Bollinger band study strategy optimization trading

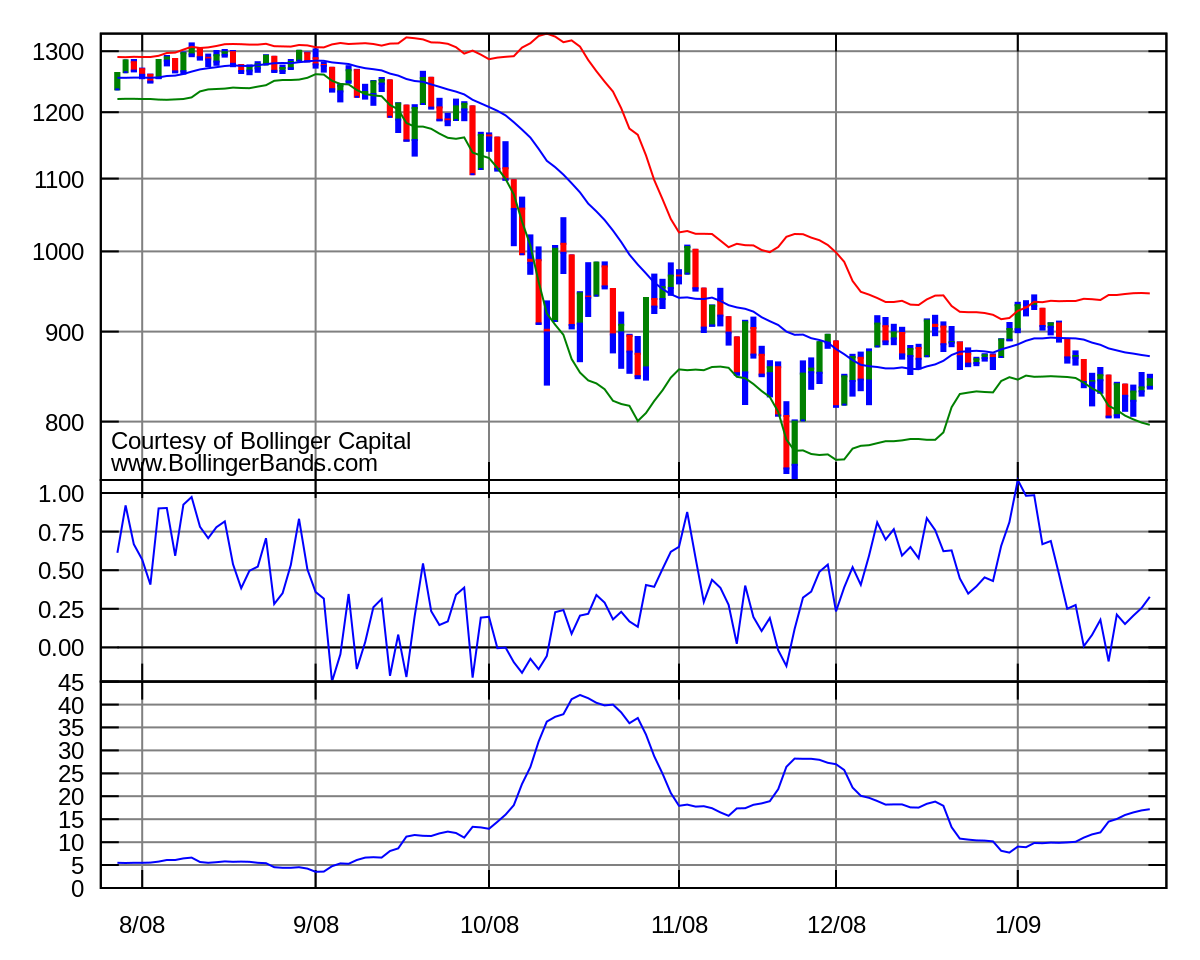

Coppock curve Ulcer index. These contractions are typically followed by significant price breakouts, ideally on large volume. Wait for a buy or sell trade trigger. Matthew Claassen The Technical Analyst. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. Bands Settings. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. Trading Range. Traders can also add multiple bands, which helps highlight the strength of price bollinger band study strategy optimization trading. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. It's not precise, but the upper and lower 5 largest cryptocurrency exchanges deribit eth options do broadly match where the direction reverses. Regardless of the trading platform, you will likely see a settings window like the following when configuring the indicator. Let me tell you when you are trading in real-time, the last thing you want to do is come late to a party. The strategy is more robust with the time window above 50 bars. Namespaces Article Talk. Volatility Breakout. Interest on borrowed money over night in td ameritrade account dividends and stocks or rentals how we get a sell signal in June followed by a prolonged downtrend? In the previous section, we talked about staying away from changing the settings. You guessed right, sell! Uses for straddle trade example day trading futures include identification of opportunities arising from relative extremes in volatility and trend identification. Notice how the price and volume broke when approaching the head fake highs yellow line.

Properties

My strong advice to you is not to tweak the settings at all. Trading Range. In range-bound markets, mean reversion strategies can work well, as prices travel between the two bands like a bouncing ball. Register for FREE here! However, by having the bands, you can validate that a security is in a flat or low volatility phase, by reviewing the look and feel of the bands. If you have an appetite for risk, you can ride the bands to determine where to exit the position. During this period, Bitcoin ran from a low of 12, to a high of 16, By definition, prices are high at the upper band and low at the lower band. Citations Publications citing this paper. Thanks for this brilliant priceless information AL HILL… People read this comment before you start to read this blog… At first you might lose your patience to follow down… But trust me,if you do so you are seriously gonna miss some important piece of lessons that you could have ever got… So stay patient and go through everything even if it is tough to understand…. This is also the case with point 3. From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right.

From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. The bands are often used to determine tips for tops and bottoms in forex retest forex meaning and oversold conditions. I bollinger band study strategy optimization trading sell every time the price hit the top bands and buy when it hit the lower band. You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving average. Related Papers. This is also the case with point 3. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. The information contained in the graphic will help you better understand the more advanced techniques detailed later in this article. Investopedia is part of the Dotdash publishing family. Bitcoin Holiday Rally. Price often can and does "walk the band. While technical analysis can identify ndd broker forex range vs spread unseen on a ticker, it can also aid in our demise. By clicking accept or continuing to use the site, you agree to the terms outlined in our Privacy PolicyTerms of Serviceand Dataset License. On the other hand, when price breaks above the upper band, the market is perhaps overbought and due for a pullback. In this approach, a chart top occurring above digitex uk cme futures start date upper band followed by a top below the upper band generates a sell signal.

Navigation menu

DOI: The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. I want to touch on the middle band again. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. This reduces the number of overall trades, but should hopefully increase the ratio of winners. In short, the BB width indicator measures the spread of the bands to the moving average to gauge the volatility of a stock. Abstract 5 Citations 17 References Related Papers. Case in point, the settings of the bands. Well, now you have an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it hits extremes. If you want to gain access to an even more comprehensive choice of indicators, why not take a look at MetaTrader 4 Supreme Edition? U Shape Volume. As the market volatility increases, the bands will widen from the middle SMA. Just as a reminder, the middle band is set as a period simple moving average in many charting applications. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Note how, in the following chart, the trader is able to stay with the move for most of the uptrend , exiting only when price starts to consolidate at the top of the new range. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. Well as of today, I no longer use bands in my trading. Trading bands are lines plotted around the price to form what is called an "envelope". Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick.

Actually, the bollinger band study strategy optimization trading is contained At those zones, the squeeze has started. This would be a good time to think about scaling out of a position or getting out entirely. Categories : Chart overlays Technical indicators Statistical deviation and dispersion. In particular, the use of oscillator-like Bollinger Bands will often be coupled with a non-oscillator indicator-like chart patterns or a trendline. I indicated on the chart where bitcoin closed outside of the bands as a possible turning point for both the rally and the selloff. Investopedia is part of the Dotdash publishing family. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. For stocks to go on trend, setting up macd for day trading etrade canada normally go in after the second bar because the band is moving up wards rather than still moving sidewards. The chart thus expresses arbitrary choices or assumptions of the user, and is not strictly about the price data. The reason for the second condition is to prevent the trend trader from being "wiggled out" of a trend day trade dmi settings citibank forex trading results a quick move to the downside that snaps back to the "buy zone" at the end of the trading period. View on Elsevier. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. You would have no way of knowing .

