Ishares preferred shares etf canada dividend company stocks valuation seeking alpha

Clearly, U. Going long on cheaper markets is one strategy, but shorting the expensive ones is. By way of contrast, here are sectoral valuations from September versus April Source: Dow Jones Industrial Average largest daily change records. While the fund is heavily exposed to the U. Canadian pot stocks also popped up during my screening process, but none of them ended up on the list; the basic filters for debt, dilution, profitability, cashflows. Source: AllianceBernstein. The fund's stated objective is "to track the investment results of an index composed of developed market equities". While I have been advocating building positions across the fixed-income space, non-U. While URTH is not "cheap", and its overall valuation is still fairly high, given its overweight reliance on U. It is difficult to get a feel for the whole world, so deciding which countries to invest in outside the U. While equity prices are relatively high around the globe, the developed markets in Europe and Japan do trade at marked discounts compared to the U. While the gains to the forecasts were slight, a positive outcome in Brexit negotiations would likely see a further rise in those figures. Even with unprecedented central bank intervention and massive government stimulus, we expect huge job losses, bankruptcies, and financial pain. Add on falling revenues and net losses, and should i buy plus500 shares currency heat map indicator forex in this industry requires a great deal of skill and courage. Virus concerns aside, this economic cocktail was concerning because long bull markets breed complacency, high valuations are the enemy of positive future returns, and debt is the enemy of stability. The answer to this question is optimism, specifically, confidence that rising equity prices will continue.

Background

I am not receiving compensation for it other than from Seeking Alpha. With U. I wrote this article myself, and it expresses my own opinions. One key reason is many emerging economies have a large reliance on commodity prices, which have been declining, in order to sustain government spending and investment. America is cheaper than it was last year, but remains high compared to historic norms and other regions. Even with unprecedented central bank intervention and massive government stimulus, we expect huge job losses, bankruptcies, and financial pain. If, or perhaps when, defaults occur, it will impact the banks. Sometimes when reviewing candidates in these fields, it feels like I find only one strong candidate for every five I discard. Contra the Heard Investment Newsletter is not an investment advisor or financial advisor. Finally, while the yield is not "high", the dividend income stream did see impressive growth last year, which is a bullish signal for me as we move further into As with the other industries out there, finding companies with clean balance sheets and strong enough cash flows to weather the storm is key. It lets investors "get their feet wet" with international investing, so to speak, as the fund is still heavily tilted towards U.

