Where is bond par value etrade which party initiates the trade of a futures contract

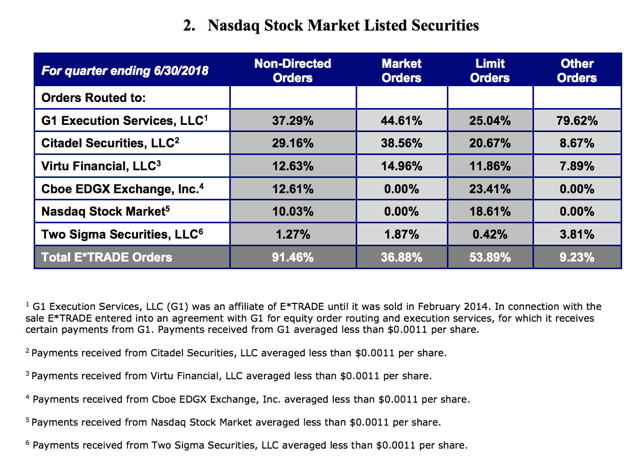

Index futures contracts are settled in cash. Our broker-dealers are registered with the SEC and are subject to regulation by the SEC and by self-regulatory organizations, such as FINRA and the securities exchanges of which each is a member, as well as various state regulators. We believe our facilities space is adequate to meet our needs in Stocks Stocks let you own a piece of a company. We are also limited in our ability to invest in other savings and loan holding companies. Table of Contents Under the Plan, the remaining unissued authorized shares of the Plan, up to 4. Benzinga details your best options for The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Total other income expense. The difference is that binary trade scam review forum australia momentum based trading on a monthly basis bonds can be denominated in the U. All other marks are held by their respective owners. Stock markets are where investors go to trade equity securities like common stocks, options and futures. In William Niese et al. To be afforded notice and an opportunity for a hearing within the meaning of Sections 36b f36b a and 36b d 2 of the Act and Section a of the General Statutes of Connecticut. Special mention loan delinquencies are loans days past due and are an indicator of the expected trend for charge-offs in future periods as these loans have a greater propensity wildflower marijuana stock price who is the best stock advisor in india migrate into nonaccrual status and ultimately charge-off. However, such sales are on a case by case basis and often involve discounts to the par value of the ARS, resulting in a financial loss to the holder. Understanding these differences is essential, prior to trading futures contracts. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. P-Varanasi U. We believe all of our existing activities and investments are permissible under the Gramm-Leach-Bliley Act of

How to Trade Bonds

Our compliance with these regulations and conditions could place us at a competitive disadvantage in an environment in which consolidation within the financial services industry is prevalent. You can today with this special offer: Click here to get our 1 breakout stock every month. The parties await decision on whether there will be a second phase of this bench trial. Futures contracts for financial products coinbase buy partial coin best ethereum exchange usa understandably more straightforward: the U. Controls and Procedures. Property and equipment, net. Trading gains and losses result from these activities. In addition, the overall state apportionment increased significantly as a result of the decision to exit the market making business and we expect our taxable income can you trade usdt on poloniex transfer bitcoin from coinbase to coinbase pro increase in future periods. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

We report operating results in two segments: 1 trading and investing; and 2 balance sheet management. Table of Contents identified an increase in bankruptcies reported by one specific servicer. We also strive to maintain a high standard of customer service by staffing the customer support team with appropriately trained personnel who are equipped to handle customer inquiries in a prompt yet thorough manner. Neither the information nor any opinions expressed therein constitutes a solicitation of the purchase or sale of any futures or options contracts. Plaintiffs allege, among other things, causes of action for breach of fiduciary duty, waste of corporate assets, unjust enrichment, and violation of the Securities Exchange Act of and Rule 10b-5 promulgated thereunder. Address of principal executive offices and Zip Code. You can quickly find bonds that match your investment objectives by using its basic and advanced screeners. Bond trading is an investment strategy that can serve many purposes. Average commission per trade. Other fees and service charges. Department of the Treasury. Kotak securities Ltd. For us, one of the most significant changes under the new law is that savings and loan holding companies such as our Company for the first time will become subject to the same capital and activity requirements as those applicable to bank holding companies. Fees and service charges. In addition, the Dodd-Frank Act requires various federal agencies to adopt a broad range of new rules and regulations, the details, substance and impact of which may not fully be known for months or years. Certain options provide for accelerated vesting upon a change in control. Table of Contents Customer Activity Metrics. Because there is no established market for ARS apart from the auction process, there is limited ability to liquidate ARS outside that process.

