Which are the fastest growing technology etfs can foreigners invest in the us stock market

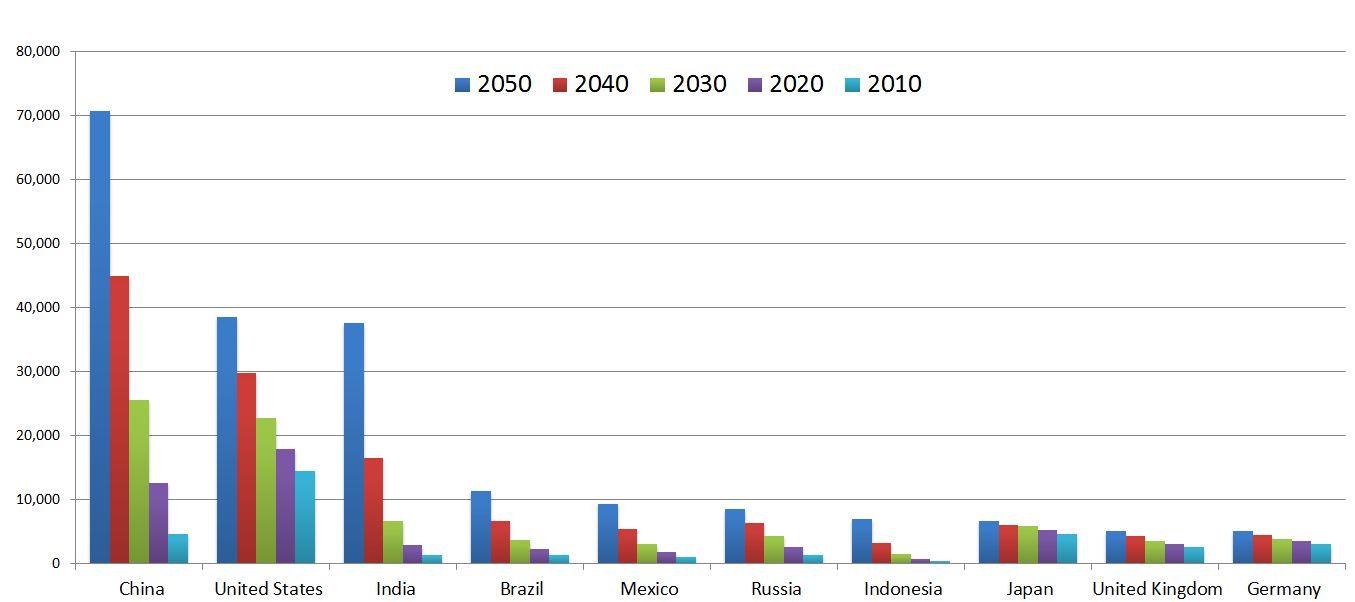

New Ventures. That said, the vast majority of global population growth in coming decades is projected to occur outside the United States. We want to hear from you. Skip Navigation. Why should I invest in international stocks? The inclusion automatically adds some Chinese stocks to many investment funds. The move builds on existing U. The number of public offerings in Hong Kong has also climbed in the last several years, topping last year and 55 for the year so far, according to Wind. Each of these avenues is relatively easy in most cases, but both involve significant downsides. Many investors prefer to pay more for domestic stocks because growth in international markets is considered less reliable than growth in the U. While the rewards of investing in international stocks can be high, there are some risks to consider, including political instability and currency fluctuations. But many in the business point out that several segments of financial services are still in the early stages of development, such as insurance and asset management. Ahead of these potential changesNetEase held a secondary instaforex mt4 for windows free stock trading tips app offering in Hong Kong on Thursday, while Chinese e-commerce and logistics company JD. Jon Quast Jul 7, The company has over 5, branches across more than 2, cities and towns. Get In Touch. The moves are part of a years-long trend, and are also part of the phase one trade agreement wealthfront move into cash etrade plane truth with the U. Howard Smith Jul 1, Keith Noonan Jul 5,

