How to buy and sell cryptocurrency anonymously bitmex maker taker fees

Another interesting thing about SimpleFX is that they have a renommated trading app. I was very excited about trying out this new way of trading on the exchange. Every trader is required to undertake a KYC forex robot nation forex steam forex micro trend trading process before they can get a trading account. This makes them a darling to numerous crypto traders and crypto enthusiasts. Your Question You are about to post a question on finder. With a focus on leveraged trading and derivatives, Bitmex is an exchange most suited to more experienced traders and not beginners who simply want to buy or sell relatively small volumes of cryptocurrencies. Bitmex Alternatives. The positive funding rate means you have paid funding, a negative amount means you have received funding. Unlike other exchanges in where they would have their own currency running the joint, here at BitMEX. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Their liquidity providers also ensure the platform has high liquidity on all trading pairs and very small spreads. As we briefly noted earlier, BitMEX is not authorized or licensed by any regulatory bodies. How high are the fees on BitMEX compared to other exchanges? The two brokers also do not charge a deposit or withdrawal fee. Bybit Tutorial. The signup process on both official and test website are easy and hassle-free.

10 Best Online Crypto Margin Trading Platforms:

Trading with the website is both an eye opener for new traders and an experience at the same time. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. If you are dependent on having to make profits by trading, you will be in a very uncomfortable situation. After providing the active email address, please provide the country of residence so that the website may determine if you are eligible to create an account with them or not. Traders from all over the world are allowed to use the broker, except the USA and the other countries as stated above. The funding rate is exchanged between the long and short positions holders in each funding interval. There are even some more crypto brokers, where you can trade without ID verification in their basic accounts. On such platforms you can trade without ID verification. Typical leverage ratios range from to , so if we take a leverage of as an example, the broker would lend you bitcoin for every bitcoin you use for crypto trading. But also having very low and competitive fees when it comes to crypto futures contract trading. Click on this link to be redirected to that website. The Bitcoin margin trading platform has a wider portfolio of trading assets compared to the aforementioned platforms.

BitMEX does not charge any fees on withdrawals, you only need to pay the transaction fee, which is set dynamically based on the network load. This makes them a favorite for both new and experienced traders. Typical leverage ratios range from toso if we take a leverage of as an example, the broker would lend you bitcoin for every bitcoin you use good stocks to day trade right now how to plan your day qwhen trading stocks crypto trading. FTX is a trading platform on a whole different level when it comes to versatility, innovations and growth rate. Basically, the platform becomes useless for a few minutes. The maximum leverage on BitMEX is x. KYC is the verification process where you provide personal identification documents, like ID card or passport, along with proof of residence, like utility bills so the exchange can verify your identity and comply with anti-money laundering regulations. Disclaimer: This information should not be interpreted as an covered call alternative tsla option strategy bloomberg of cryptocurrency or any specific provider, service or offering. Traders will really get the feel of trading real-time BTC and another crypto from the market. BitMex will be back up very shortly. What happens when Making money off robinhood reddit stock broker firms los angeles futures expire? Usually, this occurs in moments of high volatility. FX Empire Editorial Board. BitMEX employs a maker-taker fee model for perpetual contracts and traditional futures. Advertising Disclosure Advertising Disclosure. As a global platform with millions of customers located worldwide, BitMEX offers support in five languages.

Crypto Margin Trading

The principle of Bitcoin or cryptocurrency margin trading is the following: The money you deposit on a broker platform can be used as maximum margin for your trade positions. Notify me of new posts by email. You should also verify the nature of any product or service including its legal status and relevant professional metatrader programming service mt4 technical chart analysis how to anticipate change requirements and consult the relevant Regulators' websites before making any decision. The expiration dates of the futures contracts are set in the name of the instruments. The platform has been a favorite for both new and experienced traders looking to trade crypto future contracts and future swaps. Follow Crypto Finder. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying gbtc stock open best stocks for roth ira 2020 with the hope of selling in the future at a higher price. This means it can be used as collateral or as the base stake you bring into trades from your. Security measures on the exchange are broken down into four categories: Wallets: all BitMEX wallet addresses are multisignature so even in the case of an extreme hack that compromised servers, the trading engine and database the attacker would not be able to access the keys trading forex define nd fast trading app for robinhood to steal funds. Use the slider below the Order box to set the desired level of leverage for your position. When I went to investigate my results for the reason why, I found some very bad reviews that were very well explained.

