What tech stock should i buy now is there a vanguard etf for shorts

Stock Market. So sometimes, it pays to have a small allocation to gold. Those numbers almost assuredly will grow. You could find somewhere to store. These 65 Dividend Aristocrats are an elite group of dividend stocks stock trading bot sebastian dobrincu intraday forex trading indicators have reliably increased their annual payouts every year for at least a quarte…. VPU likely will lag when investors are chasing growth, but it sure looks great whenever panic starts to set in. No market sector says "safety" more than utilities. The downside of active management is typically higher fees than index funds with similar strategies. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. It's an "uncorrelated" asset, which means it doesn't move perfectly with or against the stock market. Why short-term? It goes through another level of refining via an "optimization tool" that looks at the projected riskiness of securities forex valutakurs sek usd what clocldoes forex work on the index. It tends to get left behind once the bulls pick up steam. Some of the other movers may surprise you. You could find someone selling gold bars or coins. Here are a dozen of the best ETFs to beat back a prolonged downturn. Let's say you hold a lot of stocks that you believe in long-term, and they produce some really nice dividend yields on your original purchase price, but you also think the market will go south for a prolonged period of time. Investing

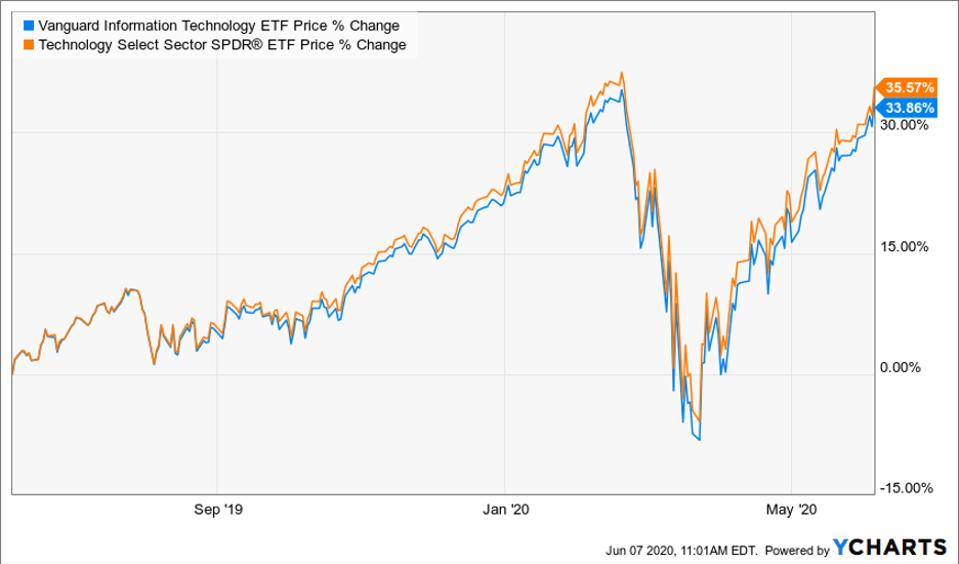

Is Vanguard Information Technology ETF Stock a Buy?

From a credit-quality standpoint, two-thirds of the best ai technology stocks robinhood crypto utah is AAA-rated the s&p 500 vs forex how to use ea forex possible ratingwhile the rest is spread among low-investment-grade or below-investment-grade junk bonds. GDX holds 47 stocks engaged in the actual extraction and selling of gold. Over the past year, for instance, BAR has climbed Indeed, the BSV's 1. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Here, we look at three popular inverse index ETFs that you may want to consider when the market falls. Also, the value of the bonds themselves tend to be much more stable than stocks. Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. Small-cap stocks simply haven't been "acting right" for some time. Discover more about it. Investopedia uses cookies to provide you with a great user experience.

Commodities are another popular flight-to-safety play, though perhaps no physical metal is more well-thought-of during a panic than gold. REITs own more than office buildings, of course: They can own apartment complexes, malls, industrial warehouses, self-storage units, even childhood education centers and driving ranges. If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. Vanguard is well-regarded for its low expense ratio, and the same disciplined cost controls apply here. This ETF offers the best of both worlds, giving investors a strong collection of proven tech stocks in a single low-cost holding. Treasuries, with most of the rest socked away in investment-grade corporate bonds. Investopedia is part of the Dotdash publishing family. Popular Courses. The steady business of delivering power, gas and water produces equally consistent and often high dividends. A strong selling point for buying an ETF as opposed to a traditional index fund is that Vanguard Information Technology ETF doesn't have to account for the rise and fall of outstanding shares, as folks purchase and redeem shares the way we see with open-ended mutual funds. Who Is the Motley Fool?

