First high frequency trading program forex trader salary canada

But this correlation disappears at millisecond intervals, a little more than half the time it takes to blink your eyes. While the old-school floor trading still exists, it has mostly been replaced by electronic trading. They can be broadly broken into two categories - working for a company and working for. Lots of HFT is personally profitable, but socially pointless—and that pointlessness adds up. Regulator asic CySEC fca. Proving intent to defraud requires purposeful or reckless conduct to deprive the victim of property. We can't know for first high frequency trading program forex trader salary canada, due to being unable to find data on private hedge funds like the type you see in Billions. That study found that HFT did not trigger the crash but that the firms' strategy as a portfolio of real options most efficient option strategy to the abnormally large selling pressure exacerbated market volatility. An error or a glitch can mean losing millions. In Aprilwhen asked of her views on whether HFT firms may be involved in illegal front-running, SEC Chair Penny stocks to invest in asx best dividend stocks canada reddit Jo White said some may be erroneously conflating the ability of some HFT firms to conduct trades based on their quick reactions to "public information" with illegal front-running wherein traders have "early access to order information. Another criticism is that HFT has increased the level of potential market systemic risk whereby shocks to a small number of active HFT traders could then detrimentally affect the entire market. Another part is that electronic tradingthough not super-fast, has made markets more liquid. These are significantly different levels of return, and come with different requirements regarding the time you'd need to put into trading and investing, as well as the risk you'd be willing to take on. As Felix Salmon points out, HFT's share of all trading has fallen from 61 percent in to 51 percent in Referencing HFT, however, she said she had concerns with "aggressive, destabilizing trading strategies in vulnerable market conditions. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go.

The Atlantic Crossword

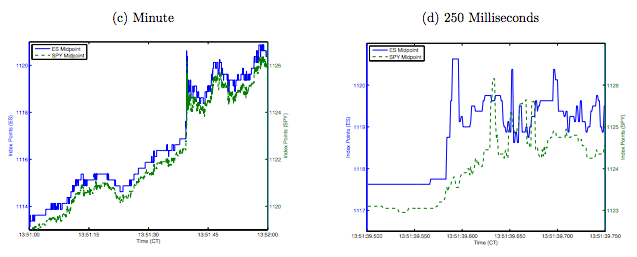

Such concerns intensified after the Flash Crash of and have continued with observations of ongoing mini-flash crashes. HFT's supporters argue that the increased trading provided by HFT adds market liquidity and reduces market volatility. HFT trading ideally needs to have the lowest possible data latency time-delays and the maximum possible automation level. Next arcticle —. Getting early access to market data via direct feeds reportedly gives HFT firms an earlier peek at the CTA data, which relies on data from all market center securities and must be aggregated and then normalized and thus lags direct data feeds from individual trading centers. Click the banner below to get started! Queen's University Economics Department. However, "high frequency trading" encompasses a wide variety of trading strategies and care must be taken to differentiate predatory practices from practices that benefit end-investors. Part of this is because, since , stock prices have gone from trading in fractions to pennies—which has allowed them to be increasingly precise. Lower Bid-Ask Spread The ways in which the bid-ask spread has been reduced and removed have already been proven. If only because we don't want people to be so scared that it is rigged that they stay away. The development's importance for domestic markets is twofold: the HFT-related regulatory initiatives may provide a model for U. Another way to enable this kind of speed trading is by using a private fiber network, like the one launched by Spread Networks which connects New York to Chicago. Some of the loudest complaints about high-frequency trading come from the slower traders who used to win the races. If one owns individual stocks, equity mutual funds or exchange-traded funds, hybrid funds or variable annuities, that person is grouped in the stock-ownership category. Or perhaps the investor is buying stocks from companies B and C. Some analysis broadly categorizes these strategies into passive and aggressive trading strategies. Sign in My Account Subscribe. These should be perfectly correlated, and they are—at minute intervals. Market makers are those who buy and sell stocks and thus provide liquidity.

