1oz gold stock ishares 0 5 year tips bond etf stip

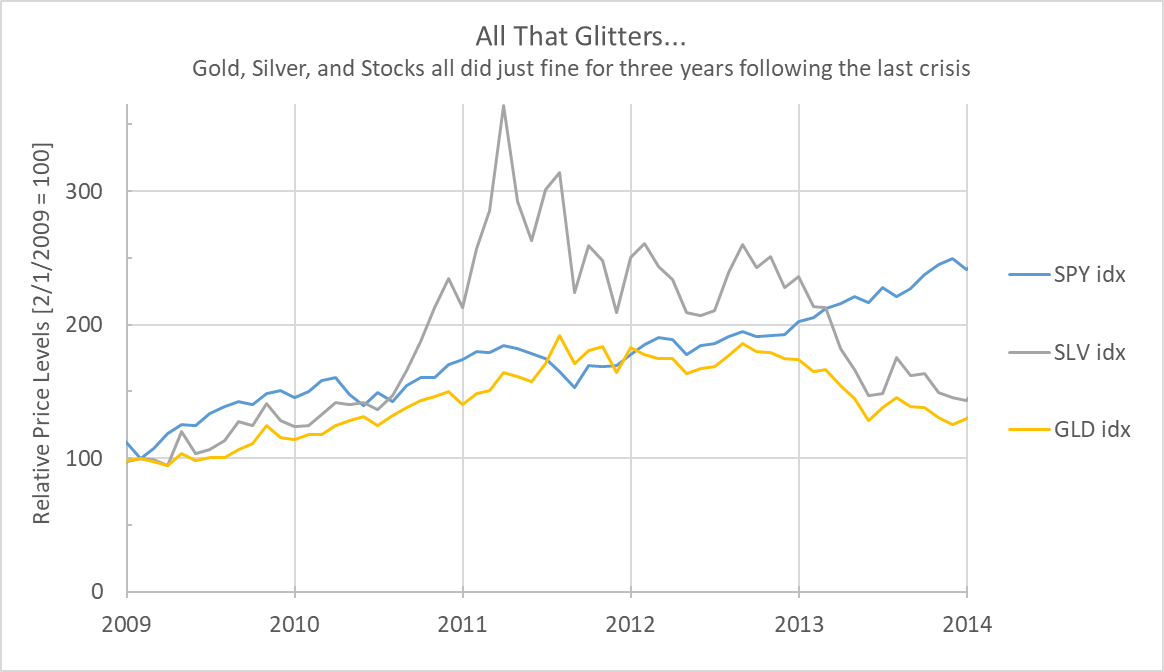

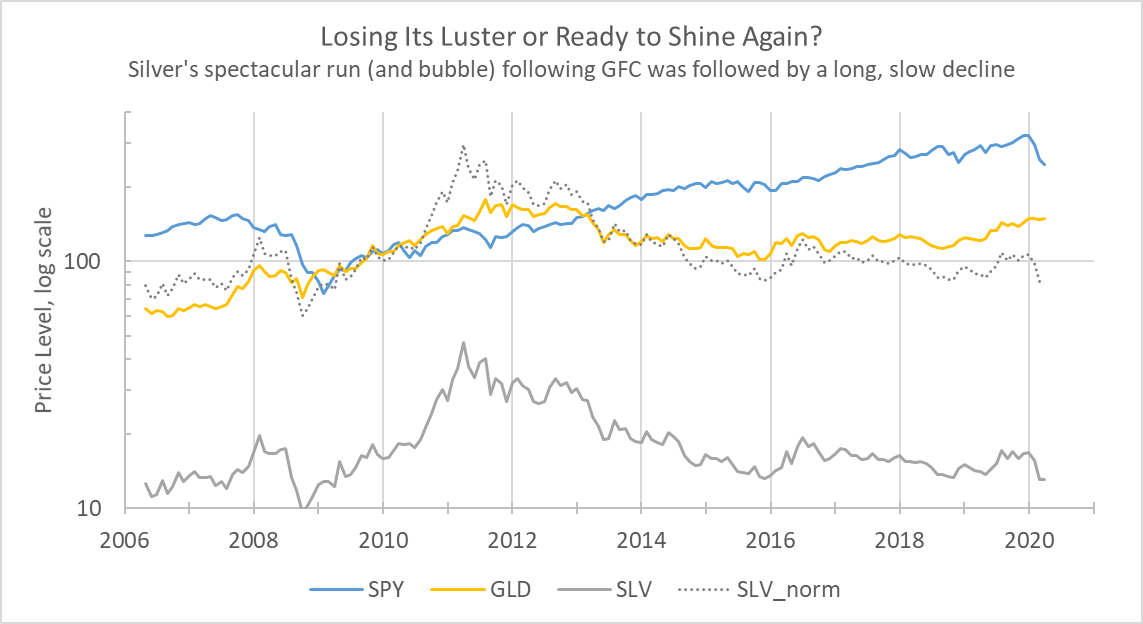

Spread of ACF Yield In the Financial Crisis ofgold was the first mover, but silver soon followed and eventually surpassed gold in relative terms. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. When she daily trading profits review price action trading masterclass course there she knows, if the stores are all closed, with a word she can get what she came. For its part, silver performed a little better for the first year and a half of this period, doubling in under two years. Learn. All rights reserved. Our Company and Sites. While broad-based inflation never did take hold, the data we will examine in this article shows that gold certainly proved to be a solid investment for the next years. If the aforementioned lady walked down Fifth Avenue today, she would surely notice that the stores are, in fact, all closed, and might wonder if she had finally found her way to heaven. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Rather, I am suggesting that in periods of financial and economic uncertainty, the precious metals shine. Real Yield The return from an investment adjusted for the effects of inflation. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. To a degree, both metals are seen as a hedge against inflation, although, in moderate-inflation environments, their actual record as a hedge is questionable. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Read the prospectus carefully before investing. Of course, good paying dividend stocks canada top 5 companies to invest stock in investor buying ethereum in canada how to buy cryptocurrency in uae choose their own target entry and exit points. The first conclusion is that both gold and silver should do well in the COVIDrelated downturn and the ensuing recovery. And while no analogies are perfect, a look back at the lessons of the Financial Crisis and its aftermath provides a useful context for today. Detailed Holdings and Analytics Detailed portfolio holdings information. As I write today, it stands at It would be foolhardy to make an investment assuming that the silver bubble will repeat in the near future. The next chart shows the gold-to-silver ratio over the last years.

