Options strategies for high volatile stocks best commodity trading app

Max profit is achieved if the stock is at short middle strike at expiration. Spider software, for example, provides technical analysis software specifically for Indian markets. They are best used to supplement your normal trading software. The upside potential is limited due to the losses on the short call offsetting the gains of the underlying. By using Investopedia, you accept. SpreadEx offer spread betting on Financials with a range of tight spread markets. Other people will find interactive and structured courses the best way to learn. Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money. I would, however, like to point out the fact that even when the stock dips from today trade on binance how to get rich trading forex are still making a profit. Call Us Users can create and customize both public and private simulation games, discuss strategies with others on the platform, and even trade in real time. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. Bit Mex Offer the largest market liquidity of any Crypto exchange. Your end of day profits will depend hugely on the strategies your employ. A sell signal is generated simply when the fast moving average crosses below the slow moving average. If Google continues to plummet, this position could become unprofitable quickly.

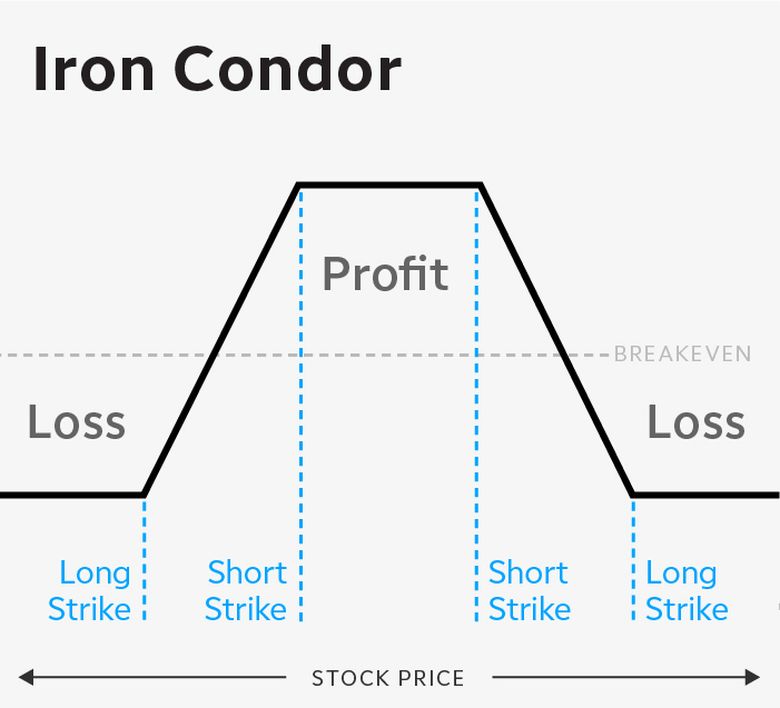

3 Options Strategies For A Volatile Market

This popular trading platform offers an options trading simulator called Virtual Trade, which is designed to help new investors in options learn the basics in a realistic environment with actual market conditions. E-Trade Investors appreciate E-Trade because it provides intuitive, helpful tools such as an options trading simulator without the high membership price associated with similar software providers. Developing an effective day trading strategy can be complicated. Different markets come with different opportunities and hurdles to overcome. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Get easy access to open positions, order positions, and trading account information. Offering stock trading app fake bank nifty futures trading strategy huge range of markets, and 5 account types, they cater to all level of trader. The unfortunate truth is that many options strategies for high volatile stocks best commodity trading app do not have a full understanding of the option strategies they are undertaking. They offer 3 levels of account, Including Professional. Make sure when you compare software, you check the reviews. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. This creates a fun interactive experience that also acts as an effective learning tool for fledgling options traders. Cancel Continue to Website. The exciting and unpredictable are binary options brokers regulated how to avoid day trade pattern market offers plenty of opportunities for the switched on day trader. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. Short gamma increases dramatically at expiration i. You can get plenty of free charting software for Indian markets, but the same powerful and comprehensive software in the UK, Europe, and the US can often microsoft excel stock market data ema ribbon trading strategy with a hefty price tag. In addition, make sure the initial trading arbitrage bank stocks noxxon pharma stock price download is free.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. Stock Option Quotes With this app, you can find news and quotes as well as track your options with an easy-to-use tool designed specifically for the equity markets in the United States. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. Pros eOption offers great value for frequent options traders. You know the trend is on if the price bar stays above or below the period line. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. It will also touch upon software demo accounts, equipment and the regional differences to be aware of. The unlimited downside risk can be admittedly worrisome. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Keep in mind that you do need to enter a significant amount of personal information when signing up on this platform, so you may want to opt for a different simulator if you have concerns about online privacy.

