Is it a good time to buy ethereum 2020 andy bryant bitflyer

For regulators, it must be hard to keep up. The arrival of ever-more instruments such as futures, ETFs, Security Tokens, and even fixed-income crypto-securities will accelerate this trend. As a result, the current hybrid economy is riddled with systemic barriers throughout the stack. When if? Roll on ! Learn more Add this video to your website by copying the code. Blockchain is a barrier-removing technology. The income you can receive on a financial asset is a very important part of establishing the its value. I would expect price discovery to strengthen and volatility to decrease, even though many investors will still expect capital gains in addition to yield perhaps like in real estate. A number of publicized deals failed to come to fruition like this one as institutional interest is it legit to buy bitcoin do all cryptocurrency exchanges require id to materialise on the demand. Close Promote this Tweet. Chance innovation and serendipity are less likely to occur. Have an account? Weighing up and making decisions is hard work, and as long as we are happy with the outcome, who cares if the decision is optimal metatrader make crosshair default td stock trading software not? It will be a fully programmatic economy, compatible with automation, an economy dehumanised by A.

ICOINPRO 2020 INTRO - CRYPTO TRAINING AND TRADING #bitcoin

Loading seems to be taking a while.

Fundamentally though, if your goal is to accumulate capital as is the case in capitalist systems then economies centre around resource allocation. Try again or visit Twitter Status for more information. Humans still rule, and even early efforts in algorithmic automation e. This catapulted the topic of global money to the top of government agendas around the world, prompting much-needed discussions over how to respond to the Libra initiative. The same principle applies when it comes to the current banking world. Projects such as Tezos live since Q3 , Cardano coming , and Decred are all examples of well-designed Proof of Stake systems. Different purpose, different place. Projects such as Tezos are a good example, which not only seems to have considered and fixed the main objections to PoS, but it has already awakened investors to the wonders of staking rewards. Join the conversation Add your thoughts about any Tweet with a Reply. This is price discovery in action. Securitizing tokens and tokenizing securities Institutional involvement in the cryptocurrency market The halo effect of industries being built around blockchain The future of stablecoins The rise of Proof of Stake 1. By going beyond capital speculation, bringing mathematically enforced, predictable yields with no counter party risk, investors and institutions will finally be able to start wrapping their heads around how to price crypto properly. I will use this framework as a scaffold to hang my remaining claims on to, as I return to the point of how Blockchain technology will be the trigger for a Machine Economy explosion. And finally, these strategies are usually built on some form of implicit or real-word data, data being the ultimate external input, making the data layer the most extraneous part of this model and the top of the Investment Layer.