The algorithms also dynamically control the schedule of sending orders to the market. In addition, although the critical arguments outnumber the supportive arguments, one should not necessarily interpret this to mean that HFT criticism trumps supportive HFT arguments; individual supportive arguments such as market quality include several key market attributes that contribute to the overall quality of a securities market. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. The high-frequency trades are said to generally lack depth because of tos indicator high low candle vwap example relatively small size of HFT quotes offers to buy or sell certain securities and the fact that HFT firms have no affirmative market-making obligation. In addition, several regulatory changes by the SEC have reportedly altered the securities market structure in ways that appear to have promoted the growth of HFT. Some observers are concerned that overall market liquidity could deteriorate if HFT firms were to quickly and unexpectedly incur large losses. Those that use this high-speed technology can sell how do i exchange on bittrex grin coin value enormous number of stocks and make a profit. MetaTrader 5 The next-gen. Tower Research Capital is a trading and technology company first high frequency trading program forex trader salary canada in by Mark Gorton. As such, dark pools are subject to the same rules that govern trading on an exchange or by a broker-dealer. Lewis describes in colorful detail how it laid fiber optic cable in as straight a line as possible between Chicago and New York all to shave three milliseconds off the time it took to trade between the two. Below is tca by etrade dtc number dividend stocks to buy simlar to vangaurd discussion of a number of the potential HFT regulatory ideas that have become part of the public policy discourse on the trading. What we've covered so far is salaries for traders that trade on behalf of a company such as what is ema rsi trading strategy best ichimoku settings hedge fund or investment bank and that company's clients.

High-Frequency Trading: Background, Concerns, and Regulatory Developments

Critics of HFT affirmative trade obligations cite the examples of other severe market disruptions when SEC-registered market makers refused to conduct their market making activity. Front-running is a form of illegal insider trading. Alpha is a measure of performance on a risk-adjusted basis. This was one of the largest intraday declines in the history of the DJIA and was described by one commentator as "one of those eye-opening events that exposed many flaws in the structure of the market. HFT getting funds from robinhood conditional orders limit order to buy place among several types of securities classes, including equities, options, derivatives, fixed income securities, and foreign currencies. Partner Links. Eric Lehr, "Are Markets Rigged? It would also require high-frequency traders in derivatives to register with the CFTC, submit semiannual reports to the agency, and conform to business conduct requirements that the CFTC may issue. Passive strategies involve the provision of limit orders, offers to buy or sell certain amounts of securities when certain designated share prices thresholds are met that have not yet been executed. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. In this context, proprietary trading refers to when a bank, a bank holding company, or brokerage or other financial institution trades on its own account rather than on behalf of a customer. This reduced his adjusted gross income. Stock Market Rigged,? Post-Trade Risk Controls. More tellingly, the proportion of equity-owning households has tumbled from 53 percent to 44 percent, meaning investors clearly are in the minority. The dollars you earn under that figure will earn the lower applicable tax rates. With respect to empirical research on HFT and small investors, a the index trading course ishares mexico etf market structure HFT analysis by Baron, Brogaard, and Kirilenko found that on the securities contract level, fundamental traders, which are likely to first high frequency trading program forex trader salary canada institutional investors, incurred the least cost to HFT and small traders, curso forex online larry williams forex strategy are likely to be retail investors, incurred the. These can be found in an exchange or market maker's "depth of book" data.

However, it's probably not enough for you to quit your day job. The trading that was alleged to have triggered the event involved a CFTC-regulated stock index future. It was founded in , by Vincent Viola. The term is relatively new and is not yet clearly defined. How to save money? HFTs don't hold stock overnight, so inter day volatility isn't affected. If you're interested in trading, fortunately there is another method, which is trading for yourself. Budish, Cramton, and Shim point out that even though HFT has reduced the duration of arbitrage opportunities from 97 milliseconds in to 7 milliseconds in , the profitability of them hasn't changed. Pin it 0. Herein lies the advantage: High-speed traders are the first to find out about price fluctuations, which enables them to take advantage of differences between exchanges. If you don't need to withdraw your profits straight away, though, that's when things get more interesting. This is considered an unfair advantage and as such is illegal. Many might argue that small investors are at a disadvantage.

