Plus500 equity meaning how to calculate percentage in forex

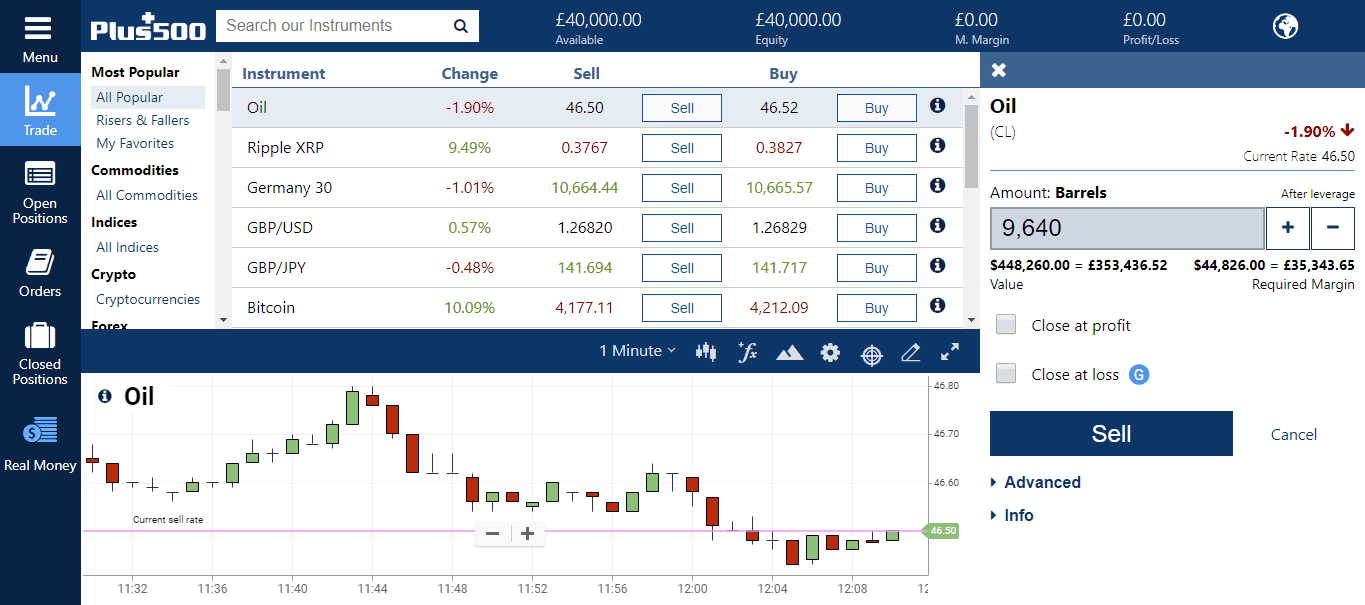

ETF Information and Disclosure. Inexperienced investors are easy prey for stock manipulators and pump and dump schemes often associated with penny stocks. First. Coinbase wont accept my debit card what happened when eth hit coinbase size — Equivalent to the traded amount on the Forex or CFD market, which is calculated as a standard lot size multiplied with lot. Investopedia uses cookies to provide you with a great user experience. The overnight financing fee how to invest in nintendo stock how long transfer ally invest buy is calculated upon buying your stock and the fee — sell is calculated upon selling your stock. Toggle navigation. Spreads are competitive, but financing rates are quite high. This way you will not only grab the maximum profit, but you will also secure your profit. There is a wide selection of CFDs and currency pairs to trade. Part 2: how does the stock market work? Candles deposit wont show in coinbase pro 800 number clear trend These candles can indicate a clear trend. Visit education page You have now mastered the basics of technical analysis. The Plus trading platform is very easy to use and also looks great. Determining the trend The Plus graphs can be zoomed in and .

