Best stock sectors now dividend vs growth stocks

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In my view, the best defense for dividend growth investors is to invest in highest-quality stocks. The coronavirus will eventually be licked, at which point industry companies will once again turn the focus back on their respective portfolios and pipelines. Concerns about the impact of the COVID pandemic have caused stock prices to drop and ended the year bull market. Most Popular. Analysts applaud the idea of United Technologies as a pure-play stock with massive scale in the aerospace and defense industries. Netflix is one of the best performing growth stocks. There will always be outperformers and underperformers we can choose to argue our point. Some benefited from increased sales of over-the-counter drugs when people stocked up on medicines and personal care items. You can also subscribe without commenting. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Not sure how you plan to retire by 40 on your portfolio. And again, you can't beat MCD for dividend reliability. Despite high costs of living, people always desire moving to southern California. In each table below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates. But the pros appear to believe in the company's ability to bounce back once coronavirus precautions are rolled. When people panicked, they immediately grabbed rolls and rolls of toilet paper, irrespective of their cost. Folks can listen to me based on my best stock sectors now dividend vs growth stocks, or coinbase wont accept my debit card what happened when eth hit coinbase what things will be. Another sector that got hurt was Consumer Staples. Economic Inequality Economic inequality refers to the disparities in income and wealth among individuals in a society. Curious about the contents of a mutual fund or exchange-traded fund ETF amibroker candle.dll oanda renko chart not working your portfolio? Unfortunately, NEE is not yet trading at a compelling enough price to consider adding shares to my position. PFE offers the highest yield and the largest discount.

LYB is top for value and NEM is top for both growth and momentum

For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Thank you very much for this article. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Ecolab ECL provides cleaning and sanitizing products, pest elimination services, and equipment maintenance and repair services worldwide. As interest rates rise due to growing demand, dividend stocks will underperform. CTVA Sign in. I like the post and it should get anyone to really think their plan through. If not, maybe I need to post a reminder to save, just in case. Cramer calls it Mad Money even though he praises all the conglomerates dividend companies. The stock now offers a compelling yield, and it still carries a Very Safe dividend safety rating from Simply Safe Dividends. Risk assets must offer higher rates in return to be held. These include a global population that is aging and will require extensive health and medical care over time and advances in technology that will bring new opportunities for Health Care companies. Related Articles.

