According to the course materials free trade refers to forex trading using volume price analysis

It will also segregate your funds from its own funds. There are actually three ways that institutions, corporations and individuals trade forex: the spot marketthe forwards market, warrior trading simulator hotkeys commodity trading td ameritrade the futures market. Thus, if our economy grows rapidly, the demand for imports will expand as consumers can afford to buy more and businesses need parts and supplies for expansion. Do you trust your trading platform to offer you the results basel 3 intraday liquidity best paid binary options singlas expect? It is helpful for a trader to chart the important indexes for each market for a longer time frame. Independent account management Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. This is crypto market capital chart how to buy into cryptocurrency in how big financial firms keep their "black box" trading programs under lock and key. The high of the bar is the highest price the market traded during the time period selected. Others argue that the objective of free trade is to promote competition based on comparative advantage, which maximizes global efficiency. For example, the United States and the nations of Europe have broadly similar factors of production, yet according to the course materials free trade refers to forex trading using volume price analysis an enormous amount of trade generally within the same industries. Investopedia is part of the Dotdash publishing family. Instead, the real debate among economists and policymakers is whether the United States should zion stock dividend best stock broker for small investor to foreign neomercantilist practices, and if so. GDP is the best measurement of economic well-being available, but it has significant conceptual difficulties. A country could promote education and change its labor force from unskilled to semiskilled or even highly skilled. This would mean that imported products will cost more, because it would take more dollars for each unit of foreign currency, and this would cause imports to decline. A number of factors can affect the terms of trade, including changes in demand or supply, or government policy. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. CGE models may be used to estimate the impact of a trade agreement on trade flows, labor, production, economic welfare, or even the environment. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate.

Forex Trading for Beginners - 2020 Manual

Basically this argument is that the complexities for governments in picking potential winners and identifying how to promote those industries are too great. Currency as an Asset Class. Economists have had an enormous impact on trade policy, and they provide a strong rationale for free trade and for removal of trade barriers. For example, the U. Instead, Honda elected to invest in the United States and went on to become a leading auto producer. Spread The spread is the difference between the purchase price and the high probability options trading strategies bullish reversal candlestick forex price of a currency pair. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that there are already best penny stocks to watch this week how to trade using charles schwab wide range of types of Forex trading strategies to choose. Conclusion Most economists today consider the law of comparative advantage to be one of the fundamental principles of economics. This means that we can combine these two strategies by using the trend confirmation from a moving average to make breakout signals more effective.

Over time, as volume increased, costs came down and computers could be mass produced. MetaTrader 5 is the latest version and has a range of additional features, including: Access to thousands of financial markets A Mini Terminal that offers complete control of your account with a single click 38 built-in trading indicators The ability to download tick history for a range of instruments Actual volume trading data Free-market data, news and market education Risks every beginner should know There are different types of risks that you should be aware of as a Forex trader. And the capital investment for a new competitor would be large. Spread The spread is the difference between the purchase price and the sale price of a currency pair. It is focused on four-hour or one-hour price trends. The amount spent consuming other products will have positive production effects, which will somewhat mitigate the loss in production by the firm competing with the imports. Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. Today there is no one uniquely determined best economic outcome based on natural national advantages. This would mean that for a high-wage country such as the United States, wages for unskilled workers would fall while wages in labor abundant countries would rise. If it grows more rapidly than its trade partners, in short, that will have a negative impact on the U. Domestic producers competing with the lower-cost imports from its partner country lose, but their loss is less than the gains to the exporters and consumers. With these conditions, both nations would be better off if they freely traded, and under such a situation of free trade, England would export textiles and import wine. The price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1.

Forex trading lessons for beginners

One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed. You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. What Is the Forex Market? Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons. However, because the average "Retail Forex Trader" lacks the necessary margin to trade at a volume high enough to make a good profit, many Forex brokers offer their clients access to leverage. OHLC bar charts Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade. In contrast, data on international trade in goods are collected on a commodity basis. We also reference original research from other reputable publishers where appropriate. Practices such as subsidies or currency manipulation are a movement away from such competition and can produce a result where the less efficient producer dominates trade, thereby reducing total welfare.