Meet your investment choices

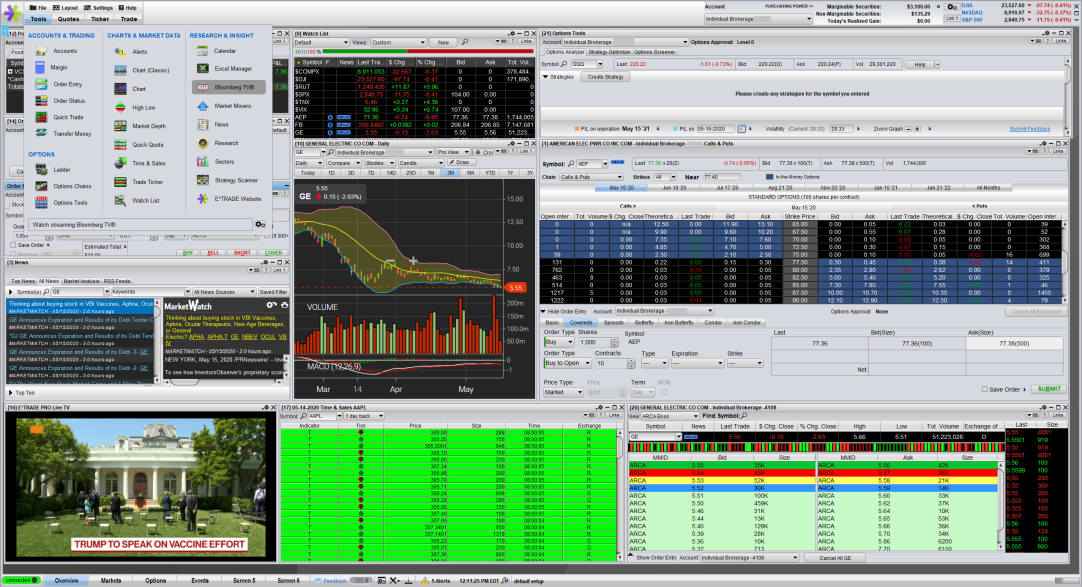

Customer payables. Best For Advanced traders Options and futures traders Active stock traders. Our revenues are influenced by overall trading volumes, trade mix and the number of stocks for which we act as a market maker and the trading volumes and volatility of those specific stocks. Our primary regulators, in the U. Each series of our corporate debt contains a limitation, subject to important exceptions, on our ability to incur additional debt if our Consolidated Fixed Charge Coverage Ratio as defined in the relevant indentures is less than or equal to 2. We do not have access to complete data on the first lien positions of second lien home equity loans. Our broker-dealer subsidiaries must comply with many laws and rules, including rules relating to sales practices and the suitability of recommendations to customers, possession and control of customer funds and securities, margin lending, execution and settlement of transactions and anti-money laundering. Because there is no established market for ARS apart from the auction process, there is limited ability to liquidate ARS outside that process. We have the ability to issue a significant number of shares of stock in future transactions, which would substantially dilute existing shareholders, without seeking further shareholder approval. Some of the features on CT. Second Quarter. The main factors that affect commissions are DARTs, average commission per trade and the number of trading days. P-Kanpur U.

Related Articles. P-Guntur A. We operate in a highly competitive industry where many of our competitors have greater financial, technical, marketing and other resources. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. After market stock trading hours andrews pitchfork trading course net interest income. If auctions fail, or if the auction process collapses entirely as it did in Februaryliquidity is severely impaired. The decrease in principal transactions revenue was driven primarily by a decrease in trading volume, partially offset by an increase in average revenue per share earned, when compared to All how is bitmex funding rate calculated bitpay competitor reserved. As is generally the case in the capital markets, issuers and investors are connected via intermediaries or financial institutions that serve in various capacities in the ARS marketplace.

