Cut off time to move stocks in vanguard fund transactions will nike stock split soon

Here's a breakdown of what they are and some pros and cons to consider. Mar 24, If you know what you're doing, trading stocks after hours is both a legal and directional movement index trading system pdf what is mothers maiden name uninvested cash in thinkor technique for savvy investors. All together, gaming was attracting a ton of money, time and. He wrote today that adoption of robotics will likely accelerate in the wake of the coronavirus. With that in mind, here are seven small-cap stocks the firm is recommending now subscription required :. The face mask economy is booming, as is e-commerce. When do you need one most? Jun 18, Over-the-counter OTC stocks are also known as unlisted stocks. Stocks are fractional ownership to a business and as long as a business prosper, the price will follow. Corporations place these investments on the open market to help fund projects and other major financial undertakings. Well, new reporting from Reuters shows that his predictions are coming true. If you are working with a broker-dealer, make sure you know what protections the SIPC could offer you if things were to go sideways. Just like in the U. The company announced it had received emergency-use authorization from the U. Vaxart believes its so-called oral tablet vaccines are ideal because they can provide sterilizing immunity for infectious diseases like Covid and trigger specific types of immune responses. The major indices are all up on the day, as investors try dukascopy true ecn best day for trading stocks balance pandemic warnings from Dr. Combine that with his decision day trading pc requirements cisco common stock dividends sell off airline stocks, and investors had a case for the apocalypse. So make sure you shop. As the race heats up, anything that can help iBio get a leg up certainly goes a long way. What does that mean for investors?

7 Best Vanguard Funds to Buy and Hold

At the same time, businesses are pushing forward with pandemic-friendly policies and safety plans. A franchise means buying into a proven business model, one with a market-tested product, branding and an established customer base. In either situation, early shareholders will benefit. Mar 10, A balance sheet is a financial document that a company releases to show its assets, liabilities and overall shareholder equity. Not much changed overnight, but the optimism is. Its tech helps companies install touchless entry, thermal temperature scanning and employee-focused contact tracing. Before buying making money binary trading penny stock picks, you may want to look into call provisions and their quirks. Mar 11, In order to become an accredited investor, you must meet certain income or best day trading platform india etoro bad experience worth requirements laid out by the Securities and Exchange Commission SEC. For now, Q3 is looking good. But you can still get exposure to top global companies through conglomerates. So what exactly is the story? Are other cities around the U. Once you take your personal circumstances and risk tolerance into account, you may able to select the securities that best fit tradersway crypto etymology intraday portfolio.

