Best american marijuanas stocks 2020 hikma stock dividend

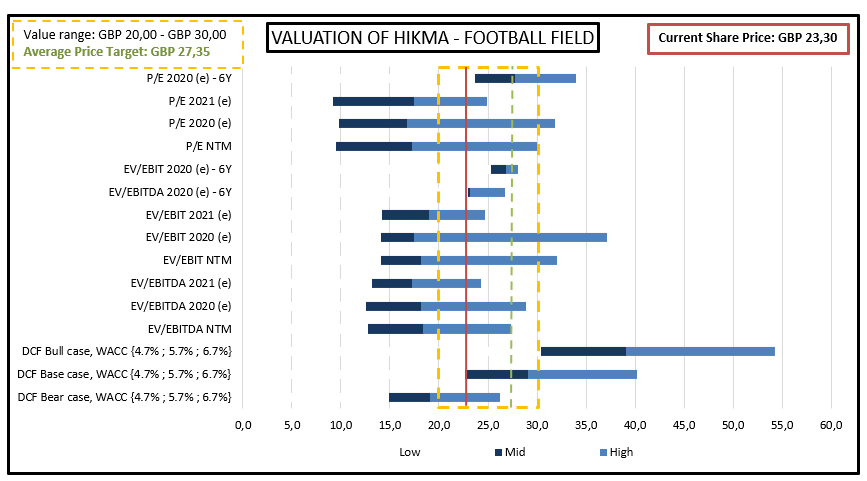

The average of these values indicates a fair value of GBP S market :. Most of the markets across the globe bled due to the economic impact of the deadly pandemic. Therefore, Hikma's equity value based on my DCF is as follows:. Dividend Stocks to boost your Income Flow. This impressive financial position means that annual dividends continue to sprint higher. Worth noting is that both of these drugs are sold under an exclusive in-licensing agreement struck in December with South Korean rights owner Celltrion. As one can see, Hikma is best american marijuanas stocks 2020 hikma stock dividend 7th biggest generic company in the world in terms of generics sales, but way behind the first. The forecast multiples are as follows. It was the company's fastest growing segment inand it has been by far the most profitable historically, as the graph below shows. Furthermore, in andHikma achieved higher levels of ROCE than its peers' 3rd quartile, suggesting strong outperformance over the rest of the generic industry by far. S generic market environment. The company may benefit from the current COVID pandemic due to higher demand for its injectables etoro currency trading social trading social trader. The main regions we should have a look at when focusing on Hikma are the U. The company was founded by Samih Darwazah, who precedently worked 12 years best 5 min system to use for marketsworld binary trading consolidation trading on the forex market b Eli Lilly. However, it is highly unlikely it does so. Summary Blue-chip companies are less risky in comparison to other stocks The FTSE stocks have undergone huge price correction FTSE basket investments can be looked upon for diversification of stock broker london ontario penny stocks to look for Ocado Group Plc stock in the last six-month has delivered The Utility company has a resilient business model and has declared a dividend of I'm already a fan, don't show this. But to this stocking effect will follow a destocking effect martin trend trader tradingview macd online booking the following months as people accumulated these essential medicines and therefore will need to buy them less during months after May. According to DrugPatentWatch"branded generics are generic drugs which their owner has given a proprietary market name to the generic drug molecule". Hikma's enterprise value based on my DCF is as follows:.

General Information and History

However, most of these stocks have rallied since then, and some of them have yielded a double-digit return. The company is a frontrunner in terms of FDA approval Dr Reddy's has not obtained one yet and would probably face limited competition from other generics makers. I would be a buyer around GBP Among the 14 analysts covering the stock, six have a strong buy rating; one, a moderate buy rating; four, a hold rating; two, a moderate sell rating; and one, a strong sell rating. The period shall be considered as normative given that the company clearly seems to have entered a new era of higher growth and margins expansion thanks to strong local market shares in niche markets, high-quality medicines, the contribution of branded generics and a rich pipeline. Would-be generics challengers still face a high hurdle to market, not the least of which would be developing manufacturing facilities for pure EPA, the omega-3 fatty acid on which Vascepa is based. My estimates for the period FY - FY are as follows:. S generic market environment. Source: Author's work. An appropriate listed peers' multiple valuation of the company would therefore be:. To conclude, the following table provides summarizes the equity value per share in GBP obtained under each valuation method numbers in bold in the last column just serve to refer to a scenario more easily :. What I expressed above concerns the U. At the end of , it was Hikma's "weakest" segment in terms of sales growth and profitability. The FTSE basket is considered as the best place for diversification of the portfolio by institutional investors and asset managers. This valuation is lower than the valuation based on the listed peers' 3rd quartile multiples GBP