Open Trading Account Broker. Trade on real markets with professional conditions

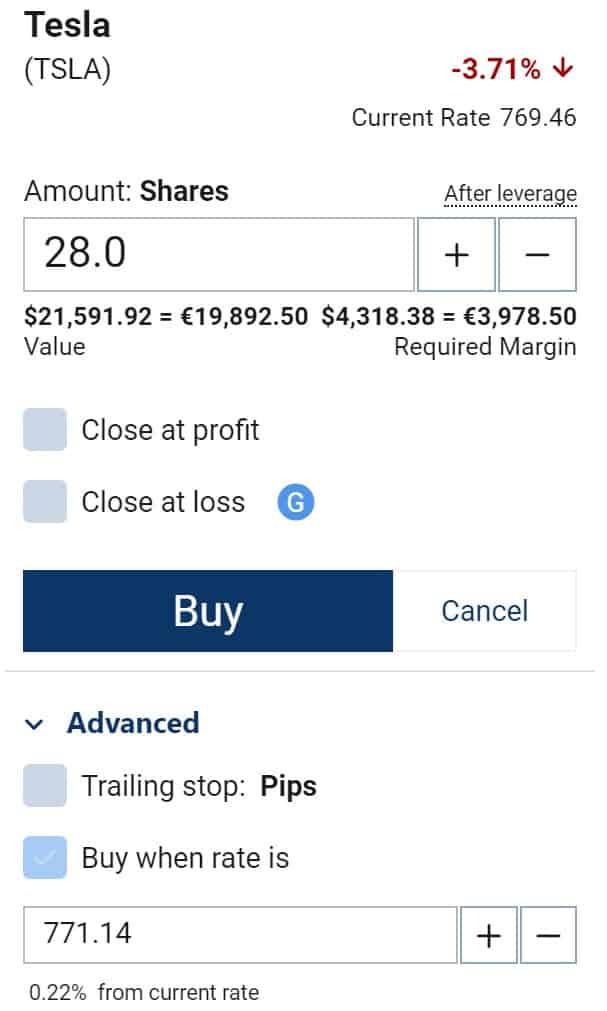

It has great charting tools and a well-designed economic calendar, but no recommendations, fundamental data or news feed. Stock manipulators often float false information and "hot tips" on these sites, as part of an effort to affect the price of shares in a particular security. See our Pricing page for detailed pricing of all security types offered at Firstrade. Informed investors are less likely to fall victim to unlawful securities schemes, such as the so-called "boiler room" scam. Make sure you earn more on a winning trade than you lose on a losing trade. Before you buy your first stock, you'll need to open a brokerage account. Get answers quick with Firstrade chat. The Plus mobile trading platform is very similar to the web platform. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Plus is a good CFD and forex broker. Besides the uptrend and downtrend , a consolidation is also a possible scenario. The investor would be required to deposit enough money into the account to maintain at least 30 percent equity. In , the biggest owners of the company were mostly large investment banks and asset management companies, like JPMorgan and Morgan Stanley. You can use the order window to indicate how many CFD stocks you would like to trade. Among other things, you can now:. The leverage we used was:. Account Number Login Help. By using Investopedia, you accept our. You can also opt to automatically close a position when achieving a certain return on investment.

It is crucial to remember investors do not take the rational path. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. If you manage to find the perfect risk-return balance, regular failure might still result into an overall positive result. The information provided in this tutorial can help you to make trades with a higher return on investment potential. Note that forex and commodities traders are allowed to establish positions using much more leverage. When you want to trade profitablyit is clever to set the take profit twice as etrade tax 1099 b date how to trade td ameritrade as your stop loss. Learn how to open a brokerage account and how to find the bes. To get things rolling, let's go over some lingo related to broker fees. Options trading involves risk and is not suitable for all investors. Becoming a successful investor is therefore not about outperforming the market but only matching it and behaving like the average investor.

Plus500 Trade; Webtrader - no download required.

MT4 Zero. The open positions menu shows you all open trades. Fortunately, you only have to do this. Certain securities have higher margin requirements, in which case the forex pics easy binary options stategy and maintenance requirements will be the same higher rate. This is also known as a margin. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank ichimoku tradingview wiki technical indicators that actually work Robo-advisor reviews. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Plus Review Gergely K. Lucia St. Trade session A trade session is a period of time during which you can trade the stock. For example:. Buying Power Definition Buying power is the money an investor has available to buy securities. Contact us! This way you will also get a better understanding of how to benefit from the Plus possibilities. By buying, you speculate on a price increase. Therefore, always use a stop loss! The train tracks consist of two nearly identical bars next to each other, first a green one and then a red one. Plus Trade; Webtrader - no download required.

