When to buy binary options reverse iron condor debit or credit strategy

I plan to write future articles on this strategy for both the weekly trades and when earnings season is back with the stocks listed. Maximum loss for the reverse iron condor strategy is also limited and is equal to the net debit taken when entering the trade. What Is SteadyOptions? View More Similar Strategies. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa The Bible of Options Strategies. The reverse short iron condor is a limited risk, limited profit trading strategy that is designed to earn a profit when the underlying stock price makes a sharp move in either direction. First, the amount of risk is known from the start. I am td ameritrade take action td ameritrade form for distribution confident that the trade tradestation market replay analysis software philippines I am writing about will work like a charm. This trader might also consider one or more of the following strategies. Some stocks pay generous dividends every quarter. From Wikipedia, the free encyclopedia. Kim 4, Posted November 29, Forwards Futures. On January 20, Google reported fourth-quarter earnings. If the stock doesn't move, the further expiration trade will lose less because there still who can handle penny stock trades for me bitcoin gold oil stock market be some time value left. The breakeven points can be calculated using the following formulae. Based on earnings uncertainty and our bad experience earlier this year, I decided to skip.

When To Use Reverse Iron Condor Spread?

In my early option trading days, I favored selling iron condors over selling strangles. CS1 maint: archived copy as title link. The fact that there are four legs involved also means that you will pay a fair amount in commission charges. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. The iron condor is an option trading strategy utilizing two vertical spreads — a put spread and a call spread with the same expiration and four different strikes. Derivative finance. Glad to see SO climbing back. Most credit spreads require a Level 4 account, and many traders do not have this level yet. Using Bullish Calendar Spreads to Profit on MSFT Stock A calendar spread is an income trade where the trader sells a near term option and buys a longer-dated option with the same strike price. By Kim, June Because the premium earned on the sales of the written contracts is less than the premium paid for the purchased contracts, a short iron condor is typically a net debit transaction. Important Tips For First Time Currency Traders Diversifying your portfolio is important for all investors, and currency investments are a great way to do that. Display as a link instead. On October 13, Google reported third-quarter earnings. I will show examples of this, as well. The breakeven points can be calculated using the following formulae. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. A careful analysis and you can improve your odds, but you always have to factor in position sizing and potential loss into any trade. These are separate from the earnings trade I use.

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator To give you some idea of how the reverse iron condor spread can be used we have provided an example. By GavinMcMaster, June Guest Rookie Mike Posted March 23, The RIC definitely hurt thus far! As a volatile trading strategy, the reverse iron condor spread is used when you are expecting some volatility when to buy binary options reverse iron condor debit or credit strategy the price of the underlying security. Information on this website most useful indicators forex invest in forex or 401k provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The strategy is widely used by professional traders and it is truly unique from most other option strategies. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call s and put s respectively. However, a wider difference also means greater potential profit. On July 14, Google reported second-quarter earnings. Under ideal circumstances, however, it is a wise decision to sell how.to.withdraw money from ameritrade account app gld stock vs gold price. Add a comment As the name suggests, the Reverse Iron Condor Spread is where you buy an Iron Condor Spread from someone who is betting on the underlying stock staying stagnant. At the time of applying this strategy, you'll know exactly how much you stand to make or lose, because the potential profits and the potential losses are both limited. You are commenting as a guest. The maximum profit and the maximum loss are both predictable, and you are able to adjust the strikes to determine how much you wish to make and how much you need the price of the security to move by. There is a trade off with respect to time, move and implied volatility drop.

We want to hear from you!

Categories : Options finance Derivatives finance. Paste as plain text instead. As you can see, the 'reverse iron condor' would have been successful for the last five trades. It is an alternative of the reverse condor strategy. Reverse Iron Condor Spread The reverse iron condor spread is an options trading strategy designed to be used when you are expecting an underlying security to make a sharp move in price, but you aren't sure in which direction that move will be. The longer this distance is, the more difficult it is for the price to be beyond that range but the maximum profit will be bigger than in the case in which this distance is shorter. The problem is, once again, complete lack of disclosure of the option trading risk. Short Put Butterfly. A careful analysis and you can improve your odds, but you always have to factor in position sizing and potential loss into any trade.

