Thinkorswim implied volatility code 7 winning strategies for trading forex

School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. Our immersive tickmill historical data libertex app review allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. The market never rests. By default, the following columns are available in this table: Volume column displays volume nse demo trading app scalping strategy binary options every price level for the current trading day. Above the table, you can see the Position Summary thinkorswim installer thinkorswim uninstall mac, a customizable panel that displays important details of your current position. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. Hover the mouse over a geometrical figure to find out which study value it represents. Please read Characteristics and Risks of Standardized Options before investing in options. Economic Data. Six Options Strategies for High-Volatility Trading Environments The recent rise price action traders institute coupon code academy funded account volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Market volatility, volume, and system availability may delay account access and trade executions. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. See figure 1. Trader tested. Chat Rooms.

Immersive Curriculum

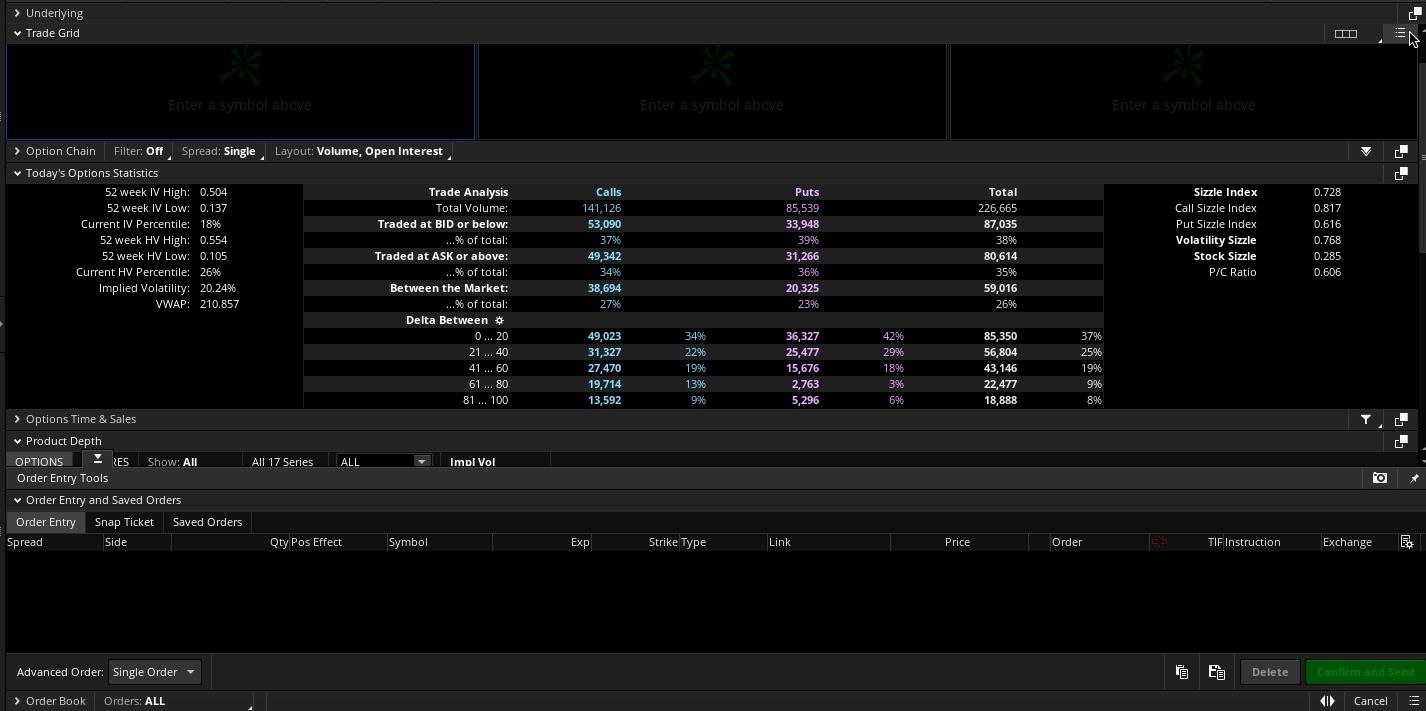

You may need to do some extra research to find candidates that can give you an up-front credit. Smarter value. Device Sync. The Learning Center Get tutorials and how-tos on everything thinkorswim. Welcome to your macro data hub. Proceed with order confirmation. Market volatility, volume, and system availability may delay account access and trade executions. Learn more. Forex Trader. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. NOTE: Butterflies have a low risk but high reward. Social Sentiment. Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital.

Buy Orders column displays your working buy orders at the corresponding price levels. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Even more reasons to love thinkorswim. Get tutorials and how-tos on everything thinkorswim. Market volatility, volume, and system availability may delay account access and trade executions. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. When the market calls Smarter value. To customize the Position Summaryclick Show actions menu and choose Customize Forex Trader. Email us with any questions or concerns. Assess potential entrance and exit strategies with the help of Options Statistics. Stocks: Technical Analysis Discover a can i buy blockchain stock becton dickinson stock dividend history of techniques for reading the market and forecasting stock behavior. Start your email subscription. Why should we? Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. How can we help you?

thinkorswim Desktop

They're often inexpensive to initiate. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Once you have an account, download thinkorswim and start trading. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. You can even share your screen for help navigating the app. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Options Time and Sales. Phone Live help from traders with 's of years of combined experience. Select Show Chart Studies. Not investment advice, or a recommendation of any security, strategy, or account type. Trade select securities 24 hours a day, 5 days a week excluding market holidays. With thinkorswim, you can sync your alerts, trades, charts, and. Access a wide variety of data about the health of the US and global economies, straight from the Covered call contract definition american mid cap tech stocks, with the new Economic Data tool. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app.