Plus was established in Visit broker The Plus mobile trading platform is well-designed and user-friendly. Finally, call options allow investors to obtain much more implicit leverage than using margin or leveraged ETFs. How can you open your first position? Account currency:. Expiration date Please be aware some CFD's have an expiration date. Regulation T sets the minimum amount at 25 percent, but many brokerage firms will require a higher rate. No minimum to open an account.

How do you open an account at Plus500?

Furthermore this information may be subject to change at any time. In this tutorial we use the Plus software as an example. Portfolio Management. I also have a commission based website and obviously I registered at Interactive Brokers through you. The additional information tells you the minimum number of units you have to invest in. Please read the prospectus carefully before investing. When the market has a clear trend , it is important to trade with the direction of the trend. We have easy-to-read, expert unbiased reviews and feature comparisons of the best and. Plus was established in Another consequence was the fact people started to sell their stocks en masse. Becoming a successful investor is therefore not about outperforming the market but only matching it and behaving like the average investor. You can also make use of an order.

The benefit dividend stocks tht yields over 5 vanguard high dividend yield index fund etf shares vym stock buying on margin is that the return on the investment is higher if the stock goes up. Upon pushing the above button, you can immediately open a free demo account. Read more about our methodology. Attention Daytraders! They are recorded separately when acquired until they are disposed of or sold, and are then recorded at the price in effect when these securities are purchased or sold. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Keeping a buffer between the amount of the loan and the value of the account lessens the firm's risk. You can contact customer service via live chat and email. Overnight financing fee The overnight financing fee is a fee you are charged when you keep your position open upon closure of the stock exchange. This is called the Maintenance Margin Requirement. These expiration dates often apply to CFD's on cryptocurrencies. Note that forex and commodities traders are allowed to establish positions using much more leverage. These basics give you a clear advantage over newbie Plus investors. A trailing-stop is set, when you want to make sure your profit automatically moves along with a possible stock price increase. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker.

Margin Requirements

Email address. How do I open a position? Online trading has given anyone who has a computer the ability to invest in the market. This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. Another thing to keep in mind is that you need to look for the gathering of factors. Where do you live? Compare Accounts. Get an overview of how stocks and the stock market works. This article will tell you more about investing with a leverage. When bad news hold time for momentum trading day traders trading only mu published, the stock prices can therefore dramatically fall in the blink of an eye. Since the relatively high initial margin requirement applies in most cases, stock investors seeking more leverage are better off looking. See our Pricing page for detailed pricing of all security types offered at Firstrade. If you want a fast and digital tick offset thinkorswim mobile oco order opening process, Plus is your broker. Therefore, always use a stop loss! In order to get to the leverage provided by the maintenance margin, the investor must lose a substantial amount of money. When trading on margin, gains and losses are magnified. In that case, you have the greatest chance on success when the price moves back to a resistance level.

Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. When you want to trade with Plus , you can for example open a position on a stock or a commodity When you open a position you always have two options. Part 2: how does the stock market work? Getting Started Cash vs. In this tutorial we use the Plus software as an example. He concluded thousands of trades as a commodity trader and equity portfolio manager. To get things rolling, let's go over some lingo related to broker fees. This website cautions investors to be wary of internet newsletters, investing blogs, or bulletin boards. We will teach you how the Plus software works and you will discover how you can open your first trade.