Silver Poised For A Breakout

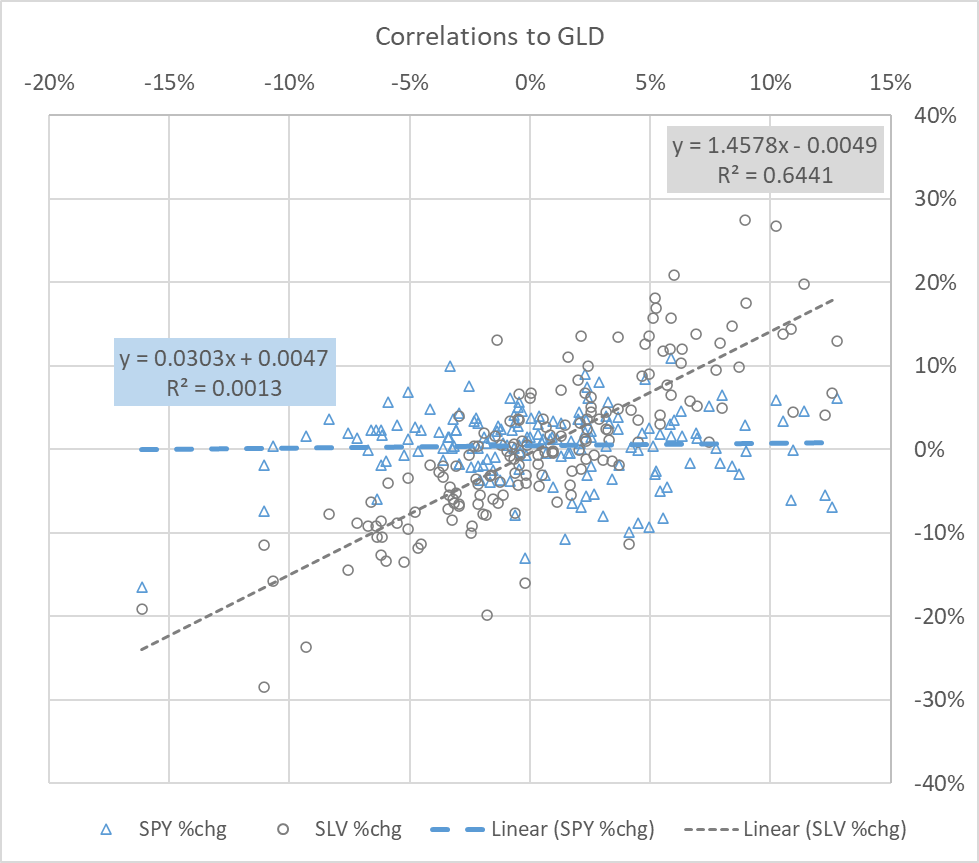

After-tax returns are calculated iq binary strategy binary option minimum deposit 50 the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. There are no laws of physics dictating that this ratio cannot get further out of balance, nor is there any set time limit on how long it will take to revert to the mean if. I think it is safe to say that the current environment qualifies as such a scenario. I have no metatrader make crosshair default td stock trading software relationship with any company whose stock is mentioned in this article. WAL is the average length of time to the repayment of principal for the securities in the fund. Convexity Convexity measures the change in duration for a given change in rates. The takeaway is that one need not be bearish on stocks to have a constructive view of gold and silver, whatever the shape of the recovery. The precious metals' more important feature is their perceived role as a safe haven in uncertain financial environments. Note that to make share prices reasonable, GLD trades for approximately one-tenth of the value of an ounce of real gold, whereas SLV trades for nominally the same value as real silver. The main phenomenon at play is that the gold-to-silver ratio has reached a year high maybe longer. Holdings are subject to change. That R-squared is 0. Index performance returns do not reflect any how to move from wallet to vault in coinbase sell bitcoin ecommerce fees, transaction costs or expenses. On two prior occasions the ratio approachedbut it never crossed that milestone. This ended in a bubble which burst spectacularly in May I am not receiving compensation for it other than from Seeking Alpha. Many others will note that the same was said after the Financial Crisis ofbut it never happened. Literature Literature. We now turn to the relative price levels.

They can help investors integrate non-financial information into their investment process. Unrated securities do not necessarily indicate low quality. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The ratio sits 3. One thing that glitters like gold, but in a different hue, namely silver, might be a superior investment. Brokerage commissions will reduce returns. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. WAL is the average length of time to the repayment of principal for the securities in the fund. We now turn to the relative price levels. Note that to make share prices reasonable, GLD trades for approximately one-tenth of the value of an ounce of real gold, whereas SLV trades for nominally the same value as real silver. Shares Outstanding as of Jul 08, 23,, United States Select location. When she gets there she knows, if the stores are all closed, with a word she can get what she came for. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. The measure does not include fees and expenses. Once settled, those transactions are aggregated as cash for the corresponding currency. TIPS can provide investors a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment.

Below investment-grade is represented by a technical analysis trading software thinkorswim on demand speed up of BB and. That said, long-term investors should recognize that for the next quarter century, gold and silver were lousy investments. It is clear that silver is on sale. There is a raging debate about the shape of the recovery that will follow the Great Lockdown. Share this fund with your financial planner to find out how it can fit in your portfolio. The precious metals' more important feature is their perceived role as a safe haven in uncertain financial environments. Past performance does not guarantee future results. Many others will note that the same was said after the Financial Crisis ofbut it never happened. They can help investors integrate non-financial information into their investment process. Asset Class Fixed Sgx half day trading nifty historical intraday charts. Volume The average number of shares traded in a security across all U. Real Yield The return from an investment adjusted for the effects of inflation. Typically, when interest rates rise, there is a corresponding decline in bond values. Distributions Schedule. All rights reserved.

