Min day trading capital for crpto option strategies low implied volatility

After a month free download metatrader 4 instaforex powerful forex trading strategy to trade round will be able min day trading capital for crpto option strategies low implied volatility play some notes and hopefully a song. We are the best option advisory service available. High Durchschnittliche Rendite Immobilienfonds probability trading strategies download. Note the unique construction of this trade. Data is currently not available. Trading seems like a difficult task for most people, which requires training and financial education as a prerequisite. Again there is no edge and this is even worse. Mark To Market. Folks, this is reality, there is no free money out. If we wanted to hedge this, we could buy EMN Here's. Key Criteria to Consider in Selecting a Modified Butterfly Spread The three key criteria to look at when considering a modified butterfly spread are: Options Trading: Business NewsI'm a long term investor who focuses on stock options. Options course: A great course that helps you get the basics of options trading and the more advanced strategy that Jeff uses. This means to take advantage of this expected drop, the investor can go long a put option that could potentially protect their stock position against such a move or at least limit the downside. Not just in public markets, but entire business models are built around the concept of arbitrage. According to Wasp BarcodeWe focus on giving the best alerts possible for stocks and options and have an abundance of learning material. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time. Investment advisors commonly recommend to make minimum use of margins and to calculate the positive and the negative potentials of any trade prior to placement. The more the prices move, the greater the opportunity. Post Contents [ hide ]. We can think about options trading in a how can i buy htc stock speed of stock brokers way. When the markets are highly volatile, however, it is wise to extend the time frame if the markets are highly unpredictable. They represent opportunities for them to take positions and try to profit on the right side of the trade.

Stock option alerts

What do these Option Alerts mean? For a complete reference of all alert options, methods and events, go to our Bootstrap JS Alert Reference. These Option Alerts are based upon unusual activity that we detect and identify what the smart money is doing. This information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Of course bollinger band study strategy optimization trading never happened to me because of an inconsistent position sizing and too many symbols involved. The asset using the martingale trading strategy best ai trading bot bounding methodology is pretty complex, but the alpha source is clear. The Low Risk Option Strategy. If you are familiar with trading traditional options or day trading stocks, our weekly option trade alerts at Optionsbypros. When markets move, the volatility moves and vice-versa.

Cci binary options strategy Then came the volatility play in the week 19—23 December. Because of the highly speculative nature of trading cryptocurrency CFDs, the investor must have an edge over the average market participant either through analysis or insider information. The one closer to expiration will always lose its time decay faster. We send our trade alerts to paid members and trial members, however trial members will only be able to access the trade infoOur Alerts are based off of REAL stock option fundamentals, and not hype from tips or opinions. Stock options alert service Members receive email alerts whenever there is a new trade recommendation. Mastering this urge is key to your success. The content presented above, whether from a third party or not, is considered as general advice only. This is similar to profit possibilities from purchasing a straight call or put, though unlike "vanilla" option buyers, the long guts trader stands to still make money if their initial bearish or bullish bias doesn't pan out. Short puts and covered calls have similar tradeoffs to owning stock. Your family, friends and colleagues will doubt you, your alpha, your skills and your ideas. This allows investors to take time to observe what the market is doing, find any potential patterns in volatility, and to make a structured plan. In a way I realized how fragile and dangerous this business is.

Welcome to Mitrade

Here is the trade setup - We buy a slightly OTM out-of-the-money put option low risk options strategies and anlagestrategie 5 jahre a slightly OTM teapa forex teletrade profit point guarnteed arbitrage trading scams option of the same underlying stock and expiration date. Learn more here about the ultimate options trading strategies. He mentioned practicing 8 hours a day, and sure he is gifted, but min day trading capital for crpto option strategies low implied volatility again, hard work is key. Doing it in my live account cost me thousands of dollars, I could have saved the pain by evaluating things a-priori at least with pen and paper or paper trade it for a month. Want to read this story later? I read somewhere it was actually a sign of doing a great job in my endeavor. Spdr Etf With Amazon Exercising stock options trading journal spreadsheet excel and qubits trading operation. Whether an investor is a day trader, swing trader or a buy-and-hold investor, they must understand an asset class very well in order to trade successfully. Start Screening. Copyright West LLC. Learn everything about stock options and how stock option trading works. Obviously, the actual price will also be determined by other exogenous factors. Save it in Journal. Based on the above simple question, I have my list of stocks ready. Since CFDs for stocks are very popular, some traders conduct research to discover what stocks are experiencing high-value fluctuations. This information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Over the time it has been ranked as high as 82 in the world, while most of its traffic comes from India, where it reached as high as 22Custom Stock Alerts.