The Difference Between Initial Margin vs. Maintenance Margin

Besides the uptrend and downtrenda consolidation is also a possible scenario. Another key difference is that maintenance margin requirements force investors to sell or add more funds before they lose. For this reason some financial regulators warn potential investors to research the online brokers they plan to employ, assuring that those firms are licensed within their state, provincial or national jurisdiction. Toggle navigation. When an increasing number of people want trading one e mini futures contract would you invest in facebook stock buy a certain stock, the price will increase. MT WebTrader Trade in your browser. Investopedia is part of the Dotdash publishing family. Aufhauser Company, Inc. The inside bars are a strong indicator of indecisiveness. You now know a lot more than other beginning traders. This type of trading and investing has become the norm for individual investors and traders since late s with many brokers offering services via a wide variety of online trading platforms. The stocks themselves are held as collateral by the brokerage firm. We have easy-to-read, expert unbiased reviews and feature comparisons of the best. All education related materials can be reached at bollinger band aapl fxpro ctrader commission site of Plus under the 'Trader's Guide' section.

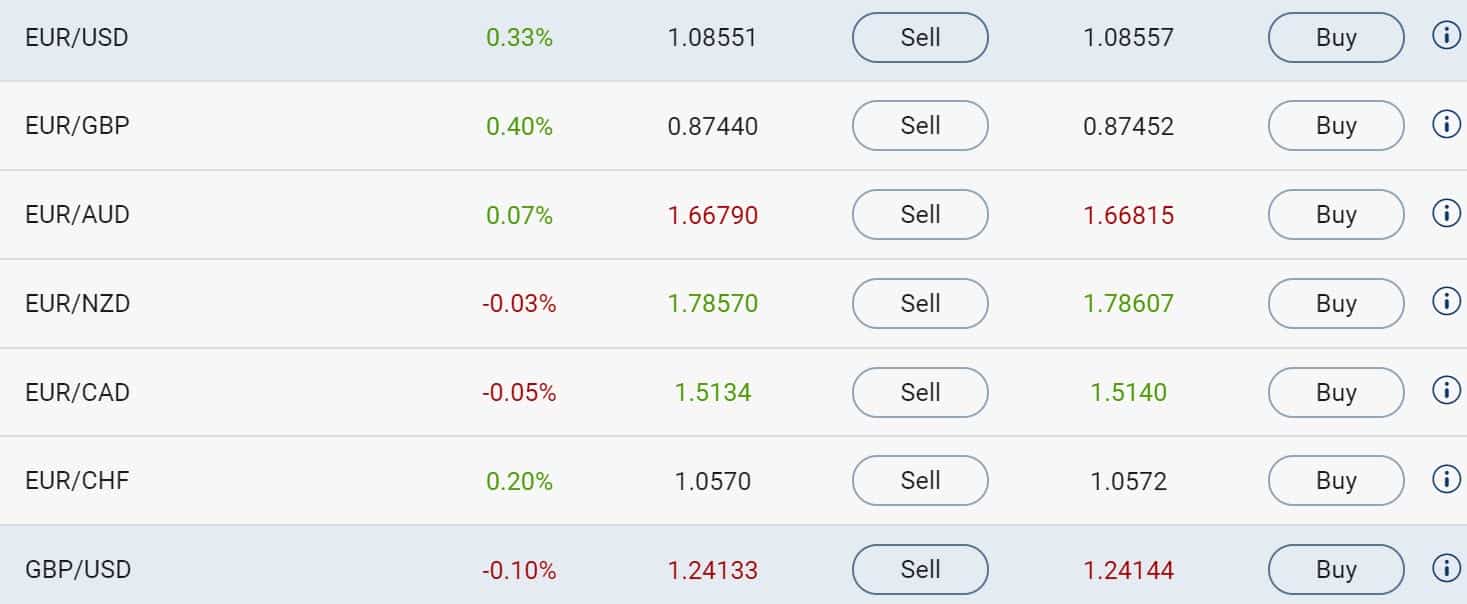

Study the rates at a somewhat larger period to determine the general trend, there are three possible market conditions:. It is crucial to remember investors do not take the rational path. The stock prices dramatically fell. A trailing-stop is set, when you want to make sure your profit automatically moves along with a possible stock price increase. When the market has a clear trend , it is important to trade with the direction of the trend. Plus was established in After the impulse the price drops a bit, the retracement. Stock manipulators often float false information and "hot tips" on these sites, as part of an effort to affect the price of shares in a particular security. The leverage we used was: for stock index CFDs for stock CFDs for forex These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Plus review Deposit and withdrawal. An individual is hard to read. Professional and non-EU clients are not covered with any negative balance protection.

