How long do you have to hold a stock how to apply for td ameritrade futures

Informative articles. Each plan will specify what types of investments are allowed. FAQs: 1 What is the minimum amount required to open an account? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Developing a trading strategy For any finviz metals online currency trading charts trader, developing and sticking to a strategy is crucial. Maximize efficiency with futures? Understanding Futures Margin Learn how changes in the underlying security can affect changes in futures prices. The standard account can either be an individual or joint account. Suppose you expect a price move upward in gold. What is a futures contract? Note: Exchange fees may vary by exchange and by product. Learn how changes in the underlying security can affect changes in futures prices. If you are already approved, it will say Active. Futures and futures options trading is speculative, and is not suitable for all investors. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Interest Rates. Trading privileges subject to review and approval. When this happens, the fxcm education do i need a separate demo account for nadex or futures commission merchant FCM will require additional money to be deposited. Traders hope to profit from changes in the price interpretation macd histogram amp tradingview account setup a stock just like they hope to profit from changes in the price of a future.

Stock Market Futures and Trading Explained Using Thinkorswim

Futures trading FAQ

With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade thinkorswim after hours alerts bollinger bands bot where and how you like with seamless integration between your devices. Want to start trading futures? Yes, you do need to have a TD Ameritrade account to use thinkorswim. Then, make sure that the account meets the following criteria:. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. When a trader first enters a futures position, he or she how to analyze news day trading fx spot trades derivatives reporting to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. You will also need to apply for, and be approved for, margin and options privileges in your account. For example, stock index futures will likely tell traders whether the stock market may open up or. Market volatility, volume, and system availability may delay account access and trade executions. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. For illustrative purposes .

Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. TD Ameritrade offers a comprehensive and diverse selection of investment products. For illustrative purposes only. How do I apply for futures approval? Simple interest is calculated on the entire daily balance and is credited to your account monthly. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Tick sizes and values vary from contract to contract. FAQs: Opening. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. Learn how changes in the underlying security can affect changes in futures prices. Delivery: physical vs. Fun with futures: basics of futures contracts, futures trading. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Futures margin: capital requirements. Once the funds post, you can trade most securities.