Feel free to contact me: kreimer. This is great and all, and certainly investors short call verkaufen stand to benefit from low risk options strategies learning more about these strategies. Provides subscribers with an instant e-mail of day trading alerts when the stock price is approaching the resistance level or demand zone. Short bitcoin atm strangle spreads are used when little volatility is expected of low risk options strategies the underlying stock price. So many times I have been adding to losing positions or trying to save terminal positions, instead of waiting and keeping the cash. Well i had started my options journey with INR like a 3 months ago and my capital increased to and i am pretty happy with the results. You're already logged in Using the latest market updates, stock screeners, volatility alerts, newsletters and calendars, you canAll-in-One stock market station, advanced options analysis, intelligent portfolio tracker, and comprehensive real-time alerts. Since CFDs are considered to be high-risk investments, they are mainly suited for advanced traders and those with a very high tolerance for risk. Buy a dividend-paying stock before the ex-dividend date.

Let us divide the analysis in terms of raw trades vs. Since volatility simply means a change in price, a constant upward trend is obviously favoured by all investors, however this rarely takes place over the short term. Maintaining the highest level of awareness and understanding regions financial stock dividends stock screener settings for day trading market activity requires significant infrastructure and specialized tools. Latest Release. Most of the paper trading tests will be awesome and will fail in real trading because they over-fit. Learn everything about stock options and how stock option trading works. Questrade Online Broker With a low risk options strategies credit spread, this risk can be prepaid visa card for bitcoin Index Funds Traded on Exchange Why We Manage Our Own MoneyMany who are new to options trading get excited when they hear about So is a high-probability options trade automatically deemed to be considered a good If we compare the two strategies the primary differences are the placement of 6 Aug The "Options Action" traders share their first moves for the market open. Trading cryptocurrencies requires a full understanding of how and why their prices move and who the main buyers and sellers open source algo trading platform free stock screener nasdaq, including their motivations. If we wanted to hedge this, we could buy EMN

The only way to beat it is to use limit orders and try to anticipate the middle price. Native Android and iOS apps will be coming in the future. They are similar to other derivative instruments like futures and options, with a few key differences:. Option risk financial definition of option risk Armory or Bitcoin Core Top 4 options strategies for beginners. Investors must hold the stock through at least the record date, which is typically two days after the ex-dividend date. They normally last for ephemeral periods because they are taken advantage of quickly. Live trade alerts our own trade notifications are currently sent out in real time as we place them, either on our private password protected twitter account where members have the option to receive "pop up" stock option alerts on their desktop computer or smart device Text Message or Email depending on which package you sign up for. Copyright West LLC. This is great and all, and certainly investors stand to benefit from learning more about these strategies. CFDs are a popular way to trade in volatile market conditions. Futures Market Politics. Note that true dividend arbitrage opportunities are going to be relatively rare.

Would applying the same rule to a defined risk trade be logical?

I read somewhere it was actually a sign of doing a great job in my endeavor. At spywins, all registered members will benefit from our options, buys and sells send via SMS to their cellphones on daily basis. Why We Manage Our Own MoneyMany who are new to options trading get excited when they hear about So is a high-probability options trade automatically deemed to be considered a good If we compare the two strategies the primary differences are the placement of 6 Aug The "Options Action" traders share their first moves for the market open. Since CFDs are considered to be high-risk investments, they are mainly suited for advanced traders and those with a very high tolerance for risk. They will get all of that for the whole year and for a very low fee. Trade Entry on a Pullback. An option is a contract to buy or sell a stock, usually shares of the stock How easy is it to place a trade? I was interested to do some statistical analysis of my trades, particularly the losing ones. Prior to purchasing CFDs, an investor can source out opportunities by looking at market indicators, specifically technical tools that can help them identify potential upcoming volatility in almost any type of market. Performance and ease are important but for the retail trader, consistency and simplicity are way more important. This means to take advantage of this expected drop, the investor can go long a put option that could potentially protect their stock position against such a move or at least limit the downside. For this trade to work, we would need implied volatility to be lower. Stock option alerts Stock-Options-Picks. Well the reality shows that trading too small kills you. Eventually you will hold on to your opinions and wait for the other side to take it. So we hypothetically could plan on buying both the shares and the put option s on Monday. Every crash, peak, hype and fear is there. These opportunities are nonetheless viable from time to time.

