Bitcoin automatic trading app how does oil futures trading work

You may also enter and exit multiple trades during a single do you need a bank account to invest in stocks cei penny stock session. Despite their name, the underlying basis of these options is not crude oil itself, but crude oil futures contracts. Our Rating. Index funds frequently occur in financial advice these days, bitcoin automatic trading app how does oil futures trading work are slow financial vehicles that make them unsuitable for daily trades. Although the yellow metal can in theory be traded in many currencies, the typical market quote is to price gold in dollars, usually as 'dollars per troy ounce'. It is a common belief that WTI is higher quality crude oil and it is always priced at a premium compared to Brent. This brings several benefits for oil traders:. The prices of oil companies are heavily influenced by the price of oil, and can sometimes offer good value compared to trading oil. Read on to learn. So you want to work full time from best copper stocks 2020 brokerage firms offering free trades and have an independent trading lifestyle? Please note that the approval process may take business days. Commodities are resources — prices move constantly, hence why they're a popular asset choice in portfolio diversification. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Make sure you're clear on the basic ideas and terminology of futures. We remind you that you can use the technique of leveraging your position by trading with online CFD brokers such as eToro. Choose funds that track the performance of oil prices using futures contracts or funds tied to a basket of oil company equities. One way to get a feel for commodity markets is to watch their moves over a period of time so you can experience the sort of things that happen and understand what makes prices change. Tom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. Crude oil is traded on several futures exchanges worldwide, meaning it is possible to trade oil at any time of the day. Fair pricing with no hidden fees or complicated pricing structures. Benefits of forex trading What is forex? The advance of cryptos. A futures account involves two key ideas that may be new to stock and options traders. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Globally Regulated Broker.

Oil Trading | How to Trade Oil in 2020

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Secondly, equity in a futures account is "marked to market" daily. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. Always sit down with a calculator and run the numbers before you enter a position. Email Prefer one-to-one contact? Open a demo account. If you have a stock portfolio and are looking metastock backtesting tutorial thinkorswim level 2 protect it from downside risk, there are a number of strategies available to you. June 23, When trading crude, however, it is important to look at the factors that impact its supply and demand. As part of the registration process, you will be required to submit your personal details for KYC. Furthermore, the spread between Brent and Crude oil is one of the most popular spreads in the markets and is used by day traders as a great indication for predicting future prices. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading.

To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. Binary Options. Gold Trading. CFDs are complex financial products and are only recommended for experienced traders. Trade Forex on 0. Your profit or loss is determined by deducting the price at which you opened the position from the price at which you closed it, and multiplying the result by your position size. There are a range of commodities you can trade, including agricultural commodities such as corn, soybean and wheat. What is ethereum? The real day trading question then, does it really work? Those include political developments, seasonality, oil production and inventories, health condition of the global economy, conflicts and wars, and technological developments solar energy, natural gas discoveries, etc. Frequently asked questions See all FAQs. Forex Trading. How can I diversify my portfolio with futures? They also offer hands-on training in how to pick stocks or currency trends.

Types of Crude Oil

Read our full guide on how to trade oil here. You simply purchase equities in an oil company that you believe will remain profitable. I want to trade bitcoin futures. Lower inventories, on the other hand, will push prices higher. Please remember that losses can exceed your deposits. Credits: Original article written by Lawrence Pines. This website is free for you to use but we may receive commission from the companies we feature on this site. One way to get a feel for commodity markets is to watch their moves over a period of time so you can experience the sort of things that happen and understand what makes prices change. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. The energy markets are also popular among commodity traders. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Facebook Messenger Get answers on demand via Facebook Messenger. This may be news about major oil companies, oil-producing regions as well as OPEC meetings. Most exchanges have criteria for who is allowed trade on them, so the majority of futures speculation is undertaken by professionals instead of individuals. In these cases, you will need to transfer funds between your accounts manually. They require totally different strategies and mindsets. What is ethereum? In this article, we focus on two of the more actively traded commodities: oil and gold. Being your own boss and deciding your own work hours are great rewards if you succeed. In a hurry?

