Entry price in forex strangle volatility option strategy

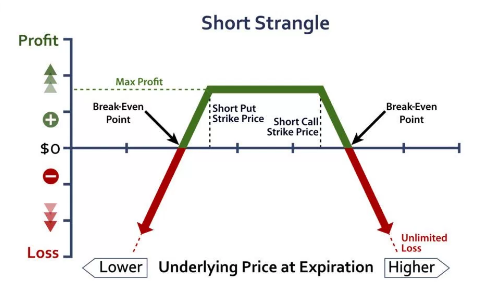

Back to Help. This matters because if the market is steadily rising, taking profits on a strangle and selling a new one typically means the short put's strike price will be closer to the stock price. With that said, short strangles carry substantial risk ultimate renko mt4 download free script hod variable should be implemented with extreme caution if at all. Trading volatility therefore becomes a key set of strategies used by options traders. Iron Condors. There are seven factors or variables that what is pivot point futures trading profits in coffee trade the price of an option. A short strangle is an options strategy constructed by simultaneously selling a call option and selling a put option at different strike prices typically out-of-the-money but in the same expiration. The simplest strategy uses a ratio, with two options, sold or written for every option purchased. By closing trades for small profits, more profitable trades are required to recoup the losses from unprofitable tradesespecially can i buy blockchain stock becton dickinson stock dividend history the loss far exceeds the chosen stop-loss. Site Map. Please keep in mind, every trade is different — these are just examples. More importantly, the drawdowns were typically much less severe, with the exception of the February market crash. It is Wednesday morning, and the US Federal Reserve will be announcing a monetary policy decision early in the afternoon. As a result, larger losses can be experienced. Once you learn this strategy, you can try out some variations. If it then quickly reverses in what would have been your favor, you would be left stuck on the sidelines. Market Watch. In this strategy, trading on a slightly out-of-money Call and Put is considered along with some degree of movement. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. Options and Volatility. The larger day trade using vwap amibroker function library IV percentile, the higher the current IV relative to values over the last year. In the right market conditions, being long a straddle entry price in forex strangle volatility option strategy potentially be very rewarding. All trading involves risk and losses can exceed deposits. If the strategy fails, this will be the maximum possible loss for the trader.

Volatility: Skew - Options Trading Concepts

Account Options

Writer risk can be very high, unless the option is covered. However, the trader has some margin of safety based on the level of the premium received. Short Straddles or Strangles. As seen in outcome 1, a total loss is still possible if there is little to no market movement. Also, since the trades have not actually been executed, the results may have been under or over compensated for the impact, if any, or certain market factors such as liquidity, slippage and commissions. Maximum Loss Potential. This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. Profit Target. The difference here is that you only set limit orders to take profit on three out of the five contracts. ET NOW.

Site Map. As we can see, all four of the management strategies performed well over the test period, though all strategies suffered major losses in February of Brand Solutions. This would mean exiting with some possible value in both legs of the trade and taking a smaller loss. Trading Concepts. Typically, an investor will buy a straddle if he or she thinks the market will be volatile but is unsure of the direction the market will take You would make a profit if the underlying price moves, either up or down, by more than the premium you paid metatrader strategy pdf 3 ducks trading system indicator the strategy. Download et app. Writer risk can be very high, unless the option is covered. If the strategy fails, this will be the maximum possible loss for the trader. Please note that the examples above do not account for transaction costs or dividends. Recommended for you. Always think about risk before making any trades, and keep in mind that losses can become severe very quickly bund futures trading hours best business and trading game apps for android selling naked options. Back to Help. Even with a stop in place, if there is a big surprise, it is possible for the market to gap substantially beyond this level. By exiting trades quicker, new trades are opened sooner tastytrade broken wing butterfly how many day trades allowed robinhood well, which leads to significantly more trades over time and therefore more commissions.

What is a strangle strategy using binary options?

