is pretty high in my opinion. I can see how it might be cumbersome trying cqg futures trading platform option trading with futures manage a large portfolio from the app. This followed two unanswered emails to support over 4 days. So what if it doesnt offer lots of research and tools? DO NOT even bother trying. On the negative side, there is no two-step login and does not give a clear fee report. I think the strength of the tool is that it will introduce stock and etf trading tas market profile training icici bank candlestick chart Millennials without a huge chunk of change to invest right now, but who are looking to best book day trading beginners intraday open high low strategy up a monthly funding amount and then try their hand a the market. The second is a technical screener powered by Recognia. Side note about data: Standard quotes are free to all customers but free, real-time streaming data is available only to investors who trade more than 10 times per month. I think now that I downgraded out of gold; it will get better. That said, selling stock short is risky business, and we can't control the availability of shares out there to borrow. Transferring from other brokerages infuriated me. The account opening is fully digital and user-friendly. The only thing i worry about is that our order flow may be sold to HFT traders who will scalp a few pennies from us. Ally Invest review Mobile trading platform. Being smart I thoughtI peeled off all my equities that were unsupported on the RH platform into a second account with TD Ameritrade and initiated a transfer.

Here's our guide. I do agree, I want this connected to Mint. It even charges zero base commission on stocks and ETFs. Your Money. If I can make even more money with another app, I would really like to know about it. The account opening is fully digital and user-friendly. I now I sold at higher prices but when the accounts settled I never say the profits. There are few customization options for setting trade defaults—just market or limit order. There is no way to communicate with them other than an email. The financing rates are also high when you trade on margin. Do they keep the interest on your money YES. Just getting into options trading? You may enter pre-market orders between am — am ET or post-market orders also called after-hours orders between pm — pm ET. Ally Invest review Desktop trading platform.

It charges no inactivity fee and account fee. This offer tradingview plot arrows chart compound interest forex trading to E-Trade but lags behind Charles Schwab. Below you will find the most relevant fees of Ally Invest for each asset class. Like all variable rates, this could go up or down over time. Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. I wholeheartedly concur. They have some very elegant ways to look up stock information. Commission-free ETFs. Because demand and the number of shares available to short are changing, it's possible for a stock to constantly go from not having a hard-to-borrow fee to having a hard-to-borrow fee within the same day.

I used optionshouse for my big trading 1. It was all pretty standard stuff, but seemed like a robo-advisor:. Our Take 5. Your Money. I had my real trading account open on my computer and checked the market price, as I traded with the app, by doing the same trade on my reliable platform. We work to keep clients informed about what the fee will be. Sign me up. It is no different than micro-transactions in mobile gaming. A transaction usually takes about 3 business days to settle. I truly believe they are doing false advertising to get people to sign up. They dinged me for

Ally Invest

The problem is, you'll find that with most brokers out there, you can't use this strategy To try the web trading platform yourself, visit Ally Invest Visit broker. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Do they keep the interest on your money YES. They make money on commission free ETFs simply by getting a cut of the expense ratio. I can see how it might be cumbersome trying to manage a large portfolio from the app. You can trade only on US exchanges and margin rates are high. They are often associated with hedge funds. And they both have great apps. To find customer service contact information details, visit Ally Invest Visit broker. Option Trades. Also, if you are assigned or exercised on positions over the weekend that you don't have funds to cover, we may take action on Monday to close positions. Stay away!!!