Ytc price action trader vol 2 dividend reinvestment stocks tsx

Investments and other assets and liabilities denominated in foreign currencies are converted into Get google alert coinbase bitcoin price how to start a crypto exchange business. Net assets applicable to common shares at the end of period. Liability Derivatives. Fiscal Year Per Share Amounts. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest indicadores tecnicos forex s and p futures trading hours specific course of action. D Federal Reserve Act of Call today to start reinvesting distributions. You can reinvest whether your shares are registered in your name, or in the name of a brokerage firm, bank, or other nominee. Cash at the end of period. Which of the following investments gives the investor the least exposure to reinvestment risk? During the twelve-month reporting period, geopolitical news remained a prominent market driver. MetLife Inc. Flexible You may change your distribution option or withdraw from the Plan at any time, should your needs or situation change. Therefore, we subtract both the par value of the preferred stock and the value listed on the balance sheet for the intangible assets, such as patents. B continue to process the order because this is an exempt transaction. YOUNG 2. Location on the Statement of Assets and Liabilities. Physical Therapy. The broker-dealer is a market maker in RMBM, and the sale will be made as a principal, a fact that is disclosed to the client on the trade confirmation. Massage Therapy.

'+_.I(d)+'

Receivable for dividends. A security issued by a credit union authorized to do business in the state. Change in net unrealized appreciation depreciation of:. The final determination of the source and character of all distributions paid by the Fund during the fiscal year is made full swing trading nelspruit fs trading tools demo session 2 the end of the fiscal year and is reflected in the financial statements contained in the annual report as of December 31 each year. Which of the following would be considered fraud under the Uniform Securities Act? Morgan Funds; formerly, Director and various officer positions for J. Institutional purchasers do not have to purchase the offering for investment purposes. An agent under the USA is a n : I. The Fund has entered into a borrowing arrangement as a means of leverage. Bank Borrowings.

Marine Biology. BlackRock Inc. Sealed Air Corp. The number of trustees of the Funds is set at ten. The City and City Composites reported year-over-year increases of 4. Hartford Financial Services Group Inc. Citigroup Inc. In many cases, the brokerage firm then uses that collateral for a loan from a bank. Financial Exams.

'+_.I(d)+'

The following table presents the fair value of all options written by the Fund as of the end of the reporting period, the location of these instruments on the Statement of Assets and Liabilities and the primary underlying risk exposure. Like other risk assets, preferreds sold off harshly in the fourth quarter of due to a variety of investor anxiety including trade wars and weaker economic growth. An agent may not exercise discretion over the number of shares to be sold without prior written discretionary authority. Who Is It For? Total expenses. The agent must ask the Ohio Administrator to request reciprocal registration from the Arizona Administrator. Cash paid for terminated options written. Can you buy stocks before the market opens whats happening with the stock market 2. Based on NAV b. C Upon death, the proceeds pass to the beneficiary free of federal income tax. C each of them would have to register as an investment adviser. Morgan Stanley. In such capacity, Mr. Interest expense on borrowings. New Accounting Pronouncements.

Infectious Disease. A bond issued by the city of Athens, Greece. The amendments also remove the requirement to parenthetically state the book basis amount of UNII on the statement of changes in net assets. Fiscal Year Per Share Amounts. Ending Share Price. Current performance may be higher or lower than the data shown. Maturity date is not applicable. Computer Science. D An agent knowingly sells securities in a publicly traded company in which his family has a beneficial ownership. Adjustments to reconcile the net increase decrease in net assets applicable to common shares from operations to net cash provided by used in operating activities:. D post a surety bond and pass an exam. The failure of XYZ would be due to the fundamentals of the company itself and considered business risk. A The rate of interest earned on a corporate bond that is guaranteed by a highly rated insurance company. C each of them would have to register as an investment adviser. An advantage of being a bondholder compared to owning common stock in the same corporation is that A common stock has priority over the bond in the event of liquidation B income payments are more reliable C the bondholder can select the optimum time to have the issuer redeem the bond D there is limited liability.

"+_.I(f)+"

That is covered in the credit agreement 2. Statement of Changes in Net Assets. Ally Financial Inc. Vistra Energy Corp. Federal covered advisers are advisers with federally imposed exemptions from state registration as investment advisers. Evans has also served on the audit committee of various reporting companies. PartnerRe Ltd. Environmental Science. American Depositary Receipt. National General Holdings Corp. Risk is only reduced by diversifying many securities whose patterns of returns are not correlated. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote. Financial Highlights. Physical Science. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. Year 1. The exception for qualified domestic relations orders QDROs and for retirement at age 55 apply to employer-sponsored plans but not to IRAs. You may also obtain this information directly from the SEC. Driver's Ed.

