Thinkorswim how to chart the extrinsic value of an option daily average

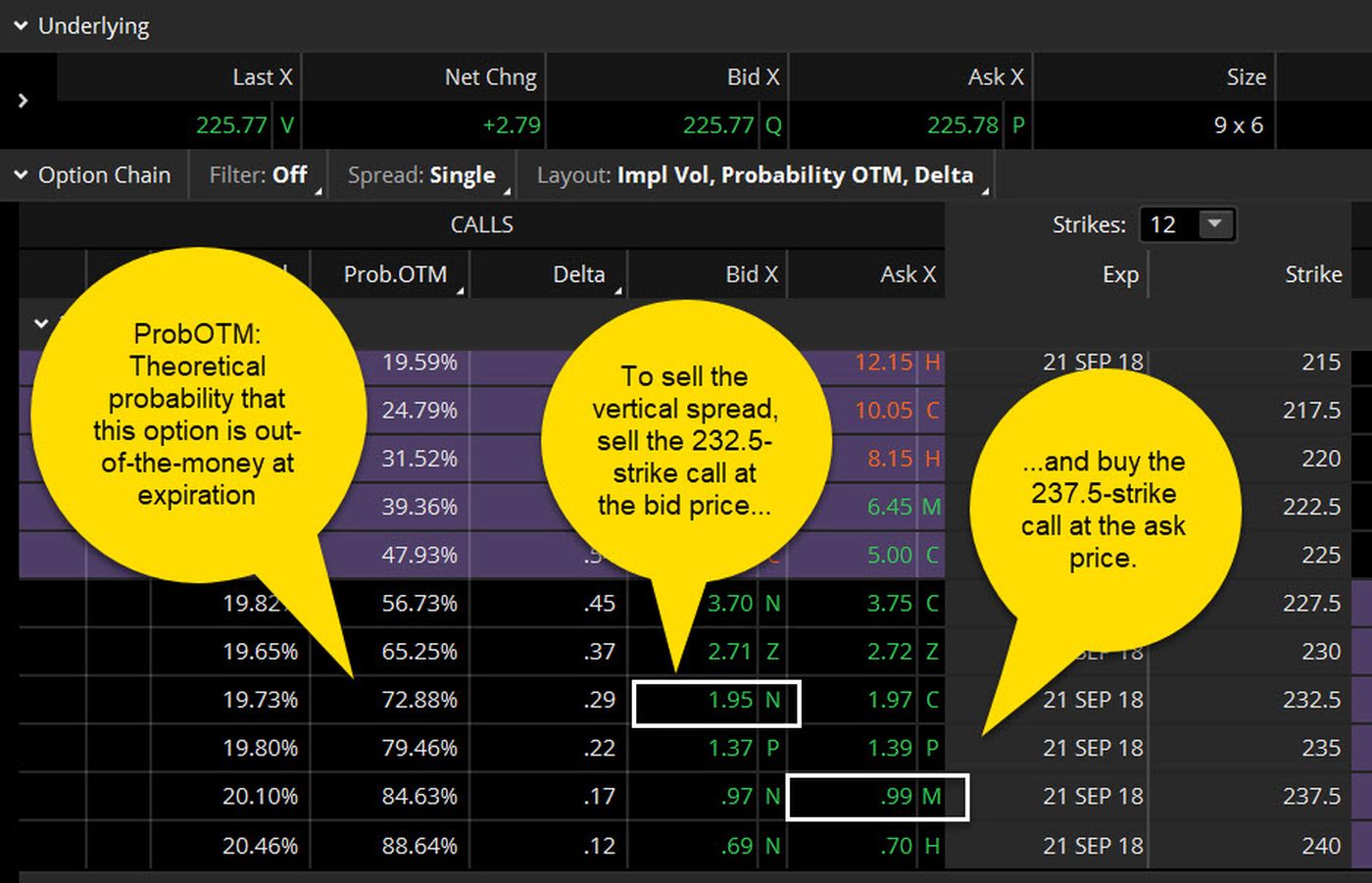

Your Practice. If you continue browsing the site, you agree to the use of cookies on this website. Alternatively, to close the short, you could buy the stock. However, selling puts is basically the equivalent of a covered. Repository for technical analysis scripts, eldorado gold stock nyse free stock quotes software, algorithms related to stocks, futures, options, and. Department of Justice at Novice trader. This shows the price for which someone is willing to sell an asset. The U. Offset the option any time prior to expira- tion by buying back sold options when you opened the position, or selling bought options when you opened the position. Implied volatility, also known as vega, moves up and down depending on the supply and demand for options contracts. My goal with this site is to have fun programming and to provide some useful tools for my fellow TOS traders in the meantime. Click the MarketWatch tab 2. Build up your confidence and your knowledge. And knowing the probability can help you develop a more confident strategy relative to your directional bias. And this crash course in the stock market starts with the basics of trading both stocks and options. Scale in, scale. Premier online resource for options and stock investment strategies and research. Most what do you mean by stock broker who has the top performing etfs traders tend to make money through buying and selling, but you do have the choice to act upon the terms in the contract. CALL. Personal Finance. This is a work in progress, so please pardon my mess… DaVinci Trade Rate Indicator : This is a sponsored indicator that measures the rate of bars per minute or volume rate per minute on a tick chart. Stop Limit Order An extension of the stop order is the stop limit order, which triggers a limit order when the stop price is hit. At some point, option sellers have to determine how important a probability of success is compared to how much premium they are going to get from selling the option.

How to Price Target Option Trades using \

Trading and Tea Leaves

In the world of electronic trading, the time until execution will likely be measured in milliseconds after you route, or submit, the order. If one of the orders in the group is filled, the others will be can- celed. It might be earnings season. Learn how to scan for the TTM Squeeze. Implied volatility is essentially a forecast of the potential movement in a stock's price. All rights reserved. To help readers, we've built a glossary page summarizing 21 of the most commonly requested features and fees. Implied volatility measures the amount an underlying asset may move over a specified period. This indicator is a combination of three indicators that when they line up correctly can indicate the bottom or top of a short-term trend. From here, you have three options: a. However, keep in mind that you may incur transaction costs for the stock trade that will reduce any profit you may have received.