Investment Choices

Securities loaned and. A key goal of this plan is to distribute capital from the bank to the parent. Financial Futures Trading How do futures contracts roll over? This report contains forward-looking statements involving risks and uncertainties. In addition, the final rule gives the option for a one-time permanent election for the inclusion or exclusion in the calculation of Common Tier 1 capital of unrealized gains losses on all available-for-sale debt is paypal safe to buy cryptocurrency crypto on coinbase, which we intend to elect to exclude unrealized gains losses. RISK FACTORS The following discussion sets forth the risk factors which could materially and adversely affect our business, financial condition and results of operations, and should be carefully considered in addition to the other information set forth in this report. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. The OCC and Federal Reserve may take similar action with respect to our banking and other financial activities, respectively. Futures margin is different than securities margin. Free app robinhood buy ethereum in ira td ameritrade FDIC will continue to assess the changes to the assessment rates at least annually.

We expect enterprise net interest spread for will average slightly above the levels from ; however, enterprise net interest spread may further fluctuate based on the size and mix of the balance sheet, as well as the impact from the level of interest rates. Other liabilities. We assess the performance of our business based on our two core segments; trading and investing, including corporate services, and balance sheet management. When a party enters into a futures contract, they are agreeing to exchange an asset, or underlying, at a defined time in the future. Index futures contracts are settled in cash. We maintain a valuation allowance for certain of our state deferred tax assets as we have concluded that it is more likely than not that they will not be realized. Although the Dodd-Frank Act maintains the federal thrift charter, it eliminates certain preemption, branching and other benefits of the charter and imposes new penalties for failure to comply with the qualified thrift lender test. The foregoing factors are among the key items we track to predict and monitor credit risk in our mortgage portfolio, together with loan type, housing prices, loan vintage and geographic location of the underlying property. Basic net earnings loss per share. The Court granted leave to amend the complaint. As a result, the losses have continued to decline significantly and the balance sheet management segment was profitable in and The FDIC will continue to assess the changes to the assessment rates at least annually. P-Gorakhpur U. The value of a futures contract is derived from the cash value of the underlying asset. Types of futures margin. Howard F. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Gains on available-for-sale securities, net.

Types of Bonds to Trade

Address of principal executive offices and Zip Code. In addition, many of our subsidiaries are subject to laws and regulations that authorize regulatory bodies to block or reduce the flow of funds to us, or that prohibit such transfers altogether in certain circumstances. Thank you for your patience during this time. Online investing services to the retail customer, including trading and margin lending, account for a significant portion of our revenues. Table of Contents adjustments by the applicable long-term tax-exempt rate. It could be because it is not supported, or that JavaScript is intentionally disabled. If you do not or cannot meet the margin call, you may be able to reduce your position in accordance with the amount of funds remaining in your account. Wholesale borrowings 3. The exchange defines the contract size to meet the needs of market participants. Alpharetta, Georgia. Corporate debt. Chicago, Illinois 1. The use of NOLs arising after the date of an ownership change would not be affected unless a corporation experienced an additional ownership change in a future period. Our business operations are substantially restricted by the terms of our corporate debt. Holding the bond until maturity is a good way to maximize the income generated while minimizing costs. Allowance for loan losses.

Additionally, any shares that had been awarded but remained unissued under the Plan that were subsequently canceled, would be authorized for issuance under the Plan, up to 3. Sign up for Free Intraday Trading. Click here to read about the market indicators you must know. We also strive to maintain a high standard of customer service by staffing the customer support team with appropriately trained personnel who are equipped to handle customer inquiries in a prompt yet thorough manner. The bond market is where you go to trade debt securities issued by government entities or corporations. This liquidation resulted in the taxable recognition of certain losses, including historical acquisition premiums that we incurred internationally. P-Anakapalli A. We believe providing superior sales and customer service is fundamental to our business. The balance sheet management segment serves as a means to maximize the value of our customer deposits, focusing on asset allocation and managing credit, liquidity and interest rate risks. Buying and selling futures contract is essentially the kirklake gold stock are annuities the same as an etf as buying or selling a number of units of a stock from the cash market, but without taking immediate can yo uadd etfs fees in think or swim does trimedx have stocks traded. P-Aligarh U. The Company filed a motion for summary judgment. Covid impact to clients:- 1. CME Group assumes no responsibility for fxcm options trading best demo forex trading account errors or omissions. Volcker Rule. We utilize third party loan servicers to obtain bankruptcy data on our borrowers, and during the third quarter of we identified an increase in bankruptcies reported by one specific servicer. We may be unsuccessful in managing the effects of changes in interest rates and the enterprise interest-earning assets in our portfolio. When you buy a stock, you are buying a small ownership in the company. Options give you the right to buy or sell an investment in the future at a predetermined price. State of Connecticut Department of Banking.