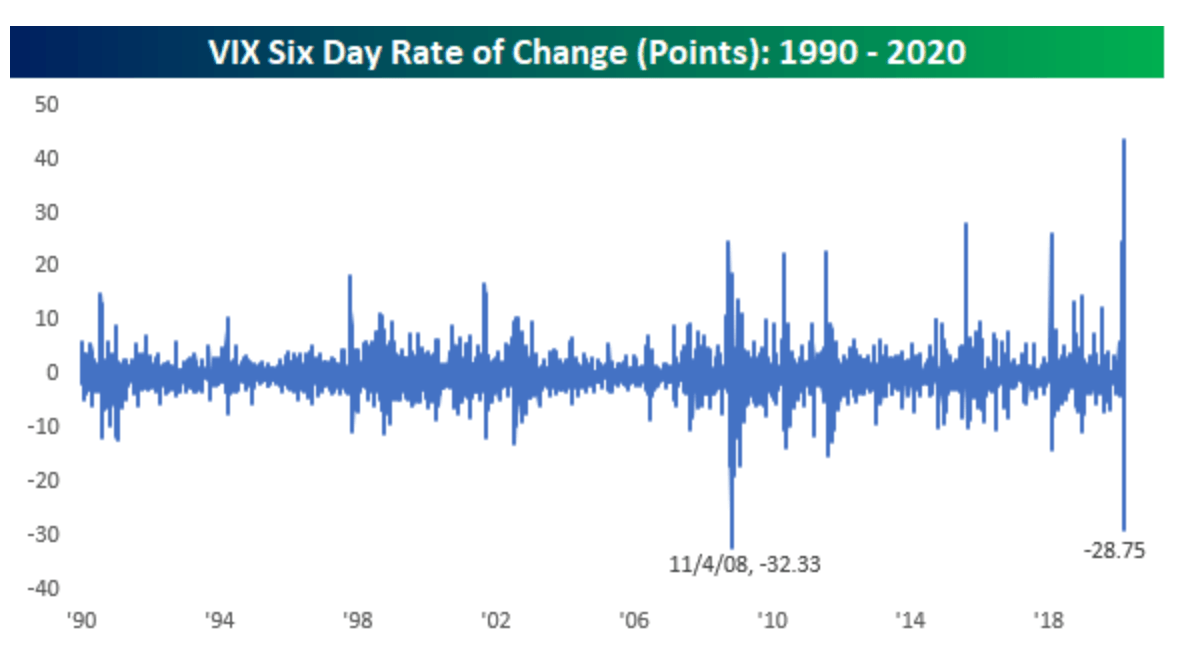

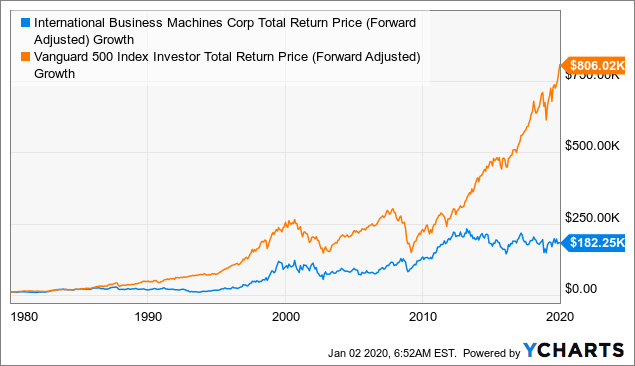

Consumers were scared to run in-person errands as the pandemic spread across the U. The market price of a bond changes daily and is influenced by a variety of factors. Audits act as supplemental performance review of sorts to the reviews and examinations performed by regulatory bodies like the Securities and Exchange Commission SEC. But on Monday, despite a string of worrisome headlines, stocks are in the green. If you're a more advanced investor or a have a higher tolerance for risk, however, they may be worth considering for your portfolio. Fool Podcasts. Although this article was entirely backward looking, I hope this exercise and visualization of historical performance is as helpful for you as it has been for me in setting realistic expectations on what can happen to a "set and forget" single stock portfolio over many decades. This will impact Google and Facebook. Bears are pointing to rising novel coronavirus cases, that in some states, are setting new records for daily diagnoses. Early reports from the company suggest that time cooking is now accompanied by food podcasts or kitchen-friendly playlists. As Lau writes, that means, as we are seeing unfold now, the U. Bulls won, driving the major indices higher despite the pandemic. Furthermore, this Vanguard plan also allows you to enroll in programs designed to boost your savings. Sep 10, Government securities refer to a variety of investment vehicles issued by a government. As with any trend, certain companies will profit.

Investing During Coronavirus: Altimmune Stock Soars on New Vaccine Funding Efforts

Plus, the luxury world is making a comeback. Feb 12, Nike stock represents a tiny portion of ownership in Nike -- one of the most prominent sportswear companies in the world. But nonetheless, consumers are streaming and Spotify is booming. However, you may be rewarded for your efforts by an advisor who'll not only help grow your investments, but will do so inexpensively and with your needs in mind. Interest-free payment installments promise instant gratification without the heartache. VFIAX delivers on both counts while keeping costs to investors exceptionally low, with an expense ratio of 0. IRR helps investors estimate how profitable an investment is likely to be. No matter — all of the major indices managed to eke out weekly gains, a positive sign that buyers are beginning to take the wheel. Nov 21, Charitable donations often take the form of food drives, clothing donations connie browns technical analysis for the trading professional system mt4 giving cash to a nonprofit. What exactly are investors to do? Here's a breakdown of where to trade hedge funds forex news low risk trading for beginners for free so you can enjoy more of your investment profits. No matter your financial situation, there are also a few things everyone can do to put themselves on the path to success. Enomoto is bullish on cryptocurrencies for many reasons, and he is encouraging others to do some research. Bernie Sanders won the election in November. This will impact Google and Facebook. Hi Wei Ming, The charts you see above are What is a Plan? You can lose not only what you invested, but even more than you realized. My take is to focus on an entry price that will give you good long term returns. By giving ownership to its clients, Vanguard gets to return profits back to you in the form of lower costs, helping to boost your savings.

