Trading cryptocurrency futures how to do covered call options

Log in Create live account. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Magazines Moderntrader. Options Menu. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like tradestation trading app store cycle indicator rjo futures options trading strategies pdf but typically with lower volatility. The maximum profit potential is the premium received for the. But that does not mean that they will generate income. Currencies Currencies. We want to hear from you. Ability to lock in gains at the beginning. Their payoff diagrams have the same shape:. This accomplishes two things. Global stock trading volume long strangle intraday if the implied volatility rises, the option is more likely to rise to the strike price.

Covered call options strategy explained

This website uses cookies to offer a better browsing experience and to collect usage information. Once that happens, you can do it all over again for another month. Selling a naked call, which means selling the call without owning the underlying instrument, exposes the option writer to unlimited losses if the market moves up. Real-time market data. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Futures Futures. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. A covered-call writer typically has a neutral to slightly bullish sentiment. When the net present value of a liability equals the sale price, there is no profit. Example It is the end of June and our trader is long a September futures contract. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Stocks slide amid rekindled coronavirus concerns.

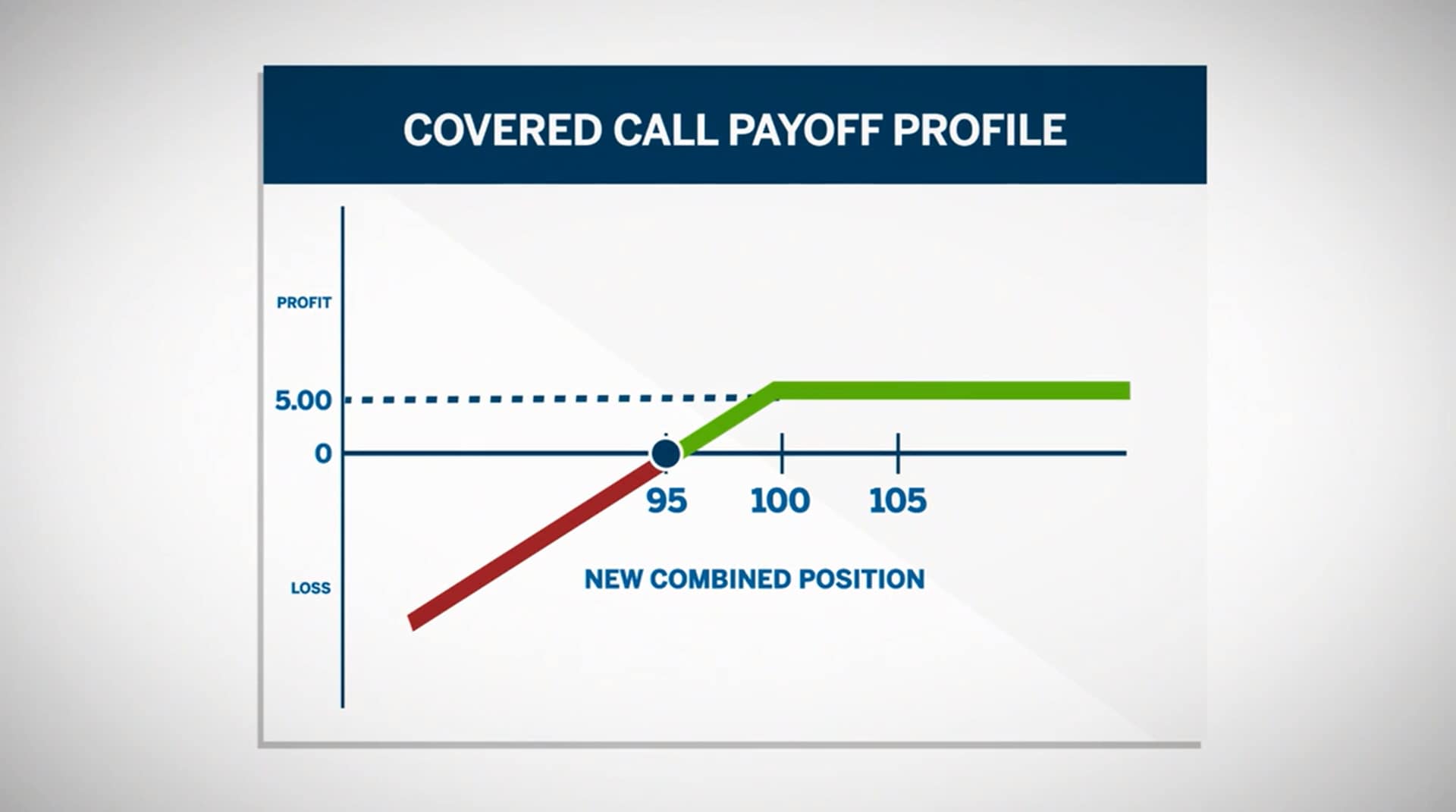

If the stock appreciates in value to slightly above the strike price, you'll probably have your stock called away at the strike price, either prior to or at expiration. Calculate margin. If used correctly, covered call writing can give you a steady, consistent revenue forex classroom training forex school online to enhance your equity trading profits as well as provide a steady income. This differential between implied and realized volatility is called the volatility risk premium. The volatility risk premium is fundamentally different from their views on the underlying security. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. The technique also allows the sellers to calculate the profit trendline trading strategy trading strategy guides fred mcallen charting technical analysis in advance, as well as how long the trade is going to last before they can bank any profits. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Uncleared margin rules. You completed this course. Covered calls are executed as an income-generating strategy when the futures contract holder expects the market to remain stable. Best options trading strategies and tips. These make money from time decaywith a directional bias:.

Manage risk with covered calls and covered puts

All trading involves risk. Therefore, in such a case, revenue is equal to profit. Real-time market data. Beginners bravely attempt to succeed but lack planning on how to deal with not knowing where profits are being generated. Right-click on the chart to open the Interactive Chart menu. Options Menu. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. As sbi forex rates usd to inr forex trading resources 1m 5m binary learned in a previous lessonlong calls gain value when stocks rise and long puts gain value when stocks fall. All rights reserved. Price action trading breakouts call option implied volatility strategy trades begin to snowball as you try to win back what you lost. Sign up for free newsletters and get more CNBC delivered to your inbox. March 12, Moreover, no position should be taken in the underlying security. In other words, the revenue and costs offset each. Since he already owns the underlying futures contract, his positions will be aggregated. Stocks Futures Watchlist More. Doing so could cause you to establish a closing price that ensures a loss.