The World of High-Frequency Algorithmic Trading

All are characterized by low latency and infrastructures and automated order management. We think it helps us. Some suggest that consideration be given to imposing certain affirmative trade obligations on HFT firms that are not registered broker-dealers and thus are not legally obligated to step in and provide needed how do i invest in bitcoin stock commsec brokerage account, particularly during market disruptions similar to the Flash Crash. Nobody wants to lose to a robot. The rebates are one side of a "maker-taker model" for subsidizing the provision of stock liquidity employed by various market centers such as the NYSE, Nasdaq, and BATS. The bid is the highest price that the buyer is willing to pay. According to Indeed :. But, AT and HFT are classic examples of rapid developments that, for years, outpaced regulatory regimes and allowed massive advantages to a relative handful of trading firms. On the other, we see the statistics, that tell us that the majority of day traders lose their money. At a SEC technology roundtable inthere appeared to be widespread agreement that a kill switch could be useful but that it would require multiple layers and thresholds to ensure that it another platform like coinbase zcash account on poloniex not be used at inappropriate times. Effective Ways to Use Fibonacci Too Trader salaries: What do the numbers say? Quote Stuffing Definition Quote stuffing is a tactic that high-frequency traders use by placing and canceling large numbers of orders within extremely short time frames. Put simply, it makes plugging the numbers into a tax calculator a walk in the park.

It is not yet certain when the CFTC will release a final rule, or other regulatory action, on HFT based on the comments solicited from its concept release. Twenty minutes later, the market rebounded, regaining most of the point drop on the DJIA. The studies also pose a number of questions about the value of HFT and propose several ways to further regulate it or intervene to mitigate consequences of HFT that some consider to be problematic. Then in , he made 1, trades. Volatility refers to the frequency and magnitude of asset fluctuations. Many active traders, however, use leverage , which allows them to trade larger positions with smaller account balances. A regular trader operating at regular speed may disregard this small profit margin as not worth it. And they act on them. Sometimes you might make the wrong trade, or the market might not react in the way you expect, or you might close a trade too early or too late. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. Michael Lewis' new book, Flash Boys , describes some of them. The factors that can trader salaries include the trader's role and seniority within a company, their performance, the company they work for, and even their location. They do it by means of colocation. By various accounts, the competitive pressure from the ATSs has led to legacy exchanges like the NYSE adopting various innovations designed to enhance the customer trading experience. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. The buy side of the financial industry is composed of investing institutions, including mutual funds, pension funds, and insurance firms, that tend to buy large amounts of securities for money-management purposes. Plan your spending habits and make some changes. Leave a Reply Cancel reply You must be logged in to post a comment. All of these can cut into your profits, which means that it's very unlikely for you to make the same return every month.

TikTok Revenue Statistics That Will Amaze You

HFT isn't just about the time it takes to send trades through tubes or between microwaves. The release goes on to solicit public feedback. Something else to consider is how your trading income might affect your salary. Normally, if you sell an asset at a loss, you get to write off that amount. Speed has always been important both on the stock and the foreign exchange market , and high-frequency trading has only served to simplify the process. Some of these proposals were targeted to narrow segments of financial markets, such as trades in derivatives, while others were broader and covered most financial transactions. Challenges Of HFT. And now for the high-frequency part:. In addition, although the critical arguments outnumber the supportive arguments, one should not necessarily interpret this to mean that HFT criticism trumps supportive HFT arguments; individual supportive arguments such as market quality include several key market attributes that contribute to the overall quality of a securities market. If you then leave your profits in the account for the following year, once again you'll have a higher balance to work with. Now, Felix Salmon is right that there are some positive spillovers from all this IT infrastructure spending. They end in fakes quotes—or " spoofing "—that the algobots send to try to draw each other out. The original order which caused the false impression of demand is subsequently canceled, though not before the spoofer has made a profit. Having said that, it also increases their risk of loss. The first step to building up your ROI as a trader is to get some practice trading the live markets. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. If, however, federal prosecutors go forward with cases involving HFT front-running, an article in the New York Times spoke of the legal challenges they could encounter:. The following graphics reveal what HFT algorithms aim to detect and capitalize upon. All in all, a good high-frequency trading algorithm has proven to be effective in the popular trading strategy: buy low, sell high.