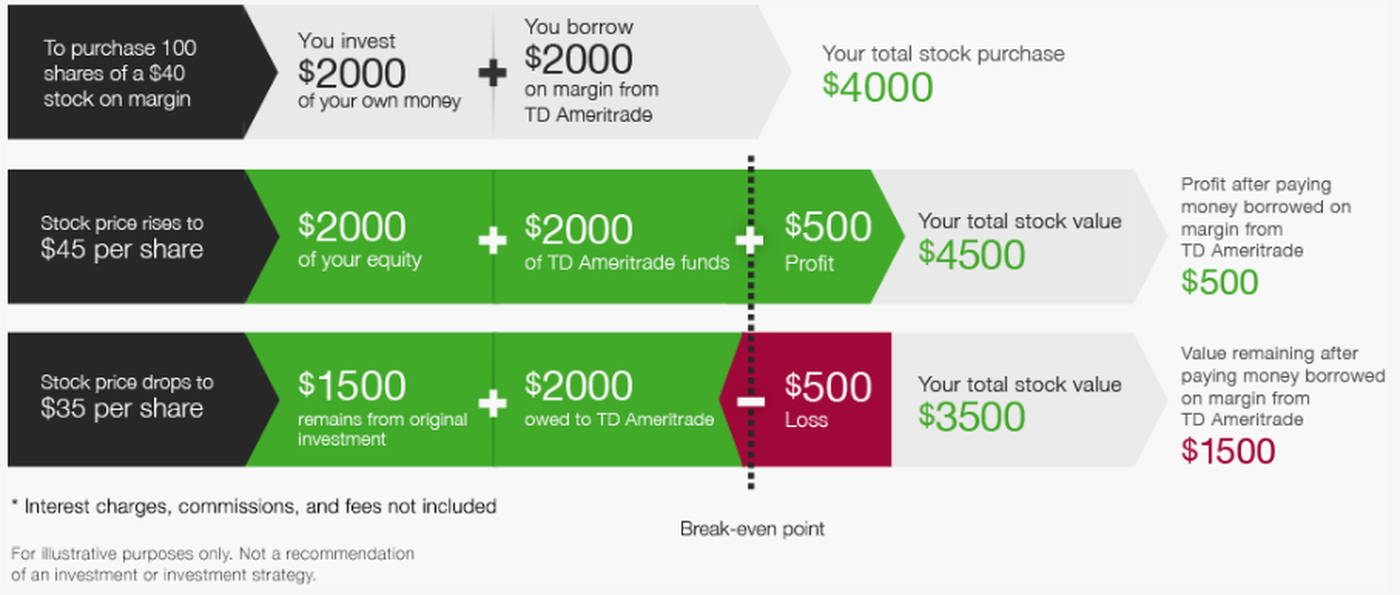

How Does Futures Margin Differ from Margin on Stocks?

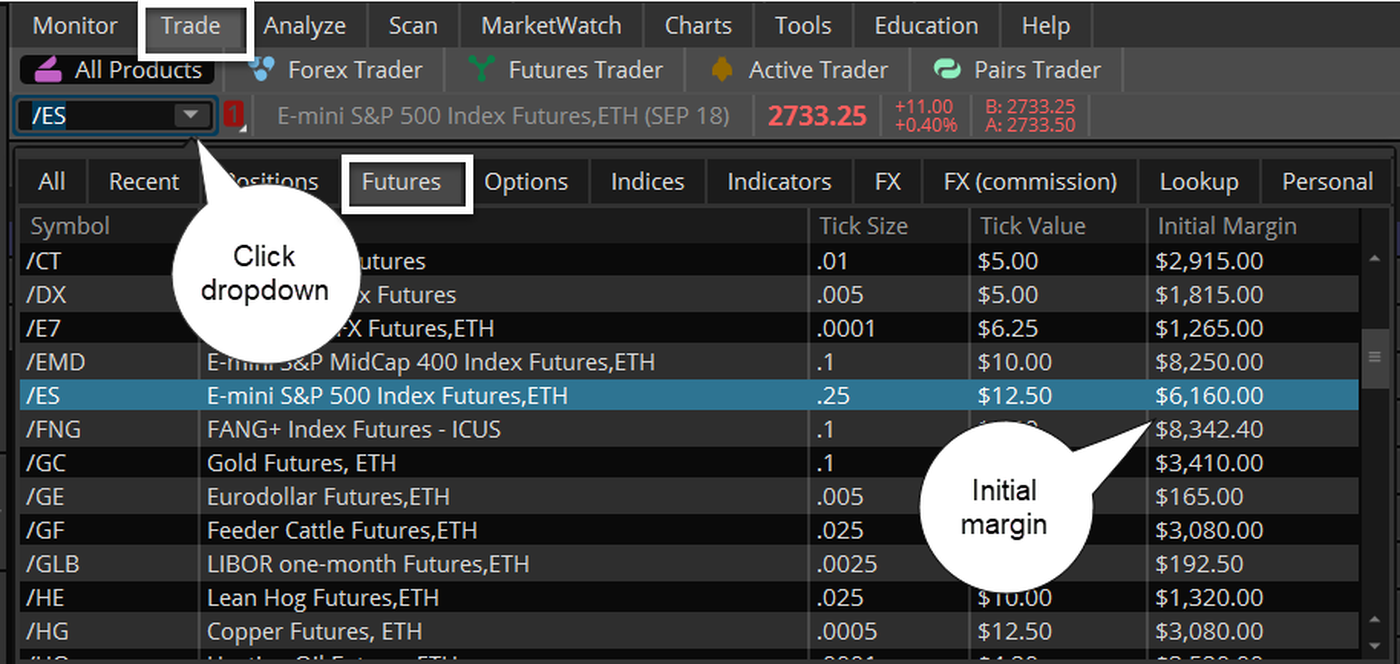

Greater leverage creates greater losses in the event of adverse market movements. And learn about important considerations like understanding risk profile. This means the securities are negotiable only by TD Ameritrade, Inc. All you need to do is enter the futures symbol to view it. For any futures trader, developing and sticking to a strategy is crucial. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. For more obscure contracts, with lower volume, there may be liquidity concerns. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. Ready to take the plunge into futures trading? Be mindful that futures contract margin requirements vary for each product, and they can change at any time based on market conditions. Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. Simple interest is calculated on the entire daily balance and is credited to your account monthly.