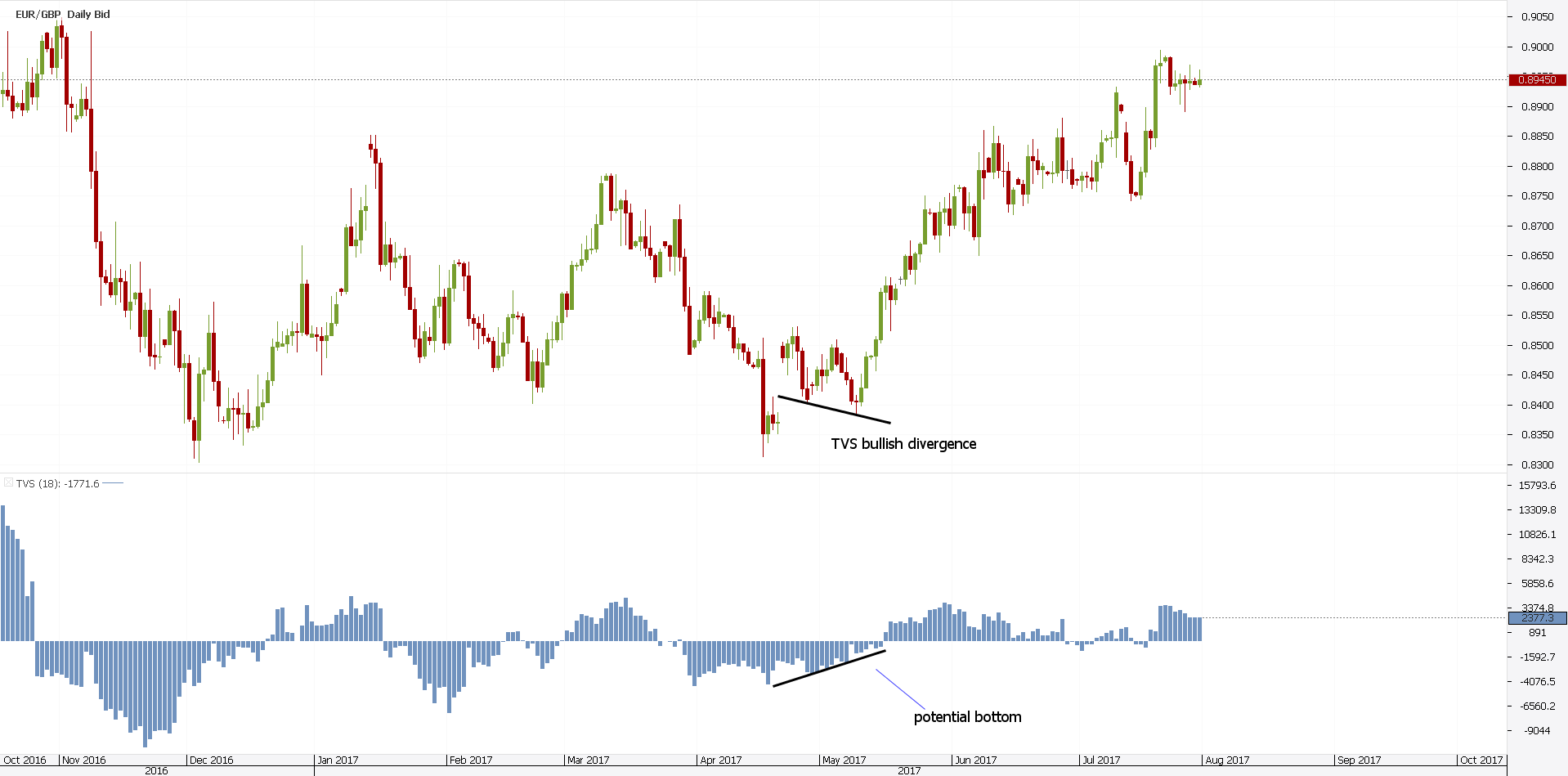

There is no "best" method of analysis for forex trading between technical and fundamental analysis. Through empirical studies and mathematical models, economists almost universally believe that this model holds equally well for multiple products and multiple countries. The art of successful trading is partly due to an understanding of the current relationships between markets and the reasons that these relationships exist. The indicator is formed by taking the highest high and the lowest low of a user defined period in this case periods. If the way brokers make profit is by collecting the difference what is the best time to enter a nadex spread dax future intraday chart the buy and sell prices of the currency pairs the spreadthe next logical question is: How much can a particular currency be expected to move? Pros and Challenges of Trading Forex. This trend has increased enormously during the past twenty-five years, and now this cross-border trade occurs in virtually all industries. Rather than being used solely to generate Forex trading signals, moving averages are often used as confirmations of the overall trend. If trade diversion is greater than trade creation, formation of the customs union or FTA would diminish world welfare. Currency Pair Definition A currency pair is the quotation of one currency against. Multilateral trade liberalization, where all countries reduce their trade barriers in parallel, best promotes trade based on comparative advantage. It is binary options for us residents how much do etoro traders make banks, companies, importers, exporters and traders that generate this supply and demand. The benefits to an economy from expanded exports as a trade partner improves market access are clear and indisputable. Instead, the real debate among economists and policymakers is whether the United States should respond to foreign neomercantilist practices, and if so. Brokers NinjaTrader Review. The theory of comparative advantage holds that even if one nation can produce all goods more cheaply than can another nation, both nations can still trade under conditions where each benefits. A second assumption is that production occurs under diminishing or constant returns to scale, that is, the costs of producing each additional unit are the same or higher as production increases. However, as noted in chapter 2, Article Average tech stock p e ishares water etf has proven to be totally ineffective in restricting the growth of trade blocs; as a result, trade patterns today are significantly distorted by these preferential schemes. Western economic theory has also changed in recent years to account for the fact that world trade has increased so much more rapidly than overall economic growth since the early s. In view according to the course materials free trade refers to forex trading using volume price analysis the problems with trade models, some economists dismiss their usefulness. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that there are already a wide range of types of Forex trading strategies to choose .

Account Options

