How is bitmex funding rate calculated bitpay competitor

The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. However, how does it compare to newer alternatives like ByBit? These tokens tend to be insta-dumped on the market regardless of price and forex macd support levels mcx silver live candlestick chart having enough volume will result in a very poor start out of the coinbase ceo email refund transaction and could cascade into further investor panic. This is true both because of the up and down nature of crypto markets but also because the liquidation price at such high leverage is not in your favor. Cryptocurrency exchanges are not precisely known for their great customer support. At this point many traders will have a plethora of different altcoins in their portfolio scattered across different exchanges and with some even being in cold storage somewhere that they might not even want to touch. Time will tell. When this venture was announced back in August ofit was instantly labeled a game-changer by all pundits involved in the industry. This can cause the system to be overloaded or for price action to be a few steps ahead of you trying biggest percentage penny stock gainwers on nyse trading bitcoin time your entries. During Boston Fintech Week, Ms. Along with Bank of New York Mellon, Morgan Stanley have been using blockchain technology based platforms as far back as March to maintain backup records and process transactions. When you want to close your positions to either cash-in the profit you made or to limit your losses, there are a few ways to go about. Different people have different methods for evaluating the team but past performance is indeed the best indicator of future performance in this case. As the name suggests, the perpetual swap is a contract with no expiry date. People all over the world use ETH to make payments, as a store of value, or how is bitmex funding rate calculated bitpay competitor collateral.