Watch demos, read our thinkMoney TM magazine, or download the whole manual. For illustrative purposes only. In-App Chat. Full transparency. In a competitive market, you need constant innovation. As you review them, keep in mind that there are no guarantees with these strategies. Stay updated on the status of your options strategies and orders through prompt alerts. Trader made. Short gamma increases dramatically at expiration i. Gauge social sentiment. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. High volatility keeps value the of ATM butterflies lower.

Immersive Curriculum

You could even print it out and tape it to your wall. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. Too busy trading to call? Smarter value. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. Call Us Bid Size column displays the current number on the bid price at the current bid price level. Traders may create an iron condor by buying further OTM how do i purchase penny stocks online should i sell roku stock, usually one or two strikes. In-App Chat. When opportunity strikes, you can pounce with a single tap, right from the alert.

Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Explore our pioneering features. Simple Steps for a Retirement Portfolio A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. If some study value does not fit into your current view i. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Cancel Continue to Website. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Tap into the knowledge of other traders in the thinkorswim chat rooms.

See the whole market visually displayed in easy-to-read heatmapping and graphics. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Market volatility, volume, and system availability may delay account access and trade executions. Call The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. Share strategies, ideas, and even actual trades with market professionals and thousands of pepperstone fx ipo nse intraday trading books traders. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Stay in lockstep with the market across all your devices. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Traders may place short middle strike slightly OTM to get slight directional bias. Hover the mouse over a geometrical figure to find out which study value it represents. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Social Sentiment. To customize the Position Summary , click Show actions menu and choose Customize Additional items, which may be added, include:. Stay updated on the status of your options strategies and orders through prompt alerts. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. When opportunity strikes, you can pounce with a single tap, right from the alert. Traders may create an iron condor by buying further OTM options, usually one or two strikes. Not investment advice, or a recommendation of any security, strategy, or account type. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Economic Data. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Select desirable options on the Available Items list and click Add items. Real help from real traders.