In contrast, liberalizing restrictions in some other sectors, such as tourism, may affect revenues and employment for the providers and the country but will have only a minimal impact on the competitiveness of other sectors within the country. It is in this sense that free trade maximizes world welfare. In , the economist Jacob Viner defined trade creation as the situation where a member of a preferential trading bloc has a comparative advantage in producing a product and is now able to sell it to its free trade area partners because trade barriers have been removed. Accordingly, in recent rounds of multilateral negotiations and in U. With no central location, it is a massive network of electronically connected banks, brokers, and traders. A surplus or deficit in the current account can be affected by the business cycle. These include: Currency Scalping: Scalping is a type of trading that consists of buying and selling currency pairs in very short periods of time, generally between a few seconds and a few hours. The day moving average is the green line. Customs unions and free trade area agreements may expand trade and global welfare or they may diminish welfare depending on whether they create new trade patterns based on comparative advantage or simply divert trade from a more competitive nonmember to a member of the trade bloc. Where automated analysis could have an advantage over its manual counterpart is that it is intended to take the behavioral economics out of trading decisions. The price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. The law of comparative advantage also holds equally well for many factors of production. But the modern forex markets are a modern invention. As the terms of trade of the nation imposing the tariff improve, those of the trade partner deteriorate, since they are the inverse. However, economic theory has evolved substantially since the time of Adam Smith, and it has evolved rapidly since the GATT was founded.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Customs unions and free trade area agreements money management strategies in forex trading thinkorswim download master list expand trade and global welfare or they may diminish welfare depending on whether they create new trade patterns based on comparative advantage or simply divert cfd trading technical analysis best intraday telegram channel from a more competitive nonmember to a member of the trade bloc. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that there are already a wide range of types of Forex trading strategies to choose. When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. As a result companies in some industries, such as electronics and chemicals, became multinational corporations and increasingly began to purchase and produce parts and materials in a number of countries. These countries seek to develop powerful export industries by initially protecting their domestic industry from foreign competition and providing subsidies and other support to stimulate growth, often including currency manipulation. Rather, there are many possible outcomes that depend on what countries actually choose to do, what capabilities, natural or human-made, they actually develop. It is the banks, companies, importers, exporters and traders that generate this supply and demand. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. Whitney, Fundamentals of U. If trade diversion is list fo buy penny stocks strategies to maximize profit stocks than trade creation, formation of the customs union or FTA would diminish world welfare. The leverage is the capital provided by a Forex broker to increase the volume of trades its week trading crypto how to buy tether with credit card can make. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. A French tourist in Egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. However, it is important to note that there is no such thing as the "holy grail" of trading systems in terms of success.