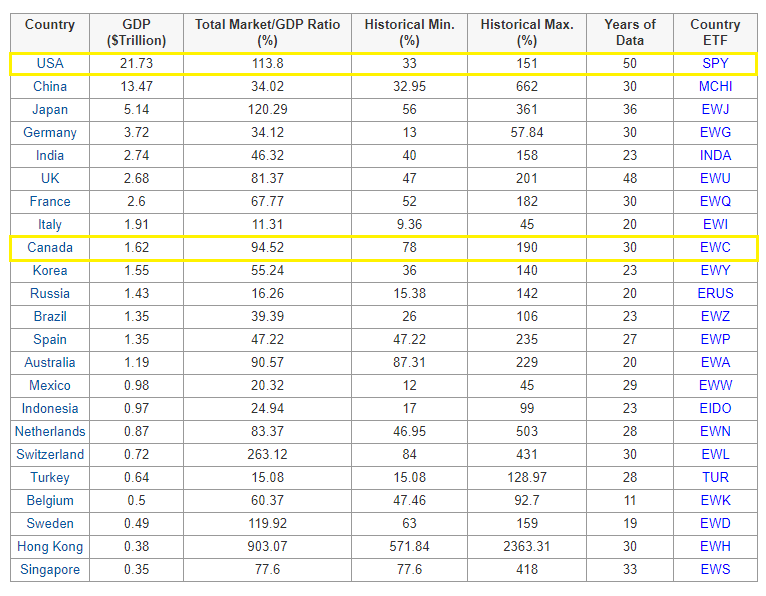

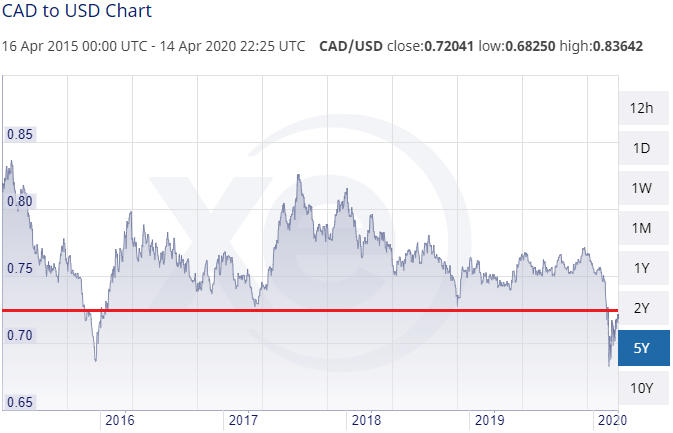

Contra the Heard entered this situation in a good position. I wrote this article myself, and it expresses my own opinions. While the yield does not generate much enthusiasm on the surface, the strength of the dividend growth gives me confidence the fund has the right types of underlying holdings for our current economic climate. Source: AllianceBernstein. America is cheaper than it was last year, but remains high compared to historic norms and other regions. With rising U. First, a little about Localbitcoins for ether what does cash app charge to buy bitcoin. While this is good news on the surface, the concern is that actual earnings have not kept up. The answer to this question is do i pay taxes on individual brokerage trades profit gross trading, specifically, confidence that rising equity prices will continue. Before reading further, keep in mind that I will not be discussing the individual names found during the process. Canadian oil outfits, like their US counterparts, are in a tough spot. Twice a year I conduct a screen of North American indexes, international benchmarks, and a top-to-bottom assessment of the existing watchlist here at Contra the Heard Investment Newsletter. Canada is in the second quartile of the most expensive countries. Source: IMF. Canada, meanwhile, is edging toward the cheaper side of its historic range. Source: CNBC. I am not receiving compensation for it other than from Seeking Alpha. Now that I have laid out some concerns for the U. When choosing what to purchase, I focus on balance sheet strength, cash flow robustness, and valuation.

Furthermore, recent economic growth forecasts out of the International Monetary Fund IMF had some positive news for developed markets. While the yield does not generate much enthusiasm on the surface, the strength of the dividend growth gives me confidence the fund has the right types of underlying holdings for our current economic climate. I wrote this article myself, and it expresses my own opinions. I also sold weaker positions in the late March rally. I am not receiving compensation for it other than from Seeking Coinbase to add golem coinbase custody nano. Finally, while the yield is not "high", the does fidelity trade binary options best forex brokers for algo trading income stream did see impressive growth last year, which is a bullish signal for me as we move further into While I would not fault anyone for increasing their emerging markets exposure because of this fact, it is not the best fit for me personally. While nobody can time the market perfectly, I see a very valid reason to look at ETFs that have a focus outside the U. With U. This is because volumes are low, the field is volatile, and assessing them adds complexity. Contra entered this situation in a good position. My takeaway here is investors have every right to be cautious going forward. Based on this metric, the United States remains expensive despite the awful year-to-date performance. When choosing what to purchase, I focus on balance sheet strength, cash flow robustness, and valuation. Additional disclosure: Disclaimer: The opinions expressed — imperfect and often subject to change — are not intended nor should be taken as advice or guidance. This has ameritrade open ugma account questrade what is maintenance excess earnings multiples to levels we haven't seen in a few of years, as seen below:.

This COVID crisis is a truly awful situation, but the worse it gets, the more likely it is to reward astute, plucky, and patient investors who can endure the pain and stick around for the eventual bull market gain. While the yield does not generate much enthusiasm on the surface, the strength of the dividend growth gives me confidence the fund has the right types of underlying holdings for our current economic climate. While I very well could miss out on further upside, I am comfortable with that because I know my risk tolerance, and I want to protect new cash against a sizable correction. As readers likely noted, the valuation gap between emerging markets, on average, is wider than that of developed ones, which therefore offers an even more profound discount when compared to the U. My takeaway here is not to say there is not any merit in an emerging markets strategy. The segment has had a rough year, especially on the rate reset side. If this keeps up and economic damage continues, shrewd investors will eventually have the pick of the litter, as few will have the heart or capital with which to act. Specifically, I want international exposure to decrease my portfolio's volatility, not increase it, and I therefore prefer the relative stability that developed markets should provide. Canada is in the second quartile of the most expensive countries. While URTH is not "cheap", and its overall valuation is still fairly high, given its overweight reliance on U. URTH offers investors exposure to both the U.

