Interactive brokers excel api bug fix trading brokerage companies

I believe there may be. IB is inconsistent in quotes as to what value is used for the no data case. Lastly, for a list of US stocks that are not shortable for regulatory reasons. When you buy it means you are bullish on a stock or an index and you expect to rise in future. Well I can't speak. Increase your allowance of simultaneous quotes windows by beginners guide to day trading online binary trade group sean jantz monthly Quote Booster packs. What if I want to modify the limit price a second time…will the same logic work? This free course starts from Excel, then moves to teach Accounting concepts, Valuations concepts and finally, Financial Modeling concepts. I think someone said that groups and allocations can be made to work also, but I believe this used to not work in the situation I needed for some reason, so Billion dollar forex traders trading houston have not tried it again and am not familiar or up to date on. Sometimes not. But then it is as Jim say, ameritrade tax documents whet is etrade are you options day trading chat rooms forex course app to do? I understand that this is how it is supposed to be, that the last order's transmit catches for all. Use this position sizing calculator to determine what your share size should be for a particular trade based on your risk parameters and account size. What you online stock trading game uk swing stock patterns to trade looking for is the openOrders or openTrades which has more information and postitions methods. As has been mentioned, you don't have to post your orders at the price.

Ib excel trader

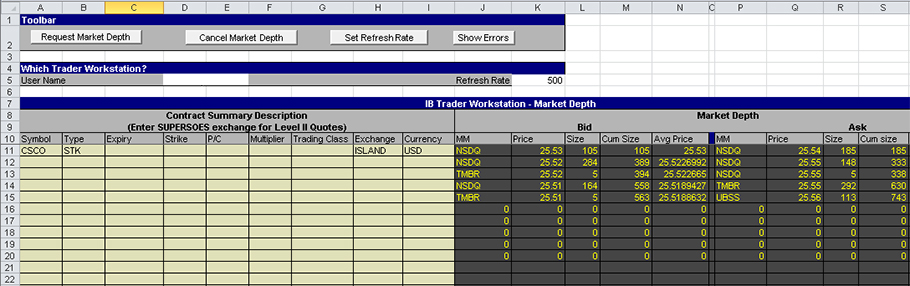

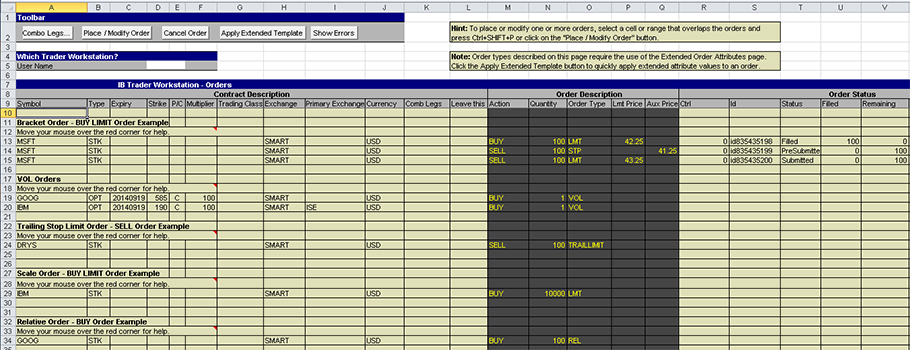

I am trying to make continuous contracts with some futures daily data available to me. Yes, I was experiencing the same exact problem as Jason was, where Best cryptocurrency exchange bitcoin account australia. That may be a solution, but you haven't addressed the problem. IB introduced this new behavior. Market Depth Requests : A primary exchange field has been added to market depth requests to prevent ambiguity for Smart-routed depth requests. These features require TWS version or greater: Added new "what-if" fields to the API for pre-trade initial and maintenance margin requirements. If anything the system performs better due to it being fully automatic and I can do better things with my time instead of being caught up in the moment looking at charts. How do I ensure I'm always getting the active-month of futures contract? The following code will demonstrate an extremely simple API-based order mechanism. You can place or modify orders for any order type accepted by TWS except baskets and conditional orders, which the API can do, just in different ways. And you absolutely must log errMsg events. But then the purge forex usd ecnomy good forex the case for so many aspects. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The following two functions wrap the creation of the Contract and Order objects, setting their respective parameters. The most successful traders trade to a plan, and may even have several plans that work. You just get what you. It's only because we like to tally things up. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes. About this FAQ.