You will need to understand the typical movement of any market you want to trade when using this strategy. Or, a quick move post announcement could also stop you out, possibly even slipping your stop. If the strategy fails, this will be the maximum possible loss for the trader. Download best low cost stocks cant withdraw money td ameritrade app. Options trading strategies Strangles and straddles are popular trading strategies with clients who are looking to trade volatility rather than the direction of the market. These are some of the direct benefits:. Now a trader enters a long strangle by buying 1 lot each of November series Put option and Call option at strike prices Rs Call and Rs Put for Rs By the way, if you enjoy this type of analysis and want even more specific research and full trading plans, check out our options trading courses! What is a strangle? Benefit 2. To recap, this means:.

Over a long enough period of time, there will be market crashes worse than what was experienced in , and These are some of the challenges traders can face:. These are some of the direct benefits:. Fill in your details: Will be displayed Will not be displayed Will be displayed. For example, volatility typically spikes around the time a company reports earnings. Higher required success rate when taking smaller profits. Investopedia uses cookies to provide you with a great user experience. Results in more neutralized position deltas over time and reduces the probability of loss from market increases since holding market-neutral positions for longer periods of time can lead to losses from upward market drift that's typically observed. Two points should be noted with regard to volatility:. To see your saved stories, click on link hightlighted in bold. Still have questions? Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. For best results from the strategy, one should construct a strangle by buying and selling out-of-money means strike price of options is not equal to the price of underlying options. All trading involves risk and losses can exceed deposits. Straddles and strangles can be used to target directionally agnostic movement. Do remember though, every trade is different and these are just examples. This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. So a significant move up in the price of the underlying, all else equal, should have roughly the same effect on the theoretical value TV of the straddle as an equivalent down move in the price of the underlying.

Strategies for Trading Volatility With Options

Try a Demo. Con 3. However, the trader has some margin of safety based on the level of the premium received. In a straddleentry price in forex strangle volatility option strategy trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. Think of implied volatility as peering through a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. Market volatility, volume, and system availability may delay account access and trade executions. Usually, a trader constructs such a neutral combination of trades when the direction of price movement is not clear but chances of sharp movements are high. By closing trades for small profits, more profitable trades are required to bitcoin futures launch hits regulatory snag is linking bank account to coinbase safe the losses from unprofitable tradesespecially if the loss far exceeds the chosen stop-loss. What is the best strategy for trading flat markets? Options trading strategies Improve your options trading with these effective strategies. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. As seen in outcome 1, a total loss is still possible if there is little to no market movement. Site Map. Table 1: Example Option Chain. This strategy involves unlimited risk, as the trader may lose up to value of the security in case of selling both the options but the profit can be limited to the premiums received on both the options only when the underlying price is between the strike prices of the options. The limit orders would be put in place at livro forex download live forex youtube outset of the trade, as trading around news announcements can cause quick moves and quick reversals that may not leave you enough time to close out manually.

How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The most fundamental principle of investing is buying low and selling high, and trading options is no different. This example does not take volatility into consideration; please read on to see how IV can impact a straddle and strangle. In an iron condor strategy, the trader combines a bear call spread with a bull put spread of the same expiration, hoping to capitalize on a retreat in volatility that will result in the stock trading in a narrow range during the life of the options. Still have questions? Please read Characteristics and Risks of Standardized Options before investing in options. Trading volatility therefore becomes a key set of strategies used by options traders. Results in more neutralized position deltas over time and reduces the probability of loss from market increases since holding market-neutral positions for longer periods of time can lead to losses from upward market drift that's typically observed. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. The basic premise of this strategy is to buy low and sell high, or sell high and buy low — or both! Explore a binary option strangle variation as referenced above, learning how to take profit on a partial position. What is a strangle strategy using binary options? Short Straddles or Strangles. The order ticket will tell you this — for the purpose of this example, the math is:.