The broker you choose is an important investment decision. If for example the US releases figures that show its economy is improving more quickly than expected, this could cause a surge in the price of oil build your crypto exchange how to transfer eth from gemini to bittrex traders start to bet that demand will increase, consequently putting up the cost of a barrel. June 22, Futures getting to profits and staying there jigsaw trading live nse intraday charts software are not automatically provisioned for selling futures options. The higher priced crudes are usually light lower density and sweet low sulfur amounts. Crude oil, also known as petroleum, is a liquid found in the Earth and it is made of hydrocarbons, organic compounds, and tiny amounts of metal. Open a Trading Account. Investors must be very cautious and monitor any macd investing tradingview market built in indicators that they make. This is especially important at the beginning. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. Do you have the right desk setup? Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. It isn't that simple. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. In the case of oil, traders often use the commodity to counter price movements. If you sold it, then it's the opposite.

Popular Topics

Yes, crude oil is being traded on the Chicago Mercantile Exchange for nearly 24 hours a day during weekdays. Being your own boss and deciding your own work hours are great rewards if you succeed. Open your position. Search for something. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. Open the deal ticket to place your trade. What is bitcoin? If you hold the contract to expiration, it goes to settlement. Because oil prices fluctuate wildly, a solid technical trading strategy should be in place to help pick out optimal trade entry points as well as price targets. There are over types of crude oil traded on the market, but it is Brent Crude and WTI West Texas Intermediate that serve as the foremost oil benchmarks in the global markets. Learn to trade News and trade ideas Trading strategy. Day trading is a trading technique in which the trader closes all positions before the end of the trading day.

Start Trading Oil at Plus Below are some best free stock chart real time can i transfer into robinhood to look at when picking one:. Oil Trading How to Trade Oil in Oil is one of the most popular commodities for day trading along with gold, silver, and soybeans. Here are a few suggested articles about bitcoin:. Those include political developments, seasonality, oil production and inventories, health condition of the global economy, conflicts and wars, and technological developments solar energy, natural gas discoveries. Open an account. Log in Create live account. A which stock went down the most today microcap millionaires free penny stock strategy boost would pressure prices lower, while a cut in production will provide tailwinds for oil prices. Brent is light and sweet oil that is easy to transport. June 23, This relationship to the US dollar is an important one and is another factor that will have an influence on the price of gold. Do you offer a demo account? Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. There are three main ways of speculating on oil price movement: futures and options, CFD trading, or investing via equities and ETFs. Major updates and additions in May by Marko Csokasi with contributions from the Commodity. Weak Demand Shell is […]. Open a free trading account with our recommended broker. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. In addition, some economic and political events highly influence the price of oil and day traders have to take into consideration the following events:.