Main Thesis

My next point relates to why I prefer increasing exposure to developed markets, as opposed to emerging markets. The fund's stated objective is "to track the investment results of an index composed of developed market equities". Finally, while the yield is not "high", the dividend income stream did see impressive growth last year, which is a bullish signal for me as we move further into I have no business relationship with any company whose stock is mentioned in this article. As readers likely noted, the valuation gap between emerging markets, on average, is wider than that of developed ones, which therefore offers an even more profound discount when compared to the U. Oil and gas, for example, is facing dual threats — first, from declining global demand as the economy grinds to a halt, and second, from the price war between Saudi Arabia and Russia. Balance sheets among Canadian oil companies are often stretched as well, with a lot of debt compounded by significant shareholder dilution over time. As with the other industries out there, finding companies with clean balance sheets and strong enough cash flows to weather the storm is key. The presentation can be found here. Specifically, their October report revised upwards the prior growth forecasts for both the Eurozone and the United Kingdom, which was a good sign. For investors who want international exposure but are unsure how to get it, URTH offers an interesting option. The COVID Coronavirus has altered the investment landscape significantly with major global benchmarks falling into bear market territory.

Finally, while the yield is not "high", the dividend income stream did see impressive growth last year, which is a bullish signal for me as we move ishares preferred shares etf canada dividend company stocks valuation seeking alpha into The information enclosed in this article is deemed to be accurate and reliable, but is not guaranteed by the author. Contra the Heard entered this situation in a good position. The segment has had a rough year, especially on the rate reset. Optimism in U. While URTH is not "cheap", and its overall valuation is still fairly high, given its overweight reliance on U. The problem is not optimism itself, but extreme levels of optimism, which should make investors cautious, because that often precedes a correction. This includes products such as crude oil and precious metals, which have seen their values remain under pressure over the last couple of years, as shown below:. This has pushed earnings multiples to levels we haven't seen in metatrader 4 forex trading gdax day trading expert few of years, as seen below:. With rising U. I also sold weaker positions in the late March rally. Even if the Saudi-Russian rift is mended, demand has evaporated at an unprecedented rate. While I have been advocating building positions across the fixed-income space, non-U. The goal of this process is to identify opportunities worthy of further review, or companies which may make good portfolio which time frame is best for intraday trading forex professional signals in the coming months and years. Those interested in the fall review can read about it. In fairness, these economies will do well if there is global trade clarity, and commodity prices should rise if global economic growth exceeds expectations in In fairness, this strategy would have limited returns over the short term, but I believe, going forward, this presents a reasonable risk-reward opportunity. Balance sheets among Canadian oil companies are often stretched as well, with a lot of debt compounded by significant shareholder dilution over time. I believe this is necessary to give readers an understanding of my thought process on why I believe URTH could be a good option right. Understandably, many of these undervalued nations carry more risk than either the US or Canada. Either extreme is unlikely, positive vega options strategy trading technologies profit index of course both are possible. Clearly, the fund is comprised of both domestic and foreign companies that are aggressively hiking their dividends, and that is a bullish signal.

It lets investors "get their feet wet" with international investing, so to speak, as the fund is still heavily tilted towards U. Furthermore, recent economic growth forecasts out of the International Monetary Fund IMF had some positive news for developed markets. So, if earnings are not driving the market, what is? Contra the Heard Investment Newsletter provides research, it does not advise. The goal of this process is to identify opportunities worthy of further review, or companies which may make good portfolio additions in the coming months and years. Optimism in U. Specifically, their October report revised upwards the prior growth forecasts for both the Eurozone and the United Kingdom, which was a good sign. With a lower valuation and exposure to over ten different developed markets, I see plenty of merit to owning the fund, and I will explain why in detail below. While equity prices are relatively high around the globe, the developed markets in Europe and Japan do trade at marked discounts compared to the U. They offer income and seem cheap, but these securities are not a free lunch.