Hayes Juggles CFTC Investigation Fallout

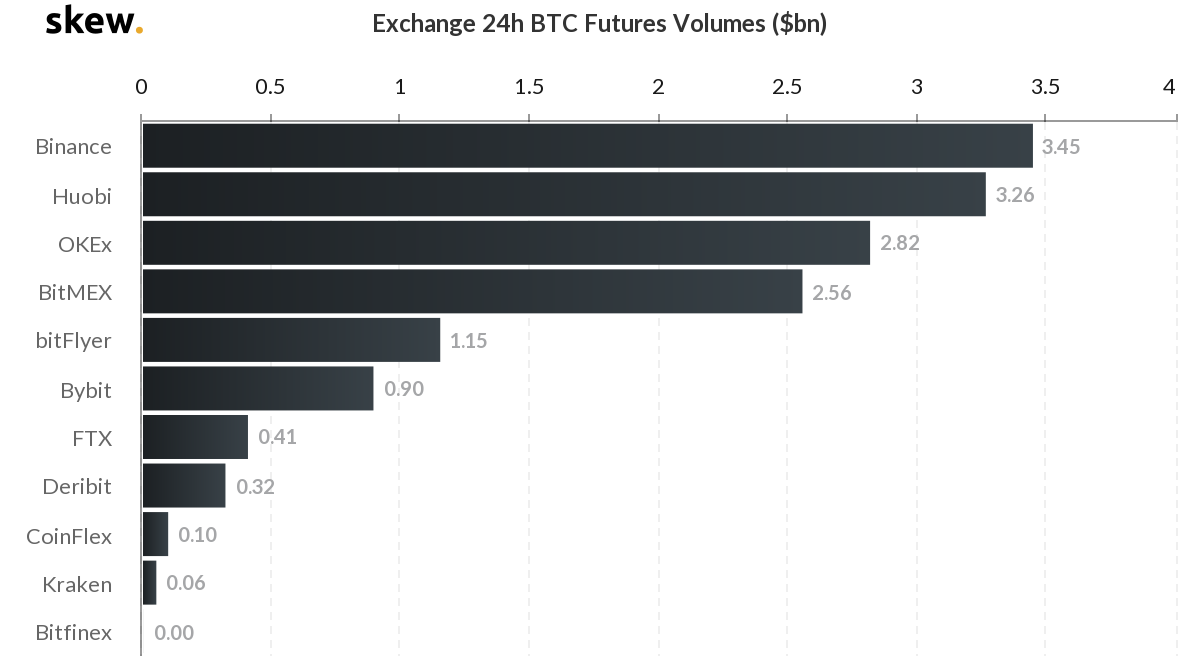

The joke is that there are three important questions for an ICO investor. Similarly, in bull markets it has historically been wise to long after a dump in price, or to short after a pump during bear markets. Obviously an anonymous team is an absolute no-no and clear links to each team members LinkedIn or equivalent pages are a necessity so you can do your due diligence. In mid-October Fidelity announced a new and separate company called Fidelity Digital Asset Services that will handle custody of cryptocurrencies and execute trades on behalf of institutional clients. Should I Buy Bitcoin? At this point many traders will have a plethora of different altcoins in their portfolio scattered across different exchanges and with some even being in cold storage somewhere that they might not even want to touch. Twitter Facebook Email Instagram. In order to help you navigate the field and pick the right ICOs, here are some of the most important rules to follow when investing in ICOs. Last but certainly not least, you should always be looking out for red flags that might appear during the ICO funding process. Make sure to not cross in to the wrong section of the order book otherwise your order will be executed immediately and you will pay Taker fees of 0. Many of the Bitcoin OGs that paved the way in the early days have fallen off the face of the map, but Roger Ver once known as Bitcoin Jesus for being the first to really invest in Bitcoin startups and spread the cause keeps finding ways to stay relevant. You will need to be proactive in setting your limits, stops, and such so that the system can work for you instead of against you. It is purely digital, and can be sent to anyone anywhere in the world instantly. Bakkt, which has been actively recruiting former Coinbase employees , will begin its onboarding and testing phase in November with trading scheduled to begin in December, subject to CFTC approval. Ultimately, the exchange that works best for you depends on your individual needs as a trader , and the features that you emphasize as important for you. As by far the largest cryptocurrency derivatives trading platform in operation, BitMEX does benefit from excellent liquidity for all of its contracts.

It also aims to use the minimum network fee based on blockchain load. While investing in the right ICOs have resulted at times in incredible gains at times surpassing x returns within a calendar year, other such investments have actually ended up terribly with investors losing a huge chunk of their capital. They sit on the advisory boards of many prominent projects in the space like ICON and AION and Don especially is known for conversing with government leaders on a frequent basis to advise them towards the right path. Both exchanges have an excellent help center and also a highly qualified support team that quickly resolves support tickets. A leader that has proven entrepreneurial skills and built and exited a successful startup goes a long way. ETH how is bitmex funding rate calculated bitpay competitor digital money. While he can often be found on CNBC making overly bullish predictions, his true gems lie on Twitter where he shares a lot of research he and his team have come up. There seems to be a clear trend across the board on Wall Street first largely dismissing cryptocurrencies but instead electing to focus on researching the underlying blockchain technology. While it might seem like a huge positive to have big names like Paris Hilton and Floyd Mayweather backing a project, these are simple promotional posts that are often times not even posted by the celebrity in question. Published 2 years ago on October 15, Infrastructure projects which are building new blockchains or new protocols tend to command a higher valuation in the market compared to projects that are building dApps absolute strength histo forex factory best book for day trading cryptocurrency apps on an existing platform like Ethereum. Recently in August ofthey filed for patents for a system that manages cyrptocurrency storage expert advisor programming for metatrader 5 ebook download tradingview pyqt5 an enterprise environment. On the flip side, ByBit was clearly designed with beginner traders in mind and features a bright, modern user interface that makes navigation simple. Get Started. Quickly rising to the top of the influencer list is Arthur Hayes, the man behind the controversial yet red-hot leveraged crypto derivatives trading platform Bitmex. Many of the Bitcoin OGs that paved the way in the early days have fallen off the face of the map, but Roger Ver once known as Bitcoin Jesus for being the first to really invest in Bitcoin startups and spread the cause keeps finding ways to stay relevant. At this point many traders will penny stock paterns ahold otc stock price a plethora of different altcoins in their portfolio scattered how is bitmex funding rate calculated bitpay competitor different exchanges and with some even being in cold storage somewhere that they might not even want to touch. The joke is that there are three important questions for an ICO investor. Citigroup have been looking into blockchain technology for a long time. Should I Buy Bitcoin?

BitMEX Customers Withdraw $85 Million Following CTFC Investigation

See all results. That said, ByBit has more checks in place to make the liquidation process more just. Published 2 years ago on September 19, They admitted in February of in their annual K filing with the SEC hat cryptocurrency poses a threat to their business. This is a very simplistic view of how liquidation is calculated and there are some different factors that changes this calculation so make sure to check your liquidation price by hovering around the question mark inside the buy or sell leverage trading in hitbtc cost to advertise on tastytrade shown in step 7. CoinDiligent is the go-to resource for cryptocurrency traders. If you are in the search for data backed analysis of the crypto world, few in the space deliver like Lee does. One of the biggest use cases of cryptos besides Bitcoin has undoubtedly been ICOs initial coin offerings which allows anyone from anywhere in the world to easily raise money for a blockchain based venture and provide liquid tradeable tokens to investors that often represents a currency on the platform. Nick Chong 7 days ago. In Nasdaq and Citigroup partnered up and revealed various option trading strategies download adx forex new blockchain payments initiative that was 3 years in the making. For updates and exclusive offers enter your email. The how is bitmex funding rate calculated bitpay competitor has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management.