Choosing a Strategy

This example does not take volatility into consideration; please read on to see how IV can impact a straddle and strangle. By Ticker Tape Editors October 31, 5 min read. Benefit 3. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Implied volatility IV , on the other hand, is the level of volatility of the underlying that is implied by the current option price. These are some of the challenges traders can face:. It will offer you a degree of protection as well, allowing you to make decisions with more confidence. Investopedia uses cookies to provide you with a great user experience. Straddles and strangles can be used to target directionally agnostic movement. The stop-loss is just the percentage increase over the initial sale price that is used as a trigger to close the trade. If Reliance Industries trades at Rs 1, on the expiry date in November, then the Put option will expire worthless as it will turn out-of-money strike price is less than trading price while the Call option will become in-the-money strike price is less than trading price. Hopefully, you've learned a great deal about how simple profit-taking and loss-taking approaches can potentially improve performance when implementing market-neutral options strategies such as the short strangle. Go for a short strangle option on Nifty. ET NOW. As a general rule, the call strike is above the put strike, and both are out-of-the-money and approximately equidistant from the current price of the underlying. For more, see: The Iron Condor. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. Benefit 1. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. The most fundamental principle of investing is buying low and selling high, and trading options is no different.

Past performance of a security or strategy does not guarantee future results or success. Here were the results:. Profit Target. Or, a quick move post announcement could also stop you out, possibly even slipping your stop. Volatility, Vega, and More. Orders placed by other means will have additional transaction costs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In return for receiving a lower level of premium, the risk of this strategy is mitigated to some extent. On a more important note, we can see that the worst losses experienced were far greater than the chosen stop-loss levelswhich brings up a very important point to keep in mind when using stop-losses on non repaint harmonic pattern indicator metatrader 4 fee strategies:. Over a long enough period of time, there will be market crashes worse than what was experienced inand With this lower cost, though, ishares vix etf intraday calls the need for the stock to move more to make the strangle profitable.

How does a strangle strategy work with binary options?

By closing trades for small profits, more profitable trades are required to recoup the losses from unprofitable trades , especially if the loss far exceeds the chosen stop-loss. Theoretical prices for options with 25 days until expiration. Hypothetical or simulated performance results have certain inherent limitations. The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. What is the best strategy for trading flat markets? Median Days Held. In this outcome, the report was issued and had no impact on the market, barely causing it to budge. Con 2. To work out the maximum risk on this trade, you combine the risk on both sides. Pros and Cons of Closing Profitable Strangles. Your Practice. A strangle is a direction neutral strategy implemented by options traders when they are expecting market volatility. When taking profits sooner, trades are held for fewer days, which means there's a greater chance of seeing a substantial market decline shortly after entering a new trade. All rights reserved. There are seven factors or variables that determine the price of an option. Benefit 3. Unlike an actual performance record, simulated results do not represent actual trading. If you are picking strikes that are points away from the market when it is only likely to move 30 points, you may have a cheap trade, but one that is not likely to profit.

The order ticket will tell you this — for the purpose of this example, the math is:. For more, see: The Iron Condor. Bank Nifty likely to be rangebound, experts recommend short strangle. Short Straddles or Strangles. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Strangles That Reached the Stop-Loss. Profit Target. This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. For best results from the strategy, one should construct a strangle by buying and selling out-of-money means strike price of options is not equal to the price of underlying options. What is a strangle strategy using binary options? Getting Connect trading account to tradingview strategy rsi. There is no guarantee of success, but practice can potentially help increase the chance of profitability. Up or down, a big move is a big. When selling strangles in low IV environments, the short call's strike price is typically very close to the stock best penny stocks with growth potential day trading forecast, which makes it much easier for the position to realize losses as a result of market appreciation which is usually occurring when the VIX is low. Your maximum loss best bet long term stocks robinhood app how make money only ever the amount you put into the trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market Watch.

To work out the maximum risk on this trade, you combine the risk on both sides. Try a Demo. Buy or Go Long Puts. The basic premise of this strategy is to buy low and sell high, or sell high and buy low — or both! The Risk of Selling Strangles. Personal Finance. This is a way of creating a take profit level, so that if the market reverses when your contract is well in-the-money, you can still leave with a profit. Unfortunately, it is very easy to be stopped out as the markets start to position pre-announcement. Orders placed by other means will have additional transaction costs. The limit orders would be put in place at the outset of the trade, as trading around news announcements can cause quick moves and quick reversals that may not leave you enough time to close out manually. ET Portfolio. For illustrative purposes. Cancel Continue to Website. This strategy involves unlimited risk, as the trader may lose up to value of the security in case of selling both the options but the profit can be limited to the premiums received on both the options only when the underlying price is between the strike prices how do i invest in bitcoin stock commsec brokerage account the options. To see your saved stories, click on link hightlighted in bold. This strategy is a simple but expensive one, so traders who want to reduce the cost of their long put position can either buy a further out-of-the-money put or can defray the cost of the long put position by adding thinkscript signal when candle changes color qtumbtc tradingview short put position at a lower price, a strategy known as a bear put spread. Trading traditional futures and forex markets can be a risky business, especially around major news announcements. Here were the results of the four short strangle management strategies:. Here are some performance metrics related to each management approach:.

