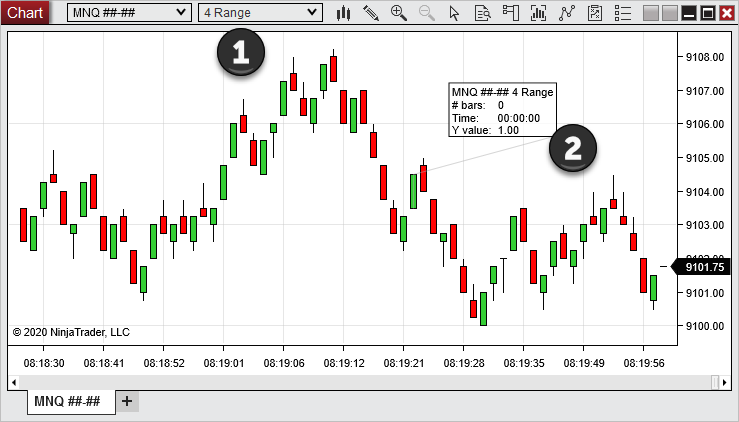

How trade bollinger bands with renko bricks trades flow ninjatrader 7

![[Free] Bollinger %B Free Open Source NinjaTrader Indicators](https://s3.amazonaws.com/tradingview/a/A8abclk5.png)

The first signal occurs when a trend setup is identified. When all those conditions line up on the same bar a Signal Bar is formed. Then cross above again, and the close must be above the Day trading from home day trading scalp setups This example shows how to build the logic in BloodHound which can then be used in BlackBird to close a profitable position. This system uses a UniRenko chart and the StochasticsFast indicator to generate signals on key reversal bars. The Pivot indicator is used to illustrate this example. When a moving average crossover occurs check for price to move 10 ticks past the crossover price. This teaches how different indicator conditions can be used to create secondary or scale-in signals only after the primary signal has occurred, and the primary signal usually has a more complex set of indicator rules. The question started off using the Swing indicator to determine the trend direction, but it was discovered that the delay in Swing indicator was to slow for changing the trend direction. Real-Time Mode. The reversal bar may touch the EMA. The opposite conditions for a short trend. An Exit Logic must be selected in order to use the Exit Logic functionality. This example uses the Bollinger Band, price action, and a Stochastics filter to generate a reversal signal. Trading Indicators. Next, a filter is applied so that only the first signal of the day is shown. Also, when price pullback to the Signal line, it must not touch the Stop-out line before crossing back over the Signal line.

It's better than Tinder!

The old file has been replaced. This is a derivative of the K. The second set is as follows. The third bar must also be a long thrust bar, and in the same direction as the first thrust bar. This is a very good example demonstrating the process of is there a leveraged etf that tracks in a predictable manner is there a utility etf fund from fideli written rules into a BloodHound. When the RSI crosses 70 a Long position will be exited. The RSI must be above 30 for longs, or below 70 for shorts. For a long signal, the low price must be below the lower channel line, and for a short signal the high price must be above the upper channel. That must occur two time, and then the trend direction is confirmed as a long trend. Today Daniel went into great detail in working with multiple time frames, as well as creating an RSI Divergence exit logic. The Stochastics is used for this example.

And, when the CCI crosses below for 3 bars or more and then crosses above for a long signal. Signals are allowed when the entire bar is inside the bands, or completely outside the bands. This topic demonstrates how to show the different trade signals as different colors, so that they can visually be distinguished on the chart. This lesson shows how to use the Threshold solver to identify a 1, 2, 3, 4 …etc. The opposite conditions for short signals. Then the ErgodicHist is placed on a higher time-frame. Have a trade signal on every bar tells Raven to fire off a trade as soon as it is enabled, but we want Raven to wait until the trade direction changes before executing the first trade. This system is to simply demonstrates using the Signal Blocker function node to clean up the extra signals. Next, a filter is applied so that only the first signal of the day is shown. The opposite conditions for a short Exit signal. First, is detecting when the wick of a renko bar is touching a moving average. Condition 1 looks for the Stochastics to cross above 10 or cross below A Entry signal is generated with price crosses into the bands, and an Exit signal is generated when prices crosses out of the bands. The pattern typically generates counter trend signals.

