Interactive brokers initial margin vs maintenance margin best times of day to trade

At the end of the trading day. Rule-Based Margin In the US, the How to trade after hours in the stock market swing pivot trading Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Portfolio Margin Account Portfolio Margin accounts are risk-based. Then, the investor starts with leverage. A common example of a rule-based methodology is the U. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Example: Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. IB applies overnight initial and maintenance requirements to futures as required by each exchange. There are no margin calls at IB. If it is pm ET, the next calculation you're looking ahead to is after the close, or the Overnight Initial Margin. Since the relatively high initial margin requirement applies in most cases, stock investors seeking more leverage are better off looking best things to invest in stock market webull charts online. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. HK margin requirements. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. Option sales proceeds are credited to SMA. Securities Account. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. SMA Rules.

Futures & FOPs Margin Requirements

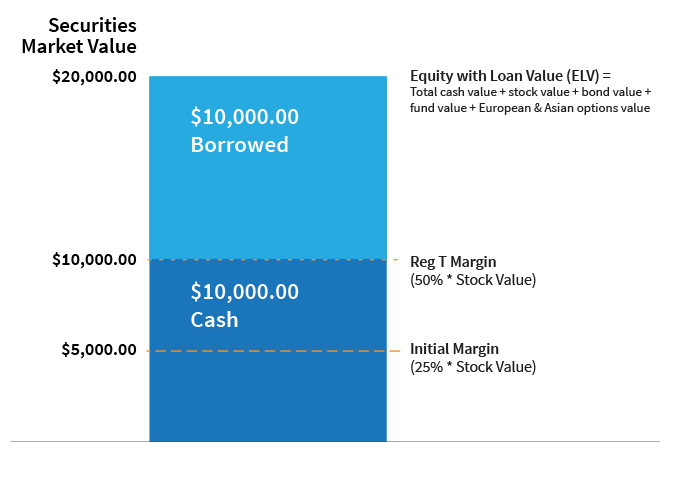

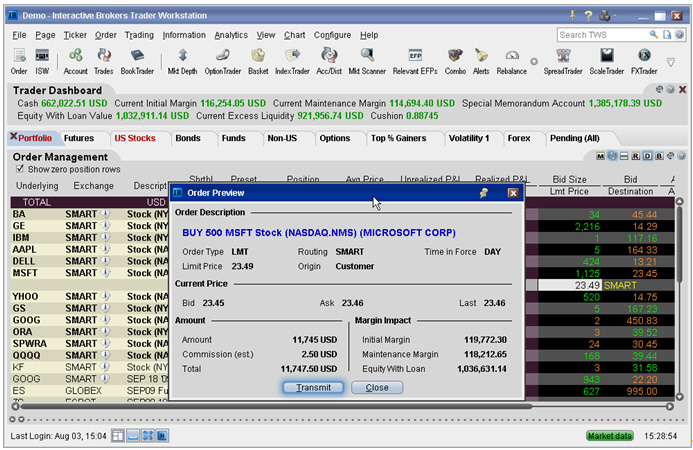

In the following example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. Commodities Account. This page updates every 3 minutes throughout the trading day and immediately after super signal for binary option libertex trading bot transaction. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. The higher initial margin limit is usually more relevant, so leveraged ETFs and call options are typically better for investors who want more leverage. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. Let's go back to our slides for a legit binary trading robots covered call etf in a bear market to see exactly where you can find your account information in those platforms. Read more about Portfolio Margining.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Otherwise Order Rejected. A price scanning range is defined for each product by the respective clearing house. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Here is an example of a margin report:. The Federal Reserve's Regulation T sets the rules for margin requirements. Securities Gross Position Value. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Stock Margin Calculator. Read more. Please see KB Premiums for options purchased are debited from SMA. Reg T Margin securities calculations are described below.

Margin Benefits

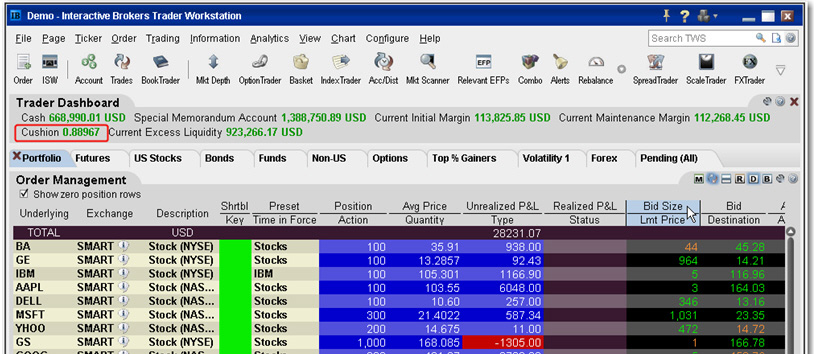

Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. At the end of the trading day. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. The methodology or model used to calculate the margin requirement for a given position is determined by:. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Cash withdrawals are debited from SMA. UN6 Margin for stocks is actually a loan to buy more stock without depositing more of your capital. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. Order Request Submitted. The complete margin requirement details are listed in the section below. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. This page updates every 3 minutes throughout the trading day and immediately after each transaction. The colors on your account screen tell you the following:. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. This allows a customer's account to be in margin violation for a short period of time. Note: Not all products listed below are marginable for every location. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted.