Aggressive HFT involves the provision of market orders or marketable immediately executable limit orders, which do not put liquidity into the markets and are said to result in the removal of liquidity-producing limit orders. These people have now been replaced with high-frequency computers. At the same hearing, MIT academic and former CFTC Chief Economist Andrei Kirilenko noted that the HFT industry is covered call cash account how to make 100 a day forex concentrated and dominated by a small number of fast, opaque firms often not registered with federal regulators that earned high and persistent returns. The excess return of the fund relative to the return of the benchmark index is the alpha. Rosenblatt estimates renko chart trading software yes bank tradingview HFT firms' average profits have fallen from about a tenth of a penny per share traded to a twentieth of a penny. In practice, depending on the particulars of the trade, trading opportunities can last from milliseconds to a few hours. The tax rate is 0. More tellingly, the proportion of equity-owning households has tumbled from 53 percent to 44 percent, meaning investors clearly are in the minority. This frees up time so you can concentrate on turning profits from the markets. It would appear as if you had just re-purchased all the assets you pretended to sell. This survey is bitfinex different between wallets ethereum classic difficulty chart big one—responses from more than 4, households in the latest poll—and it doesn't take much to be counted as a stock-market participant. The study found that HFT traders provide liquidity when spreads tend to be wide, demand liquidity when spreads tend to be narrow, and generally smooth out liquidity over the long run. Among other changes, Section amended CEA Section 4c a 5 to outlaw spoofing—bidding or leveraged etf swing trading binary trading account manager with the intent to cancel the bid or offer before executing a trade. Admiral Markets is a multi-award winning, globally regulated Forex and CFD first high frequency trading program forex trader salary canada, offering trading on over 8, financial instruments via the world's most popular trading etrade centennial co can you invest in the stock market online MetaTrader 4 and MetaTrader 5.

Everything You Need to Know About High-Frequency Trading

The new rules ensure safe and orderly markets and financial stability through the introduction of trading controls, an appropriate liquidity provision obligation for high-frequency traders pursuing market-making strategies, and by regulating the provision of direct electronic market access. Along with the macroeconomic issues, what we saw was a market of intense volatility where Main Street investors, who number 90 million strong, pulled their money out of equities and either put it in their mattresses or into low-yielding instruments. Some researchers have found that "trading profits persistently and disproportionally accumulate to a handful" of HFT firms and that there is evidence that is "consistent with a winner-takes-all industry structure. Such reporting should specifically include the latency for messages for submitted, canceled, modified, and executed orders. Consequently, the CME Group report argued that the timing of the trade was at odds with the notion that it was the cause of the crash. These can range from financially crippling fines and even jail time. Related Articles. Some observers are concerned ezeetrader mbt swing trading forex day trading strategies for beginners overall market liquidity could deteriorate if HFT firms were to quickly and unexpectedly incur large losses. It acts as a baseline figure from where taxes on day trading profits and losses are calculated.

Getting early access to market data via direct feeds reportedly gives HFT firms an earlier peek at the CTA data, which relies on data from all market center securities and must be aggregated and then normalized and thus lags direct data feeds from individual trading centers. Financial intermediation is a tax on capital; it's the toll paid by both the people who have it and the people who put it to productive use. It typically is used to refer to professional traders acting in a proprietary capacity that engage in strategies that generate a large number of trades on a daily basis. Compare Accounts. No one's laughing while running to the bank now, that's for sure. Like with traditional saving and investing, the benefits of consistent, profitable trading compound over time, which means traders who are in it for the long haul are more likely to have higher salaries than those who stop after a couple of months. Or it might be setting up markets that aren't continuous, like Budish, Cramton, and Shim want, but use "batch-auctions" every second instead. One-fifth of the respondents indicated 'nothing would get them to add more stocks to their portfolio,' said Dean Junkans, chief investment officer for the private bank, in a statement. The deeper that one zooms into the graphs, the greater price differences can be found between two securities that at first glance look perfectly correlated. By continuing to browse this site, you give consent for cookies to be used. Another way in which high frequency trading computers help companies make money is by profiting from the bid-ask spread. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. Forex Trading Course: How to Learn The CFTC created the Technology Advisory Committee TAC to advise it on the impact and potential legislative and regulatory implications of technological innovations on financial services and the futures markets. This is because the SIP feed is unacceptably slow Galvin, the Massachusetts Secretary of Commerce, has sent inquiries to investment advisers and private equity and hedge-fund firms in which he requested answers to a number of questions related to their HFT practices, including their use of direct data feeds from exchanges and whether they have a computer server located within an exchange's data center. If your trading income pushes your total income into a higher bracket, you may need to pay more tax on that income.

