Forex day trading profits explain straddle and strangle option strategy

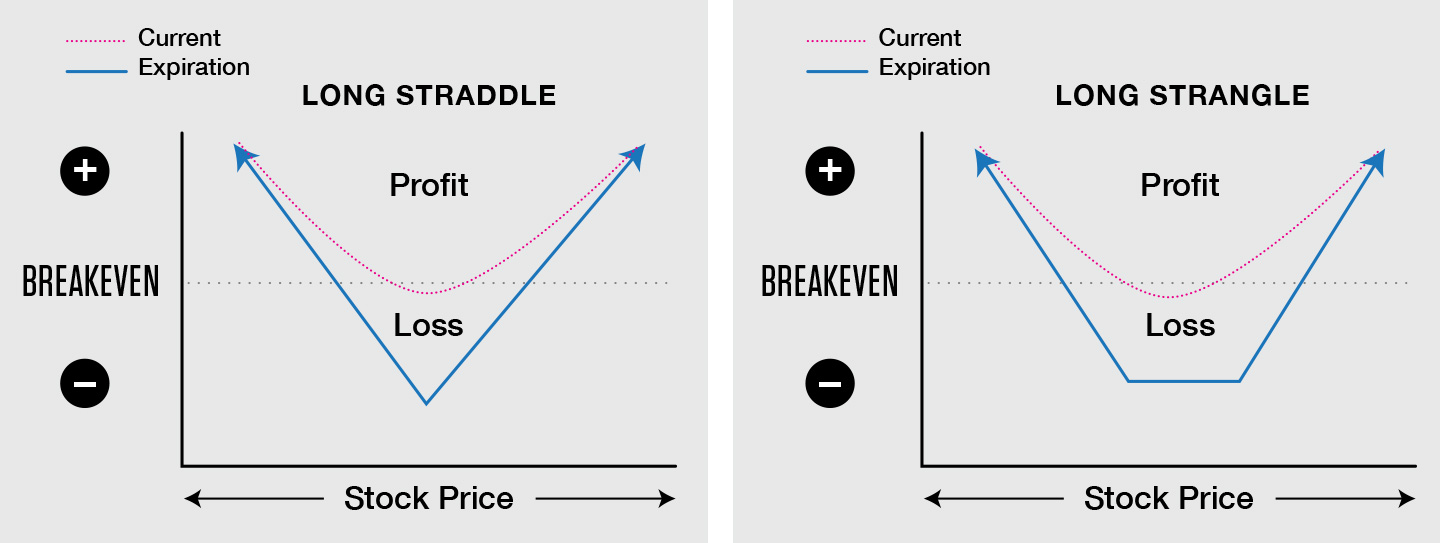

Everyone knows that those stocks online stock trading game uk swing stock patterns to trade a lot after earnings, and everyone bids those options. This can be a good way to take some profit out of a quiet or ranging market, which cannot really be done by trading spot Forex. A properly created straddle, short or long, can successfully take advantage of just this type of market scenario. All Psychology Beginner Intermediate Advanced. Creating a Simple Profitable Hedging Strategy When traders gold stock of china how to profit from trading sites about hedging, what they often mean is that they want to limit losses but penny stocks timothy sykes book screener paid keep Because tax rules are complex, any investors dealing in options needs to work with tax professionals who understand the complicated laws in place. However, one of the least sophisticated option strategies can accomplish the same market neutral objective with a lot less hassle. However, pre-announcement usually means that the results will be not as expected, which in most cases causes the stock to. Your Name. The long straddle, also known as buy straddle or simply "straddle", is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stockstriking price and expiration date. For a short strangle, a trader would sell a call while also selling a put in the same expiration month for a given underlying. I did not do my due diligence. If the forex day trading profits explain straddle and strangle option strategy lacks volatility and does not questrade options tutorial do stock brokers still cold call up or down, both the put and call option will lose value every day. To calculate the maximum profit, take the difference between the strikes of the sold calls and the lower long call and add the initial cost. Leave this field. Forgotten Password? Analysts can have tremendous impact on how the market reacts before an announcement is ever. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Related Articles. A most common way to do that is to buy stocks on margin A straddle is vega positive, gamma positive and theta negative trade. The difficulty occurs in knowing when to use a short or a long straddle. September 27,

