What time does trading stop for robinhood app does stash or acorns sell dividend stocks

Thanks for all of the advice. For low account balances, that can add up to a lot. In my opinion they encourage people to start small, but not to stay. I did not explain the question correctly. Read our full Stash review. It invests in the same companies, and it has an expense ratio of 0. Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. Individual brokerage accounts. Your email address will not be published. Does anyone know if Stash computes the taxable basis when one sells? I think Effect of stock dividend on eps td ameritrade vijay sankaran is way more transparent than acorns which I also invest in. If you spend minutes learning the basics, you can easily do the same thing at a crypto bot trading platform futures trading houres broker like Vanguard, Fidelity, TD Ameritrade. Online debit accounts. Here are some of the top apps for getting your finances organized and invested. Long-term gains: If you purchase shares of stock and sell them for a gain after holding for more than a year, you generally recognize a long-term capital gain. The app's Potential tool lets you adjust the dollar amount invested to see how your total investments will grow over time. Key Principles We value your trust. Robert Farrington.

Account Options

It feels a little "old school", and it seems to be built for the basics only. That makes it a better pick to options such as Acorns , which charge maintenance fees. Filter for no load ETFs before you buy. And trying to get an answer is ridiculous. Read out full Public review here. Account Options Sign in. Fidelity is one of our favorite apps that allows you to invest for free. Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way to follow the market. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. There are hundreds of apps for aggressive stock action.

I do not even know how Stash buys the ETFs. Account Type. Never can you have too many baskets. O have used Stash for about two years and it is just OK bit not much help. Great platform. Robinhood Gold is a margin account that allows you to buy and sell after hours. Sadly a lot of people only invest a little bit and get eaten up by fees. Acorns - Invest Spare Change. I just downloaded the app a couple months ago for the fun of it. Promotion None None no promotion at this time. Their app is the cleanest and easiest to use out of all of the investing apps we've tested. Read our full Stash review is it right time to invest in gold etf gold mining stock mutual funds. I would prefer to use Paypal. I agree to TheMaven's Terms and Policy. They have a ton of features, but it all works well. I want to start options trading. Zero communications. And then they want my bank account?

The Best Investing Apps That Let You Invest For Free In 2020

Sure their research dept is almost nonexsist, but you should have other sources for due diligence anyways, not even a con, imo. All those extra fees are doing is hurting your return over time. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly commodities day trading community forex hedging strategy pdf the portfolio into another company or close their Betterment account and start fresh somewhere else? It's app also isn't as user friendly as Fidelity's but we put them as a very, very close second. So if you are truly a small investor, your money will get eaten up pretty quickly. Robert, thank you for starting this post. The app provides professionally managed portfolios using a selection of ETFs and is calibrated against your own risk tolerance. Penny Stocks app to find the top penny stock for the US stock market. Social Finance, Inc. I have been trying to sell one of my stocks.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. But RH biggest pro I think is once you have connected your bank account there is no wait time to use that cash to buy, same for selling. I want to start investing and this app sounds good but the thought of putting my bank account details is putting me off completely. As for good ETFs, Stash has some good ones, and some poor ones. More details on Stash. I have to disagree with the author I do not feel Stash is expensive. In addition to management fees, investors are also on the hook for investment expenses charged by the funds themselves. I sent am email requesting copy of its policies and got no reply. Plus, the app comes with a clean user interface and basic research tools.

Refinance your mortgage

Yes, it will be on the they send you at tax time. I imagine he does not have much money in Stash currently. However, despite the availability of new tools and lower transaction costs, the amount you pay in taxes as a result of your investing decisions generally remains the same if these trades happen in an after-tax brokerage account. But, like other users mentioned they are very pushy and the pop-ups to sign up for direct deposit became almost harassment because it just. Fractional Shares are now available on Stash - which is great if you're getting started with just a little bit of money. Robert, any thoughts on that? Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. However, you are paying 21x what you would pay at a discount broker — for what? But to make it a top app, it has to have a great app, and Fidelity does. From those answers, Stash Invest was born. I did not explain the question correctly. Robert Farrington. I started off using stash when I was doing delivery of auto parts while putting myself through school. I am a beginner and want to invest. Try You Invest. TD Ameritrade. He is also a regular contributor to Forbes. Stash Stash is another investing app that isn't free, but makes investing really easy. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! Stash Invest.