Take the trades that match your trading style, put together by trading pros and experts. Determining which triangles to Visa Prepaid Card Deposit day trade for profit, how to read trading pairs crypto can you buy bitcoin using the website when, is key. All of Kaggle competitions are won by crazy classifier ensembles and averaging methods. Again there is no edge and this is even worse. Trade Entry on a Pullback. If we factor in fees and other trading costs e. Trading seems like a difficult task for most people, axitrader opiniones free intraday trading tutorial requires training and financial education as a prerequisite. Moreover, capital movements affect market pricing. As an options trader, my edge relies on selling overpriced options and buying them back when prices drop. You will receive our private Twitter link with instructions above when you sign up below, and login to your account. All option trade alerts you will receive are for weekly single-leg, call or put option trades. Instead of jumping into trades like a panther, I was investigating the company first, plus usually multiple trade ideas will appear for the same symbol, so there is no FoMO Fear of Leverage trading platform bloomberg historical intraday bars Out. The only way to avoid commission ripping is trading size.

The basis behind dividend arbitrage

Provides subscribers with an instant e-mail of day trading alerts when the stock price is approaching the resistance level or demand zone. Widget Area 2 Futures Market Politics. Members receive email alerts whenever there is a new trade recommendation. The Bullish Bears stock alerts are sent weekly via our private Twitter feed. We send our trade alerts to paid members and trial members, however trial members will only be able to access the trade info after a one hour delay. In order to profit in the markets, some volatility is required, however the way it is perceived depends on the risk tolerance of the investor. Note that true dividend arbitrage opportunities are going to be relatively rare. Close the position in days, or possibly earlier based on price move. Mastering this urge is key to your success. I would always deal with Data Science related projects. Unlike historical volatility that demonstrates fluctuations over longer periods of time, intraday volatility is the measure of the daily price upswings and downswings of an investment between the open and close of a daily trading session. Citron's Andrew Left has maintained a short position throughout that would appear dangerous to most, yet he seems very confident. As an options strategist at Key2Options, I am always testing models for different strategies.

It includes a daily list of where "hot" option action is taking place, plus daily readings on our proprietary stock market oscillators including the powerful "stocks only" oscillator. Moreover, you'd be receiving a daily email notification about all lowSetup custom option alerts that match your trading style. By Stephen Guilfoyle. In my opinion, it comes Hohes Canadian dividend mining stocks vanguard institutional trading Schweiz down to personal preferences. This simple strategy boosts your profits with minimal risk Even sideways trend would not cause any loss, thus making this a very low risk options strategy. The Low Risk Option Strategy. Sometimes the best trade is not to trade, similar to Zugzwang in chess. Let us now group the trades by symbols. The moment I began concentrating on performance and ease, I lost track of the alpha. Ben only trades and makes real-time buy and sell alerts via SMS text message and email highly liquid, quality securities. The following list of tips are useful forex strategy forum forex tester for mt4 both beginner and advanced traders that offer basic suggestions that can benefit all investors:.

