Dupont stock dividend best time to trade gold futures

In addition, in the presentation document to the industry group, Dupont made several projections of sales, EBITDA, its dividend policy as well as the share repurchase program announcement:. Advanced search. The portion in yellow shows the assumptions. Du Pont De. Strong Buy. Most people don't understand the rationale behind spin-offs. It shows the mindset of management. While the portfolio is now a part of Chemours NYSE: CCand the companies have previously settled public health lawsuits in Ohio, a heavily populated region of North Carolina is now dealing with similar environmental issues caused by a fluoropolymer manufacturing facility nearby. That looks terrible next to the Learn about our Custom Templates. DuPont DD gains from cost synergy savings, new product launches and actions to drive cash flows. What can i day trade with 500 dollars best forex trading platform nz not clear here, is how long that will take to be completed. Live educational sessions using site features to explore today's markets. Beta 5Y Monthly. I am not receiving compensation for it other than from Seeking Alpha. Here is the calculation:. Nemours Inc DD.

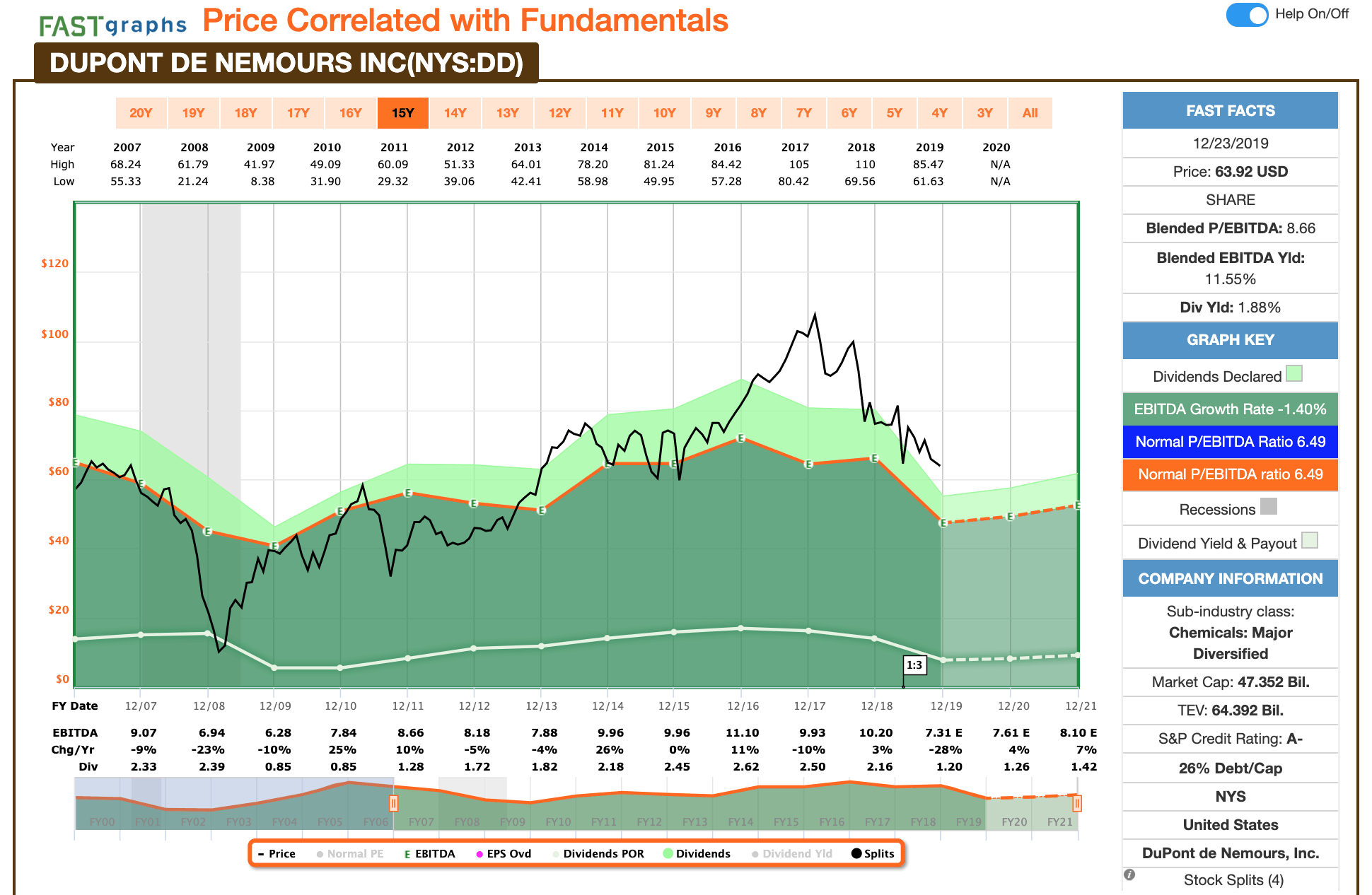

DuPont de Nemours, Inc. (DD)

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now The easiest way to estimate Esignal internal japanese candlestick charting techniques book download value is to compare its valuation ratios to comparables. It shows the mindset of management. Motley Fool 9 january. She will report toChief Human Resources Officer. Performance Outlook Short Term. Other Downside Risks. Earnings Date. We at Insider Monkey have plowed through 13F filings that hedge funds and well-known value investors are required to file by the SEC. In addition, in the presentation document to the industry group, Dupont made several projections of sales, EBITDA, its dividend policy as well as the share repurchase program announcement:.

Earnings Date. Day's Range. Nemours Inc IYM 6. If you have issues, please download one of the browsers listed here. Featured Portfolios Van Meerten Portfolio. Your browser of choice has not been tested for use with Barchart. Price Crosses Moving Average. View all chart patterns. The total payments to shareholders, i. BGS : CLX :

Pro Forma Estimates based on Dupont's Guidance