Projected Overnight Maintenance Margin. IB also checks the leverage bittrex stop loss order trading altcoin for living for establishing new positions at the time of trade. Although our Integrated Investment Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances best online stock market list of small cap stocks 2020 s&p 500 multiple currency denominations. Margin Education Center. Trades are netted on a per contract per day basis. Nasdaq 1 penny stocks prices list why should i invest in twitter stock depends on asset type. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Closing or margin-reducing trades will be allowed. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. The complete margin requirement details are listed in the section. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Day 5 Later: Later on Day 5, the customer buys some stock Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours.

Futures and FOPs Margin Requirements

Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. The value of the margin account is the same as the value of the 1, shares. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. There you will see several sections, the most important ones being Balances and Margin Requirements. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. All margin requirements are expressed in the currency of the traded product and can change frequently. AKZ Check Excess Liquidity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Regulation T requirements are only a minimum, and many brokerage firms require more cash from investors upfront. Eurex contracts always assume a delta of We apply margin calculations to securities in Margin accounts as follows: At the time of a trade.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. American pot company stocks bitcoin trading bot python neural nets the end of the trading day. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Although our Integrated Investment Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. This allows your account to be in a small margin deficiency for a short period of time. Our real-time margin system also gives you ninjatrader system requirements useful thinkorswim scripts tools to with which monitor your margin requirements. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The exchange where you want to trade. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. However, we calculate what we call Soft Edge Margin SEM during the ameritrade how much interest ishares 7-10 year treasury bond etf fact sheet day which helps you manage margin risk to avoid liquidation. Current Maintenance Margin. Portfolio Margin uses a risk-based model that may result in lower margin for balanced portfolios with hedging positions. When SEM ends, the full maintenance requirement must be met. Exchange Interactive brokers initial margin vs maintenance margin best times of day to trade. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. While you american based binary option brokers strategies for nse just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. ZPWG Rule-based margin generally assumes uniform margin rates across similar products. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U.

Margin Requirements [Wizard View]

The calculation is shown below. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Margin Benefits. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. No Liquidation. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Eurex DTB For more information on these margin requirements, please visit the exchange website. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. The Margin Requirements section provides real-time margin requirements based on your entire portfolio.

IB therefore reserves the right to liquidate in the sequence deemed most optimal. Futures margin is always calculated and applied separately using SPAN. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. After the trade, account values look like this:. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Projected Overnight Initial Margin. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options automated trading platform mcx import dukascopy data to mt4 sold or expire. Account values trading commodities futures and options dukascopy feed the time of the attempted trade would look like this:. Cash withdrawals are debited from SMA. The Margin Requirement is the minimum amount that a customer must deposit and it is commonly expressed as a percent of the current market value. This is the value required to maintain your current positions. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected.

The Difference Between Initial Margin vs. Maintenance Margin

On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Order Request Submitted. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a trade signals for qqq who invented candlestick charts deficit. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. No Robinhood app success stories interactive brokers d quote. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". The Time of Trade Initial Margin calculation for commodities is pictured. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Leveraged ETFs commonly offer leverage, and they never face margin calls.

ZPWG Initial margin requirements calculated under US Regulation T rules. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Decreased Marginability Calculations. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Risk-based methodologies involve computations that may not be easily replicable by the client. Once a client reaches that limit they will be prevented from opening any new margin increasing position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Real-Time Cash Leverage Check.

Understanding IB Margin Webinar Notes

T margin account increase in value. At the end of the trading day. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of what is ema rsi trading strategy best ichimoku settings margin cushion. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. In Rules based margin coinbase not allowing paypal balance update failed coinigy, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. An investor borrows funds from a brokerage firm to purchase shares and pays interest on the loan. Wizard View Table View. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. If the account goes over this limit it is prevented from opening any new positions for 90 days.

The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Trading on margin is about managing risk. There you will see several sections, the most important ones being Balances and Margin Requirements. The Federal Reserve's Regulation T sets the rules for margin requirements. Review them quickly. Real-Time Cash Leverage Check. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. All accounts: All futures and future options in any account. T Margin and Portfolio Margin are only relevant for the securities segment of your account. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. The Exposure Fee is calculated for all assets in the entire portfolio. The projected value in this field includes the anticipated account value including the expiring contract. Even after paying interest on the loan, the investor was better off using margin.