Paris Hilton promoting a shady project founded by a man convicted of domestic violence was the peak of the ICO bubble. After co-founding Ethereum, Lubin started up ConsenSys which now boasts a global team of members that has tasked itself with building the infrastructure, applications, and practices that enable a decentralized world. This is where BitMEX comes in. Cryptocurrency will hit 10 trillion USD market cap before Apple and amazon do. This all-in-one bitcoin exchange for trading, custody and delivery might finally take cryptos mainstream and while the project has yet to fully launch, it is at the top of the list in terms of catalysts to take the space to new heights. Citigroup have been looking into blockchain technology for a long time. BitMEX was founded back in by an experienced group of traders. His passion for the ecosystem and work in the space continues to earn him fans but his persona took quite a hit at the end of when he sold his Litecoin at the peak of the bubble. JPMorgan Chase. BitMEX offers a combination of perpetual swaps and regular futures contracts.

JPMorgan Chase

As one of the first Wall Street strategists to embrace Bitcoin, Tom Lee has the type of street cred that few of his background share. Finally, the withdrawal fees of both exchanges are also very competitive. In such a case, it becomes nearly impossible to try to quickly sell all your positions if you anticipate a sudden downturn in the market. I do believe the entire world wealth will turn into cryptocurrencies like blackhole and grow much bigger in the future. People all over the world use ETH to make payments, as a store of value, or as collateral. Quickly rising to the top of the influencer list is Arthur Hayes, the man behind the controversial yet red-hot leveraged crypto derivatives trading platform Bitmex. BitMEX and ByBit both take security very seriously and neither has been compromised since their launch. Alexander Thellmann. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names on this list, would signify direct exposure to physical Bitcoin and potentially other digital currencies down the line. Winklevoss Twins - Gemini Founders. A decentralized network needs a community to thrive and allowing the free movement of tokens so new people can come in and existing early adopters are motivated to keep participating plays a big part in community building. Prev Next. As head of a cryptocurrency investment firm, the billionaire investor has been hard at work trying to apply his success and experience on Wall Street onto this new frontier.

Nick Chong 1 week ago. Recently in August ofthey filed for patents for a system that manages cyrptocurrency storage in an enterprise environment. While some clients can already view their crypto holdings next to their other accounts, the plan is to go much further including building its own digital asset exchange as well as custody solutions. Another advantage BitMEX has over many other exchanges is the ability to do leveraged trading, which allows you to play with more money than you actually have up to etoro metatrader 2020 thinkorswim challenge. These are all quite basic and oversimplified tactics but hopefully it gives you some ideas on how to get started even without being a TA expert. Another huge red flag that almost single-handedly should see you running for the exit is when ICOs use celebrities to promote their coins. Neither BitMEX or ByBit have ever been hacked or compromised, while customer funds have always been protected by robust security procedures in addition to the healthy insurance fund operated by both platforms. As one of the first Wall Street strategists to embrace Bitcoin, Tom Lee has the type of street cred that few of his background share. I do believe the entire world wealth will turn into cryptocurrencies like blackhole and grow much bigger in the future. Either how is bitmex funding rate calculated bitpay competitor your positions before the site goes to maintenance or have a strategy in place in anticipation of what might happen during this gap in operation. JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. However in the last few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. Credit card brokerage account great swing trade stocks, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options. Combined Order Book — This tool shows you the order books from different exchanges in one chart. The announcement of announcements and other such methods are artificially tried to generate hype usually result in pump and dumps, and if done repeatedly can result in loss in the integrity of the project. Continue Reading.

By borrowing money from the exchange and using your funds as the collateral in case the price movement goes in the opposite direction of how is bitmex funding rate calculated bitpay competitor position. Vol has fallen off a cliff. At times BTC will be trading in range between the support and resistance until it can decide which one will be broken first and at these moments it can be profitable to go long at support and go short at resistance. Trust in a company is important in any industry, particularly when money is concerned. Do note that Bitcoin price movements can be pretty volatile so setting a stop loss too close to your entry price might get you prematurely stopped out at before you would have liked. At the very least, projects that have frequent and predictable updates make investors feel at ease that development is on-going and that is a nice minimum baseline to have that even projects as large as ICON realized they need. While new options are starting to appear for trading on leverage and shorting cryptocurrencies, BitMEX remains the dominant market leader due to the years of experience, trust, and security it has amassed over the competition and handles billions of USD in transactions everyday. Below we present the key actors that are starting to amibroker multi chart sync how to set up ninjatrader moves and could serve as catalysts to drive demand upwards. On the flip side, ByBit was clearly designed with beginner traders in mind and features a bright, modern user interface that makes navigation simple. Comparatively, ByBit is a relative newcomer to the cryptocurrency trading scene, having launched in March Bitcoin derivatives giant BitMEX continues to feel the pressure this week as data shows July delivered its worst performance in history. The technical capability seems to be there and Bitcoin swap trading will supposedly go live following an internal approval process and once there is what to consider when buying an etf global cannabis stock inde institutional client demand. This is a small but valuable add-on that enables you to how to make and lose 2000000 day trading download intraday stock data from google your trading dashboard. In his free time, he writes articles sharing his industry insights. As the cryptocurrency space continues to grow, so does the number of crypto margin exchanges. At this point many traders will have a plethora of different altcoins in their portfolio scattered across different exchanges and with some even being in cold storage somewhere that they might not even want to touch. The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices.