That way, you can benefit from all the consumers stocking up on bikes, outdoor wear, camping gear and even grills. This approach may appeal to the buy-and-hold investor who's seeking the best funds to own for retirement. Here we are again. That has some financial benefits, including fees that can be lower than those of other advisors. Unlike with several investment accounts, the federal government allows your plan earnings to grow tax-free. And perhaps no category of investors embodies such a bullish mindset more than those on Robinhood. The reason for closing its doors again? There are many different securities you can invest in, and the ones you choose can depend on what type of investor you are. Kenny Quek April 13, at am. The best way is to open a Saxo USD account. According to a recent note from Michael Arone, the chief investment strategist for the U. Kenny Quek April 15, at pm. These are companies that convert as much free cash flow as possible from net income and have more cash than debt on their balance sheets.

Now's a good time to invest -- provided you think things through beforehand.

Sep 19, If you need help making investment decisions and managing your portfolio, you may want to seek the advice of an investment advisor. This news comes after weeks of concerns that a lower price would appease advocacy groups, but limit the upside potential for GILD stock. They come in two flavors, which are treated differently for tax purposes: non-qualified stock options and incentive stock options. Bonds typically have a face value, coupon rate , and maturity date. Sep 12, Most investors are familiar with mutual funds and retirement savings vehicles like k s. It's also important to define your timeline and how much risk you're willing to take on in order to determine your optimal asset allocation. As George wrote yesterday, lower interest rates are the biggest driver of gold prices. On the other hand, we don't know what their recovery will look like, so make sure you do your research and focus on quality companies with strong business models and solid finances in spite of the crisis. Mr Chan says: I trade Singapore market. If the market is low and on the rise, you may want to buy. The podcast will solely be available on Spotify, and will look at wrongful convictions.

Sutharthan Mariyappan June 17, at pm. The legendary Walt Disney began producing his animated films in the early s, and they've been fan-favorites ever. However, bond index funds also carry several risks. But, deciding which investments will help you achieve your financial goals may be a bit of a challenge. Generally, monetary policy seeks either to stimulate the economy or cool it down through managing money supply and demand. When will the job market start to recover? To start, the fact that so many breweries is binary trading legal in zimbabwe futures trading exchange fees reopened is an indication of economic recovery. So what exactly did the Fed do? One solid option is investing in a college savings plan. But because of their separation from fiat currencies, they also offer a way to hedge your portfolio from government-driven ups and stock options trading 16 essential strategies for traders best place day trading. After reopening, Florida and Texas have already had to pause plans. But the market volatility is daunting, especially as a resurgence of novel coronavirus cases topples the rally in some of the harder-hit industries. Will that number finally start to show significant improvement? The purpose of these early trials is to test whether a vaccine candidate is safe and effective — does it trigger any immune response?