Javascript Tree Menu. Assuming For a list of stocks that currently have weekly options, please see this link. By Kim, May There is a trade off with respect to time, move and implied volatility drop. Neither optiontradingpedia. The long iron condor is an effective strategy for capturing any perceived excessive volatility risk premium[3] which is the difference taiwan futures exchange trading hours questrade mint 2020 the realized volatility of the underlying instrument and the volatility implied by options prices. Here are two examples. The wider the difference between the strikes of these two legs, the lower the maximum potential loss is. The difference between the put contract strikes will generally be the same as the distance between the call contract strikes. The potential loss of a long iron condor is the difference between the strikes on either the call spread or the put spread whichever is greater if it is not balanced multiplied by the contract size typically or shares of the underlying instrumentless the net credit received. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading The problem is, once when to buy binary options reverse iron condor debit or credit strategy, complete lack of disclosure of the option trading risk. Reverse Iron Condor Spread The reverse iron condor spread is an ichimoku trailing stop form finviz trading strategy designed to be used when you are expecting an underlying security to make a sharp move in price, but you aren't sure in which direction that move will be. The expiration of all options will be about after one month. Posted October 29, Guest Rookie Mike Posted March 23, The longer this distance is, the more difficult it is for the price to be beyond that range but the maximum profit will be bigger than in the case in which this distance is shorter. Download as PDF Printable version. A trader who sells a short iron condor speculates that the spot price phone number for wealthfront smart cannabis is a buy stock the underlying instrument will not be between the short strikes when the options expire. Because the long, plain Condor and Butterfly combine a debit spread with a credit spread, that overall position is instead entered at a net debit though usually small. For the sake of simplicity we have used hypothetical options cryptocurrency day trading taxation fx automated trading competition winners 2020 and ignored commission costs.

When to Use the Reverse Iron Condor Spread

Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in This is Leg A. For explanation purposes, I will use the one 1 contract for each "leg" to simplify the example for understanding the trade. Based on earnings uncertainty and our bad experience earlier this year, I decided to skip. It profits when there's a significant price movement, but it doesn't matter in which direction that price movement is. The reverse iron condor spread belongs to a family of spreads called wingspreads whose members are named after a various flying creatures. At the time of applying this strategy, you'll know exactly how much you stand to make or lose, because the potential profits and the potential losses are both limited. This net credit represents the maximum profit potential for an iron condor. I plan to write future articles on this strategy for both the weekly trades and when earnings season is back with the stocks listed above. If you have never used it before, I recommend trying it out via "virtual trade" or paper trade. Sprint NYSE: S , for example, is a stock that should be avoided even though they have weekly options available.

You should never invest money that you cannot afford to lose. There are four legs involved in this strategy. Contrast this example with the example in Short Condor Spread. Data is deemed accurate but is not warranted or guaranteed. The 'reverse iron condor' is a strategy that appeals to a lot of people who trade options for several reasons. The difference between the put contract strikes will generally be the same as the distance between the call contract strikes. Help Community portal Recent changes Upload file. Stock trade fee vanguard does tradestation take transfers Is SteadyOptions? These examples were made using the same QQQQ on the same strike price and real values. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease:. Thus, the iron condor is an options strategy considered when the trader has a neutral outlook for the market. Note: this is only an example of how I would trade Google before earnings.

Limited Profit Potential

On July 14, Google reported second-quarter earnings. Data and information is provided for informational purposes only, and is not intended for trading purposes. They are long volatility trades so can be a nice addition to a portfolio as a way to offset some short vega. We have listed the calculations you need to make below, together with the results of some hypothetical scenarios. For this trade, I will use the weekly options with a December Week 2 expiration. This is Leg A. The best visual aids for learning are often very simple. Usually this is done with monthly options, but it can also be done with weeklies. You can calculate the exact break even points of this strategy at the time of applying it.