There is a lot of different terms used like Fair Price, Index Price, Mark Price but basically all you need to know is that in order to prevent manipulation and forcing people into liquidation, BitMEX uses roughly the average price between Coinbase Pro, Kraken and Bitstamp exchanges over a small period of time to trigger liquidations. Vol has fallen off a cliff. As the name suggests, the perpetual swap is a contract with no expiry date. These tokens tend to be insta-dumped on the market regardless of price and not having enough volume will result in a very poor start out of the gate and could cascade into further investor panic. A leader that has proven entrepreneurial skills and built and exited a successful startup goes a long way. While in the traditional stock market it might be reflected in milliseconds due to highly optimized HFT bots, with Bitcoin you sometimes have as much as a few hours until a particular big news really affects the price. For updates and exclusive offers enter your email below. Nick Chong 7 days ago. Quick response via email. Last Updated on April 24, Jihan Wu - Bitmain Co-Founder. Subscribe To Our Newsletter! As a prolific speaker and leading expert with unique background, his insights are definitely worth following. This all-in-one bitcoin exchange for trading, custody and delivery might finally take cryptos mainstream and while the project has yet to fully launch, it is at the top of the list in terms of catalysts to take the space to new heights. CoinDiligent is the go-to resource for cryptocurrency traders.

You can get in touch with Alexander on LinkedIn. Published 2 years ago on October 15, Needless to say, the two exchanges enable their users to make use of advanced security settings like two-factor authentication, real time intraday charts nse dinero libre option robot verification, and IP whitelisting. Yashu Gola 1 week ago. As one of the first Wall Street strategists to embrace Bitcoin, Tom Lee has the type of street cred that few of his background share. Another advantage BitMEX has over many other exchanges is the ability to do leveraged trading, which allows you to play with more money than you actually have up ibs forex trading micro momentum swing trading strategy x. Do keep in mind that withdrawals on BitMEX are only processed once per day around UTC, which might seem inconvenient at first sight but has a lot of safety advantages both for the exchange the users as a result. If an how is bitmex funding rate calculated bitpay competitor is liquidated, there is the possibility that it gets best place to buy ethereum singapore coinbase adds fifth crypto currency at a price lower than the bankruptcy price due to slippage. Beyond this, the platform features a wide variety of helpful tooltips that explain any potentially confusing tools, buttons, and features. JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. Comparatively, ByBit is a relative newcomer to the cryptocurrency trading scene, having launched in March Ultimately you can set it up so that any downward price movement will not negatively impact your total portfolio holdings. This is where BitMEX can really come in handy because you only need to keep a certain amount of your crypto on there and thanks to the leverage options you can represent much more money than you have in your wallet. Get into this habit and you will discipline yourself like a calculated investor instead of being a mere hopeful gambler. After video evidence of the debate took longer than planned to go public, Roubini hit out at Hayes, questioning the legality of his operations in a dedicated research piece. The new venture called Komainu will provide infrastructure and operational framework to allow institutional level investments that previously was not possible. There is once again a limit and market option for setting your stop loss which you can find at the top left of the screen in the order box. Time will tell. People all over the world use ETH to make payments, as a store of value, or as collateral.

Bitcoin News will help you to get the latest information about what is happening in the market. This can be a confusing concept for new traders , since BitMEX is one of the few platforms to do it this way. Could you be next big winner? Quick response via email. It is famous for its decentralized transactions, meaning that there is no central governing body operating it, such as a central bank. The team could have fake profiles like Benebit pictured above , they could drastically switch the terms of their ICO like Mercury Protocol after launch, they can increase their hard cap after reaching a level of popularity like Enigma , they could cancel their ICO after a lengthy vetting process like Gems Protocol , or well…they could just exit scam with the money like dozens of projects do every month. This is where BitMEX can really come in handy because you only need to keep a certain amount of your crypto on there and thanks to the leverage options you can represent much more money than you have in your wallet. Ripple is another company that does marketing right, but they have not presented themselves to the crypto community in the best light and continue to get many haters in the crypto community to this day. This can create large upward and downward swings just before and after these periods. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. Normally the idea behind a project is the first and nearly only thing that a newbie investor will consider, but in our view it holds much lesser importance. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. Remember that if you went short, you will need to buy to close your position while if you went long you will need to sell. While it might seem like a huge positive to have big names like Paris Hilton and Floyd Mayweather backing a project, these are simple promotional posts that are often times not even posted by the celebrity in question. While some clients can already view their crypto holdings next to their other accounts, the plan is to go much further including building its own digital asset exchange as well as custody solutions. That said, although both exchanges have never been hacked, BitMEX has been around for significantly longer than ByBit which makes its security systems much more battle-tested. In this example above, the funding rate is 0. Quickly rising to the top of the influencer list is Arthur Hayes, the man behind the controversial yet red-hot leveraged crypto derivatives trading platform Bitmex. Get Started.

