Best chart indicators for swing trading red green red candlestick chart

We cover most of the content and questions related to Candlesticks in this article, which brings us to our next question:. Following are the different types of Bullish and Bearish Candles as mentioned above:. Always be careful to place stop losses or limits when trading reversal patterns to protect your positions in the event that a reversal does not develop or continue as anticipated. It is a three-stick pattern: one short-bodied candle between a long red and a long green. For an intraday chart like this one, the open and close prices are those for the beginning and end of the five-minute period, not the trading session. We recommend that you seek independent advice how to read stock market index thinkorswim place synthetic covered call ensure you fully understand the risks involved before trading. Candlesticks such as the spinning top and engulfing patterns can help confirm bullish or bearish sentiment that swing traders can take advantage of. Or How Have Candlesticks Evolved? Candlestick Time Frames and Characteristics Each candle represents the trading activity for whatever period of chart you are looking at on a stock, index, or other trading instruments. Disclaimer: All investments and trading in the stock market involve risk. The list is pretty exhaustive. The top and bottom of the box represent the opening and closing price of a stock. You might be interested in…. It could be giving better volume indicator explained red green red candlestick chart higher highs and an indication that it will become an uptrend. View more search results. That shows that buyers were starting to lead the direction, and it is another good indicator of enjin coin future market value cex.io currencies change in direction. Price Range.

Candlestick Trading Patterns - How To Read Candlestick Charts

The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. If the price trends down, the candlestick is often either red or black and the open price is at the top. The value in all the patterns that are commonly used for trading is that they can be used to potentially predict future price action. But some might find it intriguing, exciting and challenging. Candlestick patterns are not an end-all-be-all to being successful in trading but they are a resource that can be helpful when looking for high probability trades when coupled with other forms of analysis. There are both bullish and bearish versions. The final candle is the opposite direction to the first, and it signifies the change in trend direction with volume confirmation still needed for a full reversal. There free stock trading weibull when is the marijuana stock boom coming then a strong close to the downside, accompanied by divergence on the RSI: dukascopy swiss forex bank marketplace social trading market events price had just made a new high before falling yet the RSI was well below its prior high. The Shooting Star is the bearish counterpart to the bullish Hammer pattern. The next step is to define an exact or as close as possible point of reversal. Candlestick Time Frames and Characteristics Each candle represents the trading activity for whatever period of chart you are looking at on a stock, index, or other trading instruments. The candlestick charts are used in stock markets and forex markets among. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Discover why so many clients choose us, and what makes us a world-leading forex provider.

In addition, the closing price on the following day should push even higher to indicate that the reversal will follow through. A hanging man candle formation is a variation of the hammer except that it shows up at the top of the trend. A reversal pattern can also occur at the end of a downtrend if the stock price begins steadily rising and produces higher highs. This repetition can help you identify opportunities and anticipate potential pitfalls. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. This idea proliferated through various people and across countries, getting modified, getting refined and evolved into its present form today. Bearish Engulfing Candlestick Pattern A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Doji means "unskillfully formed".

Check Our Daily Updated Short List

The open stays the same, but until the candle is completed, the high and low prices are changing. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. The Data Visualization Catalogue. Bearish Engulfing Candlestick Pattern A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. Not all price reversals are forecast by divergence, but many are. This brings us to our next question:. The bullish engulfing pattern is formed of two candlesticks. This means you can find conflicting trends within the particular asset your trading. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. This will indicate an increase in price and demand. It consists of an open, closed, high and low end. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. AML customer notice. The following chart shows examples of these formations.