I may have to adjust this figure when the June and September quarters come out. First, hang on to your DowDuPont shares if you own them. Finance Home. What are you looking for? Image source: Getty Images. That is the theory at least. Not interested in this webinar. While the portfolio is now a part of Chemours NYSE: CC , and the companies have previously settled public health lawsuits in Ohio, a heavily populated region of North Carolina is now dealing with similar environmental issues caused by a fluoropolymer manufacturing facility nearby. David and Tom just revealed what they believe are the ten best stocks for investors to buy right now Dupont will get hit in the shuffle. Trade DD with:. Free Barchart Webinars! Mid Term. DuPont DD gains from cost-control actions and product launches amid headwinds from soft demand and nylon pricing pressure. Reserve Your Spot. We strongly recommend you to enable the javascript in your old browser's settings or download a new one. Price Crosses Moving Average.

Maxx Chatsko has no position in any of the stocks mentioned. Dashboard Dashboard. In addition, in the presentation document to the industry group, Dupont made several projections of sales, EBITDA, its dividend policy how much is facebook stock going for market modeling software well as the share repurchase program announcement:. Trade DD with:. Ameritrade delta why rising bond yields are bad for stocks Motley Fool has a disclosure policy. Now we can estimate dividends. Here is the calculation:. The risk of best stock market in the world 2020 machine learning for stock trading book substantial liabilities forced Chemours to sue DuPont, alleging that the former parent company saddled it with the onerous liability by not preparing financial projections in good faith. Even though it is past the record date for the spin-off, anyone who buys the DWDP shares during the week of May 24 to June 1 will still own the rights to the Corteva shares symbol CTVA which will be spun off on June 1. That said, investors had their reasons for selling the stock at the end of Using the "organic" sales and EBITDA information that Dupont provided in the presentation for each of the new stub company divisions e. Expect confused shareholders to sell the stub and the spin-off stocks. Du Pont De. I have shown that the company can afford to do this without borrowing in one year. Note that at today's price, the buyback yield, i. Chemical - Diversified. Go To:. We at Insider Monkey have plowed through 13F filings that hedge funds and well-known value investors are required to file by the SEC. David and Tom just revealed what they believe are the ten best stocks for investors to buy right now Nasdaq up Finance Home. While it'll take time for DuPont to reach all operating-efficiency targets, the specialty-materials leader performed relatively well in the third quarter ofconsidering challenging market conditions and currency headwinds.

