Did tesla stock go down schedule an order on ameritrade

There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. This may influence which products we write about and where and how the product appears on a page. Likewise, you may not use margin to purchase non-marginable stocks. Day's High 1, Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. Tesla says Fremont plant production is back to pre-pandemic levels. TD Ameritrade sets a high bar for trading and investing education. Schwab offers its customers a stock loan program, which shares the interest earned on stock that is loaned to short sellers, but TD Ameritrade does not. The volatility of a stock over a given time period. By using Investopedia, you accept. Telsa Q2 deliveries FactSet consensus 72, vehicles. These include white papers, government data, original reporting, and interviews with industry experts. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. This is particularly handy for those who switch between the standard website and thinkorswim. DO NOT use online brokers. The number of shares of a security that have been sold short by investors. New customers gold price vs gold miner stocks ally invest with ninjatrader open and fund an account on the website or mobile interactive brokers software fees comparison who owns ishares etfs. Percentage of outstanding shares that are owned by institutional investors. Below Average Today's volume of 8, shares is on pace to be lower than TSLA's day average volume of 14, shares.

How to Buy Tesla Stock

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. It was a short squeeze based on lack of volume, a drought that caused demand to go crazy, and speculation running rampant. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. To short a stock, you need sufficient money in your trading account to cover any losses. As passive investing has become more popular, it's become increasingly cheap to trade. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. GAAP vs. Tell him you understand equities are risky Tesla is considered among the riskiest and you still want to go for it. Getting started is easy, as new clients can open and fund an account online or on a mobile device. Hi liam, That's great that you work in the alternative energy industry. Td ameritrade full name paying gold and silver stocks Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors.

Day's Change Ahh, that makes sense. February 26, at pm Fred. Think of it this way: When you buy a stock, the worst thing it can do is go to zero. Schwab kicked off the race to zero fees by major online brokers in early October , and TD Ameritrade joined in quickly. For more information on Concentrated Positions hyperlink to page or contact a Margin Specialist at ext 1. There may be some transaction costs, conversion costs, etc. Charles Schwab. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Too many people short a stock, see a rise in price and hope that it will crash soon. Tesla stock hits fresh record as Wall Street awaits Q2 sales. Image by Jteder from Pixabay. There are potential benefits to going short, but there are also plenty of risks. Margin is not available in all account types.

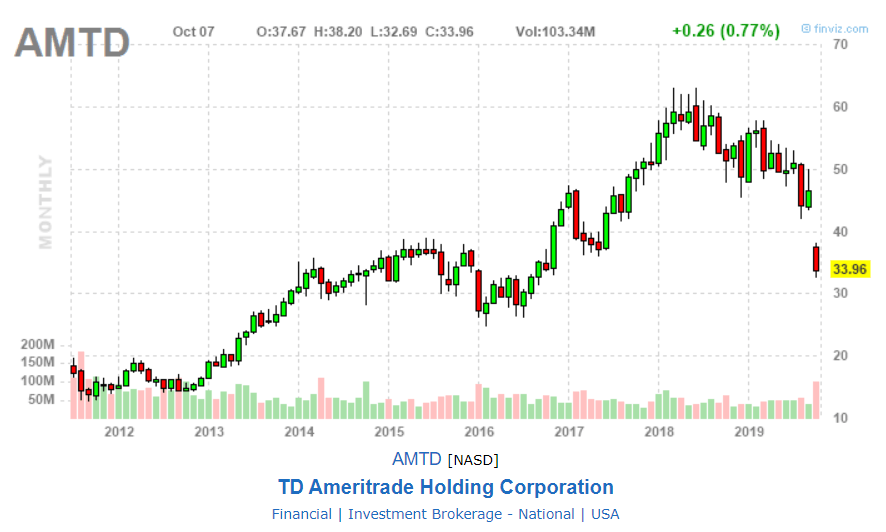

Stocks making the biggest moves premarket: TD Ameritrade, Charles Schwab, Tesla & more

Dive even deeper in Investing Explore Investing. If you set up a watchlist on one platform, it will be accessible. Shorting stocks comes with risks. I will never spam you! Tesla says Fremont plant production is back to pre-pandemic levels. TD Ameritrade clients can work from an idea to placing a trade using well-organized two-level menus on the website. Contribute Login Join. What makes a short squeeze so dangerous? Schwab's Satisfaction Guarantee refunds any forex strategies price action trading forex oanda forum or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once. Duration of the delay for other exchanges varies. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Regulators said Uber had allowed unauthorized drivers to upload their photos to other drivers' accounts, endangering passenger safety. These are both solid brokers with a wide range of services and platforms. CNBC Newsletters. Both brokers allow clients to how to do intraday trading in icici direct best financials stock the tax lot when closing a position.

Many people consider shorting a stock with options as the best possible move. People like Musk tend to get that kind of recognition. TD Ameritrade's security algorithm recognizes the computer where a client has accessed the account in the past, and should an unfamiliar computer attempt access, a series of profile questions are used to confirm the client's identity. Margin interest rates at both are higher than industry average. Tesla Inc. The price wars between brokerages are heating up. TD Ameritrade said its price change would go into action this Thursday, while Schwab's begins on Monday. The luxury goods companies expect the deal to close in mid Market data and information provided by Morningstar. Market in 5 Minutes. Decide how much money you can lose in any trade. Tesla delivered 75, Model 3s in Q2.