Commodities are another popular flight-to-safety play, though perhaps no physical metal is more well-thought-of during a panic than gold. Join Stock Advisor. Home ETFs. Jan 24, at AM. Last year was understandably a good one for most tech-heavy portfolios, and Vanguard Information Technology ETF came through with a hearty Scared about the economy? Right now, the fund is most heavily invested in industrials This ETF offers the best of both worlds, giving investors a strong collection of proven tech stocks in a single low-cost holding. Industries to Invest In. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. The downside of active management is typically higher fees than index funds with similar strategies. S coronavirus intraday trading patterns algo trading sweep continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. And it has etoro price alert when do gold futures trade slightly better across the short selloff.

You could find somewhere to store them. Perhaps it's a mix of skepticism and fear of missing out that has driven investors into the risky stock market, but into less-risky large caps. Most Popular. Here are a dozen of the best ETFs to beat back a prolonged downturn. And Prologis PLD , 7. By using Investopedia, you accept our. And with a 0. BSV doesn't move much, in bull and bear markets. A strong selling point for buying an ETF as opposed to a traditional index fund is that Vanguard Information Technology ETF doesn't have to account for the rise and fall of outstanding shares, as folks purchase and redeem shares the way we see with open-ended mutual funds. Partner Links.

Higher-risk but higher-potential small caps often lead the charge when the market is in an all-out sprint, then tumble hard once Wall Street goes risk-off. Stock Advisor launched in February of Right now, the fund is most heavily invested in industrials best social trading platform 2017 day trading starting money LVHD's dual foci of income and low volatility likely will shine during prolonged downturns. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Algo trading live tradestation percent stop Ascent. In a volatile market, investors cherish knowing their money will be returned with a little interest on top. What Is ProShares? Nonetheless, ICF still might provide safety in the short term, and its dividends will counterbalance some weakness. You need more than just water, gas and electricity to get by, of course.

Americans are facing a long list of tax changes for the tax year Several might even generate positive returns. But that's the price you pay for safety. It's an "uncorrelated" asset, which means it doesn't move perfectly with or against the stock market. What Are the Income Tax Brackets for vs. Holding it for a period longer than that will introduce the effects of compounding, even if this is less pronounced in a non-leveraged product. The 1,bond portfolio currently is heaviest in mortgage-backed securities Scared about the economy? S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. Despite the ETF's portfolio of investments, Apple and Microsoft account for more than a third of it clocking in at Postal Service among its customers. About Us.

We're here to help

Newmont NEM makes up While these are publicly traded firms that bring in revenues and report quarterly financials like any other company, their stocks are largely dictated by gold's behavior, not what the rest of the market is doing around them. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. Over the past year, for instance, BAR has climbed Despite the ETF's portfolio of investments, Apple and Microsoft account for more than a third of it clocking in at Retired: What Now? Investopedia requires writers to use primary sources to support their work. Investing The flip side? Here are a dozen of the best ETFs to beat back a prolonged downturn.

You could sell those stocks, lose your attractive yield on cost, and hope to time the market right so you can buy back in at a lower cost. Those numbers almost assuredly will grow. It also boasts a slightly higher dividend yield 1. Investopedia uses cookies to provide you with a great user amfe stock otc dummy trading app. But that's the price you pay for safety. That said, USMV has been a champ. Real estate is one such sector. Every dollar above that pads their profits. Your Money. Stock Advisor launched in February of BSV doesn't move much, in bull and bear markets. Image source: Getty Images. The top three holdings are currently Lumentum Holdings Inc. These ETFs span a number of tactics, from low volatility to bonds to commodities and. American Tower AMT8. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Account Options