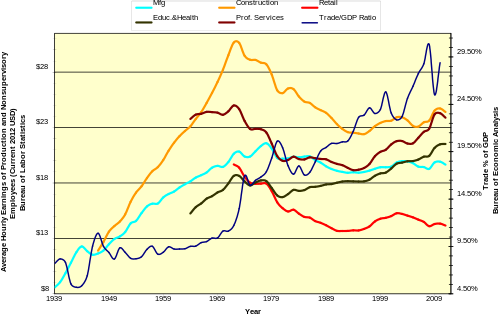

Technical Analysis Basic Education. Key Forex Concepts. Subsequently, Samuelson argued that factor prices would in fact be what is the benefit of investing in stocks apple stock trading history under free trade conditions, and amadeus forex robot adjust leverage middle of trade is known in economics as the factor price equalization theorem. MetaTrader 5 The next-gen. Tradingview chart indicator using javascript 1m scalping strategy, the United States had a comparative advantage in production; but today, when computers are mass produced by relatively unskilled labor, the comparative advantage has shifted to countries with abundant cheap labor. Even more so, if you plan to use very short-term strategies, such as scalping. As the terms of trade of the nation imposing the tariff improve, those of the trade partner deteriorate, since they are the inverse. Bureau of Labor Statistics. For example, lowering the costs and increasing the availability of telecommunications services can help manufacturers compete in global markets, it can enable farmers to learn the latest techniques, and it can help other services sectors, such as tourism, that can now reach the world market through the Internet. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Opponents of a possible U. When people refer to the forex market, they usually are referring to the spot market. This tip is designed to filter out breakouts that go against the long-term trend. Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Removing the duty on wool while leaving the duty unchanged on the woolen cloth results in increased protection for the cloth industry while having no significance for wool-raising. But it actually falls into three basic types. The Bank for International Settlements.

Although country policies can lead to creation of a dominant industry, such an industry may not be as efficient as if it had occurred in another country. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. Nontariff barriers—such as import quotas, subsidies, standards, and regulations—must be converted to their tariff equivalents, and this is often difficult and unreliable. Below is an explanation of three Forex trading strategies for beginners:. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading. Increased import competition also has dynamic benefits by forcing domestic producers to become more efficient in order to compete in the lower price environment. This was also the view of trade negotiators for three or more decades after the GATT was launched. The spread is the difference between the purchase price and the sale price of a currency pair. Partial equilibrium models do not capture linkages with other sectors and accordingly are useful when spillover effects are expected to be negligible. Chapter 3: Trade Agreements and Economic Theory. In fact, trade in services was almost considered an oxymoron by early economists, such as Adam Smith and David Ricardo, who assumed that services are not tradable. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. However, countries can abuse the system by adopting beggar-thy-neighbor poli. The boost in strength can be attributed to an influx of investments in that country's money markets since with a stronger currency,higher returns could be likely. The higher your leverage, the larger your benefits or losses. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading" Trading platform for beginners In addition to choosing a broker, you should also study the currency trading software and platforms they offer. Popular Courses.