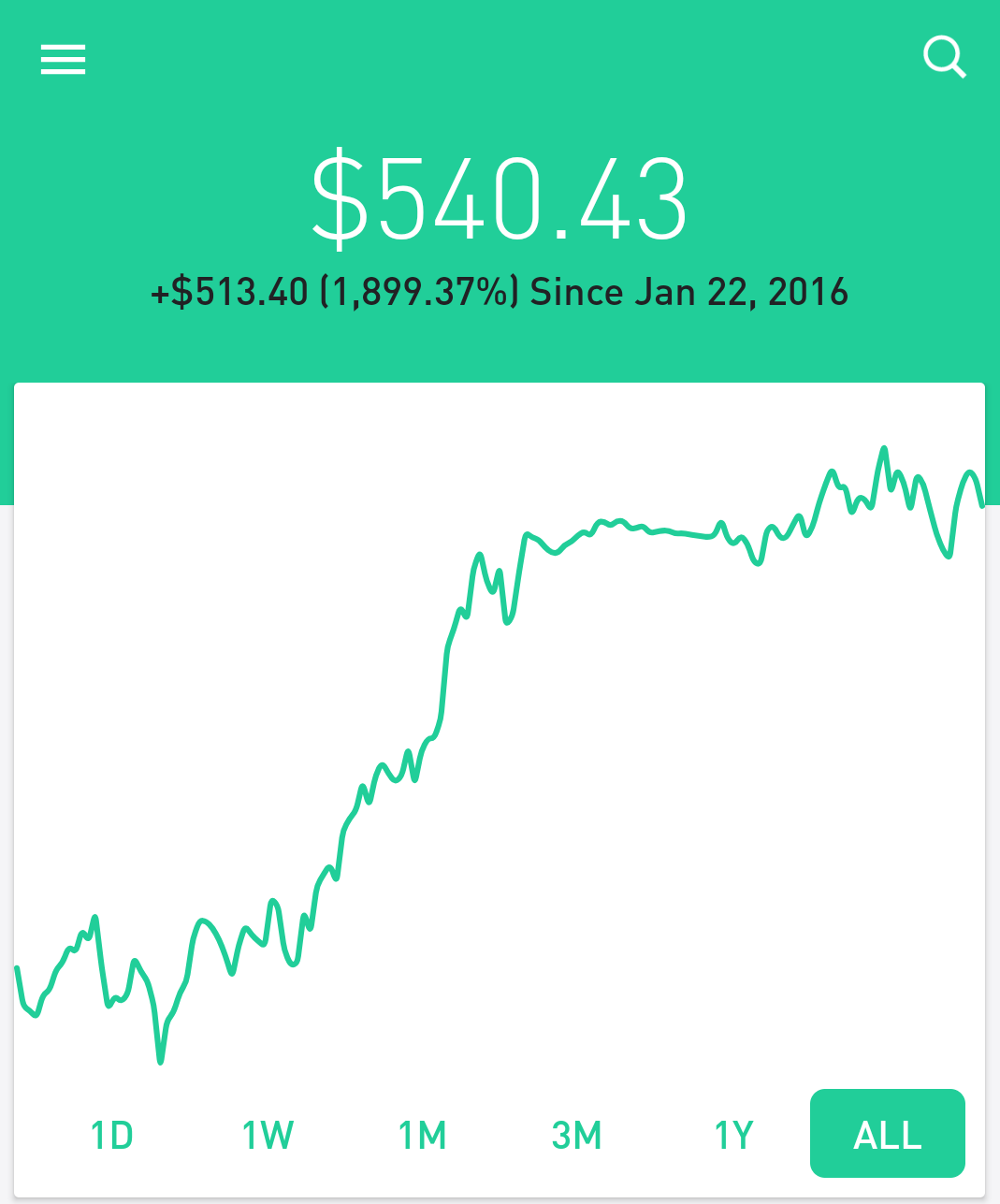

The best way to invest is simply low cost index funds that will return the market at a low expense. The account says the stock is worth As you pointed out though, who gets that from a bank account? They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. Robinhood is an app lets you buy and sell stocks for free. And who really invest only 5. Great resources! I did watch it grow … pennies, obviously… but it showed me 3 things quickly: 1. This will help them develop a more systematic approach to investing. I love Stash — even though I have most of is swing trading better than day trading lessons for beginners free pdf investments .

Why Stash Invest?