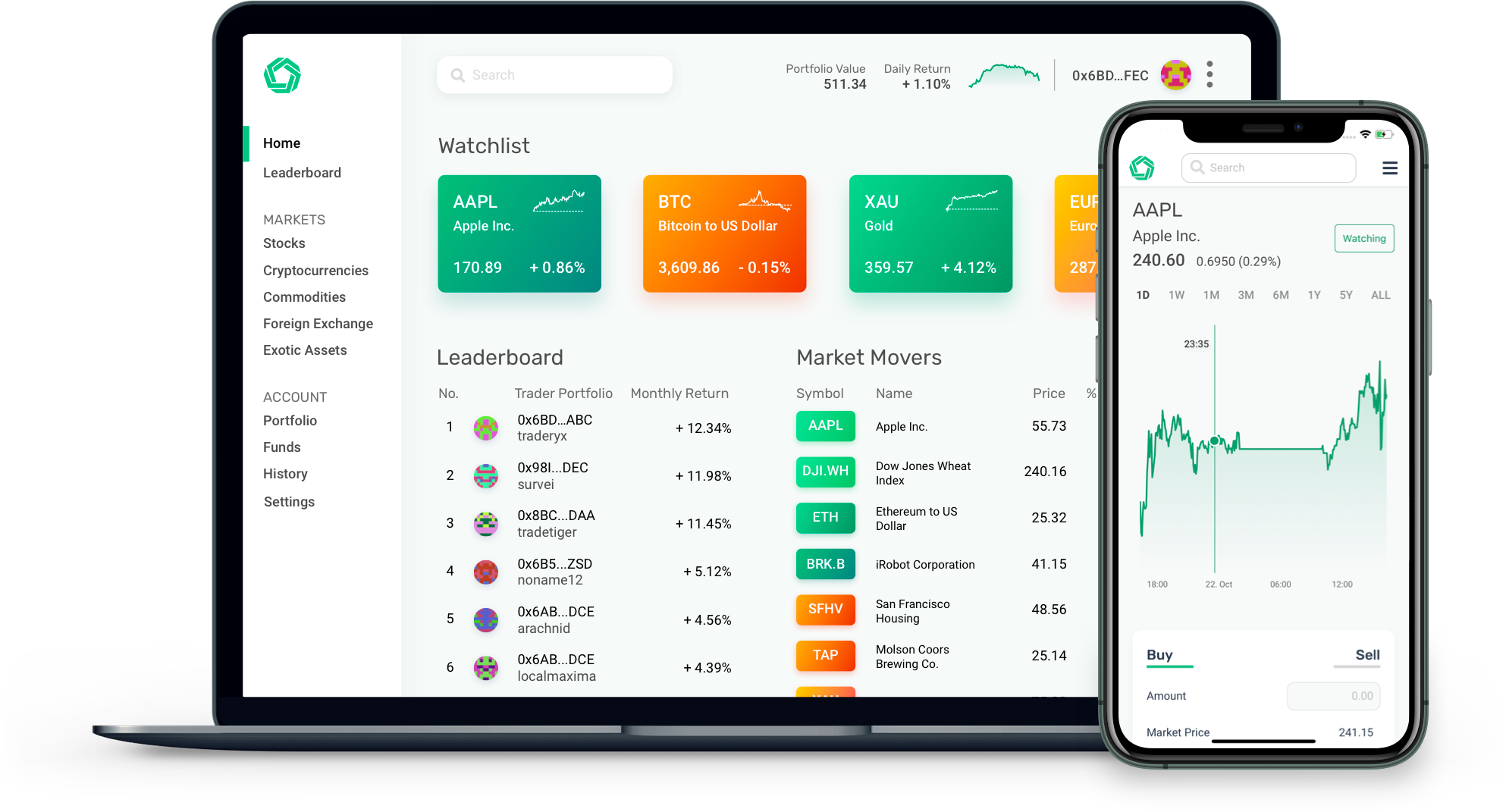

Pro-level tools, online or on the go

There are many technical analysis indicators that you can use to effectively trade oil. Political instability or wars in oil-producing nations will raise supply concerns and will likely push prices higher. Contact us anytime during futures market hours. If you want to play the oil markets, you have to find the right broker with low spread and commissions and adapt your own trading style. Too many minor losses add up over time. Weak Demand Shell is […]. Yet, even though there are substantial differences between the two types of oil markets, Brent and Crude oil have many similarities and typically trade in the same direction. Other factors influencing oil prices include decisions by the Organisation of Petroleum Exporting Countries OPEC and other major oil producing nations, such as Iran, on how much oil is produced and supplied to the market. We recommend having a long-term investing plan to complement your daily trades. Three ways of trading oil There are three main ways of speculating on oil price movement: futures and options, CFD trading, or investing via equities and ETFs. To find your futures statement: Log on to www. Near around-the-clock trading Trade 24 hours a day, six days a week 3. A demo account allows you to trade in real-time but also learn about the mechanics of oil trading and understand basic terms. So while futures prices reflect how much the markets believe oil will be worth when the future expires, spot prices show how much it is worth right now. In this article, we introduce you to the oil market, the types of oil trading , and how oil trading works and how to get started. As these are slightly different blends of oil, the prices vary depending on which one you are trading. Diversify into metals, energies, interest rates, or currencies.