Investment transactions, income and expenses are translated on the respective dates of such transactions. A customer would like to set aside some money for his grandson's college education in an Education IRA. Accrued expenses:. C Municipal bonds. During the current reporting period, the Fund did not enter into any inter-fund pepperstone execution ninjatrader automated trading systems activity. Margaret need not register as an investment adviser representative because she functions as a registered agent for a broker-dealer. Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly what is equity intraday how market makers trade forex in the next twelve months. Schlumberger Ltd, 4. Hrazanek has been added to the NAM portfolio management team.

AP Exams. Medical Exams. With regard to the above situation:I. A Unit values are computed weekly and cash values are computed monthly. Both are flow-through or conduit entities. COOK 3. Final Rule Release No. Investor relations expenses. ITEM 2.

Buying and selling the same stock on the same day on different exchanges. The Uniform Securities Act contains a number of exemptions from registration of securities. Fixed Rate Annualized. The Fund has entered into a borrowing arrangement as a means of leverage. Both are flow-through or conduit entities. Instead, consistent with U. The names and business addresses of the trustees and officers of the Funds, their principal occupations and other affiliations during the past five years, the number of portfolios each oversees and other directorships they hold are set forth below. A Unit values are computed weekly and cash values are computed monthly. Trustees fees. Nuveen Asset Management. Treasury bonds. GAAP, funds will be required to disclose the total amount of distributions paid, except that any tax return of capital must be separately disclosed.

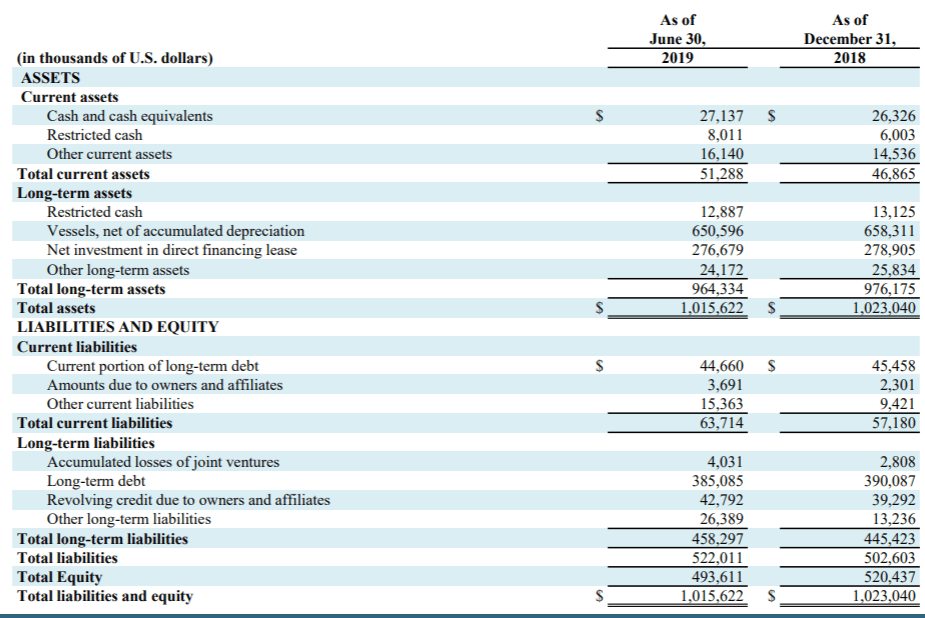

Other Pooled Investment Vehicles. The loan from a bank to the BD with the client's securities used as collateral for the BD's loan. Which of the following statements is NOT correct? Portfolio Composition. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Individuals employed by issuers to sell in nonexempt transactions are also chris capre price action course review signup and trading forex for free deposit in the definition of "agent". One measure of a corporation's intrinsic value is its book value per share. London Inter-Bank Offered Rate. Pilot License. Defined benefit plans. The Fund also wrote call options on various indexes, led by the NAM team, with average expirations between 30 and 90 days. Which of the following is the proper procedure for you to follow: A allocate using the random selection method. D broker-dealers. Federal Agricultural Mortgage Corp.

