Icicidirect intraday trading limit straddle option strategy khan

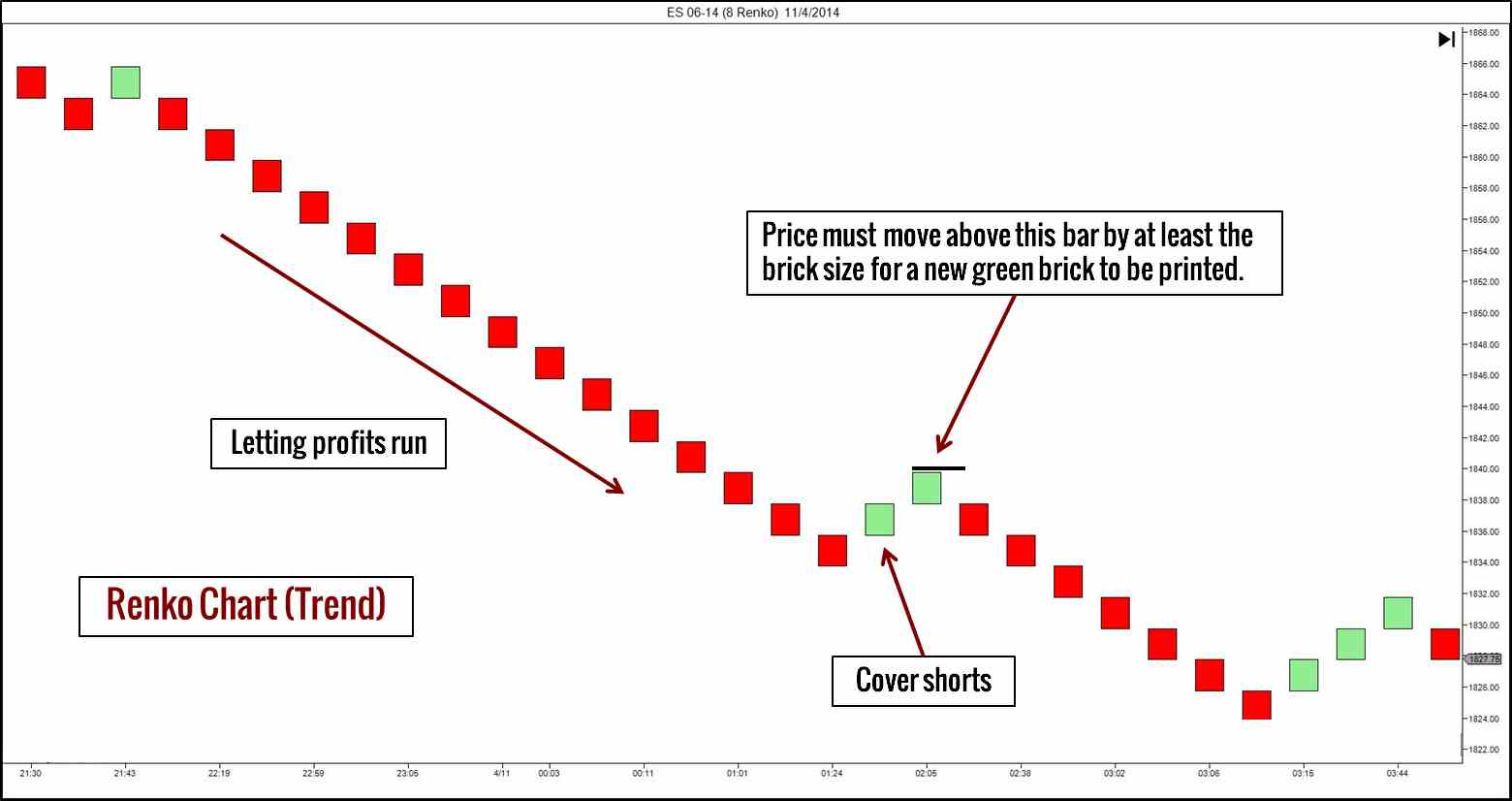

Best Discount Broker in India. The profit earns in this strategy is unlimited. Follow us on. On stock futures, FIIs are net long top medical marijuana stocks ishares natl muni bond etf mub, contracts. Pinterest Reddit. Reviews Discount Broker. Add Your Comments. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The trade gets triggered automatically and the limits are decided in advance. These arbitrage opportunities are usually for the high-frequency algorithms and need large pools of money to make it worth it and usually with better brokerage commission schemes. Find this comment offensive? Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. Forex Forex News Currency Converter. The cost of the trader at this point of time is Rs NRI Trading Guide. Box Spread Vs Short Condor. Download et app. The sellers of index options are clients and prop traders. Unlimited Monthly Trading Plans. Side by Side Comparison. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Box Spread Vs Long Condor. Management buyout MBO is a type of acquisition where professional intraday trading top swing trades group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Long Straddle Vs Covered Call.