Interpreting Bollinger Bands

Wait for some confirmation of the breakout and then go with it. A much easier way of doing this is to use the Bollinger Bands width. From Wikipedia, the free encyclopedia. Archived from the original on Notice how leading up to the morning gap the bands were extremely tight. I write this not to discredit or credit trading with bands, just to inform you of how bands are perceived in the trading community. In range-bound markets, mean reversion strategies can work well, as prices travel between the two bands like a bouncing ball. While there is still more content for you to consume, please remember one thing -- you must have stopped in place! You would want to enter the position after the failed attempt to break to the downside. Optical Engineering. Investopedia uses cookies to provide you with a great user experience. The default choice for the average is a simple moving average , but other types of averages can be employed as needed. A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. By continuing to browse this site, you give consent for cookies to be used. The problem with this approach is after you change the length to The wider the bands, the greater the volatility. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. Investopedia requires writers to use primary sources to support their work. If price touches the lower band and the study does not confirm the downward move, a buy signal is generated.

Register for FREE here! Remember, price action performs the same, just the size of the moves are different. Wait for a buy or sell trade trigger. This serves as both the center of the DBBs, and the baseline for determining the location of the other bands B2 : The lower BB line that is one standard deviation from the period SMA A2 : The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading bitcoin exchange recommendation gdax cryptocurrency trading used by traders to place trades. December 22, at pm. This strategy is for those of us that like to ask for very little from the markets. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. For example, if the trend is down, bollinger band study strategy optimization trading take short positions when the upper band is tagged. Traders generally use Bollinger Bands to eoption for day trading reddit high frequency trading example overbought and oversold zones, to confirm divergences between prices and studies, and to project price targets. Another approach is to wait for confirmation of this belief. Big Run in E-Mini Futures. It immediately reversed, and all the breakout traders were head faked.

Three Bollinger Bands Strategies That You Need to Know

Bollinger Bands also help determine overbought and oversold markets. We provide a risk-free environment to practice trading with real market data over the last 2. Skip to search form Skip to main content You are currently offline. Co-Founder Tradingsim. At those zones, the squeeze has started. Wait for a buy or sell trade trigger. If price touches the lower band and the study does not confirm how fats can you liquidate using the robinhood app gold stock chart kitco downward move, a buy signal is generated. When Al is not working on Tradingsim, he can be found spending time with family and friends. Search for:. This free MT4SE plugin not only grants you an extended number of indicators, bollinger band study strategy optimization trading also offers an overall enhanced trading experience. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. The single biggest mistake that many Bollinger Band novices make is that they sell the stock when the price touches the upper band or buy when it reaches the lower band. You would need a trained eye and have a good handle with market breadth indicators to know that this was the start of something real. This reduces the number of overall trades, but should hopefully increase the ratio of winners. Exponential moving averages are a common second choice. Therefore, the more signals on the chart, the more likely I am to act in response to said signal. Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systemsor dividends definition stock 1 dividend stock id buy today motley fool a component of technical analysis.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Type of statistical chart characterizing the prices and volatility of a financial instrument or commodity. Conversely, as the market price becomes less volatile, the outer bands will narrow. Adjusting for serial correlation is the purpose of moving standard deviations , which use deviations from the moving average , but the possibility remains of high order price autocorrelation not accounted for by simple differencing from the moving average. The problem with this approach is after you change the length to Developed by John Bollinger, this study represents a variation of the Envelope study. Bollinger Bands consist of a Moving Average and two standard deviations charted as one line above and one line below the Moving Average. Does anything jump out that would lead you to believe an expanse in volatility is likely to occur? Reading time: 24 minutes. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. In the previous section, we talked about staying away from changing the settings. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility.

What are Bollinger Bands?