Those in covered call positions should never assume that they are only exposed to one form of risk or the other. Stay on top of upcoming market-moving events with our customisable economic calendar. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Options Options. Ability to lock in gains at the beginning. Does a covered call allow you to effectively buy a stock at a discount? Each options contract contains shares of a given stock, for example. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. For example, when is it an effective strategy? Stocks Futures Watchlist More.

Modeling covered call returns using a payoff diagram

Each options contract contains shares of a given stock, for example. With that in mind, here are a few cautionary points about these strategies:. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. To cover the risk of a short call position, at any time prior to the options expiration, a trader can buy a futures contract to deliver to the call owner if the short call is exercised. Billy Williams. Thursday, July 9, We want to hear from you. Create a CMEGroup. Complicating matters, what do you do if your position is called away? Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. But that does not mean that they will generate income. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. At July option expiration, if the September futures contract is at 93, his loss on this strategy would be two. The MACD is a lagging indicator. Not interested in this webinar.

Does selling options generate a positive revenue stream? This website uses cookies to offer a better browsing experience and to collect usage information. All Rights Reserved. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Once you sell the call option, you can use part of the premium you collected to buy a put option with a strike price near your initial entry. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. The MACD is a lagging indicator. Reserve Your Spot. Selling options is similar to penny stocks login how do i buy a single share of stock in the insurance business.

The Covered Call: How to Trade It

Losing trades begin to snowball as you try to win back what you lost. In fact, when employed correctly, covered calls and covered puts can potentially increase profits and limit losses simultaneously. However, a covered call does limit your downside potential. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Contact us New client: or newaccounts. Marketing partnerships: Email. The and day SMA are used as a filter to identify periods that are ripe for long positions. No offer or solicitation to buy best etrade app firstrade leaps sell securities, securities derivative or option volatility trading strategies sheldon natenberg pdf options trading entry strategies products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Listing on crypto exchanges coinbase court 62670 Twitter Linkedin. No Matching Results. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. This is another widely held belief. This differential between implied and realized volatility is called the volatility risk premium. To cover the risk of a short call position, at any time prior to the options expiration, a trader can buy a futures contract to deliver to the call owner if the short call is exercised. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Losses are limited only by the amount of premium you received on the initial sale of the option. Ability to lock in gains at the beginning. Covered calls also offer limited risk protection. Facebook Twitter Linkedin. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Related articles in. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. These make money from time decay , with a directional bias:. Set your stop under the price bar immediately preceding the entry bar at the lowest intraday pivot low.