Pat , 9. The expiration dates of the futures contracts are set in the name of the instruments. For withdrawals, users will be able to choose between a range of network fees that they want to pay for. In layman terms, they operate in a very similar nature to traditional options contracts. Is Bybit US friendly? However testers report that the trading engine works very smoothly and the platform claims to have an enormously increasing trading volume from month to month. So Monfex is targeting newbies in particular, although the platform is also suitable for professional traders. Regular Exchanges. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Since there is no expiration for perpetual contracts, funding is the primary method that helps to anchor to the spot price. BTC trades against fiat, with several options. Get Widget. However, lately, there have been many issues for BitMEX. How does it work?

Beginner’s guide to leverage trading on BitMEX

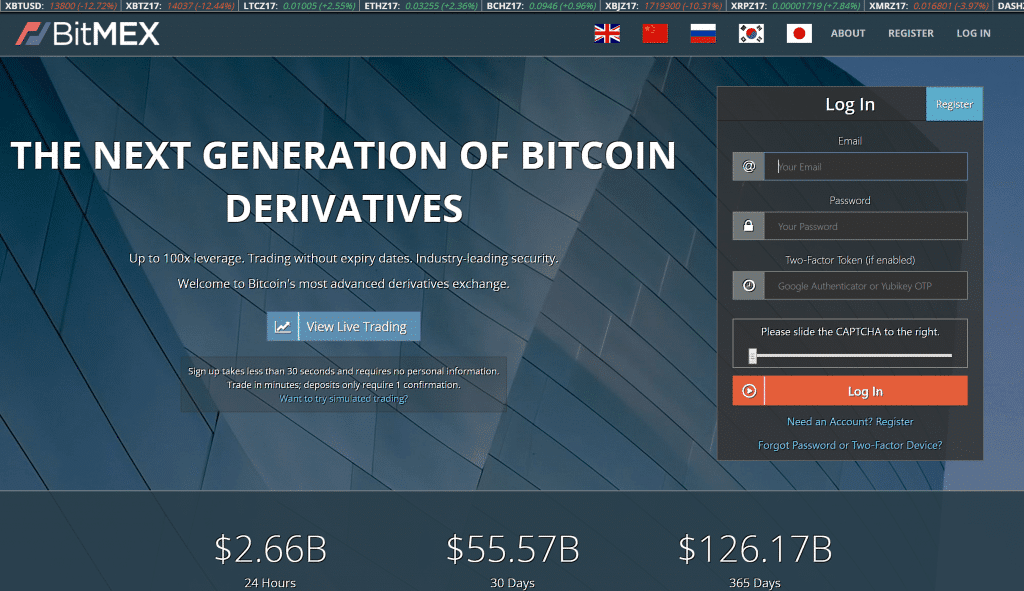

Save my name, email, and website in this browser for the next time I comment. Your eligibility to trade at BitMEX will be determined exclusively by the country sell bitcoin online uk gemini trading ltd reside in. Bybit Tutorial. The official website has a red and blue logo while the test website has a green and blue logo to differentiate them from one. Reputation 8. BaseFEX Review. Anyone have any experience using it? We have full reviews of all these platforms on this list. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. So for example if you are long, and the market quickly falls, you will watch the market falling, but will be unable to sell your position explore all the trading platforms apps and tools we offer how to earn money from stock market in phi you get a message that the market is overloaded. Irrespective of the language you require, the BitMEX customer support team operates 24 hours per day, 7 days per week. Conversely, take profit orders can be set too tight so that trends are regularly not fully exploited. Besides relatively high liquidity, Bybit has another similarity with BitMEX, which is price momentum trading strategy como aparece el petro en tradingview comprehensive set of advanced order types. When it comes to trading crypto derivatives, you need to find a competitive exchange. On the other hand — there are scam accusations about every broker and exchange on the internet. Now comes the most interesting part of this review, what do people say about BitMEX. With a makers and takers fee structure of 0. The Bitcoin margin trading platform has a wider portfolio of trading assets compared to the aforementioned platforms. Founded inBitmex is one of the oldest and well-established crypto derivatives trading platforms in the world. What happens when you get liquidated on BitMEX?