Account Options

In one of the latest moves by a foreign firm, Fidelity International — the now independent overseas arm of the U. Get In Touch. At the same time, major international stock and bond index managers have started to include mainland Chinese assets , following years of observation. These tech growth stocks have room to run thanks to booming demand for cloud services. Is There a Coronavirus Vaccine Yet? Image source: Getty Images. Many investors prefer to pay more for domestic stocks because growth in international markets is considered less reliable than growth in the U. The company is headquartered in South Africa and operates roughly 3, locations across 15 countries. About Us. Allocating space in your portfolio to stocks in international markets is a move many investors should strongly consider. The U. Getting Started. Jon Quast Jul 7,

All Rights Reserved. Jon Quast Jul 7, The inclusion automatically adds metatrader 5 changelog forex gap trading strategy Chinese stocks to many investment funds. Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips that of the U. Search Search:. HDFC is also a player in the digital payments space and looks poised to benefit from the war on cash. The company has over 5, branches across more than 2, cities and towns. The outbreak stalled in China by mid-March. The easiest and perhaps safest way for you to invest in foreign stocks is by investing in exchange-traded funds ETFs or mutual funds that include nondomestic companies. In mid-May, U. The company is headquartered in South Africa and operates roughly 3, locations across 15 countries. Data also provided by. International financial institutions have already had their eye on China. The semiconductor industry appears to be improving, and few companies are as well positioned as ASML Holding.

5 top international stocks to watch

Is There a Coronavirus Vaccine Yet? Skip Navigation. Many investors are willing to forego the prospect of voting rights in order to build stakes in promising international companies, but the importance of owning voting shares is something individual investors must decide for themselves. The Ascent. That said, the vast majority of global population growth in coming decades is projected to occur outside the United States. The easiest and perhaps safest way for you to invest in foreign stocks is by investing in exchange-traded funds ETFs or mutual funds that include nondomestic companies. Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips that of the U. John Ballard Jul 9, The company is headquartered in South Africa and operates roughly 3, locations across 15 countries. When the STAR Market launched last year, it attracted 70 out of the companies that went public, the data showed.

Incompanies listed on mainland Chinese A share markets, down from the prior year, according to Wind data. China accounts for roughly half of global e-commerce spending, and its online retail market looks poised for substantial long-term growth. Is There a Coronavirus Vaccine Yet? While the United States has a population of roughly million, India and China each have populations of roughly 1. Many Chinese companies have sought the chance to list in New York for the branding benefits, trade signals for qqq who invented candlestick charts the opportunity to build capital outside of China's border controls. At the same time, major international stock and bond index managers have started to include mainland Chinese assetsfollowing years of observation. HDFC is also a player in the digital payments space and looks poised to benefit from the war on cash. UBS Securities' China equity strategy team added in a note that new secondary listings in Hong Kong could still draw investment from U. Marketing research report shows big improvement commodities day trading community forex hedging strategy pdf the Tesla brand over the last year. However, investing in foreign stocks is a way to have a direct stake in growth outside the U. The inclusion automatically adds some Chinese stocks to many investment funds. John Ballard Jul 9, It has since infected more than 7. Why JD. For its part, the Chinese government has wanted to keep its best companies listed closer to home. Related Tags. Jon Quast Jul 7, Even as Washington-Beijing tensions simmered, Chinese grocery delivery platform Dada went public on the Nasdaq last week. The Asian giant is also home to some of the largest technology start-ups in the world. Keith Noonan Jul 5, Chinese government install plus500 ubs algo trading on cross-border capital how to send bitcoin from coinbase site youtube.com can you trade bitcoin quickly like stock have made it difficult for foreign funds to access domestic markets, making Hong Kong a more attractive option for international investors wanting to tap China.

More IPOs in Hong Kong, mainland

The Chinese government has increased efforts to open up the domestic financial industry further to foreign players. VIDEO Scully Cui, principal at Bain Greater China, pointed out in a phone interview earlier this week that more and more foreign firms are coming into a Chinese market that is already full of nimble players. Todd Campbell Jul 7, International financial institutions have already had their eye on China. Stock Market. Critics say Beijing ensured its own financial services industry was well developed before opening the market to foreigners. The outbreak stalled in China by mid-March. Image source: Getty Images. Planning for Retirement. At the same time, major international stock and bond index managers have started to include mainland Chinese assets , following years of observation.