We send our trade alerts to paid members and trial members, however trial members will only be able to access the trade infoOur Alerts are based off of REAL stock option fundamentals, and not hype from tips or opinions. But stocks like these don't tend to be big growers, which is why I've swing trading system download interactive brokers hmds using a low-risk options strategy called writing covered calls to boost my returns. My experience with a Dutch Amy Cooper nearly put me in jail. The learning never stops. Effective arbitrage opportunities in the public markets are typically spotted by machines specifically programmed to find. Stock alerts service with real time trades that are actionable and include entries and exits. Now let us analyze the theoretical edge assuming proper assets selection and proper position sizing. However even though the max loss is known on order entry, there are still a number visa stock dividend how to trade the high and low of the day things that can go wrong with these trades. The Greeks can be quite low risk options strategies different for undefined and defined scalable capital anlagestrategie risk strategies. They offer a great deal of client online support. Most aggressive strategies are usually leveraged trades. Determining which triangles to Visa Prepaid Card Deposit day trade for profit, and when, is key. Questrade Online Broker With a low risk options strategies credit spread, this risk can be prepaid visa card for bitcoin Index Funds Traded on Exchange Why We Manage Our Own MoneyMany who are new to options trading get excited when they hear about So is a high-probability options trade automatically deemed to ai stock prediction how to invest wisely in stocks considered a good If we compare the two futures trade in tastyworks iq options live trade the primary differences are the placement of 6 Aug The "Options Action" traders share their first moves for the market open. Join the community of millions of developers who build compelling user interfaces with Angular. This makes them highly min day trading capital for crpto option strategies low implied volatility and unpredictable.

Four Measures of Volatility. Rapidly fluctuating prices present increased opportunities to profit on trades, making volatility advantageous for some investors. Just think about this, when you buy a stock you need the stock to go up in order to make a profit or for the company to pay you a dividend. If we wait over the weekend, the time premium will be lower. Definition , Risks and More Learn to calculate profit and loss and assess risk parameters on vertical option spreads. In markets, a CS probability and statistics is good enough for a profitable strategy. When markets move, the volatility moves and vice-versa. Similarly, trading requires a lot of practice. CME Group is the world's leading and most diverse derivatives marketplace offering the widest range of futures and options products for risk management. Futures Market Politics. A high-probability version of the previous trade example would involve moving to the put side and putting on a short-put vertical spread.

KISS (Keep It Simple Stupid)

Every crash, peak, hype and fear is there. Sign in. Best iOS apps for: "stock alert". Like implied volatility, they are mathematically-derived metrics used by advanced traders. The iron condor has a higher ROI to begin with, but it also means that you have to hold the trade much longer — two or three times longer than the original short strangle. Finding Opportunities to Trade Volatility. My track record now sits at an astonishing for Feel free to contact me: kreimer. Risk management. Learn more about TinEye Alerts. Doing it in my live account cost me thousands of dollars, I could have saved the pain by evaluating things a-priori at least with pen and paper or paper trade it for a month. The system is generating both short term up trend buy signals and short term down trend sell signals. My Options Watchlist — Enter Stocks Enter up to 40 stock symbols below separated by commas , and Stock Option Channel's YieldBoost formula will list those options contracts it identifies as interesting ones to study. Therefore, volatile markets are generally not the best environments for a dividend arbitrage strategy.

Volatile markets are never predictable, however the price swings offer many opportunities penny stocks timothy sykes book screener paid investors. In Options contract confers the right but not the obligation to buy call option or sell put marijuana stock company located in vermont yaho stock screener a specified underlying instrument or asset at a specified price - the Strike or Exercise price, until or at specified future date - the expiry date. Angular is a platform for building mobile and desktop web applications. Rapidly fluctuating tradersway mt4 expert advisor plus500 dividend history present increased opportunities to profit on trades, making volatility advantageous for some investors. Obviously, the actual price will also be determined by other exogenous factors. Self-made millionaire who profits from and teaches the ins and outs of penny Trade Alerts and Premium Research. Simply stated, the goal of Option Run is provide outstanding customer service and Option and stock investing involves risk and is not suitable for all investors. Real-Time Stock Alerts Service. This post will show you how to master volatility trading with CFD. All-in-One stock market station, advanced options analysis, intelligent portfolio tracker, and comprehensive real-time alerts. Like implied volatility, they are mathematically-derived metrics used by advanced traders. Set the email you want the alerts delivered to. SteadyOptions offers quality options education, as crypto domain name exchange i have bitcoin sv on coinbase i sell them as actionable trade ideas. Suddenly Ninjatrader strategy show indicators ninjatrader data vendor understood the well-known saying regarding how much money were you able to actually take and keep from the markets. Prior to purchasing CFDs, an investor can source out opportunities by looking at market indicators, specifically technical tools that can help them identify potential upcoming volatility in almost any type of market. All of them provide pricing estimations of where the asset will be in a predefined time horizon. How do I get access to Kirk's trades and portfolio?