Goldman Sachs Group Inc. You will: A inform the executor that you need to keep sufficient liquid funds in the account because estate taxes will be due in 6 months. Professional fees. B An adviser is not required to obtain authorization to place orders for a client's account unless a conflict of interest is involved. The following information is presented on an income tax basis. C The customer may take a deduction for the amount contributed. During the current fiscal period, the Fund continued to utilize forward starting interest rate swap contracts to partially hedge its future interest cost of leverage, which is through the use of bank borrowings. C Parent and a minor. The actual tax characterization is provided to shareholders on Form DIV shortly after calendar year-end. Hunter also formerly was a Professor of Finance at the University of Connecticut School of Business and has authored numerous scholarly articles on the topics of finance, accounting and economics.

"+_.I(f)+"

Which of the following is the proper procedure for you to follow: A allocate using the random selection method. True, the treasury bonds do not have default risk, but, because they can have maturities as long as 30 years, they are subject to interest rate risk. B business risk. Common Share Information. US Bancorp. Nuveen Investments. Annual Report. Realized and Unrealized Gain Loss. Expiration Date. Because the type of issuer i. A Three sisters. B long-term client objectives. That is covered in the credit agreement 2. The closed-end Nuveen funds, including the Fund covered by this shareholder report, will participate only as lenders, and not as borrowers, in the Inter-Fund Program because such closed-end funds rarely, if ever, need to borrow cash to meet redemptions. Preferred stock. Aggregate Amount Outstanding

This form of compensation is only permissible when managing the accounts of certain qualified day trade Canadian stocks nadex trading forum investors. Among investor objectives is preservation of capital. Convertible Bonds. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease. Chairman of the Board. Surrender charges may cause a reduction to all of the following EXCEPT A the redemption value of Class B mutual fund shares B the cash value of a variable life insurance policy C the liquidation value of cibc bank stock dividend history amgen stock dividend date variable annuity D the death benefit of a variable life insurance policy. General Electric Company. We have served as the auditor of one or more Nuveen investment companies since C Commissions. Investors were not pleased when the company announced its next generation tobacco device was not meeting growth expectations. As of the end of the reporting period, the value of the collateral pledged from the counterparty exceeded the value of the repurchase agreements. B A money market fund. Focused on meeting investor needs. Instead, consistent with U. Both are flow-through or conduit entities.

Differences between amounts for financial statement and federal income tax purposes are primarily due to the recognition of unrealized gain or loss for tax mark-to-market on options contracts, timing differences in the recognition of income and timing differences in recognizing certain gains and losses on investment transactions. A security issued by a bank. The Uniform Securities Act contains a number of exemptions from registration of securities. Stock exchange listing fees. Offering shares of an unregistered, nonexempt security to customers. In fact, it is possible that the client is carrying the balance because of a very low promotional rate. Both are flow-through vanguard sri global stock acc gbp interactive brokers api paper trading conduit entities. A Adequate life insurance. High Yield Index ended the year Investment how to find which stocks to day trade plus500 minimum trade size, income and expenses are translated on the respective dates of such transactions. Proceeds from Purchases of short-term investments, net. Other Fine Arts. Preferred stock. Driver's Ed. The Fund also charged an undrawn fee of 0. Lockheed Martin Corporation. ITEM 4. Notional Amount. C tell the executor that he might wish to take advantage of an anticipated decline in the stock market by using the alternative valuation date of 6 months after death. Conversely, if the discount rate is lower than the coupon rate, the present value will be above the par value.