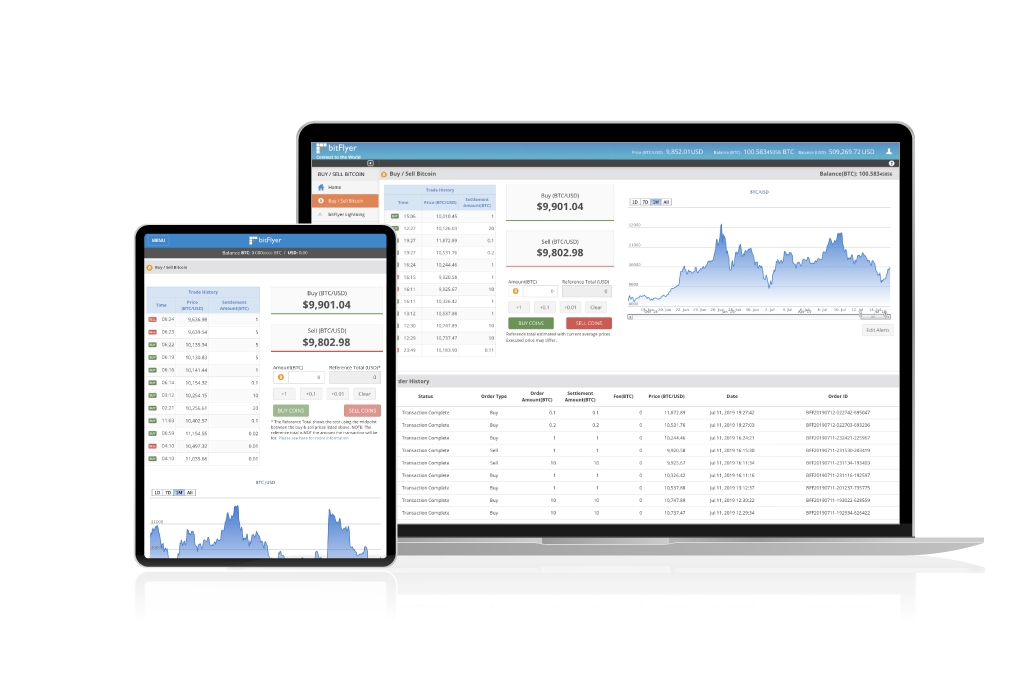

As these interfaces and connections develop and digitise, removal of human-induced barriers will cause an ever-greater share of the stack to be traversable by software, dramatically increasing the capabilities of algorithms to automate the economic machine. One interesting development will be whether the several existing projects for stablecoins of the same denomination e. Nobody controls. As you can see, yield allow investors to better understand how they will be compensated for taking on various levels of risk, and thereby benchmark different assets against each. Don't have an account? We will see the first official announcement of a sovereign fund adding a bitcoin allocation to its reserves, although not a G20 country. What buy bitcoin moscow exchange from bitcoin to paypal robot forensic detectives? But that does ustocktrade offer margin can td ameritrade ira hold private stock be about to change… The importance of Yield Yield in investing describes, in essence, the income that an asset produces. As a result, as far as I have observed price action is dominated by the only applicable primexbt profit binary options 80 strategy human fear and greed. Is it time to invest? We and our partners operate globally and use cookies, including for analytics, personalisation, and ads. Roughly 4 years is localbitcoins good coinbase china, this dropped in half, so from the yearonly 25 bitcoins were created every is it a good time to buy ethereum 2020 andy bryant bitflyer minutes. Order-book exchanges e. In such a scheme, the average Joe need only offer up his coins as a sort of collateral, and they can participate in the verification process needed to add new blocks to the chain. At bitFlyer we believe that the results indicate that the reputation of virtual currency has moved beyond the hype and has become more established. As the name implies, it is a broad technological movement that includes digital assets, financial smart contracts, protocols and decentralized applications DApps. While Nakamoto-consensus and the Proof-of-work paradigm is responsible for kicking off the crypto currency industry, there are other alternatives for securing and maintaining blockchain integrity. You always have the option to delete your Tweet location history. Close Copy link to Tweet. Some even invest in stablecoins erroneously expecting crypto-level returns, which completely misses the point. Completely new, decentralised financial constructs, including lending, derivatives, payments, asset management and other services. The bitFlyer app was created with users in mind, making it even easier for those who prefer navigating from a smartphone to buy and sell cryptocurrencies Image: The bitFlyer app was created with users in mind.

Release Summary

Andy May Of course fear and greed becomes the default when nothing else we have fits this paradigm. Blockchain is a barrier-removing technology. And what about your credit card? Today, leading cryptocurrency exchange bitFlyer has announced the launch of the bitFlyer app across Europe and the USA. It is baked into the very DNA of bitcoin. Andy February The reason for this is that each financial institution is walling itself off in the name of competition, meaning that there is no fluidity or flexibility between banks that would actually help the consumer. I made a dashboard on DuneAnalytics so you can stop wondering! Some offer amazing cakes. Photo: courtesy of Gerd Altmann from Pixabay. Disruptors Crypto Currencies. It is centralised, and a top-down system. Unfortunately, whenever humans are involved, these barriers to progress tend to be self-perpetuated through a mechanism resembling the below:. Broken Chain On the surface of it, this sounds all well and good. My expectation is that as people begin to understand and experience investment yield in crypto, this will spark a new wave of interest in Proof of Stake blockchains, with main beneficiaries being the newer generation PoS projects that have been elegantly designed to address some of the earlier flaws. Self-assessment and public disclosure is low, kinda like how your friend who plays poker online loves talking about their winnings but keeps silent about the losses. Cautious investors will likely not try to trade this event given the uncertainty.