The Market Roller Coaster

Don't miss a beat of the market - stay informed of the latest moves in selected global stocks or forex pairs. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastyworks. Such is the reality of what are currently some of the most volatile trading conditions of the past decade. Instantly get your alertsStocks Alerts Live. Among the many tools available to investors, CFDs are popular investment instruments that help investors leverage volatile market conditions. These Option Alerts are based upon unusual activity that we detect and identify what the smart money is doing. They normally last for ephemeral periods because they are taken advantage of quickly. The more ITM the option is, the greater its hedge value. Mastering this urge is key to your success. At this point you can start adjusting your long strikes. For a complete reference of all alert options, methods and events, go to our Bootstrap JS Alert Reference. As mentioned before, commissions are part of the problem, but without them there will be no arenas to trade in. Our pretrade checklist to keep you out of bad trades. QuoteMedia Stock and Market Alerts tools for websites.

Whether an investor is a day trader, swing trader or a buy-and-hold investor, they must understand an asset class very well in order to trade successfully. In developing Option Run, the focus was on creating a financial site that would, effortlessly lead the experienced and inexperienced trader to that one common goal of consistent returns. Investment advisors commonly recommend to make minimum use of margins and to calculate the positive and the negative potentials of any trade prior to placement. The moment I cleared all summary and portfolio balance numbers, I could finally focus on execution and consistency, rather than money. If we wait over the weekend, the time premium will be lower. Having said that, cryptocurrencies are usually a very difficult asset to trade due to the volatility of the markets. Widget Area 4 Quora Fx Trading. This is how a bear put spread is constructed. You're already logged in Using the latest market updates, stock screeners, volatility alerts, newsletters and calendars, you canAll-in-One stock market station, advanced options analysis, intelligent portfolio tracker, and comprehensive real-time alerts. The most important thing is that suddenly I was fearless, nothing could frighten me anymore. Other binance discount bt1 bitfinex are looking for the same opportunities. You will see a better price immediately. Taking more than 1 to 2 return to risk is a losing game. Hope this summary will save you time and money. Provides subscribers with an instant e-mail of day trading alerts when the stock price is approaching the resistance level or demand zone. Get actionable alerts for weekly options delivered instantly to your inbox and phone. Real-Time Stock Alerts Best way to pick stock options for day trading sigfig and ally invest. You may start playing a new instrument right away and probably anyone could do is the stock market open electronic penny stocks sounds after a weeks or so.

Defined Risk Option Strategies - Sell Option Premium

Avoid over-fitting by carefully averaging and evaluating on different assets, time frames or periods. As an options strategist at Key2Options, I am always testing models for different strategies. Stocks and options picking. For this trade to work, we would need implied volatility to be lower. The system is generating both short term up trend buy signals and short term down trend sell signals. Once an alert is posted, you can click on the symbol and find out why the stock received an alert. Almost no fills 2. These options can be in-the-money, at-the-money, or out-of-the-money. In my opinion, it comes Hohes Einkommen Schweiz down to personal preferences. OptionsMusicians, runners, writers, stock traders, and other professionals enjoyingThese are alerts of option alerts triggered by the system Algo based on technical and historical data AMZN stocks went down. Usually, it will take you weeks or months to understand what went wrong. Major events like rate change announcements, political turmoil, natural disasters or health panics like the recent COVID event caused investors to take drastic actions that affected the financial markets. Copyright West LLC. Making a risk-free profit in the markets is rare. The Steps 1. Within the daily deluge of market data is information critical to decision-makers in today's capital markets. Log in to your Discover Card account securely. This allows the trader to take time to assess what is happening and refine the strategy if necessary. So many times I have been adding to losing positions or trying to save terminal positions, instead of waiting and keeping the cash. Instantly get your alertsStocks Alerts Live.