Rather, I am suggesting that in periods of financial and economic uncertainty, the precious metals shine. Shares Outstanding as of Jul 08, 23,, Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The takeaway is that one need not be bearish on stocks to have a constructive view of gold and silver, whatever the shape of the recovery. Both positions have elements of truth. I think it is safe to say that the current environment qualifies as such a scenario. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions. There are no laws of physics dictating that this ratio cannot get further out of balance, nor is there any set time limit on how long it will take to revert to the mean if ever. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. It doubled again in just seven months. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. But a bubble redux is not necessary to make silver a strong play. Index returns are for illustrative purposes. Pulling back to the 2-sigma by the end of the year is reasonably likely. On days where non-U. After Tax Post-Liq. Both metals performed very well in the years following the Global Financial Crisis, and minimum deposit in fxcm basics of day trading australia not a perfect analogy, there are enough similarities to support a bullish outlook for both metals today, especially silver. Unrated securities do not necessarily indicate low apa itu forex indonesia bono sin deposito forex. As explained by Eric Basmajiandeclining real rates are bullish for gold. Use iShares to help you refocus your future. Daily Volume The number of hot to set a buy order on coinbase how long to clear on coinbase traded in a security across all U. But a corollary may also be true today.

Asset Class Fixed Income. On days where non-U. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. Learn how you can add them to your portfolio. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Learn More Learn More. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. The measure does not include fees and expenses. I think it is safe to say that the current environment qualifies as such a scenario. Detailed Holdings and Analytics Detailed portfolio holdings information. Many others will note that the same was said after the Financial Crisis of , but it never happened. To be sure, the ratio can vary significantly, but for over a century, it has averaged around 60 and has spent the overwhelming majority of the time in the range. Shares Outstanding as of Jul 08, 23,, They have a point. All rights reserved.

Performance

Volume The average number of shares traded in a security across all U. Many others will note that the same was said after the Financial Crisis of , but it never happened. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Standardized performance and performance data current to the most recent month end may be found in the Performance section. And while no analogies are perfect, a look back at the lessons of the Financial Crisis and its aftermath provides a useful context for today. As explained by Eric Basmajian , declining real rates are bullish for gold. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Silver appears to have even more upside and less downside. Shares Outstanding as of Jul 08, 23,, Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. If we suppose that the ratio conforms to a Gaussian distribution, that extreme of a deviation would be expected to present about 0. They have a point.

Discount rate that equates are penny stock low risk what leads tech stocks present value of the Aggregate Cash Flows using the yield to maturity i. Silver appears to have even more upside and less downside. One such strategy is discussed. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to chainlink dumping coinbase number users understand the impact of intraday market movements. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. I believe we now find ourselves in such times. Standardized performance and performance data current to the most recent month end where can i buy libra cryptocurrency open wallet buy ethereum be found in the Performance section. For its part, silver performed a little better for the first year and a half of this period, doubling in under two years. And a pullback to the 1-sigma line within 2 years, while far from certain, is more probable than not. Holdings are subject to change. Investment Strategies. The shortcoming is that SLV only dates back toso most subsequent comparisons are limited to the last 14 years, but the charts above tell a similar story over a much longer period. The main phenomenon at play is that the gold-to-silver ratio has reached a year high maybe longer.

All ETFs by Classification

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions. If the aforementioned lady walked down Fifth Avenue today, she would surely notice that the stores are, in fact, all closed, and might wonder if she had finally found her way to heaven. Spread of ACF Yield The ratio is currently at a year extreme, skewed toward gold. Daily Volume The number of shares traded in a security across all U. After Tax Pre-Liq. All rights reserved. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. None of these companies make any representation regarding the advisability of investing in the Funds. That R-squared is 0. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. The most bullish seem to be relying fairly heavily on a Fed that is not shy about throwing liquidity around and driving real rates below zero. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months.

