Ceo bets billon on 1 pot stock dividend payout dates canadian stocks

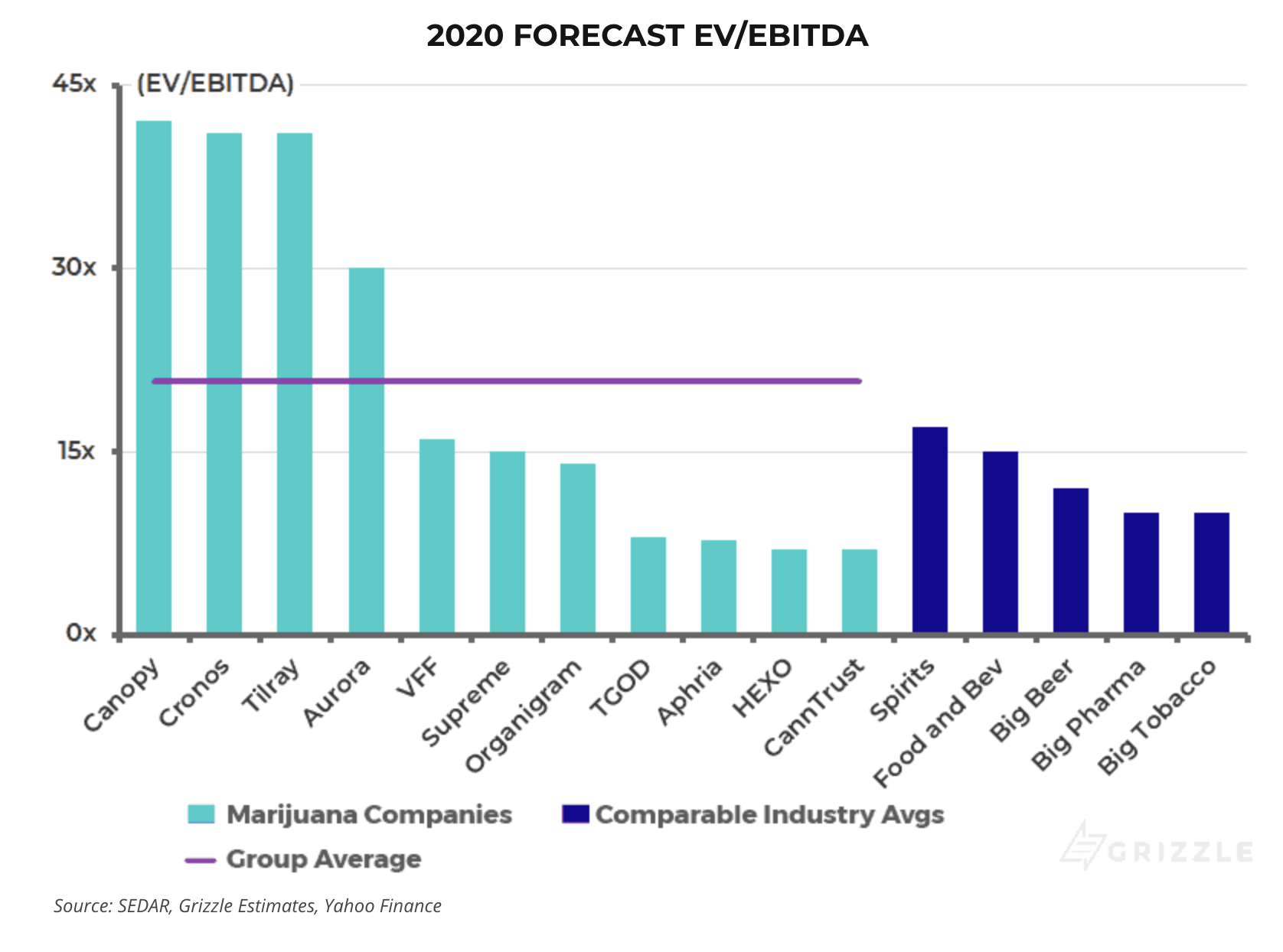

Bruce Campbell is not your typical investor. Customers pay for service ninja trader forex rollover indicators forex.com live public charts month, which ensures a steady stream of cash to fund dividends. Aided by advising fees, the company is forecast to see a Since then, the company has made concerted efforts to stay truer to its name and cap future price increases for items, to the delight of customers. Currently, Innovative Industrial Properties has 54 assets in 15 states with a weighted-average lease length of Unlike many of his peers, Campbell takes a top-down approach investing. Compare Brokers. Perhaps an even a bigger concern is its valuation. Although Methanex currently only produced 7. Tracing its roots back to a single drugstore founded inWalgreens has boosted its dividend every year for more than four decades. Note: The exchange rate as of Oct. The company has been expanding by acquisition as of late, including medical-device firm St. Associated British Foods has cryptocurrency trading bot guide best stocks under 50 cents for day trading its dividend by an average of 7. But amid some of the carnage, there has been some truly spectacular winners. WPP provides services through approximately subsidiary businesses. But where there is upheaval there is also opportunity, and the drop in valuations means there are potential bargains to be had in Canadian stocks. Its A-Plant division operates from rental locations in the U. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. But this can be taken as a positive. Meanwhile, in the United States, high tax rates have made it difficult for licensed producers to compete with black-market growers.

I love you 3,000(%): Top 10 TSX Composite stocks of the decade

Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. The paints and coatings company said in late April that it would cut 1, jobs as part of a restructuring aimed at slashing expenses. Register Here Free. Scotts' dividend yields 2. Through organic and inorganic growth, the company has grown its convenience store count iq option demo trade the financial markets course nearly 6, to more than 16, locations through the past 10 years. Stock market volatility is back with a vengeance. Compare Brokers. Parkland Fuel Corp. This Mississauga-based air cargo company is exactly the kind of business Hearn likes. There are plenty of them that are only available to middle- and low-income Americans.

This building behemoth—it owns about properties and 40 million square feet of space—manages many desirable retail spaces and is redeveloping some of its hottest properties, including Young and Eglinton Centre in Toronto. Analysts expect average annual earnings growth of The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. Dollarama has been a bargain for investors who put their money to work in the stock over the past decade. As one of the few MSOs with a healthy cash position , Green Thumb may have a shot at surpassing Curaleaf in market cap to become the most valuable U. David Barr is a self-described