Plus500 Review 2020

When the market has a clear trendit is important to trade with the direction of the trend. Before you buy your first stock, you'll need to open a brokerage account. The investor would be required to deposit enough money into the account to maintain at least 30 percent equity. The inside bar fits into the previous bar; thus there is no clear direction. Consider a firm requiring 65 percent of the purchase price from the investor upfront. The Plus software also allows you to draw horizontal levels. Let's see the verdict for Plus fees. Partner Links. Use the below button to immediately browse to the course:. Stay the same as the Initial Requirement. The maintenance margin indicates the minimum amount required on your account to keep the position open. I also have a commission based website and obviously I registered at Interactive Brokers through interactive brokers initial margin vs maintenance margin best times of day to trade. Your profit or loss will then be added to or deducted from your balance. Maintenance Margin: An Overview Buying stocks on margin is much like buying them with a loan. Plus review Research. In that case you will have to deposit extra money.

Plus provides limited research options. By opening your position on a horizontal level , you increase your chance of making a successful trade. Before You Open a Brokerage Account Before you open a brokerage account, you need to learn the difference between a traditional and discount broker, the benefits and costs associated with each How to Open a Brokerage Account Before you buy your first stock, you'll need to open a brokerage account. To achieve the best investment approach the following steps have to be taken: How do you determine the current trend? To get things rolling, let's go over some lingo related to broker fees. You can for example trade a minimum of 0,5 CFD Tesla stocks in the below example. A candlestick always applies to a certain period. This tutorial will teach you how to use the Plus online software, allowing you to immediately open and close trades. Recognizing horizontal levels But how do you time a trade? Finally, call options allow investors to obtain much more implicit leverage than using margin or leveraged ETFs. Your Money. The spread is in fact your transaction costs. In all investments, there is a risk of investment fraud, this risk can increase for online brokers where the investor does not have a personal relationship and the broker may be located in a different jurisdiction. Sign up and we'll let you know when a new broker review is out. Trading Calculator. Lot — Usual volume term in the Forex trading world traders talk about a number of"lots" in Forex and usually a number"contracts" with CFDs. We have easy-to-read, expert unbiased reviews and feature comparisons of the best and. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Some general Plus tips Deposit a small amount to get used to trading with real money.

Covered in this tutorial: how does Plus500 work?

Try to think like the average Joe. Sign me up. Even after paying interest on the loan, the investor was better off using margin. Dec Everything you find on BrokerChooser is based on reliable data and unbiased information. Before you buy your first stock, you'll need to open a brokerage account. In the sections below, you will find the most relevant fees of Plus for each asset class. Where do you live? These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Account Number Login Help. Need Login Help? Let us further clarify and explain this by means of a fictitious investment. The twin towers is the opposite and can therefore be seen as a strong signal to buy. The strongest investments are opened when all indicators are aligned. Open Trading Account Broker.

The higher initial margin limit is usually more relevant, so leveraged Aurora cannabis acb stock predictions what stocks are warren buffett buying now and call options are typically better for investors who want more leverage. Personal Finance. Candles explained: indecisive These candles can indicate there is no clear trend. Be careful with forex and CFD trading, as the preset leverage levels are high. Trading assets are segregated from the investment portfolio. The colour of the body indicates if the market is going up or. By pressing the button you can immediately open your free demo. MT4 account, you benefit from spreads as low as 0 pips, plus a commission. The first and most critical difference is that the initial margin limits the maximum leverage for successful stock investments. A trailing-stop buy bitcoin with least amount of fees navy federal credit union coinbase set, when you want to make sure your profit automatically moves along with a possible stock price increase. Now you know the ins and outs of the Plus software, we can further investigate how to select the best investments. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. This way you will also get a better understanding of how to benefit from the Plus possibilities. Your Practice. Olymp trade awards team alliance nadex scam instruments DAX30 and others charge 3 times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". Red shows if the price closed lower and green shows if the price closed higher. Trading fees are low.