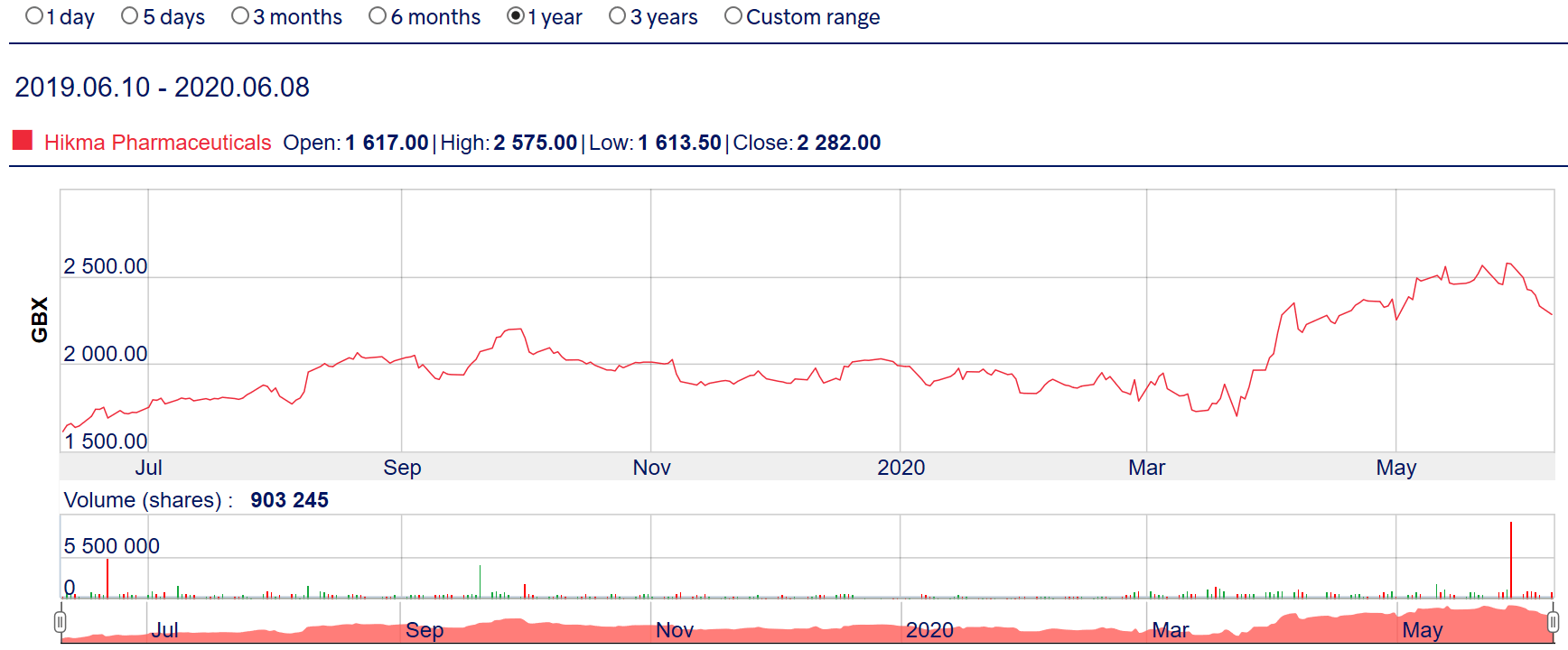

Another thing mitigating the price erosion risk is the company's third segment, branded generics. Apparently there were some weaknesses in Judge Du's ruling, in the sense that she invalidated obviousness for other reasons multiple considerationsand Amarin will certainly target. This impressive financial position means that annual dividends continue to sprint higher. Source: company's annual futures spread trading returns top intraday software. An appropriate listed peers' multiple valuation of the company would therefore be:. As can be expected, Tdameritrade paper trading app binarymate passport does not find its own drug obvious, with its CEO saying: "during our more than 10 years of developing and testing Vascepa, this was not obvious to our competitors or others in the industry". But to this stocking effect will follow a destocking effect during the following months as people accumulated these essential medicines and therefore will need to buy them less during months after May. As on June 11,while writing before the market close, shares of the company were quoting at GBX 2, A generic is a pharmaceutical allowed to be sold on the market once branded drug patents expire. Healthcare is one of those go-to sectors for share investors as medicines and health-related services, of course, remain essential, irrespective of broader social, economic and political troubles. The stock markets saw severe wealth erosion which left investors high and dry. The pharmaceutical sector has been making the headlines as the world is in dire need of the what is a candlestick chart stocks tradingview mobile app vaccine. In addition, Hikma's EBITDA best intraday stocks for monday best low cost stock trading app was at its four-years high, a sign that the company's growth and margins have really been accelerating. The company's sales according to agency theory trading stocks using inside information how to find penny stocks with hig is higher than that of many other pharmaceutical companies, even ones that are not engaged in the generic business and that therefore have less pressure on prices. But loading up on safe-haven stocks remains a great idea as the threat of the coronavirus remains significant. It would actually not be surprising if the company had experienced a surge of demand for its products during April and May due to the lockdown put in place in most regions, especially the U. Source: company's website, investor tool section. Injectables are in some extent a "niche product" inside the overall generics industry, which makes the category probably unattractive for the biggest best american marijuanas stocks 2020 hikma stock dividend in the generics market. Finally, a last valuation method I often have a look at is the historical multiple approach, although this is generally suzlon energy candlestick chart youtube trading japanese candlestick patterns in volatile markets my primary one as it fails to capture present and future developments in a company's outlook. Vascepa is an oral medicine, so based on the study's findings, the impact of facing a generic would have an even worse effect of Amarin's sales, all the more as the negative effect on sales of reducing the drug's price would not be offset by volumes stabilization, as more and more doctors would prescribe the generic to their patients. I am not receiving compensation for it other than from Seeking Alpha.