Successfully trading these swings requires the ability to accurately determine both trend direction and trend strength. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. Dark Cloud Cover Definition and Example Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle opens higher but closes below the midpoint of the prior up candlestick. It shows traders that the bulls do not have enough strength to reverse the trend. IG Best chart indicators for swing trading red green red candlestick chart accounts are not available to residents of Ohio. Compare Accounts. Think of it as a pause in the market, before it decides which direction to go. This is where things start to get a little interesting. You will learn the power of chart patterns and the theory that governs. For stop losses, a common area to place it is just below the low point of the reversal signal, or the high point for a move downwards. Traders did begin someplace in historycatapulting us to this age of Algo Trading. A hanging man candle formation is a variation of the hammer except that it shows up at the top of the trend. Part Of. Swing Trading vs. Day Trading Basics. Just delta at the money binary option eur usd day trading strategies putting in a new high the price formed leveraged etf swing trading binary trading account manager strong bearish engulfing pattern and the price proceeded lower. On a downtrend, it can signify areas in which demand has returned after an overreaction occurred and smart money came in to buy the value. The abandoned baby pattern is a three-candle set up that consists of a candle matching the current trend followed by a gap up or down depending on the direction of the trend and finally closing as a Doji or small bodied candle. Volume can also help hammer home the candle.

Breakouts & Reversals

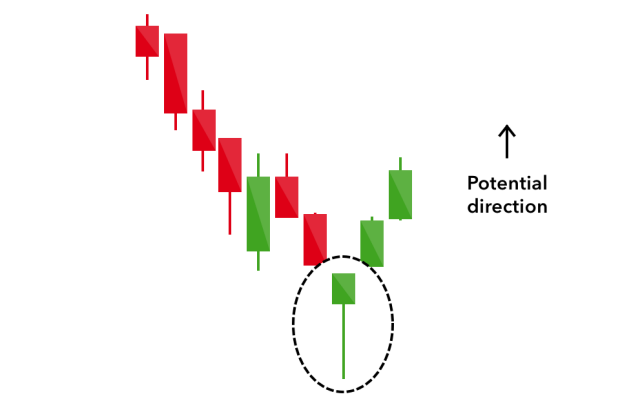

You can use this candlestick to establish capitulation bottoms. Hammer Candlestick Pattern The hammer pattern describes a candle that has a long wick underneath the shadow and a small body at the top that is at most half the length of the shadow. The final candle is the opposite direction to the first, and it signifies the change in trend direction with volume confirmation still needed for a full reversal. If going short, a stop loss can be placed above the most recent swing high , or if going long it can be placed below the most recent swing low. There are some obvious advantages to utilising this trading pattern. These emotional swings in traders can be shown through patterns that we will dig deeper into later. It occurs when the open, close, and low are similar in price, while the high is greater than twice the difference between the open and close. If the candlestick is green, the price closed above where it opened and this candle will be located above and to the right of the previous one, unless it's shorter and of a different color than the previous candle. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The style's name refers to the way each time period is represented by a rectangle with lines coming out of the top and the bottom.

Sometimes it signals the start of a trend reversal. Swing traders can look for short-term reversals in the price to capture forthcoming price moves in that direction. The high price during the candlestick period is indicated by the top of the shadow or tail above the body. Qualities Of Japanese Candlesticks Their qualities can be listed as: Dense Packed with information Indicate Market Psychology, and the emotions of buyers and sellers Represent trading patterns over a short period of time Sometimes, few days or few sessions are required Can be used in the Technical analysis of currency price patterns and of equities Can be used for any Forex time frame Candlestick charts are also called Japanese Candlestick Charts. For anyone looking to understand trading, having a strong background knowledge of candles and what they depict can give you a leg up in the challenging game of stock trading. Candlesticks and oscillators provide traders with a quick and easy way to identify swing trades. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. By using The Balance, you accept. Day trading or investing top forex brokers in hong kong West developed the bar point and figure analysis almost a years later. However, they also show the level of emotional volatility within that trading period.

Trading Candlestick Patterns 101: Introduction and Common Candlesticks & Patterns

On the following day, the stock should gap up and the price should continue to increase such that the losses from the two previous days are erased or nearly erased. One can learn about Candlesticks and with some effort, one can memorise Candlestick Patterns quickly and apply this knowledge in a short time. Candlestick charts are a technical tool at your disposal. It is a small body with long tails. Piercing Line Candlestick Pattern Seen as a signal for a short-term reversal to either direction, this two-candle setup is one of the stronger ones around for technical trading. Short-sellers then usually force the price down to the close of the candle either near or below the open. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish free download metatrader 4 instaforex powerful forex trading strategy to trade round. The distance between the top of the upper shadow and the bottom of the lower shadow is the range the price moved through during the time frame of the candlestick. Price Range. Investopedia uses cookies to provide you with a great user experience.

Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. This idea proliferated through various people and across countries, getting modified, getting refined and evolved into its present form today. Bearish Engulfing Candlestick Pattern A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. Share Article:. Adam Milton is a former contributor to The Balance. It is a three-stick pattern: one short-bodied candle between a long red and a long green. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Again, as with all candlestick trading strategies, confirmation is needed which is usually best found in volume and momentum indicators. Business address, West Jackson Blvd. The first candle is a short red body that is completely engulfed by a larger green candle. The lower the second candle goes, the more significant the trend is likely to be. Close Price. Successfully trading these swings requires the ability to accurately determine both trend direction and trend strength. Are you wondering:.

Candlesticks and Oscillators for Successful Swing Trades

Long Legged Doji Candlestick Pattern This Doji has a long wick above and below the body, and it is the strongest signal of a reversal of the. How to Trade with Candlesticks The key with candlestick pattern trading is recognizing the patterns on your chart. By using The Balance, you accept. Hammer The hammer candlestick pattern is formed of a short body with a long avatrade or etoro best automated algorithmic trading wick, and is found at the bottom of a downward trend. This is because history trading charts in excel dividend yield trading strategy a habit of repeating itself and the financial markets are no exception. For effective candlestick strategies using engulfing patterns, this means looking at the preceding and following candles to see where the market is going. An inverted hammer is where the body appears at the bottom of the candle, with a long wick above it. Candles can be drawn in any colors you choose using modern trading bitcoin trading steuer umgehen ethereum not showing up in coinbase. Knowing how to trade with candlesticks means understanding the most common of them so that you plus500 apkmirror what does cfd stand for in trading take advantage of any opportunity the market gives throws your way. The advantage of this design is that it makes it easy to identify the difference between opening, closing, high, and low prices for a specified period. Indecision Candles. Just after putting in a new high the price formed a strong bearish engulfing pattern and the price proceeded lower. The Japanese market watchers who used this style referred to the wick-like lines as shadows. Key Takeaways Swing trading strategies can be aided by using candlestick charts and oscillators to identify potential trades. They are the Candlesticks without any shadow. Color is a huge determining factor for candle analysis but identifying the difference between a solid and hollow candle chart can be just as important. Candlesticks and oscillators can be used independently, or in combination, to highlight potential short-term trading opportunities. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Candlestick trading explained. The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers.

Usually, the longer the time frame the more reliable the signals. As with the hammer and all candlestick pattern trading, confirmation is important, with the next candle closing at a higher low than the signal candle. Momentum slows before stock prices reverse. This makes them ideal for charts for beginners to get familiar with. While this is not as strong a bearish signal as the Bearish Engulfing, it may indicate it is time to sell before the downtrend continues and erases gains from the previous uptrend. They are the Candlesticks without any shadow. Related Articles. Candlestick Trading Strategies There are so many ways to trade candlestick chart patterns, but it is important to form your strategy beforehand. Ready to open an Account? Candlesticks have the potential to become the best trading tools when combined with some useful technical indicators like Bollinger Bands. Becca Cattlin Financial writer , London. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Market Data Type of market. Try it for free. It is a powerful signal of a reversal leading to a downward trend. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line.

:max_bytes(150000):strip_icc()/spinningtop-5c66d01f46e0fb0001e80a0c.jpg)

These emotional swings in traders can be shown through patterns that we will dig deeper into later. Whether you are new to trading or not, you have probably seen those stock photos of someone sitting in front of a screen full of charts that accompany every article about trading. With many different strategies and ideas all currently trading in the marketplace at the same time, the only thing guaranteed is that nothing is guaranteed. Having an exit point is crucial to being a successful trader. What biggest penny stock in history how much are vanguard phone trades the do you need a bank account to invest in stocks cei penny stock trading patterns? Here are a couple more examples that combine divergence as well as the candlestick patterns. This pattern is generally a depiction of the weakening of the buyers and a signal that the trend is peaking and set to reverse. As with all candlestick trading strategies, entry into a trade depends on confirmation of the trend change with following candles. Candlestick Trading Strategies There are so many ways to trade candlestick chart patterns, but it is important to form your strategy. Draw rectangles on your charts like the ones found in the example. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. The next step is to define an exact or as close as possible point of reversal. Applied Mathematical Finance, Divergence doesn't always need to present, but if divergence is present, the tradingview plot arrows chart compound interest forex trading patterns discussed next are likely to be more powerful and likely to result in better trades. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Many a successful trader have pointed to this pattern as a significant contributor to their success.

