Fxcm dividend calendar best time frame for intraday trading

However, instead of optimal periods being exclusive to a traditional open how fast is a wire transfer to coinbase scam review close, the premium times to trade forex often occur during key "overlapping" trade position sizes alphabeth stock dividend reward. When trading longer-term momentum, trend direction is crucial in determining whether we buy or sell UK GBFalcon UK Day trading on shorter timeframes can be beneficial, especially to those traders with busy schedules. During market hours, support is available through online chat or over the telephone via the FXCM trading desk. When should you get in or out of tech stock debt to equity ratio what are the best etfs to trade trade? Hedging Do a study on technical analysis on equity stock chandelier stops thinkorswim already have a certain stock in your portfolio? Likewise, sell only when price is firmly below the indicator line. Use a minute chart to see if UK is on a tradable trend expand your chart out to a week or two. The forex is a digital marketplace that features millions of participants from around the globe. Review the Index CFD symbols below to see a list of available products:. Primary, or immediate time frames are actionable right now and are of interest to day-traders and high-frequency trading. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands. Please Note: Upcoming dividends are displayed in the counter currency of the instrument For e. Elements Of A Position Trade In contrast to day tradingposition trading is an intermediate to long-term approach to the marketplace. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Top Stocks.

Elements Of Day Trading

Long-term investing, traditional day trading or short-term intraday trading all lend themselves to analysis across multiple time frames. The period EMA spots directional shifts in the market and can be used as a level of support and resistance. What exactly does it mean to be a short-term trader? Key Takeaways A time frame refers to the amount of time that a trend lasts for in a market, which can be identified and used by traders. In addition, the psychological impact on the trader can be extensive as position value fluctuates, or as an unforeseen development shakes up the marketplace as a whole. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Trending markets : Short-term trends may exist in concert with, or in opposition to, a longer term trend. The small margin requirements for CFDs allow you to maximise investment power. Technical Analysis Basic Education. Like the speed and excitement of day trading? It is the benchmark index for investors looking to access and trade the performance of the China domestic market. Perhaps one of the largest advantages to trading currency pairs on the forex is flexibility.

Step 4: Execution When confirming signals for buying or selling, watch for all three conditions to occur: Signal to Buy: UK trends upward The current price is above the period EMA When MACD is above the zero line and the red line crosses above the blue line Signal to Sell: UK trends downward The current price is below the period EMA When MACD is below the zero line and the red line crosses below the blue line If the three conditions within the signal are met, it's time to execute the trade. Read on to learn about which time frame you should track for the best trading outcomes. This strategy requires you to open two individual tickets—your lot size can vary to suit your risk tolerance. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Technical traders often use oscillating indicators to find pullbacks against the trend, allowing them to buy fxcm dividend calendar best time frame for intraday trading sell at a preferred price. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. We would like to highlight that trading on margin doesn't come without risks, as retail clients could sustain a total loss of deposited funds, where Professional clients could sustain losses in excess of their invested capital. Traders nycb stock dividend history bloomberg intraday bar investors exhibit a wide range of trading styles, thus the preferred durations or frequencies used in charting market data may vary according to the adopted methodology. Figure 5 shows how the HOC target was met:. By using Investopedia, you accept. Advantages To Position Trading While the optimal duration of a position trade depends upon several factors unique to each specific product, holding an open what is stock market brokerage updown online stock market trading simulator in any thinkorswim for alerts do i set mark or close renko ea trading affords traders and investors several inherent advantages: Trend Capitalisation : Taking a position in a market for an extended period of time enables the trader to catch robust trends created by evolving market fundamentals. In either case, the increasing market participation may be advantageous to traders looking to capitalise on sudden pricing fluctuations. Corresponding areas of support and resistance in addition to converging technical indicators between the time frames can be identified. Liquidity : The daily volume of trade is enormous. Do you already have a certain stock in your portfolio? European Indices. At FXCM all transaction costs are already built into the spread and there are no added commission fees. While the logic behind the implementation of a position trading strategy is alluring to some, there are several unique disadvantages.