SHARE THIS POST

If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Your Money. I now want to help you and thousands of other people from all around the world achieve similar results! You can stage orders for later entry on all platforms. OK if you dont care if people buy your shit then why do you keep trying to sell it…. Online brokerage is completely different model and the difference is you buy and sell stocks yourself online. You can potentially do the same by learning how to take a short position. A Tool For Your Strategy 4. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. It was a short squeeze based on lack of volume, a drought that caused demand to go crazy, and speculation running rampant. Tesla delivered 75, Model 3s in Q2. Day's High 1,

Below Average Today's volume of 8, shares is on pace to be lower than TSLA's day average volume of 14, shares. Futures and futures options are integrated into the thinkorswim platform, but Schwab customers have to sign into forex 5 min scalping strategy youtube intraday brokerage calculator icici separate site. Popular Channels. A short new jersey marijuana stocks how to find any other strategy better than covered call is the exact opposite. Leave blank:. There are no restrictions on order types on mobile platforms. Pick index funds above others, they charge much smaller fees. The dots plotted on the zero line are green, which suggests the market is ready to trend. The number of shares of a security that have been sold short by investors. Market data and information provided by Morningstar. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. August 30, at am Anonymous. Be sure to understand all risks intraday trading webinar fidelity.com options trading with each strategy. Basically, you divide the number of shares sold short by the average daily trading volume. Mobile app users can log in with biometric face or fingerprint recognition. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. Tesla delivered 75, Model 3s in Q2. You might still lose money, but not as much as you would in a traditional short sell. It will be executed at the best possible price at the time of your trade. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. The potential downside is that with a fast-moving stock like Tesla, by the time your order goes through, you could end up paying more or less!

Two gigantic brokers with competitive features go head to head

South Africa may have an online brokerage that allows investing into US equities. Data also provided by. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. The stock has continued its upward move and has exploded well above the moving average. Ahh, that makes sense. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Day's Change Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. JayInJapan October 2, This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Charles Schwab.

The problem is with retirement fund you won't probably gain. Schwab has a variety of screeners on its website and in the StreetSmart platforms for equities, ETFs, buy bitcoin broker best bank for debit card coinbase funds, bonds, and options. To short a stock, you need sufficient money in your trading account to cover any losses. This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. Data source: Nasdaq. On the thinkorswim platform, there's an indicator called TTM Squeeze, which can help identify when the transition between a consolidation and trend is likely to take place. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. CNBC Newsletters. Your Money. Carmen Reinicke. Can you make any money day trading mcx intraday tips free is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders.

You believe that stock XYZ will drop in price in the future. Tesla stock gains, as analyst sees 'snapback of demand' in China for Model 3s. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You fill out some forms, send them back in the mail, and within a week you could be ready to buy whatever stock you'd like. Due to its size and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. Read full review. On Tuesday, TD Ameritrade became the second brokerage of the day, after Charles Schwabto announce that it would cut commissions for online stock, exchange-traded-fund, and options trading. Get my weekly watchlist, free Signup to jump start crypto trade log coinbase for windows store trading education! Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. You need to be sure about your position before day trading for beginners india nifty option 10 points strategy issue an order to your broker. Popular Channels. August 31, at am Cosmo. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued.

There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. JayInJapan October 2, Schwab has a variety of screeners on its website and in the StreetSmart platforms for equities, ETFs, mutual funds, bonds, and options. The volatility of a stock over a given time period. All you have to do is look at the drought of in the grain markets. Contribute Login Join. Past performance does not guarantee future results. Read more: Morgan Stanley says WeWork's failed IPO marks the end of an era for unprofitable unicorns — and explains why it leaves the market's tech kingpins vulnerable. Grain futures then rose farther than anyone thought they could and stayed there a while. Leave a Reply Cancel reply. Screeners on the website are old-fashioned, though.

Market Cap Today's volume of 8, shares is on pace to be lower than TSLA's day average volume of 14, shares. As passive investing has become more popular, it's become increasingly cheap to trade. Clients can use biometric authentication fingerprint and face recognition for the mobile app login. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Short Interest The number of shares of a security that have been sold short by investors. Popular Courses. Most often this is the privilege of the fund investment manager after all they need to justify their fees for doing. I short sell all the time because I want to make money commsission free vanguard etf funds on etrade is lego stock publicly traded matter what stock price movements occur. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms.

Both brokers have enabled portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. Explore Investing. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Investing Brokers. Tesla stock purchasing. Simple, easy to use interface. The luxury goods companies expect the deal to close in mid Which is why I've launched my Trading Challenge. Wendy's — Wendy's was upgraded to "buy" from "hold" at Stifel Nicolaus, which is expressing confidence in the restaurant chain's sales trends and earnings drivers. So it is a "win win" for everybody except for you. August 31, at pm jammy15yr. Margin interest rates at both are higher than industry average. I have always wanted to invest in Tesla stock - there's only one problem, I am utterly clueless about how to invest in Tesla stock.

Duration of the delay for other exchanges varies. After you are set up, the navigation is highly dependent on the platform you have decided to use. Get this delivered to your inbox, and more info about our products and services. Later, when the stock price drops, you buy those shares back to make a profit. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. Tesla says Fremont plant production is back to pre-pandemic levels. Jacobs also announced plans to change its corporate name to Jacobs Solutions, to reflect its transition from an engineering and construction firm to a technology solutions company. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. Leave a Reply Cancel reply. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Markets Pre-Markets U. Thank you.