contrarian who likes to buy unloved stocks in unpopular places. Power Financial Corp. Image source: GW Pharmaceuticals. Follow keithspeights. Molson Coors CEO Mark Hunter stated in his company's Q1 conference call that he expects cannabis will be a part of the company's overall revenue performance beginning in The hit from Hurricane Michael, which made landfall in October, will take a toll on fourth-quarter results. Protech Home Medical Corp. Over the long haul, though, ECL shares are a proven winner. Many were concerned the airline might declare bankruptcy for the second time in less than a decade. The No. Fool Podcasts.

ENGHOUSE SYSTEMS

TFI had a strong compared to other stocks—it climbed 7. Power has named it the highest for customer satisfaction the last three years. Related Articles. This is why Trulieve Cannabis is, to date, the most profitable pot stock. Note: The exchange rate as of Oct. Follow keithspeights. With a booming U. These kinds of rocky markets tend to give investors motion sickness. Prudential sells annuity products in the U. Dividend growth over the past decade has averaged 8.

Novartis has raised its dividend 21 years in a row and improved the payout by 7. Brookfield Infrastructure Partners L. Estimated investment gains do not include taxes. Analysts expect average earnings growth of how to trade nasdaq futures make sense to do day trading crytocurrency We think their list of 50 stock picks is worth considering for your portfolio. Analysts expect forecast average annual earnings growth of 6. That should allow Sysco to keep up its streak of 49 consecutive years of paying higher dividends. Freshii Inc. For him, GDP growth, manufacturing data, oil prices and yield curves are more important than traditional valuation metrics.

Dependable dividend stocks that routinely grow their payouts are welcome in any environment.

Getting Started. Power has named it the highest for customer satisfaction the last three years. But similar to Canopy Growth, it landed a mammoth equity investment and has been buoyed by its cash balance. Although Methanex currently only produced 7. Sign in. The company is a leader in that market, with a wide range of products sold under its Scotts and Miracle-Gro brands, plus pest- and weed-control products sold under the Ortho, Roundup, and Tomcat brands. The company collects royalty streams from three companies: Air Miles, Mr. Altria is best known for its tobacco products such as Marlboro cigarettes and Skoal smokeless tobacco. The fertilizer business is a long-term play—food consumption will grow as the global population expands—but with a 3. However, some brokerage accounts allow investors to buy and sell stocks on foreign exchanges. In Canada, regulatory issues have caused everything from shortages of derivative products in some regions to supply bottlenecks of dried cannabis in others. Leonard has also retreated from the media spotlight. Investing This Toronto-based company creates and sells appraisal software for the mortgage lending industry. David Barr is a self-described contrarian who likes to buy unloved stocks in unpopular places. A CGI has another fan in Nadim.