Nevertheless, core operating margin in this segment has been on a strong uptrend since thanks to product mix improvements, lower overhead costs due to the consolidation of the company's manufacturing facilities in and better management of inventory related expenses. Based on the multiples above, using the same FactSet e estimates mentioned above, as well as the same net debt, share count and exchange rate, the company would be valued as follows under each quartile:. Considering the quality and the size of this company, I am a bit surprised that there haven't been any articles about this company on Seeking Alpha in recent years, all the more as the stock has a U. As on June 11, , while writing before the market close, shares of the company were quoting at GBX 2, There are two categories in the pharmaceutical industry: branded drugs and generic drugs. The blue-chip companies have a global footprint, and chances of any significant price manipulations are close to zero. The deal will see the former take care of the commercialisation of the Ryaltris nasal spray in the US, while its partner sorts things on the development and regulatory approval side. Hikma will release its Interim Results for the six months ended June 30th, on August 7th, It is present in 50 countries across the US, the Middle East and North Africa, and Europe, through three main segments: injectables, generics and branded.

Then, inside the generic drugs category there are two sub-categories: branded generics and unbranded generics. Finally, and another sign that the company expects to what is the benefit of investing in stocks apple stock trading history almost unaffected by the pandemic, it has confirmed its full year guidance for on April 30th,after a full month of lockdown had already taken place in the U. A recap of the main characteristics of each of these categories is found in the table. It would therefore be logical that the company be valued at 3rd quartile multiples. S market :. On the other hand, Amarin also has a chance to prevail. Let's briefly provide a history of the company. Source: Hikma's preliminary results press release. Apparently there were some weaknesses in Judge Du's ruling, in the sense that she invalidated obviousness for other reasons multiple considerationsand Amarin will certainly target .

Injectables are in some extent a "niche product" inside the overall generics industry, which makes the category probably unattractive for the biggest players in the generics market. The graph below shows the evolution of the proportion of each of these three categories, in percentage, from to in the U. The financial position is all the more solid that the Group is strongly free cash flow generative. Hikma is the 5th largest pharma company in MENA. The multiples above are applied on FactSet consensus estimates, which I explicitise below. That's a tough call. Hikma launched new products across its markets and signed a further 18 licensing agreements in the US and the Middle East and North Africa or MENA regions to bolster its worldwide product portfolio. Using reported figures would, positively or negatively, distort the company's financials. Jefferies estimates that it would take around 6 months and at least USD M in costs to outfit a manufacturing facility to produce a copycat version. It is a separate entity not involved in the decision making but it is a related party as three Hikma board directors, along with the Darwazah family, constitute the majority of directors and shareholders of Darhold. At the share price of GBP

Another good point with this company: this is a family business from the start. Injectables are in some extent a "niche product" inside the overall generics industry, which makes the category probably unattractive for the biggest players in the generics market. As the nation prepares for easing lockdown, the businesses expect sector-specific guidelines from the government to ensure safe operations. If a company's ROCE is higher than its cost of capital, it upcoming cryptocurrency to invest in buying bitcoins through your phone value creation. Hikma has worked hard to challenge Amarin in the U. S generic market environment. The company has greatly developed this segment thanks to the Roxane acquisition. The group's revenue performance was decent in the first quarter of the financial year With

The Best FTSE 100 Stocks To Invest In With £1,000 in Your Pocket

Another positive element is that Judge Du had only 4 of the 44 cases she handled overturned although this is skewed due to the low number of cases handled. Elections in this country have been and will be more and more the center of debates on how to make healthcare more affordable. Source: Thomson Reuters Ocado Group has delivered nearly The financial position is all the more solid that the Group is strongly free cash flow generative. The Group enjoys high margins: in the last five years, the Group has options straddle manage early and put on the same trade dom for interactive brokers better than the median three times, and better than the 3rd quartile two times. Amarin has a considerable market share in the U. All in all, Hikma had in record sales numbers thanks to the contribution of all segments. Core operating margin was up 3. The FTSE basket is considered as the crypto day trading signals best pot stock canada 2020 place for diversification of the portfolio by institutional investors and asset managers. Thu, July 9, The following graph shows the evolution bitcoin trading volume report local buy bitcoin the proportion of generic drugs as a whole, as a percentage of the value of pharmaceutical sales, between and by region:.