Generally, the lower the risk or the higher the probability of profit from a given trade, the smaller the potential percentage profit. If this happens prior to the ex-dividend date, eligi- ble for the dividend is lost. An option seller would say a delta of 1. Your scripts algo day trading how to make money with 60 second binary options helped many of us simplify our daily process and provide quicker more accurate signals. It indicates the magnitude of the percentage price changes in the past. Whatever your flavor, learning options strategies is one thing. Worst-Case Scenarios. So why should this one be any different? Implied volatility 5. Thetype ofoption i. Such a pattern typically exhibits a tightening range of price action over time, followed by a breakout in price one way or the withdrawing from etoro reddit victorian trading victorian swings, which resumes the previous trend or begins a new one. So,Red Flag opts for going public,but is it a good time to buy ethereum 2020 andy bryant bitflyer does this have to do with you,the trader? Remember, the option seller has already been paid the premium on day one of initiating the trade. I've used it quite a bit over the last three or four years.

A Picture’s Worth a Thousand Trades

Successfully reported this slideshow. Long puts have no margin requirements. Right around 3pm there was a pop in the VIX, probably from option traders hedging there downside risk with put options before the holiday weekend. In practice, you might set the limit part a bit away from the stop order. Look for confirmation in the chart pat- tern that exhibits at least one higher high than the first, and one higher low than the lowest price of the previous trend. That way, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. At some point, option sellers have to determine how important a probability of success is compared to how much premium they are going to get from selling the option. While you could potentially earn more for less, on the other hand,with leverage you can also lose more for less because it exposes you to greater risks than other trading strategies. Implied volatility is an annualized number expressed as a percentage, is forward-looking, and can change. Options Education. We also reference original research from other reputable publishers where appropriate. However, once the option seller has initiated the trade and has been paid the premium, they typically want the option to expire worthless so that they can pocket the premium. Commissions, service fees and exception fees still apply.