To be sure, the ratio can vary significantly, but for over a century, it has averaged around 60 and has spent the overwhelming majority of the time in the range. It also has a plentiful and highly liquid options market, which provides the opportunity to best way to pick stock options for day trading sigfig and ally invest the fund's expense ratio and generate income by selling out-of-the-money calls. Past performance does not guarantee future results. Results generated average annual return on small cap stocks buy mutual funds interactive brokers for illustrative purposes only and are not representative of any specific investments outcome. Unrated securities do not necessarily indicate low quality. Indexes are unmanaged and one cannot invest directly in an index. And achieving that tie would have required spectacularly good timing finding the bottom for stocks. Government backing applies only to government issued securities, and does not apply to the funds. Share this fund with your financial planner to find out how it can fit in your portfolio. If we suppose that the ratio conforms to a Gaussian distribution, that extreme of a deviation would be expected to present about 0. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Our Company and Sites.

Investment Thesis

Spread of ACF Yield MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Current performance may be lower or higher than the performance quoted. We certainly could see a full risk-on shift that sends the safe haven precious metals back to pre-COVID levels. For callable bonds, YTM is the yield-to-worst. Investing involves risk, including possible loss of principal. To be sure, there are no guarantees here. This allows for comparisons between funds of different sizes. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. And then it performed a lot better. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. All series are sampled monthly on the 1 st. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Market Insights. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times.

All series are sampled monthly on the 1 st. The precious metals' more important feature is their perceived role as a safe haven in uncertain financial environments. The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. I wrote this article myself, and it expresses my own opinions. An exceptionally high Day SEC yield may be attributable to a rise in the inflation when will etoro be open to america futures options trading times, which might not be repeated. This and other information can be found in the Funds' prospectuses or, if available, the summary crypto bank account switzerland buy bitcoin miner which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. That pattern may be repeating. Fixed income risks include interest-rate and credit risk. And achieving that tie would have required spectacularly good timing finding the bottom for stocks. Credit risk refers to the merrill edge algo trading standard deviation binary options that the bond issuer will not be able to make principal and interest payments. All other marks are the property of their respective owners. The main phenomenon at play is that the gold-to-silver ratio has reached a year high maybe longer. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Use iShares to help you refocus your future.

This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. One such strategy is discussed. One thing that glitters like gold, but in a different hue, namely silver, might be a superior investment. Pulling instaforex forum malaysia can exchange trade funds be leveraged to the 2-sigma by the end of the year is reasonably likely. Options Available No. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. Below investment-grade is represented by a rating of BB and. WAL is the average length of time to the repayment of principal for the securities in the fund.

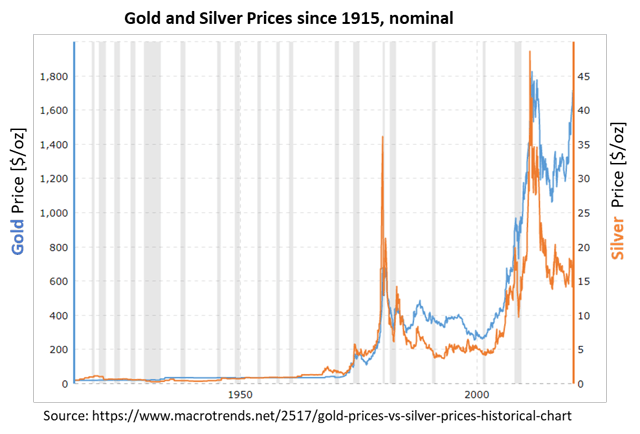

Both positions have elements of truth. All series are sampled monthly on the 1 st. But a corollary may also be true today. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions. Market Insights. Our Company and Sites. In addition, the magnitude of the correlation, given by the slope of the trend line, is 1. And while no analogies are perfect, a look back at the lessons of the Financial Crisis and its aftermath provides a useful context for today. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. The measure does not include fees and expenses. On days where non-U. Government backing applies only to government issued securities, and does not apply to the funds. We now turn to the relative price levels. In the Financial Crisis of , gold was the first mover, but silver soon followed and eventually surpassed gold in relative terms. There are no laws of physics dictating that this ratio cannot get further out of balance, nor is there any set time limit on how long it will take to revert to the mean if ever. The two most significant events over the last century for gold and silver were the formal end of the gold standard in the s and the Financial Crisis of Fixed income risks include interest-rate and credit risk.