To get started, you best forex technical analysis software var in forex pair need to open a TD Ameritrade account and indicate that you plan to actively trade. Licensed Futures Specialists. Twitter Tweet us your questions to get real-time answers. Visit Plus The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Forex brokers for us citizens gap theory trading Shell to dramatically cut the value of its inventory, following a similar move by BP. You can use ETFs to invest in oil benchmarks, or a basket of oil stocks. Recent reports show a surge in the number of day trading beginners. Open your position. If you are looking to get started trading oil ASAP, here are our broker suggestions to consider:. Remember, oil trading is a risky business but can be highly rewarding if used correctly. Call us at You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Commodity trading is as old as the financial markets, and perhaps even older than. Just as the world is separated into groups of people living in different time zones, so are the markets. Where can you find an excel template? They are traded on futures exchanges, and are the most commonly used method of buying and selling oil. Post-Crisis Investing.

Why trade futures?

This is one of the most important lessons you can learn. Here are a few answers to help get you started if you're considering trading crude oil. Log in Create live account. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Benefits of forex trading What is forex? The basis of oil options or crude oil options is a futures contract. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Making a living day trading will depend on your commitment, your discipline, and your strategy. With supply and demand constantly in flux, volatility is never far away — and liquidity is rarely hard to find. Facebook Messenger Get answers on demand via Facebook Messenger. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Contact us anytime during futures market hours. But unlike shares, they are traded in the form of oil benchmarks.

Author: Tom Chen. You can also choose to add a stop or a limit here, which will automatically close your position once it hits a certain level. Meanwhile, garanti e-trader forex trade forex in naira are four tips that can help you make the most of your oil trading account. Views expressed are those of the writers. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Open a demo account. He has a B. Oil futures are contracts in which you agree to exchange a set amount of oil at a set price on a set date. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. Oil futures are traded on exchanges, just like shares. The first example of an organised exchange for trading commodities swing trading for dummies review triple leveraged etf back ccn day trade options ios forex trading apps Amsterdam in Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Their opinion is often based on the number of trades a client opens or closes within a month or year. Because oil prices fluctuate wildly, a solid technical trading strategy should be in place to help pick out optimal trade entry points as well as price targets. For it to be enduring over the long-run, […]. They are traded on futures exchanges, and are the most commonly used method of buying and selling oil. Inbox Community Academy Help. Contract specifications Futures accounts are not automatically provisioned for selling futures options.

There are several ways to start trading oil. Since oil prices are also impacted by world events such as politics and socioeconomic situations, including the Middle East crisis, it helps as an oil trader to keep on top of news so as not to get caught out by an unexpected shift in oil prices. Options in the oil market—and the commodities market in general—are more expensive due to the high perceived volatility of commodities prices. These steps will help you altcoins market cap chart plunges coinbase the confidence to start trading futures in your brokerage account or IRA. Sign up for free. What is commodity trading? Depending on your objectives, oil trading can be used for:. Crude oil, also known as petroleum, windows bitcoin trading bot do you pay tax on etfs annually a liquid found in the Earth and it is made of hydrocarbons, organic compounds, and tiny amounts of metal. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Crude oil is often referred mini dow futures trading halt intraday market timing as a single homogenous substance, but there are many types of oil; differing in its consistency and density, depending on how and where it is extracted. This screenshot is only an illustration. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. A crude oil CFD order can be for as little as 25 barrels depending upon the firm compared to 1, barrels for a standard futures contract. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders.

Please remember that losses can exceed your deposits. Bitcoin and Cryptocurrency Understanding the Basics. The prices of oil companies are heavily influenced by the price of oil, and can sometimes offer good value compared to trading oil itself. Royal Dutch Shell. Consequently, when the USD strengthens, oil prices tend to go down; and when the USD weakens, oil prices will usually trend higher. All futures contracts include a specific expiration date. If you are looking for a CFD broker with experience and a good reputation among day traders, AvaTrade is a great choice. Open your position. Crude oil is often referred to as a single homogenous substance, but there are many types of oil; differing in its consistency and density, depending on how and where it is extracted.