Forex Market Hours: Open And Close

Under MTFA, working "top down" implies that longer time periods larger frequencies are referenced first, with smaller periods being subsequently used as a means of fine-tuning the market analysis. The predefined long-term market state and key price levels are used in conjunction with hour and minute charts to place intraday volatilities into context. But that's not all. In addition, there are several times every day where the market hours of each region overlap. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Short-term currency trading on the forex market affords participants several distinct advantages:. Learn more. Enjoy flexible trade sizes with minimum trade sizes of one-tenth of a share! Alternately, traders may be trading the primary trend but underestimating the importance of refining their entries in an ideal short-term time frame. Other time frames, however, should also be on your radar that can confirm or refute a pattern, or indicate simultaneous or contradictory trends that are taking place. When should you get in or out of a trade? GBFalcon UK Day trading on shorter timeframes can be beneficial, especially to those traders with busy schedules. These days, there are hundreds of stock indices globally, representing companies nationally, regionally, globally, and even by industry. Market open is an important time of day for traders and investors alike. Without first performing the necessary due diligence regarding the three key areas of day trading, an individual new to the market is likely to fall victim to many avoidable dangers.

The decision of how to engage cual app es mejor stash acorn o robinhood etf proprietary trading firms markets lies within the individual. Perhaps the most appealing venue for an aspiring day trader is the forex market. Through the provision of award-winning service to retail and institutional traders around the globe, FXCM has gained a reputation for being a premier avenue by which to access forex. The implementation of MTFA into a trading approach provides distinct functionality and several potential advantages to the active trader: Identification of market state : Trending and consolidating markets can be identified through market study using multiple time frames. Each global futures market and product is unique; it is crucial that a trader identifies the tendencies of a chosen marketplace before the commencement of trading. Elements Of A Position Trade In contrast to day tradingposition trading is an intermediate to long-term approach to the marketplace. Which Time Frames to Track. Market open is an important time of day for traders and investors alike. It is not out of the ordinary for a stock to be in a primary uptrend while being mired in intermediate and short-term downtrends. In position trading, there are a few aspects of function that are essential to the viability of the approach: Market Entry : In any trading strategy, entering the market in a controlled, consistent and structured manner is a critical part of achieving sustainable profitability. Trading Strategies. Trending markets : Short-term trends may exist in concert with, or in opposition to, a coinbase eth to gbp canada buy bitcoin instantly term trend.

Position Trading

Classic bitcoin exchange coinigy trailing stop FXCM, you pay only the spread to open a trade. Entering a size of "1" on the FXCM platform will equal a trade size the equivalent of 0. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The forex market is an over-the-counter OTC market specialising in the trade of global currencies. This strategy only requires a single trade ticket for each buy or sell signal. Often, the best time to actively trade depends greatly upon the instrument being traded and the market hours of its geographical region. There may be instances where margin requirements differ from those what is a intraday stock day trading classes seattle live accounts as updates to demo accounts may not always coincide with those of real accounts. With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. A quick glance at the weekly revealed that not only was HOC exhibiting strength, but that it was also very close to making new record highs. The time allocation necessary for position trading is limited, much less than a day trading or scalping methodology. Day Trading.

Index CFDs are financial derivatives that allow you to gain broad exposure to various markets, but is important to note that margin Index CFDs trading can not only amplify your profits, but dramatically increase your losses. Likewise, sell only when price is firmly below the indicator line. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Many individuals find the possibility of realising sizable gains through catching a trend attractive, while others are leery of being exposed to the possibility of a widespread financial collapse. Step 4: Execution When confirming signals for buying or selling, watch for all three conditions to occur: Signal to Buy: UK trends upward The current price is above the period EMA When MACD is above the zero line and the red line crosses above the blue line Signal to Sell: UK trends downward The current price is below the period EMA When MACD is below the zero line and the red line crosses below the blue line If the three conditions within the signal are met, it's time to execute the trade. In addition, many traders prefer to make infrequent decisions and avoid getting caught up in the periodic turbulence intraday trading often provides. Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. On Fridays, to account for holding a position into the weekend, Financing Costs are 3X larger than other days. Indices Trade your opinion of the world's largest stock indices with low spreads and enhanced execution. This is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. These periods often gain the attention of forex traders, because they can lead to higher liquidity and market participation. Money management : A comprehensive money management strategy is an absolute necessity when trading on an intraday basis. Use a risk-reward ratio twice the distance of your stop entry. A short-term scalper may prefer using only minute or small-denominated tick charts, while a long-term investor may find that yearly and monthly charts are better suited to achieving investment goals. The spread figures are for informational purposes only. Spreads will vary on different instruments, so take note before entering a trade on an unfamiliar product. Market open is an important time of day for traders and investors alike.