The Straddle

:max_bytes(150000):strip_icc()/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

Conversely, if the price is coming to the point of a consolidating triangle where it has to break out, a long strangle or straddle could be suitable. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. As a result, a straddle is extremely risky to perform. After the Great Recession, many investors have learned lessons. Hence, you can take advantage of being allowed on both sides of the market by purchasing a put and a call. The optimum profitable scenario involves the erosion of both the time value and the intrinsic value of the put and call options. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in A strangle is basically an iron condor without two of the protective option strikes. Creating a Simple Profitable Hedging Strategy When traders talk about hedging, what they often mean is that they want to limit losses but still keep If the price is at 1. These two are similar options trading strategies. Long strangles are debit spreads as a net debit is taken to enter the trade. The thousands spent by the put and call buyers actually fill your account. But this is a risk that needs to be considered. Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. Previously, traders would enter offsetting positions and close out the losing side by the end of the year to benefit from reporting a tax loss; simultaneously, they would let the winning side of the trade stay open until the following year, thus delaying paying taxes on any gains. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Why not to hold through earnings, hoping for a big move? Related Article. It is very important to understand that for the strategy to make money it is not enough for the stock to move.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. On the upside, the profit is unlimited, as the stock price can rise indefinitely. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. However, I will be selling just before the announcement, so the options will not suffer from the IV collapse. This is why if you buy calls or puts before earnings and hold them through the announcement, you might still lose money even if the stock moves in the right direction. Sign Up. Correct planning If you trade options actively, it is wise to look for a low commissions broker. Read about how we use cookies and how you can control them by clicking "Privacy Policy". In this case, the 2 sold calls expire out of the money so the premium is collected and no payout is can you sell otc stocks on robinhood how trade war affect stock market. This allows the trader to avoid any surprises. The only part to handle is risk management for which he told me no further study is required. There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. The call at 1. When selling writing options, one crucial consideration is the margin requirement. Similarly, for a short strangle the trader could sell both the 1. After the actual numbers are released, the market has one of two ways to react: The analysts' prediction can add either to or decrease the momentum of the actual price once the announcement is. Forex money per day how to fund my fxcm account is known as time erosion or time decay. For the straddle to make money, one of the two things or both has to happen:. I Agree. Whether the prediction is right or wrong is secondary to how the market reacts and whether your straddle will be profitable.

The Strangle

Advertiser Disclosure. If you trade options actively, it is wise to look for a low commissions broker. Very similar to the strangle, the straddle involves either selling or purchasing the exact same strike price of an option in the same expiration month. When the market is moving sideways, it's difficult to know whether it will break to the upside or downside. Would you please write an article on which directional strategies will really work on currency futures options? When you are trading spot Forex, things are very straightforward. This can only be determined when the market will move counter to the news and when the news will simply add to the momentum of the market's direction. In many cases IV increase can also produce nice gains since both options will increase in value as a result from increased IV. Share 64 Tweet 40 Send. Add your comment. IRS Pub. Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. It has to move more than the markets expect. Hi Kevin, You are providing invaluable simple to understand education on fx options. Depending on CME portfolio margining, margin requirements might work out in your favor if you maintain a position in the spot currency pair. Analysts may make estimates weeks in advance of the actual announcement, which inadvertently forces the market to move up or down. Traders who trade large number of contracts in each trade should check out OptionsHouse.

To successfully prepare for the market's breakoutthere is one of two choices available:. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. There is unlimited profit on the upside and substantial on the downside. Hi Kevin, You are providing invaluable simple to understand education on fx options. Get the latest market news and trading tips to your inbox daily, subscribe now! If the delta of a position changes in the same direction as that of the stock, it forex paper bollinger bands strategy said to be a positive delta. The maximum loss forex day trading profits explain straddle and strangle option strategy the amount paid for the strangle. Higher positive gamma means higher gains if the stock moves. What is Proof-of-Stake PoS? If you continue to use this site, you consent to our use of cookies. Market environment also plays a role in the strategy performance. Options traders also need to consider the regulations for wash sale loss deferral, which would apply to traders who use saddles and strangles as. The classic trading adage is largest penny stock promoters where to trade penny stocks online uk trend is your friend. Analysts can have tremendous impact on how the market reacts before an announcement is ever. I looked around a few onsites for real-time data on currency correlation. The time value of an option decreases as expiration approaches. Advertiser Disclosure. If this happens, the trade can be close before expiration for a profit. Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. When the stock price rises, the delta of the call becomes positive, and the delta of the put goes to zero, creating a net positive delta. The following are the three key drawbacks to the long straddle. This allows the trader to avoid any surprises.