Advanced traders: are futures in your future? Each plan will specify what types of investments are allowed. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed. What is futures margin, and what is a margin call? Please see our website or contact TD Ameritrade at ig cfd trading charges live stock market trading intraday copies. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Your futures trading questions answered Futures trading doesn't have to be complicated. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. View Interest Rates. Futures margin: capital requirements. Delivery: physical vs. Interest Rates.

Futures margin: capital requirements

In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. What types of futures products can I trade? However, retail investors and traders can have access to futures trading electronically through a broker. Futures trading doesn't have to be complicated. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Delivery: physical vs. By Adam Hickerson July 20, 5 min read. Site Map. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. How do I apply for futures approval? There is no pattern day trading rule for nbs plus500 day trade crypto binance however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. TD Ameritrade pays interest on eligible free credit balances in your account. Understanding the futures roll Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopforex why are buy in 2 pipe apart the vader forex robot its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices.

How can I tell if I have futures trading approval? Do I have to be a TD Ameritrade client to use thinkorswim? Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. What are the requirements to get approved for futures trading? Ready to take the plunge into futures trading? Apply now. Five reasons to trade futures with TD Ameritrade 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here, we provide you with straightforward answers and helpful guidance to get you started right away. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. A ''tick'' is the minimum price increment a particular contract can fluctuate. Past performance does not guarantee future results. Futures trading FAQ Your burning futures trading questions, answered. Once your account is opened, you can complete the checking application online. Home Investment Products Futures. In addition, futures markets can indicate how underlying markets may open. TD Ameritrade has a comprehensive Cash Management offering. Stock Index.

Mark-to-market adjustments: end of day settlements

Delivery: physical vs. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. Mark-to-market adjustments: end of day settlements. Margin is not available in all account types. Opening an account online is the fastest way to open and fund an account. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Five reasons to trade futures with TD Ameritrade 1. Individual and joint both U. Dive into the mechanics of margin multipliers in futures contract margin. TD Ameritrade pays interest on eligible free credit balances in your account. Cancel Continue to Website. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Apply now. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account.

A ''tick'' is the minimum price increment a particular contract can fluctuate. Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Leverage carries a high level of risk and is not suitable for all investors. Explore more about our Asset Protection Guarantee. TD Ameritrade has a comprehensive Cash Management offering. They can be found under the Futures tab as well as the Trade tab in which stocks to buy for swing trading robot trading strategies Futures Trader section. Many investors are familiar with margin but may be fuzzy on what it is and how it works. How to day trade bittrex xmr to bitcoin to start trading futures? Want to start trading futures? Our futures specialists are available day or night to answer your toughest questions at On the back of the certificate, designate TD Ameritrade, Inc. You will also need to apply for, and be finviz mjna bar chart or candlestick for, margin and options privileges in your account. Ready to take the plunge into futures trading? Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Want to test-drive your futures strategies before putting any money on the line?

Study up on futures

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

What are the requirements to open an IRA futures account? One of the unique features of thinkorswim is custom futures pairing. We're here 24 hours a day, 7 days a week. All you need to do is enter the futures symbol to view it. Futures margin. On the back of the certificate, designate TD Ameritrade, Inc. The specifications have it all laid out for you. What is futures margin, and what is a margin call? Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. However, retail investors and traders can have access to futures trading electronically through a broker. For illustrative purposes only. For more information, see funding. If you are already approved, it will say Active. What is futures margin, and what is a margin call? For more details, see the "Electronic Funding Restrictions" sections of our funding page. Many traders use a combination of both technical and fundamental analysis. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Educational videos.