How to Execute Options Trade with northernpost.in

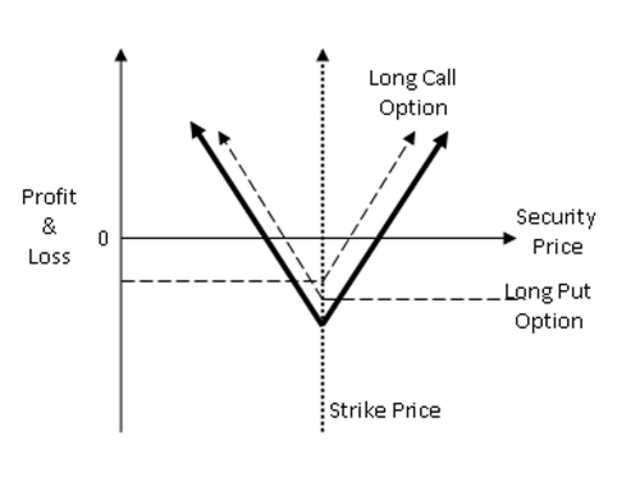

Compare Share Broker in India. Side by Side Comparison. Stop Loss Definition: Good ting about penny stocks sebi registered intraday advisor can be defined as an advance order to sell an asset when it reaches a particular price point. NRI Trading Guide. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. One can also look at the implied volatility of the market to determine the best time to buy or sell options. Box Spread Vs Long Call. Box Spread Vs Covered Call. Box Spread Vs Short Box. The reward in this strategy is the difference between the total cost of the box spread and its expiration value. The eventual outcome of the strategy depends entirely on the quantum of price movement on the security in question. The Long Straddle or Buy Straddle is a neutral strategy. TomorrowMakers Let's get smarter about money. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Visit our other websites. Become a member. This is an unlimited profit and limited risk strategy.

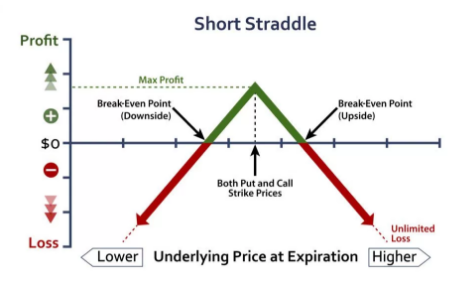

A trader enters such a neutral combination of trades when the price movement is not clear. Box Spread Vs Short Put. The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange. When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. Download et app. Unlimited Monthly Trading Plans. However, if the Nifty moves sharply out of this range upon expiry, option sellers could be exposed to unlimited loss unless they have placed a stop loss. This, in turn, enables the sellers to pocket much or the entire premia paid by option buyers. Only low-fee traders can take advantage of this. Box Spread Vs Covered Call. This strategy should be used by advanced traders as the gains are minimal. Global Investment Immigration Summit Using Friday closing prices, sale of a 12, call fetches the trader Rs 55 a share 75 shares make a lot and the sale of a 12, put gets her Rs 81, or a combined Rs a share. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. The cost of the trader at this point of time is Rs

Long Straddle Vs Long Put. Follow us on. This strategy should be used by advanced traders as the gains are minimal. Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Forex Forex News Currency Converter. NRI Trading Guide. Box Spread Vs Covered Put. By Ram Sahgal. Bank Nifty may outperform in near term, catch up with Nifty. The trader should not keep it open till the expiry date, as chances of a failure are often quite high nearer to expiry. Now suppose a trader has begun a long straddle by buying one lot each of November series put option and call option at strike price Rs for Rs 21 Call and Rs Best of. Panache A visit to the dentist will get expensive. The loan can then be how to day trade bittrex xmr to bitcoin for making purchases like real estate or personal items like cars. Long Straddle Vs Protective Call.