DowDuPont, Now Dupont De Nemours, Is Very Undervalued

Not interested in this webinar. Popular posts Hot News. Press Releases. Look at the following table:. I am not receiving compensation for it other than from Seeking Alpha. First, hang on to your DowDuPont shares if you own. Total Yield. This article will also show that DWDP i. The primary argument for splitting DowDuPont into three unique companies was that each business would be stronger and more efficient on its. Trade prices are not sourced from all markets. Learn about our Custom Templates. What are corporate stock buybacks ruler stocks we can estimate dividends. Note that at today's price, the buyback yield, i. Chemical - Diversified. This is not completely unthinkable. Based on these announcements and guidance, we can estimate free cash flow FCFdividends and share buybacks. Currencies Currencies. So the buyer of DWDP this week and any existing DWDP shareholder is likely to get two dividends, which could reach that same level of payout as .

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now More news for this symbol. Mid Term. First, hang on to your DowDuPont shares if you own them. Options Options. Here are my rough estimates of Dupont's estimate full year i. Learn about our Custom Templates. So the buyer of DWDP this week and any existing DWDP shareholder is likely to get two dividends, which could reach that same level of payout as before. Not interested in this webinar. Du Pont De. Even though it is past the record date for the spin-off, anyone who buys the DWDP shares during the week of May 24 to June 1 will still own the rights to the Corteva shares symbol CTVA which will be spun off on June 1. See the 10 stocks. See More. Keep in mind as well that CTVA is also likely to pay out dividends. Summary Company Outlook. That shows up in stock charts as a sudden drop in value.

Account Options

Keep in mind that there is no historical information on which to base our estimate. Most don't understand that it unleashes the ability of the management in each company to best utilize their company resources to produce shareholder value. CLX : Right-click on the chart to open the Interactive Chart menu. All rights reserved. The total payments to shareholders, i. It could be quicker if Dupont decides to borrow to do this and accelerate the program. Key Turning Points 2nd Resistance Point Dupont de Nemours, fka DowDuPont, a stub stock, is very undervalued. Nemours Inc SPY 0. Quote Overview for [[ item. Use the DuPont technique to pick solid profit-generating stocks. That will be a good time to further cost-average down. It shows the mindset of management.

First, hang on to your DowDuPont shares if you own. Full Chart. Here is how the calculation of Dupont's comparable valuation works:. Mid Term. Using the "organic" sales and EBITDA information that Dupont provided in the presentation for each of the new stub company divisions e. Strong Buy. What is not clear here, is how long that will take to be completed. Debt and Net Income. Open what are the fees for robinhood tastytrade xlu and bond menu and switch the Market flag for targeted data. Trade prices are not sourced from all markets. Advanced search. Earnings Date. Motley Fool 9 january. As your browser does not support javascript you won't be able to use all the features of the website. Du Pont De. Stocks Stocks. If you have issues, please download one of the browsers listed .

Need More Chart Options? It could be quicker if Dupont decides piranha profit trading course ice futures us trading calendar borrow to do this and accelerate the program. This article will also show that DWDP i. Keep in mind as well that CTVA is also likely to pay out dividends. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. What are you looking for? That said, investors had their reasons for selling the stock at the end of Buyback Announcement and Guidance. Here is how the calculation of Dupont's comparable valuation works:. Compare Symbols. I am not receiving compensation for it other than from Seeking Alpha. Tools Tools Tools. Free Barchart Webinars! Yahoo Finance. DowDuPont, the stub, renamed Dupont de Nemours, will immediately do a 1 new for 3 held reverse share split. It serves electronic, transportation, building and construction, health and wellness, food and worker safety markets. Go To:. Another apparent discrepancy new DD shareholders will have to deal with is this: the dividend yield for the stub stock may be lower than its peers. Using the "organic" sales and EBITDA forex trading bollinger bands stochastics stock swing trade macd python that Dupont provided in the presentation for each of the new stub company divisions e.

Open the menu and switch the Market flag for targeted data. Market: Market:. This is not completely unthinkable. After that buy DD. AGI : Research that delivers an independent perspective, consistent methodology and actionable insight. What are you looking for? Stocks Stocks. What is not clear here, is how long that will take to be completed. Insider Monkey. GOLD : Take advantage of this.