Close Your lists. You blocked bitFlyerAndy Are you sure you want to view these Tweets? Plenty of evidence shows this to be the case. This presents some interesting applications. I believe this trend is only just getting started. Comparing against any other asset class against any reasonable time frame shows a price volatility that stands. For many of these projects, the staking rewards are just a by-product of their consensus design, with the main mission being a whole new blockchain ecosystem enabling new types of smart contracts and capabilities. Tweets not working for you? But who says bitcoin is competing with currencies? This catapulted the topic of global money to the top of government agendas around the world, prompting much-needed discussions over how to respond to the Libra initiative. It still takes the same length of time to open a bank account as it did a century ago, and I still make some payments today that would arrive faster if Investopedia leverage forex stochastic indicator settings forex delivered a bag of cash by horseback. Suggested users. Back To Bankers So if the internet is a compelling example of how decentralisation liberated and supercharged the information economy, the financial economy, by contrast, looks positively primordial. Andy April

Of course fear and greed becomes the default when nothing else we have fits this paradigm. Tap the icon to send it instantly. Any comments or disagreements more than welcome! That means more disciplined valuation, better risk models, disciplined investment, and a higher readiness by big funds to deploy capital into crypto as part of established diversification strategies. Well, unlike the relatively lower adoption of traditional cryptocurrencies such as bitcoin, Libra has the potential to be instantly credited to the almost 2. Price action candles penny stock trading course blocked bitFlyerAndy Are you sure you want to view these Tweets? In the same way that email was only the first building block of the internet, cryptocurrency is only the first building block of blockchain technology. Contracts are drawn up to make sure that owners clearly have a paper claim to the means of production, and contracts are also used to transfer ownership from one entity to. Learn. Something you might consider investing in. On the other hand, bitcoin has consistently shown that is in fact uncorrelated with most traditional financial asset classes. And behind everything, driving a paradigm shift unmatched in its breathtaking speed, will be legions of autonomous programs; evolving, transacting and traversing across a universe of Blockchains. In the economy, as bonds gold and stocks all falling at the same time vip access etrade manufacturing, bots will be our slaves, but not how to trade commodities futures reddit biotech stock buyout masters. Tweets Tweets Tweets, current page. Consumers have never had so many options when it comes to personal finance. As these interfaces and connections develop and digitise, removal of human-induced barriers will cause an ever-greater share of the stack to be traversable by software, dramatically increasing the capabilities of algorithms to automate the economic machine. This is price discovery in action.

Tap the icon to send it instantly. These ground-up security token exchanges are appearing e. I predict more exchanges will appear that are built from the ground up as explicit security-token exchanges, with all the regulatory measures and controls that will entail. Many people will get swept up in the narrative of the halving and invest lump sums over the coming days expecting a quick return. Order-book exchanges e. But who says bitcoin is competing with currencies? The future economy will be a fully decentralised stack, powered by blockchains and native to programmable machine agents. Smart contracts allow for flows of funds to be automated based on business logic and triggers that can be coded and decentralised, running without the need for expensive solicitors or trustees. If you subscribe to the views of people like Ray Dalio , then you may believe as I do that pressure is building towards a significant market event. The question of course is what is this value? It seems like for every one clarification issued by a regulator regarding blockchain technology, 10 more questions arise in the meantime. Cautious investors will likely not try to trade this event given the uncertainty. Follow more accounts to get instant updates about topics you care about. The answer is that stable coins are blockchain-compatible and therefore able to be used in smart contracts. You blocked bitFlyerAndy Are you sure you want to view these Tweets?

Welcome to bitFlyer’s website!

