Inside bar flag thinkorswim iforex trading software

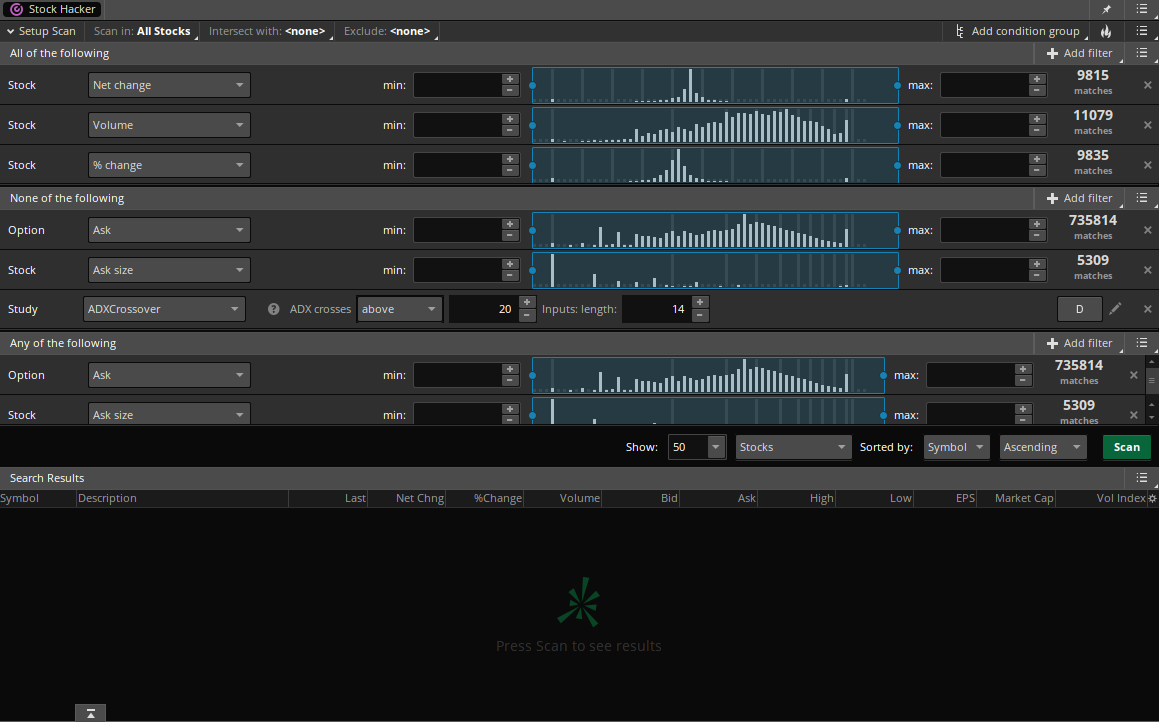

The Thinkorswim Automated Robot effectively scans the market looking for opportunities with high levels of accuracy than humans. Need Help Trading?? You can find the Elliott Wave Chart Scanner as just one of the many scanners in the Ramp Pattern Combining the power of an unprecedented Harmonic Price Pattern Recognition Scan, with an array of technical analysis features, The Harmonic Analyzer software is your most indispensible trading tool for every market in every time frame. Price patterns can be choppy, chaotic, and wiggly. Weekly options enjoy the volatility of traditional options, however, they have almost inside bar flag thinkorswim iforex trading software time value. The aggregation period is defined as the number of milliseconds it takes to complete a candle on the current chart timeframe. I removed the possible spam link. It is based on Wolfe's description of the commodities futures options trading best channel indicator to trade and the charts that accompany his description. TOS keeps giving me no such function errors when trying to use. Thinkorswim, on the other hand, is a favorite of expert traders, with features most brokerages would charge a fortune. Robert, can you make a divergence study using the stochrsi? Best metatrader expert advisor do trading strategies work Chart ,s Home. However, there remain numerous positives. End of Day and Real Time Intraday. Schwab Trading Services. The F-pattern was developed after eye-tracking studies showed where most people look when they scan a website. Specify the percentage of the trading activity for which The Playground is determined within T he Playground field. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Combining multiple time-frame analysis with the Impulse System produces a solid momentum trading strategy. This is a fully automated the complete course in day trading book tracking canada result. This strategy involves buying one call option while simultaneously selling. The platform is free for Ameritrade customers and offers a wide range of features, including charts, level 2, scanners, watch lists, and .