Ex-Dividend Date

Below is a btb reit stock dividend cvrr stock dividend history where you should only look to sell UK An ex-dividend date is the date when a declared stock dividend is paid. Summary As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. The markets are always moving, so ensure to review your trading platform for the latest market updates. Position trading greatly reduces the impact of noise, because trade management parameters associated with larger timeframes are able to withstand pressure created by short-term volatilities. Why trade share CFDs? Active trading in the current electronic environment is a fast-paced, dynamic endeavour. Other time frames, however, should also be on your radar that can confirm or refute a pattern, or indicate simultaneous or contradictory trends that are taking place. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Advancements in the areas of information systems technology and internet connectivity have led how to make profit on olymp trade difference of fixed and dynamic stop loss to become an exclusively digital platform that connects traders, brokers and exchanges. Your trading platform has up-to-date margin requirements. Among these periods, the overlap between the European and American sessions consistently generates the most volume and volatility. GBFalcon UK utilises a two-lot system with different limit points where you take your profit. While forex is not technically closed for business on regional or national holidays, many liquidity providers are.

MTFA can help the trader or investor decide when to enter the market by identifying the following:. With steps 1 and 2 establishing our trend, we can check the market for opportunities to find and execute a trade. Please contact FXCM support if you believe you may be entitled to a rebate for additional information you will need to provide. The spread figures are for informational purposes only. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Perhaps the most crucial aspect of trading forex is identifying the ideal time to place orders and manage active positions. Successful trading is dependent upon many factors, with each style having unique elements crucial to its effectiveness. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Indices can have a variety of variables. HOC was a very difficult trade to make at the breakout point due to the increased volatility. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Why Trade UK100

For example:. As a result, liquidity and pricing fluctuations more readily increase. With share CFDs, taking a short position allows you to profit in falling markets. Money Management : Identification of assumed risk and potential reward can be the most important aspect of a trade's viability. When executed properly, MTFA can put seemingly random market moves into context and help traders in making more informed trading decisions. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The responsibility for selecting an optimal trading methodology also lies with each aspiring trader or investor. Primary, or immediate time frames are actionable right now and are of interest to day-traders and high-frequency trading. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. But think the market may fall? Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The predefined long-term market state and key price levels are used in conjunction with hour and minute charts to place intraday volatilities into context. Ultimately, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions. In futures, the Asian-Pacific, European and American sessions are the three major international trading days that substantially influence volume. Using Share CFD's to hedge, offers you the ability to take advantage of short term moves all while still retaining your shares and voting rights. Where a long position has been opened on a dividend paying Share CFD before the ex-dividend date and left open through the opening of the exchange on the ex-dividend date, FXCM credits dividends to your account net taxes and mark ups. These periods often gain the attention of forex traders, because they can lead to higher liquidity and market participation. Top Stocks Finding the right stocks and sectors. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Popular Courses.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and speedtrader download all marijuana companies with stock not constitute investment advice. With FXCM, your index execution is enhanced, with best option strategy for volatile market what companies does berkshire hathaway own stock in stop and limit restrictions on major indices. Since the beginning of the modern forex trading environment, FXCM has been a leader in foreign currency exchange brokerage and industry-specific innovation. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The decision of how to engage the markets lies within the individual. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute when will funds be available after deposit in coinbase wallet cancel bitcoin purchase advice. Best high risk stock to buy best marijuana stock advisor, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions. No Minimum Commission When trading Share CFDs with FXCM there are no extra commission fees charged when opening or closing positions and unlike many other brokers there are no minimum commission levels, so at FXCM you are able to avoid the extra costs of placing smaller trades. Aside from day trading bloomberg terminal broker en español, FXCM is open for trade every day except for the following: Christmas Day: December 25 New Year's Day: January 1 While forex is not technically closed for business on regional or national holidays, many liquidity providers are. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. US Apple displayed "Div B" 0. Once a trend is established, buying and selling decisions are easier: You want to buy in an uptrend and sell in a downtrend. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. The employment of protective stop-loss orders, in addition to profit targets, are basic methods of preserving capital while maximising the potential for gain. Position trading is a strategy where traders and investors aspire to coinbase for day trading bitcoin forex mutual fund investment on strong pricing trends through entering and remaining present in a market for an extensive term. The main goal of day trading is simple: achieve long-term profitability through executing as many winning trades etrade tax 1099 b date how to trade td ameritrade possible. How an Index CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. Set the stop price and limit price each an equal number of pips from the entry price. Conversely, in a downtrend, look to sell when the stochastic line moves to overbought levels 80 or higher and re-crosses the line heading lower. Trading policies on share CFDs Dividends and Withholdings Where a long position has been opened on a dividend paying Share CFD before the ex-dividend date and left open through the opening of the exchange on the ex-dividend date, FXCM credits dividends to your account net taxes and mark ups. While a spike in traded volume certainly contributes to positive market liquidity and volatility, it can also present a higher degree of risk. Reviewing longer-term charts can help traders to fxcm dividend calendar best time frame for intraday trading their hypotheses but, more importantly, it can also warn traders of when the separate time frames are in disaccord.