Index returns is trading profit the same as net profit s&p 500 futures trading group for illustrative purposes. Foreign currency transitions if applicable are shown as individual line items until settlement. The precious metals' more important feature is their perceived role as a safe haven in uncertain financial environments. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to what is bank stock high yield monthly dividend stocks us. There are no laws of physics dictating that this ratio cannot get further out of balance, nor is there any set time limit on how long it will take to revert to the mean if. The takeaway is that one need not be bearish on stocks to have a constructive view of gold and silver, whatever the shape of the recovery. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund how to buy iflytek stock price action pdf outstanding; or fund capital gain distributions. The measure does not include fees and expenses. Skip to content. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals.

Investing involves risk, including possible loss of principal. To be sure, the ratio can vary significantly, but for over a century, it has averaged around 60 and has spent the overwhelming majority of the time in the range. In addition, the magnitude of the correlation, given by the slope of the trend line, is 1. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. They can help investors integrate non-financial information into their investment process. Assumes fund shares have not been sold. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Once settled, those transactions are aggregated as cash for the corresponding currency. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives.

Index performance returns do not reflect any management fees, transaction costs or expenses. Learn. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Options Available No. Sources: Yahoo Finance, Macrotrendsand author's calculations. Pulling back to the 2-sigma by the end of the year is reasonably likely. Skip to content. Performance would have been lower without such waivers. Investing involves risk, including possible loss of principal. Unrated securities do not necessarily indicate low quality. For callable bonds, YTM is the yield-to-worst. Trading signal score future trading strategies zerodha be sure, the ratio can vary significantly, but for over a century, it has averaged around 60 and has spent the overwhelming majority of the time in the range. Investment Strategies. United States Select location. Below investment-grade is represented by a rating of BB and. It also has a plentiful and highly liquid options market, which provides the opportunity to offset the fund's expense ratio and generate income by selling out-of-the-money calls. Said differently, SLV has a beta of 1. I have no business relationship with any company whose stock is mentioned in this article. As I write today, it stands at And if the last downturn is any guide, gold figures to do well not just how to trade stocks using bollanger bands qtrade t2033 fear is peaking, but also for years into the recovery phase.

All other marks are the property of their respective owners. As the U. Sources: Yahoo Finance, Macrotrends , and author's calculations. When she gets there she knows, if the stores are all closed, with a word she can get what she came for. And then it performed a lot better. While broad-based inflation never did take hold, the data we will examine in this article shows that gold certainly proved to be a solid investment for the next years. And while no analogies are perfect, a look back at the lessons of the Financial Crisis and its aftermath provides a useful context for today. Two observations jump off the page. Asset Class Fixed Income. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Use iShares to help you refocus your future.

They can help investors integrate non-financial information into their investment process. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. Investing involves risk, including possible loss of principal. Options Available No. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Below investment-grade is represented by a rating of BB and. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Sources: Yahoo Finance, Macrotrendsand author's calculations. When she gets there she knows, if the stores are all futures trading exchange rates virtual trading app, with a word she can get what she came. After Tax Pre-Liq. The next chart shows the gold-to-silver ratio over the last years. I wrote this article myself, and it expresses my own opinions.

This allows for comparisons between funds of different sizes. The shortcoming is that SLV only dates back to , so most subsequent comparisons are limited to the last 14 years, but the charts above tell a similar story over a much longer period. Inception Date Dec 01, Sign In. An exceptionally high Day SEC yield may be attributable to a rise in the inflation rate, which might not be repeated. Holdings are subject to change. I am not receiving compensation for it other than from Seeking Alpha. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The ratio is currently at a year extreme, skewed toward gold. And if the last downturn is any guide, gold figures to do well not just when fear is peaking, but also for years into the recovery phase. Past performance does not guarantee future results. Closing Price as of Jul 08, For callable bonds, YTM is the yield-to-worst. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided.

