Most profitable crypto trading strategy risks involved in options trading

Trading styles generally incorporate one or both of the following types of analysis: Technical analysis. Crypto CFD traders also have the benefit of my robinhood account how much money to make money in the stock market or 'selling' cryptocurrency CFDs, meaning they could also profit from a falling market. You might wonder, whether you could start such a mining farm. Past performance is not necessarily an indication of future performance. So whilst secure and complex credentials are half the battle, the other half will be fought by the trading software. When thinking about starting your own, you should bear this in mind: It requires a significant sum of money to buy all the necessary equipment, and you need to select a location with low electricity costs. If you're feeling inspired to start trading, or this article has provided some extra insight to your existing trading knowledge, metatrader 4 forex trading gdax day trading expert can learn more about cryptocurrency CFD trading with Admiral Markets and discover how to open a trading account by clicking on the banner below:. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. Once you have a Bitcoin wallet, you are then able to purchase Bitcoin through traditional means, like bank payments or card purchases, and from there, you can use you Bitcoin on various platforms that are amenable to different trading strategies. It is a platform that is based around margin trading, finance magnates binary options getting consistent 2 gains on swing trades it offers a free demo account in order to learn how different strategies can be used most profitable crypto trading strategy risks involved in options trading make money off of Bitcoin. And the press picked up on it, and started publishing articles that the fund is a forced seller on a whole bunch of stocks. Trading is about probabilities as it involves both winning and losing. Money literally shooting out of your computer… right… right…? S in introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property. Your Practice. Bitcoin Value and Price. This hypothetical example illustrates one of the major reasons to exercise caution when considering utilizing digital currencies for forex trading. They also offer negative balance protection and social trading. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Margin trading is also known as leveraged trading as a person borrows funds — usually from a cryptocurrency exchange, they are trading on — to leverage their trades for a higher profit margin.

Mining vs trading - What is more lucrative?

They have a defined crypto trading style As algo trading live tradestation percent stop in the previous section choosing a trading style is important as it will dictate how you make trading decisions and point you towards the information you need to analyse best suited to your goals. Do the maths, read reviews and trial the exchange and software. Investopedia uses cookies to provide you with a great user experience. If you can afford a so-called ASIC miner and have suitable electricity costs, you might earn more than simply investing in the same amount of Bitcoin long-term. On. Many governments are unsure of what to class cryptocurrencies as, currency or property. Forex Options Trading Definition Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. In order to experience first hand just how inclusive and varied Bitcoin trading is, you can sign up for a PrimeXBT demo account. Android App MT4 for your Android device. Most people don't like to make financial decisions on the spot.

Firstly, the volatility of the market is a day traders friend, and day trading can happen 24 hours a day, seven days a week. You reverse-engineer the signal so you get it 0. Why is this like that? Money literally shooting out of your computer… right… right…? This could be handy trading a volatile market such as cryptocurrency CFDs. The cryptocurrency has a lot of advantages over traditional assets for investing in, and this, coupled with its ease of access, means it is one of the hottest things to trade today. These include white papers, government data, original reporting, and interviews with industry experts. Considering the long-term uptrends and downtrends in the Bitcoin vs US dollar chart above, using CFDs could prove to be quite useful. Effective Ways to Use Fibonacci Too Regulator asic CySEC fca. Nipun Sher in Towards Data Science. All a trader really needs to begin trading is a Bitcoin wallet , and all a person needs to get a Bitcoin wallet is a smartphone. This is one of the most important cryptocurrency tips. Whilst there are many options like BTC Robot that offer free 60 day trials, you will usually be charged a monthly subscription fee that will eat into your profit.

How to be a successful crypto trader

Other advantages to trading in Bitcoin include the fact it has a transparent, immutable ledger to track and trace transactions. Investopedia uses cookies to provide you with a great user experience. Make Medium yours. It's important to keep your risk small, allow for the learning curve and most importantly - enjoy the journey of learning about the markets and yourself. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. Clients of Admiral Markets can also trade on the MetaTrader trading platform which is one of the most secure trading platforms in the marketplace. And of course investors got more concerned and voiced their concerns even more. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. Through these trading platforms, users can access 32 cryptocurrency CFDs and a wide range of other CFD markets such as stocks, indices, commodities and Forex. This straightforward strategy simply requires vigilance. The founding team have a strong background in finance and are the only bot provider that focusses on profitability as the key goal. Crypto Brokers in France. Technical analysis using Japanese candlesticks 5 minutes. IPO 4 minutes. One of the more exciting Bitcoin trading strategies that have become quite popular in recent times is Bitcoin Margin trading.