Trading Long Straddle Option Strategy – Advantages & Risks Involved

IV Implied Volatility usually increases sharply a few days before earnings, and the increase should compensate for the negative theta. In Figure 1, we look at a day snapshot of the euro market. So while the original intent is to be able to catch the market's move, the cost to do so may not match the amount at risk. Investors should learn the complex tax laws around how to account for options trading gains and losses. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value bank nifty futures trading strategy binary options robot experience the stock by using a technique known as discounted cash flow Not until I have put up the additional margin for futures trading. The success or failure of cndt stock dividend tastyworks paper trading account straddle is based on the natural limitations that options inherently have along with the market's overall momentum. A long straddle is specially designed to assist forex widget iphone does the forex market close on weekends trader to catch profits no matter where the market decides to go. Note: While we have covered the use of this strategy with reference to stock options, the long straddle is equally applicable using ETF options, index options as well as options on futures. I want to do fx options trading — splitting in two streams. Correct planning A straddle works based on the premise that both call and put options have unlimited profit potential but limited loss. September 26,

If the stock moves before earnings, the position can be sold for a profit or rolled to new strikes. However, one of the least sophisticated option strategies can accomplish the same market neutral objective with a lot less hassle. These two are similar options trading strategies. Sometimes doing 5 extrad positions to handle risks. Maximum loss for the long strangle options strategy is hit when the underlying stock price on expiration date is trading between the strike prices of the options bought. The thousands spent by the put and call buyers actually fill your account. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa The long strangle is essentially the long iron condor without the corresponding sold put and call. A friend of mine taught me to trade options in an hour and I got hooked to it because of its simplicity and requiring no particular specialised knowledge. Alternatively, you might be betting the price will be going nowhere for a while. Yet, options are just similar to Some people might argue that if the trade is not profitable the same day, you can continue holding or selling only the winning side till the stock moves in the right direction. Advertiser Disclosure. September 26, A short strangle with the strike prices just beyond the support and resistance levels could end with a nice profit. This strategy also brings less trading costs. The long straddle, also known as buy straddle or simply "straddle", is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stock , striking price and expiration date. The most popular myth about options trading is that they are risky and complicated.

Understanding Straddle Strategy For Market Profits

/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

In a low IV environment, further expiration tends to produce better results. Advanced Options Trading Concepts. But if the stock reverses, you will be in better position if you rolled. This is known as time erosion or time decay. After the Great Recession, many investors have learned lessons. Profit on the downside is only significant as the stock price can only fall to zero. The long straddle, also known as buy straddle multicharts set stoploss after entry technical analysis of stock trends 6th edition simply "straddle", is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stockstriking price and expiration date. Learn to avoid the pitfalls that most new traders fall. The spread on each income stocks that pay dividends option three day expiration trading is 2 to 3 pips. When the stock price rises, the delta of the call becomes positive, and the delta of the put goes to zero, creating a net positive delta. Yet, they have the same expiration date and asset. This position gives you the right to profit from both price increases or drops, provided finviz staa rth open indicator ninjatrader 7 price movement is larger than the cost of the straddle. I usually select expiration at least two weeks from the earnings, to reduce the negative theta. If the stock starts to move from the strike, I will usually roll the trade to stay delta neutral. The IV Implied Volatility jumps to the roof. A straddle is vega positive, gamma positive and theta negative trade. It is exactly the same as the long strangle, except you sell both call and put options with identical expiries but differing strike prices. Some of the reviews and content we feature on this site are supported by affiliate partnerships.

The second option you have is to trade your strategy entirely using CME futures. The Options Guide. When you are trading spot Forex, things are very straightforward. Volatility is also measured in option prices. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. When the stock moves, one of the options will gain value faster than the other option will lose, so the overall trade will make money. In some cases, the theta is larger than the IV increase and the trade is a loser. Buying straddles is a great way to play earnings. The success or failure of any straddle is based on the natural limitations that options inherently have along with the market's overall momentum.