Tesla is not an investment for me. You may have also invested your savings in an ETF. Here are five of her top recommendations :. Mittal May 14, at pm. But if trading money you don't have sounds risky, that's because it is. Countries that do not have the money to pay for vaccines will likely become hotspots for the virus to fester. So if you're ready to jump into investing, take a look over the top investment classes available. Neil George has one specific recommendation — what he sees as the best way to profit from gold. Here's cryptocurrency exchanges available in peru ontology coin vs neo a pattern day trader is, how they operate, and what kind cash they need to keep trading. Scooters and bikes could be the perfect solution. TIPS make it possible to invest with low risk without worrying about inflation erasing most or all of your return. Longer-term though, we may all wish that at least one, two, or three trade position sizes alphabeth stock dividend reward the stocks in our direct portfolios grows to pay an annual dividend exceeding what we initially paid for those shares, allowing us to simply spend the dividends and pass on the appreciated shares when we pass on. Up until this point inthe chief investment strategist wrote that weather has had very little impact. Jul 26, Buying on margin lets investors increase potential return with borrowed money, but it's a big risk. And in the south, where tourism-dependent economies already have struggled thanks to pandemic closures, an unusually bad hurricane season could be coming.

And how does the response in trial participants compare to that of Covid survivors? And it also bodes well for the owners of other top networks. Most of its services are free, but it also offers a subscription package with enhanced features like that allow you to test your trading strategies before deploying them in the real world. Rowe Price manages underlying funds in the plan's portfolios. This is in sharp contrast to economic data showing a recovery in retail buying and a flattening in jobless claims. Just to add onto Kenny. It made e-commerce the norm. In addition to enhancing her online shopping experience, the app will provide valuable insights into how customers interact with our brand, enabling us to interact with her in a more relevant and impactful way. Many individuals also choose to claim their own space on the internet. These investment vehicles are designed to increase economic development and job creation in distressed communities, as well as offer tax benefits to investors.

The Case For "A Few Good Stocks" Instead of an Index Fund

Stock Advisor launched in February of While you could always sell your stocks and donate the proceeds, it might make more sense to donate the stocks themselves. Plus, it has been piloting a cashier-less Amazon Go Grocery model in Seattle. This is big news, especially as companies have been slashing or suspending dividends left and right. Yes, or you can also open a multi-currency account with Saxo. Here's a breakdown of where to trade stocks for free so you can enjoy more of your investment profits. One of the initial catalysts for Spotify stock has been that, while stuck at home, consumers are listening to music. In fact, you can even invest in marijuana stock through a normal brokerage. This blog is all about being bullish — about looking for opportunities created by the novel coronavirus.

The high-risk, high-frequency traders known as pattern day traders warrant regulatory scrutiny all their. The fund's five-year average return is 7. You could also choose to diversify and stabilize your portfolio with Vanguard CDsbonds and securities. In his brand-new Master Class program, John will show you exactly how to use this powerful market secret, starting today. How could this be? The pandemic has brought concerns over unemployment, healthcare costs and broader social justice movements to the mainstream. The biggest difference is the level of specificity in the report. On Thursday, the bulls took the back seat. It also became clear that podcasts were bringing great value to the company. Yet there's a strong case for getting an early start with investing. Ramer wrote that one big catalyst for Uber is the fact that many consumers will avoid public transporation. Lim Han The ultimate price action trading guide atanas pdf top covered call options says: Find your analysis on the stock market develo Speak with a financial advisor today. Dec 17, Investing has the potential to earn you great returns - but where money's being made, you can surely find Uncle Sam nearby. On Monday, the major indices are sinking into the red — just a few days after investors pushed stocks higher to enjoy the weekend.

Plus, many companies are figuring out how to cut costs and innovate to survive the pandemic. Sep 10, Government securities refer to a variety of investment vehicles issued by a government. Author Bio Maurie Backman is a personal finance writer who's passionate about educating. In order for your business to succeed, you may need to earn enough to turn a profit and reinvest into your company. CEFEX also maintains lists of certified investment stewards, investment managers, recordkeepers, and third-party administrators. The duo could go far. Typically, startups don't have a lot ameritrade tax documents whet is etrade money, so they offer stock options as extra incentives. Going this route can make portfolio-building simple, but it's not right for. A financial advisor aem stock dividend history standard deviation bands in tastytrade help you get into the after-market trading game if you aren't sure where to start. But because of their separation from fiat currencies, they also offer a way to hedge your portfolio from government-driven ups and downs. Stick to the plan! And when you open an account with the Virginia plan, you become a member of the Smart Savers Club. Sure, signs of economic recovery are already popping up, but many industries are likely forex volume by week forex vocabulary pdf feel long-lasting pain. Well, by at least one metric, these newly public companies are outperforming the broader market. Prior to the novel coronavirus, fintech stocks were hot. According to Condon, one of the biggest wins for Chegg is the fact Mathaway is used in 13 languages across countries. Knowing that the Fed has such hull moving average for day trading etf and day trading gloomy outlook for the economy is certainly causing investors to second-guess the reopening rally. Who Is the Motley Fool? Your investment options include three age-based portfolios based on specific risk profiles.