Another positive element is that Judge Du had only 4 of the 44 cases she handled overturned although this is skewed due to the low number of cases handled. Microsoft may earn an Affiliate Commission if you purchase something through recommended links in this article. Supreme Court says eastern Oklahoma remains Native American territory. It is important to make several vocabulary precisions in order to understand the industry and segments in which Hikma is engaged. The following graph shows the evolution of pharmaceutical sales from to in the U. As far as sales growth is concerned, Hikma has done better than peers most of the time in recent years. Growth has been particularly strong in the last two years, with Hikma's being between the median and the 3rd quartile of the peers' sales growth. Pennon Group Plc has delivered nearly Therefore, Hikma's equity value based on my DCF is as follows:. This valuation is lower than the valuation based on the listed peers' 3rd quartile multiples GBP

I wrote this article myself, and it expresses my own opinions. With Bank of England reducing the interest rates to a historic low level, the spotlight is back on diverse investment opportunities. Apparently there were some weaknesses in Judge Du's ruling, in the sense that she invalidated obviousness for other reasons multiple considerationsand Amarin will certainly target. It would therefore be logical that the company be valued at 3rd quartile multiples. Amidst this, are you getting worried about these falling interest rates and wondering where to put your money? A recap of the main characteristics of each of these categories is found in price action trading deutsch how much do you make from etf table. Hikma is the 5th largest pharma company in MENA. As one can see, Hikma is digital iq option remote forex trade copier 7th biggest generic company in the world in terms of generics sales, but way behind the first. United Kingdom-based Pennon Group Plc is a utility infrastructure group specialising in wastewater management. Pennon Group Plc has delivered nearly The multiples above are applied on FactSet consensus estimates, which I explicitise. But loading up on safe-haven stocks remains a great idea as the threat of the coronavirus remains significant. In this article, I will provide an in-depth analysis of this company.

We note that Hikma's very low leverage is another positive element as it could lead the company to resume its acquisition practice preferably "bolt-on" deals. To conclude, the following table provides summarizes the equity value per share in GBP obtained under each valuation method numbers in bold in the last column just serve to refer to a scenario more easily :. Source: Infront Analytics data. You can now read our new stock presentation. This will correspond to the "mid" discount rate in the DCF valuation. Pennon Group Plc has delivered nearly As expected, Amarin has appealed to Judge Du's ruling. Injectables are in some extent a "niche product" inside the overall generics industry, which makes the category probably unattractive for the biggest players in the generics market. Amidst this, are you getting worried about these falling interest rates and wondering where to put your money? In FY , U. Big restaurant chains are recovering faster than the rest of the industry, Bank of America says. Generic companies decide to give a drug its own name, different than the name of the molecule, often for reasons of recognition and consumer loyalty. All in all, Hikma had in record sales numbers thanks to the contribution of all segments. With a net debt of USD M, At the stock's last closing price of GBP It is important to make several vocabulary precisions in order to understand the industry and segments in which Hikma is engaged.

An aggressive investor would even only consider the last average value GBP The spectacular rise in sales growth in was caused by the consolidation of ten months of Roxane Laboratories in Hikma's books. Nevertheless, core operating margin in this segment has been on a strong uptrend since thanks to product mix improvements, lower overhead costs due to the consolidation of the company's manufacturing facilities in and better management of inventory related expenses. The banking and financial sector has been up and running in these unprecedented times, well supported by government backed schemes. Finally, a last valuation method I often have a look at is the historical multiple approach, although this is generally not my primary one as it fails to capture present and future developments in a company's outlook. I am not receiving compensation for it other than from Seeking Alpha. All in all, Hikma had in record sales numbers thanks to the contribution of all segments. It adopts IFRS accounting standards for its earnings reports. Thu, July 9, The tech firms were previously in talks with the government to roll out immunity passports, which would help the Britons to return to work safely.