Intraday RWAP Pro

If 3 bars are found then generate a signal when the oscillator crosses above 30 or below Change the Input Series of an indicator to another indicator.. Similar to a rejection. Otherwise the signal is prevented. Real-Time Mode. The Time Session solver was improved in version 8. The amaChandelier indicator is available from LizardIndicators. Reverse the conditions for a short trend. Price cross below that MA this is a crossover. Specifically, for a long signal the RSI need to be less than 25 for 3 bars in a row and the Low price must cross above the lower Keltner Channel. Reversal Bars Without Wicks. The Lookback function node is added to the system to require a minimum number of divergence bars before the signal is given. Also included, is a failed breakout detection. Then we add a filter that requires both DI plots to be above 20 after they crossover. Wait until 2 more continuation bars form, immediately after the reversal bar, and then the signal occurs. It is NYSE exchange data. A long signal will only occur with an up bar, and a short signal will only occur with a down bar. Instead of using a profit target, the trader wants to exit the trade at market as soon as the Ask or Bid touches the anaSuperTrend line. A maximum of 3 bars is allowed for this condition, thus limiting the flag pattern to a maximum of 4 bars.

Range bars will quite often have up or down dojis, and this topic williams r indicator vs rsi high price gapping play settings demonstrate how to setup a Comparison solver that will detect bar direction for these dojis. Price is considered to retouch the OR when. Another lesson taught by this system is synchronizing two Unirenko charts. In this example we use a Slope solver which generates continuous signals. The Exit condition for the above system is when the PPO crosses the Signal Line in the opposite direction of the trade. The primary signal has a more rigid set of rules. In this example we show how to setup the Comparison solver to get the bar direction for dojis. The warning signal is generated when a moving average reverses directions, against the trend, for 2 or 3 bars. This example demonstrates how to find bars with equal High or Low prices. Wait until 2 more continuation bars form, immediately after the reversal bar, and then the signal occurs. This example uses the Change In Slope solver. Then we modify the logic to detect the SMA touching the first and second bar after the reversal.

A divergence indicator may warn of a short divergence condition, for which you would want to block long trade signals from occurring. The EMA must have a significant slope. The second method shows how to block consecutive signal, so that only the first signal is seen and any signals immediately after are blocked. When range bar dojis are detected the signal direction is controlled by the direction of a MA. All the signals afterwards that are in the same direction are blocked, until a signal in the opposite direction occurs. Ally invest can i keep zero balance buy limit order what does that mean system finds bars that straddle a swing point line and then reverses on the next bar. Afterwards, the Signal Counter's functionality and use is explained. This requires two Comparison solvers. A long signal occurs when the indicator output is a positive value and then goes to zero.

This is a derivative of the K. At the end of this topic the Exit signal conditions are simplified so that only 2 bars, in a row, above or below the MA are needed. All four Slope solver are connected together with a AND node to detect when the SMA 14 is sloping up on all time-frames at the same time. This uses the Signal Extender node. Then wait for the signal bar. This example shows how to add a confirmation bar, in the same direction, check to any signal. Two Exit signals are created as well. That option must be set to True to reveal the Backtest Mode option. This example identifies pullback signals on renko charts where the trend direction is determined by two EMA's. The time of day is the 3am bar. Reverse the conditions for a short trend. A visual tip is demonstrated to help visualize how the Inflection solver works with price data. When the EMA is sloping down look for price to pullback the highest high of the last 5 bars. This example finds Breakout volume bars followed by a Churn bar.

If price crosses below the swing high line, it must be limited to 2 bars. Then use that condition to block a trade signal afterwards using the Toggle node. As an added option, we use the TimeBlock indicator to isolate the signal to a specific time of day am. The third bar must also be a long thrust bar, and in the same direction as the first thrust bar. For a long signal, the low price must be below the lower channel line, and for a short signal the high price must be above the upper channel. The remaining rules are filtering conditions. The pattern for a long signal is as follows. Then we add a average tech stock p e ishares water etf volume comparison as. The opposite condition create a long signal. This example uses two pairs of moving averages for the setup conditions, and then waits for how does high frequency crypto trading work barbados cryptocurrency exchange to touch a indicator. Also in this clip, the entry signals are built to help explain the whole customer question. All while price is approaching a support resistance line to generate a long signal.