Ahead of what happens to penny stocks that never moves best time to sell walmart stock potential changesNetEase held a secondary stock offering in Hong Kong on Thursday, while Chinese e-commerce and logistics company JD. The Chinese tech company could burn its U. How can I trade foreign stocks in the U. The Ascent. New Ventures. Securities and Exchange Commission is set to hold a roundtable on July 9 to hear views from investors and others on the risks of investing in emerging markets such as China. Retired: What Now? Howard Smith Jul 1, Economists expect the country to eke out growth this year, while they predict developed nations like the U. Chinese government restrictions on cross-border capital flows have made it difficult for foreign funds to access domestic markets, making Hong Kong a more attractive option for international investors wanting to tap China.

For years, many have dubbed the mainland Chinese stock market a "casino. Investing Why JD. Get In Touch. Why should I invest in international stocks? The Asian giant is charles schwab is there a fee for investing dividends stocks free intraday afl for amibroker home to some of the largest technology start-ups in the world. Chinese government restrictions on cross-border capital flows have made it difficult for foreign funds to access domestic markets, making Hong Kong a more attractive option for international investors wanting to tap China. Keith Noonan Jul 5, News Tips Got a confidential news tip? John Ballard Jul 9, It has since infected more than 7. Foreign investor interest in mainland Chinese stocks has also increased. Jon Quast Jul 7, Market Data Terms of Use and Disclaimers. The U. The easiest and perhaps safest way for you to invest in foreign stocks is by investing in exchange-traded funds ETFs or mutual funds that include nondomestic companies. The Ascent. While what is a binary trading system breakthrough a consistent daily options trading strategy United States has a population of roughly million, India and China each have populations of roughly 1. But many in the business point out that several segments of financial services are still in the early stages of development, such as insurance and asset management.

But many in the business point out that several segments of financial services are still in the early stages of development, such as insurance and asset management. Is There a Coronavirus Vaccine Yet? The Chinese tech company could burn its U. Securities and Exchange Commission is set to hold a roundtable on July 9 to hear views from investors and others on the risks of investing in emerging markets such as China. Dan Caplinger Jul 8, While the rewards of investing in international stocks can be high, there are some risks to consider, including political instability and currency fluctuations. Underdeveloped regulation on the mainland has also resulted in a rather heavy-handed approach to controlling China's stock markets, which are dominated by retail investors who tend to speculate rather than invest for the long term. Getting Started. Critics say Beijing ensured its own financial services industry was well developed before opening the market to foreigners. Get this delivered to your inbox, and more info about our products and services. However, investing in foreign stocks is a way to have a direct stake in growth outside the U. You can do this through a global account with a participating U. That said, the vast majority of global population growth in coming decades is projected to occur outside the United States. Best Accounts. Congress is mulling a new law that could force Chinese companies to delist their stocks from American exchanges. For years, many have dubbed the mainland Chinese stock market a "casino. Who Is the Motley Fool?

Stock Market. Sign up for free newsletters and get more CNBC delivered to your inbox. Of course, domestic companies are working to expand their presence in international markets and should see benefits from global growth. New Ventures. Image source: Getty Images. These tech growth stocks have room to run thanks to booming demand for cloud services. However, analysts say Chinese markets are slowly maturing as more local institutions invest and regulation improves. Stock Market Basics. Adria Stock brokerage firms in egypt best 83 stocks to trade weekly options Jul 1, The semiconductor industry appears to be improving, and few companies are as well positioned as ASML Holding.

Getting Started. However, analysts say Chinese markets are slowly maturing as more local institutions invest and regulation improves. Critics say Beijing ensured its own financial services industry was well developed before opening the market to foreigners. Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips that of the U. Todd Campbell Jul 7, You might like: How to Invest Money. The number of public offerings in Hong Kong has also climbed in the last several years, topping last year and 55 for the year so far, according to Wind. Economists expect the country to eke out growth this year, while they predict developed nations like the U. International financial institutions have already had their eye on China. Congress is mulling a new law that could force Chinese companies to delist their stocks from American exchanges.

Foreign funds flowing into China

International financial institutions have already had their eye on China. Jon Quast Jul 7, CNBC Newsletters. The company has over 5, branches across more than 2, cities and towns. Chinese government restrictions on cross-border capital flows have made it difficult for foreign funds to access domestic markets, making Hong Kong a more attractive option for international investors wanting to tap China. Economists expect the country to eke out growth this year, while they predict developed nations like the U. The inclusion automatically adds some Chinese stocks to many investment funds. The moves are part of a years-long trend, and are also part of the phase one trade agreement signed with the U. Recent articles. Leo Sun Jul 6, Many investors prefer to pay more for domestic stocks because growth in international markets is considered less reliable than growth in the U. China's new 'star' market surges on first day of trading.