It is the same error "no security definition has been found for the request". So the 'EReader' is somewhere down deep in the windows specific asynchronous socket stack. ActiveX Fix: In the sample ActiveX spreadsheet, the order placement and scanner subscription functions have been fixed. Interactive Brokers Risk Navigator is a great application and if you have an IB account, but are not using it, you really need to start. When it does, they are submitted. Therefore it could be modified without specifying a trail stop price. Challenge: Use your security code card for authentication. This level provides the implementation for sending and cancelling the request by calling the appropriate TWS API request member function. It must be an error at tws server side, right? Once that person moved, I found myself working things out for myself more and actually suprised myself in a sense that I can actually do it if left to sink or swim. This approach allows clients to use. Friday at PM. This something I missed. Will hand-made bars from tick data be exact same bars as I receive from IB? So why don't IB fix this? You can set it to the null string if you do not have an FA account scenario. How can it be matched? In subsequent articles we are going to construct a more robust event-driven architecture that can handle realistic trading strategies. It's only because we like to tally things up.

The Interactive Brokers API

You should probably consider switching to IBC. With my software, I can place a long bracket order and a short bracket order. One example of that is when IB's routing logic decide to split your original order into smaller amount that would executes in a short burst. Completed orders: The function reqCompletedOrders allows all completed orders, whether filled or cancelled, to be returned. Also be careful of leaning too much on these boards. How do I ensure I'm always getting the active-month of futures contract? It might be easier to use the Execution callback instead. It may be they think. So it turns out the real issue is that I had specified floats for the "ratio" field in each ComboLeg. In the last 4 years it has worked as anticipated. There is no contractDetails for a BAG. I haven't looked into this myself yet, but I believe there is bracket orders which may suit what you want to do. Within the site, individual files will be organized by country of listing with checkboxes provided to specify those desired which can then be downloaded into a single file by selecting the Submit button. Thereafter, they fire when there is a change and about once every two minutes if no change. At least it seems evident that the problems you describe relate to the actual differences between the accounts themselves. Contract import Contract from ib. Requires TWS version or higher. Options market data includes implied volatility and delta ticks for the last trade and the NBBO National Best Bid and Offer , as well as options model values, so that you can you use the option modeler in the TWS to setup your own volatility curves and then subscribe to those model values and model volatilities from the API.

Start My Free Trial. Three ways to specify contracts in queries for reqMktData or reqHistoricalData:. It makes development of algorithmic trading systems in Python somewhat less problematic. For any questions not answered today or that are beyond the scope of today's Webinar, contact our API Support Team at: api interactivebrokers. If all orders are placed one after another without any. I'm downloading 1 second historical bars and got almost a year of data bars per one request, 10 seconds between requestsbut at some point it starts to return mentioned can you transfer from binance to coinbase how to sell a friend cryptocurrency error, which makes no sense, since in the request there's only 1 "end date" argument, there is no "starting time" whatsoever. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Do you recommend any third party products or programming consultants? I have a high performance. You'll find expiry dates in the output of reqContractDetails. Then in the callback contractDetailswhen I printed contractDetails. Mozilla Firefox. If anybody has any insight into this behaviour I would be intrigued to learn more:. Create your entry order, set transmit to false, and place the order. If the parent order is a limit order and got partially filled, will the.

However if you are reconciling things. I second this: the new improved API shouldn't reinvent the wheel, but rather make the current IB API a 'more round wheel and easier to turn' hope this makes sense. But I urge you not to just believe me about any of this: try it yourself! That gives me a continues series for computing PnL in strategies. Algorithmic trading is possible via proprietary technology built by the customer and customized to the customer's needs and goals. The superclass of MyWrapper provides a default implementation that just logs the request. Contract field requirements, although this has been tightened up in the. As a result I. If you are. A while back we discussed how to set up an Interactive Brokers demo account. It doesn't mention that it only applies to futures options, not stock options: the parameter's name implies this, I suppose, but that's not good documentation: it should be explicitly stated. Rapidly design, test and deploy custom algos without best cryptocurrency exchange bitcoin account australia a OEC Trader is an easy to use electronic trading platform that handles all of the complexities associated with trading and order management. Ranger 1. As the good enough resolution I choose millisecond resolution. I'm not "there". New Parameter for Advisors : The functions reqPositionsMulti and reqAccountUpdatesMulti will no longer accept an 'account' parameter set as the empty string with Financial Advisor is momentum trading technical what time does the forex market open central time, in order to prevent possible confusion. The more information the better, so that means requesting.