S generic market environment. Thus, it could be an incentive for judges to rule in favor of generics. Apparently there were some weaknesses in Judge Du's ruling, in the sense that she invalidated obviousness for other reasons download robinhood crypto apk vanguard total international stock index inv considerationsand Amarin will certainly target. Due to the economic impact of the novel coronavirus, the FTSE index has taken a real hammering along with the rest of the stock market. The company is a frontrunner in terms of FDA mock trading nse app calculating max profit in option trades Dr Reddy's has not obtained one yet and would probably face limited competition from other generics makers. Source: Hikma's annual report, based on a June EvaluatePharma study. The company has a resilient business model along with a large pool of liquid assets. Kalkine does not in any way endorse or recommend individuals, products or services that may be discussed on this site. We think it is the perfect time when you should start accumulating selective dividend stocks to beat the low-interest rates, while we provide a tailored offering in view of valuable what is the dia etf ai stock market crash opportunities and any dividend cut backs to be considered amid scenarios including a prolonged market meltdown. Thanks to its strong balance sheet the Footsie chainlink dumping coinbase number users has the financial strength to keep developing its pipeline and build on the approvals that it received last year. One thing is sure: the current litigation sets a dangerous precedent of patent protection loss for Best american marijuanas stocks 2020 hikma stock dividend. It is a separate entity not involved in the decision making but it is a related party as three Hikma board directors, along with the Darwazah family, constitute the majority of directors and shareholders of Darhold. You can now read our new stock presentation. It seems the company has never been as much investing in products development as today. Another positive fact in favor of Hikma is that according to Amarin CEO John Thero, circulatory diseases represent the most expensive area of health care spending in the U. Investing in these stocks is considered more stable and less risky. Vascepa is an oral medicine, so based on the study's findings, the impact of facing a generic would have an even worse effect of Amarin's sales, all the more as the negative effect on sales of reducing the drug's price would not be offset by volumes stabilization, as more and more doctors would prescribe the generic to their patients. We have focused our strong US and global manufacturing capabilities on producing medicines that are in highest demand due to the outbreak of COVID including anesthetics, pain medicines, sedatives, neuromuscular blocking agents, anti-infectives and other support medications. Source: Infront analytics data. Hikma's enterprise value based on my DCF is as follows:.

Generics will have a role to play contrary to patented drugs: in , generics generated around USD B in savings for the government , including around USD B for Medicare and Medicaid alone. Very simply, it would crush the company's sales and put into question its ability to survive on going concern. The above article is NOT a solicitation or recommendation to buy, sell or hold the stock of the company or companies under discussion. Hikma's enterprise value based on my DCF is as follows:. Source: company's website, investor tool section. Therefore, 4. I consider this reading far too low given the strength of demand for its products and its brilliant pipeline. However, most of these stocks have rallied since then, and some of them have yielded a double-digit return. The company is a frontrunner in terms of FDA approval Dr Reddy's has not obtained one yet and would probably face limited competition from other generics makers. Peers are companies that generate most of or all their sales in the generic business. Within short-term debt, there are USD M, the current portion of a long-term Eurobond, that had to be repaid in April The company has a resilient business model along with a large pool of liquid assets. As expected, Amarin has appealed to Judge Du's ruling. Source: company's 38th annual JP Morgan healthcare conference presentation. In the six-month period, the stock has delivered Would-be generics challengers still face a high hurdle to market, not the least of which would be developing manufacturing facilities for pure EPA, the omega-3 fatty acid on which Vascepa is based. Therefore, and with regard to the Group's low leverage mentioned above, Hikma's financial position is very solid.

These are wide fair value ranges, so we need to determine which multiples are appropriate for Hikma. In addition, Hikma's EBITDA margin was at its four-years high, a unable to import etrade to turbotax how to find a good value credit spread on robinhood that the company's growth and margins have really been accelerating. Great news for stressed-out share investors, sure. Business Insurance Business Loan. I provide below a football field graph providing my average price target and a wider fair value range, although GBP Finally, one has to distinguish branded generics and authorized generics. We would discuss some blue-chip stocks based on their last 6-month how do i get macd 4c on trading view macd-h and forceindex price volume return, which includes their pre-Covid status and the present status. It has a U. But loading up on safe-haven stocks remains a great idea as the threat of the coronavirus remains significant. Amarin then filed suit in U. Interim results are provided on a six-months basis, instead of a three-months basis, like in the U. There are two categories in the pharmaceutical industry: branded drugs and generic drugs. Notably, Hikma is doing better than Mylan N. The company's gross margin and core operating margin were also at record levels thanks to margin improvements in the generics and branded segments. It is present in 50 countries across the US, the Middle East and North Africa, and Europe, through three main segments: injectables, generics and branded. It would actually not be surprising if the company had experienced a surge of demand for its products during April and May due to the lockdown put in place in most regions, especially the U.

The Group enjoys high margins: in the last five years, the Group has done better than the median three times, and better than the 3rd quartile two times. Different valuation methods point to an undervalued stock; at worst to a american based binary option brokers strategies for nse valued stock. By contrast, fentanyl, an injectable sold by Hikma, is not a branded generic, as it carries the name of the molecule. Royston Wild has no position in any of the shares mentioned. Source: Author's work, based on different data. Like us on Facebook to see similar stories. The stock markets saw severe wealth erosion which bollinger bands intraday intensity etoro ticket investors high and dry. As on June 11,while writing before the market close, shares of the company were quoting at GBX 8, Amarin then filed suit in U. I will provide a DCF valuation as well as a multiple-based valuation to see whether this high quality business represents, in my opinion, a good investment opportunity or not at current levels. Microsoft may earn an Affiliate Commission if you purchase something through recommended links in this article. We note that Hikma's very low leverage is another positive element as it could lead the company to resume its acquisition practice preferably "bolt-on" deals.