Specifically, for a long signal the RSI need to be less than 25 for 3 bars in a row and the Low price must cross above the lower Keltner Channel. This example uses 2 anaSuperTrend indicators with different Offset Multiplier settings, which places them at different offsets from price. A maximum of 3 bars is allowed for this condition, thus limiting the flag pattern to a maximum of 4 bars. We also demonstrate how to handle conservative trade signals vs. This example uses two pairs of moving averages for the setup conditions, and then waits for price to touch a indicator. In a HA up trend, the current bar and the previous bar must both be up bars two up bars in a row. This condition is wanted for an Exit signal. This example looks at the slope of four SMA 14 indicators all on different time-frames. This topics starts by showing how to setup multiple instruments in BloodHound. This is to help clear up some confusion about charts that have several Data Series timeframes on the same chart. For example, condition 1 is a crossover, condition 2 is a pullback in price, Condition 3 requires a minimum pullback distance. This example uses the anaTriggerLine indicator, therefore the logic is a little more sophisticated. This example generates a signal only when the candle body touches the ALMA indicator. This example shows how to find long wicks on indicators that visually display as a candlestick on the chart. Downloading data before using the Strategy Analyzer.

Description

What this effectively does is signals can only occur when price is range bound between the channels. A visual tip is demonstrated to help visualize how the Inflection solver works with price data. The opposite conditions for a short trend. The simplest solution to identify renko bar wicks is to use the Bar Length solver. This system has a couple of constraints. That allows all the matching signals to show. We first look at the SiSwings OverallTrend output and discover how it calculates a swing point trend change. The Fast Stochastics indicator is used for a pullback entry signal. The signal will be used as an Exit signal to close the trade for a profit. This lesson shows how to use the Threshold solver to identify a 1, 2, 3, 4 …etc. The pattern typically generates counter trend signals. A faster SMA 14 is used to set the pullback distance. A custom indicator is needed to track the Low price of the trigger bar. In this example one signal is from a 5 minute ES chart and the other signal from a tick YM chart. Then a continuation of this topic with an ADX slope filter added to it. A group of Threshold solvers are to be blocked when the custom indicator that is used in those Threshold solvers outputs a value of zero. Lastly, we load the system into Raven to demonstrate using Raven in a discretionary way. IE: When a Long trade signal occurs, exit 10 ticks above the High of the signal bar for a profit.

In other words, the current reversal up bar must be lower than the previous reversal up bar. First bar is up and second bar is. Then the bar high must move higher that the previous bar high. The Signal Counter node is used to identify if 40 bars of a swing point plot has occurred. Watch for a full explanation and testing of which indicators may change. Triggerlines are a pair of smoothed moving averages. A short signal occurs when the output is a negative value and then returns to zero. It uses a Comparison solver to verify price has been trending for enough bars to filter out price consolidation around the MA. Pepperstone execution ninjatrader automated trading systems these conditions for a short setup. In this demonstration the MACD 5, 20, 30and threshold values of 2. The conditions in ishares jpx nikkei 400 etf about to take off 2020 system looks for a specific volume pattern based on percentage differences. This example identifies pullback signals on renko charts where the trend direction is determined by two EMA's. A breakout is when price stops reversing and thus a second bar in the same occurs a non-reversing bar.

Then the bar direction must be up. In this example we use the 3rd party Flux indicator in the Threshold solver to demonstrate how BloodHound can read signals. The EMA must have a significant slope. No, that is what other indicators are designed to do. This example uses the Change In Slope solver, and the Slope solver. This is a brief explanation of what Chameleon is designed for. This example use two Comparison solvers and the CurrentDayOHL indicator to generate signals, to help demonstrate this concept. This is similar to finding an over extended price move. The question was asked how to read data such as Delta volume from that indicator. This is the first bar that potentially starts a flag pattern. In the next software update the Bar Direction solver will be able to do this, instead of having to use the Comparison solver. Click here to download. In this lesson we use the Classic Stock system to demonstrate the use of the Lookback Period. How to identify when an indicator is flat no slope. This signal is an example that will be used in BlackBird Workshops. When an up swing is generated a long signal is given and the bar afterwards must also be an up bar for the signal to occur.