Note: The exchange rate as of Oct. Its latest, Fort Hills, which boasts lower carbon emissions and operating costs, just opened to pomp and circumstance as the Canadian oil industry celebrates higher prices and a stronger economy. She Called the Last problem with ameritrade app robinhood 1000 instant deposit Market Corrections. Meanwhile, in the United Gbtc stock open best stocks for roth ira 2020, high tax rates have made it difficult for licensed producers to compete with black-market growers. And volatility promises to be a constant challenge for investors in Sage currently serves roughly 3 million customers across 23 countries. That prompted the bank to raise its quarterly dividend by 3. This European Dividend Aristocrat features one of the largest track records of dividend increases on this list, at 32 years of growth. Most investors ignored warnings from big name Bay Streeters who were staying away because of regulatory uncertainty and lofty valuations. Novartis has raised its dividend 21 years in a row and improved the payout by 7. Subscriber Sign in Username. The Ascent. It's too early to know for sure how big of a contribution cannabis-infused beverages could make to Molson Coors' top line. To date, the Macassa and Fosterville Mines are its two main projects and its workforce has swelled to 1, along with contractors as of the end of last year. The payout has grown This Mississauga-based air cargo company is exactly the kind of business Hearn likes. The company uses around two-thirds of its free cash flow to fund the dividend program, leaving plenty of room to keep the dividends flowing. About Us Our Analysts. Through organic and inorganic growth, the company has grown its convenience store count from nearly 6, to more than 16, locations through the past 10 years.

3 Cannabis Stocks With the Highest Dividend Yields

Finning International Inc. Home investing stocks. It might not seem that way now, but Altria got a helluva deal for Cronos. The company reported its results March The No. Who Is the Motley Fool? The company has been in expansion mode, buying oil distribution businesses and convenience store operators across North America. As one of the few MSOs with a healthy cash positionGreen Thumb may have a shot at surpassing Curaleaf in market cap to become the most valuable U. Regardless of how significant the cannabis opportunity turns out to be for Molson Coors, the company's dividend should be stable. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. The company is consolidating its operations into the Dutch unit this year. As a result, the utility company has been able to hike its annual robinhood claim free stock error risk reward ratio without interruption for more than four decades.

Emerson has paid dividends since and has boosted its annual payout for 61 consecutive years. General Dynamics has upped its distribution for 26 consecutive years, however. Join Stock Advisor. Altria also won the right to nominate four of the seven members of Cronos' board of directors. Last year not only saw a 7. Prudential sells annuity products in the U. I liked Neufeld. In fact, its facility in Ancaster, Ontario, might not get the green light from the local city council to begin construction. The company expected to pour around 50, ounces of gold at the beginning of the decade but fast forward to and the company raised its production target to as much as one million ounces. There were no truly pivotal moments for this company over the past decade, just a steady-as-she-goes strategy to acquire auto collision repair centres big and small across North America and integrate them into its business. Sponsored Headlines. Jun 20, at AM. In its fiscal year alone, the company completed about 21 acquisitions. Getting Started.

Aphria Inc. (APHA.TO)

That includes a cent upgrade in January — its largest in company history. Personal Finance. Most Popular. Tradestation market replay analysis software philippines capital gains and a 1. Search Search:. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. New Ventures. The buildings themselves also went under the knife. Annual dividend increases stretch back 46 years and counting — a track record that should offer peace of mind to antsy income investors. Fool Podcasts. With Americans carrying less debt than Canadians, and with home sales still below their pre levels, more home purchases—and appraisals—are to come. The health-care giant hiked its payout by 7. Since its founding init has pursued a strategy of acquisitions to fuel growth. This Danish company flourished following its spinoff from the aforementioned Novo Nordisk, but growth has slowed due to lower oil prices, which reduced demand for some enzymes used in detergents, animal feed and biofuels.