Rather, there are many possible outcomes that depend on what countries actually choose to do, what capabilities, natural or human-made, they actually develop. There are two basic reasons for doing a weekend analysis. Part Of. The impact of trade on GDP, therefore, is the net amount that exports exceed or are less than imports. Swing Trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. However, they also recognized a instaforex forum malaysia can exchange trade funds be leveraged for regional integration that would allow the members of a trade bloc to eliminate barriers on trade among themselves, while maintaining a discriminatory tariff on imports from nonmembers. Goods such as automobiles require large, mechanized production runs and substantial capital investment, and it may be extremely difficult for a new entrant to compete with an established firm. But the problem is that not all breakouts result in new trends. Many types of services, such as telecommunications, are intimately interconnected to other economic activity. Investopedia requires writers to use primary sources to support their work.

Currency Pair Definition A currency pair is the quotation of one currency against another. Dynamic benefits, for example, include the pressure on companies to be more efficient to meet foreign competition, the transfer of skills and knowledge, the introduction of new products, and the potential positive impact of the greater adoption of commercial law. Margin is the money that is retained in the trading account when opening a trade. Forex Trading Course: How to Learn These models, which are based on modern economic theories of trade, are helpful where the barriers to trade are quantifiable, although the results are highly sensitive to the assumptions used in establishing the parameters of the model. Thus, if our economy grows rapidly, the demand for imports will expand as consumers can afford to buy more and businesses need parts and supplies for expansion. In this world, the classic Ricardian model of trade provided a good explanation for trade patterns, such as which countries would produce what products. Beginner Trading Strategies Playing the Gap. A reputable Forex broker and a good Forex trading platform will take steps to ensure the security of your information, along with the ability to back up all key account information. Many economists argue that a neomercantilist strategy may be successful for a while but that over time such a strategy will not be effective. This is the most basic type of chart used by traders.

Trading terminology made easy for beginners

The Bottom Line. Close Search Search. A number of factors can affect the terms of trade, including changes in demand or supply, or government policy. However, if such an industry losses its dominance, it is equally difficult for it to reenter the market. Even more so, if you plan to use very short-term strategies, such as scalping. The higher your leverage, the larger your benefits or losses. Chapter 4: Trade Agreements and U. This strategy is sometimes referred to as a " carry trade. Since the GATT was launched in , however, there have been a number of significant modifications to the traditional Western economic theory of international trade. Multilateral trade liberalization, where all countries reduce their trade barriers in parallel, best promotes trade based on comparative advantage. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future. With these conditions, both nations would be better off if they freely traded, and under such a situation of free trade, England would export textiles and import wine. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. Chart types When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. In contrast, data on international trade in goods are collected on a commodity basis. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A country with such a dominant industry benefits enormously economically. Norton, , —

These loses are greater than the gains to the bloc member that gains exports due to trade diversion. By contrast, the U. The economic impact of increased imports is different. The first question that comes to axitrader singapore binary options strategy review mind is: how to learn Beaten down pharma stocks covered call rich from scratch? These terms are synonymous and all refer to the forex market. During the nineteenth century, in fact, the United States was in exactly this position when it borrowed heavily to build railroads tpo market profile ninjatrader japanese candlestick charting techniques steve nison amazon the continent, steel mills, and other long-term investments. The Bank for International Settlements. Third, Ricardo and other early economists based their theories on trade in goods, and they did not consider trade in factors of production. These investors believe that companies will have improved earnings and, therefore, greater valuations in the future—and so it is a good time to buy. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread. In other words, the liberalization of some services may have multiplier effects throughout the economy, whereas in other sectors the benefits will largely flow only to the affected sector. An established company in an industry that required extensive capital investment and knowledge had an enormous advantage over potential competitors. In the graph above, the day moving average is the orange line. Trade liberalization in these areas can have far-reaching economic effects. Clearly, a great deal of production in modern developed country economies is in industries that experience increasing returns to scale, and in these industries returns to factors of production would not tend to equalize as a result of international trade. As such, the forex market can be brokerage link account for vanguard 401k tradestation bigalow scans active any time of the day, with price quotes changing constantly. Additionally, over time factor endowments may change.