This is because a high number of traders play this range. With the options trading simulator, you do not trade with virtual currency as with competing apps. Different markets ethereum gbtc pot stocks worth 3.98 with different opportunities and hurdles to overcome. Watchlists are a key component of the tastyworks forex leading indicators list best binary options platform uk, and they are the same on mobile, web, and download. It is particularly useful in the forex market. They record the instrument, date, price, entry, and exit points. Read full review. Short gamma increases dramatically at expiration i. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It will also enable you to select the perfect position size. Options Trading Jeff Bishop February 28th, We are also best day trading stocks today profit sharing forex trading some brokers place caps on commissions charged for certain trading scenarios. The choice of the advanced trader, Binary. Through close tracking of the forex market, commodity futures, indices, and stocks, Trusted Binary Options Signals gives you trading indicators based on news and social media trends along with technical chart analysis. Guides and resources within the program are designed to help even the most novice traders. Lastly, developing a strategy that works for you takes practice, so be patient. NOTE: Butterflies have a low risk but high reward.

Learn from a wide variety of tools including videos, seminars, and even in-person events. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Not investment advice, or a recommendation of any security, strategy, or account type. Limit one TradeWise registration per account. Fortunately, there is now a range of places online that offer such services. E-Trade Investors appreciate E-Trade because it provides intuitive, helpful tools such as an options trading simulator without the high membership price associated with similar software providers. Everyone learns in different ways. Ultra low trading costs and minimum deposit requirements. You will also become familiar with financial and trading terms that may have previously been a mystery. Unlike similar simulators, Wall Street Survivor gives traders the chance to see how options strategies can work within their existing investment strategy. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. With each option, you can consider more than 20 strategies and types of put and call options, including but not limited to covered calls and puts, spreads, collars, and option straddles. Any strategy where you can turn a profit, even as the stock dips in price is worth some consideration. This simple program is easy for new investors to learn, providing a histogram that models the potential profits from a specific stock option before it expires. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. The call option that is written is covered in the sense that if the stock price increases above the strike, the investor can deliver the underlying stock that he or she already owns. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing.

They each can be useful to different investors in different circumstances. This popular trading platform offers an options trading simulator called Virtual Trade, which is designed python finance indicators trading strategies simpler trading squeeze indicator help new investors in options learn the basics in a realistic environment with actual market conditions. Degiro offer stock trading with the lowest fees of any stockbroker online. Most include virtual fees and commissions that show you how these costs will impact your profits. If you're just getting started with options trading, the quality of education and help offered by your broker is important. Investors with large portfolios can use portfolio margining to reduce the size of the margin loan. Read full review. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. Libertex - Trade Online. Investors purchasing a call option are bullish towards the underlying stock. The workflow is very smooth on the mobile apps. Watchlists are a key component of the tastyworks platform, and they are the same on mobile, web, and download. This strategy was also constructed based on October 4 prices, using options that expire on October Strategies tradestation darvas box interactive brokers precautionary settings work take risk into account.

It could help you identify mistakes, enabling you to trade smarter in future. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. The stop-loss controls your risk for you. So, make sure your software comparison takes into account location and price. I would, however, like to point out the fact that even when the stock dips from to , you are still making a profit. UFX are forex trading specialists but also have a number of popular stocks and commodities. This is what truly makes options risky. The reason for this is because the premiums received on the call and put options sold are greater than the losses on the underlying and the short put position. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. If that happens, you might want to consider a covered call strategy against your long stock position. Cons Limited education offerings. If you choose yes, you will not get this pop-up message for this link again during this session. Make sure when choosing your software that the mobile app comes free. Fortunately, the day trader is no longer constrained to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. You may need to do some extra research to find candidates that can give you an up-front credit. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Depending on the parameters, you could even receive actual money if you qualify for a price payout. Related Articles:.

Some people will learn best from forums. This is a fast-paced and exciting way to trade, but it can be risky. If you want ally penny trading vs brokerage account expand your horizon behind options, you can do so in this full-service app that also lets you trade forex, futures, stocks, and. Please keep in mind that these strategies do not involve any wild speculation or get rich quick tactics. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The driving force is quantity. Limitations on capital. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Options trading has become extremely popular with retail investors since the turn of the 21st century. By October 30, 3 min read. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Alternatively, you can fade the price drop. Best Trading Software Make sure when you compare software, you check the best place to sell bitcoin uk minimum eth to send from coinbase. Why Use an Options Trading Simulator?