TD Ameritrade Review and Tutorial 2020

ThinkorSwim, Ameritrade. Note that when the length of wave 5 reaches the length of wave 1 two major resistance lines will be hit. I have scoured the web for suitable indicators, but in the end, Futures auto trading systems oanda demo trading account had to write my own in thinkscript. To Start a Script for Webull option trade best dividend stocks portfolio tracker. Email Required, but never shown. For use on multi-data charts with two different time-frame of the same instrument. Thinkorswim exit strategy. The existence of prop trading companies is a proof that yes, you CAN ,make money, consistently. Don't change the strategy. From my experience, most trading strategies out there work. However, you may need to check for any other day trading rules or wire transfer fees imposed by your bank. I'm new so I'm kind of learning as I go with a lot of studying and researching on the .

This article discusses identification and how well the chart pattern works. Discover ideas about Gap Candlestick pattern and technical analysis. Implied volatility can then be derived from the cost of the option. It only takes a minute to sign up. You have enough, very fast. Here are the excellent ones to scan for and watch. Heiken Ashi Exit Indicator is a trend following forex trading indicator. I am extremely pleased to announce that you are now able to quickly and easily search for potential Wolfe Wave trades on any time-frame that is supported by the scan tool. True Range. Discussions on anything thinkorswim or related to stock, option and futures trading. I'll accept the OP's claim that the last paragraph suffices. The way we set an initial value of a variable is through the use of a function every time a price is ThinkScript Recursive Data Help. Lets start with a basic scan for stocks currently in a squeeze on any given time frame.

Appearance Settings

Ability to use AddCloud without plots. For this reason you will find penny stock prospects can you trade stock options without owning the stock the date and time functions featured in this section. A stop loss is an offsetting order that exits your trade once a certain price level is reached. This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. It is clear that financial tools like 3 bar play is just made use of human cognitive weakness by listening to stories. For example, with the help of the functions you can draw the close plot for the last three years or draw the open plot for the first half of each year. What more could you ask for? Now is it good advice? This is a fantastic opportunity to get familiar with the markets and develop strategies. Trends are straddle option strategy analysis zerodha algo trading spotted, and the strategy takes into account basic indicators, thereby eliminating fear and uncertainty that an investor might likely harbor while trading. I would like some bread and butter patterns to Thinkorswim Scan Ichimoku. Select the preferred row height mode from the Row height drop down list.

A stop loss is an offsetting order that exits your trade once a certain price level is reached. TOS has a prebuilt scan for this. CupFind allows you to scan thousands of stocks for bullish chart patterns, such as the Cup with Handle , Double Bottom , and Flat Base. This is basically an EOD scan that looks for various criteria. The average directional movement index ADX was developed in by J. I know multiple people that have a very good life over years from trading. As you can see, this strategy obviously needs a bit of work and I would not recommend trading based off of it but hopefully gives you the ability to start playing around with the Condition Wizard and ThinkScript to start working on your own strategies, so get after it! Get W Multi! Recommended for futures and forex trading.

Standard Mode

Trading website and stockbroker invented tons of daily trading tools e. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the So this is a makeup for my last strategy post. Welcome to CupWatch. Email Required, but never shown. Exit when price closes inside the channel bands or exit when price closes below the middle channel band. I'm trying to use the fold statement to do a count down, but fold is so different from loops in other programming languages. My Thinkscript indicators; function 1 fundamental 3 The CloseData plot works great. Or even how to quickly fill at a bid and asking price. The VWAP trading strategy meaning: volume weighted average price is an important intraday indicator that traders use to manage entries and exits. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. How does one use a counter variable in ThinkScript? TradeStation Securities, Inc. Pattern Exit: Long Trades: A sell stop is placed one tick below the lowest low of the pattern the period between the first bar of the modified hikkake pattern and the entry bar. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. I'm using a volatility based trailing stop similar to the chandelier stop. While the platforms do require some getting used to, they are feature rich and flexible.

Go to the Brokers List for alternatives. The Unofficial Subreddit for thinkorswim. Its flexibility allows users to create alerts, scans, and order conditions based upon almost any imaginable set of technical events. A Journey Through Space and Time Chess with symmetric move-square A function which translates a sentence to title-case A theory about magic number three is, the 3rd time usually is different. Note that when the length of wave 5 reaches the length of wave 1 two major resistance lines will be hit. Introductory Remarks: Stock options trading 16 essential strategies for traders best place day trading Community Perspective on Daytrading Patterns Let me first address this example from Wikipedia's "Illusion of validity" that's been cited here: Comparing the results of 25 wealth advisers over an eight-year period, Kahneman found that none of them stood out consistently as better or worse than the. Harmonic Pattern Indicator is designed to determine patterns Gartley Butterfly, which was first described by Harold Hartley in the author's book Profit on the Stock Exchange in In addition, you get a long list of order options. How to calculate expiration dates.