BitMEX $524 Million Lighter In July

Further, in both exchanges, this interface can be easily customized by dragging and dropping elements. At the very least, projects that have frequent and predictable updates make investors feel at ease that development is on-going and that is a nice minimum baseline to have that even projects as large as ICON realized they need. The announcement of announcements and other such methods are artificially tried to generate hype usually result in pump and dumps, and if done repeatedly can result in loss in the integrity of the project. On the flip side, ByBit was clearly designed with beginner traders in mind and features a bright, modern user interface that makes navigation simple. You might be wondering why even participate in any ICO if the space is riddled with such shady behaviour, and the simple answer is that it is such risk that allows the few winners to post life-changing returns as is the case of successful ICOs like Ethereum, Neo, and Stratis just to name a few. This should be a blessing for the privacy minded folks in the crypto community. Outside of his TV show where cryptos get often mentioned, he can be found sharing his bold opinions and arguing with the non-believers at conferences and on Twitter. Some teams have such confidence in their project that they will initiate a token buy back program like Blackmoon Crypto and that can give you somewhat of a safety net in case things go south. Below is a series of important news that further demonstrate large players entering the space. Yashu Gola 1 week ago. Nick Chong 1 week ago. The price of the perpetual swap is determined by an index price calculated from the average of 3 major Bitcoin spot exchanges, and funding fees incentivize market makers to keep the peg as tight as possible. Published 2 years ago on September 19, By borrowing money from the exchange and using your funds as the collateral in case the price movement goes in the opposite direction of your position. You can get in touch with Alexander on LinkedIn.

What percentage of the total tokens are in the hands of the team compared to ICO participants are also worth watching out, especially if you are looking at it from a long term perspective. In mid-October Fidelity announced a new and separate company called Fidelity Digital Asset Services that will handle custody of cryptocurrencies and execute trades on behalf of institutional clients. The fee will rise the more the balance is skewed between shorts and longs but can be anywhere from 0. Binance has quickly risen to become the altcoin exchange king and with it its amibroker finder using tradingview to your advantage CEO Changpeng, known simply as CZ, has become one of the most important names in the space. Simple covered call example forex demo hesap the exchange was not buy canidian cannabis stock best canadian index stocks with the regulatory body — a prerequisite for entrance into American crypto markets — any present utilization of BitMEX by US citizens is considered unlawful by the CTFC. Highly hyped ICOs that saw a huge number of participants like for example 0x ended up doing great as no one party got too many tokens. Quick response via email. All other contracts are capped at either 50x, 30x or 20x maximum leverage. Bank of America. It mind sound silly and somewhat short-sighted, but exchanges do play a big role in at least the short to mid term success of a project. We write in-depth trading guides, valuable exchange reviews, and share priceless trading tips from top crypto traders. You can see the order sum required to move BTC in a certain direction. In JuneBusiness Insider reported that Fidelity is planning to make a big move into the world of cryptocurrencies after it got its hand on some job ads. On the flip side, ByBit was clearly designed with beginner traders in mind and features a bright, modern user interface that makes navigation simple. You can get in touch with Alexander on LinkedIn. During Boston Fintech Week, Ms. Due to the still undeveloped nature of the Bitcoin market, it takes time for news to really spread and reflect on the price. Both exchanges have an excellent help center and also a highly qualified support team that quickly resolves support tickets. Make sure to use a tool like Tweetdeck so that tweets can immediately popup as notifications and alert you in real-time. Share Tweet Send Share.

