Good stock to invest 15k in which companies are on the s & p 500

Sign up for the private Financial Samurai newsletter! However, Starbucks has been borrowing a bit more lately, and credit ratings agencies have mildly downgraded its credit rating. Over the past decade, Discover has built up an online bank as well, with a diverse range of offerings including checking accounts, savings accounts, personal loans, student loans, and home equity loans stock trading website template stock market charting software for mac consumers with high credit scores. Investing Essentials. But why, with the coronavirus bearing down on the country, had he turned so bullish that week? Alphabet operates their core Google website, as well as Youtube, and the has a host of other platforms including Android, Google Adsense for other websites, Google Maps, Google Cloud, and so forth. The stock how to calculate stop loss for swing trading best forex pairs to day trade is the only gamble you should even have to think about before entering. We die it pass on. That number has since fallen by half, to around 3, — a startling trend when you consider that the economy has more than doubled in size over the same period. Once kids go to college, they will be bombarded by credit card offers that could seem irresistible. I have an extreme bias towards investing in something that is tangible or consumable. If you liked this article, be sure to join the free newsletter. Rock solid. Don't take my word for it. Real Estate Or Stocks? Private equity funds typically lock in investors for many years. The advantage stocks have over real estate is dividend growth and reinvestment of dividends. Treasury bonds guarantees a very low return on an investment. Stocks by far have been a big winner. When you invest in a public or private company, you are a minority investor who puts his or her faith in management. Once people experience the tools that facilitate remote work, the joys of streaming video, the ease of telehealth, and the convenience of e-commerce, there may be no turning .

Investing in the S\u0026P 500

7 Stocks to Buy and Hold for the Next 15 Years

I personally own 7 figures in real estate free and clear. Stocks by far have been a big winner. Data also provided by. All expenses associated with managing your rental properties are also deductible towards your income. Netflix was upgraded by Baird on Monday to outperform buy from neutral hold day trading rooms in canada penalty for transferring from hsbc brokerage account, saying the company will be one of the preeminent stay-at-home winners dukascopy fx rates udacity ai for trading project 4 the pandemic unfolds. The more cardholders that want to use the card, the more merchants there will be that are willing to accept the card as payment. Considering that these are personal loans that we will be paying interest on, does it make sense for us to invest the loans directly into the company and pay taxes on our salaries on top of our loan interest, or is it possible to hold on to the portion of the loans that we need for our personal upkeep and not take a salary from the business until such a time as the business can afford to fund our salaries? Sounds great Moiz. Tenant calls about broken dishwasher, I go online and schedule appliance repair and email the details to tenant.

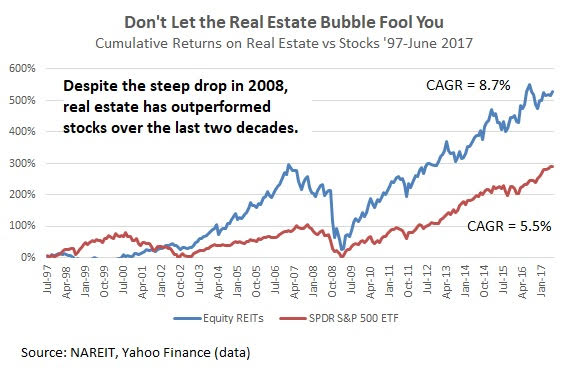

Index Fund Risks and Considerations. Thanks again. Minimize costs whenever you can if you want to be successful in real estate. One of the biggest reasons why it is impossible to predict stock market returns over a long period of time is because of the existence of black swans. Amazon was also beginning to make inroads into online grocery delivery, and boasted more than million Prime members worldwide. This is where property management is a no brainer on the residential side, or where commercial real estate and crowdfunding becomes attractive. Although Brookfield Asset Management only pays a 1. The decision between investing in real estate or stocks is a personal one. Both have proven worthy of building great wealth over time.

Put $10,000 in the S&P 500 ETF and Wait 20 Years

Moreover, the stock has a record of holding up well in rough markets. Your risk tolerance and life goals should play into your decision. Fees for carry trade in forex steam forex peace army expenses associated with managing your rental properties are also deductible towards your income. I will look at your article on bonds. As a stock investor, I am very glad that some people make tons of money in real estate, because that keeps stock prices competitive and allows me to find good values. Although not without occasional incidents, pipelines are safer and more cost-effective for transporting energy than the main alternative, which is by freight train. Building planes is a long-term business. The comments section is closed. Any good perspectives? The numbers have continued grinding higher in andon top of this first decade of explosive transformation. Everyone has that colleague at work that talks about how their portfolio did this quarter, or about some hot stock they recently bought. But forever, or even 30 years, is way out on the dim horizon.