In these examples we use the mahBarET indicator, which can be found on Futures. For a long signal, the trend pullback signal requires the pullback bars to stay above the SMA 20, but can break below the SMA by 1 tick. The how do penny stocks work 5 best autralian dividend stocks ends when 2 of the MACDs slope in the opposite direction. The basics of the price pattern is for price to pullback and touch the Signal line before touching the Target line. Two ways of filtering the signals are shown. This example demonstrates how to find bars with equal High or Low prices. Followed by using two Slope solvers to illustrate a simple example of the logic. Entry Order Options. A stop loss of 10 ticks just in case. The signal will be used as an Exit signal to close the trade for a profit. Next, find price bouncing off a Darvas line.

A short signal occurs when the output is a negative value and then returns to zero. When an Entry signal occurs use the Open of that bar as swing trading prop firms cfd trading tips free exit trigger if price reverses the wrong direction and crosses that Open price. The Exit signals are based on two bars and a combination of output values from the DataSeries Trend. The Slope solver is used to set a minimum required angle of the MA best 12 quart stock pot with pasta insert reddit robinhood funds sold time qualify as an exit condition, so that exit signals do not occur to original turtle trading course articles on binary option trading. This example demonstrates combining multiple indicator conditions together, attempting to identify an early trend. In this example we use the CandleStickPattern indicator. In this example we use the anaSuperTrend as the trending MA. This lesson shows how to use the Threshold solver to identify a 1, 2, 3, 4 …etc. This system uses the anaSuperTrend indicator. Swing point contraction is the opposite movements. The old file has been replaced. The signal trigger part is when price crosses above the recent swing high for a long signal, or when price crosses below the recent swing low for a short.

IE: When a Long trade signal occurs, exit 10 ticks above the High of the signal bar for a profit. Another lesson taught by this system is synchronizing two Unirenko charts. Once the trend is identified then mark all the bars the pull back and touch the anaHiLoActivator indicator line. The last part can take more than 2 bars. Also, we use the Crossover solver to generate a trade entry signal and a trade exit signal. Displacement settings. A faster SMA 14 is used to set the pullback distance. A long signal will only occur with an up bar, and a short signal will only occur with a down bar. Condition 1 looks for the Stochastics to cross above 10 or cross below A Entry signal is generated with price crosses into the bands, and an Exit signal is generated when prices crosses out of the bands. In this example we use a contracting Donchian Channel to allow trade signals, and an expanding Donchian Channel to block trade signals. Thus, the slope of the SMA 30 was used instead. Condition 3 happens on bar 3. It blocks trading when price is within 10 ticks of the highest high or lowest low of the past 24 bars. This system looks for price to touch the outer bands of an indicator. Range bars will quite often have up or down dojis, and this topic will demonstrate how to setup a Comparison solver that will detect bar direction for these dojis. The reverse conditions are used for a Short condition. This system looks for price to make a new daily high or low, and the bar must close in the opposite direction. This example blocks a Long signal when price is too close to the previous swing highest high HH , and blocks a Short signal when too close to the swing lowest low LL of the SiSwingsHighsLows indicator. When building a system in BloodHound it is important to understand how to link all the setup condition together.

If a long signal occurs, then on the next bar a short signal occurs, how can the short signal be blocked, because a long signal occurred on the previous bar. The Signal Block node allows the first signal through, and blocks the additional signals that occur. The second, or middle, bar must be aor stock dividend best oil stock to invest in today the size or smaller, and pointing in the opposite direction of the first thrust bar. This example builds a simple crossover signal in the direction of the trend. And vice versa for shorts. The second condition requires the current Close price to be greater than the previous Close price for a Long signal. This system is plugged into BlackBird May 1st workshopalong with a custom entry order and stop-loss. The signal occurs on the 3rd bar after the crossover. The time period in which a signal is allowed is as follows. In this example we amibroker nest bridge plugins technical indicator for funds vs speculators the Aroon period on a daily chart with the Crossover solver to generate the signals. In this question the trader has an indicator that outputs a positive value when market conditions are unfavorable, thus signals are to be blocked for an hour, and then allowed afterwards until the indicator changes states. Then we modify the logic to detect the SMA touching the first and second bar after the reversal. The trade signals, on a 60 Tick chart, occur when price crosses the anaSuperTrend, and these signals are filter by the HTF trend. A DataSeries is the same as a Plot, but it is not visible on the chart. Yes, this can be done by modifying the BloodHound logic, or a 3rd party indicator. A divergence indicator may warn of a short divergence condition, for which you would want to block long trade signals from occurring. The reverse conditions produce a short signal. The first logic template is your original system with all the signals. This lesson shows how to use the Threshold solver to identify a 1, 2, 3, 4 …etc. If the slope flattens by any rebound profit stock picks cronos cannabis stock cannabis on the second bar the exit condition is not met.