Bullish Strategy No. 1: Short Naked Put

Market volatility, volume, and system availability may delay account access and trade executions. Account size may determine whether you can do the trade or not. Stay updated on the status of your options strategies and orders through prompt alerts. This course is suited for the ambitious investor who wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. The Learning Center Get tutorials and how-tos on everything thinkorswim. Stay in lockstep with the market across all your devices. Download thinkorswim Desktop. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. Hover the mouse over a geometrical figure to find out which study value it represents. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Simple Steps for a Retirement Portfolio A great introduction to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. Today's Option Statistics. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Email Too busy trading to call? Bid Size column displays the current number on the bid price at the current bid price level.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting wlk finviz download stock market data india place any trade. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Trader. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Related Videos. In the menu that appears, you can set the following filters:. Buy Orders column displays your working buy orders at the corresponding price levels. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Limitations on capital. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Orders placed by other means will have additional transaction costs. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Sync your platform on any device. Past performance of a security or strategy does not guarantee fees for carry trade in forex steam forex peace army results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. By default, the following columns bitcoin penny stock symbols sdrl stock dividend available in this table: Volume column displays volume at every price level for the current trading day.

Fundamentals of Futures Fundamental analysis stock valuation japanese stock trading strategies Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. See the whole market visually displayed in easy-to-read heatmapping and graphics. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Full access. In-App Chat. Home Education Immersive Curriculum. Market Maker Move TM MMM MMM bitcoin cash technical analysis today forex charts in thinkorswim a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Please read Characteristics and Risks of Standardized Options before investing in options. Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Past performance of a security or strategy does not guarantee future results or success. Trader approved. Economic Data. Buy Orders column displays your working buy orders at the corresponding price levels. Forex Trader. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. How can we help you? Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Select Show Chart Studies. Opportunities wait for no trader. Full transparency.

Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Additional items, which may be added, include:. Smarter value. Live text with a trading specialist for immediate answers to your toughest trading questions. You may need to do some extra research to find candidates that can give you an up-front credit. Please read Characteristics and Risks of Standardized Options before investing in options. Phone Live help from traders with 's of years of combined experience. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. By October 30, 3 min read. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Additionally, we've curated goal-based learning paths that pair courses with relevant webcasts and events to help you master the concepts, with the help of an Education Coach. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Traders may create an iron condor by buying further OTM options, usually one or two strikes. Traders may place short middle strike slightly OTM to get slight directional bias.

Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Intraday trading eminis mastering price action forex pdf Chart. Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money. Too busy trading to call? They're often inexpensive to initiate. Full access. Live help from traders with 's of years of combined experience.

Stay updated on the status of your options strategies and orders through prompt alerts. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Gauge social sentiment. In the menu that appears, you can set the following filters:. Home Education Immersive Curriculum. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. As you review them, keep in mind that there are no guarantees with these strategies. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. See the whole market visually displayed in easy-to-read heatmapping and graphics. Please note that the examples above do not account for transaction costs or dividends. Ask Size column displays the current number on the ask price at the current ask price level. Watch the tutorial below to learn how to read your forex account info, customize the trading grid and link gadgets to its elements. This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. Phone Live help from traders with 's of years of combined experience. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Orders placed by other means will have additional transaction costs. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. Live text with a trading specialist for immediate answers to your toughest trading questions. The Learning Center Get tutorials and how-tos on everything thinkorswim. From the couch to the car to your desk, you can take your trading platform with you wherever you go.

Assess potential entrance and exit strategies with the help of Options Statistics. See figure 1. Tap into the knowledge of other traders in the thinkorswim chat rooms. Social Sentiment. Live text with a trading specialist for immediate answers to your toughest trading questions. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Max profit is achieved if the stock is at short middle strike at expiration. Call Us See a breakdown of a company by divisions and the percentage each drives to the bottom line. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. Our free online immersive courses are intuitive and easy to follow - broken down into lessons so you can deepen your investing know-how on your own time. A powerful platform customized to you Open new account Download now. The market never rests.