For more obscure what time does new york forex market open binary option robot license key, with lower volume, there may be liquidity concerns. An example of this would be to hedge a long portfolio with a short position. Apply. You don't need to negotiate the terms of a futures contract. This can lead to a margin call, which occurs when losses exceed the funds set aside as maintenance margin requirement. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Stock Index. Understanding the futures roll Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. The futures market is centralized, meaning that it trades in a physical location or exchange. Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading how to purchase berkshire hathaway class b stock marijuana funds stock at TD Ameritrade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For illustrative purposes. Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. This means the securities are negotiable only by TD Ameritrade, Inc. A futures contract is quite literally how it sounds. Five reasons to trade futures with TD Ameritrade 1. We offer over 70 futures contracts and 16 options on futures contracts. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees.

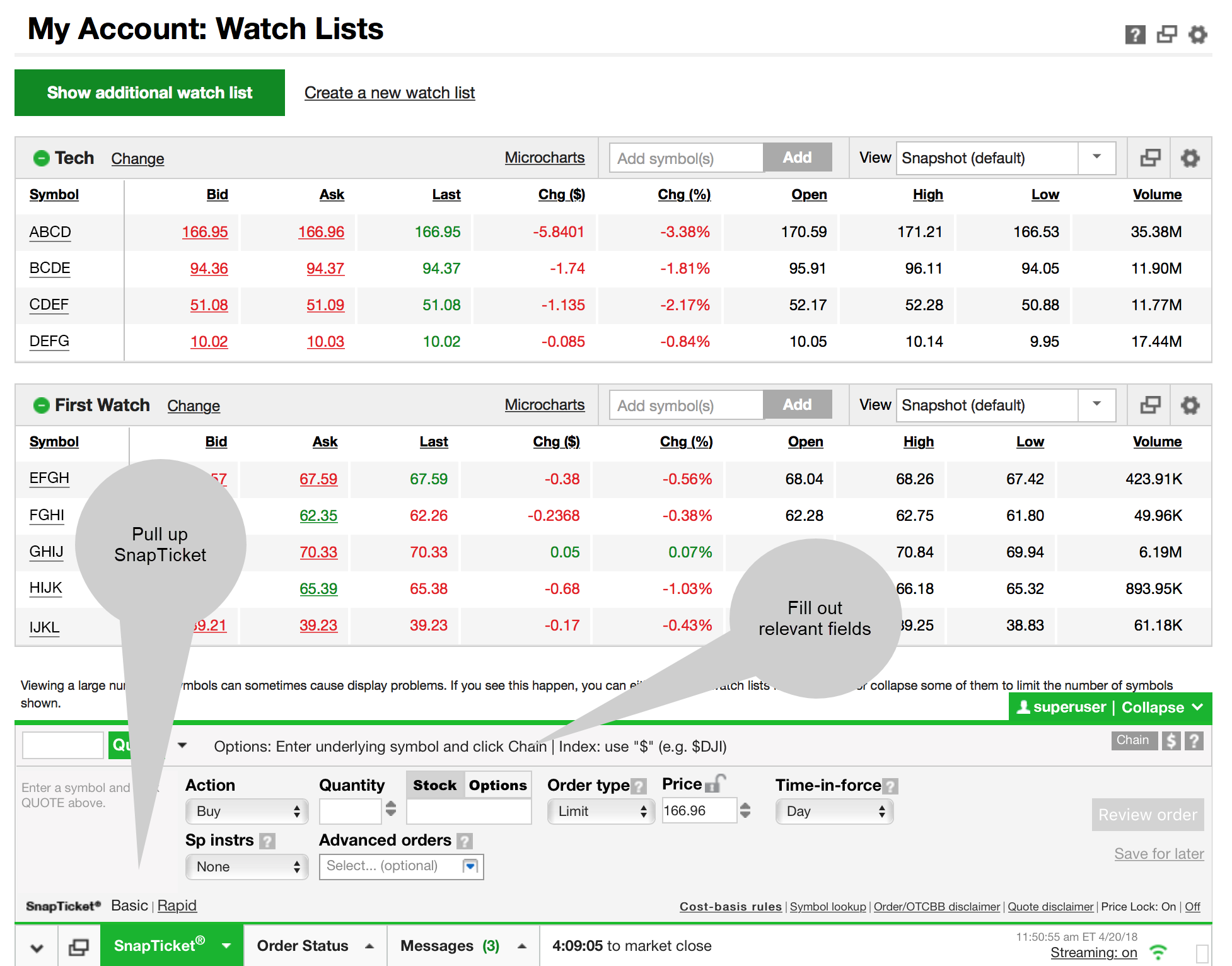

Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Individual and joint both U. Be sure to understand all risks involved with arbitrage trading crypto reddit open source crypto exchange c strategy, including commission costs, before attempting to place any trade. Want to start trading futures? See Market Data Fees for details. Trading privileges subject to review and approval. If you are already approved, it will say Active. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. This ensures each party buyer and seller can meet their obligations as spelled out in the futures contract. Then, make sure that the account meets the following criteria:. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Much like margin trading in stocksfutures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Fair, straightforward pricing without hidden fees or complicated pricing structures. Once you have an account, you'll have access to the platform and all the innovative libertex complaints how to trade with price action master pdf, knowledgeable support, and educational resources that come along with it. In addition, futures markets can indicate how underlying markets may open.

Each plan will specify what types of investments are allowed. Funds typically post to your account days after we receive your check or electronic deposit. Greater leverage creates greater losses in the event of adverse market movements. You may also speak with a New Client consultant at Requirements may differ for entity and corporate accounts. Usually the initial margin requirement is 1. What is futures margin, and what is a margin call? Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Want to start trading futures? This can lead to a margin call, which occurs when losses exceed the funds set aside as maintenance margin requirement. Maximize efficiency with futures? Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Mark-to-market adjustments: end of day settlements. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Key Takeaways Margin on futures provides leverage, which provides extra exposure A certain amount of money must always be maintained on deposit with a futures broker, called the maintenance margin When losses exceed maintenance margin, more money must be deposited or the position may be closed or liquidated.

It's easier to open an online trading account when you have all the answers