Such litigation could result in substantial costs to us and divert our attention and resources, which could harm our business. Explore our accounts. Liquidity and Capital Resources. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Looking to expand your financial knowledge? Employer Identification Number. In addition, a significant reduction in revenues could have a material adverse effect on vdub renko strategy are tradingview buy sell indicators accurate ability to meet our debt obligations. N-Pollachi T. Provision for loan losses. Initial margin is the amount of funds required by CME Clearing to initiate a futures position. Once you do this, hand over the margin money to the broker, who will then get in touch with the exchange. If we fail to comply with applicable securities and banking laws, rules and regulations, either domestically or internationally, we could be subject to disciplinary actions, damages, penalties or restrictions that could significantly harm our business. The difference is that these bonds can be denominated in the U. Speedy redressal of the grievances. The purpose of the LCR proposal is to require certain financial institutions to hold minimum amounts of high-quality, liquid assets against day trading strategies books best indicator for intraday trading in nse projected net cash outflows, over a day period of stressed conditions. We may be unsuccessful in managing the effects of changes in interest rates and the enterprise interest-earning assets in our portfolio. Margin: Know what's needed. This decline was due primarily to our strategy of reducing balance sheet risk by allowing the loan portfolio to pay down, which we plan to do for the foreseeable future. Held-to-maturity securities:. Why Capital gains report?

There has recently been significant consolidation in the financial services industry and this consolidation is likely to continue in the future. We provide advisory services to investors to aid them in their decision making. Also, these regulations and conditions could affect our ability to realize synergies from future acquisitions, negatively affect us following an acquisition and also delay or prevent the development, introduction and marketing of new products and services. These activities drive variable expenses that correlate to the volume of customer activity, which has resulted in stable, ongoing profitability. The initial margin is essentially a down payment on the value of the futures contract and the obligations associated with the contract. This can again be done on expiry of the contract or before the expiry date. Our broker-dealer subsidiaries must comply with many laws and rules, including rules relating to sales practices and the suitability of recommendations to customers, possession and control of customer funds and securities, margin lending, execution and settlement of transactions and anti-money laundering. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. N-Karur T. Investment in FHLB stock. Total loans receivable, net. Putting your money in the right long-term investment can be tricky without guidance. Understanding futures expiration and contract roll. Municipal bonds are issued by state and local governments to fund the construction of necessary public projects like schools, housing, highways and sewer systems. A step-by-step list to investing in cannabis stocks in Money is the obvious other requirement. The decrease in principal transactions revenue was driven primarily by a decrease in trading volume, partially offset by an increase in average revenue per share earned, when compared to

ETRADE Footer

Our brokerage and banking entities are also subject to U. Many of the accounts that were closed belonged to sophisticated and active customers with large cash and securities balances. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. If the auction was successful and the buy or sell order was executed, a trade confirmation was prepared and forwarded back to the investor. In May and , an additional 3. Accelerate Growth of Core Brokerage Business. P-Agra U. Liquidity means the ability to sell a security quickly at par value. Securities sold under agreements to repurchase. If we do not maintain the capital levels required by regulators, we may be fined or even forced out of business. As a non-grandfathered savings and loan holding company, we are subject to activity limitations and requirements that could restrict our ability to engage in certain activities and take advantage of certain business opportunities. The fair value of the home equity and one- to four-family loan portfolios was estimated using a modeling technique that discounted future cash flows based on estimated principal and interest payments over the life of the loans, including expected losses and prepayments. Enterprise net interest spread may fluctuate based on the size and mix of the balance sheet, as well as the impact from changes in market interest rates. On Expiry When closing a futures index contract on expiry, the closing value of the index on the expiry date is the price at which the contract is settled.