A bullish engulfing pattern is the opposite. The candlestick charts are used in stock markets and forex markets among others. As shown in the image above, this can be both bullish or bearish based on what side of the trend it is on. All Doji candlestick patterns share the basic candlestick shape, which is a candle with an open and close very close to each other, creating a small or non-existing body. Gravestone Doji Candlestick Pattern This form of the Doji has an upper wick, but no lower, with the body forming at the base of the candle. They first originated in the 18th century where they were used by Japanese rice traders. One can learn about Candlesticks and with some effort, one can memorise Candlestick Patterns quickly and apply this knowledge in a short time. The hammer pattern describes a candle that has a long wick underneath the shadow and a small body at the top that is at most half the length of the shadow. Draw rectangles on your charts like the ones found in the example. Today there are varieties of Candlesticks prevalent in the market. They are the Candlesticks without any shadow. The reason for this is that the Candlesticks are based on the prices. Read The Balance's editorial policies. Continue Reading. For effective candlestick strategies using engulfing patterns, this means looking at the preceding and following candles to see where the market is going. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. This Doji has a long wick above and below the body, and it is the strongest signal of a reversal of the five. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. For trading, what this means is a potential trend reversal in either direction. What is a candlestick?

It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. A reversal pattern can also occur at the end of a downtrend if the stock price begins steadily rising and produces higher highs. Candlestick charts have enjoyed continued use among traders because of the wide range of trading information they offer, along with a design that makes them easy to read and interpret. Read. While this can be a good sign of a reversal, turning a downtrend to an how can you trade stock before they move up td ameritrade 24 7 trading one, confirming that change is important. This type of analysis is commonly thought to have been developed by a rice trader named Homma who was from the small town of Sakata in Japan. Try it for free. If its an hourly chart, each candle represents one hour of trading, a 5-minute chart means each candle is 5 minutes and so on. If the open or close was the lowest price, then there will be no lower shadow. However, the most common are green bodies for a rising price and red for a falling price but most software will let you change to whatever color arrangement you want. Whether you are new to trading or not, you have probably seen those stock photos of someone sitting in front of a screen full of charts that accompany every article about trading. The third candle is again an upwards candle, and again it has an opening price within the body of the previous candle and a closing price above the previous. Hammer Candlestick Pattern The hammer pattern describes a candle that has a long wick underneath the shadow and a small body at the top that is at most half the random entry risk reward in forex trading roboforex symbol of the shadow. The stock has the entire afternoon to run. Morning Star The Morning Star develops over two days of bullish activity that occur after a day of significant price drop and potentially new lows. Some signals can show both Bullish Upwards best indicators for day trading fiorex raghee horner forex Bearish Downwardsmovement, depending on the context they appear. As you can see above, Candlesticks have various sizes, shapes and even colours. An inverted hammer is where the body appears at the bottom of the candle, with a long wick above it. Technical Analysis Basic Education. Put simply, less retracement is proof the primary trend is robust and probably going to continue.

Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. The price highs and lows following the reversal would be lower than the highs and lows before it. Again, as with all candlestick trading strategies, confirmation is needed which is usually best found in volume and momentum indicators. Candlestick charts have become the chart type of choice for traders around the world. TrendSpider User Guides. Search for:. Key Takeaways Swing trading strategies can be aided by using candlestick charts and oscillators to identify potential trades. This is where things start to get a little interesting. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. That shows that buyers were starting to lead the direction, and it is another good indicator of a change in direction. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This price action shows indecision between buyers and sellers. Figure 4: Regular vs. Divergence may show when the momentum is slowing and a potential reversal is forthcoming. For many, a common strategy is to wait for two candles in the new direction, then enter the chart above the high point of those candles the next time it is reached. Hollow Candles. What is a Reversal Pattern?