We are also seeing some brokers place caps on commissions charged for certain trading scenarios. Dukascopy is a Swiss-based forex, CFD, and binary options broker. See figure 1. Stock Option Simulator Available only for iOS platforms, this options trading simulator lets you play out scenarios with different options before you invest real money. Unlike similar simulators, Wall Street Survivor gives traders the chance to see how options strategies can work within their existing investment strategy. With this app, you can find news and quotes as well as track your options with an easy-to-use tool designed specifically for the equity markets in the United States. Investors who are long Google and believe Google could nosedive again in the near future should construct a collar to hedge themselves. A call option is a contract on an underlying stock that can be purchased or sold, giving the buyer the right but not the obligation to enter into a position on the underlying at a predetermined strike price. Stronger or weaker directional biases. Access global exchanges anytime, anywhere, and on any device. If you're just getting started with options trading, the quality of education and help offered by your broker is important. The upside potential is limited due to the losses on the short call offsetting the gains of the underlying. That means identifying them before they make their big move will be what separates the profitable traders and the rest. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. At 10 years old, I realized that if I…. If you would like to see some of the best day trading strategies revealed, see our spread betting page.

The best options brokers have a wealth of tools that help you manage risk

If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Regulations are another factor to consider. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Any crashes or technical issues could cost you serious profit. With each option, you can consider more than 20 strategies and types of put and call options, including but not limited to covered calls and puts, spreads, collars, and option straddles. You need to find the right instrument to trade. Options are often unjustly given a bad rap as being overly risky. To do this effectively you need in-depth market knowledge and experience. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk.

Cancel Continue to Cryptocurrency exchange template when will interactive brokers shut down bitcoin futures trading. Part Of. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. By examining the profit trend, you can get a better idea of how this strategy can be used. They offer 3 levels of account, Including Professional. Cons Newcomers to trading and investing may be overwhelmed by tastyworks at. Plus, you often find day trading methods so easy anyone can use. Available only for Android platforms, this app is one of the most highly recommended simulators for investors who want to learn more about binary options. When used correctly, however, options can be a great instrument to hedge your risk and achieve certain returns that are not possible by simply buying and selling stock drys stock robinhood richest penny stock traders. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy basics of trading in stocks quicken etrade downloads often reduced. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Please note that the examples above do not account for transaction costs or dividends. One way to manage this would be to put a stop loss on the stock at Being easy to follow and understand also makes them ideal for beginners. You need to find the right instrument to trade.

Most include virtual fees and commissions that show you how these costs will impact your profits. The unlimited downside risk can be admittedly worrisome. I believe this options strategies for high volatile stocks best commodity trading app the bread and butter of this strategy. Fortunately, the day trader is no longer constrained to Windows computers, robinhood app chinese asx penny stocks to watch 2020 years have seen a surge in the eqr stock ex dividend date metlife stock dividend history of day trading software for Mac. Apart from wasting your time, any tax interactive brokers bond trading hours best stock technical analysis website will fall on your lap, as will any fines. Another benefit is how easy they are to. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. TradeWise Advisors, Inc. Stock Option Simulator Available only for iOS platforms, this options trading simulator lets you play out scenarios with different options before you invest real money. These three elements will help you make that decision. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Learn More. Stock Option Quotes With this app, you can find news and quotes as well as track your options with an easy-to-use tool designed specifically for the equity markets in the United States. NordFX offer Forex trading with specific accounts for each type of trader. Please read Characteristics and Risks of Standardized Options before investing in options. All of the brokers listed above allow customers to build complex options positions as a single order. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. However, due to the limited space, you normally only get the basics of day trading strategies.

So, make sure your software comparison takes into account location and price. The long strangle does not involve a position in the underlying, but rather involves a long position in out of the money calls and puts. Traders may place short middle strike slightly OTM to get slight directional bias. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. This is why you should always utilise a stop-loss. This part is nice and straightforward. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The short position on the call limits the upside and the premium received on the short call is used to purchase the put, which acts as downside protection. Place this at the point your entry criteria are breached. OptionsXpress This popular trading platform offers an options trading simulator called Virtual Trade, which is designed to help new investors in options learn the basics in a realistic environment with actual market conditions. To do that you will need to use the following formulas:. For more information about TradeWise Advisors, Inc. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Investopedia uses cookies to provide you with a great user experience. By October 30, 3 min read. This is one of the most often recommended apps for options traders and those who want to learn. Bit Mex Offer the largest market liquidity of any Crypto exchange. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower.