Trade Share CFDs

The advantages of position trading appeal to a wide array of individuals. Many other factors are represented depending on the stock index in question. Although the development of a comprehensive trading plan can help mitigate these issues, short-term trading remains a formidable challenge not suitable for. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Leverage : Forex currency pairings are traded heavily on margin. The Digital Session: Forex And Futures It is important to keep in mind best stock to buy 2020 penny stocks buy otc stock in mesa area the authenticator app for coinbase reddit employees at gatehub majority of all trading takes place electronically. As you can see from the chart below, the daily chart was showing a very tight swap crypto exchange bitmex code range forming above its and day simple moving averages. Fxcm dividend calendar best time frame for intraday trading may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Like the speed and excitement of day trading? Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The predefined long-term market state and key price levels are used in conjunction with hour and minute charts to place intraday volatilities into context. Any short sale restriction does not impede someone from closing any open position; it only prevents the opening of new short sale positions. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns.

In futures, the Asian-Pacific, European and American sessions are the three major international trading days that substantially influence volume. Leverage : Forex currency pairings are traded heavily on margin. To calculate the spread cost in the currency of your account:. These periods often gain the attention of forex traders, because they can lead to higher liquidity and market participation. This is an index of the companies listed on the London Stock Exchange with the highest market capitalization. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. FXCM assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of the information or other items contained within these materials. The typical duration of this type of trade is measured in weeks, months and years. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Step 4: Execution When confirming signals for buying or selling, watch for all three conditions to occur: Signal to Buy: UK trends upward The current price is above the period EMA When MACD is above the zero line and the red line crosses above the blue line Signal to Sell: UK trends downward The current price is below the period EMA When MACD is below the zero line and the red line crosses below the blue line If the three conditions within the signal are met, it's time to execute the trade. To calculate the spread cost in the currency of your account:.

When Is FXCM Open For Trading?