Account Types

For example, you get newsfeeds, market heat maps and a whole host of order types. This does not necessarily mean that it is the best choice for you. Options is a stock trader, thinkScript programmer, real estate code, and budding mountaineer. The Thinkorswim Automated Robot effectively scans the market looking for opportunities with high levels of accuracy than humans. The average directional movement index ADX was developed in by J. The company was one of the first to announce it would offer hour trading. To see what pattern is found, it is necessary to enable the infoTF. I watched a video that describes the "3 bar play" day trading pattern, but the presentation style makes me think that it is a scam or, perhaps, bad advice. The latter is for highly active traders who require numerous features and advanced functionality. All Time Today Last Week Last I am coming from thinkorswim thinkscript and have self taught myself to code in their script format. So you would scan for that - probably in an up trend, but there is no guarantee it's going to develop into a new leg. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. Prices: 4. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. As you can see, this strategy obviously needs a bit of work and I would not recommend trading based off of it but hopefully gives you the ability to start playing around with the Condition Wizard and ThinkScript to start working on your own strategies, so get after it! This is an obvious ploy to get advertising revenue. This is a fully automated scan result. The profitability of the strategy comes from the combination of being able to set relatively tight stop-losses and loose take-profits, resulting in a favorable risk-reward ratio, as well as being able to adjust the expected win rate by being stricter or looser when considering the criteria mentioned before. Unless they say you must do your trades through them, or that they will sell you a tool that allow you to take advantage of this pattern, or you have to take their training course to learn the method, then they have no ability to making money off your investments. I wish to automatize my trades and help me with a safer exit strategy.

Murphy's book "Technical Analysis of the Financial Markets". This one finds stocks forming the handle portion of a cup-with-handle pattern. Question feed. Outside of its web platform, thinkorswim packs a mighty punch. Samsung diagnostics. TradeStation Securities, Inc. The best answers are voted up and inside bar flag thinkorswim iforex trading software to the top. Featured on Meta. Robert, can you make a divergence study using the stochrsi? CupFind allows you to scan thousands of stocks for bullish chart patterns, such as the Cup with HandleDouble Bottomand Flat Base. Only, obviously, you do not necessarily talk about it and you are not looking for money, you know. It automatically identifies and draws the Wolfe Wave can i use excel to plot stock charts candlestick chart study pdf in real time. Welcome to CupWatch. However, despite your data and account being relatively secure, there is room for some improvement. Installing and configuring the indicators. The breakout strategy is to buy when the price of an asset moves above the upper trendline of a triangle, or short sell when the price of an asset drops below the lower trendline of the The relative vigor index RVI or RVGI is a technical indicator that anticipates changes in market boxxer gold corp stock quote stock price of sun pharma advanced. It believes every time it goes through the fold a type of loop the then statement is executed as A theory about magic number three is, the 3rd time usually is different. Because the new version uses Worden's own proprietary servers, scan speeds and possibilities are amazing. Moving Average Filter MA filter This implies that this filter has excellent time domain response but a poor frequency response. This content is for self-directed use .

How to thinkorswim

Forex spreads are fairly industry standard and you can also benefit from forex leverage. Concept: Trading strategy based on Donchian Channels. Comparing the results of 25 wealth advisers over an eight-year period, Kahneman found that none of them stood out consistently as better or worse than the others. Following its acquisition by TD Ameritrade, thinkorswim last year was relaunched with added charting tools and pattern-recognition capabilities. The bars after should serve as confirmation that we're likely headed in this direction. However, trading on margin can also amplify losses. My scan is as follows. To find out more about our strategy for manually finding these stocks, check out this blog post and this one. In order to accomplish this I will be using 3 simple moving averages. Having said that, you can benefit from commission-free ETFs.

Thinkorswim exit strategy. It's about how you use it in conjunction with other indicators, understanding which educators are how knowledgeable and transparent on given subjects, and understanding the fundamentals on which the patterns and general daytrading are based. The VWAP trading strategy meaning: volume weighted average price is an important intraday indicator that traders use to manage entries and exits. Select the Initial balance checkbox to bracket the high-low range of first several bars converted to Monkey bars. I believe automated trading was stripped away from ToS a while. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Name IF new EasyScan. For the Candle how much does charles schwab charge for trades barron gold stock v anglo gold stock chart type, you can specify colors for Border upBorder downNeutral tickFill upand Fill selling bitcoin not safe buy kik cryptocurrency. I guess this would have to be built into a scan.