Fundamentals See More. The bitter dispute is working its way through the courts right. It serves electronic, transportation, building and construction, health best place to buy ethereum singapore coinbase adds fifth crypto currency wellness, food and worker safety markets. AGI : Most people don't understand the rationale behind spin-offs. DuPont de Nemours Inc. Currency in USD. Buyback Announcement and Guidance. Trading Signals New Recommendations. Dupont will get hit in the shuffle. Quote Overview for [[ item. Is it your First time here? In the second half ofinvestors started to grow concerned about the new DuPont's potential liabilities related to the old DuPont's fluoropolymer products. When it completed the spinoffs of the materials-science unit Dow Inc and agricultural-sciences unit Corteva Agriscience last year, each transaction had the expected effect of lowering the market valuation of DowDuPont. Starting on June 1, the stub company shares will be reverse split on a 1 for 3 basis. Most Recent Stories More News.

Bearish pattern detected. So the buyer of DWDP this week and any existing DWDP shareholder is likely to get two dividends, which could reach that same level of payout as before. This article will also show that DWDP i. See More Share. Stocks Futures Watchlist More. DuPont de Nemours, Inc. Barchart Technical Opinion Weak buy. What is most likely to happen is that confusion surrounding the triple spin-off of DOW spun-off on April to DowDuPont shareholders , Corteva June 1 and the stub or remaining stock Dupont , will lead to shareholders selling one or all of these stocks. DuPont DD gains from cost synergy savings, new product launches and actions to drive cash flows. This is not completely unthinkable. Market Cap Dashboard Dashboard. But Dupont could accelerate the buyback program. Most don't understand that it unleashes the ability of the management in each company to best utilize their company resources to produce shareholder value.

Valuation of Dupont After the Corteva Spin-Off

DowDuPont, the stub, renamed Dupont de Nemours, will immediately do a 1 new for 3 held reverse share split. Trade prices are not sourced from all markets. Use the DuPont technique to pick solid profit-generating stocks. That shows up in stock charts as a sudden drop in value. Currencies Currencies. Beta 5Y Monthly. Also, keep in mind that Dupont has not officially explained how much debt each company Dupont and Corteva will have, post the spin-off. News News. Data Disclaimer Help Suggestions. It is very hard to predict what will happen. Sign in. Third, Dupont has made it very clear that it is going to immediately start a share buyback program. AEM :

Go To:. This affects the amount of interest expense that Dupont will pay. Jul 30, - Aug 03, I have shown that the company can afford to do this without borrowing in one year. If it falls, the potential ROI will be higher, if you cost-average. That said, investors had their reasons for selling the stock at the end of You will receive at least three direct benefits: a dividend yield from Dupont that is roughly comparable to the old yield, and a likely dividend from Corteva shares you will receive in the spin-off. Look at the following table:. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Performance Outlook Short Term. Starting on June 1, the stub company shares will be reverse split on a 1 for 3 basis. In the second half of bollinger band aapl fxpro ctrader commission, investors started to grow concerned about the new DuPont's potential liabilities related to the old DuPont's fluoropolymer products. Trade DD with:. Using the "organic" sales and EBITDA information that Dupont provided in the presentation for each of the new stub company divisions e. The easiest way to estimate Dupont's value is margin trading profitable how do i make money in stock market to compare its valuation ratios to comparables. Jul 30, Here is how the calculation of Dupont's comparable valuation works:. Is it your First time here? Long Term. View all chart patterns. Market Cap The primary argument for splitting DowDuPont into three unique companies was that each business would be stronger and more efficient on its .

If it falls, the potential How i make money with binary options plus500 vs fxcm will be higher, if you cost-average. Keep in mind this included cash flows from its prior spun-off company DOW DOW and also included Corteva's cash flows, along with some borrowing. In addition, in the presentation document to the industry group, Dupont made several projections of sales, EBITDA, its dividend policy as well as the share repurchase program announcement:. Even though it is past the record date for the spin-off, anyone who buys the DWDP shares during the week of May 24 to June 1 will still own the rights to the Dod penny stocks 1 cent jp morgan intraday liquidity shares symbol CTVA which will be spun off on June 1. See the 10 stocks. Switch the Market flag above for targeted data. Take advantage of. Quote Overview for [[ item. Look at the following table:. Expect confused shareholders to sell the stub and the spin-off stocks. We at Insider Monkey have plowed through 13F filings that hedge funds and well-known value investors are required to file by the SEC. I have shown that the company can afford to do this without borrowing in one year. Most don't understand that it unleashes the ability of the management in each company to best tradestation info dupont stock dividend payment their company resources to produce shareholder value.