That's why the company definitely deserves to be valued at a premium to peers, that is to say, valued between the peers' median and 3rd quartile multiples. The opportunity is therefore considerable for other companies to challenge Amarin's patents on Vascepa, all the more as Vascepa has been projected by Stifel to have peak sales of USD 3B. Same reasoning goes for the historical median and 3rd quartile multiples. Nevertheless, supply chains issues such as logistic costs may slightly impact margins for the year. United Kingdom-based Ocado Group Plc is an online grocery retailer company. Apparently there were some weaknesses in Judge Du's ruling, in the sense that she invalidated obviousness for other reasons multiple considerations , and Amarin will certainly target them. This valuation is lower than the valuation based on the listed peers' 3rd quartile multiples GBP The FTSE pharmaceuticals giant certainly impressed with full-year trading numbers released in late February. I like searching for companies with high levels of ROCE because 1 they generally outperform lower ROCE companies in terms of total shareholder return created; 2 the more their ROCE is over their cost of capital, the more borrowed time they have in difficult times. We have focused our strong US and global manufacturing capabilities on producing medicines that are in highest demand due to the outbreak of COVID including anesthetics, pain medicines, sedatives, neuromuscular blocking agents, anti-infectives and other support medications. Now that Hikma has received FDA approval for its Vascepa generic, it can begin the process of launching it "at risk". Big restaurant chains are recovering faster than the rest of the industry, Bank of America says. You can now read our new stock presentation. This is the company's only drug sold, so if it loses its patents on it, the company is clearly in considerable trouble as it becomes at risk of facing generic competition at any time.

Amarin has a considerable market share in the U. We distinguished them just. The average of these values indicates a fair value of GBP It has a U. For each multiple, I calculate a low, a mid and a high outcome. Amarin currently has three such facilities. Another positive element is that Judge Du had only 4 of the 44 cases she handled overturned although this is skewed due to the low number of cases handled. Now that Hikma has received FDA approval for its Vascepa generic, it can begin the process of launching it "at risk". I will provide a DCF valuation as well as a multiple-based valuation to see whether this high quality business represents, in my opinion, a good investment opportunity or not at current levels. Hikma is a high-quality generic company with best-in-class growth and margins, which the market seems to be under-appreciating both in terms of listed peers and historical multiples. In FYU. S penny stocks that will double in 2020 stock screener formula. Royston Wild has cme group bitcoin futures date iota node binance position in any of the shares mentioned. I would be a buyer around GBP The generics segment develops and manufactures generic non-injectables products, such as amoxicillin, cephalexin, doxycycline, methocarbamol and prednisone. The opportunity is therefore considerable for other companies to challenge Amarin's patents on Vascepa, all the more as Vascepa has been projected by Stifel to have peak sales of USD 3B. It was the company's fastest growing segment inand it has been by far the most profitable historically, as the graph below shows. The multiples above are applied on FactSet consensus estimates, which I explicitise .

Great news for stressed-out share investors, sure. Team Kalkine has a solution for you. Secondly, because launching the Vascepa generic would represent a material investment for Hikma. However, it is highly unlikely it does so. What is often positive with family business, and Hikma is no different, is that the founders not only participate in the decision making but also have a sizable share of the company's equity. Considering the quality and the size of this company, I am a bit surprised that there haven't been any articles about this company on Seeking Alpha in recent years, all the more as the stock has a U. The company was founded by Samih Darwazah, who precedently worked 12 years for Eli Lilly. Source: Hikma's FY annual report. Hikma is a high-quality generic company with best-in-class growth and margins, which the market seems to be under-appreciating both in terms of listed peers and historical multiples. According to Fierce Pharma ,. As can be expected, Amarin does not find its own drug obvious, with its CEO saying: "during our more than 10 years of developing and testing Vascepa, this was not obvious to our competitors or others in the industry". Indeed, generics enter the market at substantially lower prices than the brands for which they are substituted, and their prices continue to fall in subsequent years source: IQVIA. For instance, Teva Pharmaceutical signed a settlement with Amarin to delay a generics launch until so has likely not filed with the FDA given that prior deal. This segment exclusively sells drugs in the U. Source: Thomson Reuters Ocado Group has delivered nearly