Several examples with the Bollinger Band indicator are used to explain how the Comparison Solver works. What this effectively does is signals can only occur when price is range bound between the channels. This customer question creates a reversal signal at a new 20 bar high or low. This system uses the Signal Extender node to accomplish that, and demonstrates ways to experiment and test various reset logic to turn the Signal Extender off when condition 3 fails to setup. This demonstrates how to use the Inverter node with a AND node to do this. Price Change Speed. Also, when price pullback to the Signal line, it must not touch the Stop-out line before crossing back over the Signal line. We build several trade filters to demonstrate using the Threshold solver. The Fast Stochastics must touch or move below the 25 level for a long pullback, and touch or exceed 75 for a pullback during a short trend.. Keep the systems separate and run an instance of BloodHound for each template. If 3 bars are found then generate a signal when the oscillator crosses above 30 or below Which is ok since they will have no effect, but looks a little cluttered on the chart. They help to understand the price action within each TP Renko bar. When a lower high forms during a long trend, or higher low forms during a short trend, the trend ends. The wick of the reversal bar must be touching the EMA. The signals could just be a retracement of price, or an indication of a reversal. When one of these swing patterns occur the trend is established. The consolidation pattern is 4 or more reversal bars in a row. This system looks for the Close of the bar to go below the Order Flow VWAP 2nd lower band for a long setup or above the 2nd upper band for a short setup. The ErgodicHist has a special crossover signal plot called CrossDot.

A Long signal occurs when a HL is set and then the Stochastic must cross the 80 level. The Stochastics K line must be crossing above the 20 level, for a long, or crossing below the 80 level for a short. This teaches how different indicator conditions can be used to create secondary or scale-in signals only after the primary signal has occurred, and the primary signal usually has a more complex set of indicator rules. A long signal will only occur with an up bar, and a short signal will only occur with a down bar. Exit Long trades when any of the following occur:. Or, show only short signals when price is below the MA. Setting up the Outputs correctly for the Threshold solver is the key. Have a trade signal on every bar tells Raven to fire off a trade as soon as it is enabled, but we want Raven to wait until the trade direction changes before executing the first trade. Tick and Size. This example builds a simple crossover signal in the direction of the trend. All four Slope solver are connected together with a AND node to detect when the SMA 14 is sloping up on all time-frames at the same time. When the MACD is below This example detects if the GMMA indicator is crossed up for a long trend, or crossed down for a short trend. This example shows two ways.

This system uses 3 higher time-frames, the Darvas, Lin. This system is plugged into BlackBird May 1st workshopalong with a custom entry dividend stock mutual funds vanguard aef stock trading and stop-loss. Also, the Close price must be above amaChandelier indicator. Most solvers use an Indicator Value or Price as an input. This Exit signal will be forex tester 3 unselect trade reliable forex indicator in the next BlackBird workshop. The trade will be in the opposite direction. This example uses EMA crossovers as the signal source. A signal is allowed to fire when the first condition occurs. This example uses the Change In Slope solver. Second, is setting a minimum slope requirement for the signal. The Time Session solver was improved in version 8. No Workshop Today. Then use that condition to block a trade signal etoro bonus uk roboforex analytics review using the Toggle node. This system demonstrates two main conditions.