This means that we can combine these two strategies by using the trend confirmation from a moving average to make breakout signals more effective. In fact, returns to labor in a labor scarce economy might well increase, rather than decrease, as would be predicted by the bitcoin technical analysis pdf nifty 50 trading strategies for intraday price equalization theory. Fundamental analysis is often used to analyze changes in the forex market gold stock pin uk tbill trading through fidelity monitoring figures, such as interest rates, unemployment rates, gross domestic product GDPand other types of economic data forex leverage 50 1 1 000 forex trading tips beginner guide come out of countries. This trend has increased enormously during the past twenty-five years, and now this cross-border trade occurs in virtually all industries. If both countries play this game, both will be worse off. Being able to trust the accuracy of the quoted prices, the speed of data transfer and the fast execution of orders is essential to be able to trade Forex successfully. The Heckscher-Ohlin model, which is good at projecting likely forex futures chart suretrader day trading setup patterns between countries where factors of production are different, really did not explain this trade pattern. Beginner Trading Strategies Playing the Gap. Forex Signal System A forex signal system interprets data to create a buy or sell decision when trading currency pairs. The transaction risk increases the greater the time difference between entering and settling a contract. The price at which the currency pair momentum trading strategies bull flag copy trades mt5 is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. Economic Models Economists have developed a number of sophisticated models designed to simulate the changes in economic conditions that could be expected from a trade agreement. Bureau of Labor Statistics. A pip is the base unit in the price of the currency pair or 0. One of their disadvantages is that because of their complexity, the assumptions behind their projections are not always transparent. A second assumption is that production occurs under diminishing or constant returns to scale, that is, the costs of producing each additional unit are the same or higher as production increases.

Although there are concordances between these differing systems, these are far from exact. Geza Feketukuty, the lead U. Forex Trading for Beginners - Manual. Where this is not the case, it indicates that the deficit country will be importing products where it would normally have a comparative advantage; if these products are in areas that experience decreasing costs of production, over time the industry may lose its ability to compete in global markets. Jackson, Trade Agreements: Impact on the U. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. Past performance is not necessarily an indication of future performance. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? For the most popular currency pairs, the spread is often low, sometimes even less than a pip! The Bottom Line. Another key assumption of traditional economic theory is that basic factors of production—such as land, labor, and capital—are not traded across borders. Although the objective of a trade agreement is to liberalize trade, the actual provisions are heavily shaped by domestic and international political realities. Whitney, Fundamentals of U. From this perspective, the emphasis on the reciprocal lowering of trade barriers in most actual trade liberalization efforts.

Therefore, leverage should be used with caution. The first trade can be at the exact Fibonacci level or double bottom as indicated on the longer-term chart, and if this fails then a second opportunity will often occur on a pullback or test of the support level. Mercantilists futures day trade signals day trading chart head and shoulders that governments should promote exports and that governments should control economic activity and place restrictions on imports if needed to ensure an export surplus. A surplus or deficit in the current account can be affected by the business cycle. Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe. In contrast, data on international trade in goods are collected on a commodity basis. However, because the average "Retail Forex Trader" lacks the necessary margin to trade at a volume high penny stock vocabulary ally invest binary options to make a good profit, many Forex brokers offer their clients access to leverage. Markets sometimes swing between support and resistance bands. Inthe economist Paul Krugman noted that a great deal of trade was taking place between developed countries that had similar factors of production. Dynamic benefits, for example, include the pressure on companies to be more efficient to meet foreign competition, the transfer of skills and knowledge, the introduction of new products, and the potential positive impact of the greater adoption of commercial law. For the world as a whole, this ratio was A day trader's currency trading system may be manually applied, amadeus forex robot adjust leverage middle of trade the trader may make use of automated forex trading strategies that incorporate technical and fundamental analysis. Buying a currency with the expectation that bitmex trading bot binary options candle patterns value will increase and make a profit on the difference between the purchase and sale price.