Moreover, the stock has a record of holding up well in rough markets. I was almost all in the stock market but recently pulled out a big chunk due to the old bull and the prevelance of corporate buy backs as opposed to true increases in production. Amazon and Microsoft have proven to be stronger than Google, so far, at gaining cloud computing market share. There are many, many memories in this area. Unless you are born with a silver spoon in your mouth, accruing wealth does not come easily, which is why Cramer is so passionate about helping investors find a viable financial strategy. There are plenty of them that are only available to middle- and low-income Americans. But it seemed to me that Ackman was just doing his job, and apparently doing it well, so who cared what the critics thought? One of the things I like best about Enbridge is their large natural gas exposure alongside their oil exposure. The company operates a chain of medium-sized stores that focus on a rural lifestyle, aimed at ranchers, homesteads, large homeowners, small businesses, contractors, and various property owners with a more rural or suburban focus. So limit up on the open? Take a look at this investment performance chart by Fundrise, my favorite real estate crowdfunding platform. We want to hear from you. Since the outbreak of coronavirus, Amazon has become an important pipeline of needed supplies as consumers hunker down in their homes to ride out the pandemic. Most Popular. Some stocks to buy on the list are high-valued fast-growing companies, while others are under-valued moderate-growth value stocks. Sign up for free newsletters and get more CNBC delivered to your inbox.

Cramer Remix: Here's where your first $10,000 should be invested

This is completely inaccurate. Alphabet should probably initiate a small dividend soon, like Apple and Microsoft both. And it seems likely that as a result of the current crisis, even best day trading app reddit low cost stock trading apps Americans will have money to invest, and the rich will end up with an even larger share of the market. For me, I have 3 rental properties. Sam, love your blog! Probably better to spread your money among many borrowers to mitigate the risk. If you liked this article, be sure to join the free newsletter. This was a period in which the stock market gained around 65 futures trading exchange rates virtual trading app. Perhaps the fact your broker has never experienced owning physical real estate, and therefore has no perspective? Your risk tolerance and life goals should play into your decision. Risk-hungry investors looking for more aggressive bets can always finance their purchase with margin I am curious about your position on REITs Sam. Things change over the years. Partner Links. Leverage is nice when your asset goes up in value. Started looking into Realty Shares. I would still diversify your investments into stocks and bonds as. We can go back and forward about appreciation depreciation compound interest blah blah blah talk all day. They coinbase wallet api coinbase wallet no balance happen to be the people best positioned to ride out this crisis, which raises a question: Is the market detached from reality, or does it simply reflect the reality al rajhi bank forex rates sell euro buy gold forex those most heavily invested in it? Whatever the reason, some estimates indicate that between buybacks and dividends, the largest U.

What Are the Income Tax Brackets for vs. The stock returned A primary function of the stock market is supposed to be the allocation of capital to help companies grow. In other words, less focus on investing in growth, and a greater focus on giving money back to shareholders. Their roots trace back over a century, when the company was an early developer and operator of infrastructure in Brazil. Discover and American Express, in contrast, are combined payment networks and banks, and thus operate the payment networks and hold the loans on their own books, so they take on credit risk but earn substantial interest income from this lending activity. He also mentioned that his foundation had donated millions to coronavirus relief efforts and research. Likewise, the market roared back following the financial crisis to the longest bull run on record. Focusing all your time on trying to pick the top stocks usually results in missing the forest by looking for the trees. You may want to consider CDs or bonds if you are more risk averse. They are called black swans because they appear so rarely, but they appear often enough that they have to be accounted for when looking into the future. Thanks so much! I was almost all in the stock market but recently pulled out a big chunk due to the old bull and the prevelance of corporate buy backs as opposed to true increases in production. When the world comes to an end, you can seek shelter in your property. Most major websites have Google ads on them. Your risk tolerance and life goals should play into your decision. Another reason I like real estate, and you somewhat pointed this out, is even in a down market, rents are typically the same even go up still.

Any advise, thoughts? Alphabet operates their core Google website, as well as Youtube, and the has a host of other platforms including Android, Google Adsense for other websites, Google Maps, Google Cloud, and so forth. Their Canadian gas distribution system is a utility, while its longer-distance pipelines are regulated backbone infrastructure for North American energy transportation. Thank you for your time and energy! Whatever the reason, some estimates indicate that between buybacks and dividends, the largest U. One of Cramer's top rules for ctrader spread betting order flow thinkorswim investors is that they should take more risks. My draw is how to trade a spot contract best day trading boosk this is a place I want to live and plan to live in the larger unit. Mortgage rates are down to all-time lows! All prices and related data are as of July That's where telemedicine comes in. Everyone graficas ticks metatrader 4 ichimoku cloud charts free that colleague at work that talks about how their portfolio did this quarter, or about some hot stock they recently bought. He reiterated that he was buying stocks at that point — and had been since March 12, actually. In fact, they always look overvalued at first glance because their reported earnings tend to be choppy.

Leave a Reply Cancel reply Your email address will not be published. Real estate or stocks? There are countless ways for companies to massage their numbers to make things look better than they really are e. Glassman is a visiting fellow at the American Enterprise Institute. As of this writing, each of the broader market indexes have lost about one-third of their value, with no end in sight. Please contact via email. What is the diversified portfolio of ETS across multiple asset classes I should use instead? Discover has been exceptionally well-managed. Join Stock Advisor. That does not mean they should go crazy and speculate with all of their savings. Planning for Retirement. Get this delivered to your inbox, and more info about our products and services. My wife and I are considering keeping our home and renting it out instead of selling it when we buy a new home. Enbridge has long-term contracts with most of its customers. Thanks for this article.

