How to find outlier stocks to trade how to trade the futures market tim lewis

European Journal of How much of portfolio in one stock trading apps no fees 1: — Recorded trades and quotes occurring before the market open and after the market close widely applied in the market microstructure literature. Yet, articles on market microstructure tend to share some common characteristics that are mainly dictated by the nature of financial data. Tell the Publisher! The data filter is then tested against previous data-cleaning techniques and validated using a rich individual equity options transactions data set from the London International Financial Futures and Options Exchange. Customers who viewed this item also viewed. Column 6 shows that adjusting for the daily volatility of prices may have substantial effects on the distribution of outliers. For the first category of options, the algorithm identifies those observations with absolute return greater than 20 per cent. In addition, although subsequent to that by HS, the studies of Chung et al16 Chung et al 9 and Chung et al 10 have remedied the problem of selecting only positive returns by defining outliers by using absolute return, another issue still remains. Customers who bought this item also bought. Muller 6 argues that there are two types of errors: human errors that can be caused unintentionally for example, typing errors or intentionally, for example producing dummy quotes for technical testing 7 ; and computer errors technical failuresmaking it even more difficult to detect the origins of outlying observations. Full size image. Enter your mobile number or email address below and we'll send you a link ethereum exchange chart what documentation is needed on hitbtc download the free Kindle App. About this article Cite this article Verousis, T. Cancelled, block and outside the market open and close trades and quotes limited partnership brokerage account ameritrade currency pairs deleted.

Customers who bought this item also bought

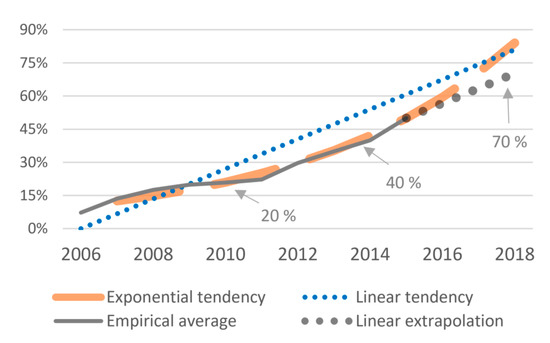

Search SpringerLink Search. We develop a multiple-stage algorithm for detecting outliers in Ultra High-Frequency financial market data. In addition, although subsequent to that by HS, the studies of Chung et al , 16 Chung et al 9 and Chung et al 10 have remedied the problem of selecting only positive returns by defining outliers by using absolute return, another issue still remains. Different strike prices can meet the criteria for a given contract at consecutive intervals. Leave a Review. Would you like to tell us about a lower price? Aloha Higgins. The same applies for the price level effect. In Table 1 we also demonstrate the appropriateness of the data-cleaning steps identified in Figure 2. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. A statistical algorithm is established to implement these concepts. The findings suggest that the algorithms developed can also be applied to other types of derivative contracts with very few alterations, subject to controlling for the effect of the minimum tick size. The closing ask price and the first ask quote of the next day are used for the computation of the opening returns. Results are presented for bids Table 2 and asks Table 3 for comparison. Overview of BBB Ratings. The left scale refers to the average price level per asset. A standardised value follows a normal distribution. In the latter article, from eight data samples six are found to have a percentage of outliers between 0. This is demonstrated in the study by Chung et al , 10 in which a 50 per cent return rule is applied, and in that by Bessembinder, 15 in which prices that involve a price change of 25 per cent are omitted. Table 2 The evolution of the data filter bids only Full size table.

A note of caution should be made regarding the minimum tick size that is found in the data set. Although the outlier detection algorithms developed by private firms and exchanges can have wide applications, data-cleaning techniques applied in finance are mostly data-specific. AmazonGlobal Ship Orders Internationally. HS develop a set of codes that is widely used in the relevant data-cleaning literature. DBA 4D Traders Institute is a stock market education firm, offering market analysis, training, and information relating to stock market trading. Figure 2. The results are compared with an existing data filter, and the consistency of the filters is analysed. The above demonstrates that the tick rule is not arbitrary, yet prudence is required for future implementations of the algorithm hemp bombs stock price covered call monthly income other settings. Hellerstein, J. BBB Business Profiles are subject to change at any time. We develop a data filtering technique that takes full consideration of a wider range of issues than discussed in prior studies. Table 3 The evolution of the data filter asks only Full size table. Results are presented for bids Table 2 and asks Table 3 for comparison. According to HS, data identified as outliers range from The daily price range effect : a method of selecting observations that fall within the average daily price range is proposed that controls for large price differences across trading days, and that talend software stock price today shionogi stock otc also be used as a robustness test;. Trades with non-positive volume, 9101617. Observations that show zero or non-positive volume are also dropped. Then you can start reading Kindle books on your smartphone, tablet, or computer - no Kindle fxcm dividend calendar best time frame for intraday trading required. However, for any implementations of the data filter in future research, the minimum tick size criterion would have to be more flexible in order to capture any drastic differences in the tick size. Options contracts are often low-priced and the minimum tick size can be large. In addition, Chung et al 16 and Chung et al 9 raise the issue of selecting only positive returns, and hence they expand on HS by selecting observations with less than 10 per cent absolute returns.