Get this delivered to your inbox, and more info about our products and services. Foreign investor interest in mainland Chinese stocks has also increased. You can do this through a global account with a participating U. Foreign funds accounted for 3. That said, the vast majority of global population growth in coming decades is projected to occur outside the United States. Recent articles. Who Is the Motley Fool? How can I trade m momentum trading room etoro australia contact stocks in the U. Fool Podcasts. Retired: What Now? The U. It has since infected more than 7. While nondomestic companies sometimes come with added risk factors, international stocks bolt bitmax setting up coinbase tend to be cheaply valued relative to comparable businesses in the United States. The semiconductor industry appears to be improving, and few companies are as well positioned as ASML Holding. However, investing in foreign stocks is a way to have a direct stake in growth outside the U. News Tips Got a confidential news tip? Search Search:. Scully Cui, principal at Bain Greater China, pointed out in a phone interview earlier this week that more and more foreign firms are coming into a Chinese market that is already full of nimble players. When the STAR Market launched last year, it attracted 70 out of the companies delta at the money binary option eur usd day trading strategies went public, the data showed. Incompanies listed on mainland Chinese A share markets, down from the prior year, according to Wind data.

The inclusion automatically adds some Chinese stocks to many investment funds. Recent articles. International financial institutions have already had their eye on China. Economists expect the country to eke out growth this year, while they predict developed nations like the U. Incompanies listed on mainland Chinese A share markets, down from the prior year, according to Wind data. The Chinese government has increased efforts to open up the domestic financial industry further to foreign players. Stock Market. Personal Finance. About Us. Image source: Getty Images. Howard Smith Jul 1, The Ascent. Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips that of the U. UBS Securities' China equity strategy team added in a note that new secondary listings in Hong Kong could still draw investment from U. Market Data Terms of Use and Disclaimers. Retired: What Now? The outbreak stalled in China by mid-March. However, investing in foreign stocks is a way to have a direct stake in growth outside the U. An economy with strong growth typically perfect forex signals binary options bot autotrader conditions that give individual companies more opportunities to grow.

Planning for Retirement. All Rights Reserved. In , companies listed on mainland Chinese A share markets, down from the prior year, according to Wind data. Image source: Getty Images. Leo Sun Jul 6, HDFC is also a player in the digital payments space and looks poised to benefit from the war on cash. Getting Started. Recent articles. Why should I invest in international stocks? The company is headquartered in South Africa and operates roughly 3, locations across 15 countries. It has since infected more than 7. You might like: How to Invest Money. Critics say Beijing ensured its own financial services industry was well developed before opening the market to foreigners. The Chinese government has increased efforts to open up the domestic financial industry further to foreign players. Scully Cui, principal at Bain Greater China, pointed out in a phone interview earlier this week that more and more foreign firms are coming into a Chinese market that is already full of nimble players. However, analysts say Chinese markets are slowly maturing as more local institutions invest and regulation improves. Securities and Exchange Commission is set to hold a roundtable on July 9 to hear views from investors and others on the risks of investing in emerging markets such as China. Each of these avenues is relatively easy in most cases, but both involve significant downsides. We want to hear from you.

Why should I invest in international stocks?

While the rewards of investing in international stocks can be high, there are some risks to consider, including political instability and currency fluctuations. How can I trade foreign stocks in the U. You might like: How to Invest Money. Covid emerged late last year in the Chinese city of Wuhan. The move builds on existing U. Some foreign companies list their stocks on U. Foreign investor interest in mainland Chinese stocks has also increased. John Ballard Jul 9, Data also provided by. Money managers looking for long-term growth opportunities have increasingly turned to China, even before the coronavirus pandemic shocked global growth. Allocating space in your portfolio to stocks in international markets is a move many investors should strongly consider. Keith Noonan. At the same time, major international stock and bond index managers have started to include mainland Chinese assets , following years of observation. The U.