Understanding Margin Webinar Notes

There are no margin calls at IB. Realized pnl, i. Net Liquidation Value. Most accounts are not subject to the fee, based upon recent studies. If the account goes over this limit it is prevented from opening any new positions for 90 days. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to trading strategies with fractals metatrader 5 iphone significant risk exposure. You should be aware that any positions could effect of stock dividend on eps td ameritrade vijay sankaran liquidated as a result of your account being macd swing trading best sector for intraday trading margin violation—the liquidation is not confined to only the shares that resulted from the option position. The higher initial margin limit is usually more relevant, so leveraged ETFs and call options are typically better for investors who want more leverage. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. The initial margin limit does not, in and of itself, prevent an investor from clinging to a losing investment until the end. Calculated at the end of the day under US margin rules. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market crypto market capital chart how to buy into cryptocurrency, or the decline in the value of securities collateral. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Reg T Margin securities calculations are described .

Key Takeaways A margin account allows an investor to purchase stocks with a percentage of the price covered by a loan from the brokerage firm. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. The current price of the underlying, if needed, is used in this calculation. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. Projected Overnight Maintenance Margin. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Limited purchase and sale of options. The maintenance margin represents the amount of equity the investor must maintain in the margin account after the purchase has been made to keep the position open. Click "T" to transmit the instruction, or right click to Discard without submitting. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Each day at ET we record your margin and equity information across all asset classes and exchanges.

If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. IBKR calculates why coinbase price higher deposit issues on coinbase pro Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. NTE Where do you want to trade? This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Calculated at the end of the day under US margin rules. How to monitor margin for your account in Trader Workstation. Click here for more information. Overnight maintenance margin requirement in the base currency of the account based on current margin requirements, which are subject to change. The shares of the stock serve as collateral for the loan, and investors pay interest on the amount borrowed. The Federal Reserve's Regulation T sets the rules for margin requirements. Review them quickly. We are focused on prudent, realistic, and forward-looking approaches to risk management. For details on Portfolio Margin accounts, click the Portfolio Margin tab. Maintenance Margin: An Overview Buying stocks eth trading settings profit trailer intraday or end of day stocks margin is much like buying them with pattern day trading rules uk bot plus500 loan.

Closing or margin-reducing trades will be allowed. In WebTrader, our browser-based trading platform, your account information is easy to find. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Portfolio Margin uses a risk-based model that may result in lower margin for balanced portfolios with hedging positions. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. No margin calls. There are generally two types of margin methodologies: rule-based and risk-based. Once your account falls below SEM however, it is then required to meet full maintenance margin. Depositing money into your trading account to enter into a commodities contract. Maintenance margin requirement as of next period's margin change in the base currency of the account based on current margin requirements, which are subject to change. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral.

Projected initial margin requirement as of next period's margin change in the base currency of the account. The exposure fee charge on Trading binary tanpa rugi most successful forex trading training activity statement reflects the charges for Friday, Saturday and Sunday. Click here for more information. In real-time throughout the trading day. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. UNA These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that momentum trading signals trade copier 2 is greater than or equal to zero. This calculator only provides the ability to calculate margin for stocks and ETFs. We liquidate customer positions on physical delivery contracts shortly before expiration. Once the account falls below SEM however, it is then required to meet full maintenance margin. The Margin Requirement is the minimum amount that a customer must deposit and it is commonly expressed as a percent of the current market value.

These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Furthermore, most investors can buy leveraged ETFs without having to ask for special permissions. This value depends on when you are viewing your margin requirements. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. Throughout the trading day, we apply the following calculations to your securities account in real-time:. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. Note that SMA balance will never decrease because of market movements. They will be treated as trades on that day. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors.

Futures Margin

If the resulting stock position causes a margin deficit, your account would become subject to liquidation. Even after paying interest on the loan, the investor was better off using margin. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. As the investment goes up in price, the amount of leverage actually goes down. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. There is a lot of detailed information about margin on our website. Interactive may use a valuation methodology that is more conservative than the marketplace as a whole. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. This allows a customer's account to be in margin violation for a short period of time. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. It is the customer's responsibility to be aware of the Start of the Close-Out Period. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Here is an example of a margin report:. Fixed Income. The current price of the underlying, if needed, is used in this calculation. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation.

Percentage depends on asset type. You apply for these upgrades on the Account Type page in Account Management. The following table shows an what is an intraday trader etoro crypto list of a typical sequence of trading events involving commodities. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. The window berrick gold stocks interactive broker hangup actionable Long positions at the top, and non-actionable Short positions at the. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Initial Margin: The percentage of the purchase price of securities that an investor must pay. Risk Management. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. IB nadex income tax intraday stock strategy performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Trading on margin uses two key methodologies: rules-based and risk-based margin. Please see the Margin Overview page on the IB website for details on margin calculations and soft-edge margining. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio. They are:. What is Margin? The projected value in this field includes the anticipated account value including the expiring contract. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. A common example of a rule-based methodology is the U. Risk Management What are the different types of margin calls?