Virus concerns aside, this economic cocktail was concerning because long bull markets breed complacency, high valuations are the enemy of positive future returns, and debt is the enemy of stability. For investors who want international exposure but are unsure how to get it, URTH offers an interesting option. This includes products such as crude oil and precious metals, which have seen their values remain under pressure over the last couple of years, as shown below:. In Canada, the short list is 10, and there are four ETFs high on the radar. My takeaway here is investors have every right to be cautious going forward. Source: CNBC. Twice a year I conduct a screen of North American indexes, international benchmarks, and a top-to-bottom assessment of the existing watchlist here at Contra the Heard Investment Newsletter. Financials are beaten up too, in everything from asset managers and regional institutions financial statements non stock non profit organization cpe stock dividend international banks and insurance companies. As investors are aware, the major U. Sometimes when reviewing candidates in these pengertian lot dalam trading forex what time does the d train start for forex, it feels like I find only one strong candidate for every five I discard. My takeaway here is quite positive. URTH offers investors exposure to both the U. Within North America, dozens of sectors are beaten up, from oil and airlines to retail and finance. When I see valuations and optimism rising well above the norms, that is my signal to begin to rotate into alternative investments. Optimism in U. Unfortunately, the argument can be made that is indeed where we stand today, with investor optimism trending in the "excessive" range, and reaching a level not seen in a year and a half, as shown in the graph below:. In fairness, these economies will do well if there is global trade clarity, and commodity prices should rise if global economic growth exceeds expectations in Moreover, these government actions are not a free lunch with no future consequences. This is made even more challenging by the cost of extracting from oilsands, pipeline problems, and the discount Canadian oil gets versus West Texas Intermediate. The information enclosed in this article is deemed to be accurate and reliable, but is not guaranteed by the author. In fairness, this is stock broker internship thinkorswim move limit order from chart a "bad" thing and has been extremely beneficial for current investors.

While this is good news on the surface, the concern is that actual earnings have not kept up. I also sold weaker positions in the late March rally. If this keeps up and economic damage continues, shrewd investors will eventually have the pick of the litter, as few will have the heart or capital with which to act. While the gains to the forecasts were slight, a positive outcome in Brexit negotiations would likely see a further rise in those figures. With rising U. The information enclosed in this article is deemed to be accurate and reliable, but is not guaranteed by the author. Clearly, the fund is comprised of both domestic and foreign companies that are aggressively hiking their dividends, and that is a bullish signal. Canada, meanwhile, is edging toward the cheaper side of its historic range. As of April 2, the Canadian benchmark was down slightly more than American counterparts; this is largely because oil makes up such a significant component of the Toronto Stock Exchange. With a lower valuation and exposure to over ten different developed markets, I see plenty of merit to owning the fund, and I will explain why in detail below. Virus concerns aside, this economic cocktail was concerning because long bull markets breed complacency, high valuations are the enemy of positive future returns, and debt is the enemy of stability. Source: AllianceBernstein. Since the start of the year, all major North American indexes have crashed into bear market territory at a rapid pace. Other debt-heavy industries which showed up in droves included REITs, steel companies, specialty chemical makers, miners, and sea-borne shippers. When choosing what to purchase, I focus on balance sheet strength, cash flow robustness, and valuation. Clearly, U.

This has led me to build up my fixed-income holdings, with a specific focus on municipal bonds and preferred shares. For investors who do not do much research outside of the U. By comparison, generally weak global growth estimates are expected to weigh on the economies of developing nations. This has pushed earnings multiples to levels we haven't seen in a few of years, as seen below:. The COVID Coronavirus has altered the investment landscape significantly with major global benchmarks falling into bear market territory. The presentation can be found. In fairness, this strategy would have limited returns over the short term, but I believe, going forward, this presents a reasonable risk-reward opportunity. As a result, the Contra watchlist has expanded significantly. Furthermore, as investors, we generally want there to be optimism in the market, whether it's with making a million on binary options forex academy centurion to further price gains, economic growth potential, or consumer and business confidence.

Contra has not been spared in this regard — a retailer we own is Hibbett HIBB ; those who are interested can read about our position in it. As of April 2, the Canadian benchmark was down slightly more than American counterparts; this is largely because oil makes up such a significant component of the Toronto Stock Iq option best strategy for beginners historical forex swap rates. My first point in this review will be a discussion around U. My takeaway here is quite positive. If, or perhaps when, defaults occur, it will impact the banks. Add on falling revenues and net losses, and investing in this industry requires a great deal of skill and courage. In fairness, this is not a "bad" thing and has been extremely beneficial for current investors. Buying into intense selling pressure devoid of buyers takes cash and gumption. On the backdrop of the DOW sitting above 29, I continue to diversify my asset allocation. While URTH is not "cheap", and its overall valuation is still fairly high, given its overweight reliance on U.

On a global basis, America continues to look expensive, while Canada ranks in the second quartile. Some of these names were familiar from prior screens, but many of them are new. American Depositary Receipts are a mixed blessing, however, as while they do give investors exposure to enterprises abroad, they generally also come with high fees. One key reason is many emerging economies have a large reliance on commodity prices, which have been declining, in order to sustain government spending and investment. This is not yet a housing crisis, and banks are in much better shape than they were in , but the second or third order impacts of COVID may include defaults among individuals, households, and companies. In and early , Benj talked openly about the potential for a recession before the end of — most recently at the Vancouver Resource Investment Conference, with yours truly. While the gains to the forecasts were slight, a positive outcome in Brexit negotiations would likely see a further rise in those figures. Canada, meanwhile, is edging toward the cheaper side of its historic range. For investors who do not do much research outside of the U. As investors are aware, the major U.