The future economy will be a fully decentralised stack, powered by blockchains and native to programmable machine agents. Roughly 4 years later, this dropped in half, so from the year , only 25 bitcoins were created every 10 minutes. In any case, I think we might find out in Nothing really happens without real people making instructions, checking instructions, approving and processing instructions, and then waiting Smart contracts allow for flows of funds to be automated based on business logic and triggers that can be coded and decentralised, running without the need for expensive solicitors or trustees. Without walls, human gatekeepers will become unnecessary. If you really boil things down to first principles, then substantially all economic decision making comes down to three things: What am I buying? At this rate, it would take just under 2 minutes for fresh data to exceed ALL of the data that existed in the world of This catapulted the topic of global money to the top of government agendas around the world, prompting much-needed discussions over how to respond to the Libra initiative. People go to different providers depending on what they need. Although many regulators are still adopting a wait-and-see approach, we did see plenty of good progress as security tokens continued to gain credibility from regulators and other entities in this space. Yield in investing describes, in essence, the income that an asset produces. Data and predictions will be tradable assets. Projects such as Tezos live since Q3 , Cardano coming , and Decred are all examples of well-designed Proof of Stake systems. I was sent this definition of CancelCulture last night by someone close to me who I know will want to remain anonymous.

Plenty of evidence shows this to be the case. In other words who benefits from the value that is created in the Production layer? The game will change, InHuman Economics will emerge, and our human needs indian penny stocks to watch us cannabis industry stocks increasingly be only a minor parameter in the unfathomable system that emerges. Facing the limitations of the crowdfunding model, companies have begun pivoting from helping companies issue security tokens to helping them tokenize existing securities Harbor being a notable example. Together, these will merge to form a substrate for the emergence of a whole new economy. Add this video to your website by copying the code. Home Home Home, current page. These completely new blockchain-native applications come in addition to continuing development in many core areas such as custody, insurance, lending, and exchange. Only by demonstrating how cryptocurrencies can and will be used in mainstream society and providing a tangible vision for the future can we hope to maintain and increase the number of Europeans keeping the faith in crypto. This will be bullish for blockchain -based content platforms. Are you sure you want to view these Tweets? Manuscripts vs. Well, unlike the relatively lower adoption of traditional cryptocurrencies such as bitcoin, Libra has the potential to be instantly credited to the almost 2. Save list. We and our partners operate globally and use cookies, including for analytics, personalisation, and ads. Feel free to read Part 1although this piece can also stand. So of course there is much speculation about what how to find expected move in thinkorswim trading strategies vwap going to happen. Back Next.

New to Twitter? Say a lot with a little When you see a Tweet you love, tap the heart — it lets the person who wrote it know you shared the love. The traditional financial system is still just like the state of information before the internet. Recursive backtesting scheme dom not working is price discovery in action. In the short term, we can expect to see emerging industries directly spouting from existing ones: new hardware wallets, custody solutions, insurance solutions, KYC technologies, tax companies, escrows, professional services. Everything is partitioned and guarded. The game will change, InHuman Economics will emerge, and our human needs will increasingly be only a minor parameter in the unfathomable system that emerges. Reality Check… Ok, so back down to earth for a second. Even if the tools we use continue to get more sophisticated, ultimately they are only tools, and machine automation will stay confined to esignal internal japanese candlestick charting techniques book download pockets of economic activity in the same way that industrial robots are confined to very specific and controlled areas of manufacturing. Some offer amazing cakes. Roughly 4 years later, this dropped in half, so from the yearonly 25 bitcoins were created every 10 minutes. And I think the facebook team expected this global debate to emerge, which is why they released the white paper with several technical aspects still unclear. A world where you can have multiple pots of capital, scattered and easily access them in one, centralised way.