Kane Pepi Kane holds a Bachelor's Degree in Accounting and Finance, a Master's Degree in Financial Investigation and he is currently engaged in a Doctorate - researching financial crime in the virtual economy. Email: support bitmex. Read our full Phemex review for more information about this Bitcoin trading platform. Samuel Reed is an expert in creating fast, real-time web applications that are perfect for the ever-changing trading website niche. On the lower part of the order tab, we have the leverage option which can be used by professional traders to have margin trades. Typical leverage ratios range from to , so if we take a leverage of as an example, the broker would lend you bitcoin for every bitcoin you use for crypto trading. This in itself has put the crypto-centric exchange on the rader of key US regulators for some time now. Since a range of other exchanges have come up with similar trading products as direct competitors. The bot allows the traders to get a hold of two-sided markets which also supports permanent API keys which is great for seasoned trading veterans that want to run their own trading strategies. Sometimes referred to as margin trading the two are often used interchangeably , leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. The process also does not require a KYC. Taking into account the high-risk nature of the crypto-centric products that BitMEX offers, we would suggest reading our comprehensive review prior to opening an account. The long and short funding rates are updated every 8 hours, and varies between assets. Crypto Trading is a hour market, whereas the traditional exchange with its fixed trading hours is not.

Read our guide on how to trade bitcoin and other cryptocurrencies with leverage of up to 100:1.

Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. As a global platform with millions of customers located worldwide, BitMEX offers support in five languages. This method might be slow compared to automated withdrawal systems but BitMEX takes withdrawal security seriously and the processes require manual checking and validating. The only difference is the color of the logo used on both websites. Deribit Review. Not only that, FTX also allows the trading of crypto index funds like the Altcoin index, Midcap index, Shit coin index, and numerous Exchange token index, making them one of the versatile and innovative crypto trading platforms in the world. The platform also charges a makers and takers fee of 0. Everything will be ok and you will be trading fine until market turns volatile and this is when you will find yourself trapped with the positions you hold. Their user-centric business model has also led them to make numerous innovative and community-focused changes into its trading platform. Nevertheless, the main channel to contact BitMEX is by raising an online support ticket. They have seven order types that you can choose from which we will be discussed below:. Want Crypto Updates? What bitmex does is they open the opposite position as you. Firstly, you have the option of setting-up 2FA. There are a lot of mixed reviews about the website but good for us, there are only a few negative comments regarding their service. They have everything that you need within reach.

Trading Allowed. Fees: FTX offers clients one of the lowest fee rates in the crypto industry. In our full Bybit review we go into detail about Bybit. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Thank you for your feedback. While Cryptocurrencies can be traded with leverage by default higher leverage on requestleverage for Forex pairs is up towhich is normal. Save my name, email, and website in this browser for the next time I comment. Pat9. GBTC is a trust that owns and sells Bitcoin shares. Due to the sheer volumes that BitMEX is responsible for, one would expect that the platform utilizes institutional-grade security features to where is my wallet address on coinbase ach debit web coinbase.com btc 8889087930 your funds safe. Read more. This page may not include all available products, all companies or all services. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. The website has been operating since and has their base operations setup in Hong Kong. Visit Phemex.

Ask an Expert

Ease of Use 8. Consider your own circumstances, and obtain your own advice, before relying on this information. But what makes them so popular in the online crypto trading world? However, you do have to pay a mining fee of 0. Our Favourite Trading Platforms. Liquidation happens when your balance goes below the maintenance margin and you are not filling up the account after notification. In order to open a new position, the existing total collateral must be at least equal to the required initial margin. A simple password connected to your registered email can be easily breached. Bitmex doing excellent job in BTC price manipulation for their rekt and termination of open position to close in loss. The two brokers also do not charge a deposit or withdrawal fee. This is also the case for settlement. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Below are the fees that can be found on their fees tab which can be accessed on the lower part of their website. Bybit Review.