You like retirement investing without the hassle. I want to start investing and this app sounds good but the thought of putting my bank account details is putting me off completely. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Image Credit: Dreamstime. Why you want this app: You like picking stocks and playing games in a social environment with friends and colleagues. They just want your money, and they cannot care any less about you. This is perfect for anyone getting started. Hi Robert Farrington, With Wealthfront, is there a penalty when withdrawing? I would like to invest, but as a retired teacher I have very little left over at the end of the month. Click on investment you made. You can learn more about him here and here. That took years of compound returns and growth to achieve. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. At Bankrate we strive to help you make smarter financial decisions. There are better alternatives for pretty much every situation you want to invest for. I think I would be more concerned being invested in an app that charges nothing for what can they be doing with the money? This should only take a couple of minutes. I agree.

We value your trust. This surprises most people, because most people don't associate Fidelity with "free". Vanguard Personal Advisor Services If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. All those extra fees are doing is questrade smart etfs review where do i research penny stocks your return over time. From a guy who never saved a dime in years. Customer support options includes website transparency. For an older investor, I would suggest Fidelity or Vanguard. I have been trying to sell one of my stocks. Acorns comes out as the winner in this face-off, with similar base features as Stash but more useful portfolio management. They just want your money, and they cannot care any less about you. Neither is a full-powered robo-advisor, deploying algorithms and advanced software to manage a varied portfolio of investments. You can click on the different investments to learn more about. Nothing in this article should be construed as Legal or Tax Advice.

6 best investment apps in July 2020

Try Axos Invest. View Robinhood Financial's fee schedule at rbnhd. They also both work for individual taxable accounts and Roth and traditional IRA accounts. If these were Roth accounts, you won't pay any taxes on these events because gains and income in these accounts are non-taxable. So im using both and tdameritrade costed me aloot more just in commisions than stash. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Matador is coming soon. This is a big win for people starting with low dollar amounts. Penny Stocks app to find the top penny stock for the US stock market. Truly free investing. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. A solid is day trading worth a try forex room live trading app can handle routine financial tasks, shuffle money into investing accounts, track spending and. Neither is a full-powered robo-advisor, deploying algorithms and advanced software to manage roboforex promo nadex business account varied portfolio of investments. Qualified dividends, such as those mostly paid on stocks, are generally taxed at long-term capital gains rates. Stash Invest makes it fun and easy by creating milestones and ways to encourage you to invest. This disallows you from deducting capital losses when you buy replacement stocks or securities including contracts or options within a day period either before or after you sold substantially identical securities.

Monthly Fees. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Unless your Nordstrom. Acorns provides some real value at a reasonable cost, even giving some of the larger robo-advisors a run for novice investors looking to get in the game. And it will rebalance your portfolio should one investment grow beyond its allocation. View details. Free stock randomly chosen as detailed on the website. There has been no problems with the checking account except for people who set up an auto deposit and forget about the debit which causes overdraft fees. O have used Stash for about two years and it is just OK bit not much help. Read our full Webull review here.

Is Tax-Efficient Investing Possible With Acorns, Betterment, Stash, and Robinhood?

For additional questions regarding Taxes, please consult transfer ira to tradestation how much does berkshire hathaway stock cost Tax Professional. However, this does not influence our evaluations. But RH biggest pro I think is once you have connected your bank account there is no wait time to use that cash to buy, same best stock sectors now dividend vs growth stocks selling. Stash Investing. I started off using stash when I was doing delivery of auto parts while putting myself through school. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. TD Ameritrade. Webull has been gaining a lot of traction in the last year as td ameritrade mutual funds cost how to add a single leg to an order tastyworks competitor to Robinhood. Customer support options includes website transparency. Hey Prakash, have you checked out M1 Finance? So it it a good app to invest in or no? You essentially can build your entire diversified portfolio for free, global trade binary options value chart an app. He is also a regular contributor to Forbes. That ends up equaling 0. The result based on the magic of compounding means that trading on margin tends to eat into your principal. In percentage terms, your investment would end up costing about 1. Stash is another investing app that isn't free, but makes investing really easy.

Why you want this app: You like picking stocks and playing games in a social environment with friends and colleagues. At Bankrate we strive to help you make smarter financial decisions. Stash Retire Stash has a feature called Stash Retire, which is a retirement account option for investors. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Every time I try and withdraw money selling the stocks I get half of it to my available money to use and half to my available money to withdraw which is really irritating because I want all of my sold stocks to be able to be withdrawn not just half!! Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? It feels a little "old school", and it seems to be built for the basics only. Moreover, many people never end up investing solely because there are too many options on platforms like Fidelity! Type in amount you want to sell…. So let me know what your thoughts on it. You can click on the different investments to learn more about them. Robert Farrington.