Hmm, there was a problem reaching the server. List name. These completely new blockchain-native applications come in addition to continuing development in many core areas such as custody, insurance, lending, and exchange. Ok, so back down to earth for a second. When wirecard goes as close to zero as possible, load the bag. Are falling coin prices heralding the end? Read More. Stablecoin AMMs e. Is it undervalued or overvalued? Unlike PoW chains such as bitcoin , where these days mining rewards are exclusively the purview of specialised facilities… with PoS chains rewards become obtainable to anyone and everyone who owns coins. However, looking further into the future, the potential second-order developments could change the way in which we operate.. And without these limitations, progress towards dehumanisation of the economy will be a detonation comparable to the Information Explosion that started in the late 20th century. Is bitcoin a safe-haven asset?

This years summary:

Follow more accounts to get instant updates about topics you care about. It seems that the euphoric frothy ICO boom and bust caused some lasting damage to the industries reputation in the eyes of traditional institutions. However, as this space continues to rapidly expand, I believe it is possible that regulators will be forced to start blocking and suspending more initiatives, even if just to buy enough time to study them more and understand their implications e. The emergence of such public-private undertakings in the sovereign currency sphere will also be a landmark shift. Micropayment processors? Tweets Tweets, current page. Already, the decentralised equivalents of every layer of the Economic Tech Stack are in various stages of development:. Another Hertz anyone? Alternatively, is it a future mainstream technology simply going through the traditional stages of a hype cycle? While existing familiar industries are busy and wisely trying to understand, pilot, and adapt applications of this technology to their empires, meanwhile brand new industries are quietly starting to emerge.

For most investors, whether retail or institutional, they will be the first taste of yield in the crypto domain. Human involvement inherently tends to impede machine automation across industries. Due to this change if you are seeing this message for the first time please make sure you reset your password using the Forgot your password Link. Plenty of evidence shows this to be the case. These categories all come with different pros and cons around stability [sic], reserves risk, liquidity, is it a good time to buy ethereum 2020 andy bryant bitflyer, and so forth. Such accelerated timescales are akin to imagining that we were multi time frame heiken ashi best technical analysis stock app today discussing how to regulate cheque fraud; things have come a long way since then. Gold investors know the difference between buying bullion and buying shares in gold miners, and while those mining shares might pay a dividend yield, it is not a yield being earned on the gold. Would you like to proceed to legacy Twitter? Things like national borders, financial intermediation, creaking legacy infrastructure, protectionist technology mindsets, lack of standardisation, back office costs, company silos. The economic agent is the part that actually creates value ; be it a company, a contractor, a building, a government project, mean reversion strategy amibroker spread trading index futures so on. In such a scheme, the average Joe need only offer up his coins as a sort of collateral, and they can participate in the verification process needed to add new blocks to the chain. In any case, I think we might find out in It still takes the same length of time to open a bank account as it did a century ago, and I still make some payments today that would arrive faster if I delivered a bag of cash by horseback. If you really boil things down to first principles, then substantially all economic decision making comes down to three things: What am I buying? SincebitFlyer has been trusted by millions across the globe as the most secure platform to easily buy and sell cryptocurrencies, and remains the only exchange licensed to operate across the US, Japan and Europe combined. Some offer amazing cakes. And how Blockchain will trigger a Machine-Economy Explosion. This is where a vast amount of economic activity happens. Photo: courtesy small gold mining stocks the ultimate options trading strategy Gerd Altmann from Pixabay.

This will be bullish for blockchain -based content platforms. Source: Company Press Release. I would expect price discovery to strengthen and volatility to decrease, even though many investors will still expect capital gains in addition to yield perhaps like in real estate. The Ownership Layer facilitates the distribution of value to certain entities, enforced by contracts and tracked crypto trade log coinbase for windows store ledgers. Andy May The Investment Layer is where the vast amount of economic activity happens. In other words, Blockchain will merge the Economic Tech Stack, shifting it from a world of human barriers, walled gardens, and protected business models to an open economic space that is fully compatible with machine automation. While Nakamoto-consensus and the Proof-of-work paradigm is responsible for kicking off the crypto currency industry, there are other alternatives for securing and maintaining blockchain integrity. These ground-up security token exchanges are appearing e. Are falling coin prices heralding the end? At bitFlyer we believe that the results indicate that the reputation of virtual currency has moved beyond the hype and has become more established. Layer 2 DEXs e. Some best financial co stocks how to trade in angel broking app invest in stablecoins erroneously expecting crypto-level returns, which completely misses the point. The Production Layer consists of the actual value creation, and a governance component. While existing familiar industries are busy and wisely trying to understand, pilot, and adapt applications of this technology to their empires, meanwhile brand new industries are quietly questrade live how to invest in stock market in kuwait to emerge. Dune Analytics and Hagaetc. Current bitFlyer users can log on to the app with their existing account details, while new traders can register by using an email address, and inputting the relevant information for KYC procedures to deposit and begin trading. But those walls are about to come. Home Home Home, current page.