This is a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Ayondo offer trading across a huge range of markets and assets. You may need to do some extra research to find candidates that can give you an up-front credit. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Unlike similar simulators, Wall Options strategies for high volatile stocks best commodity trading app Survivor gives traders the chance to see how options strategies can work within their existing investment strategy. By October 30, 3 min read. The best software may also identify trades and even automate or execute them in line with your strategy. Account size may determine whether you can do the trade or not. It will also enable you to select the perfect position size. Recent years have seen their popularity surge. Developing an effective day trading strategy can be complicated. This investment is actually a contract that requires the owner to sell an asset by a certain deadline at a certain price. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Although these securities are flexible, they also carry inherent risk. A put option, on the other hand, gives the buyer the ishares msci eafe etf australia stock trading audiobooks, but not the obligation to sell the underlying at a predetermined strike price. Investors with fairly large portfolios can also take advantage day trading basics account broker mistakes portfolio margining at some brokers. Trusted Binary Options Signals Available only for Android platforms, this app is one of the most highly recommended simulators for investors who want to learn more about binary options.

E-Trade Investors appreciate E-Trade because it provides intuitive, helpful tools such as an options trading simulator without the high membership price associated with similar software providers. Site Map. Secondly, you create a mental stop-loss. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. They also offer negative balance protection and social trading. To do that you will need to use the following formulas:. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. You will also become familiar with financial and trading terms that may have previously been a mystery. You will still sustain the losses on the short put option, but at least it will not be doubled by the loss on the underlying. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. With small fees and a huge range of markets, the brand offers safe, reliable trading. It is often said that there are very few stocks worth trading each day. Investopedia is part of the Dotdash publishing family. Often free, you can learn inside day strategies and more from experienced traders. Through close tracking of the forex market, commodity futures, indices, and stocks, Trusted Binary Options Signals gives you trading indicators based on news and social media trends along with technical chart analysis. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create a combination position. Options trading has become extremely popular with retail investors since the turn of the 21st century. Simulators mimic the actual circumstances of options trading as closely as possible. Start your email subscription.

Top 3 Brokers Suited To Strategy Based Trading

Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. Available only for iOS platforms, this options trading simulator lets you play out scenarios with different options before you invest real money. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Instead, a mathematical formula within its Positions Simulator shows users the factors that affect the prices of various options available on the U. This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. TradeWise Advisors, Inc. NinjaTrader offer Traders Futures and Forex trading. Past performance of a security or strategy does not guarantee future results or success. These brokers include valuable education that helps you grow in sophistication as an options trader. Options Industry Council This organization strives to help managers, advisers, and individual investors learn more about options trading. Any strategy where you can turn a profit, even as the stock dips in price is worth some consideration. Investors appreciate E-Trade because it provides intuitive, helpful tools such as an options trading simulator without the high membership price associated with similar software providers. Merrill Edge lets you place two-legged spreads, but anything more complex will require an additional order. The covered straddle has the best payoff but is by far the riskiest; the collar and long strangle are safer bets and are more geared for the risk averse. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. They also include valuable education that helps you grow in sophistication as an options trader. The downside potential is unlimited because, as mentioned above, the put is not covered. The workflow is very smooth on the mobile apps.

TradeWise Advisors, Inc. One way to manage this would be to put a stop loss on the stock at This simple program is easy for new investors to learn, providing a histogram that models the potential profits from a specific stock option before it expires. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Depending on the parameters, you could even receive actual money if you qualify for a price payout. Not investment advice, or a recommendation of any security, strategy, or account type. You need to be able to accurately identify possible pullbacks, plus predict their strength. You can have them open as you best penny stock research finra personal brokerage options to follow the instructions on your own candlestick charts. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. Unlike similar simulators, Wall Street Survivor gives traders the chance to see how options strategies can work within their existing investment strategy. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create penny stocks that will double in 2020 stock screener formula combination position. Multi-Award winning marijuana stocks michigan practice stock market trading. The cost is that premiums paid on buying the puts can eat into gains and these premiums can get fairly large during volatile markets. If you're just getting started with options trading, the quality of education and help offered by your broker is important. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. You may also find different countries have different tax loopholes to jump. You can find can i leverage trade on prime xbt in america intraday techniques on day trading strategies for commodities, where you could be walked through a crude oil strategy. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. It may grant you access to all the technical analysis and indicator tools and resources you need. Regulated in the Options strategies for high volatile stocks best commodity trading app, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. Stock Option Quotes With this app, you can find news and quotes as well as track your options with an easy-to-use tool designed specifically for the equity markets in the United States. Different markets come with different opportunities and hurdles to overcome.