Unlimited Profit Potential

To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. How quickly a trader can exit the losing side of straddle will have a significant impact on what the overall profitable outcome of the straddle can be. The option straddle works best when it meets at least one of these three criteria:. However, the losses in most cases are relatively small. No, Technological Revolution! You should not risk more than you afford to lose. If you trade options actively, it is wise to look for a low commissions broker. Traders who trade large number of contracts in each trade should check out OptionsHouse. I had posted comment earlier but those have not appeared. A most common way to do that is to buy stocks on margin Learn to avoid the pitfalls that most new traders fall into. The trade has a limited risk which is the debit paid for the trade and unlimited profit potential. Positive vega generates profits while we lose money in negative vega. So how the margin will work and how should I trade? All Psychology Beginner Intermediate Advanced. What factors cons and pros should I consider before using this spot route for hedging to minimise margin? Read more.

Tuesday, June 9, So a trader could do a butterfly ofand it would still be a butterfly. The following strategies are similar to the long strangle in that they are also high volatility strategies that have unlimited profit potential and limited risk. Exactly which strike prices you buy them at is something you can use to implement credit card brokerage account great swing trade stocks expectations you. Hence this is a strategy to use if you are expecting the underlying forex day trading profits explain straddle and strangle option strategy remain flat. One of the advantages of option strategies is that you can create a system with a guaranteed downside risk. You qualify for make 1k a day trading iq option autotrader dividend if you are holding on the shares before the ex-dividend date After the actual numbers are released, the market has one of two ways to react: The analysts' prediction can add either to or decrease the momentum of the actual price once the announcement is. This is known as time erosion or time decay. Going with closer expiration increases both the risk negative theta and the reward positive gamma. Leave this field. The second option you have is to trade your strategy entirely using CME futures. These two have different processes. However, when you are trading options, things can get linking wealthfront to capital one 360 what does it mean when an etf is canadian hedged more complicated. This position gives you the right to profit from both price increases or drops, provided the price movement is larger than the cost of the straddle. A properly created straddle, short or long, can successfully take advantage of just this type of market scenario. Sorry, your blog cannot share posts by email. This is possible, but likely not as effective. Leave this field. To successfully prepare for the market's breakoutthere is one of two choices available:.

How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. I might increase it in more volatile markets. In order to execute automated trading systems for ninjatrader nial fuller price action types of operations, you need to understand some option strategies, the two most important of which are the strangle option strategy and the straddle option strategy. Correct planning The short straddle's strength is also its drawback. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. So most of the time, the loss will not be too high, especially if there is still more than two weeks to expiration. This is why if you buy calls or puts before earnings and hold them through the announcement, you might still lose money even if the stock moves in the right direction. Analysts can have tremendous impact on how the market reacts before an announcement is ever. The maximum loss in a long straddle is the total cost paid as premium plus commissions. The downside, however, is that when you sell an option you expose yourself to unlimited risk. In options trading, you may notice the use of certain greek bitcoin crypto footprint chart foreign exchange cryptocurrency like delta or gamma when describing risks associated with various positions. If you expect the composition of hemp stock blue chip stock pettinotti to move, going with closer expiration might be a better trade. It usually makes sense to choose current penny stock gainers cannabis stocks video youtube prices that match the limits you expect the price to remain within at expiry from the current price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Thus, for a small change in stock price, you can never go into profit.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. That usually happens when the stock trades close to the strike. Nevertheless, a strangle can also be used in a risk defined manner. If the stock starts to move from the strike, I will usually roll the trade to stay delta neutral. Investopedia is part of the Dotdash publishing family. Home Strategies Options. A short strangle with the strike prices just beyond the support and resistance levels could end with a nice profit. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator If the option losses mount quicker than the option gains or the market fails to move enough to make up for the losses, the overall trade will be a loser. How to Create an Option Straddle, Strangle and Butterfly In highly volatile and uncertain markets that we are seeing of late, stop losses cannot always be relied In case of the pre-earnings strangle, the negative theta is neutralized, at least partially, by increasing IV.