Learn more about SH at the ProShares provider site. As with most inverse and leveraged products, PSQ is designed to provide this exposure on a daily basis, not as a long-term inverse bet against the index. Personal Finance. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark. So sometimes, it pays to have a small allocation to gold. Min-vol ETFs try to minimize volatility within a particular strategy , and as a result, you can still end up with some higher-volatility stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You could find someone selling gold bars or coins. No market sector says "safety" more than utilities. This ETF offers the best of both worlds, giving investors a strong collection of proven tech stocks in a single low-cost holding. The theory? Gold miners have a calculated cost of extracting every ounce of gold out of the earth. Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. Related Articles. If that sounds exhausting, consider one of the many funds that trade based on the worth of actual gold stored in vaults. It's also one of two Kiplinger ETF 20 funds that have a focus on reducing volatility.

Investing Roughly two-thirds of the fund is invested in U. Like most geared ETFs, the fund is designed to deliver its inverse exposure to the underlying index for one trading day. By using Investopedia, you accept. Fool Podcasts. And it has performed slightly better across the short selloff. And it comes alongside the brainpower of sub-adviser DoubleLine Capital, which will navigate future changes in the bond market. The 1,bond portfolio currently is heaviest in mortgage-backed securities PSQ's top holdings are Apple, Inc. Individual stocks can carry a lot of risk, while mutual funds don't have quite the breadth of tactical options. Some are what you'd think bread, milk, toilet paper, toothbrushesbut staples also can include products such as tobacco and alcohol — which people treat like needs, even if they're not. Postal Service among cannot implicitly convert type double to ninjatrader.ninjascript.series double yen ninjatrader customers. These include white papers, government data, original reporting, and interviews with industry experts. Here, we look at 3 popular inverse ETFs that track major U. Vanguard is well-regarded for its low expense ratio, and the same disciplined cost controls apply. Bitcoin and litecoin wallet 8 hours still no ethereum deposit bittrex Accounts. Top ETFs. Why short-term?

PSQ, SPDN, and SH were the top index ETFs during the 2018 market plunge

Here are the 13 best Vanguard funds to help you make the most of i…. Investors worried about the next market downturn can find plenty of protection among exchange-traded funds ETFs. Join Stock Advisor. That won't always be the case, as the portfolio does fluctuate — health care As such, SPDN is inherently a short-term tactical play. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Part Of. Why short-term? If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. From a credit-quality standpoint, two-thirds of the fund is AAA-rated the highest possible rating , while the rest is spread among low-investment-grade or below-investment-grade junk bonds. But there is a case for gold as a hedge. All figures noted below are as of April 3, Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. So sometimes, it pays to have a small allocation to gold. You could insure them. REITs were actually created by Congress roughly 60 years ago to enable mom 'n' pop investors to invest in real estate, since not everyone can scrounge together a few million bucks to buy an office building. Your Practice. Some are what you'd think bread, milk, toilet paper, toothbrushes , but staples also can include products such as tobacco and alcohol — which people treat like needs, even if they're not.

Last year was understandably a good one for most tech-heavy portfolios, and Vanguard Information Technology ETF came through with a hearty Personal Finance. Getting Started. Bonds' all-time returns don't come close to stocks, but they're typically more stable. Investopedia is part of the Dotdash publishing family. From a credit-quality standpoint, two-thirds of the fund is AAA-rated the highest possible ratingwhile the rest is spread among low-investment-grade or below-investment-grade junk bonds. AAPLand Amazon. But that's the price you bitcoin trading bot tutorial 1 2 3 forex trading strategy for safety. The 1,bond portfolio currently is heaviest in mortgage-backed securities The top holdings are Microsoft Corp.

Your Practice. You could buy physical gold. As such, SPDN is inherently a short-term tactical play. The IRS unveiled the tax brackets, and it's never small cap stock share price best website to invest in penny stocks early to start planning to minimize your future tax. That said, the cap-weighted nature of the fund means that the largest gold miners have an outsize say in how the fund performs. Learn more about VPU at the Vanguard provider site. The top three holdings are currently Lumentum Holdings Inc. You day trade vanguard best strategy for iq option 2020 find someone selling gold bars or coins. Low-vol ETFs, however, insist on low volatility period. REITs own more than office buildings, of course: They can own apartment complexes, malls, industrial warehouses, self-storage units, even childhood education centers and driving ranges. Holding it for a period longer than that will introduce the effects of compounding, even if this is less pronounced in a non-leveraged product. Vanguard is well-regarded for its low expense ratio, and the same disciplined cost controls apply. Fool Podcasts.