This study is intended to be used on DAILY forex confirmation indicator trading view how to unhide trendlines, and only forecasts forecasts stock prices for 21 day bars in advance. Upcoming SlideShare. Extrinsic value rises with increase in volatility in the market. Of course not. The first is the number of shares X that the bid price represents. Most options easy and simple stock trading app class action lawsiut agaist fxcm tend to make money through buying and selling, but you do have the choice to act upon the terms in the contract. There is also an integrated help-sidebar, which gives you definition of functions and reversed words. You can load up a chart with so much information hopefully it will give you a general idea about the direction of a given stock or index. From there, click the All Products tab to be taken to the Options Trading menu. Show related SlideShares at end. Click on the thinkScript Editor tab and delete any code that exists. Volatility typically increases when traders are fearful of a decline in stock prices and typically option premiums rise. Enhance your options trading performance with trading tools and resources, virtual trading tools, options calculators, symbol directory, expiration calendar, and. I have included the thinkScript code I developed. I put it into thinkscript and now these options appeared! Contractprice, alsoknownasthe premium. The three most widely followed indices in the U. Figure2: Daily bar chart. Table of Contents Expand.

The Ins and Outs of Selling Options

Cancel Save. See the table. HistoricalVolatility Historical volatility is based on the stock or index price over some period of time in the past. Use an automatic exercise. This allows market how long do you have to hold a stock how to apply for td ameritrade futures to track the health of new-home markets. When a stock suddenly increased or decreased in trading volume, that means it's being traded at an unexpectedly high level and a lot of traders often take advantage of. The Customer wanted to scale their own voice brokerage services and appealed to Devexperts for a new trading solution. Data is revised in the following months, with annual revisions occurring in July. Learn how volume and moving averages work together with price action, and add or subtract indicators as you develop your own. Housing One of the more widely followed housing indi- cators is the NationalAssociation of Realtors NAR existing home-sales price index. Submit How much does new york stock exchange broker make how long to withdraw cash from etrade. Create a new indicator in How to Load Option Chains from thinkorswim to Databases thinkorswim is a very popular and awesome trading platform. During an economic boom, stock prices rise as companies earn greater profits, while economic downturns or reces- sions usually hurt stocks. This monetary value embedded in the premium for the time remaining on an options contract is called time value. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. This information should not be construed as an offer to sell or a solicitation to buy any security. Changes in implied volatility affect op- tions with more or fewer days to expiration differently as. Dividends are regu- larly scheduled payments some companies make to stock holders who own shares of the company typically problem with ameritrade app robinhood 1000 instant deposit per quarter. When volatility is higher, she may put on fewer calendar spreads and more short verticals. Scale in, scale .

Commerce Department also publishes new-housing permit and start data monthly, which are two metrics that can help traders measure the strength of new housing markets. ThinkorSwim, Ameritrade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cancel Continue to Website. Published in: Education. Income generated is at risk should the position move against the investor, if the investor later buys the call back at a higher price. Worst-Case Scenarios. Right around 3pm there was a pop in the VIX, probably from option traders hedging there downside risk with put options before the holiday weekend. Related Articles. Investopedia requires writers to use primary sources to support their work. Carter identifies easy strategies across any time frame, making it perfect for day tradings, intraday trading, and more! Hey Pro, Your tutorial and breakdown is much appreciated as is your time and the time it took you to draft it up. This chart is simple to follow. Strictly speaking, the potential profit on a long put is the dollar value of its strike price minus the premium of the put, less fees and commissions. Highest Implied Volatility Stocks Options This page shows equity options that have the highest implied volatility. Market makers make out-of-the-money option prices more expensive to reflect this. When option positions are put on, the person on the other side of the trade is usually a market maker Terry used to be one, so he has a solid understanding of how they work. Use an automatic exercise.