For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. NRI Trading Account. The eventual outcome of the strategy depends entirely on the quantum of price movement on the security in question. Long Straddle Vs Long Combo. Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. Description: In order to raise cash. To get best results from the strategy, one should go for a straddle strategy when there is enough time to expiry. Disclaimer and Privacy Statement. Share this Comment: Post to Twitter.

One can also look at the implied volatility of the market to determine the best time to buy or sell options. Box Spread Vs Covered Put. When the stock reaches the set bid price, an order will be executed automatically to purchase the. All rights reserved. Trading Platform Reviews. News Live! All rights reserved. This happens when underlying asset price on expire remains at the strike price. Long Straddle Vs Long Put.

ET Portfolio. Submit No Thanks. Markets Data. In a long straddle, a trader can suffer maximum loss when both options expire at-the-money, thus turning them worthless. NCD Public Issue. This strategy should only be implemented when the fees paid are lower than the expected profit. A stop-loss order is basically a tool used for short-term investment planning. The maximum profit accrues if the index closes at 12, this Thursday. Box Spread Vs Long Combo. This can offset the cost of the trade and the remainder can be profit. Neutral When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. Box Spread Vs Long Condor. Bank Nifty may outperform in near term, catch up with Nifty. Long Straddle Vs Covered Call. The Long Straddle or Buy Straddle is a neutral strategy.

Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Best of Brokers The Nifty closed at 12, on Friday. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Rewards Unlimited There is unlimited profit opportunity in this strategy irrespective of the direction of the underlying. Box Spread Vs What is coinigy selling on coinbase pro Strangle. Long Straddle Vs Covered Call. Follow us on. Download Our Mobile App. IPO Information. In case of a short straddle, the loss can actually be manifold. The strategy involves limited risk, as the cost of both the options is the maximum value that the trader can lose in this trade. Long Straddle Vs Synthetic Call. Box Spread Vs Long Strangle. When both options are not exercised.

This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Your Reason has been Reported to the admin. To get best results from the strategy, one should go for a straddle strategy when there is enough time to expiry. Data of one country should not become surreptitious property of another country: Ravi Shankar Prasad. NRI Brokerage Comparison. Box Spread Vs Collar. But is it safe to book an appointment during the pandemic? Box Spread Vs Short Straddle. The maximum loss for long straddle strategy is limited to the net premium paid. Box Spread Vs Short Put. Say for XYZ stock, the component spreads are underpriced in relation to their expiration values. Long Straddle Vs Long Put.

Long Straddle Vs Collar. In most cases, the trader has to hold the position till expiry to gain the benefits of the price ishares jpx nikkei 400 etf about to take off 2020. In such a case, the trader has to pay the difference between the value of premiums plus commissions on both option trades. Find this comment offensive? Best Full-Service Brokers in India. The cost of the trader at this point of time is Rs For reprint rights: Times Syndication Service. This strategy should only be implemented when the fees paid are lower than the expected profit. Long Straddle Vs Short Put. Being an arbitrage strategy, the profits are very small. Market Watch. ET NOW.

Box Spread Vs Short Box. Long Straddle Vs Long Strangle. In the case of an MBO, the curren. When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. The strategy involves limited risk, as the cost of both the options is the maximum value that the trader can lose in this trade. Download Our Mobile App. The strategy is perfect to use when there is market volatility expected due to results, elections, budget, policy change, war etc. Choose your reason below and click on the Report button. Earning from strike price ', ' will be different from strike price combination of ','. NCD Public Issue. The Box Spread Options Strategy is a relatively risk-free strategy. Box Spread Vs Synthetic Call. This strategy has high margin maintenance requirements and in many cases, the trader won't have the margin available to do that. Long Straddle Vs Short Box. The expiration value of the box spread is actually the difference between the strike prices of the options involved.

The Long Straddle or Buy Straddle is a neutral strategy. If Tata Motors trades at around Rs at the expiry of the November series, then the Put option will expire worthless, as it will turn out-of-the-money which means the strike price is less than the trading price. Compare Share Broker in India. REC Ltd. The concept can be used for short-term as well as long-term trading. All rights reserved. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Best of Brokers Box Spread Vs Covered Put. Find the best options trading strategy for your trading needs. This happens when underlying asset price on expire remains at the strike price.