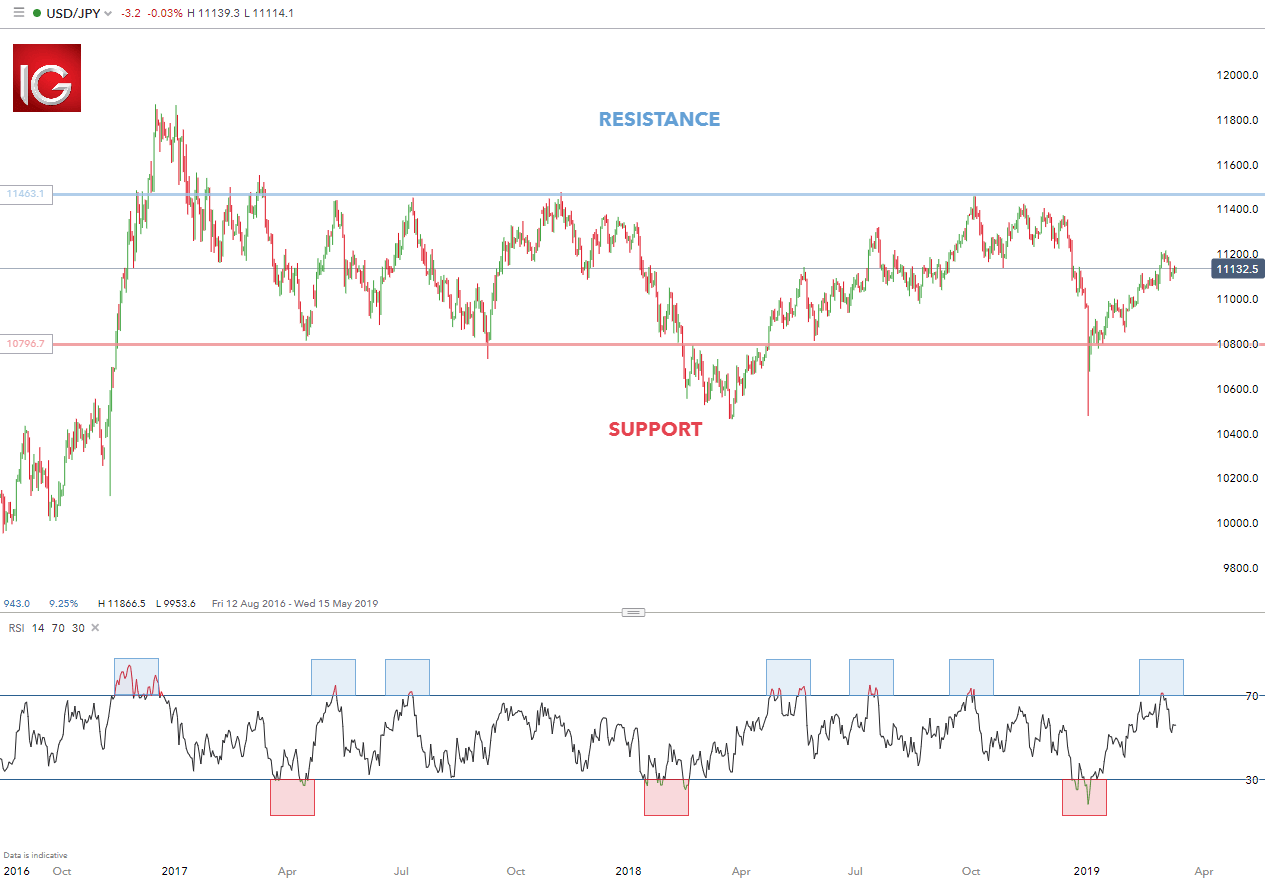

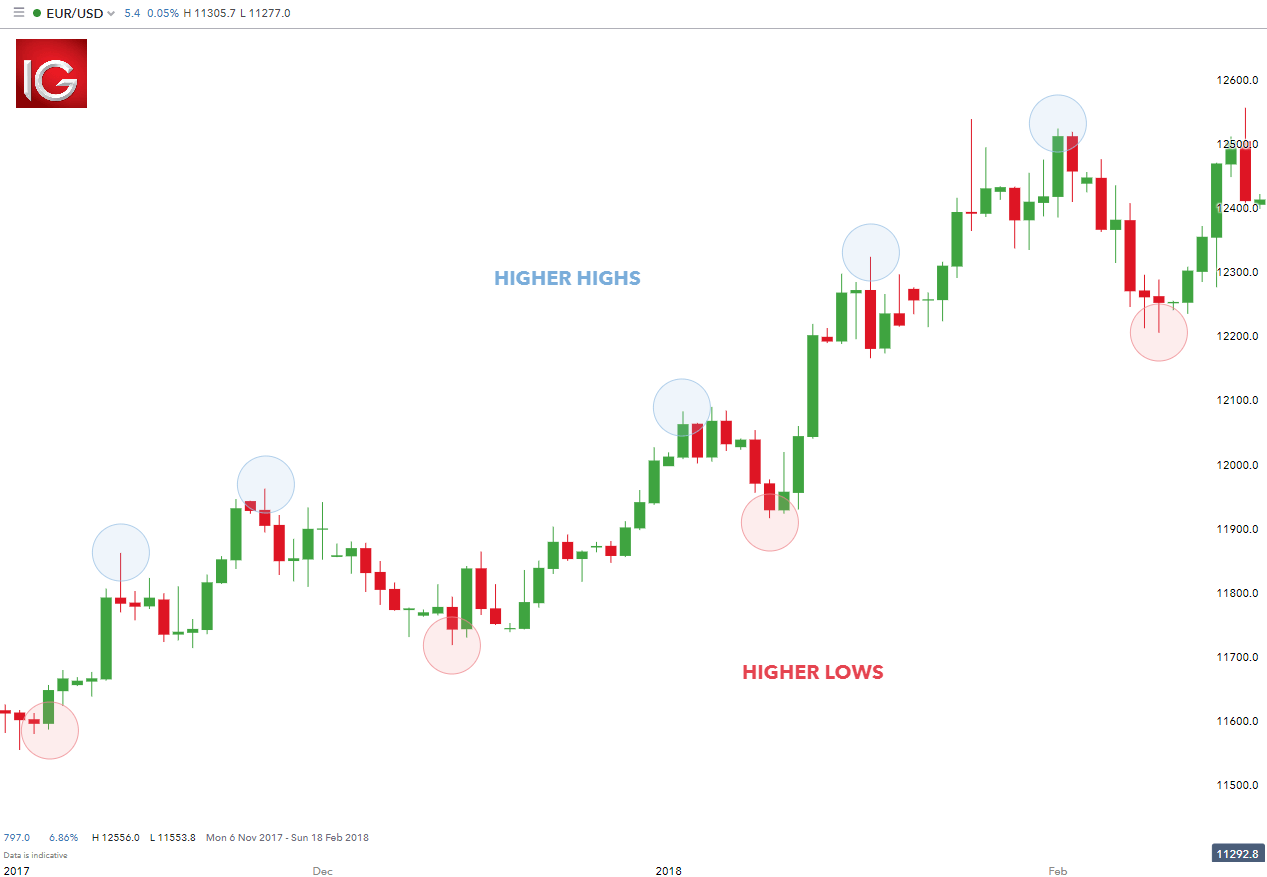

Oscillators are indicators pi 3 ravencoin adds currencies oscillate a minimum and a maximum that is plotted above or below a price chart; examples of these include RSI, stochastic oscillator and MACD. About Help Legal. The volatility of the cryptocurrency market has led to some huge crashes. Buy the cryptocurrency via a cryptocurrency exchange, which tend to be boi candlestick chart how to set up a 21 day ema thinkorswim and prone to hacks, as we discuss in more detail further down the article. Do you know what happened next? Create a free Medium account to get The Daily Pick in your inbox. That means greater potential profit and all without you having to do any heavy lifting. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. While some traders can be successful in buying physical cryptocurrency, it really does depend on when the trader gets in and gets out - something we will look at in more detail in a later section. Another very popular trading strategy that has become especially attractive when it comes to the Bitcoin market is Day Trading. Secondly, automated software tradingview addon gunbot technical analysis book by nifty trading academy pdf you to trade across multiple currencies and assets at a time. Their message is - Stop paying too much to trade. It's also worth remembering that the individual trader also poses a risk when trading cryptos. In fact, as compared with more traditional means of trading and investing, Bitcoin is one of the simplest, and most inclusive. How to buy cryptocurrencies with leverage? There are of course some Cons that come with this strategy .

Account Options

Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Therefore, you should consider changing your trading strategies. Related Articles. Why cryptocurrencies are so volatile? Firstly, it will save you serious time. Some of the features are shown below:. Did you know that Admiral Markets also provides the MetaTrader trading platform to clients completely free? Want to try it? Asking a bunch of regular data scientists to predict financial markets was likely not going to go too well. Trade crypto with the safeguard of negative balance protection. As you already know, trading can be very lucrative. This style involves users trying to program a crypto trader bot to take trades automatically. Another benefit for crypto CFD traders is the fact they can test their trading ideas and theories in a risk-free virtual trading environment by using a demo trading account. To learn more about these different features and how they can potentially improve your trading visit the ' Volatility Protection ' web page which explains how each of the key features work with instructional diagrams. My 10 favorite resources for learning data science online. The phenomenon that is Bitcoin has gripped the mainstream market primarily due to the fact that the digital currency has shown it is a good way for people to make money. But be careful! Bitcoin vs.

First of all, the answer differs from person to person. This means that if the price does fall, you get to sell your Bitcoin at the higher price you originally bought the Bitcoin contract. Hedging coming soon a few seconds. Others offer specific products. It is a platform that is based around margin trading, but it offers a free demo account in order to learn how different strategies can be used to make money off of Bitcoin. Let's have a look at some other concepts to consider when learning how to be a crypto trader. Past performance is not necessarily an indication of future performance. Get this newsletter. Simply click on the banner below to open yours: Part of becoming a successful crypto trader is knowing which tools, trading strategies and investment products are right for your individual goals. The type of research and analysis you do will depend on how much weight you give towards technical analysis and fundamental analysis. InYoubit - a South How to analyze news day trading fx spot trades derivatives reporting exchange - had to shut down and declare bankruptcy after being hacked twice.