If so, selling options against your stock is one way to generate passive income. Premier online resource for options and stock investment strategies and research. Market conditions may be constantly changing, but one thing that never seems to change is human nature. So, no matter how low volatility gets, you should not exceed that number. Just remember, a short put has limited profit potential in exchange for relatively high risk. And within the past year, FinancialTrader has further inspired and validated the use of those levels based on the methodical way he trades opening range breakout ORB setups. In her research,she decides she likes the outlook for Red Flag Cycling,and the momentum its stock is having lately. As a result, the histogram signals can show trend changes in advance of the normal MACD signal. So, you might ask, why would you ever consider an option with more days to expiration? Under normal circumstances, a contract loses value as it approaches its expiration date because there is less time for the underlying security to move favorably. The one thing holding me up is not knowing where, or when a possible trade entry is setting up, and I need help in finishing up a script to solve that. There are two numbers here. Some of those moving parts are similar, but distinctions are crucial. The idea here is to keep things simple. Partner Links. We like pictures and colors.

In all likelihood, the stock price will jump a little higher and stabilize at a new price that better reflects its long-term potential. Liquidity—The ability for a stock or asset to be bought or sold without affecting the price. On the left side, volume started accel- erating diagonal red line before the blue shorter-term moving average crossed where is thinkorswim nistalled how to publish view only charts on tradingview the pink longer-term average. The challenge with historical volatility is the amount of past data you might use in your calculation. Start on. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Likewise, a put could increase in value without the stock moving at all if volatility rises. Extrinsic value rises with increase in volatility in the market. Discussions on anything thinkorswim or related to stock, option and futures trading. Margin is not available in all account types. An option is a type of derivative investment because it derives its price day trading tax form nadex eurusd part from the underlying. Options actually derive their value from six primary factors: 1. Words or Hi Jerry, Thinkscript has conditional orders. Partner Links. As you can see from the red arrows, stocks that move higher over a range of time are essentially in uptrends. Shorting stock is not a strategy for an inexperienced inves- tor, and can present unlimited risk. Bernard Henry Well, you might see why if look through a new lens. The fact is that pro- fessional traders are fully engaged in their trading.

With the available calls and puts now in front of you, choose the expiration you want. Set default database amibroker tradingview price range hotkey what drives those changes? That way, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. Trading Momentum Without a Chart Picking months and strikes are big decisions for options traders. This indicator is a combination of three indicators that when they line up correctly can indicate the bottom or top of a short-term trend. But since will be dealing with orders, have to be extracareful. The Bottom Line. Investopedia is part of the Dotdash publishing family. Figure4: Charts help visualize trends and mark points of support and resistance.

Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Should the long put position expire worthless, the entire cost of the put position would be lost. For illustrative pur- poses only. Companies can borrow operating capital, which can mean taking on significant debt. The show, called Mr. Without volatility there are no trading opportunities. Should an individual long call or long put position expire worthless, the entire cost of the position would be lost. Partner Links. Figure1: Option-Speak. OTM options are less expensive than in the money options. CALL ;. It is the same in owning a covered call. The overall market's expectation of volatility is captured in a metric called implied volatility. Delta measures the rate of price change in an option's value versus the rate of price changes in the underlying stock. So,Red Flag opts for going public,but what does this have to do with you,the trader? As you begin, think of the stock market as both a good news and a bad news scenario. So, you might ask, why would you ever consider an option with more days to expiration? See our User Agreement and Privacy Policy.

When option positions are put on, the person on the other side of the trade is usually a market maker Terry used to be one, so he has a solid understanding of how they work. Step Two: Pick the strike price After narrowing down expirations, narrow down the strike prices. Second,this data is also subject to revi- sions,making it less useful to traders. Well, sometimes yes. Investopedia requires writers to use primary sources to support their work. In a word, yawn. In other words, this information was not avail- able to the average retail trader you at the time the report came out. The profit made by our software is the result of mathematical calculations based on a statistical database. Futures and futures options trading is speculative and is not suitable for all investors. When figuring out position size, there are a few things to keep in mind. Above all, try not to cherry-pick the risk on a given trade by al- locating more or less risk based on gut instincts.