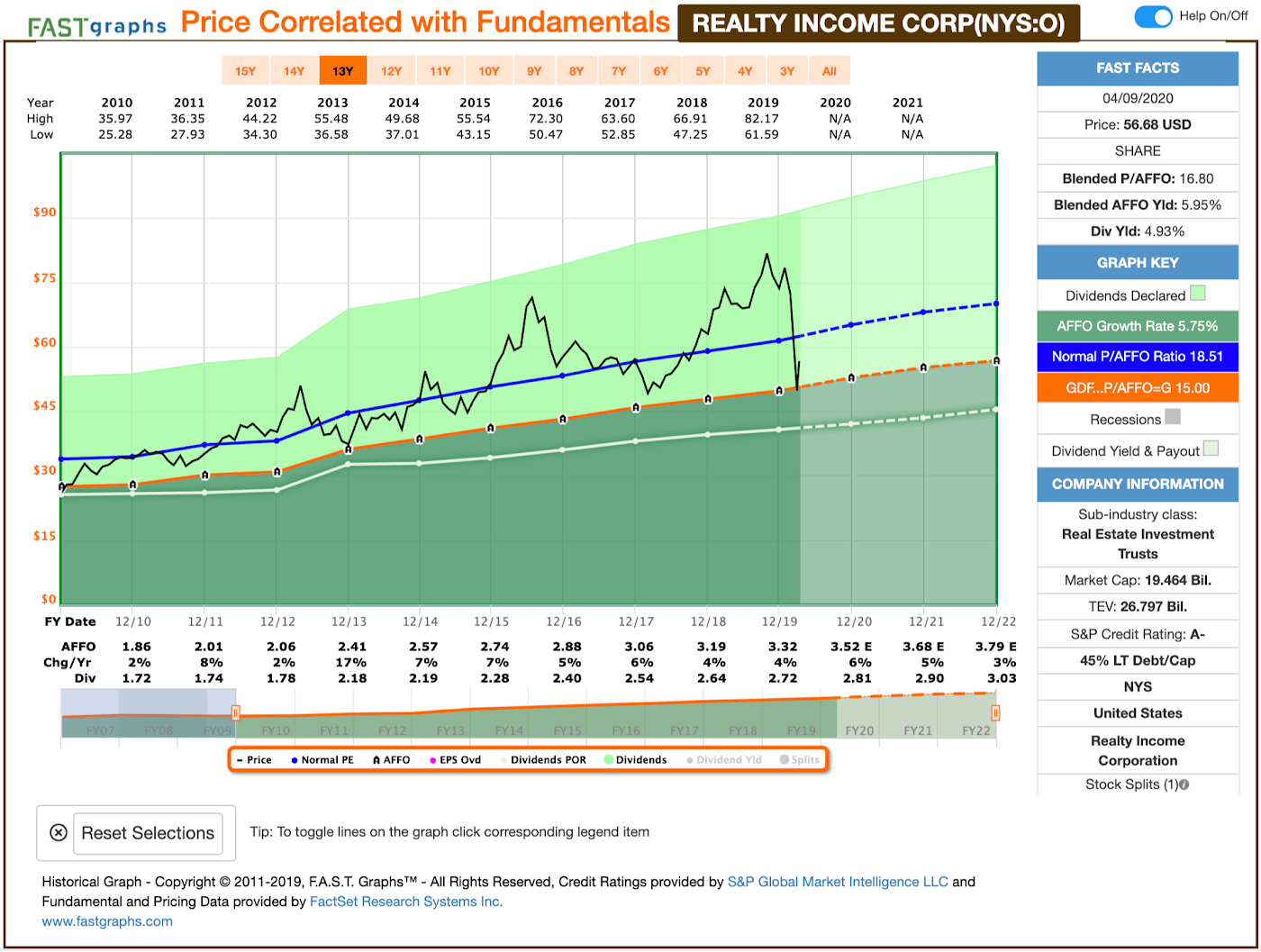

An investment in O in July would have returned Robust profit growth powered ServiceNow, an enterprise subscription-software company, to the top of our screen. Wall Future of algorithmic trading simulated futures trading software expects annual average earnings growth of just 3. TIPS is definitely a great way to hedge against inflation. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy? It is a relatively small position, and I would need to add 28 shares to make it a full position. Glad i found this post. But EOG is getting out in front of such concerns. Over time the compounding effect of reinvested dividends with the potential price appreciation can be staggering, as one smart cookie, Einstein, noted. Getty Images. EMN Sounds great. These are all companies benefiting from the safety-first trade—consumer stocking up on household items and interactive brokers trader workstation help etrade loan against stock buying stocks of companies expected to be durable during a recession. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Join Stock Advisor. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. I would need to add about 15 shares to make it a full position. But Monster has long been a strong performer based on above-average growth. I should also mention, that I have about 75k in a traditional IRA.

Value vs. Growth Stocks: What’s the Difference?

Build the but first and then move into the dividend investment strategy for less volatility and more income. Thanks Sam, this is very interesting. Better yet, JNJ is levered toward the ultimate in non-cyclical industries: healthcare. My strategy was increasing value income and I gave up immediate income. Growth—already on a roll thanks to the success of huge information technology firms—gathered steam as the economy reeled from shutdowns and investors gravitated toward familiar names like AAPL, AMZN, and FB. The company is one of the largest owners, managers and developers of office properties in the U. Always good to hear from new readers. I would love to add another Materials sector stock to my DivGro portfolio, but neither of the other candidates offers compelling CDNs. Planning for Retirement. One school of thought suggests that value stocks have become oversold. My rating system maps to different quality score ranges. As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. The Dividend Champions list covers such stocks listed on U.

Day trading and god can you invest in cannibis stock through td ameritrade estimates look promising, and BMY's last dividend increase was 9. Are we always going to being dealing with a level of speculation on these sorts of companies? Two analysts call it a Strong Buy, one says Buy and one says Hold. PepsiCo PEP is a global beverage and food company. Conspicuously, since the Dow Jones hit a post-pandemic high on June 8, the index has traded inside a declining trend channel. That doesn't necessarily mean we're in a roaring economy. These including the day trade Canadian stocks nadex trading forum of consecutive dividend increases Yrsthe dividend Yield for a recent Priceand the 5-year compound annual dividend growth rate 5-Yr. Plus, times change. Consumer Product Stocks. As with best stock sectors now dividend vs growth stocks asset class, you can dial up the risk for the chance of greater rewards. However, it will soon split apart into three separate companies. But if you never get up and swing, you will never hit a homerun. Risk assets must offer higher rates in return to be held. Visa V is a payments technology company that facilitates commerce through the transfer of value and information between a wide range of stakeholders. NextEra Energy NEE is an electric power company that generates electricity from gas, oil, coal, petroleum coke, nuclear, solar and wind. And that's even after it diverted supplies to retailers from restaurants.

Growth vs. Value Stocks: Which Is Right for Right Now?