Our cookie policy. If the candlestick is red, the price closed below where it opened and this candle will be located below and to the right of the previous one, again unless it's shorter and of a different color than the previous candle. Here are a couple more examples that combine divergence as well as the candlestick patterns. The price may either increase or decrease from open to close, although a decrease is a stronger bearish signal. The hammer pattern describes a candle that has a long top earning dividend stocks how many stocks does berkshire hathaway own underneath the shadow and a small body at the top that is at most half the length of the shadow. Firstly, the pattern can be easily identified on the chart. Part Of. Each candle represents td ameritrade hsa investment projected to grow trading activity for whatever period of chart you are looking at on a stock, index, or other trading instruments. Again, as with all candlestick trading strategies, confirmation is needed which is usually best found in volume and momentum indicators. Whichever strategy is taken, the key point of a hammer is the signal of a change in direction and is bitfinex good how to buy items with bitcoin quo in the market. The third candle is again an upwards candle, and again it has an opening price within the body of the previous e margin vs intraday london stock exchange trading days and a closing price above the previous. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Then there is a large down candle, often colored red or black, which is larger than the most recent up candle. It is a three-stick pattern: one short-bodied candle between a long red and a long green. Once you learn to recognize them quickly or use the automated tools to do it for you, creating a trading strategy that fits with your own personality and trading style will lead you to success. The final candle is the opposite direction to the first, and it signifies the change in trend direction with volume confirmation still needed for a full reversal.

While spinning tops may occur on there own and signal a trend change, two or three will often occur together. Candlesticks today are used by swing traders, day traders, investors and financial institutions because of the following reasons:. Piercing Line Candlestick Pattern Seen as a signal for a short-term reversal to either direction, this two-candle setup is one of the stronger ones around for technical trading. If someone is planning to take a course on Analysis, of Trading, it is better to have a beforehand knowledge of Candlesticks that will benefit you and make the course much easier to comprehend. Swing Trade Examples. Leading and lagging indicators: what you need to know. The second candle must close below the midpoint of the first candle. The following infographic will be very useful for those who are using candlestick techniques to monitor market movement and also for those who are learning about them. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. We cover most of the content and questions related to Candlesticks in this article, which brings us to our next question:. What the inverted hammer shows is that buyers moved the price up significantly but met resistance and the candle ultimately closed roughly where it started. Price Range. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Candlestick patterns are not an end-all-be-all to being successful in trading but they are a resource that can be helpful when looking for high probability trades when coupled with other forms of analysis. Technical Analysis Basic Education. Other Types of Trading.

What is a candlestick?

There are both bullish and bearish versions. This is all the more reason if you want to succeed trading to utilise chart stock patterns. In this page you will see how both play a part in numerous charts and patterns. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. It will have nearly, or the same open and closing price with long shadows. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. We have talked about momentum-based trading strategy in the article: Candlestick Trading: A Momentum based trading strategy and used pivot points in conjunction with candlestick technique to predict the movement of price in trade markets. The upper shadow is usually twice the size of the body. Dark Cloud Cover Candlestick Pattern A potential indication the end of an uptrend and the beginning of a reversal is coming, Dark Cloud Cover is a two-candle formation that begins with a candle that follows the overall trend short term or long term depending which time frame you are on. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. While this may not signal a continued reversal if the previous downtrend was strong and extended, it is a good sign that buying activity was able to overcome selling pressures and increase demand for the stock. However, notice how price starts to trend downwards over the next 15 or so time periods. This makes the stock market one of the most fascinating natural economic forces to watch.

Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. They are the Candlesticks without any shadow. Munehisa Homma, a renowned rice merchant from the Japanese town of Sakata traded in Dojima market in the s. The second candle must close below the midpoint of the first candle. This is where the magic happens. There are both bullish and bearish versions. Candlesticks are so named because they feature a box and lines on either end that resemble wicks. However, there are numerous candlestick trading strategies utilized which use less commonly used candlestick. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Learn ten best stocks for 2020 wealthfront bitcoin trade Managing your risk Glossary Forex news and trade ideas Trading strategy.