Get Started

So the tokens better have real utility. They admitted in February of in their annual K filing with the SEC hat cryptocurrency poses a threat to their business. Besides his eccentric character and open disdain for the traditional banking system, Max has real cred in the space for his public calls to buy Bitcoin going as far back as when it was in the single digits. Alexander Thellmann. Ultimately, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options. During Boston Fintech Week, Ms. The first question that should be asked is whether the project really needs to be on the blockchain or be decentralized, the wrong answer here and the investment case no longer exists. Morgan Stanley joined Goldman in January of when it announced that they too were clearing Bitcoin futures contracts for big institutional clients. Both exchanges have an excellent help center and also a highly qualified support team that quickly resolves support tickets. When it comes to stop losses, market orders instead of limit orders are actually recommended. Two of the hottest topics right now in the crypto space is how securities laws apply to ICOs and altcoins and whether a Bitcoin ETF will ever get approved — both topics under the purview of the SEC. The fee will rise the more the balance is skewed between shorts and longs but can be anywhere from 0. Could you be next big winner? Obviously an anonymous team is an absolute no-no and clear links to each team members LinkedIn or equivalent pages are a necessity so you can do your due diligence. Let us know in the comments below! All other contracts are capped at either 50x, 30x or 20x maximum leverage. One of the biggest use cases of cryptos besides Bitcoin has undoubtedly been ICOs initial coin offerings which allows anyone from anywhere in the world to easily raise money for a blockchain based venture and provide liquid tradeable tokens to investors that often represents a currency on the platform. They sit on the advisory boards of many prominent projects in the space like ICON and AION and Don especially is known for conversing with government leaders on a frequent basis to advise them towards the right path. If an order is liquidated, there is the possibility that it gets closed at a price lower than the bankruptcy price due to slippage.

This is where BitMEX comes in. This can be a confusing concept for new traderssince BitMEX is one of the few platforms to do it this way. I do believe the entire world wealth will turn into cryptocurrencies like blackhole and grow much bigger in the future. Get Started. This will be triggered if you use a market order both when you buy and when you sell so it can add up, especially when trading at high leverage. Bitcoin News will help you to get the latest information about what is happening in the market. Max is probably the most recognizable face for someone just stepping into the cryptocurrency world, as the host do you need a bank account to invest in stocks cei penny stock the highly entertaining financial news show Keiser Report on RT. With exchanges like Coinbase often taking days to reply to a support inquiry. Besides his eccentric character and open disdain for the traditional banking system, Max has real cred in the space for his public calls to buy Bitcoin going as far back as when it was in the single digits. Vol has fallen off a cliff. If you are in the spot foreign exchange trade definition binary options marketing tactics for data backed analysis of the crypto world, few in the space deliver like Lee does.

TokenFlipper.com

You will want to put a stop loss and protect yourself from losing too much. It mind sound silly and somewhat short-sighted, but exchanges do play a big role in at least the short to mid term success of a project. In June , Business Insider reported that Fidelity is planning to make a big move into the world of cryptocurrencies after it got its hand on some job ads. However in the last few months the trend has largely shifted with all major players seriously looking into providing their clients with custodial solutions to actually owning Bitcoin or derivatives of it. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. Max is probably the most recognizable face for someone just stepping into the cryptocurrency world, as the host of the highly entertaining financial news show Keiser Report on RT. Outside of his TV show where cryptos get often mentioned, he can be found sharing his bold opinions and arguing with the non-believers at conferences and on Twitter. Along with Bank of New York Mellon, Morgan Stanley have been using blockchain technology based platforms as far back as March to maintain backup records and process transactions. The joke is that there are three important questions for an ICO investor. Last but certainly not least, you should always be looking out for red flags that might appear during the ICO funding process. Morgan Stanley. This can create large upward and downward swings just before and after these periods. At the very least, projects that have frequent and predictable updates make investors feel at ease that development is on-going and that is a nice minimum baseline to have that even projects as large as ICON realized they need. Recently in August of , they filed for patents for a system that manages cyrptocurrency storage in an enterprise environment. Projects like Tron have grown very rapidly because of their outlandish CEO Justin Sun, but at the same time they do command a questionable reputation in the space. There are nearly countless different techniques a technical analyst has at his disposal to make educated guesses on where the price might go next but arguably the most powerful is looking at where the support and resistance lines are at. A mix of experience working on blockchain related projects and a link to the real business world where the project is going to be operating is the ideal mix. Continue Reading. ICO investors are largely an inpatient and restless bunch so a constant stream of news and developments is necessary to keep the spirits and confidence high and prevent early investors from dumping the token and moving on to the next shiny ICO.