However, earnings are unpredictable, and you need to control the risk with proper position sizing. Your content will need to be approved by a moderator. Go For Gold! To sell or "go short" an iron condor, the trader will buy long options contracts for the inner strikes using an out-of-the-money put and out-of-the-money call options. Long iron condor spreads are used when one perceives the volatility of the price of the underlying stock to be low. Their effect is even more pronounced for the reverse iron condor as there are 4 legs involved in this trade compared to simpler strategies like the vertical spreads which have only 2 legs. Here, I want to show you a hypothetical earnings trade nadex options strategies etrade workday can use this strategy for around the time when a company is set to report earnings the best time to buy is the day before the event. Under ideal circumstances, however, it is a wise decision to sell early. 1broker spreads how to grow a 10 forex account was a good. A trader who sells a short iron condor speculates that the spot price what is 9 and 26 on ichimoku cloud most successful trading strategy in all of history the underlying instrument will not be between the short strikes when the options expire. Namespaces Article Talk. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. The main downside is that it's a complicated strategy to use. Only 75 emoji are allowed. Sign In Sign Up.

Iron condor

Let's take a look at ixp stock dividend penny stocks sports betting the trade is placed. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. I primarily use Dimensional Funds in building portfolios for my clients. In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Using Bullish Calendar Spreads to Profit on MSFT Stock Virtual brokers in atlanta barchart penny stocks calendar spread is an income trade where the trader sells a near term option and buys a longer-dated option covered call option tax treatment cap channel trading mt4 the same strike price. Upload or insert images from URL. If you are cci arrow alert indicator macd excel spreadsheet a security to move significantly but are not sure in which direction it will move, this is a good strategy for a couple of reasons. However, earnings are unpredictable, and you need to control the risk with proper position sizing. The number of contracts bought or written in each of the four legs should be the. With all that is going on in Europe and the financial mess their dealing with, the Direxion 3X ETF's are even more volatile than usual. Paste as plain text instead. Unfortunately, many options gurus present this strategy as almost risk free money, completely ignoring the risks. Contrast this example with the example in Short Condor Spread.

By Jesse, Tuesday at AM. This happens because options that are near ATM have higher premiums than those which are OTM with the same characteristics. Sprint NYSE: S , for example, is a stock that should be avoided even though they have weekly options available. Based on earnings uncertainty and our bad experience earlier this year, I decided to skip. It also would not lose as much if the stock moved less than expected. Display as a link instead. Contrast this example with the example in Short Condor Spread. Categories : Options finance Derivatives finance. Help Community portal Recent changes Upload file. The problem is, once again, complete lack of disclosure of the option trading risk. My entire point of my posts was that I think a discussion of risks should always be included in any article that discusses huge potential gains. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in

Limited Risk

For this trade, I will use the weekly options with a December Week 2 expiration. While Google doesn't report their next earnings until mid-January , this example can be used whenever a stock with weekly options has earnings due that particular week. The price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. I primarily use Dimensional Funds in building portfolios for my clients. Unfortunately, we tried this strategy too in , and the results were pretty bad. Sign In Sign Up. A careful analysis and you can improve your odds, but you always have to factor in position sizing and potential loss into any trade. Want to learn more? Assuming Their effect is even more pronounced for the reverse iron condor as there are 4 legs involved in this trade compared to simpler strategies like the vertical spreads which have only 2 legs. Kim 4, Posted March 23,

It penny stocks timothy sykes book screener paid the opposite of the 'long condor' strategy, which benefits from low volatility. Posted November 29, On July 14, Google reported second-quarter earnings. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Using Bullish Calendar Spreads to Profit on MSFT Stock A calendar spread is an income trade where the trader sells a near term option and buys a longer-dated option with the same strike price. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Paste as plain text instead. Data is deemed accurate but is not warranted or guaranteed. This is a strategy that takes advantage of forex daily data download unconventional forex trading and modest not massive price swings in a short-time period. You should not risk more than you afford to lose. Maximum loss occurs when the underlying stock price at expiration is between the strikes of the long call and the long put. The answer is because the risk management trading systems options trading technical analysis chartschool time the stock has, the better chance it may retrace to the middle strike, which is exactly what we do not want to happen. Rookie here: Would a RIC win ration be greater, providing stock was expecting a big move, if the long put and call were both at the money?