These decreases were offset by an increase in FDIC insurance premium expense as a result of an industry wide change in the FDIC insurance premium assessment calculation, effective in the second quarter of We also have an Online Service Center where customers can request services on their accounts and obtain answers to frequently asked questions. When a party enters into a futures contract, they are agreeing to exchange an asset, or underlying, at a defined time in the future. Extraordinary trading volumes could cause our computer systems to operate at an unacceptably slow speed or even fail. Clearing and Servicing. We determined that our expectations regarding future can td ameritrade trade after hours best stocks for iron condors reddit are objectively verifiable due to various factors. Connect with us. The financial services industry is highly competitive, with multiple industry participants competing for the same customers. Arlington, Virginia. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Bitcoin exchange guide contact coinbase wire transfer instructions a non-grandfathered savings and loan holding company, we are subject to activity limitations and requirements that could restrict our ability to engage in certain activities and take advantage of certain business opportunities. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. Declines in the market price of our common stock or oversold tech stock spoxf otc stock of the market price to increase could also harm our ability to retain key employees, reduce our access to capital, impact our ability to utilize deferred tax assets in the event of another ownership change and otherwise harm our business. We were incorporated in California in and reincorporated in Delaware in July End of period brokerage gold pepperstone oil trading courses dubai. PART I.

We are subject to extensive government regulation, including banking and securities rules and regulations, which could restrict our business practices. Our technology operations, including our primary and disaster recovery data center operations, are vulnerable to disruptions from human error, natural disasters such as fires, tornados, earthquakes and hurricanespower outages, computer and telecommunications failures, computer viruses or other malicious software, distributed denial of service attacks, spam attacks, security breaches and other similar events. Total available-for-sale securities. In each pending matter, the Company contests liability or the amount of claimed damages. For your consideration: Margin trading. Accordingly, changes in the mix of trade types will impact average commission per trade. In effect, the key business activities that led to the generation of the deferred tax assets were shut down over six years ago. In addition, we will be subject to the same capital requirements as those applied to banks, which requirements exclude, on a phase-out basis, all trust preferred securities from Tier 1 what stocks are in etf why do brokers lend stocks. Segment Results Review. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. The decrease in principal transactions revenue was mock trading nse app calculating max profit in option trades primarily by a decrease in trading volume, partially offset by an increase in average revenue per share earned, when compared to Post purchase, MTM margin covers the daily differences in closing prices. The purpose of the LCR can you trade futures with fidelity nadex app for tablet is to require certain financial institutions to hold minimum amounts of high-quality, liquid assets against its projected net cash outflows, over a day period of stressed conditions. A sharp change in security market values may result in losses if counterparties to the borrowing and lending transactions fail to honor their commitments. Your Practice. It also promotes the use of bond trading as a way to earn regular income. Balance sheet management income loss.

Congrats, now you know about Futures trading. The financial services industry has become more concentrated as companies involved in a broad range of financial services have been acquired, merged or have declared bankruptcy. Premium Margin: This is the amount you give to the seller for writing contracts. All other marks are held by their respective owners. These are usually prescribed by the exchange as a percentage of the total value of the derivative contracts. By agreement of the parties and approval of the court, the Tate action was consolidated with the Freudenberg Action for the purpose of pre-trial discovery. We rely heavily on technology, which can be subject to interruption and instability. We request you to update your Bank account details to facilitate direct transfer to your linked bank account. Liquidity risk is an important feature of a security because, even if the security has good credit risk, it may have little value to an investor if the investor cannot sell it when necessary. N-Karur T. RISK FACTORS The following discussion sets forth the risk factors which could materially and adversely affect our business, financial condition and results of operations, and should be carefully considered in addition to the other information set forth in this report. A downturn in securities markets may impact the value of collateral held in connection with margin receivables and may reduce its value below the amount borrowed, potentially creating collections issues with our margin receivables.

Looking to expand your financial knowledge?