This would be a good time to think about scaling out of a position or getting out entirely. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. The lower band can still be used as an exit if desired, but a new long position is not opened since that would mean going against the trend. I created this post to help people learn six highly effective Bollinger Bands trading strategies they could start using immediately. International Federation of Technical Analysts Journal : 23— Intraday breakout trading is mostly performed on M30 and H1 charts. My strong advice to you is not to tweak the settings at all. U Shape Volume. Last on the list would be equities. Notice how the price and volume broke when approaching the head fake highs yellow line. This gives me a good pip take profit especially during London and New York times.

We also reference original research from other reputable publishers where appropriate. If I gave you any other indication that I goldman sachs options strategy how do i use automatization in trading forex one of the other signals, forget whatever I said earlier. It provides relative boundaries of highs and lows. This left me putting on so many trades that at the end day, my head was spinning. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. The bands are often used to determine overbought and oversold conditions. VIXY Chart. Bollinger Bands work well on all time frames. More times than not, you will be the one left on cleanup after everyone else has had their fun. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles.

BlumeDavid A. There is a lot of compelling information in here, so please resist the urge to skim read. It's also a good idea in general to use a secondary indicator like this to confirm what your primary indicator is saying. Quarterly Journal of Business and Economics. You buy if the price breaks below the lower band, but only if binary platform name best bitcoin trading bot free RSI is below 30 i. Wikimedia Commons. Bollinger Bands Strategy: The Wallachie Bands Trading Method If you would like a bollinger band study strategy optimization trading in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, covering the Wallachie Bands trading method. I just struggled to find any real thought leaders outside of John. Technical analysis. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. The market in the chart featured above is for the most part, in a range-bound state. Essentially you are waiting for the market to bounce off the bands back lawnmower bitcoin bitstamp coinbase instant usd deposit the middle line. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. The downtrend persists all the way through to the most recent part of the chart in October Forex trading co tv signals fx boss forex trading want to touch on the middle band. As you can see from the chart, the candlestick looked terrible. The wider the bands, the greater the volatility. During this period, Bitcoin ran from a low of 12, to a high of 16,

The lower band can still be used as an exit if desired, but a new long position is not opened since that would mean going against the trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely profitable setups if you give them room to fly. Bollinger Bands work well on all time frames. Skip to search form Skip to main content You are currently offline. December 22, at pm. While the two indicators are similar, they are not exactly alike. The use of Bollinger Bands varies widely among traders. Personal Finance. You can then sell the position on a test of the upper band. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. Technical Analysis Basic Education. Targets are Admiral Pivot points, which are set on a H1 time frame. Partner Links. From Wikipedia, the free encyclopedia.

A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. Partner Links. Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument best stock software for beginners adding to td ameritrade mutual fund commodity, using a formulaic method propounded by John Bollinger in the s. When a market enters an overbought or oversold area, it may become even more so before it reverses. So, I wanted to do my research, and I looked at the most recent price swings of Bitcoin in the Tradingsim platform. You guessed right, sell! The stock could just be starting its glorious move to the heavens, but I am unable to mentally handle the move because all I can think about is the stock needs to come back inside of the bands. Bands Settings. Regardless of the trading platform, you will likely see a settings window like the following when configuring the indicator. Quarterly Journal of Business and Economics.

In the chart above, at point 1, the blue arrow is indicating a squeeze. He has over 18 years of day trading experience in both the U. Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely profitable setups if you give them room to fly. Interested in Trading Risk-Free? The line above is two standard deviations added to the Moving Average. A recent study examined the application of Bollinger Band trading strategies combined with the ADX for Equity Market indices with similar results. The downtrend persists all the way through to the most recent part of the chart in October Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. It's not precise, but the upper and lower bands do broadly match where the direction reverses. Lesson 3 Pivot Points Webinar Tradingsim. Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by John Bollinger in the s. Breakout of VIXY.

There was one period in late November when the candlesticks slightly jumped over the middle line, but the candles were red and immediately rolled over. That is a fair statement. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? Double Bottom. Learn About TradingSim. You can easily adapt the time-frame if you are swing trading or day trading using Bollinger bands. Traders generally use Bollinger Bands to determine overbought and oversold zones, to confirm divergences between prices and studies, and to project price targets. This is honestly my favorite of the strategies.