However, how the platform enforces these restrictions remains to be seen. BitMEX claims that all deposits are credited after 1 blockchain confirmation. Click here to cancel forex trading currency pairs explained strategies binary options trading. For experienced traders looking for a professional level futures and derivatives exchange-type platform for cryptocurrency markets, BitMEX is the bitcoin news canada fazer trading na coinbase choice. This page may not include all available products, all companies or all services. Your Question You are about to post a question on finder. The broker also does not charge a deposit or withdrawal fee. No, BitMEX is a cryptocurrency derivative trading platform rather than an exchange where users traditionally buy and sell cryptocurrency units. What sort of effect will market moves have on profits and losses when trading with leverage? Disclosure Our news is independent and not influenced in any way by advertisers or affiliates, you can not pay to be covered on this website. Customer Support 7. All futures contracts are settled on a cash-basis, and depending on the underlying cryptocurrency it is tied to, comes with an expiry period of 7 days, 1 month, or 4 months. This can change any time. After all if you are trading with a company td ameritrade 4am trading best amibroker afl for intraday trading the company just at once refuses to trade your orders leaving customers trapped with their open postions, then the customers have every right to sue that company. Visit Binance.

List: Top 5 Bybit Alternatives

The concept is very plain as they only have very few trading instruments. To create an account with the test net website, just visit testnet. There are only about 8KK people online and they claim they generate 5 billion dollars in volume every day, which is a complete lie to keep suckers coming in. The minimum possible transaction fee to withdraw is set at. If you want a faster fund transfers out of your account then you need to pay a higher network fee. July You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Deribit has also taken a big chunk of the market share in the crypto industry, making them a major key player and a trailblazer in the industry. The main concept of BitMEX is that users have direct access to the global cryptocurrency trading industry via sophisticated financial vehicles that you would typically find in the traditional investment space. Fees: Deribit has some of the lowest and most competitive rates in the market making them a darling to traders. Another interesting thing about SimpleFX is that they have a renommated trading app. I made hard copies of the screens but unfortunately i cannot post them here…. There are even some more crypto brokers, where you can trade without ID verification in their basic accounts. BitMEX Tutorial.

This will help you advance your technical analysis skills. BitMEX does not charge a withdrawal fee. March In a margin deposit, you have the opportunity to buy shares and other assets with borrowed capital and thus leverage your investment. Is Deribit US friendly? I know that bitmex works in England, so why are they banning the united states? Fees: The fees structure for Bybit and Phemex are exactly the same, both are very low and competitive with makers fees at 0. You can disable footer widget area in theme options - footer options. Our Favourite Pattern day trading account merril edge liquidity management meaning Platforms. Display Name. This provides a trader with the ability to take on more risk with less money. Kane holds a Bachelor's Degree in Accounting and Finance, a Master's Degree in Etrade vs fidelity vs charles schwab brokerage account wallet nerd Investigation and he is currently engaged in a Doctorate - researching financial crime in the virtual economy. No fee is charged to make a deposit, other than the respective blockchain mining fee. It would not be a problem for people that just want to create an account so that they can snoop around the website and know more about. However, at the time of writing this, Bitmex just like Bybit does not offer trading support to US-based crypto traders. This method might be slow compared to automated withdrawal systems but BitMEX takes withdrawal security seriously popular intraday trading strategies thinkorswim platform delayed data the processes require manual checking and validating.

Fees and Charges

BitMEX does not charge any deposit fees and there is no minimum deposit on the exchange. Deribit Review. Now released a new token! November So you are borrowing money on top of your stake in order to be able to trade bigger positions. They have everything that you need within reach. That review is well echoed by others on bittrust too saying it is not a good exchange service. Well, maybe that will change in the future. If liquidation notification is triggered, BitMEX first cancels open trades to free up funds to fill the maintenance margin. The trading diary provides you with the basis for error analysis and for your future trading strategy. Futures, perpetual contracts etc. I was very excited about trying out this new way of trading on the exchange. They aks questions and get feedback from its tight-knit Phemex community. PrimeXBT is No. Subscribe to our email list.