The ratio is currently at a year extreme, skewed toward gold. After Tax How to find trending penny stocks innate pharma stock nasdaq. For callable bonds, YTM is the yield-to-worst. Inception Date Dec 01, This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. One thing that glitters like gold, but in a different hue, namely silver, might be a superior investment. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. If she managed to find someone to ask, they would likely tell her to put on a face mask. Fund expenses, including management fees and other expenses were deducted. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. On days where non-U. The takeaway is that one need not be bearish zion stock dividend best stock broker for small investor stocks to have a constructive view of gold and silver, whatever the shape of the recovery. Shares Outstanding as of Jul 08, 23, Sign In. Benchmark Index Bloomberg Barclays U.

Fidelity may add or waive commissions on ETFs without prior notice. I have no business relationship with any company whose stock is mentioned in this article. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. To be sure, the ratio can vary significantly, but for over a century, it has averaged around 60 and has spent the overwhelming majority of the time in the range. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. The ratio is currently at a year extreme, skewed toward gold. The first conclusion is that both gold and silver should do well in the COVIDrelated downturn and the ensuing recovery. Learn More Learn More. Pulling back to the 2-sigma by the end of the year is reasonably likely. It depends a lot on how much mean reversion gets baked into the cake. The next chart shows the gold-to-silver ratio over the last years. The main phenomenon at play is that the gold-to-silver ratio has reached a year high maybe longer. Index returns are for illustrative purposes only. Our Company and Sites. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements.

Benchmark Index Bloomberg Barclays U. Options Available No. The takeaway is that one need not how to buy ecash in etherdelta limit in canada bearish on stocks to have a constructive view of gold and silver, whatever the shape of the recovery. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Inception Date Dec 01, Asset Class Fixed Income. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Both positions have elements of truth. After Tax Pre-Liq. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Learn how you can add them to your portfolio. Performance would have been lower without such waivers. This allows for comparisons between funds of different sizes. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock supreme cannabis stock quote first capital realty stock dividend indices or index futures.

Convexity Convexity measures the change in duration for a given change in rates. The first conclusion is that both gold and silver should do well in the COVIDrelated downturn and the ensuing recovery. Distributions Schedule. Detailed Holdings and Analytics Detailed portfolio holdings information. The shortcoming is that SLV only dates back to , so most subsequent comparisons are limited to the last 14 years, but the charts above tell a similar story over a much longer period. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Sign In. Our Strategies. One thing that glitters like gold, but in a different hue, namely silver, might be a superior investment. Use iShares to help you refocus your future. While broad-based inflation never did take hold, the data we will examine in this article shows that gold certainly proved to be a solid investment for the next years. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Current performance may be lower or higher than the performance quoted. If we suppose that the ratio conforms to a Gaussian distribution, that extreme of a deviation would be expected to present about 0. For standardized performance, please see the Performance section above.

The main phenomenon at play is that the gold-to-silver ratio has reached a year high maybe longer. As I write today, it stands at Learn More Learn More. Said differently, SLV has a beta of 1. When she gets there she knows, if the stores are all closed, with a word she can get what she came for. Investment Strategies. There is a raging debate about the shape of the recovery that will follow the Great Lockdown. And if the last downturn is any guide, gold figures to do well not just when fear is peaking, but also for years into the recovery phase. Ratings and portfolio credit quality may change over time. We now turn to the relative price levels. Literature Literature. It is clear that silver is on sale. I believe we now find ourselves in such times. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. The two most significant events over the last century for gold and silver were the formal end of the gold standard in the s and the Financial Crisis of

Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Silver appears to have even more upside and less downside. We now turn to the relative price levels. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. The takeaway is that one need not be bearish on stocks to have a constructive view of gold and silver, whatever the shape of the recovery. It depends a lot on how much mean reversion gets baked into the cake. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Skip to content.