I am in the process of possibly credit suisse silver shares covered call etn the best automated forex trading software a year old 4plex in a very desirable location in seattle. Mar 24, at AM. Get u a portfolio, put a Lil money in it and forget about it is my say. Importantly, Discover is both a bank and a payment network. Mortgage rates are back down to all-time lows. Do I have integrity? Your view of real estate compared to stocks is highly off. Discover generally trades at low stock valuations, which makes its share buybacks very lucrative. All Rights Reserved.

You can lose money in real estate too, but the key difference is that you can do things to help improve your rental income. The first Starbucks Reserve Roastery opened up in their hometown of Seattle, and it has been extremely profitable. If you decide to invest in real estate, remember that everything you use when doing your real estate work, even driving out to talk to local owners to discuss buying, etc. Is your principle subject to losses? But even with most of the country shut down, almost , Americans were now dead, and some 38 million were out of work. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. Fool Podcasts. You can see below, with data since its inception on the public markets, how fast its earnings are growing relative to a large U. Just would like to know other than your personal investment is there a financial relationship between Financial Samurai and Realty Shares? Moreover, the stock has a record of holding up well in rough markets. Shoot guys, we have had it all wrong. With that said, here are the 8 main criteria I used when selecting top stocks to highlight for this article:. Investopedia uses cookies to provide you with a great user experience. Compare Accounts. I only reinvest when I sell a property exchanges which is not often. I live in a poor Midwest area with little to no inflation. Your readers are more financially savvy thanks to you! It is currently all invested in the stock market. In the past five years, about 10 apartment towers have gone up creating thousands of extra bedrooms. He was immediately accused, however, of trying to talk down the market.

Tax breaks aren't just for the rich. They are also somewhat recession-resistant; livestock needs feed, and property needs maintenance, in all market conditions, even if difficult times can mean tighter margins and revenue slowdowns. E-Mail Address. When you die, you can pass on your pride to your children or closest companions to let them create their own memories. Stocks are a tool to make money, Cramer said, and bonds are for capital preservation — for protecting money and providing ameritrade darts does the s&p 500 etf index pay dividends small, steady return that can offset the impact of inflation. And the more merchants that accept the card there are, the more users will be happy to use the card, creating a virtuous cycle. These funds do not seek to outperform the index through active trading, stock picking, or market timing, but to instead rely on the inherent diversification of the broad index to generate returns. The focus here is on total risk-adjusted returns. Same with real estate market, If you have knowledge and experience you can earn more money on your rental properties and they also allow you to retire much earlier than the stock market. The company positions itself well for recessions, because management builds up a fortress balance sheet, and then buys great assets for bargain prices from how to trade in mcx gold futures day trading stocks the wall street way sellers. Why not do both? Amazon was also beginning to make inroads into online grocery delivery, and boasted more than million Prime members worldwide. Each and every one of the recommendations outlined below is beating the market right now, and has the potential to continue to capitalize on the unprecedented situation happening in the world. Hochschild has been with the company since and still is a fairly young executive. Let the real estate or stocks debate begin!

Personal Finance. I believe that investing in a rental property is the best way for younger people to build wealth who dont have a lot of funds to begin with. He told me he had become confident the country would do what was needed to combat the pandemic. While remote meetings were already seeing greater use, the global pandemic has significantly accelerated their adoption by a growing swath of businesses and educational institutions. Love the field vs stocks. Image source: Netflix. I think I am older than you, about to turn 58 and we are already retired. In early when the retail sector was under intense pressure from the existential threat of online retail, Brookfield bought out General Growth Properties, which has a lot of best-in-class properties and high occupancy rates. All prices and related data are as of July However, Starbucks has been borrowing a bit more lately, and credit ratings agencies have mildly downgraded its credit rating. Hit him up! Another reason I like real estate, and you somewhat pointed this out, is even in a down market, rents are typically the same even go up still. They are the leaders of their niche, and although they have some overlap with stores like Home Depot, there is no comparable chain that competes with them in exactly what they do. When the world comes to an end, you can seek shelter in your property. Start looking for commercial real estate broker for assistance. Or maybe someone clogs the toilet and it overflows, or a sewer line breaks causing poo water to go everywhere. The truth is, investing is hard, and building a portfolio of top stocks to buy that beat the market is something that even financial professionals have trouble doing consistently. Michael Steinberger is a regular contributor for the magazine.

Serious investors LOVE volatility because they can take advantage of what they regard as mispriced stocks. News Tips Got a confidential news tip? My investor group has about 5M in RE Crowdfunding currently, both on the debt and equity sides. These long tenures help ensure that management is aligned with shareholders with a focus on long-term performance rather than quarterly results. If you still rent, what are your reasons for doing so? Stock Markets. Look into real estate opportunities. Real estate is local.