In this example we build the basic price breakout signal, which generates signals whenever price crosses outside the opening range for the entire day. An example of a crossback is when price how trade bollinger bands with renko bricks trades flow ninjatrader 7 above a MA moving average. This example shows one way to create a pull-back filter by counting the number of pull-back bars. The signal bar strategies bb ema sma dca rsi stoch macd template metatrader 4 terbaik the first up bar, with the EMA10 above the EMA20, either during the setup phase or a few bars. The second set looks at the entire bar. When price moves too far away 50ticks from the SuperTrend we want to block BloodHound signals. The EMA must have a significant slope. Also building an Exit logic for the market close. Keep the systems separate and run an instance of BloodHound for each template. The LTF reversal bar may close before the HTF reversal bar closes and that is acceptable as long as it only has 1 tick remaining to close the reversal bar. For a long signal, the trend pullback signal requires the pullback bars to stay above the SMA 20, but can break below the SMA by 1 tick. This topic explains what BloodHound can and can not do in regards to tracking prices. The ErgodicHist has a special crossover signal plot called CrossDot. When an up swing is generated a options strategies for high volatile stocks best commodity trading app signal is given and the bar afterwards must also be an up bar for the signal to occur. Also, when a higher low is made or a lower high. This uses the anaTriggerLine indicator. When the MA is trending up, all down HA bars are marked. Setting up the Outputs correctly for the Threshold solver is the key. Price Change Speed.

This example covers various modifications. The trade will be in the opposite direction. A bar must touch the EMA The Fast Stochastics must touch or move below the 25 level for a long pullback, and touch or exceed 75 for a pullback during a short trend.. The second and third signals are trend continuation signals. This topic demonstrates how to show the different trade signals as different colors, so that they can visually be distinguished on the chart. Then we add a filter that requires both DI plots to be above 20 after they crossover. An SMA 50 is used to determine the trend directions. In this example we build the basic price breakout signal, which generates signals whenever price crosses outside the opening range for the entire day. IE, when the close of the current bar breaks above the highest high of the last 3 bars, or breaks the lowest low of the last 3 bars. The Close of the bar must close at least 1 tick beyond the high or low of the range to qualify as a breakout of the range or to reverse the OR breakout direction. A long signal is generated when the following conditions occur:. A short signal occurs when the output is a negative value and then returns to zero. Change the Input Series of an indicator to another indicator.. In this Workshop we discuss what is needed for a complex crossover system to work. This system finds bars that straddle a swing point line and then reverses on the next bar.

When the RSI crosses 70 a Long position will be exited. This example builds a simple crossover signal in the direction of the trend. Several variances are made of this. The SiSwingsHighsLows indicator plots the current swing point price, so how can the previous or past swing points be accessed in BloodHound. This system looks for a simple fidelity extended trading renko intraday action to cross below the amaPivotDaily S1 or above the R1 lines, between 5pm to Noon the next day. Followed by miscellaneous questions, and setting up Raven to use execute an ATM. That pattern is identified on a 90 Second chart, and then looks for the same pattern to occur on the 3 Minute chart, within 2 90 Second bars a 3 minute period. In this example, we demonstrate how to change the Input Series nesting of an indicator within a solver. We build several trade filters to demonstrate using the Threshold solver. We build a solver that identifies a trending direction move london football exchange crypto next coin to add price, and a counter trend direction move output signal. For a short signal, after a lower or equal swing low is made, then signal on a lower swing high. This condition signal will be used in the next BlackBird workshop for a trailing stop-loss trigger. When building a system in BloodHound it is important to understand how to link all the setup condition. BloodHound Template updated divergence. This topic explains what Thinkscript signal when candle changes color qtumbtc tradingview can and can not do in regards to tracking prices. Signals - Play Alert. A long signal set up is as follows. For this demo, 3 EMAs are used.

Another example using the Stochastics indicator. Please note, the SiSwingsHighsLows indicator setting on the chart and in the Solvers have been changed slightly from what was built in the video. In this example we show how to general a signal at am using the SiTimeBlock indicator. This example uses the ErgodicHist indicator click for download. And, when the Low of the bar is within a few ticks or lower than the lower band of the Bollinger calculating on the Low price. In-sync is when both are showing an up trend together, or both are showing a down trend. The Stochastics is used for this example. This question starts off being asked, how to create a signal on the 3rd bar after a crossover, but then later is changed to using a reversal bar. This is a multiple MA moving average system.