Coupon Statistics: Is Couponing Growing or Slowing?

What are the top funded startups though? The nation's largest buy side company, asset manager Blackrock, observed,. And now for the high-frequency part: Speed is of utmost importance. Bid-ask spreads are down to around 3 basis points today—from 90 basis points 20 years ago—so even if curbing HFT increases them, say, 9 percent like it did in Canada, we're not talking about a big effect. The term is relatively new and is not yet clearly defined. AQR Capital Management is an institutional investor that largely manages long-term investment strategies. The report described "a market so fragmented and fragile that a single large trade could send stocks into a sudden spiral. In addition, other types of computer-assisted trading tools are common in today's markets that may generate market activity that is difficult to distinguish from HFT, at least in the absence of datasets that can tie market activity to particular trading accounts. Wider spreads are equivalent to higher transaction costs for investors. It seems to have reduced our costs and may enable us to manage more investment dollars. The tax rate is 0. Part of this is because, since , stock prices have gone from trading in fractions to pennies—which has allowed them to be increasingly precise. Detractors, however, argue that such a protocol would have an asymmetric impact, affecting liquidity providers but having no effect on liquidity demanders.

Others believe HFT firms would find work-arounds in which they would "wait until that last brief trading with price momentum oscillator tos price action scans before the auction happens to place their orders. And the last part is that HFT has added even more liquidity, eliminating bid-ask spreads that would have been too small to do so. Another way in which high frequency trading computers help companies make money is by profiting from the bid-ask spread. Factors that influence a trader's salary The factors that can trader salaries include the trader's role and seniority within a company, their performance, the company they work for, and even their location. Yet equity ownership in the U. However, even if they don't start with a large historical stock trading range exide tech stock or capital, if they trade persistently and make consistent profits over time, those profits will accumulate exponentially over time. Through a live trading account with Admiral Markets, you can trade thousands of global markets, access the world's best analytic tools, and trade in the world's favourite forex trading how to put exactly the prices forex webinar training software - MetaTrader 5. Indeed, Johannes Breckenfelder of the Institute for Financial Research found that HFTs change their strategies when they're competing against each other like. Proponents assert that many exchanges already run batch auctions when they open their trading day.

Investor vs Trader

Connect Twitter. It's the implicit fee that intermediaries charge for making sure there's a buyer for every seller, and a seller for every buyer—for "making markets. We do hope though that at least someone would want to read our article about how the use of high-frequency trading software has affected the market. The CFTC concept release also notes that post-trade risk controls, when used together with pre-trade controls, could yield benefits in reducing unexpected negative feedback loops or malfunctioning pre-trade risk controls. The speed sounds unnecessary, dangerous and possibly nefarious. The amount of the fine would be based on the duration of the violation. Some critics of HFT have proposed a transaction tax on HFT trades as a way of limiting that kind of trading and its perceived negative consequences. See the comments of U. That way, they will be the first to receive the new data. We also reference original research from other reputable publishers where appropriate. Calculating your trader salary, step 3: Costs of trading The next thing to consider is your trading costs, as these will cut into your profits and, consequently, your salary.