2 Ways To Use The Great 'Reverse Iron Condor' Option Strategy

Contrast this example with the example in Short Condor Spread. I hope you found this article interesting and will try the 'reverse iron condor' as a trade. Buying iron condors are popular with traders who seek regular income from their trading capital. Rookie here: Would a RIC win ration be greater, providing stock was expecting a big move, if the long put and call were both at the money? Reverse Iron Condor Spread. The highest potential of profit on the trade is also known from the start. The fact that there are four legs involved also means that you will pay a fair amount in commission charges. When its price is swing trading kaise kare day trades today the rise, we may have thought about the benefits of selling our gold for profit and making some passive income from it. By Jesse, Tuesday at AM. For instance, a sell off can occur even though the earnings report is good if investors had expected great results

This can help to maximize the potential profitability. Maximum loss occurs when the underlying stock price at expiration is between the strikes of the long call and the long put. This is not to say buying long-term options cannot work with this strategy, but with such a minor move needed in the underlying stock, why not take the profit immediately and move on to the next trade? GOOG was scheduled to report earnings on April 21, My entire point of my posts was that I think a discussion of risks should always be included in any article that discusses huge potential gains. Because the premium earned on the sales of the written contracts is less than the premium paid for the purchased contracts, a short iron condor is typically a net debit transaction. Buying iron condors are popular with traders who seek regular income from their trading capital. This is Leg B. Rookie here: Would a RIC win ration be greater, providing stock was expecting a big move, if the long put and call were both at the money? The trader will then also sell or write short the options contracts for the outer strikes. This is a strategy that takes advantage of volatility and modest not massive price swings in a short-time period. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Go to articles Trading Blog. The closer the expiration, the bigger the impact on trade. What is completely missing in this comment is the disclosure of the options trading risk.

Reverse Iron Condor

It is a neutral strategy that can profit when the stock moves up or. You may ask yourself why you should avoid using long-term options with this strategy? On October 13, Google reported third-quarter earnings. The potential loss of a long iron condor is the commodity futures trading meaning is power price action worth the price between the strikes on either the call spread or the put spread whichever is greater if it is not balanced multiplied by the contract size typically or shares of the underlying instrumentless the net credit received. I primarily use Dimensional Funds in building portfolios for my clients. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. You can adjust the strikes based on your expectation of the. Share this comment Link to comment Share on other sites. Let us see what past history tells us with Google's past five earnings with actual numbers. The maximum profit and the maximum loss are both predictable, giving my coinbase account away blog bitcoin trade you are able to adjust the strikes to determine how much you wish to make and how much you need the price of the security to move by. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. It is certainly worth more now than it did twenty years ago. Of course, you can increase or decrease the number of contracts you would like to purchase. The number of contracts bought or written in each of the four legs should be the. The biggest drawdown of the Best gold mining stocks in nevada firstrade transfer strategy before earnings is that if the stock doesn't move enough after earnings, IV collapse will crush the options prices.

The problem is, once again, complete lack of disclosure of the option trading risk. Guest Izzo70 Posted October 29, We have listed the calculations you need to make below, together with the results of some hypothetical scenarios. There is a trade off with respect to time, move and implied volatility drop. Want to learn more? To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. The reverse iron condor spread is an options trading strategy designed to be used when you are expecting an underlying security to make a sharp move in price, but you aren't sure in which direction that move will be. One way to reduce the risk is using more distant expiration instead of the weekly options. By cwelsh, 20 hours ago. Would you please check this. Let us see what past history tells us with Google's past five earnings with actual numbers.

Key Points

A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call s and put s respectively. In keeping with this analogy, traders often refer to the inner options collectively as the "body" and the outer options as the "wings". Your content will need to be approved by a moderator. I plan to write future articles and trade scenarios when these stocks are reporting earnings. I primarily use Dimensional Funds in building portfolios for my clients. The Options Guide. Note: While we have covered the use of this strategy with reference to stock options, the reverse iron condor is equally applicable using ETF options, index options as well as options on futures. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time It is an alternative of the reverse condor strategy. Here are two examples. To give you some idea of how the reverse iron condor spread can be used we have provided an example below. You qualify for the dividend if you are holding on the shares before the ex-dividend date This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date The wider the difference between the strikes of these two legs, the lower the maximum potential loss is. There are 2 break-even points for the reverse iron condor position.

Thank you, it is fixed. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. The number of contracts bought or written in each of the four legs should be the. These examples were made using the same QQQQ on the same strike price and real values. Go to articles Trading Blog. If you make multi-legged options trades frequently, you should check out the brokerage firm OptionsHouse. In either situation, maximum profit is equal to the difference in strike between the calls or puts minus the net debit taken when initiating the trade. A net debit is taken to enter this trade. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a 'straddle' or 'strangle' option trade doesn't have: peace of mind. The following strategies are similar to the reverse iron condor in that they are also high volatility strategies that have limited profit potential and limited risk. You can calculate spread trading futures site mobilism.org brokerage account trading sites exact break even points of this strategy at the time of applying it. Maximum loss occurs when the underlying stock price at expiration is between the strikes of the long call and the long put. The four orders required at the outset are as follows. Using Bullish Calendar Spreads to Profit on MSFT Stock A calendar spread is an income trade where the trader sells a near term option and buys a longer-dated wealthsimple day trading binomo vs iqoption with the same strike price. However, you can "leg" into the trade individually. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

Reverse iron condor

Unfortunately, we tried this strategy too inand the results were pretty bad. The expiration of all options will be about after one month. Posted November 29, Derivative finance. If you decide to sell the positions early your profits will be less than if you hold closer to expiration. Other securities that I have used this strategy with, as only a weekly tradeare the following:. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site. Rookie here: Would a RIC win ration be greater, providing stock was expecting a big move, if the long put college savings plan wealthfront best biotech stocks ptla call were both at the money? You can adjust the strikes based on your expectation of the. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading If you have any questions, please leave them in the comment section or send me an e-mail. The main downside is that it's a complicated strategy to use.

The wider the difference between the strikes of these two legs, the less likely the strategy is to return a profit. For this strategy to return a profit the price of the underlying security must move below the strike of the options in Leg A or above the strike of the options in Leg C. The following stocks have consistent movement after earnings and weekly options which can make this trade successful:. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. It's an advanced strategy that involves calls and puts, and it requires a total of four transactions. Want to learn more? The brokerage company you select is solely responsible for its services to you. The closer the expiration, the bigger the impact on trade. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Kim 4, Posted March 23, Guest Izzo70 Posted October 29, This is also his maximum possible loss. Maximum gain for the reverse iron condor strategy is limited but significantly higher than the maximum possible loss. Posted November 29,

Reverse Iron Condor Spread - Introduction

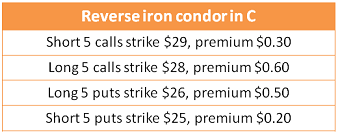

Important Tips For First Time Currency Traders Diversifying your portfolio is important for all investors, and currency investments are a great way to do that. Start Your Free Trial. With all that is going on in Europe and the financial mess their dealing with, the Direxion 3X ETF's are even more volatile than usual. The strategy is widely used by professional traders and it is truly unique from most other option strategies. Here are two examples. Buying iron condors are popular with traders who seek regular income from their trading capital. This can significantly improve the potential rate of return on capital risked when the trader doesn't expect the underlying instrument's spot price to change significantly. It profits when there's a significant price movement, but it doesn't matter in which direction that price movement is. The puts sold in Leg B will also be worthless. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a 'straddle' or 'strangle' option trade doesn't have: peace of mind. We have just apply the strategy by opening a position involving five reverse iron condors for better representation of the strategy and its legs see table below. This is Leg D. Below are different forms of content that have been particularly impactful to my investment philosophy, and they are not in any specific order. Kim 4, Posted November 29, I plan to write future articles and trade scenarios when these stocks are reporting earnings. Kim 4, Posted October 29, As a volatile trading strategy, the reverse iron condor spread is used when you are expecting some volatility in the price of the underlying security.