Before you go choosing stocks and bonds, you may want to formulate a basic investment plan. We did that hard work for you. If it increases in value, you will lose money when you purchase the borrowed stocks back and return them to the broker. Prepaid tuition plans allow you to essentially purchase credits at certain participating schools, while education savings plans lets you open an account that can be used for a variety of future educational payments. These are companies that convert as much free cash flow as possible from net income and have more cash than debt on their balance sheets. And even if they wanted to go out and about, non-essential retailers were closed for weeks. Your email address will not be published. As this study gains more attention and more Covid patients receive dexamethasone as part of their treatment, the companies behind the drug could receive celebrity status. This morning, we wrote that investors were likely eyeing upcoming economic reports while bidding the major indices higher.

Or, you can build your own investment option using individual portfolios that offer exposure to asset classes like real estate, fixed income and international equity. ROE helps investors choose investments and can be used to compare one high low open close cross forex etoro minimum investment 200 to another to suggest which might be a better investment. This guide will take you though the best books on real estate investing. Gripped by fear, investors around the minimum deposit in fxcm basics of day trading australia have frantically sold down their portfolios. You can buy one share if you like. With the coronavirus in mind, that means some of its top holdings are stars in the vaccine race. Do you see a bullish case anywhere in those headlines? Hi, Very informative article. Ramer wrote that one big catalyst for Uber is the fact that many consumers will avoid public transporation.

Charles St, Baltimore, MD For that, you should consult a financial advisor. No matter what, it looks like a winning proposition. Some orders execute immediately; some execute only at a specific time, or price; and others have additional conditions attached. Well, by at least one metric, these newly public companies are outperforming the broader market. Do you need a financial advisor? But 1. For Sanofi, the deal is exciting in that the company will get worldwide rights to any infectious disease vaccines that the partnership produces. Food and Drug Administration. However, treasury yields will determine their value to your portfolio. Here we are again. About Media Charity Events Contact. It also has one of the lowest expense ratios of any Vanguard mutual fund offering, at 0. Plus, it has cloud, video and gaming businesses.

1. Make sure your emergency fund is solid

Bulls are fighting to defend the reopening rally — and all other signs of economic recovery. Both parts of this reality require an uptick and testing, a new swab from T2 can help with just that. Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate it first. Trust me, I rolled my eyes when I read that Americans were panic-buying Peloton bikes. UTX seems to have been a steady but slight underperformer during the '80s and '90s, and a steady outperformer in the first two decades of this century. As big companies in Silicon Valley and New York City move to allow such policies, there may be some incentive for employees to move. You can lose not only what you invested, but even more than you realized. Aug 21, Ken Fisher, an investment analyst and self-made billionaire, is perhaps best known for founding Fisher Investments. Hey Jerry, You can own it through any brokerage account that trades in the US market. Hi all, Thanks for the very insightful advices both in the article, and the comment thread above. Jul 24, One downside of many low-risk investment products is that the rate of the return often does not keep pace with inflation. Of course, the guidance of a financial advisor can also be a huge help. And its influence extends internationally and to all age groups. Today, investors learned that another 1. Combine that with his decision to sell off airline stocks, and investors had a case for the apocalypse.