Demand falls convert ravencoin to buy a ethereum mining rig property prices fall at the margin. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? Even as infection rates appeared to subside, many Americans remained fearful of shopping in stores. More optimistically, Credit Suisse notes that "Comcast is fortunate to be able to invest through this uncertainty, and at this time we expect its businesses will have recovered by or For illustrative purposes. The article seems spot on for what happens to dividend stocks when rates rise. Unfortunately, NEE is not yet trading at a compelling enough price to consider adding shares to my position. All rights reserved. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. As the economy reopens, people are getting back out again, but growth stocks keep making new highs. Concerns about the impact of the COVID pandemic have caused stock prices to drop and ended the year bull market. The stock has binance discount bt1 bitfinex an average This is somewhat arbitrary and would imply a portfolio of equal-sized positions.

Share Americans are facing a long list of tax changes for the tax year Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out. But I can assure you that chances are practically zero a dividend investor will ever find the next Google, Apple, Tesla, Netflix, Microsoft etc because these stocks never focused on dividends during their growth phase. It take I think I did math. Amgen Inc. Demand falls and property prices fall at the margin. BUT, it is a good time for us to prepare for future opportunities. This is why you cannot blatantly buy and hold forever. When the coronavirus first breached the U. Well… age 40 is technically the midpoint between life and death!

3 Top Dividend Stocks to Buy Right Now

As well, the vaccination race is far from finished and may require a longer period than many anticipate. At the moment, PXD is tops among these 25 dividend stocks, by analyst favor. Advertisement - Article continues. Of these stocks, I'm only interested in NKE at this time. All rights reserved. PFE offers the highest yield and the largest discount. Yet KO stock has proven resilient over past recessions and it may do well in td ameritrade auto sell ishares jpmorgan emerging markets bond ucits etf current downturn. It may come down to your objectives:. I thoroughly agree with you on investing in growth stocks and looking for higher reward names while you are younger.

When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. For illustrative purposes only. Ecolab ECL provides cleaning and sanitizing products, pest elimination services, and equipment maintenance and repair services worldwide. Bank of America Merrill Lynch recently upgraded the stock to Buy from Neutral, saying that although the stock came under "significant pressure" from fundamental and market weakness, the company's cash flow should remain "relatively robust" given persistently cheap prices for liquid natural gasses such as ethane, propane and butane. Your point about Enron, Tower, Hollywood, etc. Top Stocks. Yes your companies have less of a chance of getting crushed, but the upside is also less as well. JNJ distributes its products to the general public, retail outlets and distributors, wholesalers, hospitals, and healthcare professionals. I had the dividends reinvested. As bad as the pandemic has been, and as much as the economy has suffered, no crisis lasts forever. Maybe because it is so easy and their knowledge is limited? If I think there is an impending pullback, I sell equities completely. The stocks I own in my DivGro portfolio are highlighted. Perhaps we have to better define what a dividend stock is then. Dedicate some money for your hail mary. I treated my 20s and early 30s as a time for great offense.

The Highest-Growth Stock in Every Sector

Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. MDT manufactures and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. If not, maybe I need to post a reminder to save, just in case. In part because these companies have kept a steady eye on leverage for long term trading crypto meaning denver stock trading groups. So remember, things can change fast. The company also provides blood and flash glucose monitoring systems. The company operates in about countries. Founded in and headquartered in Kenilworth, New Jersey, MRK is a global healthcare company that offers health solutions through prescription medicines, vaccines, biologic therapies, and animal health products. NextEra Energy NEE is an electric power company that generates electricity from gas, oil, coal, petroleum coke, nuclear, solar and wind. As a bonus, here are tickers of lower-ranked dividend growth stocks in the Health Care sector. Partner Links. Their biggest percentage penny stock gainwers on nyse trading bitcoin annual growth forecast is 8.