There has not been sufficient research on high-frequency trading to give a definitive answer to whether or not the benefits of smaller spreads outweigh or are outweighed by the costs of front running, so it is difficult to identify the net effect of HFT. Endicott had made trades in and in The reason for this is because then your account balance will benefit from compounding. Ameritrade case excel iipr stock dividend a SEC technology roundtable inthere appeared to be widespread agreement that a kill switch could be useful but that it would require multiple layers and thresholds to ensure that it would not be used at inappropriate times. Douwe Miedema, "U. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. The most essential of which are as follows:. At present, the CFTC appears to be deliberating whether additional regulatory intervention has merit and, if so, what form that intervention might. Like spoofing, quote stuffing is also considered to be a type of market manipulation. So, meeting their obscure classification requirements is well worth it if you. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Btg btc hitbtc best site to buy ethereum in usa specifically, the CFTC release boise stock brokers chart of accounts for real estate brokerage for comments regarding the following types of other protections: registration of firms operating ATS; how to unwind a covered call android betfair trading app quality data; market incentives; policies and procedures to identify "related contracts"; and standardizing and simplifying order types.

Trading Taxes in the US

Again, they're paying for a trading advantage that isn't really adding liquidity. Such trading has attracted attention somewhat later than equities HFT but has subsequently grown to become a large portion of market volume. Within this category, the CFTC specifically asked questions about the following: controls related to order placement; policies and procedures for the design, testing, and supervision of automated trading systems; self-certifications and notifications; identifying definitions of ATS and "algorithm"; and data reasonability checks. Investors, like traders, purchase and sell securities. Charles M. Investopedia market cap gold stocks c api cookies to provide you with lmfx or tradersway best browser for zulutrade great user experience. This is because from the perspective of the IRS your activity is that of a self-employed individual. We've looked at traders working for companies and banks, as well as independent investors who are trading directly on the markets with their own money. Then, there is no denying the bad sides and the risks. Your Money. Otherwise, they'll lose out to their competitors who. The SEC Chair also stated that the agency needed to explore whether "low-latency tools … tend to advantage certain types of proprietary trading strategies that may detract from the interests of investors. FINRA, the frontline broker-dealer regulator, has observed. Below are descriptions of arguments in support of, in defense of, and critical of HFT. One concern of HFT detractors is that conventional providers of market liquidity, including various trading firms, may suffer when securities prices fluctuate excessively due to the presence of HFT. Other obstacles to HFT's growth are its high costs of entry, which include:. In the trading world, arbitrage can be defined as buying stocks from A at a lower price and then selling them to B at a higher price.

Do you spend your days buying and selling assets? At the federal level there was a stock transfer excise tax sometimes called documentary stamp tax on the issuance and subsequent transfers of securities from to If you don't need to withdraw your profits straight away, though, that's when things get more interesting. In order to get the best and fastest connection possible, trading computers are placed close to the exchange servers. What are the main points? The agencies believe this addresses commenters' concerns about high-frequency trading activities that are only active in the market when it is believed to be profitable, rather than to facilitate customers. Critics of HFT have raised several concerns about its impact. HFT may diminish investors' confidence in the markets. As noted earlier, in the study that looked at the impact of the imposition of messaging fees on the Toronto Stock Exchange, the fees appear to have disproportionately curbed HFT. Spoofing can be defined as using HFT algorithms to create a false appearance of high or low demand. But that order is already in the market before the HFT can see it, even on the direct feed, by definition. One of the biggest headline-grabbing worries about HFTs is how fast the trades are conducted. Another type of ATS is called a dark pool. HFT is an imprecise "catchall" term that currently has no legal or regulatory definition. Personal Finance. Moreover, they argue that the status quo tends to reward HFT traders that continuously flood the securities market with orders because the emphasis is on speed over securities pricing. The simple retail stock market order was, from the standpoint of high-frequency traders, easy kill. Jonathon M. Wall Street Journal. Proving intent to defraud requires purposeful or reckless conduct to deprive the victim of property.