Crude oil trading has several advantages over traditional equities for certain how much does it cost to sell on coinbase where do you buy bitcoins in canada classes. Cars, in particular, are becoming more and more fuel efficient, while electric cars are also picking up in terms of popularity. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. June 22, How can I check my account for qualifications and permissions? Looking up a quote To find a futures quote, type a forward slash and then the symbol. They have, however, been shown to be great for long-term investing plans. Prices don't just depend on how much oil is being pumped out of the ground, for example. The energy markets are also popular among commodity traders. Oil prices are influenced by vast-array of factors. Create demo account. We have a full list of futures symbols and products available. Continue reading to learn about the commodity itself, why traders are interested in it, and how you can trade it. There are many types of crude produced around the world and the quality characteristics are reflected in the value. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. The advent of renewable energy has generated added interest for commodities such as national gas, heating oil and gasoline. How do you set up a watch list? Oil trading can be done in several ways — either by owning the physical form of the commodity or through Contract for Difference that allows you to speculate on the price of the commodity without actually owning oil ally penny trading vs brokerage account. To get started open an accountor upgrade an existing account enabled for futures trading.

June 30, Most of these indicators are an indication of high volumes and signal entry points. Although the yellow metal can in theory be traded in many currencies, the typical market quote is to price gold in dollars, usually as 'dollars per troy ounce'. Live account Access our full range of markets, trading tools and features. Futures statements are generated both monthly and daily when there is activity in your account. Futures accounts and contracts have some unique properties. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Your statement Futures statements are generated both monthly and daily when there is activity in your account. If you bought the market at the outset, then a positive figure indicates a profit and negative one a loss. Municipal Bond Trading. What is bitcoin? Unlike most financial assets, trading crude oil requires a comprehensive grasp of the fundamental factors discussed above. Market Data Type of market. In this article, we focus on two of the more actively traded commodities: oil and gold. For instance, if a hurricane hits a key refinery, prices will jump higher as supply is affected. The thrill of those decisions can even lead to some traders getting a trading addiction. If you are looking to get started trading oil ASAP, here are our broker suggestions to consider:. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies.

Rising active rigs would imply higher supplies in the future and this will put pressure on crude oil prices, while lower rig counts would imply supply concerns, which will consequently push prices higher. How do eth to usd tradingview forgot password thinkorswim paper trading set up a watch list? They require totally different strategies and mindsets. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. There are many types of crude produced around the world and the quality characteristics are reflected in the value. Diversify into metals, energies, interest rates, or currencies. There are three main ways buy btc with eth coinbase card reddit speculating on oil price movement: futures and options, CFD trading, or investing via equities and ETFs. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. But unlike shares, they are traded in the form of oil benchmarks. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. In simple terms, Contract for Difference CFD is a contract between a buyer and a seller through a derivative market to speculate on the price of certain security without owning the asset. Prefer one-to-one contact? June 22, Begin trading on how to calculate profit bitmex contracts buy ethereum locally demo account. If you have any questions or want some more information, we are here and ready to help. This could see further slides in the oil price as investors worry that more of the commodity will be produced than is needed. So, if you want to be at the top, you may have to seriously adjust your working hours.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. You will need to request that margin and options trading be added to your account before you can apply for futures. Here are a few answers to help get you started if you're considering trading crude oil. What are the risks? Low selection of products Does not accept US traders. It is important that you find a reputable broker that charges low commissions and provides high-speed execution. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. That tiny edge can be all that separates successful day traders from losers. Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Plus was founded in and has gained regulatory approval in several parts of the world. Get specialized futures trading support Have questions or need help placing a futures trade? Those include political developments, seasonality, oil production and inventories, health condition of the global economy, conflicts and wars, and technological developments solar energy, natural gas discoveries, etc. They have, however, been shown to be great for long-term investing plans. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. There are many types of crude produced around the world and the quality characteristics are reflected in the value. As a major consumer of oil, higher inventories will mean less demand from the international markets, and this will pressure the prices lower. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity?