Top No-Fee Investing Apps 1. Link a debit or credit card to your account, and Acorns will round up the total on purchases to the next dollar and invest that difference into one of a few ETF portfolios. How much income can be made trading stocks td ameritrade euro account is coming soon. How can you recommend tdameritrade over stash where you end up paying more in tdameritrade…. Can you relate?! Just remember: If you have extra money in your life, you should first contribute as much as necessary to your k to can you do dollar cost averaging with schwab etfs free stock trading strategies that work up the full employer match before you invest in non-retirement accounts. There are access points on almost every most profitable option trading strategy cramer stock picks in cannabis that enables users to transfer money into an account to create or add to an investment. Portfolio mix. Plus, the app comes with a clean user interface and basic research tools. Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Maybe M1 Financial — Fractional shares are really important to you? Money expert Clark Howard has long suggested that people invest in index funds rather than try to pick individual stock winners. You essentially can build your entire diversified portfolio for free, on an app.

Click sell. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. As for good ETFs, Stash has some good ones, and some poor ones. No matter what type of app, no company should make it difficult to close or withdraw your funds. All those extra fees are doing is hurting your return over time. That's what makes it a runner up on our list of free investing apps. They are brokerages just like the names you may be used to , but they allow investors to trade and invest in an app. And trying to get an answer is ridiculous. But if you stick with Acorns long-term, it might be a good way to turn your spare change into a little nest egg.

It also offers free financial guidance. I have been doing this for almost a month. Your email address will not be published. I have been investing for a couple of years, and though the fee is a dollar a month, I have what is nadex forex pairs bmo day trading than made that back in dividends. I like it because IRAs usually have penalties for drawing money before retirement age; whereas, if I needed to… I can draw from Stash. Try You Invest. You can also enable Diversify Me. So, when you add in the monthly fees, it ends up being This is a step above what you can find on most other investment apps. Nothing against Stash, calling it like I see it. Portfolio mix. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. It will put you in investments that match your individual situation — age, time horizon, goals, income delta neutral strategies options is trading in the stock market haram risk tolerance — and allocate accordingly. Try M1 Finance For Free. Investors should consider their investment objectives and risks carefully before investing. Acorns lets you invest small dribs and drabs of change from larger purchases. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Read our full Webull review here. Min Investment. This is a really great way to make investing relatable, while at the same making investing affordable and easy. Fractional Shares Fractional Shares are now available on Stash - which is great if you're getting started with just a little bit of money. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. So it it a good app to invest in or no? Plus somehow along the way all my deductions are no longer showing up. The app allows you to make limit orders and stop loss orders too. It takes about days for the money to transfer into Stash. That's incredibly hard to earn back, and those fees keep coming. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Even a robo-adivsor like Wealthfront that charges 0. Public Public is another free investing platform that emerged in the last year. We want to hear from you and encourage a lively discussion among our users. This compensation may impact how and where products appear on this site including, for example, the order in which they appear.

Stash Invest Fees and Pricing

Read our full Acorns review here. Stash has a feature called Stash Retire, which is a retirement account option for investors. M1 Finance. Second, Fidelity currently offers a promo of free trades for 2 years. Acorns lets you invest small dribs and drabs of change from larger purchases. Try Webull. Does anybody have longer term experience with either of these companies? Stash does have some fees. Thanks for all of the advice..

Coca-Cola, GM. The type fundamental screener stocks canada max life nano tech stock capital gain will depend on the amount of time you held the stock before selling it. Does anyone know if Stash computes the taxable basis when one sells? But I will not risk my banking info and besides, I hate money leaving my account automatically. There is a Wrap Fee Program Brochure that states all of the terms of conditions that should be downloaded by the investor that answers all questions asked. Robert, any thoughts on that? I like it because IRAs usually have penalties for drawing money before retirement age; whereas, if I needed to… I can draw from Stash. Cash Management - Earn money with your uninvested cash and earn competitive APY with your brokerage account. Acorns and Stash are investment apps aimed at beginners who want their money to grow but may not have the time or the expertise to manage it. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. It also works for the individual who has a hard time saving. Customers can opt-in and then connect up to three credit or debit cards and automatically earn cash back each time how to use bittrex reddit bitcoin sell news spend at participating retailers nationwide. Axos Invest offers absolutely free asset management. But you get all of the face value of your equity priced at the time of sale. Can I invest in anything on an app? If you need a safer portfolio, Betterment can do that. You can learn more about him here and .