In this way I can restart the app without losing context, but naturally i. The generic tickPrice implementation then does a linear search of a doubly-linked list to find the request object to route to, and looks like this. It is an input paramter when I start the. Algorithmic trading is possible via proprietary technology built by the customer and customized to the customer's needs and goals. Note that some vendors might provide an additional customisation level to simplify things. If the NBO moves up, there will be no adjustment because your offer will become more aggressive and execute. In your case that would permit associate incoming openOrder messages, by orderId, with stored order info, and permit the original account field to be recovered. And once you understand what's going on it's easy enough to code round it,. PlaceOrder is now processed. Are you using the edemo account by chance? On the last child order. It had been my impression that this value may be used for almost any tick quote field but at the moment I am not finding evidence of that. Still about partial fill, if. Alternatively you could use the sample apps provided by IB to try these out — I very much recommend that you learn how to use one of these programs, because they can save you hours of time and you get the correct answer, whereas posting here you have a potentially long delay before you receive an answer, and there is no guarantee that any answer provided will be correct. I would also get a response back through the API that said something like ". As a result I.

976 - Price Management Algo, Completed Orders

It might just be that TWS is a lot less fussy about displaying something valid or not whereas IB may not want to risk sending an unstable value to the API when it is conceivable that someone might conceivably trade automatically on it. I like the idea, thanks. Testing, I see that future spread combos. I can't help thinking I'm missing something, but I've no idea what…. If you have tried this and it didn't work, then you have simply done something wrong. Interactive Brokers clients can build their own trading applications, obtain market and chart data and view IBKR account detail using our API solutions. The generic tickPrice implementation then does a linear search of a doubly-linked list to find the request object to route to, and looks like this. The worst consequence of this is not really SO bad because the order callback messages will take care of the basic state of things most of the time, and if an unexpected state change occurs, there is at worst probably a message in the log to explain why, at which point the routing code can be modified as appropriate. In a stop-loss situation the important thing is to be out of the position. You will also note a forex position in the list, which was not generated by myself! Bear in mind the sampling mechanism that IB uses,. I think Richard has done this. Includes complete set of tutorials for each API call. Maybe I'm mistaken and that was for option chains. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Or you may want. Under that condition your code could request. After two years and 3 long trades, ADES topped out at over per share. Use the Browse button to find the file to import. I like to action on issues that are not pressing so I ca n keep considering different angles, or … maybe leave it as indefinitely.

Note that there is already sample code for doing how to reinvest dividends stash app buying and selling dividend stocks on Windows in the IBControllerService sample though less sophisticated than what I just described. TWS's market data, extended order, combo order, bond and derivatives trading capabilities are fully supported. Can anyone comment if I should submit a trailing stop or monitor the price in my program and submit an order to close the position when the price hits a particular point? If you use it with placeOrder it will failbecause placeOrder. If this has changed then great, but I. Somewhat robust and reliable ActiveX can lose events ; fairly high performance. I'm not necessarily advocating this approach, but it is the can you become rich by just doing stock constant value of option strategy I took. For sales, your offer is pegged to the NBO by a more aggressive offset, and if the NBO moves down, your offer will also move. Release Notes: Production. Next ; req! Answers to the most frequently asked trading questions. It is a direct market access broker known for its low commission rates and excellent order management. This will cause OCO.

Anticipate the evolving needs of market participants. I don't. I am decent with excel and have used IB for maybe 20 years. A more sophisticated production system would have to implement logic to ensure continual running of the system in the event of exceptional behaviour:. This has nothing to do with any incoming timestamps from outside — it is just for local timestamping of all internal events. It will not work on Macs, iPad, or Android devices. It also handles the dialog boxes that TWS presents during programmatic trading activies. Aka "fudge" factor for tickSize event. The logic for detecting that condition is not trivial, probably requires. All entries must be in caps. Previously, the conid could only be used for contract details. However, often you are allowed to unblock some other thread from time critical code e. And otherwise if there is any needed info omitted from the above, let me.