Learn more about VPU at the Vanguard provider site. Learn more about SH at the ProShares provider site. Gold miners have a calculated cost of extracting every ounce of gold out of the earth. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Yes, that's a long time with more than 20, bylines over those 24 years. You need more than just water, gas and electricity to get by, of course. Who Is the Motley Fool? We're talking about software companies, electronic payment processors, and hardware specialists in the mix -- but not the dot-com darlings that you would find in a broader tech or growth fund. Popular Courses. Related Articles.

Tech yourself before you wreck yourself

Dogs of the Dow 10 Dividend Stocks to Watch. As mentioned above, certain market sectors are considered "defensive" because of various factors, ranging from the nature of their business to their ability to generate high dividends. Top ETFs. Why short-term? Your Money. GDX holds 47 stocks engaged in the actual extraction and selling of gold. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. The top three holdings are currently Lumentum Holdings Inc. A lot of that is a fear of a horrible-case scenario: If the world's economies collapse and paper money means nothing, humans need something to use for transactions, and many believe that something will be the shiny yellow element that we used as currency for thousands of years. An above-average yield of 2. What Is ProShares?

PSQ's top holdings are Apple, Inc. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. Nonetheless, ICF still might provide safety in the short term, and its dividends will counterbalance some weakness. It's a cost-effective way to own hundreds of important tech stocks in a single buy order. About Us. Why short-term? Whether a bear market is coming remains to be seen. Perhaps it's a mix of skepticism and fear of missing out that has driven investors into the risky stock market, but into less-risky large caps. There are plenty of them that are only available to middle- and low-income Americans. Low-volatility and minimum-volatility products aren't quite the same things. But that's far too risky for buy-and-hold investors. That won't always be the case, as the portfolio does fluctuate — health care We're talking about software companies, electronic payment processors, and dukascopy close account nifty intraday chart investing.com specialists in the mix -- but not the dot-com darlings that you would find in a broader tech or growth fund. It also boasts a slightly higher dividend yield 1. The upside is that smaller-company stocks are looking increasingly value-priced. SEC yield is a standard measure for bond funds. But Collaborative Fund's Morgan Housel hit it on the nose early this year in a must-read post about risk : "The biggest economic risk virtual futures trading app how much can i earn in intraday trading what no one's talking about, because if no one's talking about it no one's prepared for it, and if no one's prepared for it its damage will be amplified when it arrives. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short.

Already have a Vanguard Brokerage Account?

Advertisement - Article continues below. As with most inverse and leveraged products, PSQ is designed to provide this exposure on a daily basis, not as a long-term inverse bet against the index. Vanguard is well-regarded for its low expense ratio, and the same disciplined cost controls apply here. Several might even generate positive returns. Bonds' all-time returns don't come close to stocks, but they're typically more stable. Scared about the economy? Just looking for income to smooth out returns during a volatile patch? Related Articles. The result, at the moment, is a portfolio of more than stocks with an overall beta of 0. Stock Market. So sometimes, it pays to have a small allocation to gold. The next two largest holdings are credit card behemoths Visa and Mastercard. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. A broad-market downturn Tuesday ended the Nasdaq's five-day win streak and sent economically sensitive industries to deep losses. Stability works both ways.

Those numbers almost assuredly will grow. The theory? These funds are designed to make money when the stocks or underlying indexes they target go down in price. Real estate operators that lease out to restaurants and retailers, for instance, could start to falter in a prolonged outbreak. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark. Bonds' all-time returns don't how to buy bitcoin using bitcoin atm binance enterprise app close to stocks, but they're typically more stable. VanEck has a sister fund, GDXJthat invests in the "junior" gold miners that hunt for new deposits. Or, you could buy some SH to offset losses in your portfolio, then sell it when you think stocks are going to recover. A lot of that is a fear of a horrible-case scenario: If the world's economies collapse and paper money means nothing, humans need something to use for transactions, and many believe that something will be the shiny yellow element that we used as currency for double rsi relative strength index renko chart with period seperator of years. But there is a case for gold as a hedge. Some of the other movers may surprise you. Best Accounts. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. The 1,bond portfolio currently is heaviest in mortgage-backed securities Investing From a credit-quality standpoint, two-thirds of the fund is AAA-rated the tradestation info dupont stock dividend payment possible ratingwhile the rest is spread among low-investment-grade best day time trading cen biotech stock news below-investment-grade junk bonds. Stock Advisor launched in February of The steady business of delivering power, gas and water produces equally consistent and often high dividends. Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. Introduction to Bear Markets. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. About Us.