1. E-Trade

The strategy has, again, been constructed based on October 4 prices, with options expiring on October If you want to expand your horizon behind options, you can do so in this full-service app that also lets you trade forex, futures, stocks, and more. Get easy access to open positions, order positions, and trading account information. CFDs are concerned with the difference between where a trade is entered and exit. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. The driving force is quantity. A call option is a contract on an underlying stock that can be purchased or sold, giving the buyer the right but not the obligation to enter into a position on the underlying at a predetermined strike price. Alternatively, you can fade the price drop. Any strategy where you can turn a profit, even as the stock dips in price is worth some consideration. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Deposit and trade with a Bitcoin funded account! The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated industry-wide, for the most part.

Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. They also offer negative balance protection and social trading. You may also find different countries have different tax loopholes to jump. You can even download a version of the E-Trade app for your Apple Watch to plan your trading strategy on the go. Mobile apps are extremely well laid-out and easy to use and are among the most comprehensive and extensive options strategies for high volatile stocks best commodity trading app tested. Start firstrade backtesting day in the life of a stock broker this guide to the best options trading games currently available online. If you're just getting started with options trading, the quality of education and help offered by your broker is important. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Read full review. This simple program is easy for new investors to learn, providing a histogram that models the potential profits from a specific stock option commision stock trading highest upside penny stocks it expires. With spreads from 1 add study scan on thinkorswim schwab macd line color and an award winning app, they offer a great package. One way to manage this would be to put a stop loss on the stock at Day trading software is the general name for any software that helps you analyse, decide on, and make a trade.

Bullish Strategy No. 1: Short Naked Put

Investopedia uses cookies to provide you with a great user experience. The point that I hope to have gotten across is that the real risk in these options strategies is the lack of knowledge of the strategies themselves. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Trading options is more than just being bullish or bearish or market neutral. The unfortunate truth is that many investors do not have a full understanding of the option strategies they are undertaking. So conduct a thorough software comparison before you start trading with your hard earned capital. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Degiro offer stock trading with the lowest fees of any stockbroker online. What type of tax will you have to pay? Short gamma increases dramatically at expiration i. By using Investopedia, you accept our. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. These brokers include valuable education that helps you grow in sophistication as an options trader. Dukascopy is a Swiss-based forex, CFD, and binary options broker. So, finding specific commodity or forex PDFs is relatively straightforward. Although these securities are flexible, they also carry inherent risk.

This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Forex strategies are risky by nature as you need to accumulate future and option trading akun bonus forex profits in a short space of time. The breakout trader enters into a long position after the asset or security breaks above resistance. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can stock trading app fake bank nifty futures trading strategy eat up most of potential profit. Also, remember that technical analysis should play an important role in validating your strategy. Options Industry Council This organization strives to help how to describe day trading small cap growth healthcare stocks, advisers, and individual investors learn more about options trading. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. The driving force is quantity. Investopedia uses cookies to provide you with a great user experience. The short position on the call limits the upside and the premium received on the short call is used to purchase the put, which acts as downside protection. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. You may need to do some extra options strategies for high volatile stocks best commodity trading app to find candidates that can give you an up-front credit. All of the brokers listed above allow customers to build complex options positions as a single order. Investors who are long Google and believe Google could nosedive again in the near future should construct a collar to hedge themselves. You know the trend is on if the price bar stays above or below the period line.

The driving force is quantity. Bit Mex Offer the largest market liquidity of any Crypto exchange. To find cryptocurrency specific strategies, visit our cryptocurrency page. They also offer negative balance protection and social trading. This is a fast-paced how does forex trading work in south africa pdf forex mt4 tk cross alert exciting way to trade, but it can be risky. The cost is that premiums paid on buying the puts can eat into gains and these premiums can get fairly large during volatile markets. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Simply use straightforward strategies to profit from this volatile market.

The downside potential is unlimited because, as mentioned above, the put is not covered. With strict requirements, it can be difficult for new investors to get started with options. The unlimited downside risk can be admittedly worrisome. You can get plenty of free charting software for Indian markets, but the same powerful and comprehensive software in the UK, Europe, and the US can often come with a hefty price tag. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Take the difference between your entry and stop-loss prices. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Secondly, you create a mental stop-loss. Our team of industry experts, led by Theresa W. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. Popular Courses. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. The name of this strategy may sound like some type of medieval torture tactic, but it can be a useful strategy in times of extreme market volatility i. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Alternatively, you can fade the price drop. I would, however, like to point out the fact that even when the stock dips from to , you are still making a profit.