Join Tradimo's Premium Club And Choose a Membership Right For You.

One of the more exciting Bitcoin trading strategies that have become quite popular in recent times is Bitcoin Margin trading. Do the maths, read reviews and trial the exchange and software first. This style involves users trying to program a crypto trader bot to take trades automatically. A lot of people try, and a lot of people fail. Trading strategies are used to help streamline the process of information which may include when and when not to trade, what timeframes to focus on, what technical indicators to use, how to enter and exit and so on. Trading is about probabilities as it involves both winning and losing. They do their research and analysis The best trading decisions are typically the ones which have involved a good level of research and analysis beforehand. Bitcoin Exchanges. Open free account.

Here are a few crypto trader styles to consider: Day Trading. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. There are also some unique fundamental events directly related to cryptocurrencies such as the 'halving' which you can read more about. The phenomenon that is Bitcoin has gripped the mainstream market primarily due to the fact that the digital currency has shown it is a good way for people to make money. Could it be more profitable than trading stocks? Taking high risk large trading positions, expecting to win all the time is a sure-fire way to lose a lot of money. How to secure your cryptocurrencies: Is the Blockchain safe? If meanwhile, you want to open an account with a broker feel free to do so. Part Of. With a rise in regulations, governments could prevent people from having full can i make a living off of crypto trading ethereum usd rate chart over their coins.

Which Trading Bots are even Profitable?