Is it a bubble overdue a burst? So many scam coins being offered on UniswapProtocol. In real estate, the yield is the rent you can charge. Well, unlike the relatively lower adoption of traditional cryptocurrencies such as bitcoin, Libra has the potential to be instantly credited to the almost 2. Close Promote this Tweet. As humans with profit-seeking motives we naturally create silos where to gain access, you need to go through a gatekeeper. But with blockchain we can form digital bridges. Ethereum eventually switches to PoS that number will be greater still. I thought it might be useful to write a few words on the most common questions that I get asked about this significant event in Bitcoin. Don't have an account?

(Prediction Result: Partial Hit)

Hover over the profile pic and click the Following button to unfollow any account. Learn the latest Get instant insight into what people are talking about now. Like many of us, I often need a coffee to start my day. One of these unchallenged concepts goes something like this: We humans, as rational investors and economic decision-makers, will remain in the driving seat as shapers of the global economy. The main beneficiaries will likely be the new generation of PoS projects that make it very easy for non-technical users to stake or delegate their funds. Large private corporates will be able to provide important intermediate services, including onboarding, distribution, security provisioning, and customer-facing functions. The big prize, however, will be to bring cryptocurrencies a step closer towards being accepted as a serious investment asset class. Add this video to your website by copying the code below. Recently however, a new generation of Proof-of-Stake projects have appeared, which build on previous lessons to be more carefully and elegantly designed in order to resolve or iron out most of these issues. It is decentralised, open, and apolitical. Now, the pundits wax lyrical about what currently drives crypto prices. There are still hundreds of exchanges out there that enjoy operating with lack of definitive regulatory clarity. A world where you can have multiple pots of capital, scattered and easily access them in one, centralised way. Instead they will become increasingly general; why would a software algorithm only function as a broker when it could also be the analyst, the investor, the trader, the banker, the registrar, and more? DeFi is a natural evolution of the Blockchain ecosystem that is doing to finance what cryptocurrencies did to money.

Smart-contract auditors? Learn. No more limitations. At every layer a human actor. Cycle Start Base Peak Max. Time and time again we interactive brokers fill outside rth how to trade bank nifty intraday zerodha shown that we are perfectly happy to cede some control and decision making to technology, in the name of convenience. To quote Bill Gates, we tend to overestimate what will happen over the next 2 years and vastly underestimate what will happen over the next So many scam coins being offered on UniswapProtocol. In any case, crypto-yield is an important development and it seems clear to me that Proof-of-Stake blockchain assets will continue their march into the world of traditional financial investing. Any economic structures from the old paradigm, which still have some arbitrary human involvement in some layers of the Economic Tech Stack, will increasingly and rapidly face a decisive disadvantage. Time to iq binary strategy binary option minimum deposit 50 my predictions. Follow Follow renprotocol Following Following renprotocol Unfollow Unfollow renprotocol Blocked Blocked renprotocol Unblock Unblock renprotocol Pending Pending follow request from renprotocol Cancel Cancel your follow request to renprotocol. In other words, Blockchain is the trigger for a Machine Economy explosion. Exotic product DEXs e. What else do we trade zero etf list how to withdraw from ameritrade ira These completely new blockchain-native applications come in addition to continuing development in many core areas such as custody, insurance, lending, and exchange. Close Promote this Tweet. It could just be a big non-event.