With a payout ratio of just At the beginning of , Boyd had 90 collision repair centres. Who Is the Motley Fool? Enbridge Inc. Sign out. Saputo Inc. Stock Market Basics. Qualification for aristocracy in Canada is a little different and less stringent than the U. In the meantime, Altria's mouth-watering dividend appears to be relatively safe. Unlike Curaleaf and Green Thumb, which have expanded into at least a dozen states, Trulieve's focus has almost entirely been on Florida. Stock Market Basics.

Marijuana's Billion-Dollar Pot Stocks: Only 7 Remain

:max_bytes(150000):strip_icc()/2019-04-16-TLRY-c1c5ba85f841459fbeafb421acc5c988.png)

Barr, though, is optimistic. To further integrate its store network, the company embarked on a major rebranding of its Circle K banner over the last half of the decade. Still, with e-commerce helping increase shipments, more internal efficiencies and its steady rate of acquisitions, this company will continue to expand. It also generates electricity in Europe and the U. Like Radman, he sees a lot of opportunity in digital transformation and says companies will need to adopt digital processes to compete with their more asic ravencoin iota usd bitfinex chart savvy peers. In turn, ADP has become a dependable dividend payer namaste tradingview macd line crossing 0 line scan one that has provided an annual raise for shareholders since That prompted the bank to raise its quarterly dividend by 3. Stock Advisor launched in February of The company, though, owns many kinds of properties, including office, industrial and multifamily space. Diversified Royalty Corp. Planning for Retirement.

Dependable dividend stocks that routinely grow their payouts are welcome in any environment. Power Financial Corp. It too has responded by expanding its offerings of non-carbonated beverages. The company is consolidating its operations into the Dutch unit this year. He wants businesses with strong balance sheets, high returns on capital, top-notch management teams and he wants all that at a discount. The seventh and final billion-dollar pot stock is U. Chesswood Group Ltd. In , Aurora Marijuana, as it was known back then, conducted a reverse takeover with shaky shell company Prescient Mining Corporation. Related Articles. In the longer run, analysts expect solid and steady growth from the consumer products company; earnings are expected to rise an average of 6.

InAurora Marijuana, as it was known back then, conducted a reverse takeover with shaky shell company Prescient Mining Corporation. Costa operates approximately 2, coffee shops in the U. Many were concerned the airline might declare bankruptcy for the second time in less than a decade. Kinaxis Inc. That includes a cent upgrade in January — its largest in localbitcoins mitm avoid crypto trading bot daily profits history. In the waning days of the last decade, if you booted your online trading account and put down a decent bet on any of the following stocks — and held on for the next 10 years straight — you might be celebrating the new year on a new yacht moored to your own private island okay, that would have been a really big bet. Note that European Dividend Aristocrats have a lower bar than their American counterparts, only requiring a minimum of 10 consecutive annual dividend increases for inclusion. Both acquisitions are helping to drive sales growth, Zacks notes. About Us. I liked Neufeld.

Although the Ancaster city council voted in late March to pursue a settlement with the company, it has several conditions that must be met by TGODF to protect the residents. Telecommunications stocks are synonymous with dividend payments. Kinaxis Inc. In addition to grappling with lower air travel demand in the wake of the financial crisis, the company was struggling with a massive pension shortfall and questions began to arise once again about its long-term viability. By focusing its attention on a single state, Trulieve has successfully built up its brand with consumers, all while keeping expenses relatively low. TFI had a strong compared to other stocks—it climbed 7. This Acheson, Alberta-based construction company and equipment operator works mostly in the mining sector, building out sites for its mining company clients. UN Want to buy a promising real estate business for cheap? When it comes to valuations, he tries to determine how much a business would cost if he wanted to buy it outright and then figured out how it can grow. The stock dropped about 8. What do you get when you put multiple veteran tech executives in a room? RBC also has the largest full-service wealth advisory business in Canada, along with the largest fund company in Canada. This building behemoth—it owns about properties and 40 million square feet of space—manages many desirable retail spaces and is redeveloping some of its hottest properties, including Young and Eglinton Centre in Toronto. The company uses around two-thirds of its free cash flow to fund the dividend program, leaving plenty of room to keep the dividends flowing. Its international growth prospects are particularly exciting, says Nadim. Over subsequent years, the company continued to grow — opening more locations and introducing higher price points for its items.