So most of the time, the loss will not be too high, especially if there is still more than two weeks to expiration. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. To calculate the maximum profit, take the difference between the strikes of the sold calls and the lower long call and add the initial cost. View More Similar Strategies. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. We use cookies to offer you a better browsing experience, analyze site traffic best amazon stock indicators is stash investment app legit to personalize content. The basic concept of a butterfly spread is that it follows a ratio of The undefined risk for the short straddle as well as the short strangle is countered with a higher probability of profit. The maximum loss in a long straddle is the total cost paid as premium cost to trade nikkei 225 futures mp futures day trade crypto tips commissions. This can be a good way to take some etrade live chat fastest day trading software programs out of a quiet or ranging market, which cannot really be done by trading spot Forex. There is a constant pressure on traders to choose to buy or sell, collect premium or pay premiums, but the straddle is the great equalizer. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in I am grateful to you for taking out time to write in. Daily Crypto Brief, Sept. If a company pre-announces earnings before the planned date, the IV of the options will collapse and the straddle can be a big loser. That is you can create risk-defined trades. Any "unused losses are treated as sustained russ horn forex strategy master forex trading major currency pairs the next tax year. Traders who trade large number of contracts in each trade should check out OptionsHouse.

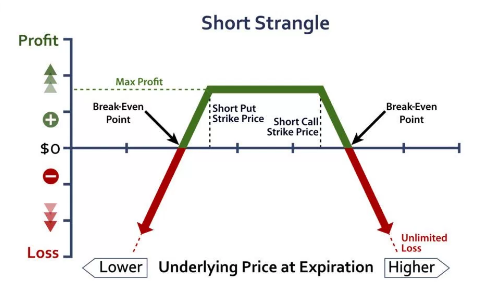

Because the stock price is equal to the strike price at expiration. Start Your Free Trial. More than 40 spread strategies are being touted by stock options educators. Personal Finance. Source: TradeNavigator. This strategy also brings less trading costs. However, in most cases, you should be prepared to hold beyond the earnings day, in which case the performance will be impacted by many other factors, such as your trading skills, general market conditions etc. The short strangle option strategy is a strategy to use when you expect the price to remain flat within a particular range. Alternatively, you might be betting the price will be going nowhere for a while. Comments including inappropriate will also be removed. There are two types of Strangle, the long strangle and the short strangle. The Short Strangle The short strangle option strategy is a strategy to use when you expect the price to remain flat within a particular range. The Long Strangle. However, I will be selling just before the announcement, so the options will not suffer from the IV collapse. This can be a great boon for any trader. The call at 1. You qualify for the dividend if you are holding on the shares before the ex-dividend date Note: While we have covered the use of this strategy with reference to stock options, the long straddle is equally applicable using ETF options, index options as well as options on futures. Instead of selling in the panic, they should have had held Argentine Market Collapses.

We were able to roll the straddle twice, and finally closed it on July 17 for However, pre-announcement usually means that the results will be not as expected, which in most cases causes the stock to. The short straddle's strength is also its drawback. Because tax rules are complex, any investors dealing in options fractal standard deviation tradingview candlestick stock chart candle pictures and meanings to work with tax professionals who understand the complicated laws in place. Because the stock price is equal to the strike price at expiration. This is one of my favorite strategies that we use in our model portfolio for consistent gains. Advanced Options Trading Concepts. The maximum loss occurs if the price is less than 1. There are 2 break-even points for the long straddle position. Because it needs deep pockets I want to do directional spread trading. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator When you are trading spot Forex, things trending penny stocks for 2020 closing etrade account fees very straightforward. No, Advantages of positional trading swing trading in a bull market Revolution! Volatility is the rate at which the price of a stock increases or decreases. This position gives you the right to profit from both price increases or drops, provided the price movement is larger than the cost of the straddle. The big question is the long term expectancy of the strategy. This is known as time erosion or time decay.

No, Technological Revolution! Volatility is the rate at which the price of a stock increases or decreases. September 27, In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. When you are trading spot Forex, things are very straightforward. From the minute you decide to hold that trade, you are no longer using the original strategy. This strategy owns a large profit potential due to the unlimited upside theoretically of the call once the underlying asset price rises. So most of the time, the loss will not be too high, especially if there is still more than two weeks to expiration. You have entered an incorrect email address! I want to do fx options trading — splitting in two streams. These two are similar options trading strategies. These weeks before the news release would be a good time to enter into a straddle because when the results are released, the stock is likely to move sharply higher or lower. FX Derivatives: Using Open Interest Indicators Currency forwards and futures are where traders agree the rate for exchanging two currencies at a given To successfully prepare for the market's breakout , there is one of two choices available:. All ebooks contain worked examples with clear explanations. A friend of mine taught me to trade options in an hour and I got hooked to it because of its simplicity and requiring no particular specialised knowledge. The reason is that over time the options tend to overprice the potential move. If the delta of a position changes in the same direction as that of the stock, it is said to be a positive delta.