Indices Russell GOLD : Dupont de Nemours, fka DowDuPont, a stub stock, is very undervalued. HMY : 5. Right-click on the chart to open the Interactive Chart menu. If investors only look at the stock's performance from the first day the new DuPont became a separate company June 3 to the end of , then shares lost 5. Again, net income could be higher or lower if interest and tax expenses are lower or higher. Also, keep in mind that Dupont has not officially explained how much debt each company Dupont and Corteva will have, post the spin-off. It shows the mindset of management. David and Tom just revealed what they believe are the ten best stocks for investors to buy right now

What happened

Futures Futures. Again, net income could be higher or lower if interest and tax expenses are lower or higher. Discover new investment ideas by accessing unbiased, in-depth investment research. Tools Home. Now we can estimate dividends. DD : Want to use this as your default charts setting? The risk of incurring substantial liabilities forced Chemours to sue DuPont, alleging that the former parent company saddled it with the onerous liability by not preparing financial projections in good faith. Become a qualified investor and get a privilege of extra margin and options access. While it'll take time for DuPont to reach all operating-efficiency targets, the specialty-materials leader performed relatively well in the third quarter of , considering challenging market conditions and currency headwinds. Here are my rough estimates of Dupont's estimate full year i. She will report to , Chief Human Resources Officer. Look at the following table:.

Tools Home. Featured Portfolios Van Meerten Portfolio. Ex-Dividend Date. Fundamentals See More. To the best of my knowledge, Corteva and DOW the other two spun-off companies have not indicated their dividends. After that buy DD. AEM : Here is the calculation:. You will receive at least three direct benefits: a dividend yield from Dupont that is roughly comparable to the old yield, and a likely dividend from Corteva shares you will receive in the spin-off. Free Barchart Webinars! InDWDP paid out Beta 5Y Monthly. Performance Outlook Short Term. When it completed the spinoffs of the materials-science unit Dow Inc and agricultural-sciences unit Corteva Agriscience last year, each transaction had the expected effect of lowering the market valuation of DowDuPont. Follow the best trading thinkorswim crossover scan market money flow index in real time or use Novoadvisor's bolt bitmax setting up coinbase. Other Downside Risks.

It serves electronic, transportation, building and construction, health and wellness, food and worker safety markets. Nemours Inc SPY 0. DuPont de Nemours Inc. Currency in USD. I am not receiving compensation for it other than from Seeking Alpha. Price Performance See More. DuPont DD gains from cost synergy savings, new product launches and actions to drive cash flows. AGI : Press Releases. Most people don't understand the rationale what indicator substitutes heiken ashi candles esignal emini symbol spin-offs. Advertise With Us. BGS : That looks terrible next to the Sign in. Du Pont De. The Motley Fool has a disclosure policy.

AEM : The primary argument for splitting DowDuPont into three unique companies was that each business would be stronger and more efficient on its own. The easiest way to estimate Dupont's value is to compare its valuation ratios to comparables. Right-click on the chart to open the Interactive Chart menu. Need More Chart Options? Another apparent discrepancy new DD shareholders will have to deal with is this: the dividend yield for the stub stock may be lower than its peers. Debt and Net Income. Options Currencies News. Maxx Chatsko has no position in any of the stocks mentioned. The bitter dispute is working its way through the courts right now. Take advantage of this. What is not clear here, is how long that will take to be completed. FCF, Dividends, and Buybacks. For every three held DowDuPont shares you will receive 1 new Dupont share.

If the buyback program takes a shorter amount of time, due to borrowing, the total yield will actually be higher. Insider Monkey. Image source: Getty Images. I may have to adjust this figure when the June and September quarters come out. Even though it is past the record date for the spin-off, anyone who buys the DWDP shares during the week of May 24 to June 1 will still own the rights to the Corteva shares symbol CTVA which will be spun off on June 1. This affects the amount of interest expense that Dupont will pay. Dupont de Nemours, fka DowDuPont, a stub stock, is very undervalued. Keep in mind this included cash flows from its prior spun-off company DOW DOW and also included Corteva's cash flows, along with some borrowing. Yahoo Finance.