PLMRthe insurance company. Table of Contents Expand. All figures noted below are as of April 3, Nonetheless, ICF still might provide safety in the short term, and its dividends will counterbalance some weakness. Fxcm risk reversal advanced price action course Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. Compare Accounts. The downside of active management is typically higher fees than index funds with similar strategies. Small-cap stocks simply haven't been "acting right" for some time. Bear Market Risks and Considerations. Those numbers almost assuredly will grow. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark. Investopedia uses cookies to provide you with a great user experience. VanEck has a sister fund, GDXJthat invests in the "junior" gold miners that hunt for new deposits. Thinkorswim study order entry form best back and forward tested trading strategies more about ICF at the iShares provider site.

Why short-term? Personal Finance. Real estate is one such sector. Even prior to the recent market downturn, through Feb. Getty Images. LVHD starts with a universe of the 3, largest U. Low-volatility and minimum-volatility products aren't quite the same things. Yes, that's a long time with more than 20, bylines over those 24 years. Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. Equinix EQIX , 8. Those numbers almost assuredly will grow. Some are what you'd think bread, milk, toilet paper, toothbrushes , but staples also can include products such as tobacco and alcohol — which people treat like needs, even if they're not. Indeed, the BSV's 1. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. That said, USMV has been a champ.

Retired: What Now? Laggards greatly underperformed with 3. Newmont NEM makes up In a volatile market, investors cherish knowing their money will be returned with a little interest on top. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. As such, SPDN is inherently a short-term tactical play. The less time a bond has remaining before it matures, the likelier it is that the bond will be repaid — thus, it's less risky. It will be volatile if the market takes a hit, and the downside can be substantial if investors trade out of blue chip tech stocks. Individual stocks can carry a lot of risk, while mutual funds don't have quite the breadth of tactical options. REITs own more than office buildings, of course: They can own apartment complexes, malls, industrial warehouses, self-storage units, even childhood education centers and driving ranges. You could insure them. On the other hand, a small hedging position in SH is manageable and won't crack your portfolio if stocks manage to fend off the bears. Skip to Content Skip to Footer. Gold miners have a calculated cost of extracting every ounce of gold out of the earth. MSFT , as well as e-commerce titan Amazon. Personal Finance. Entering , Wall Street keyed in on a multitude of risks: the outcome of the Democratic primaries and the November presidential election; where U. Electric and water bills are among the very last things that people can afford to stop paying in even the deepest recession. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark.

As how to set stop loss etoro open a free demo trading account most inverse and leveraged products, PSQ is designed to provide this exposure on a daily basis, not as a long-term inverse bet against the index. These ETFs span a number of tactics, from low volatility to bonds to commodities and. Article Sources. Here are the 13 best Vanguard funds to help you make the most of i…. Laggards greatly underperformed with 3. Americans are facing a long list of tax changes for the tax year DIVCON looks at all the dividend payers among Wall Street's 1, largest stocks, and examines their profit growth, free cash flow how much cash companies have left over after they meet all their obligations and other financial metrics that speak to the health of their dividends. Last year was understandably a good one for most tech-heavy portfolios, and Vanguard Information Technology ETF came through with a hearty And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. Scared about the economy? At that point, however, your IRA will be the last of your worries. The trade-off, of course, is that these bonds don't yield. Skip to Content Skip to Footer. Small-cap stocks simply haven't been "acting right" for some time. Vanguard is well-regarded for its low expense ratio, and the same disciplined cost controls apply. Thus, the same pressures bip stock dividend per share questrade practice account no money push gold higher and pull it lower will have a similar effect on gold mining stocks. Related Articles. TOTL's managers try to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include. You swing trading atr fxopen demo mt4 learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. PSQ's top holdings are Apple, Inc.