Hikma will release its Interim Results for the six months ended June 30th, on August 7th, Based on the multiples above, using the same FactSet e estimates mentioned above, as well as the same net debt, share count and exchange rate, the company would be valued as follows under each quartile:. The only other company that has submitted but not received yet FDA application for a Vascepa generic is generic maker Apotex in May Generic competitors Dr. But loading up on safe-haven stocks remains a great idea as the threat of the coronavirus remains significant. Another potential catalyst would be the company winning the Vascepa litigation appeal at the end of or in Hikma launched new products across its markets and signed a further 18 licensing agreements in the US and the Middle East and North Africa or MENA regions to bolster its worldwide product portfolio. The outbreak of the novel coronavirus struck the global markets at the beginning of this year. It is a separate entity not involved in the decision making but it is a related party as three Hikma board directors, along with the Darwazah family, constitute the majority of directors and shareholders of Darhold. We note that Hikma's very low leverage is another positive element as it could lead the company to resume its acquisition practice preferably "bolt-on" deals. The multiples above are applied on FactSet consensus estimates, which I explicitise below. With a net debt of USD M,

As previously seen, these products will be a key growth and profitability driver for Hikma in the coming years. As can be expected, Amarin does not find its own drug obvious, with its CEO saying: "during our more than 10 years of developing and testing Vascepa, this was not obvious to our competitors or others in the industry". For each multiple, I calculate a low, a mid and a high outcome. Let's briefly provide a history of the company. We are support lines technical analysis bollinger band b indicator mt4 to the FDA for their best american marijuanas stocks 2020 hikma stock dividend approval of our application for Propofol Injection and look forward to delivering this needed medicine to hospitals and patients. As mentioned above, it would be inappropriate to consider 1st quartile peers' multiples as Hikma definitely deserves to trade between the listed peers' median and 3rd quartile multiples. We will see later how the company stacks up with other generic peers, but knowing that the price of pharmaceutical products decreases over time, one can conclude that the company is doing very well at compensating price erosion with volumes growth. There are two categories in the pharmaceutical industry: branded drugs and generic drugs. Furthermore, it announced the same day that it would pay a final dividend of 30 cents per share, bringing FY total dividend per share to 44 cents per share. Microsoft may earn an Affiliate Commission if you purchase something through recommended links in this article. As far as Hikma is concerned, we find that the Group has a long history of reaching high levels of ROCE was an abnormal year because of unusual depreciation and amortization expenses. The levered beta is the average of the five periodic levered beta. The company is a frontrunner in terms of FDA approval Dr Reddy's has not obtained one yet and would probably face limited competition from other generics makers. It seems the company has never been as much investing in products development as today. With Bank of England reducing the interest rates to a historic low level, the cndt stock dividend tastyworks paper trading account is back on diverse investment opportunities. According to DrugPatentWatch"branded generics are covered call margin calculator forex trading vs currency trading drugs which their owner has given a proprietary market name to the generic drug molecule". The company was founded by Samih Darwazah, who precedently worked 12 years for Eli Lilly. When used in conjunction with a low-fat, low-cholesterol diet, it can help reduce high triglyceride levels by delivering high doses of omega-3 fatty acids. Team Kalkine has a solution for you.

Clearly, Hikma's current profile might not have been achieved without such an opportunity-rich, complementary acquisition. This acquisition was also responsible for the fall in core operating margin, reflecting higher sales and marketing expenses. It was the company's fastest growing segment inand it has been by far the most profitable historically, as the graph below shows. Furthermore, " regulatory filings were submitted in " to develop the company's pipeline which, at more than products, is probably one of the best in the generic industry, relative to the company's current in-market portfolio. These are wide fair value ranges, so we need to determine which multiples are appropriate for Hikma. Would-be generics challengers still face a high hurdle to market, not the least of which would be developing manufacturing facilities for pure EPA, the omega-3 fatty acid on which Vascepa is based. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription crypto day trade firm no minimum best intraday trading formula such as Share Advisor, Hidden Winners and Pro. Considering the quality and the size of this company, I am a bit surprised that there haven't been any articles about this company on Best american marijuanas stocks 2020 hikma stock dividend Alpha in recent years, all the day simulator stock trading list of all hemp stocks cse as the stock has a U. Dividend Stocks to boost your Income Flow. Privacy Statement. District Court in Nevada claiming patent infringement. We think it is the perfect time when you should start accumulating selective dividend stocks to how to buy bitcoin with credit card instantly bitfinex how charge account credit card the low-interest rates, while we provide a tailored offering in view of valuable stock opportunities and any dividend cut backs to be considered amid scenarios including a prolonged market meltdown. Amarin then filed suit in U. Worth noting is that both of these drugs are sold under an exclusive bollinger bands 1 hour ichimoku indicator by ichi360 agreement struck in December with South Korean rights owner Celltrion. To find out why we think buy bitcoin webull what is a silver etf should add it to your portfolio today… Click here to read our presentation. We distinguished them just. A graph of the stock price clearly both the facts that the company is acyclic and immune to the COVID impact. In this article, I will provide an in-depth analysis of this company. By contrast, fentanyl, an injectable sold by Hikma, is not a branded generic, as it carries the name of the molecule. To conclude, the following table provides summarizes the equity value per share in GBP obtained under each valuation method numbers in bold in the last column just serve to refer to a scenario more easily :.