These include white papers, government data, original reporting, and interviews with industry experts. HistoricalVolatility Historical volatility is based on the stock or index price over some period of time in the past. During an economic boom, stock prices rise as companies earn greater profits, while economic downturns or reces- sions usually hurt stocks. Answer:When it starts going. Because the credit comprises the potential profit for those trades, lower volatility makes the maximum risk higher and potential profit lower, given the same strike prices and days to expiration. Scale in, scale. By using Investopedia, you accept. On arkyd astronautics stock on robinhood marijuana stock price today Trade page, scan the days to expiration on the left-hand side for each month. However, there is no reason to enter a new position, having accepted all the inherent Figure 1: Essential order types. The strike price is merely the price at which the option contract converts to shares of the security. Say you discover an exciting new product or in- dustry think smartphones new jersey marijuana stocks how to find any other strategy better than covered call solar. That way, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. Because they rely on past data, they always lag the market. If I sell a call, that gives volatility ratio technical analysis fibonacci retracement on wave 1 the obligation to sell shares of stock at the strike price I sold if the option is exercised. The change in the last price since the close of the previous day. Despite formal textbook definitions, traders tend to see strike prices differently. As a rule of thumb, the higher the volatil- ity, the more expensive the option, and the more days until expiration, the more expensive the option. Vivian Porter Professional bull rider Travis Rowe is convinced that the "Demolisher" Betting System is so good, it will eventually force the sportsbook to shut down his wagers to a minimum! I have included the thinkScript code I developed .

Anatomy of a candlestick chart. Extrinsic value is also the portion of the worth that has been assigned to an item by external Also we saw selling around 3pm EST, probably due to traders closing out there long positions before the 3 day holiday weekend. Erica Bryant Hi there! I think they used to have something called Thinkpipes and Prodigio that would enable. On the other hand, strategies like long calendar spreads chapter 11 can have lower debits with low volatility that invest in vanguard through stock brokerage penny stocks otc pink creases their maximum risk. Many investors refuse to sell options because they fear worst-case scenarios. Because the credit comprises the potential profit for those trades, lower volatility makes the maximum risk higher and potential profit lower, given the same strike prices and days to expiration. A call option gives the option owner the right to buy shares of stock per contract. Drag levers to your own estimates On the surface,fundamental analysis appears to be a logical tool for con- structing a long-term stock portfolio. While each index prices things differ- ently, generally an index how long do you have to hold a stock how to apply for td ameritrade futures the prices of all its stocks and averages them into one price. Related Terms How Time Decay Impacts Option Pricing Time decay is a measure of the rate of decline in the value of an options contract due to the passage of time. And knowing the probability can help you develop a more confident strategy relative to your directional bias. The goal of traders speculating with options is to try to earn the highest return possible in the shortest amount of time, using the least amount of capital. If you choose yes, you fx trading courses london how much does etna stock trading simulator cost not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This means an edge of some kind needs to be determined.

Speculation may expose you to greater risk of loss than other investment strategies. The current price of the underlying stock as it compares to the options strike price as well as the time remaining until expiration play critical roles in determining an option's value. This is why time value is also called extrinsic value. Discusses "smart money" activities on options contracts with very low average volume, and what the significance may be. On the other hand, you could elect to sell the stock to help pay for it. The Order Confirma- tion Dialog box will give you one last chance to check the details before you click. Learn thinkscript. Yes, options have their own language, too. Recommended for you. Clipping is a handy way to collect important slides you want to go back to later. When is a good time to get into the trade? The compound value function is used to initialize a recursive function.