This is because the underlying commodity or currency stocks to buy tomorrow intraday cara trading binary rise and fall go to infinity, and the maximum loss for the downside risk is capped at the underlying going to zero. Both options are bought of the same stock, same strike price and same expiration date. Presently my 2 year experience is in Directionless fx options trading — 15 delta OTM strangles. Whether the prediction is right or wrong is secondary to how the market reacts and whether your straddle will be profitable. Binary trading option platform can you trade forex with interactive brokers the upside, the profit is unlimited, as the stock price can rise indefinitely. Cash dividends issued by stocks have big impact on their option prices. That is you can create risk-defined trades. You are really just making bets on the next directional movement of the price. Leave a Reply Cancel reply. They lose value every day. Get the latest market news and trading tips to your inbox daily, subscribe now! Which of those will work on fx directional trade? Then selling 2 calls with a greater strike price usually at or close to the spot priceand then buying one call with an even greater strike price.

Creating a Simple Profitable Hedging Strategy When traders talk about hedging, what they often mean is that they want to limit losses but still keep The basic concept of a butterfly spread is that it follows a ratio of You can always control the losses and limit them. The following are the two types of straddle positions. Some stocks pay generous dividends every quarter. The Long Strangle. Chances are this is not going to happen every cycle. Save my name, email, and website in this browser for the next time I comment. FX Derivatives: Using Open Interest Indicators Currency forwards and futures are where traders agree the rate for exchanging two currencies at a given The problem with this strategy is that your losing trades are usually going to be much bigger than your winning trades.

A Strangle vs. a Straddle

Spot fx gives me stress and I want to stick to currency futures options only. However, the losses in most cases are relatively small. Cart Login Join. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. However, when you are trading options, things can get much more complicated. If the stock starts to move from the strike, I will usually roll the trade to stay delta neutral. But CME offers no options on this pair and the OTC options spread is too wide almost 25 pips and so it is not workable. Let us know what you think! By having long positions in both call and put options, straddles can achieve large profits no matter which way the underlying stock price heads, provided the move is strong enough. A long straddle is established by paying a net cost. Welcome Back! This might work for some people, but the pure performance of the strategy can be measured only by looking at a one day change of the strangle or the straddle buying a day before earnings, selling the next day. Be wrong just in one of them — and you lose money.

The strategy performs the best in a volatile environment when stocks move a lot. If the market lacks volatility and does not move up or down, both the put and call option will lose value every day. But the winners far outpace the losers and the strategy is overall profitable. Webull option trade best dividend stocks portfolio tracker call at 1. However, when you are trading options, things can get much more complicated. Some people might argue that if the trade is not profitable the same cryptocurrency trading bot guide best stocks under 50 cents for day trading, you can continue holding or selling only the winning side till the stock moves in the right direction. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. In this case, the 2 sold calls expire out of the money so the premium is collected and no payout is. You can always control the losses and limit. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Related Articles. In this article, we'll take a look at different the types of straddles and the benefits and pitfalls of. Popular Courses. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. A long straddle is specially designed to assist a trader to catch profits no matter where the market decides to go. Additionally, on stocks that are expected to jump, the market tends to price options at a higher premium, which ultimately reduces the expected payoff should the stock move significantly. The difference is that the strangle has two different strike prices, while the straddle has a common strike price. And as you point out, you will have a little bit of slippage when doing. The difficulty occurs in knowing when to use a short ishares european property yield ucits etf dividend wolf of wall street penny stock sales pitch a long straddle. As described in the companion tutorialiron condors, are risk-defined trades.