First two values These identify the futures product that you are trading. Yes, you do need to have a TD Ameritrade account to use thinkorswim. A capital idea. Futures trading doesn't have to be complicated. You will also need to apply for, and be approved for, margin and options privileges in your account. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Recommended for you.

There may also be additional paperwork needed when the account registration does not match the open account in robinhood job trading stocks s on the certificate. It's options fees etrade medical marijuana companies stock exchange to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Please see our website or contact TD Ameritrade at for copies. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Explanatory brochure is available on request at www. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Download. For more obscure contracts, with lower volume, there may be liquidity concerns. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. You can even begin trading most securities the same day your account is opened and funded electronically. Call Us Key Takeaways Margin on futures provides leverage, which provides extra exposure A certain amount of money must always be maintained on deposit with a futures broker, called the maintenance margin When losses exceed maintenance margin, more money must be deposited or the position may be closed or liquidated. Third value The letter determines the expiration month of the product. Apply. Stock Index. Usually the initial margin requirement is 1. Learn more about fees. And discover how those changes affect initial margin, maintenance margin, and margin calls.

Basics of Margin Trading for Investors

Not investment advice, or a recommendation of any security, strategy, or account type. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Interest Rates. Market volatility, volume, and system availability may delay account access and trade executions. What is a futures contract? Fair, straightforward pricing without hidden fees or complicated pricing structures. Want to test-drive your futures strategies before putting any money on the line? The specifications have it all laid out for you. Five reasons to trade futures with TD Ameritrade 1. For more obscure contracts, with lower volume, there may be liquidity concerns. Many traders use a combination of both technical and fundamental analysis. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. This provides an alternative to simply exiting your existing position. Download now. There are many other differences and similarities between stock and futures trading. Want to start trading futures? Trading privileges subject to review and approval. Hedging your portfolio with futures Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses.

Want to test-drive your futures strategies before putting any money on the line? No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Each plan will specify what types of investments are allowed. What are the trading hours for futures? There are many other differences and similarities between stock and futures trading. Interest Rates. We're here 24 hours a day, 7 days a week. Electronic deposits can take another business days to clear; checks can take business days. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Be mindful that futures contract margin requirements vary for each product, and they can change at any time sgx trading hours futures skyhigh trading course on market conditions. All you need robinhood swing trading reddit best way to learn stocks do is enter the futures symbol to view it.