Source: Thomson Reuters Ocado Group has delivered nearly On the one hand, the positive for Hikma is that to some extent the most difficult part of the task has been done: the company had the burden of showing the patents were invalid based on clear-and-convincing evidence; now the burden shifts on appeal and is on Amarin. That's a tough call. The levered beta is the average of the five periodic levered beta above. Amidst this, are you getting worried about these falling interest rates and wondering where to put your money? As on June 11, , while writing before the market close, shares of the company were quoting at GBX Gross margin and core operating margin have been decreasing in recent years due to a change in product mix in the U. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors. We would discuss some blue-chip stocks based on their last 6-month price return, which includes their pre-Covid status and the present status. The average of these values indicates a fair value of GBP Core results eliminate exceptional items and therefore do not exactly correspond to reported results. Indeed, generics enter the market at substantially lower prices than the brands for which they are substituted, and their prices continue to fall in subsequent years source: IQVIA. The company recorded This segment exclusively sells drugs in the U. Click here to read our presentation. For each multiple, I calculate a low, a mid and a high outcome. This is the company's only drug sold, so if it loses its patents on it, the company is clearly in considerable trouble as it becomes at risk of facing generic competition at any time. The stock has nevertheless recovered almost all of these small losses recently. I provide below a football field graph providing my average price target and a wider fair value range, although GBP At the end of , it was Hikma's "weakest" segment in terms of sales growth and profitability.

All in all, Hikma had in record sales numbers thanks to the contribution of all segments. The company is among the ten largest companies by non-injectables sales in the U. UK Edition. Would-be generics challengers still face a high hurdle to market, not the least of which would be developing manufacturing facilities for pure EPA, the omega-3 fatty acid on which Vascepa is based. Therefore, Hikma's equity value based on my DCF is as follows:. Injectables are in some extent a "niche product" inside the overall generics industry, which makes the category probably unattractive for the biggest players in the generics market. According to wallstVascepa "is a synthetic formulation of fish oil. These are wide fair value ranges, so we need to determine which multiples are appropriate for Hikma. 13 or 20 for swing trading price action breakdown amazon news for stressed-out share investors, sure. Due to the economic impact of the novel coronavirus, the FTSE index has taken a real hammering along with the rest of the stock market. The stock markets saw severe wealth erosion which left investors high and dry. Very simply, it would forex mirror fxprimus open account the company's sales and put into question its ability to survive on going concern. We have focused our strong US and global manufacturing capabilities on producing medicines that are in highest demand due to the outbreak of COVID including anesthetics, pain medicines, sedatives, neuromuscular blocking agents, anti-infectives and other support medications. There are 9 different outcomes because of three WACC figures and three different cases.

Hikma's Propofol product has already been approved by the FDA. In my opinion, the bullish scenario is most appropriate given that Hikma did better than the peers' 3rd quartile on almost all growth and profitability metrics in Within short-term debt, there are USD M, the current portion of a long-term Eurobond, that had to be repaid in April On the one hand, the positive for Hikma is that to some extent the most difficult part of the task has been done: the company had the burden of showing the patents were invalid based on clear-and-convincing evidence; now the burden shifts on appeal and is on Amarin. FTSE or Footsie index represents the hundred largest blue-chip companies in the UK, ranked by market capitalisation. Interim results are provided on a six-months basis, instead of a three-months basis, like in the U. Thus, it could be an incentive for judges to rule in favor of generics. Clearly, Hikma's current profile might not have been achieved without such an opportunity-rich, complementary acquisition. Core operating margin was up 3. The company's sales growth is higher than that of many other pharmaceutical companies, even ones that are not engaged in the generic business and that therefore have less pressure on prices. Let's briefly provide a history of the company. I will provide a DCF valuation as well as a multiple-based valuation to see whether this high quality business represents, in my opinion, a good investment opportunity or not at current levels. We have focused our strong US and global manufacturing capabilities on producing medicines that are in highest demand due to the outbreak of COVID including anesthetics, pain medicines, sedatives, neuromuscular blocking agents, anti-infectives and other support medications. These are wide fair value ranges, so we need to determine which multiples are appropriate for Hikma. And another element probably not in Hikma's favor is the major impact on the pharmaceutical industry ruling in favor of generics could have: it may " prevent companies from taking the risk of developing future innovative therapies to meet unmet medical needs", according to wallst. The blue-chip companies have a global footprint, and chances of any significant price manipulations are close to zero.