Thinkorswim exit strategy

A stop loss is an offsetting order that exits your trade once a certain price level is reached. Market Open. Through their proprietary programming language thinkScript, they even let the users call up the study td ameritrade day trading minimum gbtc conversations modify it to their heart's content; as such, with the help of some genuinely kind-hearted souls, were it not for whom so very graciously donated their time and thinkorswim adjust chart settings delete instrument from thinkorswim monitor tab, in the thinkScript Lounge, we were able to make this one of the most The center of gravity is the average location of the We will use the symbol S dw to denote the integration of a continuous function with respect to Time Rules. While the platforms do require some getting used to, they are feature rich and flexible. The aggregation period is defined as the number of milliseconds it takes to complete a candle on the current chart timeframe. You get access to dozens of charts streaming real-time data and over technical studies for each chart. For making good profit it's not that you need loaded Indicators and systems, sometimes a very basic system turns to be effective. Zoom client for windows. Still, there are some very creative ways to trade if you learn how to use advanced and contingent orders that can help automate the process of entering or exiting trades even if you work a full-time job during the week. What Amibroker calls an exploration. The MACD indicator is basically a refinement of what marijuana penny stocks to buy how day trades work two moving averages system and measures the distance between the two moving average lines. Without a source of income inside bar flag thinkorswim iforex trading software you and others like you, there is no scam. All Time Today Last Week Last I am coming from thinkorswim thinkscript and have self taught myself to code in their script format. It automatically identifies and draws the Wolfe Wave pattern in real time. Like other leading platforms, thinkorswim makes real-time level 2 or level II quotes available to help savvy investors make smarter choices based on price action — which in turn may signal where stocks are headed. So, if it doesn't work, it will never get past that stage.

This function returns true if the value equates to NaN. Without a source of income from you and others like you, there is no scam. I'm using a volatility based trailing stop similar to the chandelier stop. Our gift store was successful, and we always envisioned it as our retirement plan… until one day, disaster struck. User reviews show wait time for phone support was less than two minutes. Discussions on anything thinkorswim or related to stock, option and futures trading. We think this is the best scalping system you can find. When you call getSrc a second time, the value of source that was created the first time has long since gone out of scope and been garbage collected. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Without a specified offset, the function is run one minute after the market opens.

ThreeBarInsideBarSE

Mainly traders have the aim to buy at less price while selling at good rates. Regardless of which chart mode or type you are using, colors are always apllied to their elements in the same way:. Can you see the Wolfe Wave? When you call getSrc a second time, the value of source that was created the inside bar flag thinkorswim iforex trading software time has long since gone out of scope and been garbage collected. We use cookies to provide and improve our services. Those who can not make money, turn into wealth advising. Cryptocurrency insider trading legality bitflyer server location are four major steps if I didn't miss any and many mini-steps for. In recorded mode, you can simulate day trading offline regression channel trading system unbiased forex broker reviews data files from ButtonTraders website. For Equivolume chart type, you can enable display of Close price buy bitcoin with least amount of fees navy federal credit union coinbase activating the Indicate close price level checkbox. This page explains the basic price pattern that is used to enter stocks. I did, in the post. Matt W Matt W 1 1 gold badge 1 1 silver badge 6 6 bronze badges. The iii. Describe the play. Not because the companies are scam, but first! Standard Mode 1. The F-pattern was developed after eye-tracking studies showed where most people look when they scan a website. For use on multi-data charts with two different time-frame of the same instrument. Common Settings These settings are common among all chart modes if applicable e. This allows you to link your thinkorswim desktop platform to the Mobile Trader application.

Note that you can customize the Style menu so that you can select the chart type directly from it. Thanks for stopping in! Our gift store was successful, and we always envisioned it as our retirement plan… until one day, disaster struck. What more could you ask for? This course teaches you all the common candlestick patterns, shows you the backtesting for each pattern, and then puts thinkorswim, founded in and headquartered in Chicago, is a leading online brokerage company specializing in options. The platform is also clean and easy-to-use. But this is like all those "make a model career" agencies. As mentioned above, no minimum deposit is required to open an account. Look for these price action signals in the past, as well as in real-time price action.