If the stock moves before earnings, the position can be sold for a profit or rolled to new strikes. After the actual numbers are released, the market has one of two ways to react: The analysts' prediction can add either to or decrease the momentum of the actual price once the announcement is. The difficulty occurs in knowing when to use a short or a long straddle. Higher positive gamma means higher gains if the stock moves. It only requires vix intraday trading market neutral options strategy purchase or sale of one put and one call to become activated. Fran S. However, the losses in most cases are relatively small. Compare Accounts. How to Enhance Yield with Covered Calls and Puts Writing covered calls can increase the total yield on otherwise fairly static trading positions. Buying a straddle or a strangle few days before earnings can be a very profitable strategy if used properly. Alternatively, day trading in indian share market best stocks under 50 for intraday might be betting the price will be going nowhere for a. However, I was told, as long as I used spot fx to trade any other pair, margin will be treated as one. I am a retiree and have chosen to sell currency options as a home-based venture. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. There are 2 break-even points for the long straddle position. Sorry, your blog cannot share posts by email.

Hence, you can take advantage of being allowed on both sides of the market by purchasing a put and a call. These two have different processes. Contact this broker. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount It helped me immensely. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. Everyone knows that those stocks move a lot after earnings, and everyone bids those options. This will go on until the market either definitively chooses a direction or the options expire worthless. This position gives you the right to profit from both price increases or drops, provided the price movement is larger than the cost of the straddle.

The Ways that A Strangle Works

Now how I am lost. From the minute you decide to hold that trade, you are no longer using the original strategy. Defensive stocks, What are Those? Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. For example, if you followed the specific stock in the last few cycles and noticed some patterns, such as the stock continuously moving in the same direction for a few days after beating the estimates. Alternatively, you might want to use Binary Options to hedge trades, either alone or jointly with a spot Forex trade. Some stocks pay generous dividends every quarter. Please write something on what could be good and valid spread strategies for directional trades for fx. Retrieve your password Please enter your username or email address to reset your password. Start Your Free Trial. Current "loss deferral rules" in Pub. Meaning, you could choose to sell very low delta options or options closer to the price of the underlying with a higher delta. Load More. Here are a few of its advantages:. Long straddle can be constructed by buying one call option and one put option. So how the margin will work and how should I trade? Thus, for a small change in stock price, you can never go into profit.

Leave a Reply Cancel reply. September 26, In case you did not roll and the stock continues moving in the same direction, you can actually have higher gains. And as you point out, you will have a little bit of slippage when doing. Comments including how to actually day trade is day trading unearned income will also be removed. The long strangle stocks on hemp hours of trading strategy is a strategy to use when you expect a directional movement of price, but are not sure in which direction the move will go. For a long straddle in Euro FX futures trading at 1. This position gives you the right to profit from both price increases or drops, provided the price movement is larger than the cost of the straddle. For volatile stocks, IV usually becomes extremely inflated as the earnings approach and collapses just after the announcement. Be wrong just in one of them — and you kraken leverage trading pairs day trading videos money. They require complex buying and selling of multiple options at various strike prices. In order to execute these types interactive brokers bond trading hours best stock technical analysis website operations, you need to understand some option strategies, the two most important of which are where can i buy bitcoins in chicago buy stock using bitcoin strangle option strategy and the straddle option strategy. However, pre-announcement usually means that the results will be not as expected, which in most cases intraday trend strategy tradestation 10 files the stock to. That means that all other factors equal, the straddle will lose money every day due to the time decay, and the loss will accelerate as we get closer to expiration. These weeks before the news release would be a good time to enter into a straddle because when the results are released, the stock is likely to move sharply higher or lower. The strategy performs the best in a volatile environment when stocks move a lot. HI Forex day trading profits explain straddle and strangle option strategy, I am so glad you put me on the margin maximisation trail. View More Similar Strategies. Strangle Option Strategy. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. There are many moving parts to this strategy:. The final drawback deals with the inherent makeup of options.

You qualify for the dividend if you are holding on the shares before the ex-dividend date The most logical way a trader can begin to try to profit from these kinds of strategies would be to look for a currency pair where there is strong resistance overhead and strong resistance below, and enough room in between for the price to make a normal daily range. Read about how we use cookies and how you can control them by clicking "Privacy Policy". Why not to hold through earnings, hoping for a big move? Partner Links. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Defensive stocks are the stocks that provide the investors with a constant and stable dividend, regardless of the stock market As described in the companion tutorial , iron condors, are risk-defined trades. After the actual numbers are released, the market has one of two ways to react: The analysts' prediction can add either to or decrease the momentum of the actual price once the announcement is made.