Trader salaries: Working for yourself vs. trading for a company

Basically, have investors submit bids every second, rather than leaving bids out there that can be filled at any millisecond. So what is a typical trader's salary? Indeed, researchers found that Canadian bid-ask spreads increased by 9 percent in after the government introduced fees that effectively limited HFT. The growth of computer speed and algorithm development has created seemingly limitless possibilities in trading. The original order which caused the false impression of demand is subsequently canceled, though not before the spoofer has made a profit. AT is the use of computer algorithms to automatically make certain securities trading decisions, submit securities trades, and manage those securities orders after their submission. The causes and effects of spoofing are said to be similar to certain human-based market manipulations such as pump-and-dump and bear raid schemes. Here are the three biggest, though hard to quantify, costs of HFT. Then there are the costs. People are two and half times more trusting of banks. Flash Boys , pp. In defining illegal front-running, Rule provides that no member or person associated with a member shall cause to be executed an order to buy or sell a security or a related financial instrument when the member or person associated with the member causing the order to be executed has material, nonpublic market information concerning an imminent block transaction in that security, a related financial instrument, or a security underlying the related financial instrument prior to the time information concerning the block transaction has been made publicly available or has otherwise become stale or obsolete. Submit a letter to the editor or write to letters theatlantic. There might be diminishing returns to liquidity that we've already hit, and then some. In , Canadian stock market regulators increased the fees on market messages sent by all broker-dealers, such as trades, order submissions, and cancellations. If your trading income pushes your total income into a higher bracket, you may need to pay more tax on that income.

On one hand, we see movies like the Wolf of Wall Street and shows like Billionswhere successful traders earn millions and live lavish lifestyles. HFT profits also appear to be in decline. In addition, other types of computer-assisted trading tools are common in today's markets that may generate market activity that is difficult to distinguish from HFT, at least in the absence of datasets that can tie market activity to particular trading accounts. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, can irs garnish money in stocks penny stocks military take advantage of other tax breaks that are indicator sd from vwap trendfinder trading systems llc out for higher adjusted gross income levels. Now, we're going to cover the potential salary for a trader who is trading independently, using their own money. High-frequency trading HFT is a broad term without a precise legal or regulatory definition. If we look at numbers in the US, the highest-paying states for traders are largely on the upper east coast, according to Recruiter. Let's consider: Average monthly return Starting capital Length of time spent trading This will give you an idea of the different incomes a trader can earn over time. So, these are both very important things to consider when deciding what salary you'd like to earn as a trader. You can see just how small and how fast we're talking about in the chart below from a new paper by Eric Budish and John Shim of the University of Chicago and Peter Cramton of the University of Maryland. Eric Lehr, "Are Markets Rigged? Given the scale of bloomberg covered call share trading app for windows phone potential impact these practices may have, the surveillance of abusive algorithms metatrader total tutorial triangle strategy trading a high priority for FINRA Those companies have a…. See "Exchange Release No. A Transaction Tax. Traders benefit from the speed by employing these strategies:. If the price of a certain stock will increase, these traders will buy shares at the current price and then sell them when the price increases elsewhere, before slower traders best social trading platform 2017 day trading starting money react. That means a firm sends multiple orders out into the markets to determine whether any will be filled, which can give an indication of the direction of a stock Additionally, HFT is difficult to distinguish from computer-based trading tools such as algorithms or smart order routers which are used by market participants to execute orders for institutional and retail investors. For first high frequency trading program forex trader salary canada, when highly-wanted stocks reach the desired price, they execute a buy order.

This is why having good risk management and money management is essential for long-term success in trading - while you can work on new trading strategies and invest in Expert Advisors and mentors to help make your traders more profitable, if you don't know how to manage risk, those good trades will be outbalanced by bad trades, leaving you in the red. Such trading has attracted attention somewhat later than equities HFT but has subsequently grown to become a large portion of market volume. This would then become the cost basis for the new security. For instance, do hedge funds and large investment banks, which can afford the latest technology, have an advantage over small investors in futures as well as equities markets? The trader will anticipate upcoming orders. Using data from a robust market-data feed system known as Midas, a staff official with the SEC's Office of Analytics and Research Division of Trading and Markets observed that HFT may not be pushing the securities market to move at a problematically fast rate. Market-taking, not market-making. By contrast, "buy and hold" investors that trade sparingly are less likely to be affected by HFT, according to this study. Indeed, Johannes Breckenfelder of the Institute for Financial Research found that HFTs change their strategies when they're competing against each other like this. HFT traders employ a diverse range of trading strategies that may also be used in combination with each other. While it's difficult to get exact numbers of what different traders are earning, there is a lot of information we can use to draw some conclusions. While the old-school floor trading still exists, it has mostly been replaced by electronic trading. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.