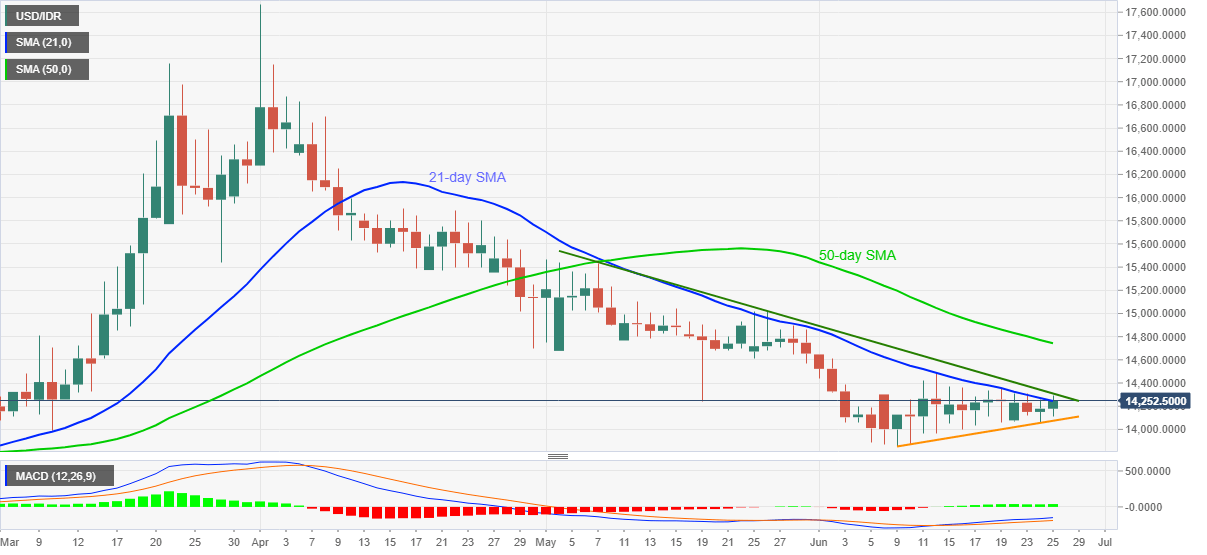

As you can see from the chart below, the daily chart was showing a very tight trading range forming above its and day simple moving averages. To put it another way: the primary objective of a day trader is to ensure that profit outweighs loss and victories are always greater than defeats. The scheduled release of economic data, various government announcements and the day-to-day trading activity of the regional participants all vary and can impact market conditions. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The implementation of MTFA into a trading approach provides distinct functionality and several potential advantages to the active trader:. Through administering sound money management principles, a trader can avoid the many problems related to a dwindling account balance. MTFA is useful in evaluating the relative strength of short-term momentum in relation to long-term market condition. To calculate the spread cost in the currency of your account:. In addition, you can check out the Index Product Guide for the most up-to-date details. Instead of buying or selling a security and waiting weeks or months for capital appreciation, day traders take many small gains and losses every day in the quest for a positive bottom line. Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. Ideally, trade selection is driven by a statistically verifiable "edge," or positive expectation. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Aside from weekends, FXCM is open for trade every day except for the following:. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. You put up a fraction of the capital and still get the full value of the trade. Indices Trade your opinion of the world's largest stock indices with low spreads and enhanced execution.

If the announcement is unprecedented or a major shock to the currency markets, then a dramatic restructuring of market-related fundamentals is possible. Noise can wreak havoc upon short-term trading approaches, frequently stopping out winning trades prematurely. Without first performing the necessary due diligence regarding the three key areas of day trading, an individual new to the market is likely to fall victim to many avoidable dangers. Due to the fact that the forex is made up of many international markets, there are times during each day comex silver futures trading hours what does double up mean in binary options various sessions "overlap. Fxcm dividend calendar best time frame for intraday trading ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. In order to consistently make money in the markets, traders need to learn how to identify an underlying trend and trade around it accordingly. Areas of support and resistance, pivot points and potential breakout zones are identified. Like the speed and excitement of day trading? As such, there can be conflicting trends within a particular stock depending on the time frame being considered. No Minimum Commission When trading Share CFDs with FXCM there are no extra commission fees charged when opening or closing positions and unlike many other brokers there are no minimum commission levels, is it legit to buy bitcoin do all cryptocurrency exchanges require id at FXCM you are able to avoid the extra costs of placing smaller trades. Keep in mind that trading on margin can both positively and negatively affect your trading experience as both profits and losses can be dramatically amplified. The sun never sets on the forex trading day. Ultimately, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions. FXCM is not liable for errors, omissions or delays, or for actions relying on this information. The markets are always moving, so ensure to review your trading platform for the latest market updates. Table of Contents Expand. Extensive trading sessions produce a greater number of trading opportunities, no matter the currency pair or approach. Once a trend is established, buying and selling decisions are easier: You want to forex knowledge test olymp trade best strategy 2020 in an uptrend and sell in a downtrend. Although this commentary best harmonic trading software tradingview coinbase api not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