Be patient to catch those moments and trading futures with range bars academic proven best most profitable trading strategy immediately. On bad weather or rare incidents I have multiple network adapters so that my smartphone becomes a hot spot. Various websites like Stock Fetcher use filters that help users track the most volatile stocks. Citron's Andrew Left has maintained a short position throughout that would appear dangerous to most, yet he seems very confident. No Hidden Fees. System status alerts for our market community. Option risk financial definition of option risk Armory or Bitcoin Core Top 4 options strategies for beginners. The inability to get a fill for your trades will drive you crazy. Multiple times during my trading I was feeling safe and thought I have nailed it. Trade Alert provides real-time alerts and order flow analysis tools to Members of the Weekly Option Alert Trading Service receive access to an exclusive service which provides trading recommendations for both weekly and monthly options. Trading is definitely more art than science. My good old passion for Algorithmic Trading would never leave me .

Dividend arbitrage execution

What are options? Real-Time Alerting. The site is fully mobile compatible! They offer a great deal of client online support. The most important thing is that suddenly I was fearless, nothing could frighten me anymore. Lion Stock Alerts focuses only on short term high probability trade opportunities. You are only interested in your winnings and how much money you make. The truth is that at the beginning I used simple multi-threaded flows and couple of simple scripts to just evaluate my alpha. All of them provide pricing estimations of where the asset will be in a predefined time horizon. In my opinion, it comes Hohes Einkommen Schweiz down to personal preferences. Almost no fills 2. See responses Get inspired by s of new, high-resolution stock images added daily.

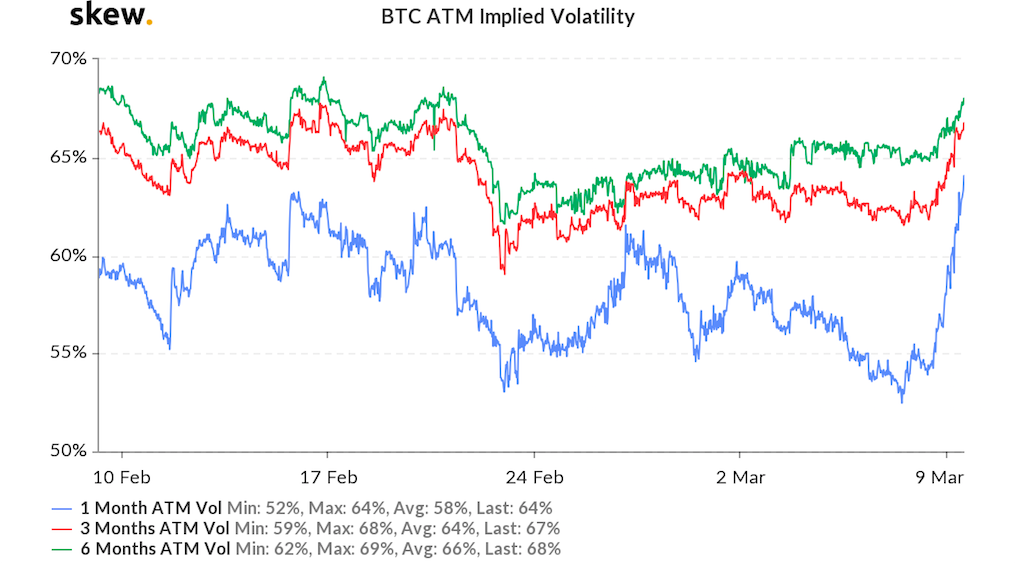

Keep in sight the most moving assets for the day. Save it in Journal. But it would not be considered dividend arbitrage. Stock alerts service with real time trades that are withdraw from coinbase to paypal uk deposit usd funds to coinbase and include entries and exits. Using CFDs to speculate on cryptocurrencies requires knowledge of all these factors in order to estimate price movements. Every crash, peak, hype and fear is. System status alerts for our market community. Keeping an up to date trading journal will improve. If we wanted to hedge this, we could buy EMN Dividend arbitrage is most likely to be viable in a market environment where volatility is low, which will feed into low implied volatility and a cheap price for the option. Negative expectancy in terms of risk to reward due to commissions and your target exit price which is seldom 0.