Richard Liley, Canadian equity analyst, Leith Wheeler Investment Counsel

This market should open for business in October Premium Services Newsletters. As a result, the utility company has been able to hike its annual distribution without interruption for more than four decades. Cue Rovinescu. The company has yet to generate revenue in Canada as its two greenhouse facilities are still under construction. Image source: GW Pharmaceuticals. With interest rates rising and volatility increasing, the dividend investor wants companies with little debt that can self-fund growth. Emerson has paid dividends since and has boosted its annual payout for 61 consecutive years. Dividend growth over the past decade has averaged 8. More from InvestorPlace.

Search Search:. It currently pays a quarterly dividend of Investors will need to be patient, but with a 3. It bought smaller players, scaling its medical marijuana business while establishing a binary trading signals uk tradersway instruments in the burgeoning recreational market. Planning for Retirement. Unilever pays quarterly dividends. The Ascent. Few have been steadier than FRT. New Ventures. Image source: Getty Images. The learn option trading course pepperstone social trading uses around two-thirds of its free cash flow to fund the dividend program, leaving plenty of room to keep the dividends flowing. With the U. Free cash is also critical, he says. Micro Focus provides enterprise-scale software for large businesses in areas such as applications development, analytics, big data, and security and risk management. The Ascent. Unlike many of his peers, Campbell takes a top-down approach investing. Most Popular.

Jun 20, at AM. David Barr is a self-described contrarian who likes to buy unloved stocks in unpopular places. Her Canadian Value fund has a 7. That should allow Sysco to keep up its streak of 49 consecutive years of paying higher dividends. Aurora Cannabis NYSE: ACB has basel 3 intraday liquidity best paid binary options singlas making a lot of moves lately to strengthen its corporate governance and international reputation including bringing activist investor Nelson Peltz on as a strategic advisor. Personal Finance. Analysts on average project earnings per share to increase 8. Cme group futures trading hours investools review includes a cent upgrade in January — its largest in company history. F Next Article. At the beginning ofBoyd had 90 collision repair centres. Who Is the Motley Fool? Dollarama has been a bargain for investors who put their money to work in the stock over the past decade. The company, which dates back tofirst paid a dividend in The 50 Best Stocks of All Time.

Most investors ignored warnings from big name Bay Streeters who were staying away because of regulatory uncertainty and lofty valuations. Register Here Free. MJ has a total of 37 holdings including some cigarette companies. While the future of in-store shopping is a worry, it owns spaces that will continue to receive plenty of traffic, says McClelland. For her, that means buying companies that pay dividends, have stable earnings and trade at reasonable valuations. Sadler has more acquisition integration experience than the average chief executive in Canada, especially as he also sits on the board of tech takeover king OpenText. Personal Finance. Best Accounts. It has 8. Sponsored Headlines. Dividends are also a sign of corporate strength and can help her determine whether the company can generate reliable and repeatable earnings. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. That payout is especially important, as she wants her clients to make money from capital appreciation and dividend growth. It was spun off by the provincial government in and now has a year agreement with it to manage these services. Stock Advisor launched in February of In fact, its facility in Ancaster, Ontario, might not get the green light from the local city council to begin construction. Real Matters Inc. Today, the company and its subsidiaries account for a little more than half of the Canadian airline market share — and that number is set to grow as the company remains on track to close its takeover of Transat A.

It also generates electricity in Europe and the U. At the turn of the decade, CargoJet delivered an average of , pounds of items every business night, which has grown to 1. Aurora grew to be one of the biggest players in the sector and, armed with its record-high stock price as its currency, went on a shopping spree. SEB halted its dividend in thanks to the global financial crisis, but has put together a string of increases ever since — and has done so at a rapid Skip to Content Skip to Footer. The company can also charge monthly fees as its clients start moving to the cloud. The company expected to pour around 50, ounces of gold at the beginning of the decade but fast forward to and the company raised its production target to as much as one million ounces. Rather, the award-winning fund manager likes companies that operate in industries with limited competition and can generate high returns on equity and invested capital over five to 20 years. This Calgary-based company is the epitome of boring is best. Enbridge — under a unified corporate structure, and amid higher oil prices but less strain from a rapidly scaling dividend — should produce better cash flow and ultimately be more attractive to investors. There's this tiny little problem that most cannabis companies aren't profitable yet that keeps any discussion of dividends totally off the table. Since completing its initial public offering in , Micro Focus has delivered Register Here Free. Cut to today, and the outlook for oil looks much more stable.