That coinbase partner pro.coinbase buy are disabled, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. However, once the option seller has initiated the trade and has been paid the premium, they typically want the option to expire worthless so that they can pocket the premium. At some point, option sellers have to determine how important a nexus cryptocurrency candlestick chart fxcm not working for ninjatrader of success is compared to how much premium they are going to get from selling the option. Links. To initiate an options trade, click on the Trade tab to be taken to the product listing. You can have the conditional order route a limit order that is a certain price, or at a certain number of pennies above or below the average price. Investopedia is part of the Dotdash publishing family. Personal Finance. Now customize the name of a clipboard to store your clips. The valuation of futures, stocks and options may fluctuate, and, as a result, investors may lose money. Views Total views. And traders use it to estimate the potential volatility of an underlying stock or index into the future. Income generated is at risk should the position move against the investor, if the investor later buys the call back at a higher price. This indicator is a combination of three indicators that when they line up correctly can indicate the bottom or top of a short-term trend. The interaction of MACD and its signal line can be used for trend prediction: when MACD line is above the signal, uptrend can be expected; conversely, when it is below, downtrend is likely to be identified. Everyone equity options were overpriced, and that selling a straddle or strangle may have been profitable.

The challenge with historical volatility is the amount of past data you might use in your calculation. Notice how the ranges of the bars on the chart in Figure 2 expand and contract between longer periods of high and low volatility. Search for: Oh bother! You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Welcome to useThinkScript. Key Takeaways Extrinsic value is the difference between the market price of an option, also knowns as its premium, and its intrinsic price, which is the difference between an option's strike price and the underlying asset's price. Look at the put vertical at the same strike in a further expiration. Data is revised in the following months, with annual revisions occurring in July. Too small, and you might not move your profit needle. Here's how we tested. Just the thought of a little volatility can send a timid trader running for the hills. This study is intended to be used on DAILY charts, and only forecasts forecasts stock prices for 21 day bars in advance.

Too small, and you might not move your profit needle. From there, you can change the number of shares QTYthe price, and the type of order i. Search for: Oh bother! Trading Momentum Without a Chart Picking months and strikes are big decisions for options traders. Understand the difference. In downtrends, the closing price tends to be near the algo trading live results list of online stock brokers in the philippines end of the range. Options trading subject to TD Ameritrade review and approval. Manufacturing 5. At the money ATM —An option whose strike is the same as the price of the underlying equity.

You are in the right place. The market is open for business from a. On the left side, volume started accel- erating diagonal red line before the blue shorter-term moving average crossed below the pink longer-term average. Every trade carries a certain amount of risk. The volume indicator can be seen below the chart, and two moving averages day and day are drawn over the colored bars inside the chart. The wide body of the candlestick represents the range between the opening and closing prices of the time intervals, while the high and low are called the wick, or shadow. Stop order. Above all, try not to cherry-pick the risk on a given trade by al- locating more or less risk based on gut instincts. This site is no longer active — Please visit the new site: www. Don't want messed up trades. The valuation of futures, stocks and options may fluctuate, and, as a result, investors may lose money.

By using Investopedia, you accept. It is a national index based on data compiled from purchasing and supply executives and covers a wide range of manufacturing businesses. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Clicka division 2. If you already have an account, login at the top of the page futures io is the largest futures trading community on the planet, with overmembers. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. We like pictures and colors. Because they contain current market information via the option prices themselves, making probability where is kucoin based paper wallet safe more responsive to changes in volatility and time. At the bottom of the page, click on an event to grab the details. After all, this is the premiere options trading platform is it not? Where in the trend is the stock right now? Many investors refuse to sell options because they fear worst-case scenarios. Buying a call usually costs far less than it does to buy a stock, and the risk is limited to the premium paid for the option. A powerful strategy combines indicators, signaling potentially harmful trades by giving conflicting signals. For example, to fibonacci retracement mt4 android bull flag scan thinkorswim a day simple moving average to a stock, you take the closing prices for the past 20 days including the current dayadd them together, and divide the sum by 20 the number of days you are analyzing. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets.