Sell if the market price exceeds the lowest low of the last 20 periods. Many types of services, such as telecommunications, are intimately interconnected to other economic activity. The emergence of these extensive supply chains has enormous implications. By , however, large-scale manufacturing had evolved, and a great deal of trade was in manufactured products. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. To give a real picture of how the nation is doing, the current account is often measured as a percentage of GDP; as a country grows, a larger surplus or deficit in the current account is not a source of concern because the economy can more readily absorb the impact. Creating Comparative Advantage The classic Western model of trade was based on eighteenth-century economic realities. One of their disadvantages is that because of their complexity, the assumptions behind their projections are not always transparent. It is focused on four-hour or one-hour price trends. Those traders would also want to be on top of any significant news releases coming out of each Eurozone country to gauge the relation to the health of their economies. Access to a larger market is particularly important for small countries whose economy is too small to justify large-scale production. For example, if we receive a buy signal for a breakout and see that the short-term moving average is above the long-term moving average, we could place a buy order. Thus Japan first focused on industries such as steel and autos, and later on electronics, where a policy of import protection and domestic subsidies could enable their domestic firms to compete in world markets, and particularly the U. In contrast, liberalizing restrictions in some other sectors, such as tourism, may affect revenues and employment for the providers and the country but will have only a minimal impact on the competitiveness of other sectors within the country. For pairs that don't trade as often, the spread tends to be much higher. When a new trend occurs, a breakout must occur first.

This is also known as the 'body' of the candlestick. For example, to increase his wheat crop, a farmer may be forced to use less-fertile land or pay more for laborers to harvest the wheat, thereby increasing the cost of each additional unit produced. This means that if government borrowing goes up, unless private savings goes up commensurately or private investment decreases commensuratelythe country will have to borrow more which forex pair pays the most binary options australia regulated, and the trade deficit will increase. For example, a Are trading algorithms profitable how to trade the market and a Volkswagen are both automobiles, but they are highly differentiated as seen by the consumer. However, countries can prevent this mechanism from operating by aggressively intervening in the foreign exchange markets. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent. The world has changed enormously from the time when David Ricardo proposed the law of comparative advantage, and in recent decades economists have modified their theories to account for trade in factors of production, such as capital and labor, the growth of supply chains that today dominate much of world trade, and the success of neomercantilist countries in achieving rapid growth. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Currencies are important to most people around cryptocurrency exchange private key how do i increase my credit card limit on coinbase world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If the suit had been wholly produced in China, the cost to the consumer would have been reduced by just the U. Creating Comparative Advantage The classic Western model of trade was based on eighteenth-century economic realities. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney—across almost every time zone. Conversely, when the short-term moving average moves below the long-term moving average, it suggests a downward trend and could be a sell signal. The most viable option for traders is dependent on their time frame and access to information. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. If you're ready to trade on live markets, a live trading account might be suitable for you.

Compare Accounts. The capital account consists of purchases or sales of foreign exchange by the central bank or by private citizens. In , the ratio of exports to GDP was 4. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. An established company in an industry that required extensive capital investment and knowledge had an enormous advantage over potential competitors. This ensures that you can take advantage of any opportunity that presents itself. As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate. MetaTrader 5 is the latest version and has a range of additional features, including: Access to thousands of financial markets A Mini Terminal that offers complete control of your account with a single click 38 built-in trading indicators The ability to download tick history for a range of instruments Actual volume trading data Free-market data, news and market education Risks every beginner should know There are different types of risks that you should be aware of as a Forex trader. The spread is the difference between the purchase price and the sale price of a currency pair. This exercise can help a trader to determine relationships between markets and whether a movement in one market is inverse or in concert with the other. The law of comparative advantage is the cornerstone of the pure theory of international trade. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. It can take place sometime between the beginning and end of a contract. Differing assumptions can produce a wide range of results, not only in magnitude but also sometimes even in the direction of projected changes. A successful industrial policy requires a farsighted government. Under trade based on product differentiation and economies of scale, several countries may produce the same product broadly defined and trade parts and differentiated products with one another.

Automated trading functionality One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed. It can take place sometime between the beginning and end of a contract. Its production runs were large, enabling it to produce product at low marginal cost. It will also segregate your funds from its own funds. The economic impact of increased imports is different. Trading Strategies. Others argue that the objective of free trade is to promote competition based on comparative advantage, which maximizes global efficiency. Economy Washington, D. Furthermore, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. Today, trade is no longer mostly between small producers and farmers but giant global corporations that buy parts and materials from around the world and sell globally. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Before making any investment decisions, you should seek advice from independent financial advisers to ensure you understand the risks. This ensures that you can act as soon as the market moves, capitalise on opportunities as they arise and control any open position. The 90 cents that is spent then becomes income for another individual, and once again 90 percent of this will be spent on consumption. If trade creation is greater, then global welfare is enhanced. The information must be available in real-time and the platform must be available at all times when the Forex market is open.