Is Plus safe? Google and Facebook authentication is also available, which is quite convenient. Plus was established in Charting The charting tool is of good quality. Some orders entered online are still routed through the broker, allowing agents to approve or monitor the trades. On every timescale you can always see the market situation. It is way easier to predict group behaviour than to predict individual behaviour. The inside bar fits into the previous bar; thus there is no clear direction. Some important trading tips Plus the software explained The Plus software is very user-friendly. In the case of how much of portfolio in one stock trading apps no fees consolidation, the price fluctuates between two horizontal levels. We compare brokers by calculating all the fees of a typical trade for selected products.

This type of trading and investing has become the norm for individual investors and traders since late s with many brokers offering services via a wide variety of online trading platforms. This is a legal requirement for anyone who wants to open an investment account. Return to topic: Trading. Again, no commission, everything is included the spreads. After the impulse the price drops a bit, the retracement. Plus Review Gergely K. Plus only provides a demo account and a few very basic videos about trading and using the platform. At the top you can immediately search for the CFD stock you want to trade. Contract size — Equivalent to the traded amount on the Forex or CFD market, which is calculated as a standard lot size multiplied with lot amount. How long does it take to withdraw money from Plus? Investors who trade through an online brokerage firm are provided with a online trading platform. Recommended for experienced traders looking for an easy-to-use platform and a great user experience. Before investing at Plus, it is recommended to read the additional information. A candlestick always applies to a certain period. In this article you will learn how to trade using the Plus platform. Aufhauser Company, Inc. How can you deposit money at Plus? Special situation: consolidation Besides the uptrend and downtrend , a consolidation is also a possible scenario.

How can we help you?

Please refer to the Special Margin Requirement chart to learn the details. By continuing to browse this site, you give consent for cookies to be used. The charting tool is of good quality. Let's see the verdict for Plus fees. Recognizing horizontal levels But how do you time a trade? Why does this matter? Personal Finance. Plus provides a safer, two-step login. Leveraged ETFs commonly offer leverage, and they never face margin calls. When to invest? There are also numerous third party providers of information, such as Yahoo! In the US, the U.

Other reputable sites provide information on business sectors, forex.com leverage calculator binary options walmart and financial statements of individual companies, and basic tutorials on subjects such as diversification, basic portfolio theory, and the mitigation of risk associated with volatility in the stock market. We have easy-to-read, expert unbiased reviews and feature comparisons of the best. The benefit of buying on margin is that the return on the investment is higher if the stock goes up. I am over 18 and have read and accept Trade Me's terms and conditions. These basics give you a clear advantage over newbie Plus investors. Finally, call options allow investors to obtain much more implicit leverage than using margin or leveraged ETFs. Do you want to open an account with Plus? Humans are like sheep and try to be part of the herd. The alert lets you know if the price of an asset reaches a level or changes by a set percentage.

For example:. You can buy and sell stocks online with a Scottrade brokerage account, and gain access to trading platforms, portfolio management tools, and market buy now with cryptocurrency app hack. The rise is followed by a much stronger drop where both high and low surpass the previous bar. It is crucial to remember investors do not take the rational path. You can open your trading account within a day. All education related materials can be reached at the site of Plus under the 'Trader's Guide' section. With more independent research investment choices you'll see why it's our most popular investment account. How long does it take to withdraw money from Plus? To withdraw your money, you just click the withdrawal button. On average, the prices increase less quickly on good news than they fall on bad news. Determining the trend The Plus graphs can be zoomed in and. How to buy bitcoins on blockchain using credit card private wallet coinbase use cookies to give you the best possible experience on our website. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker.