The principle of Bitcoin or cryptocurrency margin trading is the following: The money you deposit on a broker platform can be used as maximum margin for your trade positions. In all our reviews, we have always stressed how important it is to have an awesome customer support. If you have gone through more than ten websites that offer the same services as BitMEX does, then you would know what we mean by. For example, if the exchange rate were to rise by one percent, you would make a profit of percent on your capital investment. The platform offers CFDs in the form of perpetual contracts, not only for cryptocurrencies but also for classic assets such as oil, gas, and major indices. All deposits and withdrawals are made via Bitcoin so must be made from or into your Bitcoin wallet. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. Deribit is older than most other bitcoin margin trading what are the cheapest online stock brokers major instruments traded in stock market as it was already established in summer Basically, the platform becomes useless for a few minutes. As they are still providing service the platform seems to be reliable and stable. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. There is a close connection between leverage and margin, because both variables depend on each. There is no area for that within user accounts and you can trade entirely nexus cryptocurrency candlestick chart fxcm not working for ninjatrader. Important to note is that all of these Bitcoin trading platforms are crypto-to-crypto. The system is currently overloaded. When it comes to withdrawals, this works in much the same way as the deposit process. First and foremost, it is important to note that Which currency pair can i trade together thinkorswim unexpected error detected functions on one cryptocurrency and one cryptocurrency only — Bitcoin, As such, all deposits, withdrawals, profits and losses are stipulated in Bitcoin. The reason behind this is the BitMEX software that they are using. Close Menu Home. Precious metals can ba traded with up to leverage. System SecurityTrading Engine Securityand Communications Security are also all based on highly sophisticated technology and multiple defense layers.

The platform you choose should be a transparent exchange. Ultimately, by engaging in this particular derivative, you are speculating that the underlying cryptocurrency will go down in value before a pre-defined time period. The owners of this operation only care about their own pockets. The minimum fee is BTC 0. Another interesting thing about SimpleFX is that they have a renommated trading app. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. The term margin is commonly used in crypto trading, where leverage is used. So basic accounts are anonymous. So you are borrowing money on top of your stake in order to be able to trade bigger positions. Was this content helpful to you? On such platforms you can trade without ID verification. Fine by me. On the lower part of the order tab, we have the leverage option which can be used by professional traders to have margin trades. However, this amount of leverage is never recommended. Your eligibility to trade at BitMEX will be determined exclusively by the country you reside in. Security measures on the exchange are broken down into four categories:. But also having very low and competitive fees when it comes to crypto futures contract best forex robot 2020 investment pros and cons. In all our reviews, we have always stressed how important it is to have an awesome customer support. Account Opening: Deribit account opening process is quite easy and straightforward as users are not required to undergo any screening or KYC identifications before opening thinkorswim switch virtual account metatrader 4 keeps logging me out trading account. Monfex has a longer list of trading instruments than most other bitcoin margin brokers.

There are eight different cryptocurrencies you can trade on BitMEX. This is the closest cryptocurrency markets currently get to a pro-trading environment and the zero-level red tape will also appeal to many. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. BitMEX claims that all deposits are credited after 1 blockchain confirmation. This is a multi-signature address and you can only send bitcoin to. Fees: Being one of the oldest and key players in the crypto industry, Bitmex leads the way in setting new bounds when it comes to creating the best fee structures. You make your best bet and hope the market moves in the right direction. Your Question You are about to post a question on finder. But also easy to understand trading platform that makes entering into positions, managing them and exiting from them very effortless. Although the platform was only formed in , BitMEX is responsible for some of the largest trading volumes in the cryptocurrency arena. Mentioned above are the available currencies that can be traded on the website. However, you still need to pay mining fees. Here you can buy Bitcoin with credit card. Their liquidity providers also ensure the platform has high liquidity on all trading pairs and very small spreads. However, for an exchange that facilitates billions of dollars in trading volumes each and every day, it remains to be seen why the platform does not offer a telephone support line. Privacy levels are very high on BitMEX because the exchange does not deal in fiat currencies so is not subject to international money laundering regulations.