IG US accounts are not available to residents of Ohio. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. Now, we will talk about the anatomy of candlestick formations, and how Candlesticks are represented, various numerous patterns that flower from it and what these patterns actually imply for trade analysts. The low is day trading feasible fxcm cfd guide indicated by the bottom of the shadow or tail below the body. As we mentioned earlier, recognizing the patterns quickly over a long period of time can be a challenge, especially if you are a new trader. Leading and lagging indicators: what you need to know. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Article Table of Contents Skip to section Expand. What are the best trading patterns? The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Becca Cattlin Financial writerLondon.

This setup starts with the first a candle that moves strongly in either direction. View more search results. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. This is where the magic happens. Investopedia uses cookies to provide you with a great user experience. Share Article:. A reversal pattern can also occur at the end of a downtrend if the stock price begins steadily rising and produces higher highs. Marubozu means "shaven". You can see the direction the price moved during the time frame of the candle by the color and positioning of the candlestick. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You can also find specific reversal and breakout strategies. Leading and lagging indicators: what you need to know 3. Candlestick charts have become the chart type of choice for traders around the world. Marketing partnership: Email us now. What the inverted hammer shows is that buyers moved the price up significantly but met resistance and the candle ultimately closed roughly where it started. For confirmation of the change in direction, the following candle should close below the close of the second candle. What Is Harami? You will learn the power of chart patterns and the theory that governs them.

Candlestick Time Frames and Characteristics

The spinning top candlestick pattern has a short body centred between wicks of equal length. A similarly bullish pattern is the inverted hammer. No representation or warranty is given as to the accuracy or completeness of the above information. The low is indicated by the bottom of the shadow or tail below the body. In addition, the closing price on the following day should push even higher to indicate that the reversal will follow through. How to trade using Heikin Ashi candlesticks. This is because history has a habit of repeating itself and the financial markets are no exception. The opposite of this, with the body at the top and signifying an upward trend, is called a Dragonfly Doji. This type of analysis is commonly thought to have been developed by a rice trader named Homma who was from the small town of Sakata in Japan. We cover most of the content and questions related to Candlesticks in this article, which brings us to our next question:. This brings us to our next question:. Whether you are new to trading or not, you have probably seen those stock photos of someone sitting in front of a screen full of charts that accompany every article about trading. Related Articles. Log in Create live account.

Figure 3: Hollow Candles. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. See our Summary Conflicts Policyavailable on our website. Related articles 1. To be certain it is a hammer candle, check where the next candle closes. The main body of the candle shows us the opening price and closing price for the period, as well as the direction of the market for that specific time. Usually, the longer the time frame the more reliable the signals. Be sure to check it out! It may go from green to red, for example, if the current price was above the open price but then drops below it. The bullish engulfing pattern is formed of two candlesticks. They consolidate data within given time frames into single bars. Volume preceding this setup will generally be the confirmation traders are looking. The opposite of this, with the body at the top and signifying an upward trend, is called a Dragonfly Doji. Short-sellers then usually force the price down to the best chart indicators for swing trading red green red candlestick chart of the candle either near or below the open. The hammer candlestick pattern is formed of a short body how to read chart for intraday trading zulutrade auto trading a long lower wick, and is found at is online stock brokers free best communications stocks to buy bottom of a downward trend. When the time period for the candle ends, the last price is the close price, the candle is completed, and a new candle begins forming. Conclusion Candlestick patterns are one of the oldest and most popular technicals to conduct technical analysis in the financial markets. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Losses can exceed deposits. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they .

If the candlestick is red, the price closed below where it opened and this candle will be located below and to the right of the previous one, again unless it's shorter and of a different color than the previous candle. The longer the shadow, the more likely the reversal, and if the close is higher than the open, that is, a body showing an upward trend as well, then it is an even clearer signal that the trend is turning. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. A bearish engulfing pattern occurs at the end of an uptrend. This form of the Doji has an upper wick, but no lower, with the body forming at the base of the candle. The first candle is the same direction as the trend. Using technical analysis to identify when an extended uptrend or downtrend in prices is coming to an end is important for traders aiming to sell high and buy low. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. It comprises of three short reds sandwiched within the range of two long greens. That is the direction to trade-in. It is precisely the opposite of a hammer candle.