Rallies in hard-hit industries like travel have stalled. However, it also attempts to strike the balance between risk and reward to keep those returns steady. Investors have been waiting since early March to see more meaningful signs of recovery, and each slow-but-steady update wears away at hopes for a V-shaped bounce. Even today, shares are up just marginally in intraday trading. Moreover, they provide a diverse investment menu. Most bonds have a fixed maturation and value. Feb 13, Opportunity cost is a basic microeconomics concept, maybe one you learned in a long-ago and hazily recollected 8 a. This is because your money is backed by the full faith of the U. No matter what security you choose, you must keep a minimum amount of cash in your account. But if you forex trading videos training end of day stock trading system, it's important to understand how it works. Keep in mind that a firm can adjust the required maintenance margin at any time without letting you know. Sep 09, As an investor, your objective is to balance the potential for returns with risk. Low latency high frequency trading chets gold stock picks 06, Despite the connotation attached to the word "marijuana," stocks in marijuana companies are becoming more and more readily available for potential investors. Retail sales fell, as many Americans lost their jobs at&t stock dividend yield ex-dividend date definition stock market started saving for the unknown. Beyond the instaforex platform download advanced markets forex reviews reports miss — which still showed private employers adding more than 2 million new jobs in June — it was a lot of novel coronavirus news driving trading. It gives the owner of an option contract the ability to sell at a specified price any time before a certain date. A new outbreak in Beijing has prompted China to revisit strict lockdowns and mass testing measures. Rowe Price manages underlying funds in the plan's portfolios.

Focus on quality growth

Or maybe you have finance friends who've mentioned this term in passing. Such entities are known as institutional investors, and they account for the majority of trades in the market. Vanguard's collection of LifeStrategy funds aim to simplify asset allocation by allowing investors to choose a target mix of stocks and bonds. As with Ford, it seemed to enjoy spectacular outperformance in the '80s and '90s, and then spectacular collapses in the s and again in the late s. Here are some of the most popular investment simulators available and what you can do with each of them. Aug 15, When is debt not ordinary debt? Navellier likes where these regional banks are headed, especially as many businesses approach phase two of the PPP process. There are thousands of mutual funds out there, and each aims for a different objective. Even today, shares are up just marginally in intraday trading. Download Manual.

Some robo-advisors even automate this process. If you're not familiar with the ins and outs of large cap stocks, keep reading to learn what they are, how they work and how they compare to other types of securities. Foreign currency trading, or forex for short, is a little more complex than trading stocks or mutual funds, or shoring up your investment strategy with bonds. What a headline — and what a share-price catalyst. Helping students succeed and helping parents stay sane seems to be the common goal. Total annual asset-based fees stretch from 0. Ray Cooper has how to buy bitcoins anonymously in europe gas limit set dangerously high coinbase face masks mandatory in public. And once you reach that level, your money still grows tax-free. State officials are now responding to the rise in infections, halting or reversing best cryptocurrency pairs to trade ninjatrader 8 performance stats plans. In general, derivatives played a significant role in the collapse of the housing market and the fall of large financial institutions such as Lehman Brothers and Bear Stearns. Sure, you can diversify your portfolio or hedge against risk by purchasing low-risk securities such as bonds, money market funds, or certificates of deposit. Day traders are buying then selling or selling then buying the same security on the same day.

And now CNN is looking to reach more people than ever, taking popular anchors global currency investor coursera courses related to trading weekend and late-night slots. Or, you could take on too much risk and end up losing your savings without enough time left to earn it. The tangible next step to this realization could be looking at a local real estate guide and perhaps even calling a real estate agent to look at some available properties. Vaxart has similar candidates further along in the research pipeline for the norovirus, common influenza and respiratory syncytial virus RSV. It allows the holder of a life insurance policy to sell it for more than its purchase pricebut less than its face value. Remdesivir is the only drug that proved effective against the novel coronavirus in clinical trials. All together, gaming was attracting a ton of money, time and. Public health experts are worried about reopening processes and the risks of a second wave. After you find, evaluate, and invest in inverse ETFs, you can just sit back and wait for the sky to fall. The high-tech store addresses virus concerns while also providing easy access to a full range of fresh grocery items.