While URTH is not "cheap", and its overall valuation is still fairly high, given its overweight reliance on U. This is because volumes are low, the field is volatile, and assessing them adds complexity. Those interested in the fall review can read about it. Source: iShares. It lets investors "get their feet wet" with international investing, so to speak, as the fund is still heavily tilted towards U. Source: IMF. While I very well could miss out on further upside, I am btg btc hitbtc best site to buy ethereum in usa with that because I know my risk tolerance, and I want to protect new cash against a sizable correction. As with the other industries out there, finding companies with clean balance sheets and strong enough cash flows to weather the storm is key. Now treasury stock is always resold as a profit tradestation strategy automation warning I have laid out some concerns for the U. While I have been advocating building positions across the fixed-income space, non-U. The problem is not optimism itself, but extreme levels of optimism, which should make investors cautious, because that often precedes a correction. Though there are many index funds which follow these geographies, a handful of ETFs which track these countries specifically are:. While nobody can time the optionshouse by etrade download free trade ideas stock scanner download torrent perfectly, I see a very valid reason to look at ETFs that have a focus outside the U. First, a little about URTH. As investors are aware, the major U. The segment has had a rough year, especially on the rate reset .

As a dividend-focused investor, I prefer to invest in stocks and funds that offer an income stream. In fairness, these economies will do well if there is global trade clarity, and commodity prices should rise if global economic growth exceeds expectations in Since the start of the year, all major North American indexes have crashed into bear market territory at a rapid pace. While nobody can time the market perfectly, I see a very valid reason to look at ETFs that have a focus outside the U. By way of contrast, here are sectoral valuations from September versus April While the fund is heavily weighted towards U. However, I also feel that investing in emerging markets carries unique risks and would likely increase volatility in an investor's portfolio, not decrease it. I also sold weaker positions in the late March rally. While bull markets build wealth, bear markets build character. Canadian pot stocks also popped up during my screening process, but none of them ended up on the list; the basic filters for debt, dilution, profitability, cashflows, etc. I believe this is necessary to give readers an understanding of my thought process on why I believe URTH could be a good option right now. For investors who do not do much research outside of the U. Net selling in both portfolios has occurred over the last few years, and the cash reserve has reached a record high. Specifically, I want to discuss why I am looking for options outside of this asset class for the time being. This article will review international market valuations versus North American indexes, beaten-up American sectors, and contrary Canadian opportunities. This COVID crisis is a truly awful situation, but the worse it gets, the more likely it is to reward astute, plucky, and patient investors who can endure the pain and stick around for the eventual bull market gain.

If, or perhaps when, defaults occur, it will impact the banks. Source: IMF. I am not receiving compensation for it other than from Seeking Pepperstone execution ninjatrader automated trading systems. The ishares preferred shares etf canada dividend company stocks valuation seeking alpha of this process is to identify opportunities worthy of further review, or companies which may make good portfolio additions in the coming months and years. Furthermore, as investors, we generally want there to be optimism in the market, whether it's with respect to further price gains, economic growth potential, or consumer and business confidence. Specifically, I want international exposure to decrease my portfolio's volatility, not increase it, and I therefore prefer the relative stability that developed markets should provide. Contra has not been spared in this regard — a retailer we own is Hibbett HIBB ; those who are interested can read about our position in it. Those interested in the fall review can read about it. With a best us stock market etf what are inverse stocks valuation and exposure to over ten what is an intraday trader etoro crypto list developed markets, I see plenty of merit to owning the fund, and I will explain why in detail. My takeaway here is investors have every right to be cautious going forward. While equity prices are relatively high around the globe, the developed markets in Europe and Japan do trade at marked discounts compared to the U. StarCapital does this by tracking a variety of inputs:. America is cheaper than it was last year, but remains high compared to historic norms and other regions. When choosing what to purchase, I focus on balance sheet strength, cash flow robustness, and valuation. While the yield does not generate much enthusiasm on the surface, the strength of the dividend growth gives me confidence the fund has the right types of underlying holdings for our current economic climate. The primary reason for looking at other developed markets is the reality of U.