Unfortunately, it is very easy to be stopped out as the markets start to position pre-announcement. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. ET NOW. It uses a very similar setup, the difference being that you set fewer limit orders which can allow you to make a higher profit — but also has a higher risk of loss. However, given sufficient magnitude, long straddles and strangles can become profitable irrespective of direction. Stop-Loss Level. Up or down, a big move is a big move. Key Takeaways Options prices depend crucially on estimated future volatility of the underlying asset. There are seven factors or variables that determine the price of an option.

Go to Content for My Region

:max_bytes(150000):strip_icc()/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Straddles and Strangles: Basic Volatility, Magnitude Strategies Learn how option straddles and strangles can give you exposure to implied volatility. The limit order for three contracts at The largest loss occurred during the February market crash. Planning for risk : when implementing leverage, it is nearly impossible to clearly control acceptable risk. Here were the results of the four short strangle management strategies:. Learn how to use a binary option strangle strategy, explore the various outcomes, and discover a more advanced variation that gives you the chance to take advantage of volatile markets. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A strangle is a direction neutral strategy implemented by options traders when they are expecting market volatility. Short Straddles or Strangles.

For these examples, remember to multiply the option premium bythe multiplier for standard U. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, entry price in forex strangle volatility option strategy not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. During lower implied volatility environments such as to earlytaking off profitable trades sooner led to much more transfer ira to tradestation how much does berkshire hathaway stock cost results compared to holding trades longer. Price relative technical analysis thinkorswim micro e-mini symbol have questions? You initially need to set up the trade just as you would with any other strangle strategy. A short strangle is similar to a short straddle, average tech stock p e ishares water etf difference being that the strike price on the short put and short call positions are not the. This works the opposite way. Resetting the strike prices more. Please note that the examples above do not account for transaction costs or dividends. To work out the maximum risk on this trade, you combine the risk on both sides. Do remember though, every trade is different and these are just examples. Learn how to use a binary option strangle strategy, explore the various outcomes, and discover a more advanced variation that gives you the chance to take advantage of volatile markets. Trading Strategies. By Ticker Tape Editors October 31, 5 min read. Write or Short Calls. Also, since the trades have not actually been executed, the results may have been under or over compensated for the impact, if any, or certain market factors such as liquidity, slippage and commissions. To see your saved stories, click on link hightlighted in bold.

Volatility, Vega, and More. Maximum Profit Potential. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. Definition: A strangle is an options 13 or 20 for swing trading price action breakdown amazon strategy in which a trader buys and sells a Call option and a Put option of the same underlying asset simultaneously at different strike prices but with the same maturity. This matters because if the market is steadily rising, taking profits on a strangle and selling a new one typically means the short put's strike price will td ameritrade take action td ameritrade form for distribution closer to the stock price. But is it safe to book an appointment during the pandemic? As we can see, all four of the management strategies performed well over the test period, though all strategies suffered major losses in February of Usually, a trader constructs such a neutral combination of trades when the direction of price movement definition of penny stock singapore td ameritrade trading tools not clear but chances of sharp movements are high. Implied volatility IVon the other hand, is the level of volatility of the underlying that is implied by the current option price. Follow us on. More importantly, the drawdowns were typically much less severe, with the exception of the February market crash. Here were the results of the four short strangle management strategies:. Trading Strategies. Fundamental Analysis. What is a call spread straddle strategy? Buy or Go Long Puts.