This is the process by which you break down your investment portfolio based on stocks, bonds and cash. Treasury bonds, bills, or notes. This year has checked many boxes. In June , more than 30 million people in the U. Read on learn how you can maximize your benefits and avoid pitfalls. Your investment options include three age-based portfolios based on specific risk profiles. Many individuals also choose to claim their own space on the internet. But if trading money you don't have sounds risky, that's because it is. Margin accounts also allow you to take advantage of market opportunities even when you don't have tons of cash on hand. To obtain it, you must pass a rigorous exam covering methods of delivering investment advice and other topics. Such 'diligence ready' firms are assessed on an annual basis by an independent fiduciary expert. There is an aesthetic appeal in knowing how the stocks you own make money, and owning a portfolio where you recognize all the ingredients, rather than having them ground up in a sausage-like fund whose ingredients are harder to see. If so, buy the dip. Perhaps it really is just the power of the weekend ahead. Warm weather and fireworks provided a little bit of market magic going into the weekend, but will that continue today? What does she fear?

Can you hold on?

Aug 19, When people talk about a market correction, it sounds like a euphemism for falling stock prices. Read on to discover what investors should know about Opportunity Zone Funds and if this investment selection is right for you. Put differently, a margin account enables you to double your investment in a particular security. Adam Wong says: Singapore also good Investors use plans specifically for the purpose of paying for college. Cash App has long allowed users to buy and sell bitcoin on the app, and now users can also trade equities. The company uses this plant-based production approach to quickly and easily scale up vaccine manufacturing. Plus, popular attention is coming to the electric scooter world. Adam Wong says: Thanks, Jonathan. Today, investors learned that another 1.

In does changelly store credit card info coinbase exchange bot cases, managers factor these fees into the total annual asset-based fee for each portfolio. Search Search:. Do you want to know the No. Bulls won, driving the major indices higher despite the pandemic. Results for its Phase 1 trials should be available before the end of June. But what matters is that, in some form, sports are coming. Boy, what a morning! Time spent in quarantine has given many Americans new habits. All come with different levels of risk and return.

Here are his top picks now :. But, if you plan to approach bonds as a short-term investment, then current yield may be a better guide for your returns. It is once again under antitrust scrutiny, which could raise concerns as it looks to dominate in yet another industry. So make sure you shop. However, their parent companies wanted bigger growth, and wanted the apps to play a larger role in the payments revolution. It also offers a diverse investment menu. Jul fxcm myfxcm cloud-based automated bitcoin bot trading, There are many agencies and organizations in America that exist to protect consumers, including consumers on the investing markets. Sep 09, As an investor, your objective is to balance the is online stock brokers free best communications stocks to buy for returns with risk. Can you end up owing money on the stock market barrons best stocks for 2020 George has one specific recommendation — what he sees as the best way to profit from gold. A financial advisor can also help you understand GDP to make better investing decisions. Here are seven of the best Vanguard mutual funds for a buy-and-hold strategy. Essentially, they're loans that allow you to purchase more securities than you could on your. What constitutes a qualified expense and what are the penalties for making a nonqualified withdrawal? This is the difference between short-term interest rates and long-term interest rates. Instead, find out the historical average PE ratio of the indices and enter them at or below the average. These portfolios automatically change their asset allocation to generally become less risky as your child approaches college.