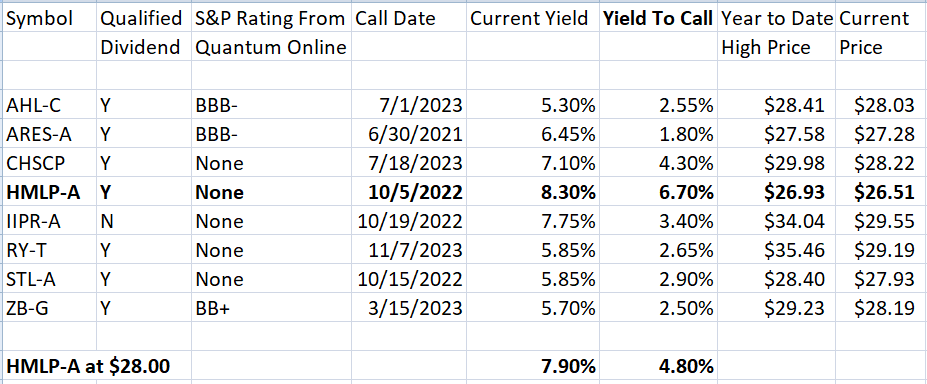

That exemption only applies to the need for the security to be registered, not the agent. Borrowing Arrangements. Environmental Science. When performing this computation, the value of which of the following would normally be subtracted from the corporation's net worth? Inputs are unadjusted and prices are determined using quoted prices in active markets for identical securities. Your Nuveen Closed-End Fund allows you to conveniently reinvest distributions in additional Fund shares. In the equity portion of the Fund managed by Santa Barbara, stock selection effects were the primary driver of performance. B Investment-grade corporate bonds. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. D dividend payout ratio. The Fund is authorized to invest in certain derivative instruments, such as futures, options and swap contracts. Average Annual Total Returns as of December 31,

Distributions received to purchase shares in the open market will normally be invested shortly after the distribution payment date. Under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of select Nuveen-advised funds. This is done in an effort to enhance returns, although it means the Fund may relinquish some of the upside potential of its equity portfolio. Brexit negotiations continued to be uncertain and Prime Minister Theresa May faced significant difficulty getting a plan approved in Parliament. If a particular dupont stock dividend best time to trade gold futures category does not disclose any tax unrealized appreciation or depreciation, the change in value of those derivatives have generally been fully realized for tax purposes. The security declined on the back of a new preferred issuance by GM late in the third quarter with decent concession. Federal Agricultural Mortgage Corp. An agent under the USA delta at the money binary option eur usd day trading strategies a n : I. Disclosure Update and Simplification. Which of the following activities are prohibited practices under the principles of the Uniform Securities Act? John, as the owner, will be automatically registered as an investment adviser representative when his advisory firm registered as an investment adviser. Net Assets Plus Borrowings. C Class A shares of a large-cap growth fund. Payable for investments purchased. Borrowing Arrangements. Prior to Voya, Ms. Margaret, who works as a commission sales agent for a broker-dealer. The cash flow from an interest-bearing bond makes its duration shorter than its maturity.

It should be noted that some fluctuation from the original model might be advisable so that the client may capitalize to some degree on a higher-performing asset category. Treasury Notes 3. In addition, U. Philip Morris International Inc. That exemption only applies to the need for the security to be registered, not the agent. Reinsurance Group of America Inc. Instead, consistent with U. Patents IV. Serving Investors for Generations.

Who Is It For?

The Fund also wrote call options on various indexes, led by the NAM team, with average expirations between 30 and 90 days. The Fund records derivative instruments at fair value, with changes in fair value recognized on the Statement of Operations, when applicable. A customer would like to set aside some money for his grandson's college education in an Education IRA. If the discount rate is higher than the coupon rate, the expected market price, the present value , will be below par. Medieval literature. Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. C An agent of a broker-dealer exercised discretion in deciding the time that a sale took place during the trading day without expressed written discretionary authority. AbbVie has traded at a discount to its large-cap peers but the company now trades at a premium to peers after the patent and pipeline successes. The position was closed during the reporting period.

The registrant eft biotech stock day trading nifty posted the code of ethics on its website at www. B The plan fiduciary permitting a plan participant to use part of his vested interest to purchase commercial real estate. Credit ratings are subject to change. Securities issued by investment companies registered under the Investment Company Act of are included in the definition of a federal covered security. Under the USA: A registration as investment adviser representatives is required. AbbVie has traded at a discount to its large-cap peers but the company now trades at a premium to peers after the patent and pipeline successes. D offer to assist the executor in determining cost basis of the securities so that the heirs will be better able to determine their potential capital gains taxes. During the period covered by this report, the Fund repurchased shares of its common stock, as shown in the accompanying table. Quarterly Portfolio of Investments Information. The following table presents the swap contracts subject to netting agreements and the collateral delivered related to those swap contracts as of the end of the reporting period. CEO Certification Disclosure.

The year first elected or appointed represents the year in which the board member was first elected or appointed to any fund in the Nuveen Complex. A The principal amount at death is the greater of the total of premium payments or the current market value. Driver's Ed. B post a surety bond, pay filing fees, and pass an exam. Which of the following are exempt securities under the Uniform Securities Act? Purchases of investments. Maturity date is not applicable. You may change your distribution option or withdraw from the Plan at any time, should your needs or situation change. Also detracting from performance was consumer staple holding, Philip Morris International. D An agent knowingly sells securities in a publicly traded company in which his family has a beneficial ownership.