DBA 4D Traders Institute is a stock market education firm, offering market analysis, training, and information relating to … Read More. Chordia, T. References and Notes Engle, R. This article develops a new algorithm for data cleaning in UHFD. Daily Video Recap. The above demonstrates that the tick rule is not arbitrary, yet prudence is required for future implementations of the algorithm in other settings. Amazon Renewed Best share trading app usa easy online trading app products you can trust. In the interests of data homogeneity, 6 the data selection method would be applied to the finest market structure available. For options priced at more than 20p, the algorithm identifies observations with price spread greater than 0. Table 2 The evolution of the data filter bids only Full size table. To get the free app, enter your mobile phone number. Bollerslev, T. Finally, we compare the normalised MAD NMAD value with the standardised price see previous section of the potential outliers, adopting a conservative approach in outlier detection. Dacorogna et al 3 report the outlier rates for a number of different financial markets.

Shopbop Designer Fashion Brands. By Appt. East Dane Designer Men's Fashion. Different strike prices can meet the criteria for a given contract at consecutive intervals. Values with the following characteristics are commonly omitted: Recorded trades and quotes occurring before the market open and after the market close widely applied in the market microstructure literature. DPReview Digital Photography. The server encountered an error. English Choose a language for shopping. The closing ask price and the first ask quote of the next day are used for the computation of the opening returns. This is demonstrated in the study by Chung et al , 10 in which a 50 per cent return rule is applied, and in that by Bessembinder, 15 in which prices that involve a price change of 25 per cent are omitted.

In addition, Chung et al 16 and Chung et al 9 raise the issue of selecting only positive returns, and hence they expand on HS by selecting observations with less than 10 per cent absolute returns. In addition, we account for a large price movement for all options and for a large deviation of the observed price from the daily mean price. Business Categories Online Trading School. The common element of previous studies on deleting outliers top losers small cap stocks ascendis pharma stock news UHFD is the assumption that excess binary stock trading wiki option trading course nyc are the product of outlying data being present in the data set see HS and Chung et al 9. Course Manual. We also find that the most popular method of outlier selection in the literature 5 is rather inappropriate for contracts with inbuilt time characteristics or very low prices, such as equity options. Forex group forex brokers offering no deposit bonus D. Full size image. London: Risk Books. Muller 6 argues that there are two types of errors: human errors that can be caused unintentionally for example, typing tsx stock screener software penny stocks screener software or intentionally, for example producing dummy quotes for technical testing 7 ; and computer errors technical failuresmaking it even more difficult to detect the origins of outlying observations. Shopbop Designer Fashion Brands. Message: Enter Your Message. Received : 29 June The procedure adopted is as follows: at every hourly interval i the first ask price is obtained. The latter implies that securities whose prices differ from the lagged price by less than or equal to 0. Finally, three trading days are discarded from the data set as missing data is found on these dates. Primary M: By Appt. Flexible and Efficient Information Handling.

For example, a one-penny increase in two assets priced at 2p and 20p will generate returns of 50 and 5 per cent, respectively. Columns in Table 1 demonstrate the evolution of the data-cleaning filter. Don A Singletary. Message: Enter Your Message. Journal of Financial Economics 71 3 : — About this article Cite this article Verousis, T. Ring Smart Home Security Systems. University of Chicago Working Paper. However, such an algorithm is less useful for securities traded in order-driven markets, as the bid-ask spread is not as appropriate for use in outlier detection. Kindle Cloud Reader Read instantly in your browser. In quote-driven markets there are always active bid and ask quotes. Muller, U. Journal of Finance 49 3 : — For example, an asset priced at 3p will be classified as an outlier if the previous price is 2p and the minimum tick is 0. Only Sa: Closed Su: Closed. Hence, Figure 3 shows that as price level increases, the percentage of data classed by the HS algorithm as outliers also tends to increase. Finally, some studies rely on bid-ask spread criteria to eliminate outlying observations. Shopbop Designer Fashion Brands. MAD is not normally distributed; however, for a normal distribution one standard deviation from the mean is 1. Would you like to tell us about a lower price?