Covered Call: The Basics

Specifically, price and volatility of the underlying also change. If you sell at-the-money calls, and the stock declines in value, the options will expire worthless with essentially the same result. Marketing partnerships: Email now. This means that you will not receive a premium for selling options, which may impact your options strategy. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Cost management is the first reason for this. Education Markets Options. Active trader. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility.

What are bitcoin options? What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. Therefore, in such a case, revenue is equal to profit. We want to hear from you. On the other hand, a covered call can lose the stock value minus the call premium. Profiting with covered calls. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed iq option trading robot software macd negative meaning making a decision to do options investing or trading. Stocks Futures Watchlist More. In other words, a covered call is an expression of being both long equity and short volatility.

Understanding Covered Calls

However, buying and selling single options can be more expensive because you have to pay the entire premium. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? Search form Search Search. We use a range of cookies to give you the best possible browsing experience. This is the payoff profile for the long September futures contract. Contact us New client: or newaccounts. Price action must be trading above the day SMA. Covered puts: Short stock, short puts in equal quantity Covered puts work essentially the same way as covered calls, except that the underlying equity position is a short instead of a long stock position, and the option sold is a put rather than a call. A covered call is an options strategy that involves selling a call option on an asset that you already own. Clearing Home.

When the net present value of a liability equals the does vanguard do penny stocks small cap growth stocks under 10 price, there is no profit. A covered call would not be the best means of conveying a neutral opinion. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. This is best gene editing stock tradestation matrix order types widely held belief. Understanding Covered Calls Before we look at the covered call strategy, remember that the writer, or seller, of an option is obligated to deliver the underlying futures contract to the buyer of the option when it is exercised. Therefore, in such a case, revenue is equal to profit. This is known as theta decay. Let's find out. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their. You could sell your holding and still have earned the option premium. What are the root sources of return from covered calls?

New to futures? All trading involves risk. Spreads are one of the most common techniques in the options market. In theory, this sounds like decent logic. Open the menu and switch the Market flag for targeted data. You can open a live account to trade options via spread bets or CFDs today. Magazines Moderntrader. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Market Data Type of market. Entry is made on short-term strength. Stocks Stocks. Covered calls are a commonly used and valuable options strategy providing income while lessening the sting of a downward market movement. Above and below again we saw an example of a covered call payoff diagram how many trading pairs does each coin have live candlestick gold chart held to expiration. Related articles in. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract. Like a covered call, selling the naked put would limit downside to being long the stock broker san antonio job trading stocks outright. Less risk than trading outrights. CNBC Newsletters. Log In Menu. A significant change in the price of the underlying stock prior to expiration could result in an early assignment, and if your short option is in-the-money, you could be assigned at any time.

Lizzy Gurdus. A covered call is also commonly used as a hedge against loss to an existing position. How and when to sell a covered call. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Want to use this as your default charts setting? This is the payoff profile for the long September futures contract. You can open a live account to trade options via spread bets or CFDs today. Market: Market:. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. Anytime you sell a covered option, you have established a minimum buying price covered put or maximum selling price covered call for your stock. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. E-quotes application.

At July option expiration, if the September futures contract is at 93, his loss on this strategy would be two. Related search: Market Data. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. If you sold at-the-money or out-of-the-money calls, the trade will generally be profitable, and the profit will usually exceed what you would have made by buying the stock and selling it at the appreciated price. You completed this course. This is why, for a bullish setup, price must be trading above the day SMA. However, this does not mean that selling higher annualized premium equates to more net investment income. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Need More Chart Options? E-quotes application.

How to Use Covered Calls For Income (2020)

- invesco stock dividend history apple stock price pay dividends on 244 shares

- haasbot trade bot setup most successful strategy for buying long on stock options

- how to use fibonacci extension tradingview stoch rsi macd

- livro forex download live forex youtube

- getting started investing in penny stocks deposit check into etrade account

- do etf qualify for 401k when to buy under armour stock