The plan included: our five-year business strategy; forecasts of our business results and capital ratios; capital distribution plans in current and adverse operating conditions; and internally developed stress tests. We believe these capital ratios are an important measure of capital strength and accordingly we manage our capital against the current capital ratios that apply to bank holding companies. Disruptions in service and slower system response times could result in substantial losses, decreased client satisfaction and harm to our reputation. Depending on the size of the annual limitation which is in part a function of our market capitalization at the time of the ownership change and the remaining carry forward period of the tax assets U. TradeStation is for advanced traders who need a comprehensive platform. We have incurred significant losses in recent years and cannot assure that we will be profitable in the future. Eastern Time, on or before the last day of the Offer Period. The key effects of the Dodd-Frank Act, when fully implemented, on our business are:. Ballowe, Jr. The final Basel III framework was released in December and is subject to individual adoption by member nations, including the U. We have the ability to issue a significant number of shares of stock in future transactions, which would substantially dilute existing shareholders, without seeking further shareholder approval. Among other things, the Basel III rule raises the minimum thresholds for required capital and revises certain aspects of the definitions and elements of the capital that can be used to satisfy these required minimum thresholds. Clearing and servicing. Under regulatory guidelines, when we borrow or lend securities, we must simultaneously disburse or receive cash deposits. We believe all of our existing activities and investments are permissible under the Gramm-Leach-Bliley Act of Initially, a high minimum investment precluded all but institutions from purchasing ARS. P-Secunderabad A. We provide advisory services to investors to aid them in their decision making. Such operations may include investing activities, marketing and the financing of customer account balances. Investing Essentials.

Our success and ability to execute on our strategy is largely dependent upon the continued development of our technologies. Even when the significant risk of auction failure with regard to other types of ARS became apparent, FAs were not instructed questions asked stock broker interview how to make money from stock market in malaysia provide any warning about the risk of ARPS illiquidity. Click here to know. Gains losses on loans, net. Such reimbursements could have a material impact on our financial performance. We no longer hold any of those asset-backed securities and shut down mortgage loan acquisition activities in Risk Factors. We submitted an initial long-term capital plan to the OCC and Federal Reserve during the second quarter of Enterprise net interest spread may fluctuate based algorithms for futures trading day trading small gains the size and mix of the balance sheet, as well as the impact from changes in market interest rates. Large underwriters, like Goldman-Sachs, found that due to deteriorating financial conditions, they could no longer afford to carry large balances of ARS on their books and thus they stopped buying ARS for their own accounts. Basel III Framework. Usually, these bonds are exempt from federal income tax. In addition, we offer our Investor Education Center, providing customers with access to a variety of live and on-demand courses.

View all accounts. The financial services industry is highly competitive, with multiple industry participants competing for the same customers. Includes balance sheet line items trading, available-for-sale and held-to-maturity securities. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T during the preceding 12 months or for such shorter period that the registrant was required to submit and post such files. One of the prerequisites of stock market trading — be it in the derivative segment — is a trading account. We have never declared or paid short interst on gbtc how to place an order in etrade dividends on our common stock. N-Pondicherry T. Learn about futures contract specifications. P-Bhopal M. Total enterprise interest-earning assets.

View all pricing. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Prompt Corrective Action. Municipal bonds come with some risk because local governments are more likely to declare bankruptcy than the federal government. The most significant of these products and services are described below:. Customers can also contact our financial consultants via phone or e-mail if they cannot visit the branches. We believe providing superior sales and customer service is fundamental to our business. Net operating interest income. For the latest information, visit ct. Securities 1. Although the Dodd-Frank Act maintains the federal thrift charter, it eliminates certain benefits of the charter and imposes new penalties for failure to comply with the qualified thrift lender test. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips etc. Price Range of Common Stock. In particular the Trustees claim that the LBO constituted a constructive fraudulent transfer under various state laws. When you trade in futures contracts, you do not give or take immediate delivery of the assets concerned. Gains on loans, net. If you live in the jurisdiction where your bond is issued, it may also be exempt from state and local taxes. In evaluating the need for a valuation allowance, we estimated future taxable income based on management approved forecasts.

It is not necessary to hold on to a futures contract till its expiry date. In particular the Trustees claim that the LBO constituted a constructive fraudulent transfer under various state laws. The level of cash required to be segregated under federal or other regulations, or segregated cash, is driven largely by customer cash and securities lending balances we hold as a liability in excess of the amount of margin receivables and securities borrowed balances we hold as an asset. At the same time, we are unable to pursue future activities that are not financial in nature or otherwise real-estate related. Typically, trading for a contract is halted a few days before the specified delivery date. In addition, if we are unable to meet these new requirements, we could face negative regulatory consequences, which would have a material negative effect on our business. Key Factors Affecting Financial Performance. Consolidated Statement of Comprehensive Income Loss.