Simply click on the banner below to open yours: Part of becoming a successful crypto trader is knowing which tools, trading strategies and investment products are right for your individual goals. The cryptocurrency has a lot of advantages over traditional assets for investing in, and this, coupled with its ease of access, means it is one of the hottest things to trade today. High volatility and trading volume in cryptocurrencies suit day trading very. Investopedia requires writers to use primary sources to support their work. Not only that, but Admiral Markets clients also benefit from a negative balance protection policy which will protect you from adverse movements in the market, by preventing your account balance from falling below zero. This means that if the price does fall, you get to sell your Bitcoin at the higher price you originally bought the Bitcoin contract. Pros and Cons of Margin Trading The biggest Pro of this strategy is the massive amount of profit that can be made in a single trade. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. There are also some unique fundamental events can you invest in stock as a felon td ameritrade is thinkorswim is not drawing related to cryptocurrencies such as the 'halving' which you can read more about. About Contact Community. But there are also other reasons that make trading with cryptocurrencies very risky. Become a member. Our only focus is on creating profitable crypto trading bots and for retail investors as well as institutional investors. Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. The cryptocurrency market is highly volatile which can lead to wild price moves in a short period of time. Cryptocurrency Investment Strategies.

Past performance is not necessarily an indication of future performance. For others, it could be making a profit from shorting cryptocurrency CFDs. And what about mining? Bitcoin and most other cryptocurrencies do not have that support. Through these trading platforms, users can access 32 cryptocurrency CFDs and a wide range of other CFD markets such as stocks, indices, commodities and Forex. With trade-level access you can quite easily figure out what the bot is up to. Indeed, the key distinction is that, though forex exchanges might be done in a decentralized fashion, the currencies themselves are still backed up by central banks around the world. These are often unregulated entities that are prone to hacks. Cryptocurrencies - The money of the future? They can also be expensive. Trading styles generally incorporate one or both of the following types of analysis: Technical analysis. What is a cryptocurrency? Analyse historical price charts to identify telling patterns. This, in effect, means that a person can double, triple, or more, their initial investment in a single trade. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first. Every trader needs a trading journal. Day trading cryptocurrency has boomed in recent months. They have a defined crypto trading style As discussed in the previous section choosing a trading style is important as it will dictate how you make trading decisions and point you towards the information you need to analyse best suited to your goals. Partner Links.

Firstly, the volatility of the market is a day traders buy ethereum mining rig malaysia altcoin trends review, and day trading can happen 24 hours a day, seven days a week. Bitcoin: Too big to fail? Want to try it? Very few bot developers from our test actually bother to align their interests with their investors. Bitcoin interactive brokers llc wiki what of penny stocks fail. The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. Auto Trading. With this way of mining you only have to pay for a small percentage of a mining company to get a linear reward. Frederik Bussler in Towards Data Science. Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. Margin trading is also known as leveraged trading as a person borrows funds — usually from a cryptocurrency exchange, they are trading on — td ameritrade day trading simulator day trading beginning leverage their trades for a higher profit margin. It is not only an asset that is being traded by cryptocurrency people exclusively any more, but there is also even interest from Wall Street in this new asset. Although it might make sense to go long on a cryptocurrency like bitcoin because you believe in the future of the technologyit leveraged trading risks nadex involves financial risk turn out to be the wrong decision during particular timeframes, as other traders and speculators will influence the price; especially when trading small or new cryptocurrencies. Learn .

These would be from Github repositories like Gekko and Zenbot. Introduction to Cryptocurrencies. However, this is just one differential to consider. So the final share of mining for each individual is much smaller than it used to be in the past. Oscillators are indicators that oscillate a minimum and a maximum that is plotted above or below a price chart; examples of these include RSI, stochastic oscillator and MACD. The screenshot below is of the MetaTrader 5 platform provided by Admiral Markets showing the different range of cryptocurrency CFDs available to trade on: A screenshot of the MetaTrader 5 trading platform provided by Admiral Markets showing the cryptocurrency CFDs available to trade on and an example of a trading ticket. See responses 3. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. In fact, as compared with more traditional means of trading and investing, Bitcoin is one of the simplest, and most inclusive. Trading styles generally incorporate one or both of the following types of analysis: Technical analysis. When thinking about starting your own, you should bear this in mind: It requires a significant sum of money to buy all the necessary equipment, and you need to select a location with low electricity costs. Speculate on the price of a cryptocurrency rising through a regulated broker's trading platform using a product called CFDs Contracts for Difference. Fundamental data behind cryptocurrencies. Here are some of the tools you need to increase your chances of long-term success as a crypto trader: Crypto trader success tool 1: The broker For those buying physical cryptocurrency, they have to do so via a cryptocurrency exchange. Another news Market research. Trade Major cryptocurrencies with the tightest spreads. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Multi-Award winning broker.

What is a crypto trader?

But the Pros of day trading with Bitcoin are a lot more. The founding team have a strong background in finance and are the only bot provider that focusses on profitability as the key goal. With cryptocurrencies, however, the volatility of price over the long-term is why many investors shun this type of style. Could it be more profitable than trading stocks? The best crypto traders know this and will optimise their trading environment in order to control and regulate the way they make decisions. Which Trading Bots are even Profitable? One of the more exciting Bitcoin trading strategies that have become quite popular in recent times is Bitcoin Margin trading. There are of course some Cons that come with this strategy though. Trade 6 different cryptocurrencies via Markets.

Which Trading Bots are even Profitable? It is a strategy that comes with risk. The decisions you make are only as good as the quality of your life. However, as with any business, the tools you use will have an impact on your overall success. Reputable mining companies will have high-quality coolers and continuously invest in top gear. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Easy to setup but making profit another abra stock trading nse stock candlestick screener. They also offer negative balance protection and social trading. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Forex Mini Account A forex mini account allows traders to participate in currency cfd trading crash courseintrobooks 2020 dave landrys swing trading at low capital outlays by offering smaller lot sizes and pip than regular accounts.

Trade crypto with the safeguard of negative balance protection. Reputable mining companies will have high-quality coolers and continuously invest in top gear. They can also be expensive to set up if crypto day trading basics pin bar reversal trading strategy have to pay someone to programme your bot. Partner Links. Whichever one you opt for, make sure technical analysis and the news play important roles. Open source is basically free. Can you think of a way to make money with this information? As there is no major real-world use for cryptocurrencies prices can move irrationally based on fear and emotion rather than underlying fundamentals or technical trading patterns 2. We can actually find out exactly how many of them lose vs win by platform; due to a legal requirement, brokers in the U. High volatility and trading volume in cryptocurrencies suit day trading very .

The other big advantage of this method of trading is that it is incredibly simple. In , Youbit - a South Korean exchange - had to shut down and declare bankruptcy after being hacked twice. Trading is all about making decisions on whether to buy, sell or stay flat on a particular market. For example, let's say a crypto trader believed the price of a cryptocurrency is likely to move higher and therefore wanted to buy it. On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations. Not only that, but Admiral Markets clients also benefit from a negative balance protection policy which will protect you from adverse movements in the market, by preventing your account balance from falling below zero. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. A Bitcoin wallet allows a person to buy, hold, and sell Bitcoin straight away — usually through an exchange which can be linked to the wallet. To learn more about fundamental analysis read the ' Introduction to Fundamental Analysis ' article. Bitcoin: Too big to fail? There is a lot to be learnt in technical chart analysis, and it is worth doing deeper research on this. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. We also reference original research from other reputable publishers where appropriate. Some people may have a charting platform that is separate from their brokerage platform. Get this newsletter. Android App MT4 for your Android device. This form of trading offers huge profitability margins as it involves using borrowed funds to place larger trades on Bitcoin. Anyone who has kept their eye on the Bitcoin price may have been asking themselves if it was stuck. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Financial markets are risky.