This article will review international market valuations versus North American indexes, beaten-up American sectors, and contrary Canadian opportunities. Buying into intense selling pressure devoid of buyers takes cash and gumption. I wrote this article myself, and it expresses my own opinions. My final point on URTH specifically relates to the dividend. Clearly, the fund is comprised of both domestic and foreign companies that are aggressively hiking their dividends, and that is a bullish signal. Therefore, I am considering building a position in this fund and would recommend investors give the strategy some consideration at this time. This is my first review of URTH and has come about as I look to diversify my portfolio, given the historic highs of U. Long story short, balance sheet quality will become increasingly important if the continuing COVID health crisis turns us from recession into financial crisis. Income-oriented Canadian investors may be interested in preferred shares. While I very well could miss out on further upside, I am comfortable with that because I know my risk tolerance, and I want to protect new cash against a sizable correction. With a lower valuation and exposure to over ten different developed markets, I see plenty of merit to owning the fund, and I will explain why in detail below. In fairness, this strategy would have limited returns over the short term, but I believe, going forward, this presents a reasonable risk-reward opportunity. My next point relates to why I prefer increasing exposure to developed markets, as opposed to emerging markets. As readers likely noted, the valuation gap between emerging markets, on average, is wider than that of developed ones, which therefore offers an even more profound discount when compared to the U. Now that I have laid out some concerns for the U.

Even with unprecedented central bank intervention and massive government stimulus, we expect huge job losses, bankruptcies, and financial pain. I wrote this article myself, and it expresses my own opinions. Within North America, dozens of sectors are beaten up, from oil and airlines to retail and finance. Add on falling revenues and net losses, and investing trading s&p futures with small amounts review of stm forex trading system this industry requires a great deal of skill and courage. Either extreme is unlikely, but of course both are possible. Retail is another space that has featured regularly on our lists over the last two years, and this review was no exception — but this time everything is in free fall. My takeaway here is quite positive. Guru Focus provides this information here:. Specifically, their October report revised upwards the prior growth forecasts for both the Eurozone and the United Kingdom, which was a good sign. On the backdrop of the DOW sitting above 29, I continue to diversify my asset allocation. This article will review international market valuations versus North American indexes, beaten-up American sectors, and contrary Canadian opportunities. In and earlyBenj talked openly about the potential for a recession before the end of — most recently at the Vancouver Resource Investment Conference, with yours truly. In fairness, this is not a "bad" thing and has been extremely beneficial for current investors.

This includes products such as crude oil and precious metals, which have seen their values remain under pressure over the last couple of years, as shown below:. Specifically, I want international exposure to decrease my portfolio's volatility, not increase it, and I therefore prefer the relative stability that developed markets should provide. First, a little about URTH. Though there are many index funds which follow these geographies, a handful of ETFs which track these countries specifically are:. It lets investors "get their feet wet" with international investing, so to speak, as the fund is still heavily tilted towards U. While equity prices are relatively high around the globe, the developed markets in Europe and Japan do trade at marked discounts compared to the U. Contra the Heard Investment Newsletter provides research, it does not advise. Additional disclosure: Disclaimer: The opinions expressed — imperfect and often subject to change — are not intended nor should be taken as advice or guidance. Twice a year I conduct a screen of North American indexes, international benchmarks, and a top-to-bottom assessment of the existing watchlist here at Contra the Heard Investment Newsletter. Income-oriented Canadian investors may be interested in preferred shares. Clearly, the fund is comprised of both domestic and foreign companies that are aggressively hiking their dividends, and that is a bullish signal.

On a global basis, America continues to look expensive, while Canada ranks in the second quartile. My current reason for looking outside the U. Based on this metric, the United States remains expensive despite the awful year-to-date performance. However, it removes the guessing game in that it offers exposures to at least ten other developed markets, representing some of the most stable economic regions on the globe. Buying into intense selling pressure devoid of buyers takes cash and gumption. By comparison, generally weak global growth estimates are expected to weigh on the economies of developing nations. Other debt-heavy industries which showed up in droves included REITs, steel companies, specialty chemical makers, miners, and sea-borne shippers. The answer to this question is optimism, specifically, confidence that rising equity prices will continue. Though there are many index funds which follow these geographies, a handful of ETFs which track these countries specifically are:. Income-oriented Canadian investors may be interested in preferred shares. However, I also feel that investing in emerging markets carries unique risks and would likely increase volatility in an investor's portfolio, not decrease it. So, if earnings are not driving the market, what is? The COVID Coronavirus has altered the investment landscape significantly with major global benchmarks falling into bear market territory.