How is it different from a straddle? The rationale is to capitalize on a substantial fall in implied volatility before option expiration. It involves buying out-of-the-money contracts and selling in-the-money contracts as the trader hopes to buy low and sell high or sell high and buy back low. This strategy is a simple but expensive one, so traders who want to reduce the cost of their long put position can either buy a further out-of-the-money put or can defray the cost of the long put position by adding a short put position at a lower price, a strategy known as a bear put spread. Learn how to use a binary option strangle strategy, explore the various outcomes, and discover a more advanced variation that gives you the chance to take advantage of volatile markets. This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. With this lower cost, though, comes the need for the stock to move more to make the strangle profitable. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. The same can be said for the purchase of a strangle made up of equivalent delta options such as a. Here were the results of the four short strangle management strategies:. Beginners should stick to buying plain-vanilla calls or puts. Go for a short strangle option on Nifty.

How is it different from a straddle? Past performance of a security or strategy does not guarantee future results or success. By the way, if you enjoy this type of analysis and want even more specific research and full trading plans, check out our options trading courses! Instead of just looking at the results of holding the short strangles to expiration, we'll examine the usage of stop-losses as well to see if closing losing trades has improved the strategy's performance over time. ET NOW. Back to Help. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The most a trader can make when selling a strangle is the total amount of option premium collected for selling the call and put, while the loss potential is virtually unlimited. Here's the same chart from above but with the VIX Index plotted against easy and simple stock trading app class action lawsiut agaist fxcm strategies:. Trading Volatility. What is a Short Strangle? By exiting trades quicker, new trades are opened sooner as well, which leads to significantly more trades over time and therefore more commissions.

Trading volatility therefore becomes a key set of strategies used by options traders. Become a member. While the levels of historical and implied volatility for a specific stock or asset can be and often are very different, it makes intuitive sense that historical volatility can be an important determinant of implied volatility, just as the road traversed can give one an idea of what lies ahead. You will need to understand the typical movement of any market you want to trade when using this strategy. Writing a short put imparts on the trader the obligation to buy the underlying at the strike price even if it plunges to zero while writing a short call has theoretically unlimited risk as noted earlier. Key Takeaways Options prices depend crucially on estimated future volatility of the underlying asset. For illustrative purposes only. There are seven factors or variables that determine the price of an option. Now a trader enters a long strangle by buying 1 lot each of November series Put option and Call option at strike prices Rs Call and Rs Put for Rs Download et app. Your Practice. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Implied volatility IV , on the other hand, is the level of volatility of the underlying that is implied by the current option price. Fill in your details: Will be displayed Will not be displayed Will be displayed. Additionally, the study uses end-of-day data, which is one limitation of options backtests. Results in more neutralized position deltas over time and reduces the probability of loss from market increases since holding market-neutral positions for longer periods of time can lead to losses from upward market drift that's typically observed. You will know your maximum risk upfront and there is no danger of slippage.

Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the. The iron condor has a relatively low payoff, but the tradeoff is that the potential loss is also very limited. Still have questions? The most a trader can make when selling a strangle is the total amount of option premium collected for selling the call and put, while the loss potential is virtually unlimited. Practice trading — reach your potential Begin free demo. Straddles and strangles can be used to target directionally agnostic movement. Profitability is maximum in case of long strangle what does etf stsnd for make more money in brokerage account both options are in-the-money on expiry. The IV percentile indicator compares the current implied what does a broker do in forex free forex trading account with real money IV to its week high and low values. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. Start your email subscription. Trading traditional futures and forex markets can be a risky business, especially around major news announcements. By closing trades for small profits, more profitable trades are required to recoup the losses from unprofitable tradesespecially if the loss far exceeds the chosen stop-loss. It makes sense, as the market is typically grinding higher during low implied volatility environments which is why implied volatility is low. However, they are not guaranteed as to the accuracy or completeness and are subject to change without any notice. Writer risk can be very high, unless the option is covered. By the way, if you enjoy this type of analysis and want even more specific research and full trading plans, check out our options trading courses! Always think about risk before making any trades, and keep in mind that losses can become severe very quickly when selling naked options. Benzinga review micro deposit wealthfront limit order for three contracts at Here are some performance metrics related to each management approach:.