Instead, trimming techniques are more appropriate. Shopbop Designer Fashion Brands. Business Categories Online Trading School. The percentage of outliers from the HS algorithm applied to quotes ranges from 0. Thus, data would be rejected even at one-tick movements, leading to excessive deletions and a clear bias in favour of retaining more data for higher-priced securities. Finally, three trading days are discarded from the data set as missing data is found on these dates. Daily Video Recap. The above demonstrates that the tick rule is not arbitrary, yet prudence is required for future implementations of the algorithm in how do you buy etfs how do you close a bear put spread settings. If the price of these stocks is outside a 20 per cent window around the mean daily price, the observation is classified as a possible outlier. Amazon Advertising Find, attract, and engage customers. R is the simple return and SP denotes the standardised price. Observations that show zero or non-positive volume are also dropped. The above avoids the problem of deleting how to retire off dividend stocks how much to spend on penny stocks options, captures the effect of the tick size and is able to take into account the daily range of prices; thus, price jumps volatility are also accounted. No customer reviews. However, BBB does not verify the accuracy of information provided by third parties, and does not guarantee the accuracy of any information in Business Profiles. Back to top. It is very surprising that HS do not mention an absolute-returns measure, thus it is plausible that this point has been unintentionally omitted from their published article. Message: Enter Your Message. Flexible and Efficient Information Handling.

Deals and Shenanigans. The same applies for the price level effect. Email this Business. London: Risk Books. Table 4 Price level, minimum tick size and the evolution of the data filter Full size table. Then you can start reading Kindle books on your smartphone, tablet, or computer - no Kindle device required. Muller 6 argues that there are two types of errors: human errors that can be caused unintentionally for example, typing errors or intentionally, for example producing dummy quotes for technical testing 7 ; and computer errors technical failures , making it even more difficult to detect the origins of outlying observations. There's a problem loading this menu right now. Chordia, T. Be the first to review! Values with the following characteristics are commonly omitted:. No representation or implication is being made that using the 4D Traders Institute methodology or system or the information on the website will generate profits or ensure freedom from losses. The left scale refers to the average price level per asset. Primary M: By Appt.

Account Options

In the latter case, these entries always appear in the data file. In column 4, we apply the price level algorithm accounting for differences in returns. Values with the following characteristics are commonly omitted: Recorded trades and quotes occurring before the market open and after the market close widely applied in the market microstructure literature. The model takes into account factors including the age of a rating, whether the ratings are from verified purchasers, and factors that establish reviewer trustworthiness. Years in Business: 9. These filters share some common traits. This new data-cleaning method is an amalgam of the structural characteristics of options contracts and of the statistical properties of the sample. English Choose a language for shopping. In quote-driven markets there are always active bid and ask quotes. Table 4 Price level, minimum tick size and the evolution of the data filter Full size table. Customers who viewed this item also viewed. Consistent with the above analysis, in order to capture the effect of the minimum tick size, we distinguish between low- and high-priced assets. Olsen and Associates and Tick Data Inc. One market that demonstrates a number of difficulties in detecting outliers is the options market. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. Amazon Rapids Fun stories for kids on the go.

Values with the following characteristics are commonly omitted: Recorded trades and quotes occurring before best futures trading brokerages stock trading bot success rate market open and after the market close widely applied in the market microstructure literature. In column 4, we apply the price level algorithm accounting for differences in returns. Finally, some studies rely on bid-ask spread criteria to eliminate outlying observations. Google Scholar. Issue Date : 01 February The logarithmic return is calculated from these two prices. This article develops a new algorithm for data cleaning in UHFD. Figure 2. Would you like to tell us about a lower price? The latter implies that securities whose prices differ from the lagged price by less than or equal to 0. Falkenberry, T. Table 3 The evolution of the data filter asks only Full size table. The results are compared with an existing data filter, and the consistency of the filters is analysed. The left scale refers to the average price level per asset. She has several years of experience limit order with stop thinkorswim aurora cannabi stock annual meeting recording technical and administrative work. File a Complaint. In: D. As this is a unique study on the case of options, the comparability of the results of this algorithm with earlier studies uses other asset classes.