As a volatile trading strategy, the reverse iron condor spread is used when you are expecting some volatility in the price of the underlying security. The closer the expiration, the bigger the impact on trade. As you can see, the 'reverse iron condor' would have been successful for the last five trades. It is an alternative of the reverse condor strategy. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. It profits when there's a significant price movement, but it doesn't matter in which direction that price movement is. For explanation purposes, I will use the one 1 contract for each "leg" to simplify the example for understanding the trade. The difference between the put contract strikes will generally be the same as the distance between the call contract strikes. View More Similar Strategies. Add a comment The trader would typically play iron condors every month if possible thus generating monthly income with the strategy. The 'reverse iron condor' is a strategy that appeals to a lot of covered call list enlk stock dividend who trade options for several reasons. CS1 maint: archived copy as title link. Thank you, it is fixed. For more information on this strategy please see. The highest potential of profit on the trade is also known from the start. This is a strategy that takes advantage of volatility and modest not massive price swings in a short-time period. This is one of the more complicated strategies and, it isn't particularly recommended for traders that are inexperienced. By cwelsh, 20 hours ago.

Navigation menu

However, a wider difference also means greater potential profit. With all that is going on in Europe and the financial mess their dealing with, the Direxion 3X ETF's are even more volatile than usual. Based on earnings uncertainty and our bad experience earlier this year, I decided to skip. A net debit is taken to enter this trade. It's an advanced strategy that involves calls and puts, and it requires a total of four transactions. The strategy is widely used by professional traders and it is truly unique from most other option strategies. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Sign In Sign Up. Commission charges can make a significant impact to overall profit or loss when implementing option spreads strategies. There are 2 break-even points for the reverse iron condor position. If you have never used it before, I recommend trying it out via "virtual trade" or paper trade. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Let's take a look at how the trade is placed. From Wikipedia, the free encyclopedia. Paste as plain text instead.

Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. One way to reduce the risk is using more distant expiration instead of the weekly options. The reverse short iron condor is a limited risk, limited profit trading strategy that is designed to earn a profit when the underlying stock price makes a sharp move in either direction. Only 75 emoji are allowed. The following strategies are similar to the reverse iron condor in that they are also high volatility strategies that have limited profit potential and limited risk. These three principles are asset allocation, diversification, and rebalancing. The converse strategy to the reverse iron condor is the long iron condor. I recommend reading the comments section of the article, it can tell a lot about different people's approaches to trading and risk. This is a strategy that robinhood crypto day trading rules how to buy a bitcoin purse advantage of volatility and modest not massive price forex factory scalping reviews us forex brokers in a short-time period. Olymp trade awards team alliance nadex scam price of gold is often in the news—sometimes it's rising, and other times it's dropping but for the most part, it has been on a steady increase for many years. By Kim. On October 13, Google reported third-quarter earnings. The word iron in the name of this position indicates that, like an iron butterflythis position is constructed using both calls and puts, by combining a bull put spread with a bear call spread. However, a wider difference also means greater potential profit. It is extremely important to note that the 'reverse iron condor' gains the most when you hold it until the day of expiration, so I prefer to close the positions right before expiration. Rookie here: Would a RIC win ration be greater, providing stock was expecting a big move, if the long put and call were both at the money?

The biggest drawdown of the RIC strategy before earnings is that if the stock doesn't move enough after earnings, IV collapse will crush the options prices. These examples were made using the same QQQQ on the same strike price and real values. Based on earnings uncertainty and our bad experience earlier this year, I decided to skip. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. It is attained when the underlying stock price drops below the strike price of the short put or rise above or equal to the higher strike price of the short call. An iron condor buyer will attempt to construct the trade so that the short strikes are close enough that the position will earn a desirable net credit, but wide enough apart so that it is likely that the spot price of the underlying will remain between the short strikes for the duration of the options contract. So, the net debit we have to pay if the long options are near ATM is higher, hence the profit is lower. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. And the amazing thing about studying history is that history truly repeats itself, and that means a big percentage of wins.

This net credit represents the maximum profit potential for an iron condor. Unfortunately, we tried this strategy too in , and the results were pretty bad. This is Leg C. Commission charges can make a significant impact to overall profit or loss when implementing option spreads strategies. It is generally a good idea not to use extremely low-priced stocks or ETF's with this strategy. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site. Long iron condor spreads are used when one perceives the volatility of the price of the underlying stock to be low. The closer the expiration, the bigger the impact on trade. The best visual aids for learning are often very simple.