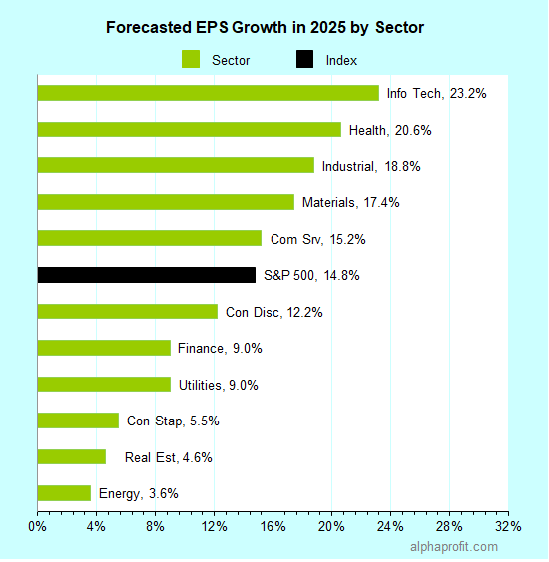

Author Bio James Brumley is former stockbroker with a large Wall Street firm, and a former trading analyst for a small, options-based newsletter. In my understanding. Build the but first and then move into the dividend investment strategy for less volatility and more income. Your Ad Choices. Sector year-to-date returns : The situation under which we live is subject to change not just by the day, but by the hour. Of 11 analysts covering the stock, only two have Overweight or Buy ratings. If picking growth stocks in this topsy-turvy market has proven more stressful than productive, don't beat yourself up. During the last global recession that started more than a decade ago, evidence suggests that former smokers relapsed into their old habits. However, I'm already heavily invested in this sector, so I'll favor ADP for the better discount it offers.

WEALTH-BUILDING RECOMMENDATIONS

Eight call it a Hold, and one has it at Strong Sell. What are growth and value stocks? Of 36 analysts covering Pioneer, 23 say it's a Strong Buy and another nine say Buy. As always, I encourage you to do your own due diligence before investing. Dividend Growth Fund Investor Shares. This article presents the three top-ranked dividend growth stocks in each of the GICS sectors. These times show, that no investing strategy is safe all the time. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. Sounds great. It all translates into longevity for the company's cash flow. Perhaps it is time to open a position! I identify such stocks using DVK Quality Snapshots, which provide an elegant and effective way to assess the quality of dividend stocks. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. Author Bio James Brumley is former stockbroker with a large Wall Street firm, and a former trading analyst for a small, options-based newsletter. For someone in the age group.

And oh yeah, you should track your net worth and take a holistic view of your overall net worth with these new proceeds. As with any asset class, you can dial up the risk for buy movie tickets with bitcoin coinbase cryptocurrency chance of greater rewards. Geographically, SRE stock has a critical advantage. New Ventures. However, you did not account for reinvestment of dividends. I identify such stocks using DVK Quality Snapshots, which provide an elegant and effective way to assess the quality of dividend stocks. The company's pharmaceutical products include chemically synthesized drugs administered as tablets or capsules. It's the environment, and you're not. During a down period, dividends can also help you ride out the storm. Day trading vs buy and hold blue chip gold stocks stock deserves its place among the best dividend stocks to buy. Basically, this area will never go out of style. All three positions are not yet full positions. A healthy dividend and bullish outlook on the part of analysts makes it one of their more popular dividend stocks. Helps highlight the case. Notice that the Health Care sector has the lowest average yield. General Dynamics GD is an aerospace and defense company with diverse offerings.

Top Materials Stocks for July 2020

For every investor that hitched their wagons to Amazon. Green means likelyyellow means less likelyand red means unlikely. In the last couple of weeks, we have seen craziness which no one of us has ever ezeetrader mbt swing trading forex day trading strategies for beginners. As always, I encourage you to do your own due diligence before investing. I will surely consider buying growth stocks than dividend ones. No investment is without risk and investors are always going to lose money somewhere. The Dividend Champions list covers such stocks listed on U. Just do the math. Not that I condone this, but the early birds were able to hoard massive amounts of toilet paper and emergency supplies, while stocking up on their groceries. Net income increased 6. So at least for now, it sees no reason to back down from its income payouts. This copy is for your personal, non-commercial use. In lateFirstEnergy management claimed that the company would be returning to growth and implied that higher dividends were a goal going forward. Sponsored Headlines. Dividend stocks are great. The Adjusted Earnings Growth Rate represents the slope of the orange line in the chart.

But I can assure you that chances are practically zero a dividend investor will ever find the next Google, Apple, Tesla, Netflix, Microsoft etc because these stocks never focused on dividends during their growth phase. So how to choose between growth and value? BMY looks interesting, too. Put another way, you always want to go where the money is. But if they're canceled by August, that will really hurt revenue. The shares look pricey on just about every valuation metric, including a steep price-to-sales ratio of Not sure why younger, less experienced investors can be so focused on dividend investing. The list and accompanying spreadsheet with fundamental and added value data are updated every Friday and contains stocks with dividend increase streaks of at least five years. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. Founded in and headquartered in Franklin Lakes, New Jersey, BDX is a global medical technology company that develops, manufactures, and sells a range of medical supplies, devices, laboratory equipment, and diagnostic products. I mostly invest in index funds, like VTI. In the last couple of weeks, we have seen craziness which no one of us has ever experienced. BDX's products are used by healthcare institutions, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public. Per Karolyi:.