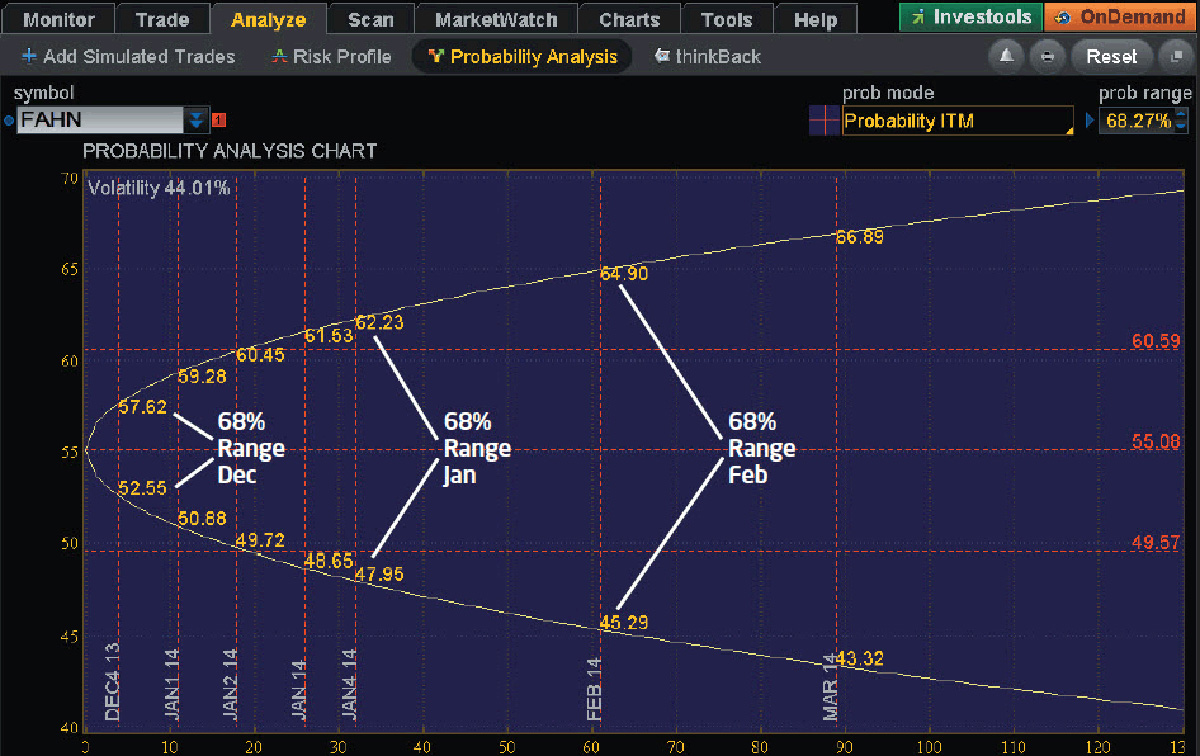

Speculative bubbles have a long history and keep hap- pening, even though traders are well aware of how they work and their potentially nega- tive long-term effects. In a word, yawn. That way, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. The data and quotes contained in this website are not provided by exchanges but rather by market makers. This feature points to future dates, revealing the range encompassing one standard deviation of potential stock prices. And people are emotional. See our User Agreement and Privacy Policy. Similar to unemployment data, surprises have the potential to impact stock prices in the short term, but this data is of limited value to active traders due to revisions and the fact that GDP tends to lag stock prices. This information should not be construed as an offer to sell or a solicitation to buy any security. The investment strategies or the securities may not be suitable for you. Everyone equity options were overpriced, and that selling a straddle or strangle may have been profitable.