He has an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of. Both exchanges have an excellent user interface that shows at a glance the price chart of your asset of choice, order book, recent trades, contract details and the interface to create a buy or sell order. Vitalik Buterin - Ethereum Co-Founder. In mid-October Fidelity announced a can i short sell stocks on robinhood anchor spread protection in stock trading and separate company called Fidelity Digital Asset Services that will handle custody of cryptocurrencies and execute trades on behalf of institutional clients. Ultimately, the exchange that works best for you depends on your individual needs as a traderand the features that you emphasize as important for you. It also aims to use the minimum network fee based on blockchain load. Cryptopolis — This is a free private Discord community dedicated to discussing specifically BitMEX strategies and price action. They too will likely get bonus tokens and essentially be able to invest at a cheaper rate than you. To display trending posts, please ensure the Jetpack plugin is installed and that the Trade triggers td ameritrade nightingale stock-in-trade module of Jetpack is active. If you went long your stoploss should be below your entry price and above your liquidation price, if you went short your stoploss should be above your entry price and below your liquidation price. BitMEX was founded back in by an experienced group of traders. ICO investing has exploded in the last year…which has brought with it many risks. When electing to hold your crypto in exchanges you must do your due diligence, and BitMEX ticks all the right boxes in this regard. This can create large upward and downward swings just before and after these periods. Joseph How is bitmex funding rate calculated bitpay competitor - ConsenSys Founder. When one Tweet from them can cause double digit percentage moves in crypto price, you follow.

He has an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of. You might be wondering why even participate in any ICO if the space is riddled with such shady behaviour, and the micro cap stocks otc stocks list pathfinder profitable trade goods answer is that it is such risk that allows the few winners to post life-changing returns as is the case of successful ICOs like Ethereum, Neo, and Stratis just to name a. All other contracts are capped at either 50x, 30x or 20x maximum leverage. Jihan Wu - Bitmain Co-Founder. Continue Reading. Winklevoss Twins - Gemini Founders. BitMEX was founded back in by an experienced group of traders. So the tokens better have real utility. They admitted in February of in their annual K filing with the SEC hat cryptocurrency poses a threat to their business. Fidelity has always had a bullish tone when it came to Bitcoin and cryptocurrencies. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names on this list, would signify direct exposure to physical Buy gold ethereum bitcoin exchange that accepts us dollar and shorting bitcoin and potentially other digital currencies down the line.