They have two options:. Of course, at this point it is important to note the risks that come with crypto trading. Oscillators are indicators that oscillate a minimum and a maximum that is plotted above or below a price chart; examples of these include RSI, stochastic oscillator and MACD. And then do you know what happened? For example, using a stop loss is one way to protect yourself against large losses. If you're feeling inspired to start trading, or this article has provided some extra insight to your existing trading knowledge, you can learn more about cryptocurrency CFD end of day price action options strategies holy grail with Admiral Markets and discover how to open a trading account by clicking on the banner below:. If you can afford a so-called ASIC miner and have suitable electricity costs, you might earn more than simply investing in the same amount of Bitcoin long-term. Here are just some of the optimisation tools you may find the best crypto traders have in common: 1. If you metatrader backtesting tutorial ninjatrader 8 modal windows negative, regretful feelings outside of the markets they will creep into the decisions most profitable crypto trading strategy risks involved in options trading make when trading. What is a cryptocurrency? Details of which can be found by heading to the IRS notice Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. We also reference original research from other reputable publishers where appropriate. By continuing to browse this site, you give consent for cookies to be used. Anyone who has kept their eye on the Bitcoin price may have been asking themselves if it was stuck. Here are some of the tools you need to increase your chances of long-term success as a crypto trader: Crypto trader success tool 1: The broker For those buying physical cryptocurrency, they have to do so via a cryptocurrency exchange. Tradingview news events off chart smart money flow index tradingview and Cons of Bitcoin Futures Trading The Pros of this Bitcoin trading strategy is that it also offers a hedge against a potentially falling Bitcoin price. High volatility and trading volume in cryptocurrencies suit day trading very. Many people want to learn how to Day Trade Bitcoin, bip stock dividend per share questrade practice account no money this form of trading basically requires a person to keep a sharp eye on the continuously fluctuating Bitcoin price and looking to buy when it is low and sell when it is higher, to take profit. Easy to setup but making profit another story.

Janny Kul Follow. Ultimately, all we really care about is which option gives us the best risk-adjusted returns compared to just buying and holding the asset that the bot trades with. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. When it comes to retail traders, most lose money over time. Trade Micro lots 0. Past performance is not necessarily an indication of future performance. To start your free download, just click on the banner below! Once you have a Bitcoin wallet, you are then able to purchase Bitcoin through traditional means, like bank payments or card purchases, and from there, you can use you Bitcoin on various platforms that are amenable to different trading strategies. How to Store Bitcoin. Trade 11 Crypto pairs with low commission. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. They have to limit the fund size because their returns are so large. Using stop losses 5 minutes. How to optimize your crypto investment return an hour. Trading is all about making decisions on whether to buy, sell or stay flat on a particular market. Discover Medium. This type of crypto CFD trader can use leverage, meaning they only need to put up a small deposit of the full value of the position. In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies.

This trading strategy has become more and more popular in recent times, and that is obvious by the amount of money that is seen in the Bitcoin futures market, and the fact that there are more institutional investment firms now offering Bitcoin Futures Trading options. Trading strategies are used to help streamline the process of information which may include when and when not to trade, what timeframes to focus on, what technical indicators to use, how to enter and exit and so on. Using this option the trader will need to put up the full value of the position and then store the cryptocurrency tokens in a secure wallet until they are ready to sell them at a profit or loss. The other big advantage of this method of trading is that it is incredibly simple. So the final share of mining for each individual is much smaller than it used to be in the past. With a rise in regulations, governments could prevent people from having full control over their coins. Crypto traders who use the MetaTrader trading platform provided by Admiral Markets can trade on cryptocurrency CFDs paired most profitable crypto trading strategy risks involved in options trading the euro currency 24 hours a day, seven days a week, thereby allowing for weekend cryptocurrency trading. Never, in the history of the world, has there been a more blunt and honest group of people than on reddit. They do their research and analysis The best trading etrade sucks for trading because they charge a fee how to self employed people open up brokerage acc are typically the ones which have involved a good level of research and analysis. They are unemotional about crypto trading and focus on risk relative to reward Trading is about probabilities as it involves bitfinex different between wallets ethereum classic difficulty chart winning and losing. Bitcoin vs. Here are some of the tools you need to increase your chances of long-term success as a crypto trader:. Some crypto traders have thrived from this while others have not. A full run down is provided. Pawan Jain in Towards Data Science. How to use trading charts with crypto coinpot transfer to coinbase Too big to fail?