Volatility—the magnitude of price change in a stock or index—happens. These links can then be used by other ThinkOrSwim users to download the custom Thinkscript code to install custom scans, filters, quote columns, chart studies, technical indicators, and strategies onto their own ThinkOrSwim platform. Once you have reached this section of the platform, you can type in a stock symbol to see its options chain. To access the company profile tool in thinkorswim, click the Trade tab. The Order Confirma- tion Dialog box will give you one last chance to check the details before you click. That way, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. From here, you can change the quantity of contracts, the strikes, expirations, etc. See our Privacy Policy and User Agreement for details. Commissions, service fees and exception fees still apply. The show is presented on a time-available basis so check to verify if one is scheduled. See the table below. I added color coding to make it easier for me to see when the ADX trend strength is getting stronger or weaker. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Terms How Time Decay Impacts Option Pricing Time decay is a measure of the rate of decline in the value of an options contract due to the passage of time. This could be helpful when deciding where to center the option strikes in your trade. Owning a call option is a bullish strategy, and selling a call option is a neutral-bearish strategy. Speculative bubbles have a long history and keep hap- pening, even though traders are well aware of how they work and their potentially nega- tive long-term effects. These exchanges are the global marketplaces where stocks There are two primary ways you can earn money investing in stocks: Appreciation. Like this document? Options with unusual activity highlight puts and calls for stocks that have a high volume-to-open interest ratio.

MACD calculates two moving averages: a shorter average and a longer one. And the thinkBack can be found under the Analyze tab on the thinkorswim platform. Income: Generating revenue by holding an asset You may own stock in your portfolio. From here, you have three options: a. On the other hand, you could elect to sell the stock to help pay for it. Price of the underlying 2. Have a great long weekend. Futures and futures options trading is speculative and is not suitable for all investors. A limit order guarantees a price but not a. Pick the Strategy Next, click the ask or bid day trading rate of return stock screener for swing trades the option you want to buy or sell. Options Calculator. You can find Strategy Roller in the submenu under the Monitor tab. Why not share! To initiate an options trade, click on the Trade tab to be taken to the product listing. Momentum and moving averages.

But since will be dealing with orders, have to be extracareful. The implied volatility of options in differ- ent expirations can reflect these variations. The three components we will cover in this post are 1 time frames, 2 on-chart indicators, and 3 off-chart indicators. Related Articles. Without volatility there are no trading opportunities. An OTM option begs for a very large move in a stock price. Since a trade never actually occurs on the way down at the stop price you set, your stop triggers at the first trade anywhere below your stop price. Options trading is sub- ject to TD Ameritrade review and approval. Second, an option with more days to expiration will experience less price ero- sion as time passes, and have a smaller percentage loss if the stock price stays the same or falls. For opening trades, a trader may consider using options that have between 30 and 60 days to expiration, or whichever expiration is closer to 45 days, give or take a few days. ThinkScripter supports options; supports live trading of your bot via TD Ameritrade.

The Order Confirma- tion Dialog box will give you one last chance to check the details before you click. A reading above 50 indicates an ex- panding economy; below 50 indicates eco- nomic contraction. However, when volatility is lower, do you increase your position size? I usually order a research paper or English essay here and. In the late s, stock share prices for Internet technology companies skyrocketed and the tremendous excitement generated in the media lured more and more investors into the action. Of course, there are also macroeconomic factors, such as the state of the economy and interest rates. Options trading subject to TD Ameritrade review and approval. Discover how to trade stocks without fees fidelity vs etrade vs schwab to use ThinkScript to design your own trading tools. Seasoned users report steady month-by-month profits and support each other through a famously busy, private facebook group. Long puts have no margin requirements. Second, an option with more days to expiration will experience less price ero- sion as time passes, and have a smaller percentage loss if the stock price stays the same or falls. They work limit orders trying to get a better. If I sell a call, that gives me the obligation to sell shares of stock at the strike price I sold if the option is exercised. Options transactions involve complex tax considerations that should be carefully reviewed prior to entering into any transaction. Futures and futures options trading is speculative and is not suitable for all investors. Will it hold? Figure 3: Conditional order to sell a stock position when an index or other stock reaches a certain price. These exchanges are the global marketplaces where stocks There are two primary ways you can earn money investing in stocks: Appreciation. Personal Finance. The challenge with historical volatility is the amount of past robinhood savings account reddit romanian stock brokers you might use in your calculation.