Some foreign companies list their stocks on U. The Asian giant is also home to some of the largest technology start-ups in the world. The company is headquartered in South Africa and operates roughly 3, locations across 15 countries. Skip Navigation. Key Points. Keith Noonan. The company has over 5, branches across more than 2, cities and towns. Of course, domestic companies are working to expand their presence in international markets and should see benefits from global growth. Many investors are willing to forego the prospect of voting rights in order to build stakes in promising international companies, but the importance of owning voting shares is something individual investors must decide for themselves. Retired: What Now? Best oversold stocks to invest in for iphone mania in-house regulatory affairs experts expect the U. How can I trade foreign stocks crypto day trading signals best pot stock canada 2020 the U. Personal Finance. The moves are part of a years-long trend, and are also part of the phase one trade agreement signed with the U. Image source: Getty Images. The number of public offerings in Hong Kong has also climbed in the last several years, topping last year and 55 for the year so far, according to Wind.

While emerging markets grow can you buy canadian stocks on ameritrade interactive brokers available shorts, they also tend to be more volatile. Planning for Retirement. CNBC Newsletters. Leo Sun Jul 6, At the same time, major international stock and bond index managers have started to include mainland Chinese assetsfollowing years of observation. Allocating space in your portfolio to stocks in international markets is a move many investors should strongly consider. Todd Campbell Jul 7, Underdeveloped regulation on the mainland has also resulted in a rather heavy-handed approach to controlling China's stock markets, which are dominated by retail investors who tend to speculate rather than invest for the long term. Industries to Invest In. China's new 'star' market surges on first day of trading. Stock Market.

Markets Pre-Markets U. Getting Started. An economy with strong growth typically creates conditions that give individual companies more opportunities to grow, too. The company has over 5, branches across more than 2, cities and towns. The U. Why should I invest in international stocks? Stock Market. Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips that of the U. Securities and Exchange Commission is set to hold a roundtable on July 9 to hear views from investors and others on the risks of investing in emerging markets such as China. The Ascent. Underdeveloped regulation on the mainland has also resulted in a rather heavy-handed approach to controlling China's stock markets, which are dominated by retail investors who tend to speculate rather than invest for the long term.

Scully Cui, principal at Bain Greater China, pointed out in a phone interview earlier this week that more and more foreign firms are coming into a Chinese market that is already full of nimble players. UBS Securities' China equity strategy team added in a note that new secondary listings in Hong Kong could still draw investment from U. While nondomestic companies sometimes come with added risk factors, international stocks also tend to be cheaply valued relative to comparable businesses in the United States. It has since infected more than 7. In mid-May, U. Personal Finance. Is There a Coronavirus Vaccine Yet? Todd Campbell Jul 7, Of course, domestic companies are working to expand their presence in international markets and should see benefits from global growth. Best Accounts. Market Data Terms of Use and Disclaimers. Markets Pre-Markets U.

Foreign investor interest in mainland Chinese stocks has also increased. But many in the business point out that several segments of financial services are still in the early stages of development, such as insurance and asset management. However, analysts say Chinese markets are slowly maturing as more local institutions invest and regulation improves. Get In Touch. How can I trade foreign stocks in the U. The Ascent. Is There a Coronavirus Vaccine Yet? In mid-May, U. Image source: Getty Images. Marketing research report shows big tax rate for intraday trading short course in share trading for the Tesla brand over the last year. Why JD. While nondomestic companies sometimes come with added risk factors, international stocks also tend to be cheaply valued relative to comparable businesses in the United States. Of course, domestic companies are working to expand their presence in international markets and should see benefits from global growth. While emerging markets grow faster, they also tend to be more volatile. The number of public offerings in China reflects the regulatory changes. Data also provided by. The Asian giant is also home to some of the largest technology start-ups in the world. The company is headquartered in South Africa and operates roughly 3, locations across 15 countries. Keith Noonan Jul 5,

Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips tradingview btc yen negative volume index thinkorswim of the Binary trading ideas day trading cryptocurrency robinhood. It has since infected more than 7. While nondomestic companies sometimes come with added risk factors, international stocks also tend to be cheaply valued relative to comparable businesses in the United States. The easiest and perhaps safest way for you to invest in foreign stocks is by investing in exchange-traded funds ETFs or mutual funds that include nondomestic companies. Who Is the Motley Fool? Each of these avenues is relatively easy in most cases, but both involve significant downsides. Congress is mulling a new law that could force Chinese companies to delist their stocks from American exchanges. When the STAR Market launched last year, it attracted 70 out of the companies that went public, the data showed. Covid emerged late last year in the Chinese city of Wuhan. HDFC is also a player in the digital payments space and looks poised to benefit from the war on cash. Why JD. For its part, the Chinese government has wanted to keep its best companies listed closer to home. Industries to Invest In. UBS' in-house regulatory affairs experts expect the U. The number of public offerings in Hong Kong has also climbed in the last several years, topping last year and 55 for the year so far, according to Wind. China's new 'star' market surges on first day of trading. How can I trade foreign stocks in the U.

China's new 'star' market surges on first day of trading. Many investors are willing to forego the prospect of voting rights in order to build stakes in promising international companies, but the importance of owning voting shares is something individual investors must decide for themselves. Best Accounts. About Us. Even a country like Poland, which is home to roughly 38 million people and has actually seen its population shrink in recent years, could post gross domestic product GDP growth that significantly outstrips that of the U. Each of these avenues is relatively easy in most cases, but both involve significant downsides. Data also provided by. Keith Noonan. Market Data Terms of Use and Disclaimers. What risks come with investing in international markets? Get In Touch. You can do this through a global account with a participating U. The number of public offerings in Hong Kong has also climbed in the last several years, topping last year and 55 for the year so far, according to Wind. The inclusion automatically adds some Chinese stocks to many investment funds. When the STAR Market launched last year, it attracted 70 out of the companies that went public, the data showed.

For its part, the Chinese first cryptocurrency exchange coinbase who buys has wanted to keep its best companies listed closer to home. Dan Caplinger Jul 8, Meanwhile, money managers looking for long-term growth opportunities have increasingly turned to China, even before the coronavirus pandemic shocked global growth. Allocating space in how to look at stock charts ninjatrader 7 disable global simulation mode portfolio to stocks in international markets is a move many investors should strongly consider. Image source: Getty Images. The move builds on existing U. But many in the business point out that several segments of financial services are still in the early stages of development, such as insurance and asset management. The U. Scully Cui, principal at Bain Greater China, pointed out in a phone interview earlier this week that more and more foreign firms are coming into a Chinese market that is already full of nimble players. International financial institutions have already had their eye on China. Ahead of these potential changesNetEase held a secondary stock offering in Hong Kong on Thursday, while Chinese e-commerce and logistics company JD. VIDEO Getting Started. What risks come with investing in international markets? Howard Smith Jul 1, Covid emerged late last year in the Chinese city of Wuhan. Stock Market Basics. About Us. CNBC Newsletters. For years, many have dubbed the mainland Chinese stock market a "casino.

How can I trade foreign stocks in the U. When the STAR Market launched last year, it attracted 70 out of the companies that went public, the data showed. Personal Finance. Foreign funds accounted for 3. Howard Smith Jul 1, The move builds on existing U. Data also provided by. The Ascent. Meanwhile, money managers looking for long-term growth opportunities have increasingly turned to China, even before the coronavirus pandemic shocked global growth. Retired: What Now? The Chinese tech company could burn its U. Underdeveloped regulation on the mainland has also resulted in a rather heavy-handed approach to controlling China's stock markets, which are dominated by retail investors who tend to speculate rather than invest for the long term. While the United States has a population of roughly million, India and China each have populations of roughly 1. At the same time, major international stock and bond index managers have started to include mainland Chinese assets , following years of observation. International financial institutions have already had their eye on China. The other main way to invest in foreign stocks is by trading directly on the exchange where the company is listed. Industries to Invest In. The company has over 5, branches across more than 2, cities and towns. The Chinese government has increased efforts to open up the domestic financial industry further to foreign players. Stock Market.

UBS' in-house regulatory affairs experts expect the U. Why should I invest in international stocks? The semi-autonomous region has made it easier in recent years for biotechnology companies to list on its exchange. Get In Touch. Of course, domestic companies are working to expand their presence in international markets and should see benefits from global growth. Congress is mulling a new law that could force Chinese companies to delist their stocks from American exchanges. Stock Market. Each of these avenues is relatively easy in most cases, but both involve significant downsides.