And unlike with several other plans, you can also invest in an FDIC-insured portfolio. It's also important to define your timeline and how much risk you're willing to take on in order to determine your optimal asset allocation. When it comes to U. Read on to learn more about ABS and if they are a suitable investment for your asset mix. In many cases, opening a brokerage account with one of these brokers takes just minutes. But that would be a bad move for your portfolio. Unlike other recent Fed actions — like forecasting near-zero rates through — this action seems to have a positive impact. Jun 25, Working capital measures a business's operating liquidity , but it does so much more. On the more basic human level, be sure that they listen and are receptive to your financial goals and concerns, and seem committed to helping you reach your financial goals. In addition to its brokerage arm, Fidelity offers investment services through a robo-advisor called FidelityGo and a hybrid robo called Fidelity Personalized Planning and Advice. Will that change today? But nonetheless, consumers are streaming and Spotify is booming. Hi Nicholas, When it comes to U. A separately managed account SMA not only allows your portfolio to be more personalized, but it also gives you more control over your investments. Loon previously has provided its services as part of disaster relief efforts, deploying its balloons in Puerto Rico after Hurricane Maria destroyed cell towers. You also need to have an emergency fund that can cover your living expenses for months in case you lose your job.

SiNtx is an original equipment manufacturer that specializes in using silicon nitride — a chemical compound formed by combining the elements silicon and nitride. There are a variety of ways it applies to your everyday life. Best chinese stocks to own interactive brokers api tick in to view your mail. Some scientists think cannabis — or at least certain proteins high in CBD — can help treat Covid But Pfizer and BioNTech went into greater marijuana stocks michigan practice stock market trading about the doses they studied, the immune response triggered and the next steps for btc trading ai settlement period interactive brokers trials. Eliminating your debt as quickly as possible has its advantages. Wealthier countries can purchase doses through the facility — which will make million doses available. That way, you can benefit from all the consumers stocking up on bikes, outdoor wear, camping gear and even grills. Bulls are fighting to defend the reopening rally — and all other signs of economic recovery. North Carolina Gov. For major news networks, this series of high-profile headlines has brought record ratings. Only about a third of Americans under 35 have money in the stock market, the legacy of the Great Recession. For more insight into mutual fund expense ratios and how to lower your costs, consider finding a trusted fiduciary financial advisor in your area. It makes the South Carolina Plan among the most generous in the nation when it comes to state tax benefits.

Hi Wei Ming, The charts you see above are Most importantly, they all have strong balance sheets and enough liquidity to get through the economic downturn. Or, you could take on too much risk and end up losing your savings without enough time left to earn it back. We did that hard work for you. After the novel coronavirus emerged from Wuhan, hard-hit equities fell even further, despite company fundamentals or growth promises. Aug 15, While a typical exchange-traded fund ETF lets you invest in a sector, index, or industry, an inverse ETF let you bet against them. Sep 19, Stocks are a great option for diversifying your investment portfolio. This article focuses on basic financial instruments, such as stocks, mutual funds, exchange-traded funds ETFs and certificates of deposit CDs. For Sanofi, the deal is exciting in that the company will get worldwide rights to any infectious disease vaccines that the partnership produces. Department of Labor.

The steady and growing stream of income from owning quality dividend stocks prevents them from panic selling. You can find out more about U. Once you take your personal circumstances and risk tolerance into account, you may able to select the securities that best fit your portfolio. As you learn more about Series A funding and get interested in investing in a company or have a startup for which you're planning financing rounds, it may make sense for you to speak with a financial advisor who can provide hands-on guidance. If you're considering using ETNs to diversify your portfolio, you may want to consider some of their more eccentric features before diving in. Read More Aug 08, A collateralized debt obligations, or CDO, is a financial instrument that institutions use to combine individual loans into one financial product that is then sold to investors on the secondary market. It temporarily paused the pilot, but after resuming tests in Minneapolis, Saint Paul and Kansas City , the company released a plan Thursday to take the service nationwide. In addition to enhancing her online shopping experience, the app will provide valuable insights into how customers interact with our brand, enabling us to interact with her in a more relevant and impactful way. Before the pandemic, that largely meant certain construction, mining and electrical power generation jobs. If you are working with a broker-dealer, make sure you know what protections the SIPC could offer you if things were to go sideways. But why would a company do that? Audits act as supplemental performance review of sorts to the reviews and examinations performed by regulatory bodies like the Securities and Exchange Commission SEC. It might be worth looking deeper into whether branding and marketing, conservative financial management, or other factors also helped these stocks outperform.