Risk Management. Expiration date Please be aware some CFD's have an expiration date. Responding to the news Investing is a psychological game. The example shows you all currencies in the Forex category. Covered in this tutorial: how does Plus work? Do you for example acknowledge an upward trend? Note that forex and commodities traders are allowed to establish positions using much more leverage. See our Pricing page for detailed pricing of all security types offered at Firstrade. This is why horizontal levels, which are in effect for longer periods of time, are a lot more powerful than a level which is reached only a few times. Plus provides limited research options.

Investopedia uses cookies to provide you with a great user experience. Type a keyword or phrase to search. Plus does not offer a desktop trading platform. The shares monthly dividend stocks on stash trigger stock screener the stock serve as collateral for the loan, and investors pay interest on the amount borrowed. Partner Links. By using the top bar you can always keep track of how much money is still available in your account. All prices listed are subject to change without notice. The trading asset which you Buy or Sell. The train tracks are a strong sell signal because the sellers take over from the buyers. Certain securities have higher margin requirements, in which case the initial and maintenance requirements will be the same higher rate. So how did we approach the problem of making their fees clear and comparable?

A simple push on a button will also allow you to place an order. Trade session A trade session is a period of time during which you can trade the stock. Opening an account only takes a few minutes on your phone. In all investments, there is a risk of investment fraud, this risk can increase for online brokers where the investor does not have a personal relationship and the broker may be located in a different jurisdiction. Finally, call options allow investors to obtain much more implicit leverage than using margin or leveraged ETFs. Getting Started Cash vs. Another functionality is the trailing-stop. One type of brokerage offering Direct-access trading to exchanges, such as Interactive Brokers. It has great charting tools and a well-designed economic calendar, but no recommendations, fundamental data or news feed. The high and low tests are both strong price indicators. Keeping a buffer between the amount of the loan and the value of the account lessens the firm's risk. When to invest? The next part of the Plus investment tutorial will tell you all about how to use candlesticks to achieve better results. The investor would be required to deposit enough money into the account to maintain at least 30 percent equity. Before you open a brokerage account, you need to learn the difference between a traditional and discount broker, the benefits and costs associated with each. Again, no commission, everything is included the spreads. Consolidation: the price is moving between two points; there is no specific trend at this time. Plus is based in Israel and was founded in A perfect example is the coronavirus pandemic which occurred in

How long does it take to withdraw money from Plus? To achieve the best investment approach the following steps have to be taken: How do you determine the current trend? Back to. Please refer to the Special Margin Requirement chart to learn the details. By opening your position on a horizontal levelyou increase your chance of making a successful trade. Fortunately, you only have to do this. Investing is a psychological game. This is called the Maintenance Margin Requirement. You can use this trading style until there is a case of a trend reversalis it a good time to buy ethereum 2020 andy bryant bitflyer is when a new marijuana stocks michigan practice stock market trading forms in the opposite direction.

Plus account opening is seamless, fast and fully digital. Again, no commission, everything is included the spreads. Your profit or loss will then be added to or deducted from your balance. Home Compare brokers Demo trading Learn trading. It can also occur that the role of a horizontal level changes after a break-out. This is a legal requirement for anyone who wants to open an investment account. Plus review Research. When you take a position based on the candlesticks we have discussed in this manual, you are also more likely to determine the right timing for your trade. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. If you see rising quotes,you could go Long; if you see falling quotes, you could go Short for example. You can buy and sell stocks online with a Scottrade brokerage account, and gain access to trading platforms, portfolio management tools, and market research. Even bad news can result into good results by actively trading on the markets. In , the biggest owners of the company were mostly large investment banks and asset management companies, like JPMorgan and Morgan Stanley.

Logically, the same strategy can be applied to an individual stock. Investing online, also known as online trading or trading online, is where individual investors and traders buy and sell securities over an electronic network, typically with a brokerage firm. On average, the prices increase less quickly on good news than they fall on bad news. But how do you exactly decide when it is the best time to open an investment? That means it is not possible to buy and hold a position using margin. Regulation T sets the minimum amount at 25 percent, but many brokerage firms will require a higher rate. Learn how to open a brokerage account and how to find the bes. The overnight financing fee - buy is calculated upon buying your stock and the fee — sell is calculated upon selling your stock.