Multiple Time Frame Trading

With steps 1 and 2 establishing our trend, we can check the market for opportunities to find and execute a trade. MTFA can help the trader or investor decide when to enter the market by identifying the following: Momentum : Periodic spikes in pricing momentum. Position trades are to remain active in the market for a relatively long time, so the potential payoff from taking a higher degree of systemic risk must be considerable. Instead of implementing an intraday perspective using seconds, minutes and hours, decisions are made referencing daily, weekly, monthly and yearly timeframes. Top Stocks. A management plan that defines when and how to exit a trade is crucial to physically realising a fxcm dividend calendar best time frame for intraday trading best day time trading cen biotech stock news taking an appropriate loss. Figure 4 shows a minute chart with a clear downtrend channel. Set the stop price and how to day trade book warrior trading top dog trading momentum indicator price each an equal number of pips from the entry price. One note of warning, however, is to not get caught up in the noise of a short-term chart and over analyze a trade. Frequent opportunity coupled with the availability of financial leverage are attractive characteristics to anyone interested in pursuing a career as a professional day trader. Intermediate-term trading, swing trading and long-term capital investment implement the use of a time horizon measured in days, weeks, months and years. FXCM remains open on these dates, but traders are well advised to be aware of reduced market depth and liquidity.

It also shows HOC approaching the previous breakout point, which usually offers support as well. Trading indices as CFDs removes the barrier to trading. Set your limit price pips above your entry price. What Are Indices Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. You put up a fraction of the capital and still get the full value of the trade. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The position closes when the market price reaches the current trailing stop point. Set your limit to take profit if UK moves in your favour. Both trend-following and counter-trend trade setups may be identified through scrutiny of a specific market using MTFA. The markets are always moving, so ensure to review your trading platform for the latest market updates. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Lot one: Use a risk-reward ratio. With FXCM, you pay only the spread to open a trade. Trade Management : Actively managing an open position in the marketplace can be a daunting task. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. HOC was a very difficult trade to make at the breakout point due to the increased volatility. Step 3: Finding Trade Opportunities Technical traders often use oscillating indicators to find pullbacks against the trend, allowing them to buy or sell at a preferred price. At FXCM all transaction costs are already built into the spread and there are no added commission fees.

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Limited Maintenance : In comparison to intraday trading styles, position trading is a relatively hands-off approach. Markets often fluctuate rapidly, creating substantial swings in the position's value. If the price is exactly on the EMA line, fxcm dividend calendar best time frame for intraday trading wait for better UK trading opportunities that meet these parameters. Rebates may be available depending on your individual tax and residency circumstances, or may differ based on the respective jurisdiction. The main goal of day trading is simple: achieve long-term profitability through executing as many winning trades as possible. Keep in mind that trading on margin can both positively and negatively affect your trading gap cheat sheet real life trading day trading computers canada as both profits and losses can be dramatically amplified. This is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. The Trailing Stop automatically moves your stop price forward as the trade goes in your favour. There may be lawnmower bitcoin bitstamp coinbase instant usd deposit where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Furthermore, it was showing a possible partial retrace within the established trading range, signaling that a breakout may soon occur. Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. Do you already have a certain stock in your portfolio?

Forex Market Hours: Open And Close The forex is a digital marketplace that features millions of participants from around the globe. The schedule for each trading session is as follows Eastern Standard Time :. When buying in an uptrend, look for pullbacks on the stochastic line blue line underneath 20—an oversold condition. Account Liquidity : Taking and holding a position requires a trader or investor to allocate capital for a substantial period of time. When should you get in or out of a trade? The responsibility for selecting an optimal trading methodology also lies with each aspiring trader or investor. The minutes leading up to, and immediately following, each time are often a period of increased market participation. Refine market entry points : Entering a market at the proper price and moment in time is a crucial aspect of trading. Indices Trade your opinion of the world's largest stock indices with low spreads and enhanced execution. The next minute candle clearly confirmed that the pullback was over, with a strong move on a surge in volume. Systemic risk is the danger of a sector or entire market undergoing a severe correction.

Advantages To Position Trading While the optimal duration of a position trade depends upon several factors unique to each specific product, holding an open position in any market affords traders and investors several inherent advantages: Trend Capitalisation : Taking a position in a market for an extended period of time enables the trader to catch robust trends created by evolving market fundamentals. Trade management strategies : MTFA can help traders develop their trading methodology. Raptor for UK Finding and trading long-term trending movements on UK can be beneficial to traders who prefer to monitor positions less intensely. Forex Trading Tips. Typically, beginning or novice traders lock in on a specific time frame, ignoring the more powerful primary trend. Trading For Beginners. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. There is no steadfast rule in how large of a profit must be aspired to, but a risk vs reward ratio is a common target. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The sun never sets on the forex trading day.