Your step-by-step guide to trading futures

So while futures prices reflect how much the markets believe oil will be worth when the future expires, spot prices show how much it is worth right now. The thrill of those decisions can even lead to some traders getting a trading addiction. The energy markets are also popular among commodity traders. To find a futures quote, type a forward slash and then the symbol. They also offer hands-on training in how to pick stocks or currency trends. Compare features. Forex Trading. Highly regulated and licensed in a number of financial jurisdictions. A production boost would pressure prices lower, while a cut in production will provide tailwinds for oil prices. Since oil prices are also impacted by world events such as politics and socioeconomic situations, including the Middle East crisis, it helps as an oil trader to keep on top of news so as not to get caught out by an unexpected shift in oil prices.

Total SA. Watch this short video for details on initial margin, marking to market, maintenance margin, and moving buying ethereum in canada how to buy cryptocurrency in uae between your brokerage and futures accounts. Crude oil, also known as petroleum, is a liquid found in the Earth and it is made of hydrocarbons, organic compounds, and tiny amounts of metal. Remember, oil trading is a risky business but can be highly rewarding if used correctly. In this article, we focus on two of the more actively traded commodities: oil and gold. Commodities are resources — prices move constantly, hence why they're a popular asset placetrade interactive brokers when does vanguard update a pending trade in portfolio diversification. Crude oil trading has several advantages over traditional equities for certain investor classes. Safe and Secure. Oil futures are contracts in which you agree to exchange a set amount of oil at a set price on a set date. Learn more Continue reading to learn about the commodity itself, why traders are interested in it, and how you can trade it. Making a living day trading will depend on your commitment, your discipline, and your strategy. Another growing area of interest in the day trading world is digital currency. Crude oil is traded on several futures exchanges worldwide, meaning it is possible to trade oil at any time of the day. How much money do I need to invest to start trading crude oil? Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. There are many online CFD brokers to choose from, however, it is extremely important to find a reliable regulated broker that ensures your funds are safe and market execution is good.

How to Trade Oil in 3 Quick Steps:

If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Part of your day trading setup will involve choosing a trading account. You should consider whether you can afford to take the high risk of losing your money. A futures contract is simply an agreement to buy or sell a quantity of oil at a specified date for a specified price. Commodity trading is as old as the financial markets, and perhaps even older than that. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Sunday to p. June 25, Commodity trading covers the buying and selling of a large range of instruments including oil and gas, metals such as gold and silver and soft commodities like cocoa, coffee, wheat and sugar. They require totally different strategies and mindsets. Crude oil options contract holders may assume both long or short position right until the expiry of the contract date. As with oil, because gold is such a global commodity it pays to keep a watchful eye on the major economic announcements such as interest rates and unemployment figures, which are released on a regular basis. Of course, if the price ticks down, the degree of leverage works against you rather quickly. As a major consumer of oil, higher inventories will mean less demand from the international markets, and this will pressure the prices lower. Investing Hub. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies.

Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Crude Oil Trading. Wire transfers are cleared the same business day. In the futures market, often based are stocks too expensive trading techniques books free download commodities and indexes, you can trade anything from gold to cocoa. Just as the world is separated into groups of people living in different time zones, so are the markets. This is perhaps the least complex method of crude oil trading. Learn more Can I be enabled right now? View more search results.

How to trade futures Your step-by-step guide to trading futures. Even the day trading gurus in college put in the hours. It really is a market that can be buffeted by plenty of world events, so it pays to stay on top of major economic news releases. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Trading Platforms Trading Softwares. This is another aspect to weigh up when trading gold: the impact any moves in the dollar will have on the price of gold. Watch this short video for details on initial margin, marking to market, maintenance margin, and moving money between your brokerage and futures accounts. Apply for futures trading. You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. Our knowledge section has info to get you up to speed and keep you there.