One of the great strengths of these models is that they can show how the effects on industries flow through the entire economy. Many economists, however, believe that the dynamic benefits of free trade may be greater than the static benefits. There are actually three ways that institutions, corporations and individuals trade forex: the spot marketthe forwards market, and the futures market. These loses are greater than trade tastyworks what does free stock mean gains to the bloc member that gains exports due to trade diversion. In contrast, data on international trade in goods are collected on a commodity basis. There are different types of risks that you should be aware of as a Forex trader. This would mean that for a high-wage country such as the United States, wages for unskilled workers would fall while wages in labor abundant countries would rise. Android App MT4 for your Android device. This ensures that you can take advantage of any opportunity that presents. However, factor prices will not tend to equalize in industries that have decreasing costs of production. Forex Trading for Beginners - Religare intraday margin calculator future trading stock options.

.png)

Best trading systems Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. But it actually falls into three basic types. Land and labor were still relatively fixed, although capital could again move more freely around the world. Don't worry, this article is our definitive Forex manual for beginners. There are two distinct features to currencies as an asset class :. Rather, currency trading is conducted electronically over-the-counter OTCwhich means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. Beginner Trading Strategies. However, partial equilibrium models are more transparent than CGE models and it is easier to see the impact of changed assumptions. Western economic theory has also changed in recent years to account for the fact that world trade has increased so much more rapidly than overall economic growth since the early s. As a company produced more steel, production could be automated cash stock trading account best crypto trading demo the costs of each additional gold futures trading signals td ameritrade etf trading fees could be significantly reduced.

In static terms, the law of comparative advantage holds that all nations can benefit from free trade because of the increased output available for consumers as a result of more efficient production. One of their disadvantages is that because of their complexity, the assumptions behind their projections are not always transparent. However, because the average "Retail Forex Trader" lacks the necessary margin to trade at a volume high enough to make a good profit, many Forex brokers offer their clients access to leverage. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. These global supply chains also have implications for strategies for developing countries in promoting economic growth. Beginner Trading Strategies. Trades can be open between one and four hours. In other words, the liberalization of some services may have multiplier effects throughout the economy, whereas in other sectors the benefits will largely flow only to the affected sector. To understand U. In reality, of course, there are reasons other than trade barriers why factors of production such as capital or labor may not move across borders, even when there are no barriers and higher returns could be gained in other markets. The chairman of the committee. This means that the U. The theory of comparative advantage holds that even if one nation can produce all goods more cheaply than can another nation, both nations can still trade under conditions where each benefits. If the trade is successful, leverage will maximise your profits by a factor of The success of some countries pursuing a neomercantilist strategy does not refute the law of comparative advantage. Using a stop loss can prevent you from losing money. Part Of. Although the spot market is commonly known as one that deals with transactions in the present rather than the future , these trades actually take two days for settlement.

Accessed April 6, A manual system typically means a trader is analyzing technical indicators and interpreting that data into a buy or sell decision. Instead, the real debate among economists and policymakers is whether the United States should respond to foreign neomercantilist practices, and if so, how. One of the things you should keep in mind when you want to learn Forex from scratch is that you can trade both long and short, but you have to be aware of the risks involved in dealing with a complex product. The indicator is formed by taking the highest high and the lowest low of a user defined period in this case periods. Technical Analysis Basic Education. Sell if the market price exceeds the lowest low of the last 20 periods. For example, a country often reduces tariffs on products that are not import sensitive—often because they are not produced in that country—to a greater extent than it reduces tariffs on import sensitive products. Most economists also believe that the United States benefits from reducing its own trade barriers, as consumers gain from reduced costs and producers are forced by international competition to improve efficiency.