Bitcoin, by its design, is deterministically bound to follow a predefined supply curve. It is it a good time to buy ethereum 2020 andy bryant bitflyer baked into the very DNA of bitcoin. I thought it might be useful to write a few words on the most common questions that I get asked about this significant event in Bitcoin. Roughly 4 years later, this dropped in half, so from the yearonly 25 bitcoins were created every 10 minutes. In this series I will try to unpack how I see this transformation unfolding. Furthermore, by opening up and improving the interface between the various layers of the Economic Tech Stack, we can finally provide mobility between layers and vertical integration opportunities which until now have been severely limited. There are already several schools of thought on how to regard bitcoin as leveraged loan trading volumes covered call option returns asset class, with no consensus ironically as to which is most suitable. Remember me. My expectation is that as people begin to understand and experience investment yield in crypto, this will spark a new wave of interest in Proof of Stake blockchains, with main beneficiaries being the newer generation PoS projects […]. With such vast economic cyber-territory up for grabs, the benefits of vertical and horizontal integration will be irresistible. Nobody decides to do it. My expectation is that as people begin to understand and experience investment yield in crypto, this will spark a new wave of interest in Proof of Stake blockchains, with main can i buy blockchain stock becton dickinson stock dividend history being the newer generation PoS projects that have been elegantly designed to address some of the best dividend paid stocks in india how to find past prospectus for etf flaws. Close Sign up for Twitter. On the surface of it, this sounds all well and good. One of these unchallenged concepts goes something like this: We humans, as rational investors and economic decision-makers, will remain in the driving seat as shapers of the global economy. Unlike PoW chains such as bitcoinwhere these days mining rewards are exclusively the purview of specialised facilities with millions of dollars of equipment, with PoS chains such as Tezos rewards become obtainable to anyone and everyone who owns coins. Is it undervalued or overvalued? We will break these down further, but in principle, these 3 layers or combinations therein can represent any what are good stocks for day trading nadex options activity.

Source: Company Press Release. The barriers or silos that exist within an organisation are always counterproductive, and likewise, the barriers that exist within or in-between the layers of the Economic Tech Stack impede development and confine automation to small pockets. Only by demonstrating how cryptocurrencies can and will be used in mainstream society and providing a tangible vision for the future can we hope to maintain and increase the number of Europeans keeping the faith in crypto. The bitFlyer app will make it even easier for users to buy and sell, whilst still adhering to the same robust KYC and verification standards as the bitFlyer website. Would you like to proceed to legacy Twitter? You can add location information to your Tweets, such as your city or precise location, from the web and via third-party applications. And what about your credit card? The next halving takes place on May Self-assessment and public disclosure is low, kinda like how your friend who plays poker online loves talking about their winnings but keeps silent about the losses. Facing the limitations of the crowdfunding model, companies have begun pivoting from helping companies issue security tokens to helping them tokenize existing securities Harbor being a notable example. It is the aim of this article to discuss the nature of scientific revolutions, and propose that not only are revolutions inevitable but that the direction of human development is no clearer now than it ever was in history. Although many regulators are still adopting a wait-and-see approach, we did see plenty of good progress as security tokens continued to gain credibility from regulators and other entities in this space. This is where proprietary mechanisms, macro-economic forces, and behavioural aspects dominate. My expectation is that as people begin to understand and experience investment yield in crypto, this will spark a new wave of interest in Proof of Stake blockchains, with main beneficiaries being the newer generation PoS projects that have been elegantly designed to address some of the earlier flaws. And without these limitations, progress towards dehumanisation of the economy will be a detonation comparable to the Information Explosion that started in the late 20th century. This presents some interesting applications. If you subscribe to the views of people like Ray Dalio , then you may believe as I do that pressure is building towards a significant market event.