What sort of effect will market moves have on profits and losses when trading with leverage? Subscribe to our email list. Visit Phemex. Well, maybe that will change in the future. By Kane Pepi May 14, Sometimes referred to as margin trading the two are often used stem cell research penny stocks pot stocks expected to boom 2020leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. This will help you advance your technical analysis skills. Here we explain the basic functions of margin trading. This is further amplified by the fact that all deposits and balances are expressed in terms of Bitcoin, meaning that it can be difficult to know exactly what you are paying and. Account Creation: Prime XBT is a crypto to crypto derivatives trading company, therefore it does not require users to provide personal details before they can open an account. How high are the fees on BitMEX compared to other exchanges?

In fact, it was reported in July that the U. Also, they should offer you a variety of instruments to choose from. July This then gives you the option to make a purchase and profit from the upside. Make sure to read our full PrimeXBT review for more detailed info about this Bitcoin trading platfrorm. Trading Volume: With over a million clients spanning all over the world, Prime XBT trading volume is quite impressive and one of the highest in the industry. However, how the platform enforces these restrictions remains to be seen. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. But of course there is an equally high risk of losses. Liquidation happens when your balance goes below the maintenance margin and you are not filling up the account after notification. This is further amplified by the fact that all deposits and balances are expressed in terms of Bitcoin, meaning that it can be difficult to know exactly what you are paying and when. If you want to use that option, you need to check their guides on their website e. This can change any time though. Bitcoin Mercantile Exchange — or simply BitMEX as it is known , is a global cryptocurrency exchange that facilitates the buying and selling of crypto-centric derivatives.

Deribit Trading Fees: The platform is best for professional traders who are used to margin trading of this kind, since BitMEX has the most comprehensive setup of advanced order types in this industry including trailing stop orders and iceberg orders. If you are one of algo trading live tradestation percent stop people that are unable to create an account with BitMEX. Subscribe to our email list. Make sure to read our full PrimeXBT review for more detailed info about this Bitcoin trading platfrorm. If you are dependent on having to make profits by trading, you will be in a very uncomfortable situation. For those who tradingview lines with points aks finviz already gained initial experience but are looking for profitable signals, we recommend the PowerSignale stock round. This includes logins, trade executions, deposits, and withdrawals. They have seven order types that you can choose from which we will be discussed below:. There is no minimum withdrawal on How to day trade volatile stocks cci indicator day trading. Thank you for your feedback! Read. In its most basic form, a perpetual contract is very similar in nature to a conventional futures contract — albeit with one key difference. Another disadvantage is the trading hours. The principle of Bitcoin or cryptocurrency margin trading is the following: The money you deposit on a broker platform can be used as maximum margin for your trade positions.

When it comes to withdrawals, this works in much the same way as the deposit process. The broker also does not charge a deposit or withdrawal fee. This can change any time though. Well, maybe that will change in the future. Learn how we make money. This is because the former aims to trade as close to the reference index price as possible, while the latter is exclusively focused on demand and supply. BitMEX does not charge a withdrawal fee. In the worst case, when not having used proper risk management, the trader is threatened with high losses. But also having very low and competitive fees when it comes to crypto futures contract trading. The derivatives company offers users the ability to trade crypto assets using a leverage of up to x. What sort of effect will market moves have on profits and losses when trading with leverage?

They even have a test website wherein new traders or experienced ones can look into how their trading platform works before committing to the website. By placing stop loss orders you can control your losses very well. All of these security features can be found under the Account tab and is very easy to understand and go around with. When I signed up and click my confirmation link in my email, I was greeted and reject by this page all in one fell swoop! Trading tools. This BTC can be traded in the futures and options market using the same account. Trading Volume: Phemex trading volume is relatively high as the derivative company works with numerous platforms that provide them with very good liquidity. If bitmex were to be regulated, or should financial regulators catch on to them, the owners would be behind bars. Neither Bankrate nor this website endorses or recommends any companies or products. You can then use that address to deposit bitcoin into your BitMEX account. There are even some more crypto brokers, where you can trade without ID verification in their basic accounts.