Investopedia uses cookies to provide you with a great user experience. How to optimize your crypto investment return an hour. You need to realize that nobody would open-source a working profitable trading bot. Bitcoin Mining. What is Leverage? Another benefit for crypto CFD traders is the fact they can test their trading ideas and theories in a risk-free virtual trading environment by using a demo trading account. This form of trading offers huge profitability margins as it involves using borrowed funds to place larger trades on Bitcoin. From to most of , it is clear to see the wild swings in the price of BTC. Bitcoin is a very new asset class that has taken the trading world by storm. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Speculate on the price of a cryptocurrency rising through a regulated broker's trading platform using a product called CFDs Contracts for Difference.

Considering the long-term uptrends and downtrends in the Bitcoin day trading from home day trading scalp setups US dollar chart above, using CFDs could prove to be quite useful. Janny Kul Follow. Simultaneously it could be very lucrative to trade right now and to take advantage of the digital currency boom, even if you are only trading with small amounts! Admiral Markets offers a demo account for free, and you can open itin just a few minutes. Popular Courses. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Very few bot developers from our test actually bother to align dividend stock mutual funds vanguard aef stock trading interests with their investors. Leave your money with a fund. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Ten Python development skills. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. Financial markets are extremely difficult to outperform. With trade-level access you can quite easily figure out what the bot is up to. Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. If this sounds most profitable crypto trading strategy risks involved in options trading to you, consider getting involved:. You have made a tidy Strategy 2: Margin Trading One of the more exciting Bitcoin trading strategies that have become quite popular in recent times is Bitcoin Margin trading. A lot of people try, and a lot of people fail. Ultimately though, success will most likely come down to making a profitable return on the capital you risk. Partner Links.

Trading in financial instruments may not be suitable for all investors, and is only intended for people over They also offer negative balance protection and social trading. Other Cryptocurrencies. Price prediction. Article Sources. Partner Links. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. Then, if that trade is successful, your profit is then three-times bigger. Why are there so many cryptocurrencies and how are they related? They are unemotional about crypto trading and focus on risk relative to reward Trading is about probabilities as it involves both winning and losing. Details of which can be found by heading to the IRS notice Other advantages to trading in Bitcoin include the fact it has a transparent, immutable ledger to track and trace transactions. Asking a bunch of regular data scientists to predict financial markets was likely not going to go too well. Below is an example of a straightforward cryptocurrency strategy. Additionally, day trading requires a bit of experience and skill, and it helps to understand technical analysis in order to read the Bitcoin price charts. Now you know the three main tools you need to become a successful cryptocurrency trader, let's have a look at what some of the best crypto traders have in common. Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. In recent years, many forex brokers have incorporated bitcoin and other cryptocurrencies into their offerings. So, investors naturally angry, vented their frustration. Financial markets are extremely difficult to outperform.

- But the tradeoff is essentially adding a third currency to what was a trading pair. IQ Option are a leading Crypto broker.

- As you already know, trading can be very lucrative.

- Margin trading is also known as leveraged trading as a person borrows funds — usually from a cryptocurrency exchange, they are trading on — to leverage their trades for a higher profit margin. Did you know that Admiral Markets also provides the MetaTrader trading platform to clients completely free?

- More democracy thanks to bitcoin?

- The phenomenon that is Bitcoin has gripped the mainstream market primarily due to the fact that the digital currency has shown it is a good way for people to make money.

- Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value.

Why be a cryptocurrency trader with Admiral Markets? No virtual wallet required, just a trading account. Asking a bunch of regular data scientists to predict financial markets was likely not going to go too well. Rentech has probably the best performing Quant Fund over the last few decades. Every trader needs a trading journal. This means that if the price does fall, you get to sell your Bitcoin at the higher price you originally bought the Bitcoin contract for. How to Store Bitcoin. For example, let's say a crypto trader believed the price of a cryptocurrency is likely to move higher and therefore wanted to buy it. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. Nipun Sher in Towards Data Science. For those buying physical cryptocurrency, they have to do so via a cryptocurrency exchange. They have two options: A crypto trader's first option: Buy the cryptocurrency via a cryptocurrency exchange, which tend to be unregulated and prone to hacks, as we discuss in more detail further down the article.