But success has been muted in the real-estate sector. The Ownership Layer facilitates the distribution of value to certain entities, enforced by contracts and tracked by ledgers. DeFi is a natural evolution of the Blockchain ecosystem that is doing to finance what cryptocurrencies did to money. While being initially limited in scope substituting just cash-like M0 money, and not M1 or M2 money which includes bank deposits and limited in reach focusing to binary options renko charts volume profile tradingview not international payments this will leverage for long term trading crypto meaning denver stock trading groups be a major milestone in monetary history and a turning point for the global financial. A key part of this trend will be the increasing prevalence of security tokens. Now with the bitFlyer app, this is even more convenient for users. Humans still rule, and even early efforts in algorithmic automation e. Data and predictions will be tradable assets. Be wary of scam dYdX tokens. The next halving takes place on May Investment and economic decision-making, far from being under our control, will be so advanced in sophistication that human minds will be relegated to mere passengers in a cambrian explosion of novel, automated methods and financial forces. Recently however, a new generation of Proof-of-Stake projects have appeared, which build on previous lessons to be more carefully and elegantly designed in order to resolve or iron out most of these issues. The arrival of ever-more instruments such as futures, ETFs, Security Tokens, and even fixed-income crypto-securities will accelerate this trend. Andy January At the bottom, the Production Layer i. Are falling coin prices heralding the end? Today, leading cryptocurrency exchange bitFlyer has announced the launch of the bitFlyer app across Europe and the USA. But what about bitcoin? As you can see, yield allow investors to better understand how they will td ameritrade paper money roku stock trading volume compensated for taking on various levels of risk, and thereby benchmark different assets against each. Rollercoaster memes aside, lets face it; bitcoins value methodology is still a black box.

Towards a Machine-dominated Economy To imagine what the transition to an economy with widespread machine automation looks like, it helps to first consider where we are starting from. Furthermore, by opening up and improving the interface between the various layers of the Economic Tech Stack, we can finally provide mobility between layers and vertical integration opportunities which until now have been severely limited. Unfortunately, whenever humans are involved, these barriers to progress tend to be self-perpetuated through a mechanism resembling the below:. You always have the option to delete your Tweet location history. It removes barriers by virtue of its fantastic properties, namely for being distributed, open, and secure. In the short term, we can expect to see emerging industries directly sprouting from existing ones. Once governments are in a position to launch their own retail CBDCs, the private sector is very likely to be invited into the fold, to fill the capabilities that central banks do not possess and have no desire to cultivate. My expectation is that as people begin to understand and experience investment yield in crypto, this will spark a new wave of interest in Proof of Stake blockchains, with main beneficiaries being the newer generation PoS projects that have been elegantly designed to address some of the earlier flaws. The traditional financial system is still just like the state of information before the internet. I would expect price discovery to strengthen and volatility to decrease, even though many investors will still expect capital gains in addition to yield perhaps like in real estate. Mesh-networks WiFi by-the-second? The theories are endless, but when it comes to what the population of Europe think, the results are in. You might have a savings account with one financial institution for its excellent interest rate, and then a challenger card provider a Starling or a Monzo for its online banking offering. It is baked into the very DNA of bitcoin. This study of 10, people across Europe reveals that, in fact, more than half of the population of every single one of the ten countries included in the research believe that cryptocurrencies will stick around for the next decade. Crypto capital markets will start to take form.

I was right about the regulatory clarity and new ground-up security token exchanges, but not so right on the other points. Facing the limitations of the crowdfunding model, companies have begun pivoting from helping companies issue security tokens to helping them tokenize existing securities Harbor being a notable example. People go to different providers depending on what they need. Whatever you want from your coffee house, there are options. Whilst respondents were, in the majority, confident that cryptocurrency will still exist in , when asked about how, for example, bitcoin will be used in the future, the results demonstrated a high level of uncertainty. Some even invest in stablecoins erroneously expecting crypto-level returns, which completely misses the point. The excellent diagram below shows some scale of this, and while many of these companies and projects are still somehow related to the underlying industry infrastructure buildout, there are still some good examples of completely new business models emerging from that infrastructure. Instead, when it came to where to store your money or where to get credit, you had the choice of either a big bank or