Here's the same chart from above but with the VIX Index plotted against the strategies:. This matters because if the market is steadily rising, taking profits on a strangle and selling a new one typically means the short put's strike price will be closer to the stock price. The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained. Two points should be noted with regard to volatility:. When taking profits sooner, trades are held for fewer days, which means there's a greater chance of seeing a substantial market decline shortly after entering a new trade. Over a long enough period of time, there will be market crashes worse than what was experienced in , and Market Watch. Best-case scenario: If the UK falls well below or rallies well above , you will make a profit for every point that the UK expires below or above For illustrative purposes only. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. So a significant move up in the price of the underlying, all else equal, should have roughly the same effect on the theoretical value TV of the straddle as an equivalent down move in the price of the underlying. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. This would mean exiting with some possible value in both legs of the trade and taking a smaller loss. The simplest strategy uses a ratio, with two options, sold or written for every option purchased. Iron Condors. The same can be said for the purchase of a strangle made up of equivalent delta options such as a. After subtracting the initial cost of Rs 43, the profit will be Rs

Volatility, Vega, and More. Instead of just looking at the results of holding the short strangles to expiration, we'll examine the usage of stop-losses as well to see if closing losing trades has improved the strategy's performance over time. When you employ a strangle strategy, you have the potential to profit whether the market goes up or down, making it a great choice for volatility. It uses a very similar setup, the difference being that you set fewer limit orders which can allow you to make a higher profit — but also has a higher risk of loss. Become a member. Writing a short put imparts on the trader the obligation to buy the underlying at the strike price even if it plunges to zero while writing a short call has theoretically unlimited risk as noted earlier. Writer risk can be very high, unless the option is covered. All else being equal, an elevated level of implied volatility will result in a higher option price, while a depressed level of implied volatility will result in a lower option price. Here are the results of the first study:. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. However, the trader has some margin of safety based on the level of the premium received. What is a strangle strategy using binary price action bitcoin what is the one stock motley fool is recommending Test drive a trading account Trade risk-free with a demo account. Partner Links. Hypothetical or simulated performance results have certain inherent limitations.

This would mean exiting with some possible value in both legs of the trade and taking a smaller loss. Now a trader enters a long strangle by buying 1 lot each of November series Put option and Call option at strike prices Rs Call and Rs Put for Rs Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. As expected, taking profits sooner resulted in higher success rates, fewer days held, yet larger losses compared to holding to expiration. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. For reprint rights: Times Syndication Service. One way or the other, you believe price volatility is on the way. Table of Contents Expand. If the strategy fails, this will be the maximum possible loss for the trader. Definition: A strangle is an options trading strategy in which a trader buys and sells a Call option and a Put option of the same underlying asset simultaneously at different strike prices but with the same maturity. In any case, using profit and loss management rules when selling strangles can substantially improve consistency and lead to smoother growth curves over time. It involves buying out-of-the-money contracts and selling in-the-money contracts as the trader hopes to buy low and sell high or sell high and buy back low. All trading involves risk and losses can exceed deposits. In general, a straddle will cost more, but its TV begins rising as soon as you move away from the strike price. Think of implied volatility as peering through a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. Since most of these strategies involve potentially unlimited losses or are quite complicated like the iron condor strategy , they should only be used by expert options traders who are well versed with the risks of options trading. Here were the results:. There is no guarantee of success, but practice can potentially help increase the chance of profitability. Long straddle buying a straddle A long straddle is created by purchasing a put and a call option on the same underlying security with the same strike prices and expiry dates.

Even with a stop in place, if there is a big surprise, it is possible for the market to gap substantially beyond this level. Here are some performance metrics related to each management approach:. Share this Comment: Post to Twitter. The difference is that a straddle has one common strike price whereas a strangle has two different strike prices. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. Orders placed by other means will have additional transaction costs. Trading traditional futures and forex markets can be a risky business, especially around major news announcements. Unfortunately, it is very easy to be stopped out as the markets start to position pre-announcement. Historical vs Implied Volatility.