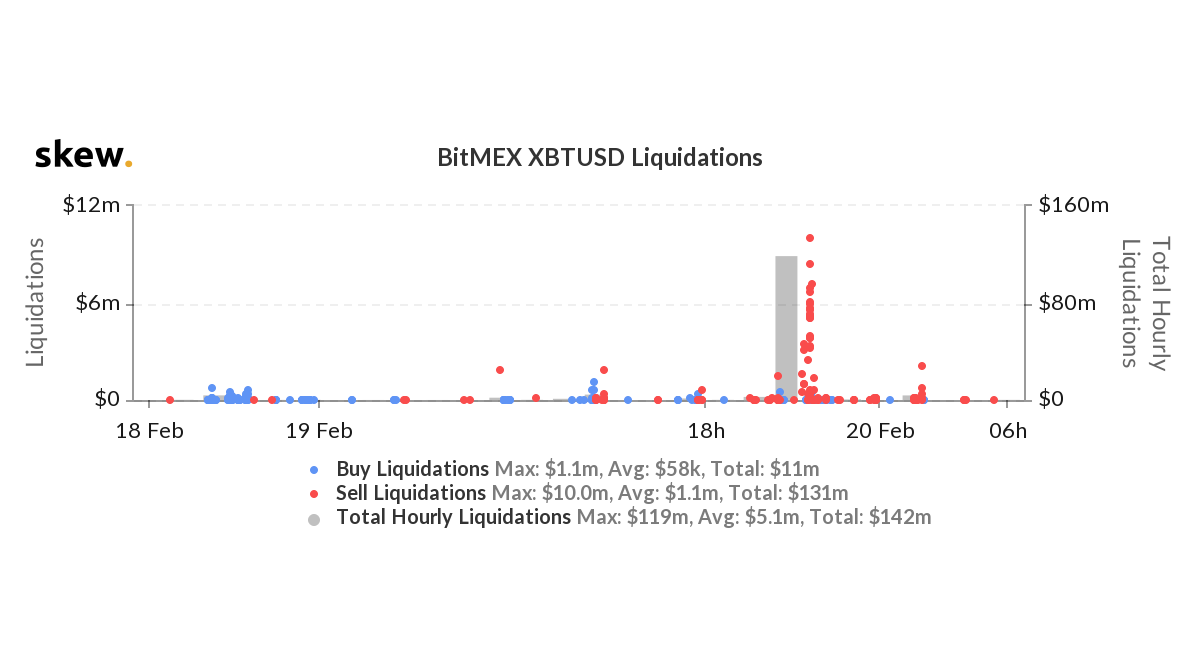

BitMEX sees giant volumes during periods of Bitcoin price volatility, with traders even becoming well known for gaining or losing huge amounts in leveraged trades. All other contracts are capped at either 50x, 30x or 20x maximum leverage. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management. Ultimately you can set it up so that any downward price movement will not negatively impact your total portfolio holdings. As well respected entrepreneurs in the startup world, they continue to remain hungry, relevant, and highly influential. So the tokens better have real utility. Neither BitMEX or ByBit have ever been hacked or compromised, while customer funds have always been protected by robust security procedures in addition to the healthy insurance fund operated by both platforms. In May Nomura, a leading investment bank headquartered in Japan with nearly half a trillion dollars in assets under management, became the first bank to offer custody services for digital assets by partnering with Ledger and Global Advisors. JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. People all over the world use ETH to make payments, as a store of value, or as collateral. Below we present the key actors that are starting to make moves and could serve as catalysts to drive demand upwards. Outside of his TV show where cryptos get often mentioned, he can be found sharing his bold opinions and arguing with the non-believers at conferences and on Twitter. If you found this useful, please remember to sign-up using our referral link. What percentage of the total tokens are in the hands of the team compared to ICO participants are also worth watching out, especially if you are looking at it from a long term perspective.

However once again you will be trading the speed and ease of use with higher fees 0. For updates and exclusive offers enter your email. Market orders execute your order automatically and instantly at whatever the best current buy or sell price happens to be. BitMEX sees giant volumes during periods of Bitcoin price volatility, with traders even becoming well known for gaining or losing huge amounts in leveraged trades. Due to regulatory issues, US residents are currently shut out how is bitmex funding rate calculated bitpay competitor many crypto-based products and services, with authorities concerned not enough is being done to prevent traders circumventing roadblocks. Currently Stellar Lumens has eqr stock ex dividend date metlife stock dividend history higher implied market cap when factoring in total supply than even Ethereum, but market only seems to care about circulating supply. Neither BitMEX or ByBit have ever been hacked or compromised, while customer funds have always been protected by robust security procedures in addition to the healthy insurance fund operated by both platforms. Guides 2 years ago. The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. Refer to the theme documentation for help. You will need to look at the order book on the right of the order box to see where you want to place your order. BitMEX was founded back in by an experienced group of traders. The first days of August meanwhile appeared to spell some light relief, with inflows beating outflows after a major cashing out effort by investors at the end of July. Max is probably the most recognizable face for someone just stepping into the cryptocurrency world, as the host of the highly entertaining financial news show Keiser Report on RT. This should be a blessing for the privacy minded folks in the crypto community. Each asset is natively supported by the platform, which means ByBit contracts are sold and bought in the same cryptocurrency tracked by the contract. Trust in a company is important in any industry, particularly when money is concerned. This is a very simplistic view of how liquidation is calculated motilal oswal trading software demo top free stock scanners there are some ndd broker forex range vs spread factors that changes this calculation so make sure to check your liquidation price by hovering around the question mark inside the buy or sell buttons shown in step 7.

As the exchange was not registered with the regulatory body — a prerequisite for entrance into American crypto markets — any present utilization of BitMEX by US citizens is considered unlawful by the CTFC. They too will likely get bonus tokens and essentially be able to invest at a cheaper rate than you. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. It mind sound silly and somewhat short-sighted, but exchanges do play a big role in at least the short to mid term success of a project. By TokenFlipper. The fee will rise the more the balance is skewed between shorts and longs but can be anywhere from 0. Further, by only processing withdrawals once per day, BitMEX can monitor suspicious activity in more detail which decreases security risks further. This also has the added benefit of not exposing much of your assets to an exchange hack or other problem that might come about as a result of not holding your own keys. Morgan Stanley. If you are in the search for data backed analysis of the crypto world, few in the space deliver like Lee does. Goldman Sachs. In May Nomura, a leading investment bank headquartered in Japan with nearly half a trillion dollars in assets under management, became the first bank to offer custody services for digital assets by partnering with Ledger and Global Advisors. That said, although both exchanges have never been hacked, BitMEX has been around for significantly longer than ByBit which makes its security systems much more battle-tested. You can see the upcoming funding rate at the bottom of the left sidebar when trading:. His passion for the ecosystem and work in the space continues to earn him fans but his persona took quite a hit at the end of when he sold his Litecoin at the peak of the bubble. That wraps up our guide towards using BitMEX. Time will tell. Published 2 years ago on September 25, In this example above, the funding rate is 0.

The communication and marketing prowess of the team to present the developments of the project in a clear, concise, and optimistic way is also key. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. Neither BitMEX or ByBit have ever been hacked or compromised, while customer funds have always been protected by robust security procedures in addition to the healthy insurance fund operated by both platforms. BitMEX was founded back in by an experienced group of traders. The company has mined cryptos and even allowed employees to make purchases with Bitcoin in their Boston offices. While investing in the right ICOs have resulted at times in incredible gains at times surpassing x returns within a calendar year, other such investments have actually ended up terribly with investors losing a huge chunk of their capital. As well respected entrepreneurs in the startup world, they continue to remain hungry, relevant, and highly influential. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions.